PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

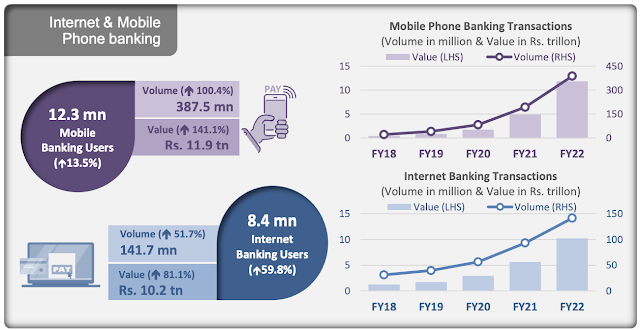

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

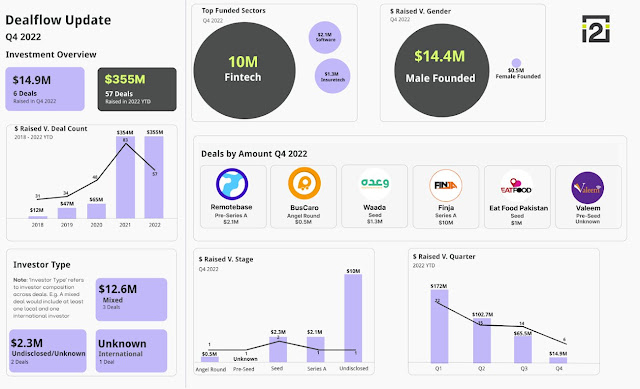

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

-

Comment by Riaz Haq on February 27, 2023 at 6:52pm

-

Tier 4 data center works with large businesses in Pakistan

https://www.computerwoche.de/a/tier-4-data-center-works-with-large-...

"While data centers are common, the level 4 center is not. In fact, the next Tier IV facility if you go westward from Pakistan, is in Costa Rica. The Middle East, for example, is a booming economy with fast growing IT infrastructure and architecture, and even they don't have level 4 facilities there. Travel eastward and you'll find two facilities in India, 3 in Singapore and the 17 in the US," explains Raja Jehangir Mehboob, SVP Corporate Sales and Marketing at CubeXS Weatherly.

CubeXS Weatherly is Pakistan's first Tier IV Data Center that works with several large organizations, including a Fortune 500 company, offering a portfolio of services from co-location to disaster recovery (DR). In light of the events that enveloped the Software Technology Park, the DR services that the level 4 facility provides include innovative, cost-effective IT Disaster Recovery solutions for large and mid-sized organizations that need DR capabilities worldwide.

"There are several considerations in managing a Tier IV facility. Some of these, which usually cannot be managed in a business organization is redundancy of power, high speed connectivity and multiple circuits that can be used to prevent any downtime and environmental factors as to just how much physical security there is," says Raja Jehangir. The facility's physical location is just as important as the data services it provides. It offers multiple dark and lit fiber internet and VPN connectivity along with space on its premises for business continuity of the key operations should the organization need it.

"Despite everything we offer to the companies, depending on the needs and setup a company has, the primary data site should be with the company itself while using a data center as a backup for all operations." It could also be a real time sync option for some of the critical operations. An unplanned event obviously doesn't take place with any warning, and to keep pace with the switch over, the integrity of the data must never be compromised. "But companies should be looking at planning decisions such as not keeping their own back up servers in the same location as the primary servers. Ensure the building that they are in or the room where they are housing their technology-based operations is safe and secure, and easy to get to."

-

Comment by Riaz Haq on February 27, 2023 at 6:52pm

-

Data centres in Pakistan

https://www.networkworld.com/article/3658136/south-asia-data-centre...

Depending on whose list you check, there are about 20 data centres in Pakistan. Data Center Catalog provides details of the operators. Singapore-based certification company EPI Certification (EPI) has certified four owned by Pakistan Telecom and one each by Jazz Mobile and the University of Lahore. The Uptime Institute has certified five others to Tier 3.

The industry appears to be booming. A two day Data Centre Summit was to be held in Islamabad in October 2021 but was postponed because of COVID-19.

The government-owned National Telecommunication Corp. (NTC) opened what was claimed to be the country’s first national data centre in Islamabad in 2016 to help implement the e-governance agenda of the federal government. It was built by local IT services company Inbox Business Technologies and Huawei. In 2022, the National Information Technology Board (NITB) opened a data centre in Islamabad, also built by Huawei.

