PakAlumni Worldwide: The Global Social Network

The Global Social Network

Goldman Sachs Projects Pakistan Economy to Become the World's 6th Largest by 2075

|

| GDP Ranking Changes Till 2075. Source: Goldman Sachs Investment Res... |

|

| Economic Growth Rate Till 2075. Source: Goldman Sachs Investment Re... |

Economic Impact of Slower Population Growth:

Daly and Gedminas argue that slowing population growth in the developed world is causing their economic growth to decelerate. At the same time, the economies of the developing countries are driven by their rising populations. Here are four key points made in the report:

1) Slower global potential growth, led by weaker population growth.

2) EM convergence remains intact, led by Asia’s powerhouses. Although real GDP growth has slowed in both developed and emerging economies, in relative terms EM growth continues to outstrip DM growth.

3) A decade of US exceptionalism that is unlikely to be repeated.

4) Less global inequality, more local inequality.

|

| Goldman Sachs' Revised GDP Projections. Source: The Path to 2075 |

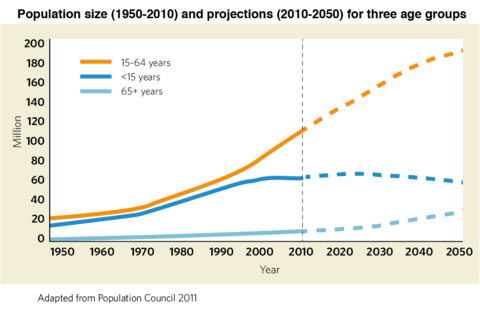

Demographic Dividend:

With rapidly aging populations and declining number of working age people in North America, Europe and East Asia, the demand for workers will increasingly be met by major labor exporting nations like Bangladesh, China, India, Mexico, Pakistan, Russia and Vietnam. Among these nations, Pakistan is the only major labor exporting country where the working age population is still rising faster than the birth rate.

|

| Pakistan Population Youngest Among Major Asian Nations. Source: Nik... |

|

| World Population 2022. Source: Visual Capitalist |

|

| World Population 2050. Source: Visual Capitalist |

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. Nearly 700,000 Pakistanis have already migrated in this calendar year as of October, 2022. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East was over half a million in the last decade.

|

| Consumer Markets in 2030. Source: WEF |

World's 7th Largest Consumer Market:

Pakistan's share of the working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. With its rising population of this working age group, Pakistan is projected by the World Economic Forum to become the world's 7th largest consumer market by 2030. Nearly 60 million Pakistanis will join the consumer class (consumers spending more than $11 per day) to raise the country's consumer market rank from 15 to 7 by 2030. WEF forecasts the world's top 10 consumer markets of 2030 to be as follows: China, India, the United States, Indonesia, Russia, Brazil, Pakistan, Japan, Egypt and Mexico. Global investors chasing bigger returns will almost certainly shift more of their attention and money to the biggest movers among the top 10 consumer markets, including Pakistan. Already, the year 2021 has been a banner year for investments in Pakistani technology startups.

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistani-Americans: Young, Well-educated and Prosperous

Last Decade Saw 16.5 Million Pakistanis Migrate Overseas

Pakistan Remittance Soar 30X Since Year 2000

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Projected to Be 7th Largest Consumer Market By 2030

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

-

Comment by Riaz Haq on December 8, 2022 at 7:25am

-

In last 65 years (1952-2018), #Pakistan's #GDP growth rate has averaged 4.92%, reaching an all time high of 10.22% in 1954 & a record low of -1.80% in 1952. If Pakistan continues to average 4.92% over the next 53 years until 2075, it will be $4.9 trillion GDP in today's dollars

https://twitter.com/haqsmusings/status/1600882957543043072?s=20&...

-

Comment by Riaz Haq on December 8, 2022 at 8:20am

-

In last 65 years (1952-2018), #Pakistan's #GDP growth rate has averaged 4.92%, reaching an all time high of 10.22% in 1954 & a record low of -1.80% in 1952. If Pakistan continues to average 4.92% over the next 53 years until 2075, it will be $4.9 trillion GDP in today's dollars

https://twitter.com/haqsmusings/status/1600882957543043072?s=20&...

