PakAlumni Worldwide: The Global Social Network

The Global Social Network

India's Economy Grew Only 0.2% Annually in the Last Two Years

The Indian government has reported an 8.4% jump in economic growth in the July-to-September period compared with a contraction of 7.4% for the same period a year earlier. The average GDP growth in India over the last two years has averaged just 0.2% per year. The news appears to indicate strong recovery after a big economic hit suffered from the COVID pandemic since early 2020. Pakistan's economy fared relatively better during the pandemic. Pakistan's GDP rose 0.5% in 2020 and 3.9% in 2021. As a result, Pakistan now fares better than India on multiple indices including Hanke Misery Index, World Happiness Index, Food Affordability Index and World Hunger Index.

India's Economy:

Welcoming the news, renowned Indian economist Kaushik Basu tweeted: "India's growth of 8.4% over Jul-Sep is welcome news. But it'll be injustice to India if we don't recognize, when this happens after -7.4% growth, it means an annual growth of 0.2% over 2 years. This is way below India's potential. India has fundamental strength to do much better".

|

| Indian Economist Kaushik Basu's Tweet |

Indian-American Nobel Laureate economist Abhijit Banerjee, too, spoke out in agreement. He said, "I think that we (Indians) are in a moment of great pain. The economy is still well below as against what it was in 2019". "We don't know how much below, but it is substantially below. And I am not blaming anybody, I am just saying", he added.

India's Rising Public Debt:

India's debt to gdp ratio is nearing 90%, the highest in the South Asia region. It has risen by 17% in the last two years, the most of any emerging economy. By contrast, Pakistan's debt to GDP ratio has increased by a mere 1.6% to 87.2% from 2019 to 2020.

|

| India's Rising Debt. Source: Business Standard |

The International Monetary Fund (IMF) has projected the Indian government debt, including that of the center and the states, to rise to a record 90.6% of gross domestic product (GDP) during 2021-22 against 89.6% in the previous year. By contrast, the percentage of Pakistan's public debt to Gross Domestic Product (GDP) including debt from the International Monetary Fund, and external and domestic debt has fallen from 87.6% in Fiscal Year (FY) 2019-20 to 83.5% in FY 2020-21.

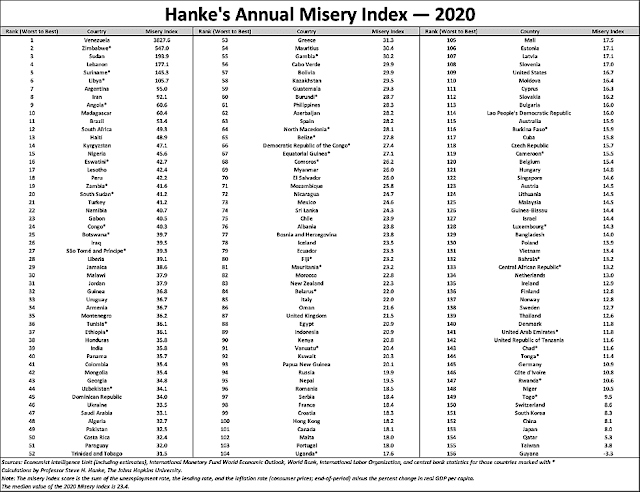

Hanke's Misery Index:

Pakistanis are less miserable than Indians in the economic sphere, according to the Hanke Annual Misery Index (HAMI) published in early 2021 by Professor Steve Hanke. With India ranked 49th worst and Pakistan ranked 39th worst, both countries find themselves among the most miserable third of the 156 nations ranked. Hanke teaches Applied Economics at Johns Hopkins University in Baltimore, Maryland. Hanke explains it as follows: "In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. The surefire way to mitigate that misery is through economic growth. All else being equal, happiness tends to blossom when growth is strong, inflation and interest rates are low, and jobs are plentiful". Several key global indices, including misery index, happiness index, hunger index, food affordability index, labor force participation rate, ILO’s minimum wage data, all show that people in Pakistan are better off than their counterparts in India. The rankings for the two South Asian nations are supported by other indices such as the World Bank Labor Participation data, International Labor Organization Global Wage Report, World Happiness Report, Food Affordability Index and Global Hunger Index.

|

| Hanke's Annual Misery Index 2021. Source: National Review |

Employment and Wages:

Labor force participation rate in Pakistan is slightly above 50% during this period, indicating about a 2% drop in 2020. Even before COVID pandemic, there was a steep decline in labor force participation rate in India. It fell from 52% in 2014 to 47% in 2020.

|

| Labor Force Participation Rates in Pakistan (Top), India (bottom). ... |

The International Labor Organization (ILO) Global Wage Report 2021 indicates that the minimum wage in Pakistan is the highest in South Asia region. Pakistan's minimum monthly wage of US$491 in terms of purchasing power parity while the minimum wage in India is $215. The minimum wage in Pakistan is the highest in developing nations in Asia Pacific, including Bangladesh, India, China and Vietnam, according to the International Labor Organization.

