PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2023: Technology Transforming Women's Lives in Rural Pakistan

Growing access to smartphones and Internet connectivity is transforming the lives of women in rural Pakistan. They are acquiring knowledge, accessing healthcare and finding economic opportunities. A recent UNDP report titled "DigitAll: What happens when women of Pakistan get access to digital and tech tools? A lot!" written by Javeria Masood describes the socioeconomic impact of technology in Pakistan in the following words:

"The world as we know it has been and is rapidly changing. Technology has proven to be one of the biggest enablers of change. There has been a significant emphasis on digital trainings, tech education, and freelancing in the last several years especially during the pandemic, through initiatives from the government, private and development sectors. Covid-19 acted as a big disrupter and accelerated the digital uptake many folds. In Pakistan, we saw the highest number of digital wallets, online services, internet-based services and adaptability out of need and demand".

|

| Pakistani Women in South Punjab. Photo by Shuja Hakim UNDP Pakistan |

Digital Transformation:

The report cites the example of Ayesha Abushakoor from Zawar Wala in South Punjab who is a Quran teacher. She is teaching students remotely in and outside Pakistan. She uses digital wallets to receive payments. The same report also cites the case of Samina, from Muzafargharh, who is getting training online to start a livestock business. Another woman Mujahida Perveen from UC Pega in Dera Ghazi Khan is managing her thyroid disease by watching YouTube videos.

Telehealth is helping more women access healthcare in remote areas of Pakistan. Startups like Sehat Kahani are employing women doctors who work from home to provide healthcare services. Sehat Kahani was founded by Dr. Sara Khurram and Dr. Iffat Zafar who raised seed funding of US$ 500,000 in 2018, followed by a pre-series of $1 million in March 2021.

Expansion of Digital Services:

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the 15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

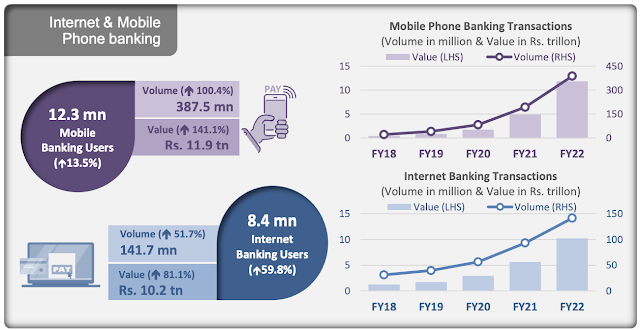

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

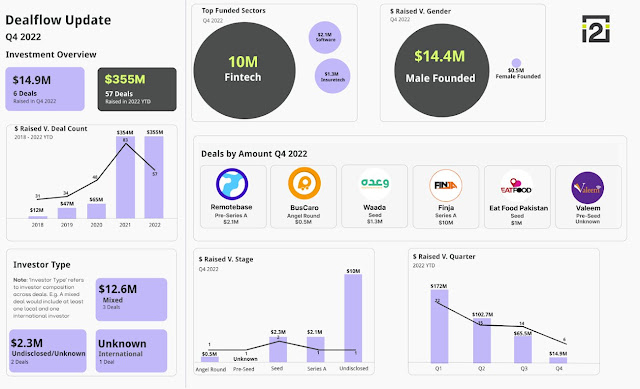

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

2021: A Banner Year For Tech Startups in Pakistan

Pakistan Projected to Be World's 6th Largest Economy By 2075

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Po...

Working Women Seeding a Silent Revolution in Pakistan

Socioeconomic Impact of New Infrastructure in Rural Pakistan

Pakistan Gets First Woman Supreme Court Judge

Pakistan at 75

Growing Presence of Pakistani Women in Science and Technology

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on August 28, 2024 at 5:41pm

-

USF Invested Rs. 79 Billion in Rural Telecom Expansion in Last Five Years

https://propakistani.pk/2024/07/30/usf-invested-rs-79-billion-in-ru...

The Universal Service Fund (USF) has launched 85 projects worth Rs. 79.1 billion in the last five years to expand telecommunication services to rural, remote, and underserved areas of Pakistan.

According to a document seen by ProPakistani, in the last five years, USF has focused on providing 3G/4G services, launching 67 projects worth Rs. 51.4 billion. This effort has resulted in the installation of 2,600 telecom towers, covering 922 kilometers of highways and motorways, and connecting 27 tourist destinations across Pakistan.

USF’s efforts have made a significant impact, serving 24.2 million people in over 12,600 mauzas. The organization has also completed 18 optical fiber cable projects worth Rs. 27.7 billion, laying 10,260 kilometers of fiber to connect more than 926 union councils and towns.

According to the USF, the expansion of telecommunication services has far-reaching implications for the country, enabling greater connectivity and access to information. USF’s initiatives have bridged the digital divide, bringing modern communication services to previously unserved and underserved areas.

Through its projects, USF aims to promote digital inclusion and socio-economic development in Pakistan. By providing reliable and high-speed internet access, USF is empowering communities and driving economic growth in the country’s most remote and rural areas.

-

Comment by Riaz Haq on October 27, 2024 at 12:43pm

-

How Marriage apps in Pakistan, where dating is banned, is taking over 'Rishta Aunties' job

https://timesofindia.indiatimes.com/technology/tech-news/how-marria...

In Pakistan, where traditional matchmakers, or "Rishta Aunties," have long played a pivotal role in arranging marriages, a new wave of digital disruption is challenging the established norms. Marriage apps, specifically designed for Muslims, are offering women an alternative path to finding a husband.

Ezza Nawaz, a textile designer from Lahore, shared her experience with AFP, stating, "When I saw my colleague happy after being married to someone she met online... I thought, since we have tried rishta aunties for four or five years, let's try this too."

