PakAlumni Worldwide: The Global Social Network

The Global Social Network

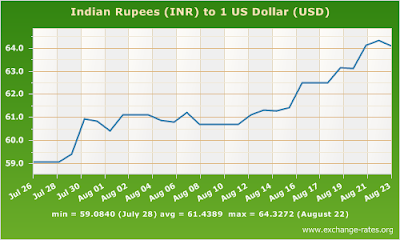

Falling Confidence Hits India Hard

Plummeting Indian rupee is the most obvious symptom of the world losing confidence in India. The crisis of confidence is so great that Jim O'Neill, former Goldman Sachs executive whose BRIC acronym made India an attractive investor destination in 2001, has recently said that “if I were to change it, I would just leave the "C"" in BRIC.

India has long run huge twin deficits. India imports a lot more than it exports, and its government spends a lot more than its revenue receipts. India has so far been able to finance its trade and budget deficits with foreign capital inflows. Such flows have been driven mainly by the easy money policies pursued by the US Federal Reserve and other central banks in Europe and Japan in recent years. Over $170 billion of India's $390 billion foreign debt is due for repayment within a year. India's current foreign exchange reserves are $278 billion, and repaying $170 billion debt will dramatically deplete its reserves causing further panic in financial markets.

The US Fed in Washington has been buying $85 billion worth of bonds with a few computer key strokes every month to stimulate the US economy.

Many investors had been borrowing money in US dollars at extremely low rates to invest their borrowings for higher returns in emerging markets like India. With US economic recovery beginning to take hold, the US Fed has signaled that it may reduce or end these bond purchases. As a result of this change, foreign investors are retrenching from the emerging markets to take advantage of better returns in US and frontier markets.

In contrast to big declines in emerging markets like India and Indonesia, some frontier markets such as the UAE, Bulgaria and Pakistan have returned over 50 percent this year in dollar terms, according to Reuters. Unlike in the big emerging economies, listed companies in Kenya or Pakistan tend to be true plays on the emerging market consumer. Earnings growth estimates for this year have risen sharply almost everywhere to 10-15 percent (versus the 9.8 percent average in emerging markets)

In addition to the stellar performance of Karachi's KSE-100 this year, Pakistani euro bonds listed on the Luxembourg stock exchange are also doing well, according to Pakistan's Dawn newspaper. In the last four months, these bonds have surged by more than 10 per cent (excluding coupon payment), which places them among the best performing in emerging and frontier markets. During this period, yields on the bonds have declined by more than 300 basis points.

India and Indonesia have been specially hard hit because both are dependent on significant foreign inflows to fill their current-account gaps. Foreign investors have already sold a net $11.6 billion of Indian debt and equities since late May, sparking fears of continued weakness, according to Reuters. As a result, Indian rupee and major Indian stock indices have both suffered double digit losses this year. Weakness in the Indian currency, which tumbled almost 15 percent this year, could further fuel inflation, and hurt consumers in an election year. Compared to 2011-12, the Indian GDP has declined by more than $200 billion to about $1.65 trillion this year.

The Reserve Bank of India (RBI), the country's central bank, has said it plans to buy long-dated government debt to stabilize markets after rising volatility threatened to hurt an economy that is already growing at the slowest pace in a decade. But the BRI actions appear to be too little too late.

There does not appear to be any quick fix to the falling rupee and declining investor confidence. The longer term solution lies in containing both the budget and the trade deficits. It will require strong political will to cut spending and reduce imports in the immediate future. Such actions will make the situation worse before it gets better. Will India's ruling politicians muster the courage to swallow the bitter pill so close to the upcoming elections in 2014? I doubt it.

Related Links:

Haq's Musings

India's Hyphenation: India-Pakistan or India-China?

India's Share of World's Poor Jumps as World Poverty Declines

Forget Chindia--Chimerica Will Rescue the World

World Bank on Poverty Across India

Superpoor India's Superpower Delusions

Are India and Pakistan Failed States?

India Home to World's Largest Number of Poor, Hungry and Illiterate

India Leads the World in Open Defecation

India Tops in Illiteracy and Defense Spending

Indians Poorer than sub-Saharan Africans

-

Comment by Riaz Haq on August 27, 2013 at 10:28am

-

Here's Jayanti Ghosh's Op Ed in the Guardian:

So now India is the latest casualty among emerging economies. Over the past 10 days, the rupee has slid to its lowest-ever rate, and the Indian economy may well be on the verge of a full-blown currency crisis. In this febrile situation, it is open season for rumours and pessimistic predictions, which then become self-fulfilling.