$1 in 2021 is equivalent in purchasing power to about $5.27 in 2075, an increase of $4.27 over 54 years. The dollar had an average inflation rate of 3.13% per year between 2021 and 2075, producing a cumulative price increase of 426.85%. The buying power of $1 in 2021 is predicted to be equivalent to $5.27 in 2075.

https://www.in2013dollars.com/us/inflation/2021?endYear=2075&am...

----------------------

Multiplying $4.9 trillion in today's dollars by 5.27 gives us $25.8 trillion in 2075 dollars.

-

Comment by Riaz Haq on December 8, 2022 at 10:23am

-

Saudis to aid Pakistan, deals eyed in Egypt, Turkey

https://www.taipeitimes.com/News/world/archives/2022/12/09/2003790430

Saudi Arabia plans to provide Pakistan with financial support, Saudi Minister of Finance Mohammed al-Jadaan said, as the kingdom looks to help shore up alliances with countries struggling with the effects of rising inflation.

The Saudi Arabian government is to “continue to support Pakistan as much as we can,” al-Jadaan said at a news conference in Riyadh.

The kingdom has taken several steps to provide financial support to countries in the region as it looks to bolster allies and cement new relationships.

Earlier this month, it extended the term of a US$3 billion deposit to boost foreign currency reserves and help Pakistan overcome economic repercussions of the COVID-19 pandemic.

Saudi Arabia is also looking to make more investments in Egypt and is planning to initiate deals in Turkey, al-Jadaan said.

“Our relationship with Turkey is improving greatly, and we hope to have investment opportunities,” he said. “We have started investing aggressively in Egypt and we will continue to look at investment opportunities and that is more important than deposits. Deposits can be pulled, but investments stay.”

Saudi Arabia is in the final stages of agreeing to deposit US$5 billion at Turkey’s central bank, the finance ministry said last month, a major boost for Turkish President Recep Tayyip Erdogan’s bid to keep the country’s currency stable ahead of presidential elections next year.

The agreement would crown a recent rapprochement that ended years of hostility between the Turkish and Saudi Arabian governments.

It also extended the maturity of a US$5 billion deposit with Egypt’s central bank last month, and the kingdom’s Public Investment Fund is also looking into US$10 billion of potential investments in Egypt’s healthcare, education, agriculture and financial sectors, the Egyptian Cabinet said in a statement.

The momentum of talks between the countries’ central banks comes after a joint effort by Saudia Arabia and Turkey to mend ties that were ruptured after the murder of Saudi Arabian journalist Jamal Khashoggi in 2018 at the kingdom’s Istanbul consulate.

-

Comment by Riaz Haq on December 8, 2022 at 6:57pm

-

Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

First, there is a large gap between the largest three economies (China, India and the US) and all other economies (although the Euro area represents a fourth economic

superpower, if it is treated as a single economy). Thus, although Indonesia, Nigeria

and Pakistan are projected to be fourth, fifth, and sixth in the 2075 GDP rankings each of them are projected to be less that one-third of the size of China, India and

the US.

Second, while China and India are projected to be larger than the US by 2075, our

projections imply that the US will remain more than twice as rich as both (and five

times as rich as countries such as Nigeria and Pakistan).

Pakistan Economic Growth

Actual:

2000-2009 4.7%

2009-2019 4.0

Projected:

2019-2029 5.0

2024-2029 6.0

2030-2039 5.9

2040-2049 5.3

2050-2059 4.7

2060-2069 4.0

2070-2079 3.4

Pakistan GDP in Trillion US$

2000 0.1

2010 0.2

2020 0.3

2030 0.6

2040 1.6

2050 3.3

2060 6.1

2070 9.9

2075 12.3

-

Comment by Riaz Haq on December 8, 2022 at 7:03pm

-

Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Pakistan Per Capita Income in thousands of 2021 US$