Taking over Rishta aunties -- the traditional matchmakers

Rishta aunties traditionally act as intermediaries, presenting women to potential suitors' families. However, marriage apps like Muzz have emerged in recent years, promising "love matches" and offering features like "chaperone" options to address family concerns.

Ezza's experience with Muzz was positive, leading to her marriage to Waseem Akhtar within three months.

Arranged marriages continue to dominate Pakistan's marriage landscape, with over 80% of Pakistanis opting for this tradition. Families often play a central role in deciding unions, sometimes even without the bride and groom meeting beforehand.

Rishta aunties are instrumental in finding suitable matches, often focusing on physical appearance and other traditional criteria. However, marriage apps like Muzz have gained popularity, attracting over 1.2 million users in Pakistan and facilitating over 15,000 marriages.

Dating apps banned in Pakistan

These apps position themselves as "halal," adhering to Islamic principles, offering features like blurred profile pictures and a clear focus on marriage proposals. Despite their popularity, they still face stigma associated with casual dating apps. Pakistan has banned dating apps like Tinder and others. In October 2022, Pakistan prohibited Tinder, Grindr, Tagged, Skout, and SayHi citing “immoral” and “indecent” content.

The concept of marriage in Pakistan is deeply ingrained in the cultural fabric, often viewed as a union of two families. Choosing one's own spouse can challenge traditional family structures and the reverence for elders.

Rshta aunties remain a cornerstone of the marriage market, offering services such as teaching young women how to walk, talk, and dress to impress potential in-laws. Many traditional matchmakers, like Fauzia Aazam, still reject marriage apps, preferring the in-person approach.

Feminist author Aisha Sarwari believes the matchmaking process can be a tool for exercising control over daughters-in-law. She emphasizes the need for a balanced approach that respects individuals without compromising traditional values.

Aneela, a digital media artist, faced challenges when using a marriage app, including encountering men who lied about their identities. She eventually resorted to using a fake name and profile to protect her privacy.

-

Comment by Riaz Haq on October 27, 2024 at 12:44pm

-

With 8% increase, digital payments share rises to 84% in FY2024

https://www.geo.tv/latest/568641-with-8-increase-digital-payments-s...

Internet banking users witness 25% increase, says State Bank.

With 62% boost, 1,346m transactions recorded valuing Rs70 tr.

Customers make 2,697m payments via mobile app wallets.

KARACHI: In a rather positive development on the economic indicators' front, the share of digital payments in the country has witnessed a notable increase of 8% to stand at 84% — from the previous 76% — in the fiscal year 2024 (FY24), The News reported on Saturday.

The data from the State Bank of Pakistan (SBP) shows that the volume and value of retail payments in the country increased by 35%.

The central bank, in its annual payment systems review for FY24, attributed the expansion in digital payments to growing number of digital channel users, facilitated by the convenience and variety of products offered through mobile banking apps, internet banking portals, and mobile wallets.

"The expanding share of digital payments is mainly associated with the increased number of customers using digital channels due to the convenience and wide range of products/services offered through these channels," said the report.

Notably, mobile app banking users increased by 16%, internet banking users by 25%, while branch-less banking (BB) mobile app wallet users grew by 2%, and e-wallet users by an impressive 85% annually during FY24.

The report said the digital payments made through mobile banking apps and internet banking portals, collectively saw a 62% increase in transactions to 1,346 million, with the value of these transactions rising by 74% to Rs70 trillion. Similarly, mobile app-based wallets experienced substantial growth, with customers making 2,697 million payments through their BB mobile app wallets and 85 million through EMIs' e-wallets.

The expansion of the POS machine network has also contributed to the growth, with the number of POS machines increasing by 8.9% to 125,593, supporting card-based transactions at a growing number of retail outlets and stores.

E-commerce payments have also seen a remarkable shift, with 87% of digital payments for e-commerce now being initiated through bank accounts or digital wallets. A total of 309 million e-commerce payments were made during FY24, with a transaction value reaching Rs406 billion.

Transactions via real-time gross settlement (RTGS) saw a significant uptick in FY24, rising from 4.9 million to 5.8 million in volume. The major contribution to RTGS transactions came from the settlement of government securities, followed by inter-bank fund transfers, third-party customer transfers and ancillary clearing settlement, respectively.

The report said that during FY24, a total of 496.1 million transactions amounting to Rs11.6 trillion were processed through Raast, which is Pakistan’s instant payment system. Last year in FY23, the number of transactions stood at 147.2 million with a value of Rs3.1 trillion.

Payment system infrastructure — which refers to the systems, applications, technologies and networks that facilitate the transfer of money among individuals, businesses and governments — plays a key role in a country’s economy as it enables efficient and secure fund transfers between individuals, businesses, government and financial institutions, according to the report.

It includes everything from payment card processing networks and digital payment platforms to brick-and-mortar banks and mobile payment solutions. A robust payment infrastructure is essential for accelerated financial inclusion and economic development.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan to Develop Urdu LLM for Generative AI

National University of Science and Technology (NUST), National Information Technology Board (NITB) and Telecom network operator Jazz have signed a Memorandum of Understanding (MOU) to develop Pakistan’s first indigenous Large Language Model (LLM) with focus on Urdu, including datasets for Pashto and Punjabi languages. It is aimed at empowering individuals, businesses, and…

ContinuePosted by Riaz Haq on November 7, 2024 at 10:06am

Will India Grow Old Before it Gets Rich?

India's population has aged faster than expected while its economic growth has slowed over the last decade. This raises the obvious questions: Will India get old before it gets rich? Is India getting poorer relative to its peers in the emerging markets? …

|

Posted by Riaz Haq on October 29, 2024 at 12:30pm — 4 Comments

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network