PakAlumni Worldwide: The Global Social Network

The Global Social Network

Harvard Kennedy School CID Projects Pakistan GDP Growth to Average 5.97% Till 2025

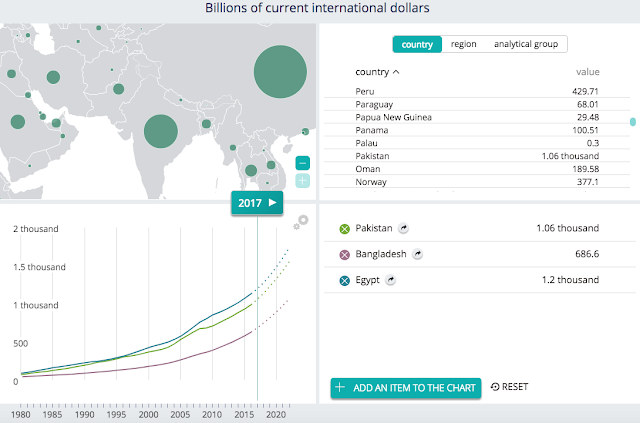

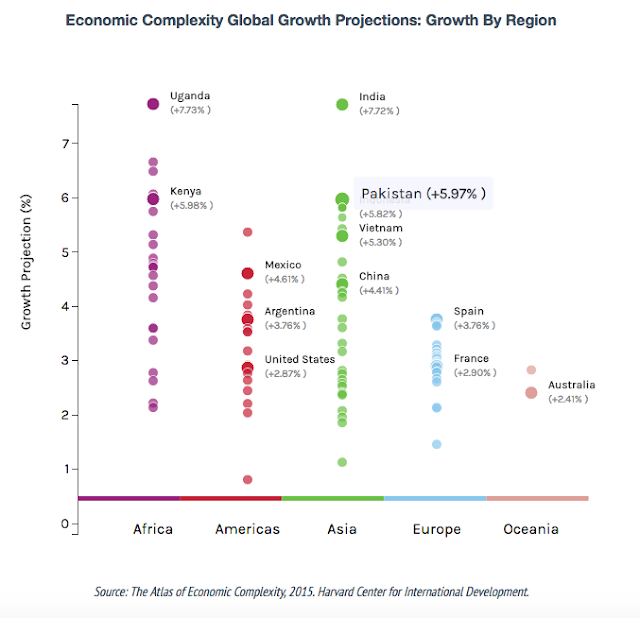

In its latest economic growth projections, Kennedy School's Center for International Development (CID) at Harvard University expects Pakistan's annual GDP growth to average 5.97% over the next 8 years, ranking it as the world's 6th fastest growing economy.

The Harvard growth projections are a bit more optimistic that other short, medium and long-term GDP growth forecasts for Pakistan offered by HSBC's 5% through 2050, IMF's 5.5% till 2020, World Bank's 5.8% until 2019 and The Economist EIU's 5.7% in 2017

Among the top 10 fastest growing economies, the CID projects Uganda to grow the fastest at 7.73%, followed by India 7.72%, Tanzania 6.66%, Senegal 6.49%, Madagascar 6.07%, Kenya 5.98%, Pakistan 5.97%, Indonesia 5.82%, Mali 5.75%, Turkey 5.64% and Philippines 5.43%.

Among Pakistan's other neighbors, China is forecast to grow at 4.41%, Sri Lanka at 3.77% and Bangladesh at 2.82%.

