PakAlumni Worldwide: The Global Social Network

The Global Social Network

India Unhappy With Changes to US H1B Visa Program

India has recently complained to the World Trade Organization against the United States over changes to visas for skilled workers that Republican presidential candidates have targeted for elimination, according to a report in the UK's Financial Times.

The WTO revealed that India had requested consultations with the US over moves by Washington to raise fees for L1 and H1B working visas and also restrictions on the number of those visas awarded. The move is the first step in initiating a dispute at the WTO.

India's WTO complaint:

India's WTO complaint is over an increase in fees on H1B visas that the US imposed on companies with workforces comprised of more than 50 percent foreign workers. A provision included in last year's federal spending bill added a new $4,000 fee for each H1B, which India argues is discriminatory to the country under its trade agreement with the US.

Meanwhile, the annual gold rush in Silicon Valley to file applications for H1B visas has just begun, as the federal government began distributing some of the 85,000 H1B visas it is authorized to issue this fiscal year, according to Vice News.

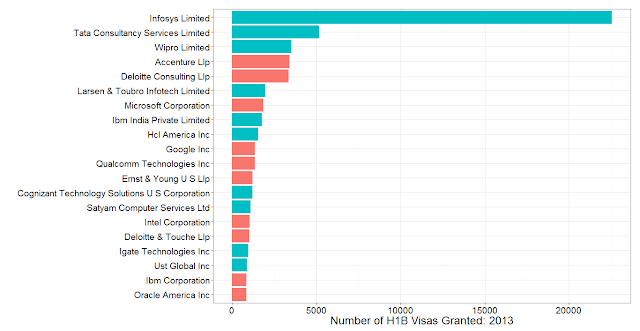

Indian Body Shops Infosys, TCS and Wipro Topped H1B Sponsor List in 2013 |

Why the Complaint?

Why is India complaining? There are two main reasons:

1. India's overall exports have suffered 18th consecutive monthly decline in February 2016, according to India's Economic Times. Exports from India amounted to US$264 billion in 2015, down -12.4% since 2011 and down -16.9% from 2014 to 2015.

2. Most of India's IT exports to the United States are made up of wages of H1B workers brought to the United States by a handful of Indian body shops like Tata Consulting Services (TCS) and Infosys. In 2014, 86% of the H1B visas for tech workers were granted to Indians, according to available data. Given India's heavy reliance on H1B workers for its IT exports earnings, it is natural that the Indian government gets very concerned whenever there's even a hint of the US possibly limiting H1B visas or making them more expensive.

Excluding the Indian H1B workers' pay, such exports drop to about one-twentieth of the the amount reported by the Indian government as IT exports, according to a 2005 study by US General Accounting Office (GAO).

|

| Cumulative Stock of H1B From 2007-2012: 775,957. Source: DICE |

Indian Body Shops:

The Indian body shops like Cognizant, TCS and Infosys that rely on the H1B visa program in the US are "the shining star" of the Indian economy, and the country's largest export, according to an Indian-American professor Ron Hira who is a strong critic of the abuses of H1B program. By complaining, the Indian government and firms that rely on the program are trying to "build up a firewall so that no other reforms can come through and constrain the program in any way."

Indian Code Coolies:

H1B workers brought in by Indian body shops are described variously as "code coolies" or "H1B slaves". Some call them "indentured servants", like the ones from India who replaced slave labor after the British empire abolished slavery.

“’Indentured servants’ is a pretty accurate term because in many cases that’s exactly what’s going on,” said Phillip Griego of San Jose’s Phillip J. Griego and Associates. Over the years, Griego and his law partner, Robert Nuddleman have represented several H-1B workers in lawsuits against body shops.