2000 0.9

2010 1.3

2020 1.4

2030 2.2

2040 4.8

2050 9.0

2060 14.9

2070 22.5

2075 27.1

-

Comment by Riaz Haq on December 8, 2022 at 7:31pm

-

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

Pakistan 4.7 4.0 5.0 6.0 5.9 5.3 4.7 4.0 3.4

China 10.3 7.7 4.2 4.0 2.5 1.6 1.1 0.9 0.5

India 6.9 6.9 5.0 5.8 4.6 3.7 3.1 2.5 2.1

Korea 4.9 3.3 2.0 1.9 1.4 0.8 0.3 -0.1 -0.2

Bangladesh 5.6 6.6 6.3 6.6 4.9 3.8 3.0 2.5 2.0

---------------------

Country GDP in Trillions of U$ from 2000 to 2075

Pakistan 0.1 0.2 0.3 0.6 1.6 3.3 6.1 9.9 12.3

China 1.8 7.4 15.5 24.5 34.1 41.9 48.6 54.8 57.0

India 0.7 2.1 2.8 6.6 13.2 22.2 33.2 45.8 52.5

Korea 0.9 1.4 1.7 2.0 2.6 3.1 3.3 3.4 3.4

Bangladesh 0.1 0.2 0.4 0.8 1.7 2.8 4.1 5.5 6.3

-------------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

Pakistan 0.9 1.3 1.4 2.2 4.8 9.0 14.9 22.5 27.1

China 1.4 5.5 10.9 17.3 24.7 31.9 40.3 50.4 55.4

India 0.7 1.7 2.0 4.3 8.2 13.3 19.6 27.1 31.3

Korea 18.7 28.8 33.0 39.3 53.6 67.7 81.8 95.2 101.8

Bangladesh 0.7 1.1 2.3 4.4 8.4 13.5 19.7 26.9 31.0

-

Comment by Riaz Haq on December 9, 2022 at 10:18am

-

#Pakistan's top court endorses #Canadian mining giant Barrick Gold's $10 billion #investment at Reko Diq in #Balochistan. It is one of the world's largest underdeveloped sites of #copper and #gold deposits.

https://www.reuters.com/markets/asia/pakistans-court-endorses-settl...

Pakistan's Supreme Court endorsed on Friday a settlement for Barrick Gold (ABX.TO) to resume mining at the Reko Diq project, one of the world's largest underdeveloped sites of copper and gold deposits, it said in an order.

The endorsement was a condition of the settlement for Barrick to resume work on the project in the southwestern province of Balochistan, bordering Afghanistan and Iran, in which it will invest $10 billion.

Chief Justice Umar Ata Bandial, the head of a five-judge panel, read out the operative part of the brief order in court.

"The agreements ... have not been found by us to be unconstitutional or illegal on the parameters and grounds spelt out," read the order seen by Reuters.

President Arif Alvi had asked the court to review the deal.

In an out of court agreement this year, Barrick Gold ended a long-running dispute with Pakistan, and agreed to restart development.

Under the deal, the company withdrew its case in an international arbitration court, which had slapped a penalty of $11 billion on Pakistan for suspending the contracts of the company and its partners in 2011.

The company's licence to mine the untapped deposits was cancelled after the Supreme Court ruled illegal the award granted to it and its partner, Chile's Antofagasta (ANTO.L).

Antofagasta had agreed to exit the project, saying its growth strategy was focused on production of copper and by-products in the Americas.

Pakistan's mineral-rich province of Balochistan is home to both Islamist militants and separatist Baloch insurgents, who have engaged in insurgency against the government for decades, demanding a greater share of the region's resources.