|

| Pakistan 2017 PPP GDP $1.06 Trillion Source: IMF |

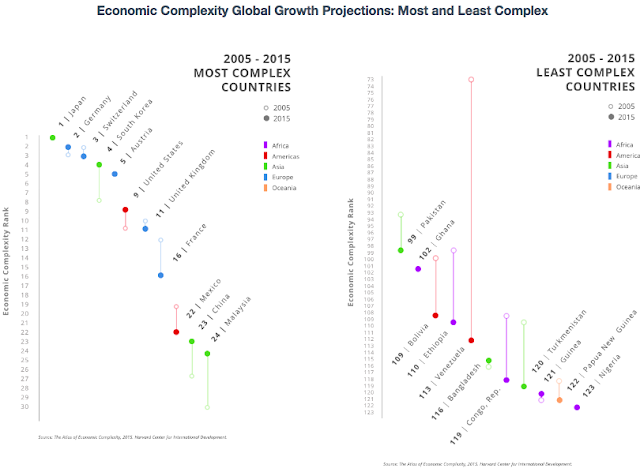

CID also released new country rankings of the 2015 Economic Complexity Index (ECI), the measure that forms the basis for much of the growth projections. It ranks Pakistan at 99 for economic complexity.

The complexity of an economy is related to the multiplicity of useful knowledge embedded in it, according to OECD. Because individuals are limited in what they know, the only way societies can expand their knowledge base is by facilitating the interaction of individuals in increasingly complex networks in order to make products. We can measure economic complexity by the mix of these products that countries are able to make.

The countries that show the fastest declines in the complexity rankings in the decade ending in 2015 nearly all have had policy regimes that have been adversarial to the accumulation of productive knowhow, with the largest declines in Cuba (-50), Venezuela (-44), Zimbabwe (-23), Tajikistan (-22), Libya (-22), and Argentina (-18). Globally, the fastest risers in complexity in 2015 have been the Philippines, Malawi (+26 to 94th), Uganda (+24 to 77th), Vietnam (+24 to 64th), and Cambodia (+16 to 88th).

The ECI finds the most complex countries in the world, as measured by the average complexity of their export basket, remain Japan, Switzerland, Germany, South Korea, and Austria. Of the 40 most complex countries, the biggest risers in the rankings for the decade ending in 2015 have been the Philippines (ECI rank: up 28 positions to rank 32nd globally), Thailand (+11 to 25th), China (+10 to 23rd), Lithuania (+9 to 30th), and South Korea (+8 to 4th). Conversely, the biggest losers have been Canada (-9 to 33rd), Serbia, Belarus, Spain (-6 to 29th), and France (-6 to 16th).

US-based consulting firm Deloitte and Touche estimates that China-Pakistan Economic Corridor (CPEC) projects will create some 700,000 direct jobs during the period 2015–2030 and raise its GDP growth rate to 7.5%, adding 2.5 percentage points to the country's current GDP growth rate of 5%.

An additional 1.4 million indirect jobs will be added in supply-chain and service sectors to support the projects. An example of indirect jobs is the massive expansion in Pakistan's cement production that will increase annual production capacity from 45 million tons to 65 million tons, according to a tweet by Bloomberg's Faseeh Mangi. Other indirect jobs will be in sectors ranging from personal services to housing and transportation.

Improved security situation and rising investments, particularly the China Pakistan Economic Corridor or CPEC-related investments led by China, are helping accelerate the economic growth in the country. It is the fear of CPEC's success that appears to be driving a growing campaign of fear, uncertainty and doubt (FUD) waged by Pakistan's detractors in South Asia region and around the world.

Related Links:

-

Comment by Riaz Haq on July 9, 2017 at 7:13am

-

Fresh corporate investments (in India) grew at the slowest pace since 1992 in the 2016-17 financial year

Analysts said a poor demand in the economy and banks’ reluctance to lend to new projects had led to this decline.https://scroll.in/latest/843180/fresh-corporate-investments-grew-at...

Fresh investments by the corporate sector in the financial year 2016-17 grew at the slowest pace since 1992, Business Standard reported on Saturday. In FY 2017, the combined capital expenditure by the country’s top 1,000 non-financial firms, in terms of revenue, was up by just 5.8% – the previous low of capital expenditure growth was recorded in 1999.

Analysts said this decline was because of poor demand in the economy and banks’ reluctance to lend to new projects.

“It’s in line with a near – collapse in banks’ credit growth in the last fiscal year,” said G Chokkalingam, founder and managing director, Equinomics Research and Advisory. “Public sector banks have put a virtual freeze on fresh lending to risky projects, fearing bad loans hitting funding for large industrial projects.”

