PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

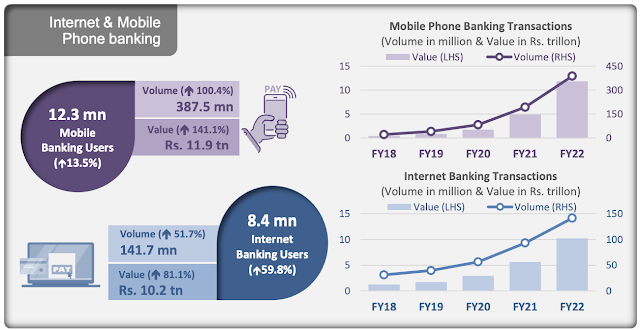

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

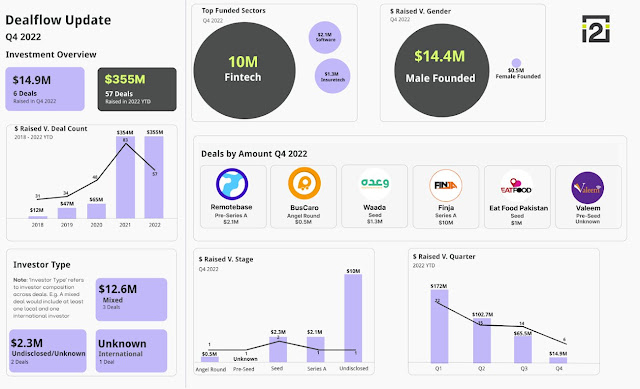

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

-

Comment by Riaz Haq on January 29, 2024 at 8:35pm

-

Pakistan’s Cybernet taps Nokia to build country’s first 600G commercial network | Lightwave

https://www.lightwaveonline.com/optical-tech/transport/article/1430...

Cybernet, Pakistan’s largest wireline operator, deployed the country’s first DWDM network at 600Gbps per wavelength. Leveraging Nokia's optical equipment, the new optical network connects Cybernet’s main metro sites and provides the enhanced network capacity needed to support growing consumer and enterprise demand for fast, high-quality broadband services.

By further strengthening its global footprint through the establishment of its international points of presence (POPs) in MC-1 in Barka (Oman), MRS-2 in Marseille (France), SmartHub in Fujairah (UAE) and SG1 in Singapore, Cybernet is providing its global peering community members with its advanced IXP platform powered by the Nokia 7750 SR and 7250 IXR routers. Cybernet offers Internet, EVPN and MPLS-based services with rich Quality of Service (QoS) at its international POPs.

Operators are looking to upgrade their optical networks to meet the rising demand for high-speed broadband access and network speeds. Cybernet partnered with Nokia to deploy a future-proof optical network capable of delivering over 600Gbps per lambda. This enhances the capacity and speed of its network to connect main metro sites within the country. Leveraging Nokia’s PSS 1830 optical transport platform, Cybernet can effectively scale its total network capacity to 28 Tbps, serving broadband and enterprise customers across Pakistan.

Cybernet implemented Nokia’s advanced integrated ROADM architecture based on flexgrid technology. Through this deployment, Cybernet can better optimize and extend the reach of its optical network. Additional software management and control functions from Nokia’s WaveSuite service enablement automation software help Cybernet to further increase operational efficiencies. Broadband and enterprise customers can also benefit from low latency, superior quality of services and enhanced customer experience.

“Using Nokia’s innovative in-house PSE-Vs chipset with super-coherent optical engines allows us to connect our main sites while also giving us headroom to grow our capacity efficiently and cost-effectively,” said Maroof Ali Shahani, COO of Cybernet. “Through our partnership with Nokia, we can meet our customers’ increasing demand for the best connectivity services while also enabling them to benefit from the latest innovations within optical technology.”

-

Comment by Riaz Haq on January 29, 2024 at 8:37pm

-

Pakistan's NayaPay Partners With Alipay+, A Cross-Border Digital Payments Service Operated By Ant International | Crowdfund Insider

https://www.crowdfundinsider.com/2024/01/220805-pakistans-nayapay-p...

NayaPay, a financial platform, has partnered with Alipay+, a cross-border digital payments and marketing platform operated by Ant International.