|

| Monthly Minimum Wages Comparison. Source: ILO |

Global Food Security:

|

| History of Inflation in Pakistan. Source: Statista |

|

| Hunger Trends in South Asia. Source: Global Hunger Index |

Amid the COVID19 pandemic, Pakistan's World Happiness ranking has dropped from 66 (score 5.693) among 153 nations last year to 105 (score 4.934) among 149 nations ranked this year. Neighboring India is ranked 139 and Afghanistan is last at 149. Nepal is ranked 87, Bangladesh 101, Pakistan 105, Myanmar126 and Sri Lanka129. Finland retained the top spot for happiness and the United States ranks 19th.

|

| Pakistan Happiness Index Trend 2013-2021 |

One of the key reasons for decline of happiness in Pakistan is that the country was forced to significantly devalue its currency as part of the IMF bailout it needed to deal with a severe balance-of-payments crisis. The rupee devaluation sparked inflation, particularly food and energy inflation. Global food prices also soared by double digits amid the coronavirus pandemic, according to Bloomberg News. Bloomberg Agriculture Subindex, a measure of key farm goods futures contracts, is up almost 20% since June. It may in part be driven by speculators in the commodities markets. These rapid price rises have hit the people in Pakistan and the rest of the world hard. In spite of these hikes, Pakistan remains among the least expensive places for food, according to recent studies. It is important for Pakistan's federal and provincial governments to rise up to the challenge and relieve the pain inflicted on the average Pakistani consumer.

Pakistan's Real GDP:

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on October 4, 2022 at 9:06pm

-

Kaushik Basu

@kaushikcbasu

India’s doing very poorly in terms of job creation. I’m not sure why but my conjecture is: An economy’s biggest driver is the investment rate. This has fallen sharply in India from 39.3% in 2009 to 30.7% in 2019 (GOI data). Why are people not investing? That’s the next question.https://twitter.com/kaushikcbasu/status/1577481003865722881?s=20&am...

-

Comment by Riaz Haq on November 21, 2022 at 8:19am

-

India's growth to slow in 2023 on fading reopening impact-Goldman Sachs

https://www.reuters.com/world/india/indias-growth-slow-2023-fading-...

Goldman Sachs expects India's economic growth to slow to 5.9% next year, from an estimated 6.9% growth in 2022, as the boost from the post-COVID reopening fades and monetary tightening weighs on domestic demand.

"We expect growth to be a tale of two halves in 2023, with a slowdown in the first half (due to dwindling reopening effects)," Santanu Sengupta, India economist at Goldman Sachs, said in a note on Sunday.

India's growth in the seven months since March 2022, which Goldman Sachs considers the post-COVID reopening, was faster than most other emerging markets in the first seven months after they reopened, the U.S. investment bank said.

"In the second half, we expect growth to re-accelerate as global growth recovers, the net export drag declines, and the investment cycle picks up," Sengupta said.

The Reserve Bank of India (RBI), last week, pegged the domestic growth rate at 7% for 2022-23.

Sengupta expects the government to continue its focus on capital spending and sees signs of the nascent investment recovery continuing, with conducive conditions helping the economy pick up in the second half.

Goldman Sachs expects headline inflation to drop to 6.1% in 2023, from 6.8% in 2022, saying government intervention was likely to cap food prices and that core goods inflation had probably peaked.

"But upside risks to services inflation are likely to keep core inflation sticky around 6% year-on-year," Sengupta added.

Goldman expects the RBI to hike the repo rate by 50 basis points (bps) in December 2022 and by 35 bps in February, taking the repo rate to 6.75%. The forecast is more hawkish than the market consensus of 6.50%.

On India's external position, Sengupta reckons the worst is over, with the dollar likely near the peak. He expects the current account deficit to remain wide due to weak exports, but said growth capital may continue to chase India.

Sengupta pegs the USD/INR INR=IN at 84, 83, and 82 over 3-, 6- and 12-month horizons, respectively, compared with 81.88 currently.

-

Comment by Riaz Haq on July 5, 2023 at 7:22am

-

India’s GDP gap with US, China is widening alarmingly

Claims and speculations about the US going into a recession and India being an economic bright star are highly exaggerated

by SUBHASH CHANDRA GARG, Ex Finance Secretary of India

https://www.deccanherald.com/amp/opinion/india-s-gdp-gap-with-us-ch...

The International Monetary Fund (IMF)’s GDP database shows that the world GDP crossed $100 trillion, in current US dollars, in 2022: it was for the first time ever. The global GDP was about $34 trillion at the turn of the century. This milestone is momentous: global GDP trebled in 20 years.

In 2019, a year before Covid-19 pandemic, global GDP was a little over $87 trillion, with the United States’s GDP amounting to $21.38 trillion, China’s amounting to $14.34 trillion, and India’s GDP amounting to $2.84 trillion.

Off late there is a lot of brouhaha about the US economy falling into recession, whereas India registering world-beating GDP growth. The facts, however, are not sanguine.

For 2022, three years after all the Covid-19 disruptions, the US GDP has grown to $25.46 trillion, China’s GDP to $18.1 trillion, and India’s GDP to $3.39 trillion.