Fresh investments, worth Rs 2.07 lakh crore, by the top 1,000 companies in the last fiscal was down from Rs 2.9 lakh crore in FY16 and an all-time high of Rs 5.7 lakh crore in FY14.

The drought, led by domestic private companies, is in complete contrast to their past behavior, an analysis of a common sample of listed companies suggested. The capex growth registered by private sector companies is also the slowest in 12 years.

The incremental capex by listed private companies was Rs 2.15 lakh crore in 2016. It nearly halved to around Rs 1.1 lakh crore in the last financial year. The amount is a third of a record high reached in 2012 and the lowest in 10 years.

-

Comment by Riaz Haq on July 12, 2017 at 7:10am

-

Moody Sees Strong #Economic Growth For #Pakistan on #China Links. #CPEC #Energy #Infrastructure #Economy

https://www.thenational.ae/business/economy/moody-s-sees-strong-gro...

Moody's Investors Service has today affirmed Pakistan's B3 issuer and senior unsecured ratings, and maintained a stable outlook.

Pakistan's medium-term growth outlook is strong, Moody's said, supported by the China-Pakistan Economic Corridor (Cpec) project" to address critical infrastructure constraints, and the continuing effects of macrostability-enhancing reforms started under the International Monetary Fund (IMF)'s Extended Fund Facility (EFF) program in 2013-16".

However, the agency added that government's debt burden is high and fiscal deficits remain relatively wide, driven by a narrow revenue base that also restricts development spending. "In addition, foreign exchange reserve adequacy, albeit stronger than a few years ago, would still be vulnerable to any significant increase in imports. Domestic politics and geopolitical risk also continue to represent a significant constraint on the rating."

Concurrently, Moody's has affirmed the B3 foreign currency senior unsecured ratings for The Second Pakistan International Sukuk Co and The Third Pakistan International Sukuk Co.

Moody's said the outlook for growth has strengthened as a result of increased macroeconomic stability due to reforms started during the three-year IMF extended fund facility programme and following the launch of the Cpec project in 2015.

In the fiscal year ended June 2016, real GDP growth reached 4.5 per cent, up from 4.1 per cent in both 2015 and 2014, The agency said. Moody's expects such growth rates to be maintained or exceeded in the next few years. By contrast, the median rate of growth for B-rated sovereigns was just 2.7 per cent in 2016.

Moody's said that from a macroeconomic stability perspective, the IMF programme succeeded in encouraging fiscal deficit reduction, more rigorous inflation management and the rebuilding of foreign exchange reserves. "While further progress will be challenging, as fiscal metrics remain weak and reserve adequacy is relatively fragile, our baseline assumption is that the steps that the authorities have taken in the last 3 to 4 years will not be reversed," it said.

Moody's expects real GDP growth will rise towards 6 per cent over the next few years, as the economic benefits of the Cpec gradually materialise and past policy reforms continue to support economic potential. The Cpec will increase Pakistan's competitiveness and lift potential GDP growth by relieving supply-side constraints, particularly in power and transport infrastructure, and by catalyzing private sector investment, the agency said.

"However, security related issues and a weak track record of public project implementation suggest the pace of project execution will be relatively slow," Moody's added. "Therefore, while the Cpec will support Pakistan's credit profile, Moody's expects the economic impact to materialise more slowly than the government envisions, resulting in real GDP growth closer to 5.5 per cent over the next two years, compared to government forecasts for 6 per cent growth in fiscal year 2018, rising to 7 per cent by 2020."

-

Comment by Riaz Haq on July 14, 2017 at 10:12am

-

46 #SEZs to be established along #CPEC route: #Pakistan BOI Chair Miftah. #China #INDUSTRY #Manufacturing

https://dnd.com.pk/46-sezs-to-be-established-along-cpec-route-mifta...

The Chairman Board of Investment (BoI) Dr Miftah Ismail has said that the federal government is planning to establish 46 Special Economic Zones (SEZs) along the mega project of China Pakistan Economic Corridor (CPEC) route in the long run.