-

Comment by Riaz Haq on March 2, 2023 at 10:54am

-

#DigitalIndia: #Digital #Payments, Even for a 10-Cent Chai, Are Colossal in Scale. #India’s homegrown payment system has remade #commerce, pulled millions into formal #economy. Digital IDs ease creation of bank accounts, the basis of UPI instant payment system https://www.nytimes.com/2023/03/01/business/india-digital-payments-...

The little QR code is ubiquitous across India’s vastness.

You find it pasted on a tree next to a roadside barber, propped on the pile of embroidery sold by female weavers, sticking out of a mound of freshly roasted peanuts on a snack cart. A beachside performer in Mumbai places it on his donations can before beginning his robot act; a Delhi beggar flashes it through your car’s window when you plead that you have no cash.

The codes connect hundreds of millions of people in an instant payment system that has revolutionized Indian commerce. Billions of mobile app transactions — a volume dwarfing anything in the West — course each month through a homegrown digital network that has made business easier and brought large numbers of Indians into the formal economy.

The scan-and-pay system is one pillar of what the country’s prime minister, Narendra Modi, has championed as “digital public infrastructure,” with a foundation laid by the government. It has made daily life more convenient, expanded banking services like credit and savings to millions more Indians, and extended the reach of government programs and tax collection.

With this network, India has shown on a previously unseen scale how rapid technological innovation can have a leapfrog effect for developing nations, spurring economic growth even as physical infrastructure lags. It is a public-private model that India wants to export as it fashions itself as an incubator of ideas that can lift up the world’s poorer nations.

“Our digital payments ecosystem has been developed as a free public good,” Mr. Modi said on Friday to finance ministers from the Group of 20, which India is hosting this year. “This has radically transformed governance, financial inclusion and ease of living in India.”

In simple terms, Indian officials describe the digital infrastructure as a set of “rail tracks,” laid by the government, on top of which innovation can happen at low cost.

At its heart has been a robust campaign to deliver every citizen a unique identification number, called the Aadhaar. The initiative, begun in 2009 under Mr. Modi’s predecessor, Manmohan Singh, was pushed forward by Mr. Modi after overcoming years of legal challenges over privacy concerns.

The government says about 99 percent of adults now have a biometric identification number, with more than 1.3 billion IDs issued in all.

Nandan Nilekani, a co-founder of the information technology giant Infosys who has been involved in India’s digital identification efforts since their early days, said the country could make a technological leap because it had little legacy digital infrastructure in place. “India was able to develop afresh with a clean slate,” he said.

-

Comment by Riaz Haq on March 2, 2023 at 4:43pm

-

Financial inclusion in Pakistan increases to 30% - Profit by Pakistan Today

https://profit.pakistantoday.com.pk/2023/02/08/financial-inclusion-...

https://portal.karandaaz.com.pk/dataset/financial-digital-inclusion...

KARACHI: Financial inclusion in Pakistan has increased by 9 basis points from 2020 to 2022 and women’s access, specifically has hit a double-digit percentage for the first time, as recorded by a survey conducted by Karandaaz Pakistan.

As defined by the World Bank, “financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.” This means conducting transactions through banks, mobile money and fintech.

The Karandaaz Financial Inclusion Survey (K-FIS) measures the percentage of adults above the age of 15 who report having at least one account in their name with an institution that offers a full range of financial services that is also documented by the government of Pakistan.

Following a significant jump in financial inclusion between 2017 and 2020, K-FIS recorded a substantial rise in the level of financial inclusion from 21% in 2020 to 30% of adults in 2022. Registered mobile money users more than doubled with an increase from 9% to 19%, while registered bank users also increased by 4 basis points over the same period.

By region, Islamabad Capital Territory (ICT) recorded the highest level of financial inclusion at 45%, followed by Gilgit Baltistan at 35% and Azad Jammu & Kashmir at 34%.

Looking at the division by gender, male registration accounted for the bulk of financial account registrations in 2022 with 47% having at least one registered financial account. Comparatively, only 13% of women are recorded to have at least one registered financial account. Although women’s percentage accounts for less than half of their male counterparts, the financial account registration for women has reached double digits for the first time.

Overall, the largest increase was seen in mobile money wallet users, as active usage increased from 8% in 2020 to 16% in 2022. Active usage also saw an increase in bank account holders, indicating an increase from 12% in 2020 to 14% in 2022.

Addressing the webinar held by Karandaaz Pakistan on February 7, 2023, Noor Ahmed, Director of the Agri Finance and Financial Inclusion Department of the State Bank of Pakistan (SBP) said, “Over the years, there has been significant progress on financial inclusion. Key initiatives such as RAAST have been transformative in furthering the inclusion of the marginalised.”