Summary:

India has complained to the World Trade Organization about changes to the US H1B that mainly benefit India's body shops like Cognizant, Infosys and Tata at the expense of both US and Indian workers. US workers lose their jobs while Indian workers are exploited as wage slaves. India uses the wages of Indian H1B workers to inflate its IT export earning by as much as 20X. Proposed changes to H1B visa program like higher fees and lower numbers threaten India's export earning which have declined for 18 months in a row. The ongoing election debate over whether the H1B program is hurting American workers rose to public consciousness amid the Republican primary debates this year. The election outcome has the potential to negatively impact Indian H1B exports earnings.

-

Comment by Riaz Haq on April 2, 2016 at 8:47pm

-

Annual race for 85,000 tech #H1B visas is under way. #India body shops in front. http://on.wsj.com/1M5H6mF via @WSJ

Many H-1Bs are issued to offshore outsourcing companies, especially from India, which have U.S. subsidiaries that bring in foreign labor they subcontract to American banks, retailers and others. Critics say those foreigners displace U.S. workers because they are often paid lower wages.

As the presidential race has thrust immigration and job displacement center stage, demand for foreign skilled-worker visas coveted by tech companies is expected to far outstrip supply again this year, likely prompting the government to hold a lottery.

U.S. Citizenship and Immigration Services, the federal agency that oversees the H-1B visa program, begins accepting applications Friday for fiscal 2017.

“April 1 isn’t so much as a start date, but a starting gun for the furious race by U.S. employers to secure skilled labor,” said Adams Nager, economic policy analyst at the Information Technology and Innovation Foundation, a tech policy think tank.

U.S. companies can sponsor 65,000 foreigners with at least a bachelor’s degree from any university. An additional 20,000 visas go to individuals with advanced degrees from U.S. institutions. Universities and nonprofits, which aren’t subject to a cap, also use H-1Bs to hire many workers each year.

The 85,000-quota is expected to be exhausted in a matter of days for the third consecutive year despite announcements by some tech companies of layoffs, according to federal officials and immigration attorneys who file petitions for companies.

Employers pay fees to the government and lawyers to apply for the visas.

“I marvel at the fact that employers are willing to pay thousands of dollars just to get a chance to be subjected to a random lottery,” said Los Angeles-based Rita Sostrin, among many attorneys who said their H-1B business has grown significantly this year.

Ms. Sostrin predicted that individuals competing for a visa in the regular “skilled” category, for people with a bachelor’s degree, will have less than a 20% chance of being selected in a lottery. Those with advanced degrees will have less than a 50% chance, she said.

“The tech industry is not slowing down here that I have seen,” said Gregory McCall, an immigration attorney in Seattle. Based on his caseload, “there are plenty of companies going like gangbusters.”

Arguing that it faces a shortage of specialized workers, the U.S. tech industry has for years lobbied to expand the H-1B program—and counted on support from the business-friendly Republican establishment. The 2016 presidential race has altered the picture.

On the campaign trail, the program has been blamed by some candidates for enabling employers to hire cheaper foreign labor at the expense of U.S. workers.

At rallies, GOP front-runner Donald Trump has featured tech workers who said they were replaced by foreigners. At a recent debate, Mr. Trump briefly disavowed his opposition to the visa program, saying such foreign workers were needed. But a short time later he switched back to opposing the program.

Republican rival Ted Cruz, who supported the program’s expansion in 2013, has called for a moratorium until it is reviewed. Democratic contender Bernie Sanders also is a critic; Hillary Clinton is a supporter.

“This is the first time the H-1B program has entered a presidential campaign. As a result, it’s received more scrutiny than it has in the past,” said Ron Hira, a Howard University professor who studies the program.

Mr. Hira, a critic of the program, said the Obama administration has failed to protect U.S. workers’ interests. “The not so subtle message to American workers is ‘tough luck’—you should be replaced by a cheaper H-1B guest worker.”

Many H-1Bs are issued to offshore outsourcing companies, especially from India, which have U.S. subsidiaries that bring in foreign labor they subcontract to American banks, retailers and others. Critics say those foreigners displace U.S. workers because they are often paid lower wages.