The US and China have added GDP of $4.08 trillion and $3.76 trillion respectively in these three years. At the same time, India could add only $0.55 trillion. Both the US and China have added more than India’s 2022-23 GDP ($3.39 trillion) during this period.

Given this, are we ratcheting up our GDP growth to catch up with the US and China, or is India’s GDP gap with the US and China widening uncomfortably?

Double depreciation of rupee

We all see INR-USD in terms of nominal exchange rates. Roughly Rs 69 equalled $1 on December 31, 2019. On December 31, 2022, it required nearly Rs 83 to get $1. The INR depreciated by about Rs 14 (or 20 per cent) in these three years. The nominal GDP, though boosted by Indian inflation, is reduced by INR’s depreciation.

There is another factor — the US inflation — the effect of which, however, usually gets missed out. The US’s real GDP growth is worked out after adjusting the USD for inflation. The US’s GDP was $21.38 trillion in 2019. If we were to account the inflation adjusted real US growth, a contraction by -2.8 per cent would bring down the US’s real GDP to $20.78 trillion in 2020, the 5.9 per cent growth in 2021 will take it to $22.01 trillion, and the 2.1 per cent growth in 2022 will make real US GDP amount to $22.47 trillion. This, however, is not done. The US’s GDP is stated by the IMF in current US dollars.

Therefore, to compare apples with apples to assess India’s relative performance, India’s GDP of $2.67 trillion (in 2020-21), $3.15 trillion (in 2021-22) and $3.39 trillion (in 2022-23) needs to be juxtaposed against the US’s nominal GDP of $21.06 trillion (in 2020), $23.06 trillion (in 2021) and $25.46 trillion (in 2022) and not the inflation adjusted real GDP.

Measuring the US’s GDP in current dollars dramatically transforms its low GDP growth during 2019-2022 from 1.67 per cent in real terms to a quite high growth of 5.99 per cent. India’s GDP growth at 6.08 per cent during this period looks impressive against the US’s real GDP growth of 1.67 per cent, but not so great compared to the 5.99 per cent growth in current US dollars.

The Chinese yuan did not depreciate much against the US dollar during this period, thereby delivering a robust GDP growth of 8.07 per cent per annum — which is much higher than India’s growth.

The truth is, not catching up, but the GDP gap is only widening.

A bright spot?

A few days back, Finance Minister Nirmala Sitharaman, in a boast-like now-deleted post, termed India a bright star again having become a $3.75 trillion economy — the fifth largest.

The IMF has projected India’s GDP to grow to $3.75 trillion in 2023-24. There are nine months still to go in FY 2023-24. Let us look at IMF’s numbers to see how bright is India’s star shining.

-

Comment by Riaz Haq on July 5, 2023 at 7:23am

-

India’s GDP gap with US, China is widening alarmingly

Claims and speculations about the US going into a recession and India being an economic bright star are highly exaggerated

by SUBHASH CHANDRA GARG, Ex Finance Secretary of India

https://www.deccanherald.com/amp/opinion/india-s-gdp-gap-with-us-ch...

India’s GDP, in current US dollars, was $1.86 trillion in 2013-14; it grew to $3.39 trillion in 2022-23. Our annual compounded GDP growth for the period 2013-2022 turns out to be 6.9 per cent; and is at 5.85 per cent during the four years between 2018-19 and 2022-23.

India’s annual compounded GDP growth from 1990-91, the year after the economic reforms began, to 2013-14, the year before the Narendra Modi-led Bharatiya Janata Party (BJP) came to power, was 7.81 per cent over a 23-year period. It might not please Sitaraman to know that India’s compounded dollar GDP growth between 2003-04 ($0.52 trillion) and 2013-14 ($1.86 trillion) was much higher at 13.59 per cent!

Against this backdrop, India’s last 4-year GDP growth of 5.85 per cent does not look exceptionally bright.

Tough policy reforms

There is an unnecessary attempt from various quarters to claim and project that the economic performance under this government has been exceptional, whereas the facts are quite on the contrary.

Instead of this misleading projection, it will do India’s economic prospects good if the focus is on real and tough policy reforms to raise the GDP growth to levels of 8-10 per cent per annum for the next 20-25 years to make India a real bright star and to serve the people well.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Silicon Valley Helping Build Pakistan's Human Capital

Last week I attended a Silicon Valley fundraiser by iCodeGuru, a Pakistani-American group focusing on arranging training and guiding young men and women from underprivileged backgrounds to get full scholarships for advanced STEM (Science, Technology, Engineering and Mathematics) degrees at universities in America. The well-attended event held at Chandni restaurant raised over…

ContinuePosted by Riaz Haq on February 25, 2025 at 10:00am — 2 Comments

US-India Ties: Strategic or Transactional?

During the last Trump Administration in 2019, India's friends in Washington argued for a US policy of "strategic altruism" with India. The new Trump administration seems to be rejecting such talk. Prior to his recent meeting with Prime Minister Narendra Modi at the White House, President Donald Trump described India as the "worst abuser of tariffs" and announced "reciprocal tariffs" on Indian…

ContinuePosted by Riaz Haq on February 19, 2025 at 10:00am — 4 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network