The collaboration between NayaPay and Alipay+ is set “to make a significant impact by deploying QR codes compatible with both RAAST and Alipay+ payment partners, including e-wallets and bank apps, thereby enhancing incoming foreign exchange flows and integrating the cashless payment systems of global markets and Pakistan.”

This strategic alliance is specifically designed “to streamline digital payments, tackling prevalent issues such as limited interoperability and elevated transaction costs.”

Through this partnership, NayaPay is well-positioned to “provide Pakistani businesses of all sizes, particularly SMEs, with a seamless connection to more than 25 Alipay+ global payment partners, which reaches a total of more than 1.5 billion consumer accounts, in addition to RAAST.”

This initiative ensures that transactions “are not only efficient but also secure, marking a major step forward in the digitization of commerce in Pakistan.”

Furthermore, this partnership is anticipated “to empower businesses in Pakistan to transact seamlessly with global visitors through a low-cost and fast payment system. This will foster documented and cashless trade and tourism between the two countries.”

This initiative is in line with the State Bank of Pakistan’s vision “for the nation’s economic advancement and digital evolution, setting a new benchmark in the region’s financial sector.”

As noted in the update, Alipay+ is “a suite of cross-border digital payment, marketing and digitalization solutions that help connect global merchants to consumers.”

Consumers enjoy seamless payment and “a broad choice of deals using their preferred payment methods while traveling abroad. Small and medium-sized businesses may use Alipay+ digital tools to enhance efficiency and achieve omni-channel growth.”

As covered in early 2022, Pakistan’s NayaPay Pvt. has reportedly acquired $13 million in early-stage capital as it aims to onboard consumers who an underbanked or financially underserved.

The Karachi-headquartered Fintech firm’s seed round has been led by Zayn Capital, MSA Novo and Silicon Valley’s early-stage investor Graph Ventures, CEO Danish Lakhani confirmed (in statements shared with Bloomberg).

NayaPay became the first startup to provide financial services after acquiring an operational license from the State Bank of Pakistan back in August 2021. The Fintech company’s chat-based payments app launched by focusing on freelancer workers and students.

-

Comment by Riaz Haq on January 30, 2024 at 6:02pm

-

China, Pakistan sign agreement to route Internet traffic through Pakistan, generate $400 million revenue

https://www.arabnews.com/node/2450631/pakistan

Dr. Umar Saif made the announcement as he inaugurated the Pakistan Internet Exchange (PIE) in Islamabad on Monday, powered by DE-CIX, an operator of carrier- and data-center-neutral Internet Exchanges, with operations in Europe, North America, Africa, the Middle East, India and Southeast Asia.

Saif said Pakistan had achieved four important milestones in collaboration with Pakistan Telecommunication Company Ltd. (PTCL), Pakistan Telecommunication Authority (PTA), DE-CIX, Shanghai Cooperation Organization (SCO), China Mobile and PEACE Cable, which stands for Pakistan and East Africa Connecting Europe, a submarine cable project designed to facilitate data transmission between Asia, Europe, and Africa.

“We have reached an agreement for China to start routing their Internet traffic through Pakistan, making Pakistan a regional hub for connectivity,” Saif said.

In a second development, the minister said UAE state-owned telecommunications company Etisalat had set up Pakistan’s first carrier neutral IXP (Internet Exchange Point) and data center to strengthen the reliability of Internet connectivity.

Thirdly, PTCL would work with DE-CIX to run the operations of the new data center, which would enable Pakistan to both bring super-scaling cloud services such as AWS, Google Cloud, and Azure to Pakistan and provide a local content hub for content services such as YouTube, TikTok and Netflix, according to Saif.

“And last but not the least, Pakistan’s Internet users can now access services locally and Pakistan can become a hub of regional connectivity.”

Explaining the measures, the IT minister said Pakistan was a massive digital market with an Internet user-base larger than the population of Italy. In recent years, the country had made significant strides in advancing fiber connectivity and multiple submarine cables making a landfall in Karachi.

Now, the PTCL data center, managed by a tier-1 data center operator like DE-CIX, would generate “exciting” prospects for localized content hosting from leading platforms like YouTube, Netflix and TikTok.

