PakAlumni Worldwide: The Global Social Network

The Global Social Network

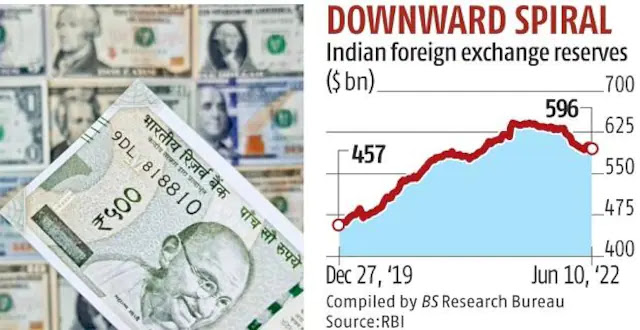

India's Forex Reserves Fall As Foreign Investors Head For The Exits

India's foreign exchange reserves are falling rapidly as foreign investors flee and the country's trade and current account deficits widen. More than $267 billion worth of India's external debt of the total $621 billion is due for repayment in the next nine months. This repayment is equivalent to about 44% of India's foreign exchange reserves. This combination of investors' exodus, widening twin deficits and short-term debt repayments has caused the Indian rupee to hit new lows. Unlike China and other nations that have accumulated large reserves by running trade surpluses, India runs perennial trade and current account deficits. The top contributor to India's forex reserves is debt which accounts for 48%. Portfolio equity investments known as “hot” money or speculative money flows account for 23% of India's forex reserves, according to an analysis published by The Hindu BusinessLine.

|

| India's Declining Forex Reserves. Source: Business Standard |

Investor Exodus:

Foreign portfolio investors have pulled out a whopping $33.5 billion from equity and $2.1 billion from debt segments of Indian financial markets, for a total net outflow of $35.6 billion from October 2021 to June 2022, according to data compiled by the National Securities Depository Limited. In the first half of this calendar year, the total net outflows were $29.7 billion.

It's not just the FPIs leaving India; a number of multinational companies are also pulling foreign direct investment (FDI) from India. Several big names including German retailer Metro AG, Swiss building-materials firm Holcim, US automaker Ford, UK banking major Royal Bank of Scotland, US motorcycle manufacturer Harley-Davidson and US banking behemoth Citibank have chosen to pull the plug on their operations in India or downsize their presence in recent years.

Widening Deficits:

India's finance ministry has warned of a growing twin deficit problem, with higher commodity prices and rising subsidy burden leading to an increase in both the fiscal and current account deficits. India's June trade deficit widened to a record high of $25.63 billion, mainly due to a rise in crude oil and coal imports, from $9.61 billion a year earlier. India's April-May fiscal deficit was $25.8 billion.

Summary:

India's current level of forex reserves is enough for less than 10 months of imports projected for 2022-23. But the country has had a structural current account deficit which has been funded by large capital inflows. The accumulation of forex reserves has been due to surplus in the capital account. Since late February, the foreign exchange reserves have declined by $36 billion. India still has large forex reserves but its economy is in the same boat as other emerging markets that run large and worsening trade and current account deficits. With declining forex reserves, India is likely to face headwinds as the US Federal Reserves raises interest rates to fight inflation.

Related Links:

Haq's Musings

South Asia Investor Review

India in Crisis: Unemployment and Hunger Persist After COVID waves

Food in Pakistan 2nd Cheapest in the World

Western Money Keeps Indian Economy Afloat

Pakistan to Become World's 6th Largest Cement Producer by 2030

How Has India Accumulated Large Forex Reserves Despite Perennial Tr...

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on July 19, 2022 at 12:51pm

-

#Indian #rupee touches another record low to 80.06 against #US dollar as foreign #investors pull out US $30 billion from the nation’s #StockMarket so far this year amid deteriorating current-account deficit & high #energy prices. #forex #Modi #BJP

https://finance.yahoo.com/news/india-rupee-drops-another-record-035...

The rupee declined to as low as 80.06 per dollar on Tuesday before reversing losses as traders cited possible central bank intervention. The currency has been buffeted by nearly $30 billion of foreign outflows from the nation’s equities so far this year -- a record sum -- and concerns over a deteriorating current-account deficit amid elevated oil and commodity prices.

India policymakers have sought to arrest the currency’s decline with a raft of measures -- from intervention to raising duties on gold imports -- with a weaker rupee adding to imported inflation pressures. Other emerging market currencies are also feeling the heat as a hawkish Federal Reserve lures capital toward the US.