-

Comment by Riaz Haq on April 2, 2016 at 10:28pm

-

China tops the list of world's 10 largest industrial producers. It is followed by the US, Japan, Germany and South Korea, according to United Nations Industrial Organization (UNIDO).

India ranks 6th in the world in terms of total manufacturing output in 2013, up from 9th place in 2008,

http://economictimes.indiatimes.com/news/economy/indicators/india-j...

India's manufacturing value added (MVA) per capita of $161.7 in 2013 (in 2005 US$) is among the lowest in the world. It's up from $131.9 in 2008.

In fact India's 2008 MVA per capita of $131.9 was lower than Pakistan's $141.1. Since 2008, Pakistan's MVA per capita has slipped to 139.1 in 2013 while India's has increased to 161.7 in this period.

Bangladesh's MVA per capita has jumped from $82.2 in 2008 to $118.3 in 2013.

On UNIDO’s industrial competitiveness index, most industrialized countries lost ground in the last three years. Among the five most competitive are four high-income countries (Germany, Japan, the Republic of Korea and the United States), along with China ranking fifth. The four are among the world’s most industrialized countries and, with China, account for 59 percent of world MVA.

https://www.unido.org/fileadmin/user_media_upgrade/Resources/Public...

-

Comment by Riaz Haq on April 3, 2016 at 10:06am

-

#India can’t find buyers for its offshore rupee "masala" bonds. #Modi #BJP http://on.wsj.com/1Tswobt via @WSJ

India’s attempt to diversify and deepen its corporate debt market has fallen flat, thanks to lack of demand and bad timing.

Last fall, Prime Minister Narendra Modi indicated to a gathering of 60,000 people at London’s Wembley Stadium that after James Bond, and Brooke Bond tea, a new type of bond was coming to markets: bond, rupee bond.

Looking for ways to help Indian companies take on more debt, invest and create jobs, the government last year allowed them to issue rupee-denominated bonds overseas.

Asia’s third-largest economy is looking to mimic China’s success with its yuan-denominated, “dim-sum” bonds which have raised more than $100 billion for Chinese and other companies since they were launched in 2007, according to data from Dealogic.

However, despite Mr. Modi’s high-profile quips, plans to issue more than $1.5 billion from so-called masala bonds have yet to raise a rupee.

-----

The holdups are hampering India’s efforts to spread the use of the rupee as an international currency, diversify its source of funds and reduce its dollar liabilities.

The outlook for masala bonds “is not very optimistic,” says Lin-Jing Leong, an investment manager at Aberdeen Asset Management Plc, which manages $4 billion in Asian debt.

Unrestricted by Indian regulations, global financial institutions like International Finance Corp., Inter-American Development Bank and European Bank for Reconstruction and Development, have issued rupee bonds outside India for more than a decade. Around $3.8 billion worth of rupee bonds are outstanding offshore, versus $64 billion worth of yuan-denominated bonds, according to Dealogic.

Masala bonds are an attractive source of funds for Indian companies as investors bear the foreign-exchange risk. Many Indian companies are struggling as the amount of rupees they have to pay to service their dollar and euro debt has ballooned as the South Asian currency has depreciated over the past year.

The masala-bond market was opened to companies late last year just as global interest in emerging markets was on the decline. The rupee has been volatile since then, adding to investors’ concerns about the downside of an investment in the currency.

Indian companies are also reluctant to pay the higher yield that investors want to compensate for the risk.

“Liquidity is going to be quite bad offshore; I would obviously require some premium with regard to yields,” said Ms. Leong of Aberdeen.

“The pricing we are getting [in masala bonds] would be a little higher than the cost at which we could raise money in the domestic market,” said Keki Mistry, chief executive officer at HDFC.