-

Comment by Riaz Haq on December 9, 2022 at 11:01am

-

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

United States 1.9 2.3 1.7 1.9 1.7 1.5 1.4 1.3 1.2

Germany 0.8 2.0 0.7 1.2 1.3 1.1 0.9 0.9 1.0

France 1.5 1.4 1.2 1.7 1.5 1.3 1.2 1.2 1.1

Italy 0.5 0.3 0.9 1.4 1.0 0.7 0.6 0.5 0.5

Japan 0.5 1.2 0.6 0.9 0.8 0.7 0.7 0.6 0.5

United Kingdom 1.6 2.0 1.4 2.0 1.9 1.6 1.5 1.3 1.2

Australia 3.1 2.6 2.3 2.5 2.4 2.1 1.8 1.7 1.5

Canada 2.1 2.3 1.7 2.1 2.0 1.9 1.7 1.6 1.6

Indonesia 5.3 5.4 3.8 4.3 3.6 3.0 2.6 2.3 2.0

Thailand 4.3 3.6 1.9 2.8 2.4 1.9 1.4 1.1 0.9

Philippines 4.5 6.4 4.4 6.0 4.9 4.1 3.5 3.1 2.7

Malaysia 4.7 5.4 2.9 3.6 3.5 2.9 2.2 1.8 1.5

Russia 5.5 2.1 0.3 1.2 1.6 1.2 1.2 1.3 1.1

Turkey 4.0 5.9 4.2 3.5 2.9 2.1 1.7 1.4 1.1

Kazakhstan 8.6 4.4 2.7 3.1 3.2 2.8 2.8 2.8 2.5

South Africa 3.6 1.7 1.8 2.8 3.6 3.4 2.9 2.6 2.2

Nigeria 8.3 3.8 3.6 4.6 6.3 6.1 5.4 4.6 3.9

Ghana 5.3 6.7 4.3 5.0 5.2 4.9 4.5 4.1 3.6

Ethiopia 8.6 9.6 8.6 10.7 8.2 6.6 5.5 4.7 4.0

------

Country GDP in Trillions of U$ from 2000 to 2075

United States 15.6 18.5 21.8 27.0 32.0 37.2 42.8 48.6 51.5

Germany 3.0 4.2 4.0 4.4 5.3 6.2 6.9 7.7 8.1

France 2.1 3.3 2.7 3.2 3.9 4.6 5.4 6.1 6.5

Italy 1.7 2.6 2.0 2.3 2.7 3.1 3.4 3.6 3.8

Japan 7.5 7.1 5.2 4.4 5.2 6.0 6.7 7.2 7.5

United Kingdom 2.5 3.1 2.9 3.3 4.3 5.2 6.1 7.1 7.6

Australia 0.6 1.5 1.4 1.8 2.3 2.8 3.3 3.9 4.3

Canada 1.1 2.0 1.7 2.3 2.8 3.4 4.1 4.8 5.2

Indonesia 0.3 0.9 1.1 2.2 4.0 6.3 9.0 12.1 13.7

Thailand 0.2 0.4 0.5 0.7 1.2 1.7 2.2 2.6 2.8

Philippines 0.1 0.3 0.4 0.7 1.4 2.5 3.9 5.6 6.6

Malaysia 0.2 0.3 0.4 0.6 1.2 1.8 2.5 3.2 3.5

Russia 0.4 2.0 1.5 2.8 3.7 4.5 5.4 6.4 6.9

Turkey 0.4 1.0 0.8 1.3 2.2 3.1 4.0 4.8 5.2

Kazakhstan 0.0 0.2 0.2 0.3 0.6 0.9 1.3 1.8 2.1

Egypt 0.2 0.3 0.4 0.8 1.9 3.5 5.8 8.8 10.4

Saudi Arabia 0.3 0.7 0.7 1.5 2.4 3.5 4.5 5.6 6.1

Pakistan 0.1 0.2 0.3 0.6 1.6 3.3 6.1 9.9 12.3

South Africa 0.2 0.5 0.4 0.5 0.9 1.4 2.1 2.8 3.3

Nigeria 0.1 0.5 0.4 0.8 1.6 3.4 6.2 10.4 13.1

Ghana 0.0 0.1 0.1 0.1 0.3 0.5 0.8 1.2 1.5

Ethiopia 0.0 0.0 0.1 0.3 0.7 1.6 2.9 4.9 6.2

-------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

United States 55.1 59.5 64.8 76.7 87.3 99.2 112.3 125.5 132.2

Germany 36.3 51.5 48.6 53.2 65.9 78.6 90.7 104.2 111.6

France 35.3 52.2 42.6 48.3 59.2 70.5 82.9 96.1 102.8

Italy 30.6 44.0 33.1 39.6 49.6 59.2 70.2 82.2 88.0

Japan 59.4 55.3 41.8 36.8 47.0 57.5 68.9 81.2 87.6

United Kingdom 42.9 48.9 42.9 47.9 60.2 72.5 85.7 99.8 106.6

Australia 31.9 70.1 55.1 64.4 75.1 86.7 98.8 112.3 119.4

Canada 36.8 58.6 45.2 56.4 64.7 74.5 85.4 97.0 103.1

Indonesia 1.3 3.8 4.1 7.5 12.9 19.8 28.2 38.0 43.4

Thailand 3.0 6.1 7.3 10.1 17.0 25.0 34.0 44.0 49.3

Philippines 1.6 2.7 3.4 5.5 9.9 15.7 23.1 32.1 37.3

Malaysia 6.8 11.1 10.6 17.0 29.5 44.2 59.2 75.1 83.5

Russia 2.9 14.0 10.6 19.9 27.2 34.1 42.1 52.1 57.2

Turkey 6.5 13.1 8.9 14.3 23.2 32.1 41.3 51.5 56.7

Kazakhstan 1.8 11.0 9.4 16.1 25.5 35.4 47.4 62.5 70.5

