PakAlumni Worldwide: The Global Social Network

The Global Social Network

India's Economy Grew Only 0.2% Annually in the Last Two Years

The Indian government has reported an 8.4% jump in economic growth in the July-to-September period compared with a contraction of 7.4% for the same period a year earlier. The average GDP growth in India over the last two years has averaged just 0.2% per year. The news appears to indicate strong recovery after a big economic hit suffered from the COVID pandemic since early 2020. Pakistan's economy fared relatively better during the pandemic. Pakistan's GDP rose 0.5% in 2020 and 3.9% in 2021. As a result, Pakistan now fares better than India on multiple indices including Hanke Misery Index, World Happiness Index, Food Affordability Index and World Hunger Index.

India's Economy:

Welcoming the news, renowned Indian economist Kaushik Basu tweeted: "India's growth of 8.4% over Jul-Sep is welcome news. But it'll be injustice to India if we don't recognize, when this happens after -7.4% growth, it means an annual growth of 0.2% over 2 years. This is way below India's potential. India has fundamental strength to do much better".

|

| Indian Economist Kaushik Basu's Tweet |

Indian-American Nobel Laureate economist Abhijit Banerjee, too, spoke out in agreement. He said, "I think that we (Indians) are in a moment of great pain. The economy is still well below as against what it was in 2019". "We don't know how much below, but it is substantially below. And I am not blaming anybody, I am just saying", he added.

India's Rising Public Debt:

India's debt to gdp ratio is nearing 90%, the highest in the South Asia region. It has risen by 17% in the last two years, the most of any emerging economy. By contrast, Pakistan's debt to GDP ratio has increased by a mere 1.6% to 87.2% from 2019 to 2020.

|

| India's Rising Debt. Source: Business Standard |

The International Monetary Fund (IMF) has projected the Indian government debt, including that of the center and the states, to rise to a record 90.6% of gross domestic product (GDP) during 2021-22 against 89.6% in the previous year. By contrast, the percentage of Pakistan's public debt to Gross Domestic Product (GDP) including debt from the International Monetary Fund, and external and domestic debt has fallen from 87.6% in Fiscal Year (FY) 2019-20 to 83.5% in FY 2020-21.

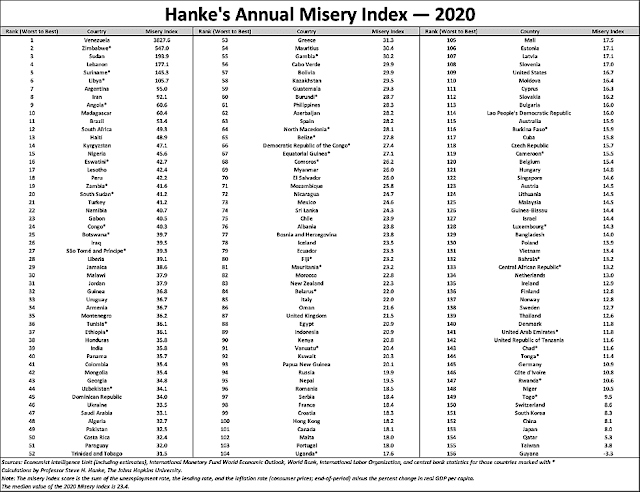

Hanke's Misery Index:

Pakistanis are less miserable than Indians in the economic sphere, according to the Hanke Annual Misery Index (HAMI) published in early 2021 by Professor Steve Hanke. With India ranked 49th worst and Pakistan ranked 39th worst, both countries find themselves among the most miserable third of the 156 nations ranked. Hanke teaches Applied Economics at Johns Hopkins University in Baltimore, Maryland. Hanke explains it as follows: "In the economic sphere, misery tends to flow from high inflation, steep borrowing costs, and unemployment. The surefire way to mitigate that misery is through economic growth. All else being equal, happiness tends to blossom when growth is strong, inflation and interest rates are low, and jobs are plentiful". Several key global indices, including misery index, happiness index, hunger index, food affordability index, labor force participation rate, ILO’s minimum wage data, all show that people in Pakistan are better off than their counterparts in India. The rankings for the two South Asian nations are supported by other indices such as the World Bank Labor Participation data, International Labor Organization Global Wage Report, World Happiness Report, Food Affordability Index and Global Hunger Index.