While addressing the concluding session of Pakistan China Industrial Cooperation dialogue in Islamabad on Thursday, he said that nine zones have already been declared prioritized during the 06th Joint Coordination Committee between Pakistan and China meeting held in December 2016.

Miftah expressed the commitment of the Pakistani government to nominate a working group to deliberate on how to build the zone. He said that either Chinese or Pakistani companies can build the zone or the same can be built jointly by both sides.

The Chairman BOI highlighted that products manufactured in these zones can not only to be exported but these can also be sold in the local Pakistani market, where they are not required to pay any customs duty. He said that this makes the zone ideal for investors as Pakistan has a big market of 200 million plus people.

Miftah Ismail said that the model can be primarily export oriented but in case of China import substitution also has a lot of potential, adding that the Government has already given its commitment to provide all utilities and security to the investors in these zones.

The Chairman Board of Investment pointed out that each zone has its special features for investors in terms of its location, raw material, skilled work force and linkages with other parts of the country and outside the country.

Miftah Ismail said that China has rich experience in developing zones particularly from 1985 to 1995 and from 2009 till 2015 and Pakistan can learn much from Chinese experience.

-

Comment by Riaz Haq on July 14, 2017 at 4:13pm

-

We’ll make #CPEC a success, come what may: #Pakistan Army Chief Gen Bajwa. #China

https://tribune.com.pk/story/1456715/well-make-cpec-success-come-ma...

General Qamar Javed Bajwa reiterated on Wednesday the determination of the army and other law enforcement agencies to provide fool-proof security to the China-Pakistan Economic Corridor (CPEC) calling the multibillion-dollar project ‘harbinger of peace and prosperity’ in the region.

“While the army will provide security to the project [CPEC], the other national institutions will have to come forward and play their respective roles,” he said while speaking at a function in Islamabad on CPEC Logistics on Wednesday.

“We as a nation can only benefit from this historic opportunity, if we prepare ourselves to embrace it. All national institutions will have to make a deliberate effort to ensure success of CPEC,” he added.

CPEC is truly a harbinger of economic development, peace and prosperity in the region, he said, adding that unlike some other countries of South Asia, Pakistan believes in focusing its energies on peace and inclusiveness, rather than divisive competition. He was apparently referring to India which publicly opposes the multibillion-dollar project.

Country’s progress: Army chief hails role of overseas Pakistanis

“CPEC would bring increasing economic integration among regional economies and reduce the development gap within various regions of Pakistan,” he said.

Gen Qamar said the Chinese investment in various fields, including energy, infrastructure, Gwadar port and special economic zones, can lay the foundation of a fast-developing Pakistan if the opportunity was optimally utilised.

“We take immense pride in our relationship with China that has always remained on an ascending trajectory and now encompasses almost every sphere of our life. The lasting imprint of this brotherly partnership is visible in state-to-state, military-to-military, business-to-business and people-to-people contacts,” he said.

The army chief went on to say that the Sino-Pak relationship is based on the principles of peaceful co-existence, commonality of interest and shared perception on regional and global issues. “We have always stood by each other through thick and thin and at every critical juncture of our history. That is why we are called Iron brothers.

“Xi Jinping’s grand vision of One Belt, One Road (OBOR) has opened up a whole new world of opportunities for the countries of the region and beyond. CPEC, being an important project of OBOR, holds great promise for turning around the economies of Pakistan, Western China and the region,” he added.

Army chief appreciates security forces for ‘winning back dissidents’

The army chief said to reap benefits from CPEC Pakistan needs education, training and skill development of the youth. “We also need to improve our existing laws and regulations to provide a facilitating framework for trade and investment activities. We need infrastructure and urban planning to ensure that we are able to handle large volume of business and transport, without any hassle,” he added.

Commenting on the prevailing security situation in Pakistan, Gen Qamar said the “country is much safer today than before as peace has been restored in Fata and the adjoining areas”. He said normalcy was also returning to Karachi. “Similarly, the law and order situation has improved significantly in Balochistan and there is great focus on socio-economic development in the province,” he added.