Egypt 2.2 3.2 3.7 6.3 12.9 22.0 33.5 47.1 54.6

Saudi Arabia 13.3 22.1 20.4 36.1 54.2 71.9 90.2 110.5 120.6

Pakistan 0.9 1.3 1.4 2.2 4.8 9.0 14.9 22.5 27.1

South Africa 4.9 9.9 6.0 8.0 12.9 19.3 27.3 37.2 42.6

Nigeria 0.8 2.8 2.1 2.9 5.1 8.9 14.4 22.0 26.5

Ghana 0.9 2.1 2.3 3.3 5.5 8.7 13.2 19.4 23.1

Ethiopia 0.2 0.4 0.9 1.9 4.0 7.3 11.8 18.1 21.9

-

Comment by Riaz Haq on December 10, 2022 at 8:38am

-

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to...

The 10 years following the creation of the BRICs acronym in 2001 represented a golden

era for emerging market economic and financial market outperformance. Between the

early 2000s and the 2007/08 Global Financial Crisis (GFC), growth was unusually strong

in most economies and especially so in EMs, fuelled by exceptionally rapid globalisation.

And, while the Global Financial Crisis drove developed economies into a deep and

lengthy recession, the majority of EMs weathered that storm relatively well. For most

economies and in most respects, our first set of BRICs projections underestimated the

speed of EM convergence over the subsequent 10 years.

The same was not true for the 10 years after that. In Exhibit 7 we compare actual GDP

growth for the period 2010-2019 with our 2011 projections.4

GDP growth has undershot

our 2011 estimates by an average of 0.6 percentage points per year (based on a

PPP-weighted average). The most notable underperformers have been Russia, Brazil,

and Latin America more generally. That said, the cross-country performance has been

mixed, with the world’s two largest economies – the US and China – matching our

projections and India slightly surpassing them.

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

Brazil 3.4 1.4 1.9 2.4 2.8 2.5 2.1 1.7 1.5

Mexico 1.5 2.7 1.8 3.0 3.0 2.6 2.2 1.7 1.4

Argentina 2.6 1.4 2.6 3.3 3.1 2.6 2.2 1.8 1.5

Colombia 3.9 3.7 3.4 3.4 3.3 2.7 2.2 1.7 1.4

Chile 4.2 3.3 2.1 2.3 2.4 2.0 1.6 1.4 1.2

Peru 5.0 4.5 3.3 4.2 4.0 3.5 2.9 2.5 2.1

------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

Brazil 5.7 13.8 7.1 10.4 15.3 21.3 28.3 36.3 40.8

Mexico 11.0 11.6 9.0 14.3 21.2 29.5 39.2 50.0 55.7

Argentina 13.0 12.7 9.0 15.2 20.9 27.2 34.5 42.5 46.7

Colombia 3.8 7.9 5.5 9.8 16.4 24.4 33.3 43.1 48.5

Chile 7.7 15.7 13.6 18.3 26.2 35.0 44.0 54.2 59.8

Ecuador 2.2 5.7 5.9 7.8 11.2 15.5 21.0 27.6 31.4

Peru 2.9 6.3 6.4 9.8 15.5 22.7 31.1 41.0 46.5

-----------

Country GDP in Trillions of U$ from 2000 to 2075

Brazil 1.0 2.7 1.5 2.3 3.5 4.9 6.4 8.0 8.7

Mexico 1.1 1.3 1.1 1.9 3.0 4.2 5.6 6.9 7.6

Argentina 0.5 0.5 0.4 0.7 1.0 1.4 1.8 2.2 2.4

Colombia 0.2 0.4 0.3 0.5 0.9 1.4 1.9 2.4 2.6

Chile 0.1 0.3 0.3 0.4 0.5 0.7 0.9 1.1 1.2

Ecuador 0.0 0.1 0.1 0.2 0.2 0.3 0.5 0.6 0.7

Peru 0.1 0.2 0.2 0.4 0.6 1.0 1.4 1.8 2.1

-

Comment by Riaz Haq on December 11, 2022 at 8:15am

-

India Can’t Dethrone China as the World’s Manufacturing Power

https://nationalinterest.org/blog/buzz/india-can%E2%80%99t-dethrone...