-

Comment by Riaz Haq on April 20, 2016 at 6:57pm

-

#US #university in #Kentucky, Recruiting Students from #India to Fill Seats, Not to Meet Standards. #highereducationAt Western Kentucky, 106 of 132 students admitted through the recruitment effort (in India) scored below the university’s requirement on an English skills test, according to a resolution adopted last fall by the graduate faculty council, which raised questions about the program. “The vast majority either didn’t have any scores or there wasn’t documentation of their language skills,” said Barbara Burch, a faculty member of the university’s Board of Regents.“Hurry Up!!!” the online posting said. “Spot Admissions” to Western Kentucky University. Scholarships of up to $17,000 were available, it added. “Letter in one day.” The offer, by a college recruiter based in India, was part of a campaign so enticing that more than 300 students swiftly applied to a college that many had probably never heard of.More than 8,000 miles away, at Western Kentucky, professors were taken by surprise when they learned last fall of the aggressive recruitment effort, sponsored by their international enrollment office. Word began to spread here on campus that a potential flood of graduate students would arrive in the spring 2016 semester.The problem — or one of them — was that many of the students did not meet the university’s standards, faculty members said, and administrators acknowledged.Western Kentucky’s deal with the recruiting company, Global Tree Overseas Education Consultants, is a type of arrangement that is becoming more common as a thriving international educational consultancy industry casts a wide net in India and other countries, luring international students to United States colleges struggling to fill seats. The university agreed to pay Global Tree a commission of 15 percent of the first year’s tuition of students who enrolled, or about $2,000 per student.But as colleges increasingly rely on these international recruiters, educators worry that students may be victimized by high-pressure sales tactics, and that universities are trading away academic standards by recruiting less qualified students who pay higher tuition.

-

Comment by Riaz Haq on April 28, 2016 at 8:59pm

-

The Feud at #India’s Central Bank. RBI's Rajan's straight talk upsets #Modi ministers. #BJP - a @WSJ op-ed http://on.wsj.com/1UjEaoD via @WSJ

Is Reserve Bank of India Governor Raghuram Rajan on his way out? Earlier this month, a comment to a reporter by the head of India’s central bank drew fire from Prime Minister Narendra Modi’s party. Mr. Rajan played down talk of India as a bright spot in the global economy by citing an Indian proverb: “In the land of the blind, the one-eyed man is king.”

Commerce Minister Nirmala Sitharaman quickly declared that she “may not be happy” with Mr. Rajan’s choice of words. Junior Finance Minister Jayant Sinha echoed his colleague’s sentiments: “We are the shining star. I don’t agree with what the governor said.”

Senior Indian officials don’t usually admonish each other in public. That Mr. Rajan’s comment—an innocuous warning against premature hubris about high growth—drew ministerial backlash suggests trouble between the governor and the Modi administration. It could signal that Mr. Modi will refuse to extend Mr. Rajan’s tenure when his three-year term expires in September.

Picking a central-bank governor he likes is, of course, the prime minister’s prerogative. But letting Mr. Rajan go would be a mistake.

The governor, who was appointed by the previous Congress Party-led government, adds global credibility to India’s economic management. His candor and perceived sense of independence are strengths, not weaknesses. Mr. Modi and Finance Minister Arun Jaitley would be foolish to overlook this.

In India, where Reserve Bank governors are usually drab, the 53-year-old Mr. Rajan cuts a dashing figure. When he was appointed three years ago, the gossip columnist Shobhaa De called him “seriously hot.”

Indian media cover Mr. Rajan like a celebrity, chronicling his fondness for old Hindi movie songs, his penchant for running half-marathons, and his use of “dosanomics,” a reference to savory pancakes popular in southern India, to explain the dangers of high inflation.

Unlike most of his predecessors at the 81-year-old bank, Mr. Rajan earned his reputation overseas before returning to India. In 2003, the International Monetary Fund appointed Mr. Rajan, a professor at the University of Chicago at the time, as its youngest-ever chief economist, and the first from a non-Western country.

Two years later, Mr. Rajan warned of a financial bubble at the Federal Reserve Bank of Kansas City’s annual policy conference at Jackson Hole, Wyo. When the global financial crisis struck in 2008, many observers hailed Mr. Rajan for his prescience.