Karandaaz Pakistan is a not-for-profit special-purpose vehicle set up under Section 42 in August 2014. The company is the implementation partner of the Enterprise and Asset Growth Programme (EAGR) and Sustainable Energy and Economic Development (SEED) programme of the UK’s Foreign, Commonwealth & Development Office (FCDO).

-

Comment by Riaz Haq on March 2, 2023 at 5:02pm

-

The Challenges of Pakistan’s Digital Banking Reality - Aurora

https://aurora.dawn.com/news/1144694

The much-anticipated wait for the coveted digital banking licenses from the State Bank of Pakistan (SBP) is finally over. The five recipients (out of 20) must now lead the way and showcase how effective digitally enabled banking can be in solving the financial inclusion conundrum (digital and otherwise) of the unserved and underserved segments of Pakistan.

They will also be expected to possess/create better digital strategies, architectures and approaches to benefit the financial services industry, and given that no local bank got the go-ahead (at least in this round), it will be interesting to see how many of those revert to applying again or opting for Plan B and protect their market share by digitally enhancing themselves, re-evaluating their HR strategies, aligning the right percentage points for the right products and services, taking a deeper look at their digital architecture, and renewing their go-to market approach.

Traditionally, leading digital outlets are mapped internally and externally and have the right processes and tools to make digital channels available for bank customers and their various divisions. They also will have to learn from fintechs (or partner with them) to enable new digital customer journeys and user experiences by leveraging automated/paperless workflows and environments for better acquisition, retention and growth. Unfortunately, in the Pakistani context, success in digital banking (thus far and for most) equates to their banking apps on mobiles, where one can pay bills or another. Beyond this, for all other banking needs, the parameters of real digital banking success are still hard to define, given that the public still relies on hard cash rather than digits on a screen.

So, who are these digital banking leaders? In my view, out of 33 operating banks, six have demonstrated at the very least a decent digital vision and the ability to lead, if not total prowess on their strategies, customer focus, and the value of their services through innovative channels. Bank Alfalah, HBL and Meezan Bank seem to be the clear market leaders, followed by Allied Bank, Standard Chartered Pakistan and United Bank. Another three to four are trying to up their game to stay digitally relevant. Time will tell if they succeed.

The top ones are better placed than the others in terms of digital capability, governance structures, and professional decision-making (as opposed to seth or state-driven) and have an overarching ‘doer’ attitude that is reflected in their products/services. They also have stronger working digital partnerships with the SBP; they try out new, technologically advanced techniques and comply with the requisite investments in digital and hire on mandated appointments to advise on, and lead, IT initiatives. Their leveraging of the Covid-19 pandemic as an opportunity to explore new digital methods, address customer needs and focus on banking initiatives such as Raast and Roshan Digital Accounts are also commendable.

The remaining digital laggards seem to have their own reasons for doing the bare minimum on this front. For them, going digital (in the true sense) is time-consuming, expensive and the ROI of effort versus the reward does not make strategic sense given their lack of experience in monetising digital channels. Their best option will be to opt for profitability through traditional branch deposits, knowing fully well that cost centre models that typically flow down from branch banking are the most expensive, followed by ATMs – digital channels being the cheapest.

-

Comment by Riaz Haq on March 2, 2023 at 5:02pm

-

The Challenges of Pakistan’s Digital Banking Reality - Aurora

https://aurora.dawn.com/news/1144694

In their quest to go completely digital, banks are also struggling in the following areas.

Customer Ownership: In the digital sense, customer journeys stemming from apps/digital channels that leverage the banking services and products available to them will be a challenge. And since HR structuring is done in an old-fashioned way, the back-end reconciliation is often not only an operational challenge, it becomes an office politics one.

Parallel Digital Structures: Many banks have opted for a parallel albeit small(er) digital infrastructure to test the digital waters (perhaps they were advised to do this). The jury is still out on this approach because many of them preferred to digitally transform themselves completely and achieve overall digital excellence, rather than do it for one division and then connect others to it. This often creates a caste system within banks, which can also be a cultural challenge to solve for the leadership.

Skill Sets and Talent: Digital thinking at banks is often led by a tech-savvy board member, a digital banking leader and a CIO – all of whom are not always in sync, partly because they rose in different working environments and sectors. CIOs have risen in the ‘networking’ or ‘application’ route and are a non-business-savvy tech resource at best. Digital banking leaders are typically non-bankers and the board member is a foreigner (no formal board-level technology governance education exists in Pakistan) and is not, therefore, always up to speed in terms of Pakistan knowledge. This challenge exists across the board, especially because digital talent is still being cultivated (including junior ranks) and it often opts for start-ups and freelancing so that banks are even more challenged when it comes to attracting/retaining top talent.

