PakAlumni Worldwide: The Global Social Network

The Global Social Network

FinCEN Files: UK is Global Center For Money Laundering and Pakistan Among its Top 3 Sources

The latest leaks of US FinCEN (Financial Crime Enforcement Network) files show that the United Kingdom (UK) is the biggest global center for money laundering. An earlier report issued by the British Crime Agency put Pakistan among the world's top sources of money laundering in the United Kingdom. The latest FinCEN leaks represent just the tip of an iceberg. The leaked 2,100 FinCEN files covering $2 trillion worth of transactions that ICIJ (International Consortium of Investigative Journalists) and Buzzfeed reporters got their hands on represent just a small sliver of the roughly 12 million SARs FinCEN has received since 2011. Pakistan's Prime Minister Imran Khan has repeatedly raised the issue of the West's inaction in stopping the illicit flows of hard currencies from developing nations to the developed world. Money laundering and other financial crimes affect the economic roots of a nation like Pakistan and slow down its human and socioeconomic development.

|

| FinCEN Leaks Represent Tip of Iceberg |

FinCEN Leaks:

Financial Crimes Enforcement Network (FinCEN) is an arm of the U.S. Treasury Department responsible for keeping tabs on and combating money laundering. All banks are required by US Law to file SARS (Suspicious Activity Reports) of transactions involving unclear sources and beneficiaries, or those connected to jurisdictions with a history of financial crime.

Banks file about 2.2 million such transactions each year. Very few of these are actually reviewed or investigated by the US government. Recently, journalists at Buzzfeed and the International Consortium of Investigative Journalists (ICIJ) have announced they have obtained 2,100 FinCEN files covering $2 trillion worth of transactions that represent just a small sliver of the roughly 12 million SARs FinCEN has received since 2011. Some of the biggest western banks, including HSBC, JP Morgan, Barclays and Standard Charter Bank are named among the institutions reporting SARS.

Pakistani Banks:

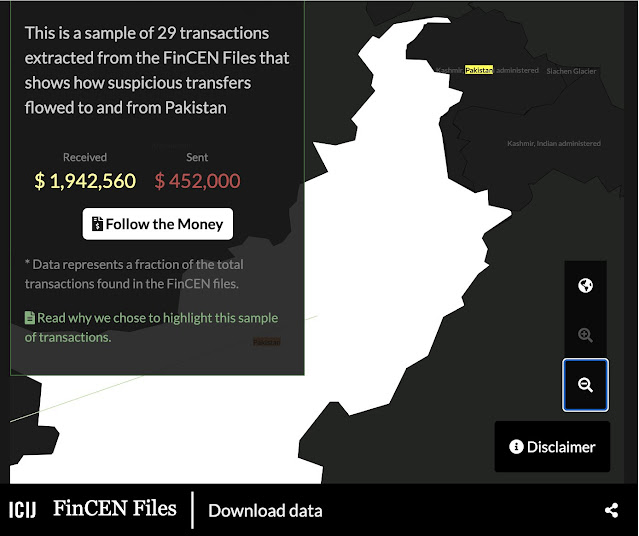

There are six Pakistani banks named among those filing suspicious activity reports with FinCEN. The banks named are Allied Bank, United Bank (UBL), Habib Metropolitan Bank, Bank Alfalah, Standard Chartered Bank Pakistan, and Habib Bank (HBL). According to the data revealed by ICIJ, 29 such suspicious transactions from and to Pakistan were flagged. Of those, the ‘received’ transactions amounted to $1,942,560, while the ‘sent’ transaction was $452,000.

FinCEN leaks show suspicious activity of a Dubai-registered company linked to Altaf Khanani of Pakistan through accounts at Danske Bank. “There can only be one reason why money has been moved out of Danske Bank and into his trading companies - and that is money laundering. Because that was the only thing that happened in those companies,” says Richard Grant, the former head of the Australian intelligence service told DR, a Danish news platform.

Pakistan Among Top 3 Sources:

British National Crime Agency (NCA) has identified Pakistan, Nigeria and Russia as the top source countries for money laundering in the United Kingdom, according to British media reports. The NCA report says the UK is a prime destination for foreign corrupt and politically exposed people (politicians and their families) to launder money.