Four years ago, Mr. Rajan returned to India to serve briefly as chief economic advisor to then-Finance Minister P. Chidambaram before taking over at the Reserve Bank.

To some in the ruling Bharatiya Janata Party, Mr. Rajan is tainted by his appointment by the Congress Party. Nor did he help his own case by coming up with a sketchy index in 2013 that appeared designed to show that the western state of Gujarat, then headed by Mr. Modi, was not among India’s most developed.

Since Mr. Modi’s election two years ago, Mr. Rajan has been pressured to boost growth by cutting interest rates. Traditionally, India’s central-bank governors haven’t enjoyed as much independence as their American counterparts, but Mr. Rajan has guarded the bank’s mandate, established last year, of taming inflation.

He met the bank’s target by bringing Consumer Price Index inflation below 6% in January. At the same time, over the past 15 months, the Reserve Bank cut interest rates by 150 basis points to 6.5%, its lowest in five years.

Some also disparage Mr. Rajan’s tendency to speak about issues outside his area of responsibility, in ways that can appear critical of the government. In a speech last year, the governor warned against fetishizing strong governments by evoking Hitler.

During a national debate about rising intolerance, Mr. Rajan lectured students at the Indian Institute of Technology in Delhi about the country’s “tradition of debate and an open spirit of inquiry.”

-

Comment by Riaz Haq on May 10, 2016 at 9:16am

-

#Indian workers chasing dreams and dollars: #India and the #H1B visa http://www.sfchronicle.com/business/article/Chasing-dreams-and-doll... … via @sfchronicle

On the outskirts of the city, an ancient temple, surrounded by a buzzing market with food and flower stalls, rises on the banks of the Osman Sagar Lake. It is barely 8 a.m., but for hours already, the temple has been surrounded by a swirling mass of petitioners. Hundreds circle it quickly but silently, praying to the Hindu deity Balaji to grant the wish that has brought them here: to obtain a guest worker visa that will allow them to take their high-tech talents to America.

The Balaji Visa Temple is among a handful of such shrines that have sprung up in recent years, offering Indian workers hope of divine help in obtaining a temporary U.S. specialty-occupation visa, familiarly known as an H-1B. Those who receive them can spend three to six years working in the U.S. — a ticket, they believe, to a better, more financially secure future.

---

Those who are successful face other concerns: Navigating a system in which their employer controls their visa, and thus their legal status, leaving some feeling like indentured servants with no power over working hours or conditions. Having wages sometimes shaved through fees assessed by sponsoring companies, who may contract them out for other work.

And increasingly, being pointed to by critics of the H-1B program, including GOP presidential candidates Donald Trump and Texas Sen. Ted Cruz, as a threat to American workers.

Still, they come in waves to cities like Hyderabad and shrines like the Balaji temple, eager to vie for a once-in-a-lifetime experience. Some have seen their applications put forward year after year without success, putting off marriage or finding a permanent home in hopes that this will be the year they get to America. To jobs that will boost their careers and pay far more than they can earn here. To a few years of adventure in the land of Hollywood and Disney World.

Every year, thousands of Indian workers from Hyderabad alone get H-1Bs, while Indians overall make up more than two-thirds of those working on H-1B visas. Their growing presence has spurred calls for reform of the system on both sides: those who want the limited number of visas expanded and those who say the system has gotten out of control.

The number of visas available, however, has always been limited. Since 2004, the cap has been set at 85,000 new H-1Bs annually — 65,000 for foreign workers with at least a bachelor’s degree, another 20,000 reserved for those with advanced degrees from U.S. universities. Trade agreements reserve up to 6,800 of those visas for skilled Chilean and Singaporean workers.

Exempt from the cap are skilled workers employed in higher education, nonprofit research or government research. Also not counted in the cap are extensions of an H-1B for a second three-year term.