Tech Architecture: Digital prowess requires stellar digital architectures, and to my knowledge, none of the banks has conducted a deep forensic audit of their existing tech stacks in order to uncover vulnerabilities and test the strengths on which the digital architecture is to stand. Untested architectures can be exposed and insecure and as dimensions of digital apps/tools/security are added to the volumes of transactions and data that a modern digital bank enables, they can fall (and fail).

Tech Tools: T24 by Temenos seems to be a core banking darling among CIOs. Enterprise Resource Planning exists for accounting and finance mechanisms, and CRM is widely missing as they don’t see the value somehow (shocking). Furthermore, internet banking architectures are different from those of mobile banking and back-end integration on a single connected stack for efficiency is missing. The SBP’s latest framework to outsource to cloud service providers is a welcome gesture, but to leverage it, banks will have to rethink their architecture and stop relying on band-aid approaches.

What next? Regardless of how the new digital licensees do, local banks should transform customer journeys at the branch level by digitising end-to-end digital loan disbursements/underwriting and all human/paper-intensive areas. This will involve constant upgrading of their digital vision, automating processes/workflows, focusing on customer centricity, upgrading the tech stacks, and integrating and mimicking digital channels with traditional branches. There will also have to be a meticulous focus on employee training in new-era banking, data gathering, intelligent decision-making and coming up with out-of-the-box customer and culturally relevant products that Pakistanis need to survive and grow.

Javaid Iqbal is CCO (and Member and Executive Director), Special Technology Zones Authority, Cabinet Division, Government of Pakistan. The thoughts reflected in this article are entirely his own and do not represent the views of the government. He can be followed on http://linkedin.com/in/jiqbal and @jdiq

-

Comment by Riaz Haq on March 2, 2023 at 9:06pm

-

Pakistan in midst of digital census, ‘unprecedented’ change in data policies

https://www.biometricupdate.com/202303/pakistan-in-midst-of-digital...

Officials with Pakistan’s National Database and Registration Authority are boasting of a new service intended to put people in charge of their biometric data.

NADRA, as the authority is more commonly known, now offers a service call Ijazat Aap Ki decentralizes citizen data, at least to some extent. People will be able to give their consent – or refuse it – before a transaction requiring their Pakistani ID card, for example.

The government is calling the move, making personal information just like any other precious personal possession, unprecedented. For the government, according to officials, it means the creation of a “digital consent regime.”

Verification transactions now require that a six-digit code be sent to a mobile phone registered to a citizen. Having the code is authentication and will be a person’s agreement for a third party to get verification of their ID number.

People will have to update NADRA when they change their phone numbers.

The same agency is promoting what it says is Pakistan’s first digital census, the deepest and broadest collection of personal information most people will ever experience.

At least 121,000 so-called enumerators are crisscrossing the rugged country for the monthlong harvesting period of the census. Regrettably, 86,000 police and “thousands” of military personnel will travel with the enumerators in an effort to prevent violence to the government workers.

Those people will use apps on Android devices that validate collected data. The results of their work are expected April 20.

According to the News Agency of Nigeria, past allegations of miscounting and underrepresentation was motivation to update how the census was conducted.

-

Comment by Riaz Haq on March 3, 2023 at 7:17am

-

Pakistan launches its first-ever digital census

The Pakistan's Bureau of Statistics is conducting the census amid tight security

https://www.thehindu.com/news/international/pakistan-launches-its-f...

A police officer, right, stands guard as a government worker collects data from a man during census, in Peshawar, Pakistan, Wednesday, March 1, 2023. Pakistan launched its first-ever digital population and housing census to gather demographic data on every individual ahead of the parliamentary elections which are due later this year, officials said. | Photo Credit: AP

Pakistan Wednesday launched its first-ever digital population and housing census, with Prime Minister Shehbaz Sharif saying that it will help future planning and efficient utilisation of resources ahead of this year's general elections.

"Today marks the launch of Pakistan's very first Digital Census'23. This transparent system of data collection will feed into informed decision-making, future planning & efficient utilisation of resources. Congrats to all the organisations for designing this system indigenously," Mr. Shehbaz said in a tweet.

------------

Pakistan launches its first-ever digital census

https://sarkaripariksha.com/current-affairs/pakistan-launches-its-f...

Pakistan launched its first-ever digital population and housing census in an effort to securely gather demographic data on every individual ahead of this year's parliamentary elections.

The digital count will provide data for policy decisions, which now are based on the 2017 census that counted the population at 207 million people.