|

| Hanke's Annual Misery Index 2021. Source: National Review |

Employment and Wages:

Labor force participation rate in Pakistan is slightly above 50% during this period, indicating about a 2% drop in 2020. Even before COVID pandemic, there was a steep decline in labor force participation rate in India. It fell from 52% in 2014 to 47% in 2020.

|

| Labor Force Participation Rates in Pakistan (Top), India (bottom). ... |

The International Labor Organization (ILO) Global Wage Report 2021 indicates that the minimum wage in Pakistan is the highest in South Asia region. Pakistan's minimum monthly wage of US$491 in terms of purchasing power parity while the minimum wage in India is $215. The minimum wage in Pakistan is the highest in developing nations in Asia Pacific, including Bangladesh, India, China and Vietnam, according to the International Labor Organization.

|

| Monthly Minimum Wages Comparison. Source: ILO |

Global Food Security:

|

| History of Inflation in Pakistan. Source: Statista |

|

| Hunger Trends in South Asia. Source: Global Hunger Index |

Amid the COVID19 pandemic, Pakistan's World Happiness ranking has dropped from 66 (score 5.693) among 153 nations last year to 105 (score 4.934) among 149 nations ranked this year. Neighboring India is ranked 139 and Afghanistan is last at 149. Nepal is ranked 87, Bangladesh 101, Pakistan 105, Myanmar126 and Sri Lanka129. Finland retained the top spot for happiness and the United States ranks 19th.

|

| Pakistan Happiness Index Trend 2013-2021 |

One of the key reasons for decline of happiness in Pakistan is that the country was forced to significantly devalue its currency as part of the IMF bailout it needed to deal with a severe balance-of-payments crisis. The rupee devaluation sparked inflation, particularly food and energy inflation. Global food prices also soared by double digits amid the coronavirus pandemic, according to Bloomberg News. Bloomberg Agriculture Subindex, a measure of key farm goods futures contracts, is up almost 20% since June. It may in part be driven by speculators in the commodities markets. These rapid price rises have hit the people in Pakistan and the rest of the world hard. In spite of these hikes, Pakistan remains among the least expensive places for food, according to recent studies. It is important for Pakistan's federal and provincial governments to rise up to the challenge and relieve the pain inflicted on the average Pakistani consumer.

Pakistan's Real GDP:

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on December 6, 2021 at 7:11am

-

India’s super growth journey high on debt

https://www.dailypioneer.com/2021/columnists/india---s-super-growth...

India joins the world aiming for a super growth on a high debt and infra push for an economic panacea.

India’s heavy investment over Rs 233.08 lakh crore investment in infrastructure, including Rs 10,500-crore Jewar airport adjacent to Delhi, is officially expected to give a major boost to the economy.

India is not alone. The entire world is trying to do that. The result is hyper-growth in world debt to $226 trillion. In its 2021 Fiscal Monitor report, the IMF said India’s debt increased from 68.9 per cent of its GDP in 2016 to 89.6 per cent in 2020. It is projected to jump to 90.6 per cent in 2021 and then decline to 88.8 per cent in 2022, to gradually reach 85.2 per cent in 2026.

Jewar has accelerated a process of development in UP with an eye on the state elections. It may make this part of the National Capital Region one of the most crowded places inviting large number of migrants that may stretch local resources.

The severe crash in the stock market has added a new concern. The nation hopes to fly on expectations but airport projects, high altitude Himalayan development, large-scale tree felling and acquisition of farm lands raise ecological concerns. But a nation striving hard to come out of the Coronavirus pandemic is looking for faster development so that there is cash flow.

The Government expanded the ‘National Infrastructure Pipeline (NIP)’ to 7,400 projects. According to Department of Industry and internal Trade, 217 projects worth Rs. 1.10 lakh crore ($ 15.09 billion) were completed as of 2020. Through the NIP, the government invested $ 1.4 trillion in infrastructure development as of July 2021.