This means that even if there is a slight market rally, investors quickly work themselves into even more gloom. Each hurriedly announced policy measure (raising duties on gold imports, some controls on capital outflows, liberalising rules for capital inflows and so on) has had the opposite of the desired effect. Everything the government does seems to be too little, too late – or even counterproductive.

These are all classic features of the panic phase of a financial market cycle. This doesn't mean that a crash is inevitable, but clearly it is possible. The real surprise in all this is that investors and Indian policymakers are surprised. For some reason, they apparently did not foresee this turn of events, even though the story of every financial crisis of the past, and many in the very recent past, should have caused some nostrils to twitch at least a year or two ago.

The Indian economy has been in trouble for quite a while already, and only wilful blindness could have led to ignorance on this. Output growth has been decelerating for several years, and private investment has fallen for 10 consecutive quarters. Industrial production has declined over the past year. But consumer price inflation is still in double digits, providing all the essential elements of stagflation (rising prices with slowing income growth).

At the moment the external sector is the weakest link. Exports are limping along but imports have ballooned (including all kinds of non-essential imports like gold), so both trade and current account deficits are at historically high levels. They are largely financed by volatile short-term capital. This has already started leaving the country: since June more than $12bn has been withdrawn by portfolio investors alone.

This situation is the result of internal and external imbalances that have been building up for years. The Indian economic boom was based on a debt-driven consumption and investment spree that mainly relied on short-term capital inflows. This generated asset booms in areas such as construction and real estate, rather than in traded goods. And it created a sense of financial euphoria that led to massive over-extension of credit to both companies and households, to compound the problem.

Sadly, this boom was also "wasted" in that it did not lead to significant improvements in the lives of the majority, as public expenditure on basic infrastructure, as well as nutrition, health, sanitation and education did not rise adequately.

We should know by now that such a debt-driven bubble is an unsustainable process that must end in tears, but those who pointed this out were derided as killjoys with no understanding of India's potential. Something similar is occurring in a number of other Asian economies that are also feeling the pain at present, such as Indonesia – while the Brazilian economy shows some similar features. The current Indian problems may be extreme, but they reflect what should now be a familiar process in all major regions of the world.....

http://www.theguardian.com/commentisfree/2013/aug/26/india-debt-bub...

-

Comment by Riaz Haq on August 27, 2013 at 10:46am

-

Here's a Business Recorder story on Karachi stock market performance:

The stock market set new trends in terms of market depth and growth in 2012-13 and the KSE-100 index grew by 48.52 percent during the period and foreign investment in the stock market exhibited a net inflow of $568.876 million. Sources told Business Recorder on Monday that the Securities and Exchange Commission of Pakistan (SECP) has compiled a data on the stock market overview during 2012-13. The SECP data revealed that the fiscal year 2012-13 started with an impressive outlook.

During the year, the stock market set new trends in terms of market depth and growth. The KSE-100 Index showed healthy performance. Numerous factors played a vital role in fuelling the index pace. These factors included implementation of long-awaited Capital Gains Tax (CGT) rules, de-mutualisation of the stock exchanges, considerable decline in the discount rate by SBP which was brought down to single digit of 9.5 percent, substantial foreign interest in stocks and declining inflation rates. Furthermore, a politically stable environment and smooth transition of government helped retain the interest of local as well as foreign investors.

The interest rate in Pakistan has seen a gradual decreasing trend since August 2012, which led to an increase in investment in the economy due to which the stock market showed a positive trend during the year. Further, the inflation rate also posted a gradual downward trend, which was positive news for the economy in general and investors in particular and which was also one of the reasons the stock market showed such bullish trend in the aforementioned period.

The data revealed that 569 companies with a paid-up capital of Rs 1,116.005 billion were listed at the KSE. The KSE-100 index started off with an upward trend. Starting from a level of 14,142.92 points the KSE-100 index continued its positive trend and touched highest-ever 22,757.72 on June 13, 2013. The index closed at 21,005.69 points on June 28, 2013. The index grew by 48.52 percent during the year. Furthermore, the volumes remained at 210.633 shares on a daily average basis which is approximately 54 percent higher as compared to the previous year.

The market capitalisation stood at Rs 5,154.737 billion at the end of June 2013. It is noteworthy that owing to high trading activity in high-worth stocks the market capitalisation grew by 43 percent as compared to the start of the year. The stock market activity was fuelled by massive foreign interest during the year. The foreign investment in the stock market exhibited a net inflow of $568.876 million.