“Pakistan is a resilient nation of over 200 million people, with a large ratio of vibrant, capable and enthusiastic youth. We need to capitalize on this opportunity to make Pakistan an economic power in coming years,” he added.

He encouraged entrepreneurs to join hands with Chinese investors and make this dream a reality. “My dream is that by the year 2030, when we complete the current phase of economic partnership between the two countries, Pakistan should at least be in league with middle income countries,” he stated.

-

Comment by Riaz Haq on July 18, 2017 at 6:55am

-

Overseas investors in #Pakistan find 94% reduction in #crime. #Lahore 94%, #Karachi 92% reduction.

https://tribune.com.pk/story/1460324/overseas-investors-find-94-red...

Overseas investors in Pakistan have observed up to 94% decline in different crimes all over the country in 2017, according to the annual survey conducted by Overseas Investors Chamber of Commerce and Industry (OICCI).

Respondents of the OICCI security survey 2017 experienced a drop in the overall street crimes with a 69% reduction in minor crimes (like mobile and cash snatching) and 90% decrease in major street crimes (like car snatching).

In terms of serious crimes like abductions/hostage taking and extortion (bhatta) – respondents across Pakistan reported major reductions as compared to 2016, ranging from 94% decrease in Lahore, closely followed by the rest of Punjab and Khyber-Pakhtunkhwa (93%) and Karachi (92%).

Security survey 2017 is conducted in June and highlights a positive movement in the OICCI members’ perception of the country’s security environment. This comprehensive security survey has been conducted every year since 2015. It reflects the foreign investors’ perception on the improving security environment in the country especially after the launch of 2013 Karachi operations.

OICCI members have reported significant improvement in confidence and comfort of their staff on security matters, which went up further after the 86% increase reported in the previous survey, as the staffs now feel even more comfortable in their everyday commute to/from the workplace.

More significantly, a noteworthy feedback from the latest OICCI security survey is that a higher number of expatriate business visitors have travelled to Pakistan in the past one year and most of the business related meetings are now being held within Pakistan. Prior to August 2013 these were conducted in other countries due to security concerns.

This is a strong indicator that Pakistan as a destination has improved on the security concerns map and that such foreign businessmen are being granted travel permissions for their visit to Pakistan from their respective embassies and travel security agencies.

An overwhelming 62% respondents reported substantial increase in the number of overseas visitors to Pakistan as compared to last year. The highest number of OICCI members’ foreign visitors was from European countries followed closely by visitors from Middle East, China, Singapore, USA and Japan.

The 2017 survey once again re-affirms that threats and security concerns have substantially reduced in Pakistan for all key stakeholders of businesses including OICCI members.

“The security environment has substantially improved not only for the survey participants, meaning foreign investors, but also for their customers, suppliers and employees,” said OICCI President Khalid Mansoor.

The 2017 OICCI security survey result mirrors the improved security environment all over Pakistan, especially in Karachi in comparison to the last year and greatly enhanced since the time prior to August 2013.

A significant majority of the respondents were confident that the general threats to business had reduced compared to last year and a look at the last survey in June 2016 echoed the improvement nation-wide with Karachi’s security situation being given the thumbs up by 89%, closely followed by Lahore and the rest of Punjab with 85% and 82%.

-

Comment by Riaz Haq on August 5, 2017 at 9:53am

-

Pakistan exports surgical goods, medical instruments worth US$ 339.19 million in 2016-17

https://www.geo.tv/latest/152449-pakistan-exports-surgical-goods-me...

Pakistan exported surgical goods and medical instruments worth US$ 339.19 million during the last fiscal year ended on June 30, 2017, as against the exports of US $ 358.766 million of the corresponding period of last year.

The exports of above mention goods were recorded at US$ 358.766 million during the financial year 2015-16.

According to the data of Pakistan Bureau of Statistics, the cutlery exports grew by 2.52 percent and reached at US$ 82.436 million in the fiscal year 2016-17 as compared to the exports of US$ 80.404 million in the same period last year.

Meanwhile, the exports of chemical and pharma products increased by 9.21 percent as chemical and pharmaceutical products valuing US $ 878.463 million exported as compared the exports of US $ 804.337 million in the same period last year.