However, the more investment is made in infrastructure, the more the nation’s cost to deliver. Unless there is an overall growth in activities — from industry to agriculture — the benefits become expensive to afford.

The IMF says that constraints on financing are particularly severe for poorer countries. Noting that in 2020, fiscal policy proved its worth, IMF director for fiscal affairs Vitor Gasper says the increase in public debt in 2020 was fully justified by the need to respond to COVID-19 and its economic, social, and financial consequences. But the increase is expected to be one-off, he said. So how to bring down the debt is the question. Debt dynamics are driven by a strong contribution from nominal GDP growth, accompanied by a much more gradual reduction in the primary deficit, he said.

The IMF said risks to the fiscal outlook are elevated. This calls for India to review its policies. Let us not forget that the 2007-08 global meltdown followed an unsustainable financial behaviour.

The results would be high inflationary tendencies that would add to costs further and create an unstable global economy leading to more conflicts. India’s inflation has risen to 12.5 per cent. Prices are rising, wages too would be rising and a cycle of inflation may continue.

This is also being seen in a regime of high taxations and high penalties on cars and car uses across the country. The silliest is the clampdown on outside state registered vehicles in Bihar, and HSRP plates. These are ignored as small issues but these small things are making lives of people difficult. User charges are being recklessly increased. At some private railway stations, parking charges are going through the roof. Ostensibly, nobody can be blamed as ‘the prices are rising’ but that needs a holistic review.

The IMF projects growth at 9.5 per cent in FY2021-22 and 8.5 per cent in FY2022-23. Headline inflation sees elevated price pressures. The contraction in economic activity, lower revenue, and pandemic-related support measures are estimated to have led to a widening of the fiscal deficit to 8.6 and 12.8 per cent of GDP in FY2020-21 for the central and state governments, respectively.

-

Comment by Riaz Haq on December 6, 2021 at 7:12am

-

India ranks 10th most indebted as a net debtor nation

https://en.wikipedia.org/wiki/List_of_debtor_nations_by_net_interna...

----------------

Debtor Nation Definition

https://www.investopedia.com/terms/d/debtor_nation.asp

One major way in which America's status as a global debtor manifests visibly is the availability of inexpensive manufacturing capabilities in China, as more and more U.S.-based businesses spend vast amounts of money in China for that purpose. Another major contributor is the large amount of U.S. debt held by China in the form of Treasury bonds. Other debtor nations include Greece, Spain, Portugal, Brazil, and India.

-

Comment by Riaz Haq on December 6, 2021 at 7:34am

-

Global debt jumps to $226 trillion, India’s dues projected to rise to 90.6% in 2021 — IMF

https://theprint.in/economy/global-debt-jumps-to-226-trillion-india...

In its 2021 Fiscal Monitor report, the IMF said India’s debt increased from 68.9 per cent of its GDP in 2016 to 89.6 per cent in 2020. It is projected to jump to 90.6 per cent in 2021 and then decline to 88.8 per cent in 2022, to gradually reach 85.2 per cent in 2026.

Constraints on financing are particularly severe for poorer countries, Gasper said. Noting that in 2020, fiscal policy proved its worth, he said the increase in public debt, in 2020, was fully justified by the need to respond to COVID-19 and its economic, social, and financial consequences. But the increase is expected to be one-off, he said.

Gasper said debt is expected to decline this year and next by about 1 percentage point of GDP per year.

-

Comment by Riaz Haq on December 6, 2021 at 10:17am

-

#Economic distress from #India’s #coronavirus #lockdowns has created a #hunger crisis. In the 2021 Global Hunger Index released in October, India ranked 101st of the 116 countries surveyed, falling seven spots from the previous year.- The Washington Post

https://www.washingtonpost.com/world/2021/12/06/india-hunger-corona...

There are no nationwide numbers on the state of food insecurity in India, but recent studies point to an alarming problem. In the 2021 Global Hunger Index released in October, India ranked 101st of the 116 countries surveyed, falling seven spots from the previous year. In a separate 2020 survey by Azim Premji University in Bangalore, 90 percent of respondents reported a reduction in food intake due to the lockdown. Twenty percent of respondents continued to battle the problem even six months later.