“The risks for the rupee remain to weaken further,” said Dhiraj Nim, economist and FX strategist at Australia & New Zealand Banking Group Ltd. “Oil prices, especially, remain a bit volatile, while external headwinds on account of Fed tightening may continue. The trade imbalance also remains wide.”

India’s central bank sees the rupee as moving toward its fair value and will step in to sell dollars from its reserves when it assesses a genuine shortfall, according to people familiar with the matter. Traders cited RBI intervening in the forex market as the currency breached 80 to a dollar.

The currency has declined 7% this year as a shortfall in India’s current account -- the broadest measure of external finances -- will probably widen to 2.9% of gross domestic product in the fiscal year ending March 31, according to a Bloomberg survey in late June, nearly double the level seen in the previous year. The rupee ended little changed at 79.95 a dollar on Tuesday.

India’s central bank is for an orderly appreciation or depreciation in the currency and is intervening in all market segments to curb volatility, Governor Shaktikanta Das said earlier this month.

Strategists at Nomura Holdings Inc and Morgan Stanley continue to remain bearish on the rupee, forecasting the currency may decline to 82 to a dollar by September. Options pricing suggest that there is 67% probability for the rupee to decline to that level between now and end-December, up from 50% at the start of July.

The Reserve Bank of India has foreign-exchange reserves of almost $600 billion, which it has been deploying to protect the rupee. Authorities have raised duties on gold import and raised levies on petroleum exports. The monetary authority has also announced measures to draw more forex inflows into the country and allowed rupee settlement of trade.

-

Comment by Riaz Haq on July 20, 2022 at 1:56pm

-

#US #Dollar is Very Strong Against All Currencies, not Just #Pakistan's. Fortune 500 companies blame the strong US$ for disappointing earnings & lower forecasts: ‘The dollar might have even had a stronger quarter than we did, which is kind of amazing.’ https://fortune.com/2022/07/20/strong-us-dollar-usd-to-euro-corpora...

In earnings call after earnings call, U.S. corporate leaders are delivering the same warning—that the strong U.S. dollar will be a drag on their profits.

“The dollar might have even had a stronger quarter than we did, which is kind of amazing,” said Salesforce CEO Marc Benioff on the company's May 31 earnings call, explaining why the company was lowering its sales guidance.

During the company's second quarter earnings call on Monday, IBM CFO Jim Kavanaugh said it wasn't "immune" to the strong dollar, "especially when currencies move at the rate, breadth, and magnitude that we've seen." IBM said the strong dollar is likely to wipe $3.5 billion off its full-year revenue, sending shares 6.9% lower in early trading on Tuesday.

Netflix CFO Spencer Neumann on Tuesday told investors that "the strengthening of the U.S. dollar is a major outlier, and we just need to kind of work through that." Netflix blamed a strong dollar for their Q2 revenue growth coming in below its forecast; it reported an increase of 8.6% versus a forecast of 9.7%.

On Tuesday, pharmaceutical manufacturer Johnson & Johnson cut its full-year profit guidance, saying that the strong dollar might lower its sales overseas.

Microsoft also trimmed its revenue forecasts based on the strengthening dollar.

An analysis from Bloomberg found that references to “foreign exchange” in earnings calls have hit a three-year high this season.

USD to euro near parity

The U.S. dollar has gained against almost every other currency in recent months. It’s up 11% versus the euro so far this year, with the exchange rate between the two currencies hitting parity for the first time in 20 years. The USD is also up 13% against the British pound, 20% against the Japanese yen, and 6% against the Chinese renminbi. The U.S. Federal Reserve's interest rate hikes are helping drive up the value of the U.S. dollar, and traders are seeking safety in the U.S. dollar and U.S. assets amid geopolitical uncertainty.

The strong U.S. dollar is a windfall for some holders of the currency, like U.S. tourists on shopping sprees in Europe. But it can weigh on corporate earnings, especially at firms that do a sizable share of their business overseas.

Why is a strong USD bad for corporate earnings?

A strong USD makes U.S. manufactured goods more expensive overseas, so foreign buyers need more local currency to pay for the U.S.-made items they bring into other countries. The rising cost of U.S. goods in foreign currencies incentivizes importers to seek goods made elsewhere, disadvantaging U.S. manufacturers. U.S. companies may try to cut costs to keep their prices competitive and preserve their margins.

A strong dollar also deflates the value of revenue generated overseas once it's converted into U.S. dollars. That poor conversion rate can hit the bottom line of U.S. companies that do a lot of their business in foreign markets, like the U.S. tech sector, which generates 60% of its revenue in foreign markets, according to Goldman Sachs.

Together, these factors can exert a small but visible drag on corporate earnings. Credit Suisse estimates that a 8-10% increase in the dollar’s value leads to a 1% fall in U.S. corporate profits.

