PakAlumni Worldwide: The Global Social Network

The Global Social Network

Goldman Sachs Projects Pakistan Economy to Become the World's 6th Largest by 2075

|

| GDP Ranking Changes Till 2075. Source: Goldman Sachs Investment Res... |

|

| Economic Growth Rate Till 2075. Source: Goldman Sachs Investment Re... |

Economic Impact of Slower Population Growth:

Daly and Gedminas argue that slowing population growth in the developed world is causing their economic growth to decelerate. At the same time, the economies of the developing countries are driven by their rising populations. Here are four key points made in the report:

1) Slower global potential growth, led by weaker population growth.

2) EM convergence remains intact, led by Asia’s powerhouses. Although real GDP growth has slowed in both developed and emerging economies, in relative terms EM growth continues to outstrip DM growth.

3) A decade of US exceptionalism that is unlikely to be repeated.

4) Less global inequality, more local inequality.

|

| Goldman Sachs' Revised GDP Projections. Source: The Path to 2075 |

Demographic Dividend:

With rapidly aging populations and declining number of working age people in North America, Europe and East Asia, the demand for workers will increasingly be met by major labor exporting nations like Bangladesh, China, India, Mexico, Pakistan, Russia and Vietnam. Among these nations, Pakistan is the only major labor exporting country where the working age population is still rising faster than the birth rate.

|

| Pakistan Population Youngest Among Major Asian Nations. Source: Nik... |

|

| World Population 2022. Source: Visual Capitalist |

|

| World Population 2050. Source: Visual Capitalist |

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. Nearly 700,000 Pakistanis have already migrated in this calendar year as of October, 2022. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East was over half a million in the last decade.

|

| Consumer Markets in 2030. Source: WEF |

World's 7th Largest Consumer Market:

Pakistan's share of the working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. With its rising population of this working age group, Pakistan is projected by the World Economic Forum to become the world's 7th largest consumer market by 2030. Nearly 60 million Pakistanis will join the consumer class (consumers spending more than $11 per day) to raise the country's consumer market rank from 15 to 7 by 2030. WEF forecasts the world's top 10 consumer markets of 2030 to be as follows: China, India, the United States, Indonesia, Russia, Brazil, Pakistan, Japan, Egypt and Mexico. Global investors chasing bigger returns will almost certainly shift more of their attention and money to the biggest movers among the top 10 consumer markets, including Pakistan. Already, the year 2021 has been a banner year for investments in Pakistani technology startups.

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistani-Americans: Young, Well-educated and Prosperous

Last Decade Saw 16.5 Million Pakistanis Migrate Overseas

Pakistan Remittance Soar 30X Since Year 2000

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Projected to Be 7th Largest Consumer Market By 2030

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

-

Comment by Riaz Haq on February 24, 2023 at 11:07am

-

GDP Growth Rate in Pakistan averaged 4.92 percent from 1952 until 2018, reaching an all time high of 10.22 percent in 1954 and a record low of -1.80 percent in 1952.

Pakistan is one of the poorest and least developed countries in Asia. Pakistan has a growing semi-industrialized economy that relies on manufacturing, agriculture and remittances. Although since 2005 the GDP has been growing an average 5 percent a year, it is not enough to keep up with fast population growth. To make things even worst, political instability, widespread corruption and lack of law enforcement hamper private investment and foreign aid.

https://tradingeconomics.com/pakistan/gdp-growth#:~:text=GDP%20Grow....

-

Comment by Riaz Haq on March 2, 2023 at 2:17pm

-

#China blames ‘certain developed country’ (reference to #US) for #Pakistan’s #economic crisis. US policy is "the main reason behind the financial difficulties of a large number of developing countries including Pakistan" #Ukraine️ #Russia #sanctions https://tribune.com.pk/story/2404069/china-blames-certain-developed...

In an apparent reference to the United States, a Chinese Foreign Ministry spokesperson on Thursday said that the financial policies of a ‘certain developed country’ were the main reason behind the financial difficulties of a large number of developing countries including Pakistan and called on concerted efforts of all parties to play a constructive role in the economic and social development of the country.

“It must be pointed out that the financial policy of a certain developed country is the main reason behind the financial difficulties of a large number of developing countries including Pakistan,” Mao Ning said while responding to a question during her regular briefing held at the International Press Centre (IPC) in Beijing.

She said that the West-led commercial creditors and the multilateral financial institutions were the basic creditors for developing countries and called on concerted efforts of all parties to play a constructive role in the economic and social development of Pakistan.

-

Comment by Riaz Haq on March 15, 2023 at 11:24am

-

Is #India ready to take #China’s place in global #economy? That’s just wishful thinking. India’s modest economic size, challenging #investment environment and substandard #infrastructure are major deterrents to fruitful collaboration. #Modi #Hindutva https://www.scmp.com/comment/opinion/article/3213475/india-ready-ta...

by Sameer Basha

India has been increasingly viewed as a natural ally to countries like Australia, which see it as an economic and military counterweight to China. They believe the best way for this to happen is through foreign direct investment into the country, to allow for a gradual transition of enterprises from China to India.