Content cached and routed from Pakistan could seamlessly reach other markets, positioning Pakistan as the regional digital connectivity hub, Saif said, and generate annual revenues ranging from $200-400 million through transit traffic to substantially add to the economy.

Owned and managed by Etisalat, PTCL is the largest integrated Information Communication Technology (ICT) company of Pakistan and DE-CIX is the world’s leading Internet Exchange (IX) operator.

Housed in the PTCL data center in Karachi, the IX is operated by DE-CIX under the DE-CIX as a Service (DaaS) model and built on DE-CIX’s award-winning interconnection infrastructure.

The interconnection platform offers local peering as well as remote access to DE-CIX Frankfurt (Germany).

Zarrar Hasham Khan, Group Chief Business Solutions Officer at PTCL & Ufone 4G, said the company’s nationwide network and DE-CIX’s interconnection infrastructure would serve as a foundation to enhance the Internet experience of customers while facilitating the local hosting of content by international platforms.

Ivo Ivanov, CEO of DE-CIX, said as one of the most populous countries in Asia and with Internet usage growing extremely fast, Pakistan needed local interconnection.

“The Pakistan Internet Exchange powered by DE-CIX will prove itself to be key to unlocking the economic potential of excellent Internet connectivity for the country,” he added.

The Pakistan Internet Exchange will be joining such success stories as the UAE-IX, powered by DE-CIX in Dubai, whose growth and success over the last twelve years have led to it being recognized as an important international Internet hub.

-

Comment by Riaz Haq on July 12, 2024 at 9:23am

-

Digital public infrastructure is transforming lives in Pakistan. Here's how

https://www.weforum.org/agenda/2024/07/digital-public-infrastructur...

Likewise, NADRA's role in the RAAST payment system - a State Bank of Pakistan initiative – highlights how DPI can transform financial transactions. RAAST, an interoperable instant payment system, utilizes NADRA's identity authentication processes to offer secure, swift KYC-compliant financial transactions across various platforms, thereby democratizing access to digital payments for millions.

Additionally, Pakistan's DPI framework has also proven instrumental in managing crises, such as the COVID-19 pandemic. Within days of initiating the lockdown, Pakistan's federal authorities announced unconditional cash transfers. The government provided approximately $75 per household, sufficient to purchase three months' worth of food staples to 12 million vulnerable households.

The targeted response, facilitated by the robust digital ID infrastructure provided by NADRA, resonates strongly with the United Nations-based Better Than Cash Alliance’s 10-point action plan. This plan urges digitizing social benefits and providing women with Digital IDs, mobile phones, and internet access to advance financial equality.

The same approach is endorsed by a recent report on the Benazir Income Support Program (BISP), which highlights significant advancements in Pakistan’s digital delivery system.

These significant opportunities need to be informed and designed with guardrails to ensure that the deployment of DPI is safe, responsible, and leveraged for inclusive societies. The Universal Safeguards for DPI initiative, and the UN Principles for Responsible Digital Payments aim to create a practical framework for countries implementing such initiatives. This initiative identifies potential risks in global DPI deployments, providing valuable insights to inform the design and implementation of future safeguards.

-

Comment by Riaz Haq on July 12, 2024 at 9:24am

-

Digital public infrastructure is transforming lives in Pakistan. Here's how

https://www.weforum.org/agenda/2024/07/digital-public-infrastructur...

Likewise, NADRA's role in the RAAST payment system - a State Bank of Pakistan initiative – highlights how DPI can transform financial transactions. RAAST, an interoperable instant payment system, utilizes NADRA's identity authentication processes to offer secure, swift KYC-compliant financial transactions across various platforms, thereby democratizing access to digital payments for millions.

Additionally, Pakistan's DPI framework has also proven instrumental in managing crises, such as the COVID-19 pandemic. Within days of initiating the lockdown, Pakistan's federal authorities announced unconditional cash transfers. The government provided approximately $75 per household, sufficient to purchase three months' worth of food staples to 12 million vulnerable households.

The targeted response, facilitated by the robust digital ID infrastructure provided by NADRA, resonates strongly with the United Nations-based Better Than Cash Alliance’s 10-point action plan. This plan urges digitizing social benefits and providing women with Digital IDs, mobile phones, and internet access to advance financial equality.