During the period from July-June, 2016-17, about 44,250 metric tons of fertilizers manufactured valuing US$ 10.158 million exported as compared the exports of the same period last year.

During the last financial year ended on June 30, 2017, exports of fertilizers manufactured grew by 100 percent as compared the corresponding period of last year, the data added.

According to the data, about 9,029 metric tons of pharmaceutical products worth US$ 212.291 million exported which was up by 3.63 percent against the exports of last year.

The country had earned US$ 204.846 million by exporting about 11,112 metric tons of pharmaceutical products during the year 2015-16, it added.

-

Comment by Riaz Haq on August 5, 2017 at 9:57am

-

#Exports from #Pakistan up by 16.16% in June, #trade deficit widens 36% in FY 2016-17 https://dnd.com.pk/exports-from-pakistan-up-by-16-16-in-june-trade-... … via @Dispatch News Desk

ISLAMABAD, Pakistan: The exports from the Country, on year-on-year basis, increased by 16.16 percent during June 2017 as compared to the exports of the same month of last fiscal year.

The exports from the country were recorded at $1.912 billion during June 2017 as compared to the exports of $1.646 billion during June 2016, showing positive growth of 16.16 percent, according to the latest data of Pakistan Bureau of Statistics (PBS) on Wednesday.

The imports during the month also grew 2.16 percent by going up from $4.438 billion during June 2016 to $4.534 billion during June 2017.

Based on the figures, the trade deficit on year-on-year basis was recorded at $2.622 billion in June 2017 as compared to the deficit of $2.792 during June 2016, showing negative growth of 6.09 percent.

On month-on-month basis, the exports from the country during June 2017 increased by 17.52 percent when compared to the exports of $1.627 billion in May 2017.

The imports into the country decreased by 10.96 percent in June 2017 when compare to the imports of $5.092 billion in May 2017.

The overall trade deficit during the fiscal year 2016-17 widened by 36.32 percent as compared to the deficit of last fiscal year, as imports into the country dipped by 18.67 percent while exports witnessing negative growth of 1.63 percent.

The trade deficit during the fiscal year 2016-17 was recorded at $32.578 billion as compared to the deficit of $23.898 billion during the fiscal year 205-16, showing negative growth of 36.32 percent, according to the PBS data

During the period under review, the imports from the country were recorded at $53.026 billion as compared to the imports of $44.685 billion during 2015-16, showing growth of 18.67 percent.

On the other hand, the exports from the country decreased by 1.63 percent by falling from the $20.787 billion last year to $20.448 billion during 2016-17, the data revealed.

-

Comment by Riaz Haq on January 13, 2019 at 8:19pm

-

Rise of #Bangladesh. CLSA's Chris Wood believes Bangladesh's reliance on #garments sector is obstacle to future growth as it faces the risk of lower #wage alternatives in #Africa, #automation & loss of duty-free #market access when it loses #LDC status. https://asia.nikkei.com/Spotlight/Cover-Story/The-rise-and-rise-of-...

"Exiting LDC status gives us some kind of strength and confidence, which is very important, not only for political leaders but also for the people," she (Shaikh Hasina) told the Nikkei Asian Review in an exclusive interview in December. "When you are in a low category, naturally when you discuss terms of projects and programs, you must depend on others' mercy. But once you have graduated, you don't have to depend on anyone because you have your own rights."

Hasina says Bangladesh's strong economic growth will not just continue, but accelerate. "In the next five years, we expect annual growth to exceed 9% and, we hope, get us to 10% by 2021," she said.

"I always shoot for a higher rate," she laughs. "Why should I predict lower?"

On many fronts, Bangladesh's economic performance has indeed exceeded even government targets. With a national strategy focused on manufacturing -- dominated by the garment industry -- the country has seen exports soar by an average annual rate of 15-17% in recent years to reach a record $36.7 billion in the year through June. They are on track to meet the government's goal of $39 billion in 2019, and Hasina has urged industry to hit $50 billion worth by 2021 to mark the 50th anniversary of what Bangladeshis call their Liberation War.