At the end of FY13, the total number of brokerage houses registered with the SECP stood at 250 as compared to 259 in the last financial year. It is pertinent to mention here that in accordance with the requirements of the 2012 Demutualization Act the individual TREC holder was required to convert into corporate entities by May 7, 2013. At present all the registered brokers are corporate entities. The KSE has 51 percent of the total brokers registered with the SECP as compared to 29 percent of LSE and 20 percent of ISE, the SECP added.

http://www.brecorder.com/market-data/stocks-a-bonds/0/1225450/

-

Comment by Riaz Haq on September 14, 2013 at 10:10am

-

Even though it is illegal to discriminate on the basis of caste, creed, religion, or gender, developers and realtors often advertise apartments for rent/sale for certain religious groups or certain castes.

Superstitious parents in India are known to have c-sections, or to plan ahead and induce labor at times that are considered auspicious. Some Hindus believe that being born at a certain time will better a child's future.

India's Delhi metro hired a monkey handler or langurwallah, to chase monkeys off the city's metro trains. Monkey handlers have also been used on the grounds of parliament and in some government buildings to scare off wild monkeys.

A woman named Shaheen Dhada posted a status on Facebook questioning a Mumbai "bandh," or shutdown, after the death of politician Bal Thackeray, known for using various forms of intimidation to achieve political ends. Her friend Renu Srinivasan liked the post. Both were arrested for their actions and the incident sparked a furor about the lack of freedom of speech in India.

Farmers with massive debt burdens have been committing suicide since 1995. Over 250,000 farmers have reportedly committed suicide. Many accuse foreign companies like Monsanto of selling farmers overpriced seeds that are forced on them by the government. The low cost of produce along with poor harvests have often caused farmers to take their own lives as they see it as the only way out of their tremendous debt.

Santosh Kumar Singh fought for nine years to prove that he was alive. His brothers declared him dead and stole his land after he married a woman of a lower caste. False death certificates are frequently issued in land grabs.

http://www.sfgate.com/technology/businessinsider/article/26-Crazy-T...

-

Comment by Riaz Haq on April 2, 2015 at 5:41pm

-

Riaz Haq

@haqsmusings

#India's end-Dec external debt soars to $461.9 billion http://reut.rs/1FcOSnh via @Reuters(Reuters) - India's external debt stood at $461.9 billion as of end-December, up 3.5 percent from end-March 2014, the government said in a release on Tuesday.

India's external debt-to-gross domestic product (GDP) ratio stood at 23.2 percent as of end-December, compared with 23.7 percent as of end-March 2014.

The country's short-term debt fell 6.7 percent from March-end 2014 to $85.6 billion as of December-end, while long-term debt rose 6.1 percent to $376.4 billion, the statement from finance ministry said.

http://www.reuters.com/article/2015/03/31/india-external-debt-idINK...

-

Comment by Riaz Haq on April 19, 2015 at 10:24am

-

India survives on large external capital inflows in the form of investments and debts in the post-Cold War era with the West boosting India against China and Pakistan."Gross capital flows have increased nearly 22 times from $42.7 billion in 1991-92 to over $932.3 billion in 2010-11. As a share of GDP, this amounted to an increase from 15.5% in 1991-92 to 55.2% in 2010-11. Much

Indian economy would collapse without such inflows.

Read the following to get a sense of the magnitude of foreign capital inflows in India:

"Strong capital flows to India in the recent period reflect the sustained momentum in domestic

economic activity, better corporate performance, the positive investment climate, the longterm

view of India as an investment destination, and favourable liquidity conditions and

interest rates in the global market. Apart from this, the prevailing higher domestic interest

rate along with a higher and stable growth rate have created a lower risk perception, which

has attracted higher capital inflows. The large excess of capital flows over and above those required to finance the current account deficit (which is currently around 1.5% of GDP) resulted in reserve accretion of

$110.5 billion during 2007/08. India’s total foreign exchange reserves were $308.4 billion as

of 4 July 2008."

http://www.bis.org/publ/bppdf/bispap44m.pdf

of the increase in financial integration occurred between 2003-04 and 2007-08. Given the

impressive economic performance indicated by close to 9% growth rate, higher domestic

interest rates and a strong currency, India's risk perception was quite low during 2003 to 2007.

Furthermore, this period was associated with favorable global conditions in the form of ample

liquidity and low interest rates in the global markets—the so-called period of Great Moderation."

http://www.adb.org/sites/default/files/publication/30234/management...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network