The same approach is endorsed by a recent report on the Benazir Income Support Program (BISP), which highlights significant advancements in Pakistan’s digital delivery system.

These significant opportunities need to be informed and designed with guardrails to ensure that the deployment of DPI is safe, responsible, and leveraged for inclusive societies. The Universal Safeguards for DPI initiative, and the UN Principles for Responsible Digital Payments aim to create a practical framework for countries implementing such initiatives. This initiative identifies potential risks in global DPI deployments, providing valuable insights to inform the design and implementation of future safeguards.

For instance, in Pakistan, NADRA's data sharing follows strict parliamentary processes. In national security cases, the crisis management cell within the Ministry of the Interior responsible for evaluation and requests of specific data fields. These standard operating procedures ensure case-by-case data sharing, a clear paper trail, and accountability to NADRA's board.

The future of Pakistan's digital economy

The potential of DPI to transform Pakistan's economy and society is immense. With projections suggesting that wholesale adoption of digital payments could boost GDP by up to 7%.

Looking ahead, Pakistan is set to launch several ambitious DPI initiatives, including expanding the RAAST payment system, implementing a nationwide digital health records system, and launching a blockchain-based land registry. These projects promise to drive efficiency and transparency across multiple sectors, positioning Pakistan as a pioneer in the global digital landscape.

-

Comment by Riaz Haq on August 15, 2024 at 8:16pm

-

Who owns Pakistan’s digital wallet throne? - Profit by Pakistan Today

https://profit.pakistantoday.com.pk/2024/07/15/who-owns-pakistans-d...

In 2008, a seismic shift occurred in Pakistan’s financial services landscape with the introduction of Branchless Banking (BB). This innovation sparked a digital revolution, reshaping how millions of Pakistanis access and use financial services. By the end of 2023, this transformation had reached new heights, with BB accounts soaring to 114 million—an 18.1% increase from the previous year. Even more striking, active accounts surged by 50.9% to 64.1 million, underscoring the growing adoption of digital financial solutions.

At the heart of this digital finance boom are two titans: Telenor Bank’s Easypaisa and Mobilink Bank’s JazzCash. These digital wallets have become household names, each carving out a significant portion of the market. While JazzCash leverages its vast customer base and market reach, Easypaisa, as a pioneer, boasts an extensive network of agents and merchants. Their rivalry not only fuels innovation but also raises a compelling question: In this rapidly evolving landscape, who truly leads the digital wallet revolution in Pakistan?

Both companies claim market leadership. VEON’s 2023 annual report states, “JazzCash was the largest domestic fintech platform and the most popular mobile fintech application in Pakistan.” Conversely, Telenor Bank’s annual report asserts, “The bank continued to solidify its position as a leading player in Pakistan’s digital financial sector in 2023.”

Given these competing claims, how can we determine which company truly leads the market?

History of Easypaisa and JazzCash

The advent of branchless banking in Pakistan can be traced back to the mid 2000s. We had Tameer Bank (Now rebranded as Telenor Bank) which was suffering from high delinquencies and was looking for a way out. As fate would have it, SBP was also looking to introduce the branchless banking regime in the country.

-

Comment by Riaz Haq on September 29, 2024 at 4:27pm

-

Visa’s Leila Serhan says Pakistan presents significant opportunity for digital payments

https://www.thenews.com.pk/print/1234879-visa-s-leila-serhan-says-p...

KARACHI: Senior Vice President and Group Country Manager for North Africa, Levant and Pakistan (NALP) at Visa Leila Serhan highlighted the importance of cybersecurity measures in promoting the growth of digital payments in Pakistan during an interview with The News.

Following are excerpts of her conversation:

Q: What initiative is Visa taking to safeguard users and support partner banks to combat fraud and cybercrime in Pakistan?

A: Cyber security is a top priority for anyone in the financial services industry, especially for Visa. We provide cutting-edge artificial intelligence-powered risk and fraud management solutions to our users and partner financial institutions, which greatly assist in every step of the transaction process.

The technologies like tokenization not only enhance user experience but also strengthens security by converting the 16-digit card number into a token, significantly improving security. Visa aims to introduce tokenization technology to all its partners and the entire ecosystem to safeguard consumer data.