A vast community of about 2.5 million Bangladeshi overseas workers further buoys the economy with remittances that jumped an annual 18% to top $15 billion in 2018. But Hasina also knows the country needs to move up the industrial value chain. Political and business leaders echo her ambitions to shift from the old model of operating as a low-cost manufacturing hub partly dependent on remittances and international aid.

To that end, Hasina launched a "Digital Bangladesh" strategy in 2009 backed by generous incentives. Now Dhaka, the nation's capital, is home to a small but growing technology sector led by CEOs who talk boldly about "leapfrogging" neighboring India in IT. Pharmaceutical manufacturing -- another Indian staple -- is also on the rise.

Behind the impressive numbers and bold ambitions, however, are daunting hurdles ranging from structural problems to deep political divisions, which have come to the fore ahead of national elections on Dec. 30.

Bangladeshi politics have been dominated for years by the bitter rivalry between Hasina and former Prime Minister Khaleda Zia, whose family histories go back to opposing sides of the liberation struggle, when Bangladesh was known as East Pakistan. Both women have been in and out of power -- and prison -- over the past three decades. Khaleda Zia, who chairs the opposition Bangladesh Nationalist Party, is in jail on corruption charges that she says are false.

Since 1981, Hasina has led the ruling Awami League, founded by her father, Sheikh Mujibur Rahman, the country's first president, who was killed by army personnel along with most of his family in 1975. The party enjoyed strong support in some past elections. But opposition activists and human rights groups have voiced concern about potential polling fraud and intimidation tactics. After two consecutive five-year terms for the ruling party, analysts point to a palpable "anti-incumbency" sentiment among some voters. Yet from an economic standpoint, many agree that a ruling party victory would support further development.

"If the polling passes without too much strife and the status quo is maintained, then [Bangladesh] would seem an attractive long-term story," said Christopher Wood, managing director and chief strategist at Hong Kong-based brokerage CLSA.

-

Comment by Riaz Haq on June 15, 2019 at 10:24am

-

India’s GDP Mis-estimation: Likelihood,

Magnitudes, Mechanisms, and Implications

Arvind Subramanian ( former Chief Economic Adviser to the Government of India)

CID Faculty Working Paper No. 354

June 2019

https://growthlab.cid.harvard.edu/files/growthlab/files/2019-06-cid...The main findings of this paper are the following. First, a variety of evidence—within India and

across countries—suggests that India’s GDP growth has been over-stated by about 2 ½ percentage

points per year in the post-2011 period, with a 95 percent confidence band of 1 percentage point.

That is, instead of the reported average growth of 6.9 percent between 2011 and 2016, actual growth

was more likely to have been between 3 ½ and 5 ½ percent. Cumulatively, over five years, the level

of GDP might have been overstated by about 9-21 percent.------------

Abstract

India changed its data sources and methodology for estimating real gross domestic product (GDP) for

the period since 2011-12. This paper shows that this change has led to a significant overestimation of

growth. Official estimates place annual average GDP growth between 2011-12 and 2016-17 at

about 7 percent. We estimate that actual growth may have been about 4½ percent with a 95 percent

confidence interval of 3 ½ -5 ½ percent. The evidence, based on disaggregated data from India and

cross-sectional/panel regressions, is robust. Lending further credence to the evidence, part of the overestimation can be related to a key methodological change, which affected the measurement of the formal

manufacturing sector. These findings alter our understanding of India’s growth performance after the

Global Financial Crisis, from spectacular to solid. Two important policy implications follow: the

entire national income accounts estimation should be revisited, harnessing new opportunities created by

the Goods and Services Tax to significantly improve it; and restoring growth should be the urgent

priority for the new government.

-

Comment by Riaz Haq on September 12, 2020 at 7:25pm

-

Is Pakistan’s Growth Rate

Balance-of-Payments Constrained?

Policies and Implications

for Development and Growth

Jesus Felipe, J. S. L. McCombie, and Kaukab Naqvi

No. 160 | May 2009

https://www.adb.org/sites/default/files/publication/28250/economics...