Due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China.

With everything seemingly going right for India, can it really replace China on the global supply chain? Unfortunately for India, due to its insufficient labor quality and infrastructure investment, fractured society, market restrictions, and trade protectionism, the South Asian nation is unlikely to replace China in the global manufacturing supply chain anytime soon.

To begin with, India’s labor quality and infrastructure availability fall far behind China’s. Many people consider India’s low labor costs a key advantage vis-à-vis China. Indeed, India’s daily median income in urban areas in 2017 was $4.21, roughly sixteen years behind China’s, which was $12.64. However, what good are low labor costs if the benefits are also relatively low? Despite India’s laudable development achievements in the past few decades, its capability enhancements have lagged far behind China’s. India’s share of stunted children today is roughly the same as China’s over two decades ago, its life-expectancy growth is twenty-five years behind China’s, and its adult literacy rate is roughly three decades behind.

Not to mention, India’s state capacity is less extensive than China’s, and many Indians who grow up in slums live their entire lives without government files. Therefore, India’s lag in labor capability enhancement behind China is likely worse than what official data suggest. These factors affect workers’ efficiency on factory floors and their ability to advance their careers in manufacturing over the long term. Low labor costs might not make up for these low labor qualities. In fact, if India cannot deal with these capability deficits effectively, its surging population might undermine India’s social stability, although the Modi administration has done well so far in this respect.

Besides labor, manufacturing also requires capital, especially infrastructure. Few developing countries can compete with China in this regard, and India is no exception. To be clear, when foreign investors chose China to be their manufacturing hub, it was, to a certain extent, a coincidence. In 1994, China reformed its tax system to enhance the central government’s control over the country’s fiscal revenues. The reform forced local governments to look for new sources of tax income and ultimately resort to local government financing vehicles (LGFVs). Because the land appreciation tax went to local governments, they began to encourage construction, sell rights to land use, and use tracts of land as collateral to fund infrastructure in the form of LGFVs. The LGFVs led to an abundance of investments and many empty industrial parks. When Western investors started to look overseas for places to build factories around the same period, China seemed especially appealing due to its availability of capital.

-------

Despite its many advantages and Western countries’ support, it is unlikely that India can replace China in the global manufacturing supply chain for the foreseeable future. Economically, despite its low labor costs, the low quality of India’s labor pool that stems from its deficits in capability development offset its labor advantages, and inadequate infrastructure investments put India at a disadvantage regarding capital costs. Socially, India’s fractured multi-dimensional society creates different economic demands for various groups, undermining the advantages of India’s large population. Politically, India’s market restrictions make its business environment less favorable and decrease its industrial labor supply. Meanwhile, protectionist traditions hinder India’s ability to adopt an export-oriented growth model and integrate itself into the global supply chain.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Canada Gets Tough on Foreign Students Amid Mounting Tensions With India

The Canadian government has recently taken a series of steps to cut the number of international students studying in Canada. This is believed to be related to the extremely hostile Indian government response to Canadian allegations that the Indian officials ordered assassinations of Sikh activists in Canada. There are now new reports that Ottawa has asked Indian students to resubmit their documents for review. Earlier, Canada made a decision to end the fast-track visa process, known as…

ContinuePosted by Riaz Haq on December 14, 2024 at 10:00am

Russian Hackers Steal Indian Military Secrets From Pakistani Cyber Spies

Hackers linked to Russian intelligence have stolen Indian military data from cyber spies believed to be working on behalf of the Pakistani state, according to an assessment by Microsoft researchers. All those involved are part of what are known as "advanced persistent threat" (APT) organizations in their respective countries. TechTarget defines "Advanced Persistent Threat (APT)…

ContinuePosted by Riaz Haq on December 8, 2024 at 8:00am

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network