Since 2013, the huge demand for H-1Bs has prompted a computerized lottery to dole out the visas. That has spurred growing criticism of India’s multibillion-dollar outsourcing industry, which supplies legions of workers for U.S. companies every year. In fiscal year 2014, the most recent year data are available, 67 percent of H-1B visa recipients were from India, the highest proportion in at least 18 years.

Indian companies, including Tata Consulting Services, Wipro and Infosys, submit tens of thousands of visa requests on behalf of U.S. clients each year. Critics say they are effectively gaming the lottery — depriving smaller companies of the chance to fairly compete for H-1Bs and taking visas that could go to more highly skilled, higher-paid workers for low-level, lower-paid programmers.

-

Comment by Riaz Haq on June 8, 2016 at 8:59am

-

#Modi Bolsters #India’s Ties With #America as #Trump's Vows to Limit immigration Worry Indian officials. #Obama #H1B

http://www.nytimes.com/2016/06/08/us/politics/narendra-modi-us-indi...

----

Another reason Washington and New Delhi have grown so close is the increasingly testy relationship between the United States and Pakistan, India’s longtime rival. Although Pakistan is formally an ally of the United States, American officials have made clear that India has displaced Pakistan in American interests and hearts.

--------------

“We have much more to do with India today than has to do with Pakistan,” Defense Secretary Ashton B. Carter said in April. “There is important business with respect to Pakistan, but we have much more, a whole global agenda with India, agenda that covers all kinds of issues.”

-----

The two sides also announced that they intended to complete a deal in which India will buy six nuclear reactors from Westinghouse by June 2017, fulfilling an agreement struck in 2005 by President George W. Bush. The price is still under discussion, but more difficult issues like liability have been resolved.

“We continue to discuss a wide range of areas where we can cooperate more effectively in order to promote jobs, promote investment, promote trade and promote greater opportunities for our people, particularly young people, in both of our countries,” President Obama said in the Oval Office during the meeting.

---

“The United States is well aware of the talent that India has,” Mr. Modi said in Hindi. “We and the United States can work together to bring forward this talent, and use it for the benefit of mankind and use it for the benefit of innovations and use it to achieve new progress.”

Mr. Modi has made clear that he intends to set aside decades of standoffishness — rooted in India’s colonial experience — to cement closer ties with Washington, in part because the next American leader may not share President Obama’s enthusiasm for India.

The news media in India has extensively chronicled comments by Mr. Trump that critics have said were racist, his “America First” views and his unorthodox campaign. While Mr. Trump, the presumptive Republican presidential nominee, has said little about India, his vows to tighten immigration policies worry Indian officials.

“Modi wants to get as much as he can out of Obama’s last months in office,” said Ashley J. Tellis, a senior associate at the Carnegie Endowment for International Peace.

--

Mr. Trump has vowed to “cancel” the Paris climate agreement if elected, something Mr. Obama is eager to prevent. Once the accord enters into legal force, no nation can legally withdraw for four years.

“If the Paris agreement achieves ratification before Inauguration Day, it would be impossible for the Trump administration to renegotiate or even drop out during the first presidential term,” said Robert N. Stavins, the director of the environmental economics program at Harvard.

---

The two sides also announced joint efforts for the United States to invest in India’s renewable energy development, including the creation of a $20 million finance initiative.

---

The two countries finalized a deal that allows their forces to help each other with crucial supplies, and the United States formally recognized India as a major defense partner, which should allow India to buy some of the most sophisticated equipment in the United States arsenal.

India’s increasing willingness to form military partnerships with the United States is, in part, a result of its deepening worries about China. Recent patrols by Chinese submarines in the Bay of Bengal have unnerved New Delhi, and a 2014 visit to India by the Chinese president, Xi Jinping, did nothing to soothe Indian sensibilities, as Chinese troops made an incursion into border territory that India claims as its own.