-

Comment by Riaz Haq on July 25, 2022 at 10:57am

-

A US Recession Will Also Come to India’s Tech Hub

Analysis by Andy Mukherjee | Bloomberg

https://www.washingtonpost.com/business/a-usrecession-will-also-com...

Look closer at the financial results of IT firms, and you’ll see signs of stagflation in plummeting profitability. Infosys managed to boost rupee earnings by just over 3% from a year earlier in the June quarter, even with nearly 24% revenue growth. A 20% EBIT margin — earnings before interest and tax as percentage of revenue — is a 3.6 percentage point drop year on year. In fact, it’s even worse than what the bellwether outsourcing firm was garnering immediately before the pandemic gave a big lift to the business.

At Infosys’s traditional Bengaluru rival, Wipro Ltd., the EBIT margin fell to its lowest since the September 2018 quarter. Partly that was because it signed up 15,000-plus net new employees, including 10,000 fresh graduates in three months through June 30. (Infosys bumped up its headcount by more than 20,000 during the same period.) But then again, competitor HCL Technologies Ltd., which hit the brakes by slashing quarterly net hiring by almost four-fifths to about 2,000, also saw a lower-than-expected EBIT margin of 17%, a multiyear low.

The margin at Tata Consultancy Services Ltd., the biggest Indian IT vendor, was better at 23.1%, but it was still 2.4 percentage points narrower than for the June quarter of 2021. TCS management has indicated that $7 billion to $9 billion worth of quarterly deal wins could be a sustainable rate. That’s “flattish” from a year-on-year growth basis, Nomura says.

Profitability might remain under pressure for the rest of this year — both because of a slowdown in the West, and the way the industry is structured in India. Offshoring is profitable, but the people it employs won’t stay on their jobs forever without onsite postings at client locations and dollar wages. With the pandemic over, travel and visa expenses are adding up. But the Indian vendors will struggle to get paid more — customers will cite the near-7% drop this year in the rupee as a reason to not bump up the dollar price of contracts. The exchange-rate advantage, however, will be insufficient to make up for the rising pressure of rupee costs.

For one thing, salary increases can’t be skimped on: TCS employs more than 600,000 people, but its attrition rate is almost touching 20%, more than double from a year earlier. Employee retention appears to be even more challenging at Infosys, where attrition surged past 28% in the June quarter. Startups that target India’s local e-commerce or fintech markets compete for the same programmers as the software exporters. While small, private-equity-funded firms are turning cautious about burning cash on payroll, an employers’ market for coding talent is perhaps a story for next year. With India’s domestic inflation rate at 7%, IT services firms have little scope for belt-tightening on wage costs.

Ultimately, all of them will resort to “pyramiding” to protect their margins. It basically means putting a lot of inexperienced code-writers under an experienced project manager and hoping that the client will still come out happy. But since rookies’ productivity has its limits, the more complicated programming will have to be sub-contracted to smaller vendors. The costs of doing that are rising as well.

-

Comment by Riaz Haq on July 30, 2022 at 5:57pm

-

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-citizens-will-divide-india-raghuram-rajan-3209792

Former Reserve Bank of India Governor Raghuram Rajan on Saturday said India's future lies in strengthening liberal democracy and its institutions as it is essential for achieving economic growth.

Warning against majoritarianism, he said Sri Lanka was an example of what happens when a country's politicians try to deflect a job crisis by targeting minorities.

Speaking at the 5th conclave of All India Professionals Congress, a wing of the Congress party, in Raipur, he said any attempt to turn a large minority into "second class citizens" will divide the country.

Mr Rajan was speaking on the topic 'Why liberal democracy is needed for India's economic development'.

".What is happening to liberal democracy in this country and is it really that necessary for Indian development? ... We absolutely must strengthen it. There is a feeling among some quarters in India today that democracy holds back India ... India needs strong, even authoritarian, leadership with few checks and balances on it to grow and we seem to be drifting in this direction," Mr Rajan said.

"I believe this argument is totally wrong. It's based on an outdated model of development that emphasizes goods and capital, not people and ideas," said the former chief economist of the International Monetary Fund.

The under-performance of the country in terms of economic growth "seems to indicate the path we are going on needs rethinking," he said.

The former RBI governor further said that "our future lies in strengthening our liberal democracy and its institutions, not weakening them, and this is in fact essential for our growth."

Elaborating on why majoritarian authoritarianism must be defeated, he said any attempt to "make second class citizens of a large minority will divide the country and create internal resentment." It will also make the country vulnerable to foreign meddling, Me Rajan added.