In its annual assessment of serious and organized crime, the NCA says: “Investment in UK property, particularly in London, continues to be an attractive mechanism to launder funds....As the UK moves towards exiting the EU in March 2019, UK-based businesses may look to increase the amount of trade they have with non-EU countries....We judge this will increase the likelihood that UK businesses will come into contact with corrupt markets, particularly in the developing world, raising the risk they will be drawn into corrupt practices.”

Here are some of the key excerpts of the UK NCA report titled "National Strategic Assessment of Serious and Organized Crime 2018":

1. "The UK is a prime destination for foreign corrupt PEPs (politically exposed persons, a euphemism for politicians and their family member) to launder the proceeds of corruption. Investment in UK property, particularly in London, continues to be an attractive mechanism to launder funds. The true scale of PEPs investment in the UK is not known, however the source countries that are most commonly seen are Russia, Nigeria and Pakistan".

2. "The overseas jurisdictions that have the most enduring impact on the UK across the majority of the different money laundering threats are: Russia, China, Hong Kong, Pakistan, and the United Arab Emirates (UAE). Some of these jurisdictions have large financial sectors which also make them attractive as destinations or transit points for the proceeds of crime."

|

| Politicians Dominate Panama Papers |

Panama Papers Leak:

The NCA report says there are "professional enablers from the banking, accounting and legal world" who facilitate the legitimization of criminal finances and are perpetuate the problem by refinancing further criminality.

In fact, there is an entire industry made up of lawyers and accountants that offers its services to help hide illicit wealth. Mossack Fonseca, the law firm that made headlines with "Panama Leaks", is just one example of companies in this industry.

Mossack Fonseca's 11.5 million leaked internal files contained information on more than 214,000 offshore entities tied to 12 current or former heads of state, 140 politicians, including Pakistan's now ex Prime Minister Nawaz Sharif's family. Icelandic Prime Minister resigned voluntarily and Pakistani Prime Minister was forced out by the country's Supreme Court.

The Panama list included showbiz and sports celebrities, lawyers, entrepreneurs, businessmen, journalists and other occupations but it was heavily dominated by politicians.

Prime Minister Nawaz Sharif is linked to 9 companies connected to his family name. Those involved are: Hassan Nawaz, Hussain Nawaz, Maryam Nawaz, Relatives of Punjab Chief Minister and brother of Prime Minister Shahbaz Sharif are linked to 7 companies. They are: Samina Durrani and Ilyas Meraj.

Former Prime Minister Benazir Bhutto was linked to one company. Her relatives and associates are linked to others: Nephew Hassan Ali Jaffery Javed Pasha, Close friend of Asif Ali Zardari (4 companies), PPP Senator Rehman Malik (1 company), PPP Senator Osman Saifullah’s family (34 companies), Anwar Saifullah, Salim Saifullah, Humayun Saifullah, Iqbal Saifullah, Javed Saifullah, Jehangir Saifullah. The Chaudharies of Gujrat have not been linked personally but other relatives have including: Waseem Gulzar Zain Sukhera (co-accused with former Prime Minister Yusuf Raza Gilani’s son in the Hajj scandal).

Pakistani Businessmen in Panama Leaks: Real Estate tycoon Malik Riaz Hussain’s son (Bahria Town) Ahmad Ali Riaz (1 company), Chairman ABM Group of Companies Azam Sultan (5 companies), Pizza Hut owner Aqeel Hussain and family (1 company), Brother Tanwir Hassan Chairman Soorty Enterprise Abdul Rashid Soorty and family, Sultan Ali Allana, Chairman of Habib Bank Limited (1 company), Khawaja Iqbal Hassan, former NIB bank President (1 company), Bashir Ahmed and Javed Shakoor of Buxly Paints (1 company), Mehmood Ahmed of Berger Paints (1 company), Hotel tycoon Sadruddin Hashwani and family (3 companies), Murtaza Haswani Owner of Hilton Pharma, Shehbaz Yasin Malik and family (1 company), The Hussain Dawood family (2 companies), Shahzada Dawood Abdul Samad Dawood Partner Saad Raja, The Abdullah family of Sapphire Textiles (5 companies), Yousuf Abdullah and his wife, Muhammad Abdullah and his wife, Shahid Abdullah and his family, Nadeem Abdullah and family, Amer Abdullah and family, Gul Muhammad Tabba of Lucky Textiles, Shahid Nazir, CEO of Masood Textile Mills (1 company), Partner Naziya Nazir Zulfiqar Ali Lakhani, from Lakson Group and owner of Colgate-Palmolive, Tetley Clover and Clover Pakistan (1 company) and Zulfiqar Paracha and family of Universal Corporation (1 company).