China’s refusal in the months since to resolve the territorial claims at the heart of the standoff has quietly infuriated Indian officials.

---

-

Comment by Riaz Haq on July 18, 2016 at 7:36am

-

How Much Longer Can India's IT Sector Hide? Bloomberg View

Companies such as Infosys, Wipro and Tata Consultancy Services (TCS) grew into global behemoths precisely because they sprung up in Bengaluru -- far from the watchful eye of Delhi-based bureaucrats. The tech industry fell into a regulatory blind-spot, unhampered by red tape and the labor laws that strangled other sectors. As one Indian minister noted over a decade ago, Indians do well “in IT and beauty contests, the two areas that the government has stayed out of." States like the one Bengaluru is in continue to exempt IT companies from especially suffocating regulations.

These firms offered businesses around the world an efficient, low-cost way to outsource their in-house IT work. Building and maintaining enterprise-specific IT infrastructure for overseas clients provided a steady stream of income. India could beat the competition for this work because of its large pool of trained, low-cost engineers.

Once wildly successful, this model has now begun to run into a whole host of problems.

First, slowing growth in the West means that many companies have cut down on the discretionary spending that once went into outsourcing contracts. Second, more restrictive visa laws in the West are making it tougher for Indian companies to get qualified engineers into their clients’ offices.

Third, that pool of Indian engineers isn’t inexhaustible. Salaries have begun to rise, threatening a business model based on generating relatively little revenue per employee. As far back as 2013, the Economist quoted one IT executive as saying that, for IBM, “the total cost of its employees in India used to be about 80% less than in America; now the gap is 30-40% and narrowing fast."

Fourth and most importantly, the technological landscape is shifting dramatically. Companies could once draw clear distinctions between the core of their business and extraneous IT work that could be outsourced. Now, with the shift to digital services and cloud computing, more and more companies view IT as integral to the transformation of their overall business. They're looking for higher-value services and more innovation than Indian IT companies have traditionally provided. Infosys's struggles with its core consulting revenue led to it declaring disappointing results last Friday.

Bengaluru's flagship companies are hardly unaware of this. Infosys has begun training its employees and board in “design thinking" -- a buzzword for prototype-driven innovation -- hoping this will help prepare them for a future in which they have to serve as all-around advisers for clients seeking to make their businesses fully digital. TCS says its revenue from such work is growing at 10 percent annually.

The problem is that these kind of projects don't require masses of low-priced engineers. TCS is hiring fewer people and laying off some.

A wave of job cutbacks could attract the baleful glare of the state. In a hangover from India's socialist past, the government has traditionally been overprotective of workers in the formal sector. While the roughly 3 million people who work in the IT industry are a tiny drop in India's billion-plus population, they account for a huge chunk of the organized labor market -- almost a quarter of the formal work force.

How will politicians and bureaucrats react to IT champions radically changing their operations, perhaps shrinking or even trying to move offshore? When some Indian airlines, as part of a necessary restructuring, tried to trim bloated bits of their work force a few years ago, the government pressured them into retreating. It's reasonable to fear that similar meddling might be in store for Indian IT.

http://www.bloomberg.com/view/articles/2016-07-17/job-cuts-could-br...

-

Comment by Riaz Haq on October 14, 2016 at 10:47pm

-

A Whiff of Scandal at Cognizant Systems as #Indian IT Slows Down. #H1B #BodyShop #India #technology http://thewire.in/72446/whiff-scandal-cognizant-cts-technology-syst... … via @thewire_in

New Delhi: Software services firm Cognizant, along with most of its peers in the broader Indian IT industry, hasn’t had a particularly great business year.

The New Jersey-based firm — which has four out of every five of its employees deployed in India — has downgraded its revenue forecast two times since January, starting from “between 10% and 14%” to “at-best 13%” and finally “around 8.5-9.5%”.

The company’s 2016 revenue forecast is not only sharply down from its growth last year (when it clocked a cool 15%), but is also its slowest pace of growth since 1997; which is when Cognizant as we know it today officially came into existence.