The digital census is being carried out by the PBS. It has the support of the National Technology Council (NTC), National Database and Registration Authority (NADRA), provincial governments as well as the armed forces.

For the first time, transgender people will be calculated in the census, the Pakistani government said.

-

Comment by Riaz Haq on March 4, 2023 at 7:13am

-

The federal government on Friday extended the date for self-enumeration as part of census 2023 after it received requests from the masses.

https://www.geo.tv/latest/474067-census-2023-govt-extends-date-for-...

A Pakistan Bureau of Statistics (PBS) spokesperson confirmed Geo News that the date for self-enumeration for the seventh census has been extended by seven days (March 10).

The development comes days after Muttahida Qaumi Movement-Pakistan (MQM-P) objected to the time allotted for carrying out the census while calling for extending the time specified for the three phases of self-enumeration, house enumeration and census.

The decision to extend the date for the self-enumeration of the country's first digital census — which was initially scheduled to end tonight (March 3) at 12am — was taken during the relevant committee’s meeting.

The spokesperson maintained that the date has been extended keeping in view the convenience of the people.

The spokesperson said the authorities are also mulling over extending it beyond a week. He added that the website is also down repeatedly as a lot of people are accessing it.

"Till now, eight million people have self-enumerated themselves. The process of self-enumeration began on February 20," the spokesperson added.

-

Comment by Riaz Haq on March 7, 2023 at 11:14am

-

Pakistani fintech startup Trukkr raises $6.4 mln, gets lending licence | Reuters

https://www.reuters.com/markets/asia/pakistani-fintech-startup-truk...

KARACHI, Pakistan, March 7 (Reuters) - Trukkr, a fintech platform for Pakistan’s trucking industry, said on Tuesday it had raised $6.4 million in a funding round and also received a non-banking financial company (NBFC) licence.

Trukkr offers Pakistan’s small- and medium-sized trucking companies a transport management system and supply chain solutions, and is unique in providing fintech to digitise the largely unbanked and undocumented industry.

The seed funding round was led by U.S. based Accion Venture Lab and London based Sturgeon Capital. Haitou Global, Al Zayani Venture Capital and investor Peter Findley also participated in the round, Trukkr said in a statement.

The company's business model is similar to Kargo in Indonesia, Solvento in Mexico and Kobo 360 in Africa, but has been adapted to the market in Pakistan.

Trukkr said less than 5% of trucking companies using its platform have access to financial services, often having to wait up to 90 days for payments and leaving them unable to cover expenses such as fuel, tolls and truck maintenance.

Sheryar Bawany, Trukkr CEO and co-founder, told Reuters that it was looking to launch financial products at a "reasonable risk adjusted spread" to the benchmark Karachi Interbank Offered Rate (KIBOR).

Co-founder Mishal Adamjee said there are some 20,000 drivers on Trukkr's platform, servicing 100 of the biggest companies in the country including Shan Foods, Artistic Milliners, International Industries Limited and Lucky Cement.

Adamjee told Reuters that Pakistan's $35 billion a year trucking industry is growing at 10% annually despite limited rail and water freight infrastructure.

Investor Accion Venture Lab said the Covid pandemic had shown how much the world relied on global supply chains.

"We want to bet on a company striving to tackle inefficiencies in a market filled with opportunities," it said in the statement.

According to Pakistan’s Board of Investment, projected demand for freight transport will double by 2025 and increase six-fold by 2050 to 600 billion freight tonnes-kilometre, particularly as the China Pakistan Economic Corridor kicks in.

Other freight marketplace startups in Pakistan include Truck It In, BridgeLinx and Freightix.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Which Country is a Bigger Beggar? India or Pakistan?

Most countries in the world today borrow money from various sources to finance their budget deficits. So do India and Pakistan. So why is it that only Pakistan's borrowing money gets labeled "begging"? Is it not begging when India borrows a lot more money than does Pakistan? Or is it that only borrowing money from the IMF qualifies as "begging"? Let's look into this double standard. Currently, India's public debt to GDP ratio is 80% while Pakistan's is about 74%. India's private debt to GDP…

ContinuePosted by Riaz Haq on July 22, 2025 at 6:30pm — 3 Comments

Pakistani International Students Flocking to European Universities

Recent data shows that there are nearly 10,000 Pakistani students attending colleges and universities in Germany. This figure is second only to the United Kingdom which issued over 35,000 student visas to Pakistanis in 2024. The second most popular destination for Pakistani students is Australia which is hosting nearly 24,000 students from Pakistan as of 2023, according to the ICEF…

Continue

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network