In Pakistan, security and fraud issues, such as social engineering, are common when making digital payments. Therefore, there is a need to educate users not to share their online transaction processing data or card information via email. Furthermore, the user card verification value is confidential and should not be shared with anyone.

Visa recently announced a strategic partnership with 1Link, the country’s largest payment service provider, to simplify remittances in the country and promote digital transactions. The partnership involves integrating the Visa Alias Directory Service within the 1LINK network to streamline incoming remittances, enhance user experience and protect sensitive payment credential information.

Remittances are crucial for the Pakistani economy, as the country is one of the top 10 remittance-receiving nations in the world, according to World Bank data. Visa has simplified the remittance process, allowing individuals whether in the United Arab Emirates, Saudi Arabia or any other market to send money back home to their parents or family using a mobile number. The Visa Alias directory facilitates fast and secure transactions, and users can conveniently send and receive money directly from their mobile phones.By providing a seamless user experience and ensuring convenience, security, and cost-effectiveness in remittance transactions, efforts are made to discourage the use of illegal remittance flows to the country. This is one of our key objectives.

Q: What efforts is Visa making to increase the acceptance of contactless payments by small businesses?

A: We are collaborating closely with banks and other stakeholders to offer customized financial products and low-cost acceptance solutions, enabling small and medium enterprises (SMEs) to accept payments in a cost-effective manner. Tap-to-phone is a key part of our strategy, and we aim to expand the reach of small and micro enterprises able to accept digital payments by 10 times. We are forming numerous partnerships to promote financial literacy, expand small businesses and enhance consumer financial inclusion.

Q: How does Visa collaborate with government entities like the State Bank of Pakistan?

A: We have had a very positive dialogue with the State Bank of Pakistan. It is great that there is an active dialogue and partnership between the government and companies like Visa in the private sector. We constantly discuss how to improve the consumer experience in Pakistan, both domestically and internationally.

-

Comment by Riaz Haq on October 20, 2024 at 4:41pm

-

This e-banking platform is narrowing Pakistan's financial gap | World Economic Forum

https://www.weforum.org/videos/edisonalliance-pakistan/

---------------

https://www.sbp.org.pk/Finc/AMAscheme.html

Through the Asaan Mobile Account (AMA) platform, any Pakistani holding a valid CNIC can open a bank account digitally in any AMA participating bank, from anywhere, at any time by using the SIM of any mobile operator. The scheme allows individuals to access AMA platform using a short code i.e *2262# and make transactions, through their basic/smart mobile phone without the need for internet connectivity.

Asaan Mobile Account (AMA) platform is a revolutionary initiative undertaken by State Bank of Pakistan (SBP) and Pakistan Telecommunication Authority (PTA), in collaboration with branchless banking (BB) providers, telecom operators and other development partners. The AMA platform has been launched under the National Financial Inclusion Strategy (NFIS) that aims to facilitate general masses, especially the low income segments, to digitally open their BB accounts and use the available financial services in a swift, easy and affordable manner.

-

Comment by Riaz Haq on January 4, 2025 at 9:32am

-

Govt launches operations for 7th digital agricultural census - Pakistan - DAWN.COM

https://www.dawn.com/news/1882579

ISLAMABAD: The Pakistan Bureau of Statistics (PBS) on Wednesday initiated field operations for the country’s 7th Agricultural Census, employing digital tools to collect vital data for evidence-based policies aimed at sustainable farming and food security.

At a launch event in Islamabad, Planning Minister Ahsan Iqbal distributed tablets to trained enumerators, emphasising the role of technology in ensuring accurate and efficient data collection.

Ceremonies were also held in several other cities, including Lahore, Karachi and Peshawar.

The PBS has trained 7,686 enumerators and supervisors nationwide for this purpose. Data collection will take place over 40 days, from Jan 1 to Feb 10, 2025, which will be pivotal in shaping policies to address food insecurity and enhance agricultural resilience. The results are expected to be compiled by August.

This census, to be conducted in collaboration with federal and provincial governments, academia and related departments, aims to provide comprehensive insights into the country’s agrarian landscape.

Planning Minister Ahsan Iqbal described agriculture as the backbone of the economy, significantly contributing to GDP, exports and employment.