In its 2022 Investment Climate Statement on India, the US State Department called the country “a challenging place to do business” and highlighted its protectionist measures, increased tariffs and an inability to adjust from “Indian standards” to international standards.

The 2023 Index of Economic Freedom ranks India 131st in the world and 27th out of 39 economies in the Asia-Pacific region. The Indian government places equity limits on foreign capital in some sectors of the economy. In these sectors, according to the government’s circular of its FDI policy, beyond the cap imposed on foreign ownership, the entity must be “owned by/held with/in the hands of resident Indian citizens and Indian companies, owned and controlled by resident Indian citizens”.

In addition, ambiguities in the tax code have meant companies like Vodafone, Cairn Energy and GE Capital have found themselves in the cross hairs of tax authorities, putting into question India’s maturity as an FDI hub.

Such actions have seen India’s FDI inflows, as a share of the global total, fall from 3.4 per cent to 2.8 per cent between 2019 and 2021, whereas China’s share has have risen from 14.5 per cent to 20.3 per cent. In recent years, companies like Harley-Davidson and the Royal Bank of Scotland have either downsized or exited India, with German retailer Metro AG selling its operations after two decades in the country.

When one compares the relative size of their economies, China had a nominal gross domestic product of US$17.7 trillion in 2021, while India’s was US$3.2 trillion. India invests only 30 per cent of its GDP, compared with 50 per cent for China; and 20 per cent of its economy comes from manufacturing, as opposed to 30 per cent of China.

Investing in a domestic network of roads, airports, seaports and rail lines, as well as streamlining FDI regulations, allows China to move its products from factories to consumers efficiently, making it an attractive prospect for investment. That is not to mention the world-class infrastructure that has transformed the urban landscapes of both old and new cities within the country.

Despite India’s economic progress, poverty is still a defining feature in its sprawling metropolises. Former Reserve Bank of India governor Raghuram Rajan has also weighed in on the India-China competition, stating: “The argument that India will replace China is very premature as India is a much smaller economy as of now.”

Unfortunately, India is not currently in a place to deliver on the expectations placed on it by countries like Australia, which remain stuck in a geopolitical gambit with China. Simply banking on its large population is a fickle way of viewing the options amid a decoupling from China’s economy. India is still decades away from realising its true potential.

The two countries’ goals also differ. China is transforming itself into a technologically driven economy in order to exceed the potential of the US. In contrast, India is attempting to position itself as a market-driven economy utilising its large population as a manufacturing base to compete with China.

-

Comment by Riaz Haq on May 26, 2023 at 6:30pm

-

Why Americans Are Having Fewer Babies - WSJ

https://www.wsj.com/articles/why-americans-are-having-fewer-babies-...

The number of babies born in the U.S. started plummeting 15 years ago and hasn’t recovered since. What looked at first like a temporary lull triggered by the 2008 financial crisis has stretched into a prolonged fertility downturn. Provisional monthly figures show that there were about 3.66 million babies born in the U.S. last year, a decline of 15% since 2007, even though there are 9% more women in their prime childbearing years.

The decline has demographers puzzled and economists worried. America’s longstanding geopolitical advantages, they say, are underpinned by a robust pool of young people. Without them, the U.S. economy will be weighed down by a worsening shortage of workers who can fill jobs and pay into programs like Social Security that care for the elderly. At the heart of the falling birthrate is a central question: Do American women simply want fewer children? Or are life circumstances impeding them from having the children that they desire?

---------

To maintain current population levels, the total fertility rate—a snapshot of the average number of babies women have over their lifetime—must stay at a “replacement rate” of 2.1 children per woman. In 2021, the U.S. rate was 1.66. Had fertility rates stayed at their 2007 peak, the U.S. would now have 9.6 million more kids, according to Kenneth Johnson, senior demographer at the University of New Hampshire.

Federal agencies are treating the slump like a temporary downturn. The Social Security Administration’s board of trustees projects that the total fertility rate will slowly climb to 2 by 2056 and hold there until the end of the century. Yet it’s been over a decade since fertility rates reached that level. Last year there were 2.8 workers for every Social Security recipient. That ratio is projected to shrink to 2.2 by 2045, roughly two-thirds what it was in 2000.

Some other developed countries are in a far deeper childbearing trough than the U.S. In South Korea, the total fertility rate hit a world record low of 0.84 in 2020 and has since sagged to 0.78. Italy’s rate slid to 1.24 last year. China’s population fell in 2022 for the first time in decades because its fertility rate has been far below the replacement rate for years. Its two-century reign as the world’s most populous country is expected to end this year when India overtakes it, if it hasn’t already.

In a recent note to clients, Neil Howe, a demographer at Hedgeye Risk Management, pointed to a World Bank report showing that the 2020s could be a second consecutive “lost decade” for global economic growth, in large part because of worsening demographics. By 2026 or 2027, he wrote, the growth rate of the working-age population in the entire high-income and emerging-market world will turn from slightly positive to slightly negative, reversing a durable driver of economic growth since the Industrial Revolution.