Referring to the ongoing crisis in Sri Lanka, he said the island nation was seeing the "consequences when a country's politicians try to deflect from the inability to create jobs by attacking a minority." This does not lead to any good, he said.

Liberalism was not an entire religion and the essence of every major religion was to seek out that which is good in everyone, which, in many ways, was also the essence of liberal democracy, Mr Rajan said.

Claiming that India's slow growth was not just due to the COVID-19 pandemic, Mr Rajan said the country's underperformance predated it.

"Indeed for about a decade, probably since the onset of the global financial crisis, we haven't been doing as well as we could. The key measure of this underperformance is our inability to create the good jobs that our youth need," the former RBI governor said.

-

Comment by Riaz Haq on July 30, 2022 at 5:58pm

-

Ex #RBI Gov R. Rajan: Turning #Muslims Into "2nd Class Citizens" Will Divide #India. Warning against majoritarianism, he cited #SriLanka as an example of what happens when politicians try to deflect a job crisis by targeting minorities. #Modi #Islamophobia https://www.ndtv.com/india-news/turning-minority-into-2nd-class-citizens-will-divide-india-raghuram-rajan-3209792

Citing the strident protests against the Centre's 'Agniveer' military recruitment scheme, Mr Rajan said it suggested how hungry the youths were for jobs.

"Just a while ago you saw 12.5 million applicants for 35,000 railway jobs. It is particularly worrisome when India has a scarcity of jobs even when so many women are not working outside their homes. India's female labour force participation is among the lowest in G-20 at 20.3 percent as in 2019," he pointed out.

Talking about the "vision of growth" of the current government led by Prime Minister Narendra Modi, he said it centres around the term 'atmanirbhar' or self-reliance.

"Now, to the extent it emphasizes better connectivity, better logistics, better roads and devotes more resources to it, in some way this (atmanirbhar vision) seems the continuation of the past reformed decades. And that's good," he said.

But, the former RBI governor said, in many ways a look at what 'atmanirbhar' is trying to achieve takes one back to an early and failed past where the focus was on physical capital and not human capital, on protection and subsidies and not on liberalization, on choosing favourites to win rather than letting the most capable succeed.

Asserting that there was a misplaced sense of priorities, Mr Rajan said the nation was not spending enough on education, with tragic consequences.

"Many (children) not having been to school for two years are dropping out. Their human capital, which is their and our most important asset in the coming years, is something we are neglecting. We are failing them by not devoting enough resources to remedial education," Mr Rajan said.

-

Comment by Riaz Haq on July 30, 2022 at 6:00pm

-

Kaushik Basu

@kaushikcbasu

IMF's just-released World Economic Outlook shows, over 3 years, 2020-2, India's annual growth is 2.9%, behind China (4.5%) & low-income country average (3.1%). This is not where India was; its economy has enough strength. This is the price of divisive politics & erosion of trust.https://twitter.com/kaushikcbasu/status/1552926615662985216?s=20&am...

-

Comment by Riaz Haq on August 2, 2022 at 7:48am

-

#India’s #Trade #Deficit Widens to Record On Costly Imports, Weak #Rupee. The gap between #exports and #imports widened to $31.02 billion in July, from $26.18 billion in June. #Modi #BJP #Economy #Inflation #Currency #Forex https://www.bloomberg.com/news/articles/2022-08-02/india-s-trade-ga...

India’s trade deficit ballooned to a record high in July, as elevated commodity prices and a weak rupee inflated the country’s import bill.

The gap between exports and imports widened to $31.02 billion in July, from $26.18 billion in June, B.V.R Subrahmanyam, India’s trade secretary, told reporters at a briefing in New Delhi Tuesday, citing preliminary data. The trade deficit in June was a record before the latest numbers were released.

-

Comment by Riaz Haq on August 3, 2022 at 7:55am

-

Record #trade deficit adds to #India's external balance challenges, #Indian currency woes. QuantEco Research revised their CAD projections for India higher for the current fiscal year to $130 billion from $105 billion. #Forex #INRUSD #economy #deficit https://www.reuters.com/world/india/record-trade-deficit-adds-india...

India's record high trade deficit in July signals a further deterioration in the country's external balances, which is likely to keep the rupee under pressure, analysts said on Wednesday.

Trade deficit in Asia's third largest economy widened to an all-time high of $31 billion, data on Tuesday showed, prompting concerns about the country's ability to fund its current account deficit and hurting the outlook for the rupee.

"I think after looking at the July trade deficit, we need to re-work on our CAD and BoP number, and thus the view on the rupee", Vikas Bajaj, head of currency derivatives at Kotak Securities, said.