------------

The basic premise of the BOP-constrained growth model is that in the long run, no

country can grow faster than the rate consistent with balance on the current account,

unless it can finance evergrowing deficits. Indeed, if imports grow faster than exports, the

current account deficit has to be financed by borrowing from abroad, i.e., by the growth

of capital inflows.6 But this cannot continue indefinitely. The seminal paper is Thirlwall

(1979).

-------

This paper examines the extent to which Pakistan’s growth has been, or is

likely to be, limited or constrained by its balance-of-payments (BOP). The

paper begins by briefly considering the BOP-constrained growth model in

the context of demand and supply-oriented approaches to economic growth.

Evidence presented suggests that Pakistan’s maximum growth rate consistent

with equilibrium on the basic balance is approximately 5% per annum. This is

below the long-term target rate of a growth of gross domestic product of 7–8%

per annum. This BOP-constrained growth approach provides some important

policy prescriptions for Pakistan’s development policy. Real exchange rate

depreciations will not lead to an improvement of the current account. Pakistan

must lift constraints that impede higher growth of exports. In particular, it must

shift its export structure to products with a higher income elasticity of demand

and sophistication.

----------

Pakistan’s output growth rate since the 1960s has averaged 5.3% per annum, and

2.5% in terms of productivity growth. While these figures are respectable by world

standards, they are not so impressive compared with those of the East Asian economies

when they were at a similar stage of development in the late 1960s. In the 1950s and

1960s Pakistan started transforming from a poor agricultural economy into a rapidly

industrializing one; yet it never subsequently achieved growth rates similar to those of

the Asian tigers or, more recently, the People’s Republic of China (PRC). The country’s

Poverty Reduction Strategy (April 2007) has targeted a growth rate of gross domestic

product (GDP) of 7–7.5% per annum for the next decade. The question that naturally

arises is whether this is feasible or whether it is a hopelessly overoptimistic target. If

the former, what are the necessary policy measures that should be taken to ensure this

outcome? If the latter, what impedes higher growth?

-------------------

In particular, there are concerns about the changing composition of output and the rise

of substantial deficits on the current and fiscal accounts. In 2001–2003, export growth

made a significant contribution to GDP growth. But in 2004–2007, when the growth rate

was higher, consumption, investment, and government expenditure were the largest

contributors. From the supply side, the service sector was the largest contributor to GDP

growth (Felipe and Lim 2008). Exports plus net factor income from abroad has fallen as

a percentage of GDP while the rapid growth has sucked in imports. This is reminiscent of

the early periods of high growth in the 1980s and 1990s when there were also significant

deficits in the current account. In fiscal year 2007–2008, the current account deficit

rose to 8.4% of GDP. This has led to a serious BOP crisis. As a consequence, rating

agencies Standard and Poor’s and Moody’s downgraded Pakistan. This will have serious

consequences for overseas borrowing.2

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Has Pakistan Destroyed India's S-400 Air Defense System at Adampur?

Pakistan claims its air force (PAF) has destroyed India's high-value Russian-made S-400 air defense system (ADS) located at the Indian Air Force (IAF) Adampur air base. India has rejected this claim and posted pictures of Prime Minister Narendra Modi posing in front of its S-400 rocket launchers in Adampur. Meanwhile, there are reports that an Indian S-400 operator, named Rambabu Kumar Singh, was killed at about the time Pakistan claims to have hit it. Pakistan is believed to have targeted…

ContinuePakistan Downs India's French Rafale Fighter Jets in History's Largest Aerial Battle

Pakistan Air Force (PAF) pilots flying Chinese-made J10C fighter jets shot down at least two Indian Air Force's French-made Rafale jets in history's largest ever aerial battle involving over 100 combat aircraft on both sides, according to multiple media reports. India had 72 warplanes on the attack and Pakistan responded with 42 of its own, according to Pakistani military. The Indian government has not yet acknowledged its losses but senior French and US intelligence officials have …

ContinuePosted by Riaz Haq on May 9, 2025 at 11:00am — 32 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network