Pakistani Judges in Panama Leaks: Serving Lahore High Court Judge Justice Farrukh Irfan, Retired Judge Malik Qayyum, Pakistani Media personnel in Panama Leaks: Mir Shakil-ur-Rehman of GEO-Jang Media Group (1 company).

FinCEN leaks differ from previous bank leaks such as the Panama Papers in a crucial way: They are a snapshot into financial crime that banks are openly reporting to the authorities.

These files mean, on a basic level, the reporting system is functioning. But the same leaks also show that banks frequently filed a SAR months after the transaction had taken place, and sometimes multiple times on the same client without anyone seemingly taking any action.

West's Inaction Hurts Poor Nations:

Speaking to the 75th plenary session pf the United Nations General Assembly (UNGS), Pakistan's Prime Minister Imran Khan raised the issue of the West's inaction is stopping the illicit flows of hard currencies from developing nations to the developed world. He said:"Every year billions of dollars leave poor countries & go to rich countries. Billions of dollars siphoned by corrupt politicians to tax havens ,expensive properties bought in western capitals. It is devastating to the developing world".

Pakistanis see the United Kingdom as the "Money Laundering Capital of the World" where corrupt leaders from developing nations use wealth looted from their people to buy expensive real estate and other assets. Private individuals and businesses from poor nations also park money in the west and other off-shore tax havens to hide their incomes and assets from the tax authorities in their countries of residence.

The multi-trillion dollar massive net outflow of money from the poor to the rich countries has been documented by the US-based Global Financial Integrity (GFI). This flow of capital has been described as "aid in reverse". It has made big headlines in Pakistan and elsewhere since the release of the Panama Papers and the Paradise Leaks which revealed true owners of offshore assets held by anonymous shell companies. Bloomberg has reported that Pakistanis alone own as much as $150 billion worth of undeclared assets offshore.

Summary:

The latest FinCEM leaks and previous Panama Papers as well as British crime agency reports confirm that the UK has attracted vast sums of illicit wealth from Pakistan and other emerging economies. Speaking to the 75th plenary session of the United Nations General Assembly (UNGS), Pakistan's Prime Minister Imran Khan raised the issue of the West's inaction is stopping the illicit flows of hard currencies from developing nations to the developed world. He said:"Every year billions of dollars leave poor countries & go to rich countries. Billions of dollars siphoned by corrupt politicians to tax havens ,expensive properties bought in western capitals. It is devastating to the developing world". Money laundering and other financial crimes affect the economic roots of a nation like Pakistan and slow down its human and socioeconomic development.

Related Links:

Haq's Musings

South Asia Investor Review

The West Enables Corruption in Developing Nations

Did Musharraf Steal Pakistani People's Money?

Pakistan Economy Hobbled By Underinvestment

Raymond Baker on Corruption in Pakistan

Nawaz Sharif Disqualified

Culture of Corruption in Pakistan

US Investigating Microsoft Bribery in Pakistan

Zardari's Corruption Probe in Switzerland

Politics of Patronage in Pakistan

Why is PIA Losing Money Amid Pakistan Aviation Boom?

-

Comment by Riaz Haq on October 21, 2020 at 8:01am

-

#TransparencyInternational #UK Head : “Foreign politicians with convictions relating to corruption should not enjoy impunity in Britain. Nor should their unexplained wealth, stashed in luxury London properties, fall out of the reach of law enforcement" https://www.ft.com/content/bef9565a-59a4-4290-8b29-f3866db21a84

Mr Sharif “has been responsible for pillaging the state and I trust that you will be supportive of our efforts to bring those responsible for corruption to account”, Mr Khan’s adviser, Mirza Shahzad Akbar, wrote to Ms Patel on October 5.

After the Panama Papers revealed hidden assets belonging to Mr Sharif’s family, he resigned as prime minister in 2017. The following year a Pakistan court sentenced him to seven years’ imprisonment for corruption. He has claimed that this and other corruption cases against him are politically motivated.

In November 2019 he flew to London after the Pakistan authorities granted him leave to travel abroad for eight weeks to seek treatment for various conditions. He sought an extension of his temporary release but the Pakistan authorities refused on the grounds that he had offered inadequate medical evidence and ordered Mr Sharif to return home.