Bajaj pointed out that until now the market consensus for India's current account deficit (CAD) was around $100 billion for the current fiscal year ending in March.

"But this definitely looks out of whack after July's trade number," he said.

In a note on Wednesday, QuantEco Research revised their CAD projections higher for the current fiscal year to $130 billion from $105 billion and the balance of payments (BoP) estimate to $60 billion from $35 billion.

The partially convertible rupee was trading at 79.02 per U.S. dollar in afternoon trade, 0.4% weaker on the day. On Tuesday, the unit had touched 78.49, its highest level since June 28. The local currency hit a record low of 80.0650 on July 19.

Vivek Kumar, a economist at QuantEco, said the recent recovery in the rupee from 80 will prove to be temporary and expects the local unit to fall to 81 to the dollar in the current fiscal year.

Bajaj said the recovery on the rupee was "broadly done" and that the currency "should once again see slow and steady move towards 80+ levels".

-

Comment by Riaz Haq on August 5, 2022 at 7:47am

-

#India, #SriLanka, #Pakistan #debt woes evoke memories of 1997 #Asian currency crisis. Back then, #Thailand’s devaluation led to a #global #market collapse. A sequel might be in the works. #PKR #INR #inflation #economy #rupee https://www.bloomberg.com/news/articles/2022-08-03/india-sri-lanka-...

Pakistan is scrambling for a bailout to avert a debt default as its currency plummets. Bangladesh has sought a preemptive loan from the International Monetary Fund. Sri Lanka has defaulted on its sovereign debt and its government has collapsed. Even India has seen the rupee plunge to all-time lows as its trade deficit balloons.

Economic and political turbulence is rattling South Asia this summer, drawing chilling comparisons to the turmoil that engulfed neighbors to the east a quarter century ago in what became known as the Asian Financial Crisis.

-

Comment by Riaz Haq on August 29, 2022 at 7:11am

-

#India's status as world's fastest growing major #economy to be short-lived. It will decelerate to 4.5% in October-December 2022.The nation is grappling with persistently high #unemployment and #inflation - Reuters poll. #Modi #Hindutva https://finance.yahoo.com/news/indias-status-worlds-fastest-growing... via @YahooFinance

By Arsh Tushar Mogre

BENGALURU (Reuters) - India likely recorded strong double-digit economic growth in the last quarter but economists polled by Reuters expected the pace to more than halve this quarter and slow further toward the end of the year as interest rates rise.

Asia's third-largest economy is grappling with persistently high unemployment and inflation, which has been running above the top of the Reserve Bank of India's tolerance band all year and is set to do so for the rest of 2022.

Growth this quarter is predicted to slow sharply to an annual 6.2% from a median forecast of 15.2% in Q2, supported mainly by statistical comparisons with a year ago rather than new momentum, before decelerating further to 4.5% in October-December.

- ADVERTISEMENT -

The median expectation for 2022 growth was 7.2%, according to an Aug. 22-26 Reuters poll, but economists said that the solid growth rate masks how rapidly the economy was expected to slow in coming months.

"Even as India remains the fastest-growing major economy, domestic consumption will perhaps not be strong enough to drive growth further as unemployment remains high and real wages are at a record low level," said Kunal Kundu, India economist at Societe Generale.

"By supporting growth through investment, the government has only fired on one engine while forgetting about the impetus which domestic consumption provides. This is why India's growth is still below its pre-pandemic trend."

The economy has not grown fast enough to accommodate some 12 million people joining the labour force each year.

Meanwhile the RBI, a relative laggard in the global tightening cycle, is set to raise its key repo rate by another 60 basis points by the end of March to try to bring inflation within the tolerance limit. [ECILT/IN]

That follows three interest rate rises this year totalling 140 basis points, and would take the repo rate to 6.00% by end-Q1 2023.

While the central bank's mandated target band is 2%-6%, inflation was expected to average 6.9% and 6.2% this quarter and next, respectively, before falling just below the top end of the range to 5.8% in Q1 2023. That is roughly in line with the central bank's projection.

"Despite signs of a cool-off in price pressures ... it is premature to go easy on the inflation fight given considerable uncertainties from geopolitical risks and hard landing risks in major economies," said Radhika Rao, senior economist at DBS.

The economy is also enduring inflation pressure from a weak rupee, which for months has been trading close to 80 to the U.S. dollar, a level the central bank has been defending in currency markets by selling dollar reserves.

The latest Reuters poll also showed India's current account deficit swelling to 3.1% of gross domestic product this year, the highest in at least a decade, which may put further pressure on the currency.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 7 Comments

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network