The Indian government dismissed the Hunger Index ranking, saying that estimates used for the undernourished population were “devoid of ground reality” and that the report disregarded its “massive effort” during the pandemic. Oxfam India, in a statement, said the Hunger Index “unfortunately reflects the reality of the country where hunger [has been] accentuated since the covid-19 pandemic.”India’s Ministry of Food and Public Distribution did not respond to requests for comment.

“The hunger crisis is, in fact, fundamentally reflective of the livelihood crisis,” said Jayati Ghosh, a development economist. People do not have money to buy food, she said, and “that’s both our employment and food systems failing.”

The unemployment rate in April to June of 2020, at the height of the first lockdown, was nearly 21 percent in urban areas, according to government figures. Even as the economy showed signs of revival this year, 15 million jobs were lost in May when a devastating second wave killed hundreds of thousands and brought the health-care system to near collapse.

-

Comment by Riaz Haq on December 6, 2021 at 11:42am

-

According to the 1981 Indian Census, close to 99% of rural India defecated in the open. This meant that Indians defecate in open spaces such as in fields, bushes, along railway tracks and roads. According to data from the World Bank, in 1990, 75% of the Indian population defecated in the open, this had dropped to 44% in 2015. However, despite this drop poorer countries such as Bangladesh and Pakistan and even sub-Saharan countries have significantly lower open defecation rates

https://repository.upenn.edu/cgi/viewcontent.cgi?article=1016&c...

-

Comment by Riaz Haq on December 6, 2021 at 11:49am

-

In 1990s, #WorldBank data showed 75% of #India's population defecated in the open, It dropped to 44% in 2015. #Bangladesh & #Pakistan & even countries in sub-Saharan #Africa have significantly lower open defecation rates. #OpenDefecation #SwachhBharat

https://repository.upenn.edu/cgi/viewcontent.cgi?article=1016&c...https://twitter.com/haqsmusings/status/1467943903345012736?s=20

-

Comment by Riaz Haq on December 6, 2021 at 2:35pm

-

India’s International Investment Position (IIP), March 2021

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51822

Today, the Reserve Bank released data relating to India’s International Investment Position as at end-March 2021.

Key Features of India’s IIP in March 2021

I. Quarterly Variations:

Net claims of non-residents on India increased by US$ 11.2 billion during Q4:2020-21 to US$ 352.7 billion in March 2021 (Table 1).

The increase in net claims was due to larger increase in foreign-owned assets in India (US$ 17.9 billion) vis-à-vis the overseas financial assets of Indian residents (US$ 6.7 billion) during the quarter.

Indian residents’ overseas financial assets abroad increased largely on the back the increase in overseas direct investment as well as currency and deposits.

Inward portfolio investment and loans were major contributors to the rise in India’s foreign liabilities.

Depreciation of the Indian rupee against the US dollar during the quarter contributed to changes in India’s liabilities, when valued in the US dollar terms.

Reserve assets accounted for over two-thirds of India’s international financial assets (Table 3).

Non-debt liabilities had 52.4 per cent share in India’s external liabilities (Table 4).

II. Annual Variations:

During 2020-21, non-residents’ net claims on India reduced by US $ 22.7 billion: increase in overseas assets of Indian residents (US$ 141.2 billion) exceeded the rise in foreign owned assets in India (US$ 118.5 billion) (Table 1).

The increase in international financial assets of Indian residents was led by a large accretion of US$ 99.2 billion in reserve assets; overseas direct investment and currency and deposits were the other major components.

Inward direct investment and portfolio equity investment together accounted for nearly 90 per cent of the increase in international financial liabilities during 2020-21.

The ratio of India’s international financial assets to international financial liabilities increased to 70.9 per cent in March 2021 from 65.6 per cent a year ago.

III. Ratio of International Financial Assets and Liabilities to GDP (at current prices):

The ratios of reserve assets, Indian residents’ overseas financial assets and claims of non-residents on India to GDP at current market prices surged during 2020-21, largely due to the decline in GDP during the year, caused by the COVID-19 pandemic (Table 2).

The ratio of net IIP of India to GDP also improved to (-) 13.1 per cent in March 2021 from (-) 13.9 per cent a year ago.