According to records submitted to the Pakistan authorities, he has given as his London address the very flat on London’s opulent Park Lane that led to his downfall. His family’s ownership of the flat was exposed by the leak of secret files from the Panama law firm Mossack Fonseca.

The letter to Ms Patel urges her to use her “extensive powers” to deport Mr Sharif, arguing she is “duty bound” to do so. It cites immigration rules that criminals sentenced to four years or more must be refused leave to remain in the UK. A Pakistan court has issued a warrant for Mr Sharif’s arrest, the letter adds.

A Pakistan official said the UK had not yet formally responded. The Home Office declined to comment.

“Foreign politicians with convictions relating to corruption should not enjoy impunity in Britain. Nor should their unexplained wealth, stashed in luxury London properties, fall out of the reach of law enforcement,” said Daniel Bruce, head of Transparency International UK.

“The UK government should work constructively with democratic countries such as Pakistan to uphold the rule of law. Action should also be taken to seize and return illicit assets held here in Britain in order to deliver justice for the victims of corruption. Failure to act on cases such as this, earns the UK an unwelcome reputation as a safe haven for dirty money.”

-

Comment by Riaz Haq on April 21, 2021 at 9:02pm

-

Foreigners are buying single-family #homes in #American suburbs, bidding up prices. They are partnering with U.S. #housing companies to buy or build #rental homes, following in the footsteps of big #US #investment firms & pension funds. #realestate https://www.wsj.com/articles/that-suburban-home-buyer-could-be-a-fo...

Big foreign investment firms that buy office buildings, hotels and shopping centers around the world have a new favorite real-estate play: single-family homes in American suburbs.These institutions are partnering with U.S. housing companies to buy or build rental homes by the thousands. In suburban neighborhoods near cities such as Atlanta, Las Vegas and Phoenix, blocks of families are sending monthly rent checks to ventures backed by Canadian pension funds, European insurers, and Asian or Middle Eastern government-run funds.

The overseas investors are following in the footsteps of many big U.S. investment firms and pension funds, which started buying single-family homes on a large scale in the aftermath of the financial crisis.

Foreign investors barely registered in these markets a few years ago. Now, they account for nearly a third of institutional investment in single-family rental homes, said Alex Foshay, head of international capital markets at real-estate services firm Newmark.

“There’s been very limited overseas investment into the single-family rental space prior to Covid, but nothing on this scale,” he said.

-

Comment by Riaz Haq on May 27, 2022 at 4:23pm

-

HOUSE OF GRAFT: Tracing the Bhutto Millions -- A special report.; Bhutto Clan Leaves Trail of Corruption

https://www.nytimes.com/1998/01/09/world/house-graft-tracing-bhutto...

Officials leading the inquiry in Pakistan say that the $100 million they have identified so far is only a small part of a windfall from corrupt activities. They maintain that an inquiry begun in Islamabad just after Ms. Bhutto's dismissal in 1996 found evidence that her family and associates generated more than $1.5 billion in illicit profits through kickbacks in virtually every sphere of government activity -- from rice deals, to the sell-off of state land, even rake-offs from state welfare schemes.

The Pakistani officials say their key break came last summer, when an informer offered to sell documents that appeared to have been taken from the Geneva office of Jens Schlegelmilch, whom Ms. Bhutto described as the family's attorney in Europe for more than 20 years, and as a close personal friend. Pakistani investigators have confirmed that the original asking price for the documents was $10 million. Eventually the seller traveled to London and concluded the deal for $1 million in cash.

The identity of the seller remains a mystery. Mr. Schlegelmilch, 55, developed his relationship with the Bhutto family through links between his Iranian-born wife and Ms. Bhutto's mother, who was also born in Iran. In a series of telephone interviews, he declined to say anything about Mr. Zardari and Ms. Bhutto, other than that he had not sold the documents. ''It wouldn't be worth selling out for $1 million,'' he said.

The documents included: statements for several accounts in Switzerland, including the Citibank accounts in Dubai and Geneva; letters from executives promising payoffs, with details of the percentage payments to be made; memorandums detailing meetings at which these ''commissions'' and ''remunerations'' were agreed on, and certificates incorporating the offshore companies used as fronts in the deals, many registered in the British Virgin Islands.

The documents also revealed the crucial role played by Western institutions. Apart from the companies that made payoffs, and the network of banks that handled the money -- which included Barclay's Bank and Union Bank of Switzerland as well as Citibank -- the arrangements made by the Bhutto family for their wealth relied on Western property companies, Western lawyers and a network of Western friends.