He noted that the data gathered from this census would play a vital role in shaping policies that tackle key challenges like resource management, crop patterns and food security. He further emphasised that the data would enable targeted support for the agricultural community, encouraging initiatives to increase productivity and enhance the welfare of farmers.

He reiterated the federal government’s commitment to ensuring that farmers across the country receive the resources and support they need for sustainable growth. He stressed that the 7th Agricultural Census was a historic step towards economic reforms and data-driven policymaking.

The minister also appreciated the modernised approach and centralised GIS technology for real-time monitoring. This will streamline data collection and analysis, enabling targeted interventions and effective resource allocation.

The initiative aligns Pakistan’s agricultural practices with global standards and seeks to enhance productivity and food security.

PBS’s focal person for the agriculture census, Sarwar Gondal, said that a decade overdue activity had been initiated by the bureau with its extensive network of 34 regional and 125 district offices.

-

Comment by Riaz Haq on January 4, 2025 at 11:06am

-

Elon Musk awaits Pakistan’s approval for Starlink launch

https://arynews.tv/elon-musk-awaits-pakistans-approval-for-starlink...

The SPACEX chief Elon Musk on Saturday said that he is awaiting approval from Pakistan government regarding the launch of Starlink in the country.

As per details, a conversation took place on the social media platform X (formerly Twitter) between Pakistani social media user Sanam Jamali and Elon Musk, regarding the launch of Starlink in Pakistan.

As per details, Sanam requested Musk to introduce Starlink in Pakistan, stating that it could pave the way for a better future, providing internet connectivity and opportunities for citizens to move forward.

Musk responded, stating that he is awaiting approval from the Pakistani government to launch Starlink in the country. Starlink, owned by SpaceX, provides internet services through a vast network of satellites.

https://x.com/elonmusk/status/1875530965734526983

Later, the Pakistan Telecommunication Authority (PTA) confirmed that talks between the government and Starlink are underway regarding the issuance of a license for satellite services.

According to PTA, the process is currently in its initial stages, as per Starlink’s request.

The PTA is reviewing the technical requirements for Starlink’s license, while the National Space Agency is examining the proposal under the national space policy.

The PTA emphasized that several technical aspects, including bandwidth, uplinking, and gateways, must be evaluated before issuing a license.

This procedure applies to all foreign satellite service providers, and regulatory approval will be required after obtaining clearance from the space agency.

Starlink

Starlink is a satellite internet constellation developed by SpaceX, a private aerospace manufacturer and space transport services company founded by Elon Musk. The constellation aims to provide fast, reliable, and global internet connectivity through a network of thousands of small satellites in low Earth orbit (LEO).

This innovative technology has the potential to revolutionize the way we access the internet, especially in remote and underserved areas where traditional fiber-optic and cellular networks are limited or unavailable.

The Starlink constellation is designed to offer high-speed internet connectivity with latency as low as 20 ms, which is comparable to or even better than many existing fiber-optic networks.

Each Starlink satellite is equipped with a phased array antenna that allows it to communicate with multiple users simultaneously, providing a high-capacity and flexible network. With Starlink, users can enjoy fast and reliable internet access from virtually anywhere in the world, making it an exciting development for global connectivity and digital inclusion.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IMF Questions Modi's GDP Data: Is India's Economy Half the Size of the Official Claim?

The Indian government reported faster-than-expected GDP growth of 8.2% for the September quarter. It came as a surprise to many economists who were expecting a slowdown based on the recent high-frequency indicators such as consumer goods sales and durable goods production, as well as two-wheeler sales. At the same time, The International Monetary Fund expressed doubts about the Indian government's GDP data. …

ContinuePosted by Riaz Haq on November 30, 2025 at 11:30am — 1 Comment

Retail Investor Growth Driving Pakistan's Bull Market

Pakistan's benchmark index KSE-100 has soared nearly 40% so far in 2025, becoming Asia's best performing market, thanks largely to phenomenal growth of retail investors. About 36,000 new trading accounts in the South Asian country were opened in the September quarter, compared to 23,600 new registrations just three months ago, according to Topline Securities, a brokerage house in Pakistan. Broad and deep participation in capital markets is essential for economic growth and wealth…

ContinuePosted by Riaz Haq on November 24, 2025 at 2:05pm — 2 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network