-

Comment by Riaz Haq on December 6, 2021 at 2:36pm

-

Pakistan's net international investment is -$121 billion in Q2/2021

https://www.sbp.org.pk/ecodata/Invest-BPM6.pdf

International Investment Position of Pakistan (BPM6) - Summary

(Stocks in Million US Dollar)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 (R) Q2 (P)

International investment position - Net (115,831.5) (116,404.7) (115,487.7) (114,657.2) (109,902.5) (113,434.9) (115,766.3) (117,725.0) (116,880.1) (120,622.4)

-

Comment by Riaz Haq on December 7, 2021 at 8:06am

-

India remains far from being open defecation free after 7 years of Swachh Bharat Mission

Toilet usage on paper, not in practice

https://mediaindia.eu/society/70066-open-defecation-free/

At the end of 2020, the Swachh Bharat Mission claimed that over 99 pc rural households had access to a toilet and most villages had been declared open defecation free. But even in the places where the toilets have actually been built and provided to people, there have been numerous reports, in thousands, of people not being able to use them due to several practical problems. First and foremost, lack of water to clean the toilet after usage. And even where water may not be a problem, there are other basic issues which show that the Swachh Bharat Abhiyan was meant more to be on paper than in practice.

“Everyone here has toilet facilities, the state government has launched a scheme in which they provided all the necessary basic requirements like cement, bricks and sand free of cost and people got a chance to build their own private toilets. In the beginning, we were glad to use our own private toilets, but had to stop within a few weeks as the septic tanks provided by the government were too small and could fill up soon and we don’t know how to clean them and it will expensive to get it cleaned by someone. So, since then we have stopped using our toilets, except for emergencies, and we have all started to go back into the near-by forest to defecate,” Shanthi, 39, resident of Pasar, a small village in Kallakurichi district in Tamil Nadu tells Media India Group.

Shanthi is not alone in her thinking and her precautious behaviour about using the private toilet. Human rights activist and National Convenor of the Safai Karmachari Andolan (SKA) Bezwada Wilson says the issue is widespread and needs to be tackled in a comprehensive manner and the answer to the question of large-scale open defecation in India did not lie in simply building toilets, without the necessary infrastructure like providing freely flowing water and sewage connections to each house.

“Women are coming outside to defecate because of various reason although many have access to toilets. The major problem behind this is, in rural areas there are no adequate water facilities and they also afraid that if once septic tank gets filled up, what will be the mechanism to clean and they have to invest money to clean,” Wilson tells Media India Group.

-

Comment by Riaz Haq on December 7, 2021 at 7:29pm

-

India’S Current Account Deficit Expected To Hit 1.4% By March As Crude Soars

https://www.cnbctv18.com/economy/indias-current-account-deficit-exp...

India's widening current account deficit (CAD), driven by the massive spike in commodity prices led by crude oil, is set to put pressure on the fragile recovery, warns a brokerage report that has revised upwards its CAD forecast to USD 45 billion or 1.4 percent of GDP by March. According to a report by British brokerage Barclays, the worries arise from the fact that the trade deficit has been jumping continuously since July.

From an average monthly trade deficit of USD 12 billion till June, it has jumped to USD 16.8 billion in July-October, with September showing the highest-ever trade deficit on record at USD 22.6 billion, the report said. "We raise our FY22 current account deficit forecast to USD 45 billion or 1.4 percent of GDP, up from USD 35 billion earlier, but a large balance of payments (BoP) surplus remains on track," it said, adding that the widening trade deficit can prove more sustained than initially thought.

Estimating that every USD 10 per barrel rise in global crude priceswill widen the trade deficit by USD 12 billion or 35 bps of GDP, as close to 85 percent of the oil demand is met through imports, and given the current elevated crude prices, the brokerage has raised its current account deficitforecast to USD 45 billion for FY22, from USD 35 billion earlier. The brokerage, however, ruled out an alarming situation and said that with record high foreign reserves, "we see no major risks to macro stability." It noted that the widening deficit trend may continue for some time as a combination of demand recovery and rising commodity prices will continue to widen the trade deficit sharply.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network