Adding to this is a potential scandal in the making. Two weeks ago, in an early morning Nasdaq notification, Cognizant announced that it had commenced an internal probe into whether “certain payments relating to facilities in India were made improperly and in possible violation of the US Foreign Corrupt Practices Act”.

The market’s reaction was swift: Cognizant’s shares closed down a little over 13% on the day of the stock exchange notification, wiping out nearly $4.5 billion off the company’s market value. Shareholder reaction was equally swift and similarly punishing, with a class-action lawsuit being filed against the company last week.

Cognizant, however, isn’t alone. Rivals Infosys and TCS have their own controversies they are grappling with — one stemming from a massive lawsuit over possible trade secret and IP violations and the other from a crisis of leadership.

Both Infosys and TCS have also slashed their own growth projections for this year. TCS in particular ended up backpedalling after announcing at first that there was nothing to worry, but then later expressing concern over demand from the BFSI sector, a massive vertical for most Indian IT companies.

“The stage is now set for what could be the worst second quarter performance in almost a decade. Revenues of the top five large cap companies are expected to grow by around 1.5% quarter on quarter. Consequently, Nasscom is likely to cut its 10-12% constant currency industry growth target as well, which it has been holding onto stubbornly,” the head of a large Mumbai-based brokerage, who declined to be identified, told The Wire.

What’s going wrong?

When financial headwinds have hit the IT industry in the past, CEOs trot out the usual suspects. Softening sectoral specific-demand, US elections, global protectionism, a particularly nasty dollar-rupee exchange rate and often whatever is the latest geo-economic event that could threaten business.

This time around, some of these factors are in play, although most of them haven’t had significant impact. BFSI (banking, financial services and insurance) sector clients are indeed pulling back on discretionary spending. The run-up to the US election has had Congress focusing (mostly unsuccessfully) on plugging H1B visa loopholes. Brexit is turning out be a minor spoilsport.

“Cyclical and seasonal factors like that are always taken into account at the CFO level and are seen as something that passes eventually. More fundamentally though, what is happening right now is that IT firms are being hit at both ends by the general reducing of their traditional bread-and-butter business and an inability to capture meaningful digital business,” a senior executive of blue-chip IT firm, who declined to be identified, told The Wire.

Digital business growth

Multiple analysts and executives across the IT industry The Wire spoke to offered up numerous examples of this two-punch blow.

-

Comment by Riaz Haq on October 14, 2016 at 10:47pm

-

#India's #startup bubble has already burst. #Modi #Achhedin http://cnnmon.ie/2dVGDWz via @CNNMoney

After a sustained funding frenzy, investor enthusiasm for the country's tech startups has fallen sharply this year. Weaker firms are laying off employees and some have closed up shop altogether.

Startup funding in the second quarter plummeted to $583 million from its recent peak of nearly $3 billion in late 2015, according to CB Insights. It's a sharp turnaround for a sector that attracted more than $8 billion last year.

"We've already felt the effects of what that bubble would be," said Arjun Malhotra, the co-founder of Indian startup incubator Investopad. "A lot of the companies that were high performing, they are crashing now."

The slowdown has occurred despite favorable conditions: The broader Indian economy is booming, and inflation is low. Global investors are on the hunt for the next Facebook (FB, Tech30) or Amazon (AMZN, Tech30).

With 1.3 billion citizens and a surplus of skilled IT workers, Indian startups proved irresistible to many investors. The success of homegrown e-commerce darlings Snapdeal and Flipkart, and ride-sharing app Ola, added credibility.

Yet there is a simple explanation for the reversal: Investors say India's tech sector experienced a classic bubble, similar to the one that rocked Silicon Valley when it burst in 1999.

"I think India is going through its first bubble," said Kashyap Deorah, a former Silicon Valley entrepreneur who now runs a startup in Delhi. "It is a bubble and it is normal."

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 3 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network