As striking as some of the payoff deals was the clinical way in which top Western executives concluded them. The documents showed painstaking negotiations over the payoffs, followed by secret contracts. In one case, involving Dassault, the contract specified elaborate arrangements intended to hide the proposed payoff for the fighter plane deal, and to prevent it from triggering French corruption laws.

-

Comment by Riaz Haq on May 28, 2022 at 11:37am

-

#Pakistan PM #ShehbazSharif Calls Himself A "Majnoo" In Court. #FIA found 28 benami accounts, allegedly of Shehbaz family, through which an amount of Pakistan Rupee 14 billion ($75 million) was laundered from 2008 to 2018 Via 17,000 transactions. https://www.ndtv.com/world-news/pakistan-pm-shehbaz-sharif-calls-hi... via @ndtv

Lahore: Pakistan Prime Minister Shehbaz Sharif testified today in a special court hearing in the Pakistan Rupee 16 billion money laundering case against him that he had refused to take any salary when he was the Chief Minister of Pakistan's Punjab province, and called himself a "majnoo" for doing so.

Shehbaz Sharif and his sons - Hamza and Suleman - were charged by Pakistan's Federal Investigation Agency or FIA in November 2020 under various sections of the Prevention of Corruption Act and Anti-Money Laundering Act.

Hamza Sharif is currently the Chief Minister of Pakistan's Punjab province, while Suleman Sharif is residing in the UK.

The FIA investigation has detected 28 benami accounts, allegedly of the Shehbaz family, through which an amount of Pakistan Rupee 14 billion (USD 75 million) was laundered from 2008 to 2018.

The FIA examined the money trail of 17,000 credit transactions.

The amount was kept in "hidden accounts" and given to Shehbaz Sharif in his personal capacity, according to the charges.

"I have not taken anything from the government in 12.5 years, and in this case, I am accused of laundering ₹ 2.5 million," Shehbaz Sharif said during the hearing.

"God has made me the Prime Minister of this country. I am a majnoo (fool) and I did not take my legal right, my salary and benefits," Pakistan's Dawn newspaper quoted him as saying.

He recalled that the secretary had sent a note to him for sugar exports during his tenure as Chief Minister of Punjab province, when he had set an export limit and rejected the notes, the report said.

Shehbaz Sharif first became Chief Minister of Punjab province in 1997 when his brother Nawaz Sharif was the Prime Minister of Pakistan.

Following General Pervez Musharraf's coup in 1999 toppling the Nawaz Sharif government, Shehbaz Sharif along with the family spent eight years in exile in Saudi Arabia before returning to Pakistan in 2007.

He became Pakistan's Punjab Chief Minister for the second term in 2008 and he grabbed the same slot for the third time in 2013.

"My family lost PKR 2 billion because of my decision. I am telling you the reality. When my son's ethanol production plant was being set up, I still decided to impose a duty on ethanol. My family lost PKR 800 million annually because of that decision. The previous government withdrew that notification stating that it was injustice with the sugar mills," he claimed.

The Prime Minister's counsel argued that the laundering case was "politically motivated" and "based on mala fide intentions" by the erstwhile government headed by Imran Khan.

During the previous hearing on May 21, the special court had issued arrest warrants against Suleman Sharif, in the case after extending the interim bails of Shehbaz Sharif and Hamza Sharif till May 28.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

US-India Ties: Does Trump Have a Grand Strategy?

Since the dawn of the 21st century, the US strategy has been to woo India and to build it up as a counterweight to rising China in the Indo-Pacific region. Most beltway analysts agree with this policy. However, the current Trump administration has taken significant actions, such as the imposition of 50% tariffs on India's exports to the US, that appear to defy this conventional wisdom widely shared in the West. Does President Trump have a grand strategy guiding these actions? George…

ContinuePosted by Riaz Haq on August 31, 2025 at 6:30pm — 11 Comments

Humbled Modi Reaches Out to China After Trump Turns Hostile

Prime Minister Narendra Modi appears to be shedding his Hindutva arrogance. He is reaching out to China after President Donald Trump and several top US administration officials have openly and repeatedly targeted India for harsh criticism over the purchase of Russian oil. Top American officials have accused India, particularly the billionaire friends of Mr. Modi, of “profiteering” from the Russian…

ContinuePosted by Riaz Haq on August 24, 2025 at 9:00am — 11 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network