This shift will make the U.S. more dependent on immigration to supply enough workers to keep the economy humming. Immigrants accounted for 80% of U.S. population growth last year, census figures show, up from 35% just over a decade ago. Yet the number of young immigrant women coming to the U.S. has diminished, Johnson said, and the decline in fertility has been greatest among Hispanics.

Having fewer children has already changed the social fabric of the country’s schools, neighborhoods and churches. J.P. De Gance, president and founder of Communio, a nonprofit that helps churches encourage marriage, said that lower marriage and birth rates are one of the largest drivers of the decline in religious affiliation that’s left pews empty across the country. That matters for the whole community, De Gance said, because churches give lonely people a place to form friendships, as well as feeding hungry people and running schools that fill gaps in public education. “When that’s diminished, the entire culture’s diminished,” he said.

-

Comment by Riaz Haq on August 10, 2023 at 5:09pm

-

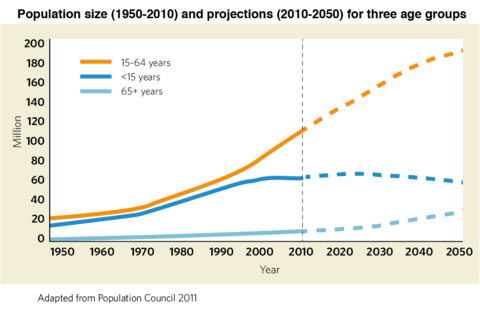

Dependency ratio is the ratio of children (under 15) and retirees (65 and above)) to working age (15-64 years) people in a population. Countries with high dependency ratios tend to perform poorly relative to countries with low dependency ratios in terms of economic growth.

A recent NY Times article by Lauren Leatherby titled "How a Vast Demographic Shift Will Reshape the World" uses charts and graphics to show how the world economic landscape will change during the rest of the century.

It shows that Pakistan will join the top 10 countries with highest share of working age population and lowest dependency ratios.

https://www.nytimes.com/interactive/2023/07/16/world/world-demograp...

Pakistan will join top 10 countries in working age population in 2050

Bangladesh is already in the top 10 working age population countries today.

https://www.nytimes.com/interactive/2023/07/16/world/world-demograp...

Countries are categorized as having large working-age populations if people between the ages of 15 and 64, an age group commonly used by demographers, make up at least 65 percent of the total population.

Countries where at least a quarter of the population is under age 15 and where less than 65 percent of the population is working age are categorized as having a large young population. Countries are categorized as having a large old population if those age 65 and older make up more than a quarter of the population.

Unless noted otherwise, graphics include all countries with a population of at least 50,000 people.

The world’s demographics have already been transformed. Europe is shrinking. China is shrinking, with India, a much younger country, overtaking it this year as the world’s most populous nation.

But what we’ve seen so far is just the beginning.

The projections are reliable, and stark: By 2050, people age 65 and older will make up nearly 40 percent of the population in some parts of East Asia and Europe. That’s almost twice the share of older adults in Florida, America’s retirement capital. Extraordinary numbers of retirees will be dependent on a shrinking number of working-age people to support them.

In all of recorded history, no country has ever been as old as these nations are expected to get.

As a result, experts predict, things many wealthier countries take for granted — like pensions, retirement ages and strict immigration policies — will need overhauls to be sustainable. And today’s wealthier countries will almost inevitably make up a smaller share of global G.D.P., economists say.

This is a sea change for Europe, the United States, China and other top economies, which have had some of the most working-age people in the world, adjusted for their populations. Their large work forces have helped to drive their economic growth.

Those countries are already aging off the list. Soon, the best-balanced work forces will mostly be in South and Southeast Asia, Africa and the Middle East, according to U.N. projections. The shift could reshape economic growth and geopolitical power balances, experts say.

-

Comment by Riaz Haq on August 11, 2024 at 6:23pm

-

Pakistan - Age Dependency Ratio (% Of Working-age Population) - 2024 Data 2025 Forecast 1960-2023 Historical. Down from 74% in 2012 to 68% in 2023

https://tradingeconomics.com/pakistan/age-dependency-ratio-percent-...

Age dependency ratio (% of working-age population) in Pakistan was reported at 68.04 % in 2023, according to the World Bank collection of development indicators, compiled from officially recognized sources. Pakistan - Age dependency ratio (% of working-age population) - actual values, historical data, forecasts and projections were sourced from the World Bank on August of 2024.

Comment

- ‹ Previous

- 1

- …

- 3

- 4

- 5

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

What Can Pakistan Do to Cut Toxic Smog in Lahore?

Citizens of Lahore have been choking from dangerous levels of toxic smog for weeks now. Schools have been closed and outdoor activities, including travel and transport, severely curtailed to reduce the burden on the healthcare system. Although toxic levels of smog have been happening at this time of the year for more than a decade, this year appears to be particularly bad with hundreds of people hospitalized to treat breathing problems. Millions of Lahoris have seen their city's air quality…

ContinuePosted by Riaz Haq on November 14, 2024 at 10:30am — 1 Comment

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network