PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

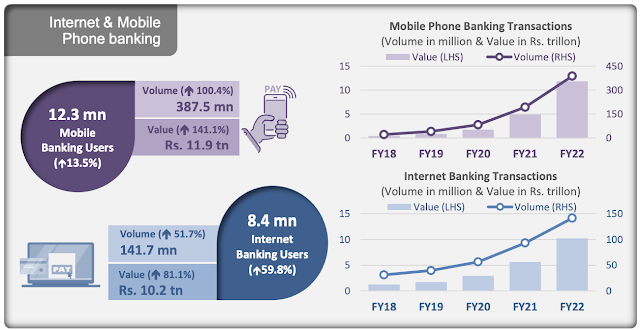

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

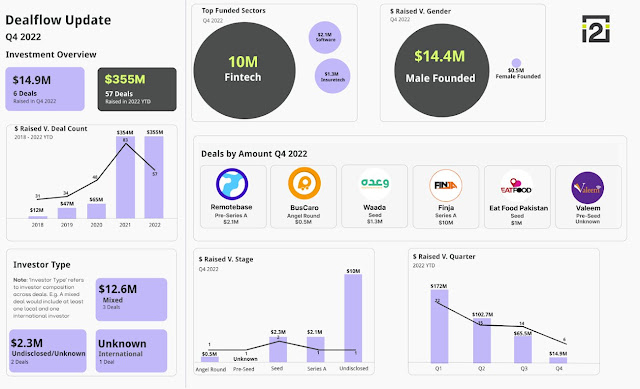

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

-

Comment by Riaz Haq on January 2, 2023 at 7:55pm

-

Airtel is the new winner of Opensignal's Download Speed Experience award in India. Our users on Airtel clocked the fastest overall mobile download speeds in India — 13.6 Mbps, on average — which were 0.3-0.6 Mbps faster than the speeds users saw on Vi and Jio and 10.6 Mbps faster than on last-placed BSNL.

https://www.opensignal.com/reports/2022/10/india/mobile-network-exp...

----------------

With average download speeds of 11.4 Mbps, Zong users saw the fastest Download Speed Experience in Pakistan — 0.7 Mbps ahead of Jazz. The gap between Zong and other operators varied significantly, ranging from 19.3% with third-placed Ufone to a staggering 204.6% over the speeds experienced by our Telenor users. However, Ufone is faster in terms of 4G Download Speed, with scores averaging 15.7 Mbps.

https://www.opensignal.com/reports/2022/08/pakistan/mobile-network-...

-

Comment by Riaz Haq on January 3, 2023 at 10:40am

-

Kalsoom Lakhani

@kalsoom82

1/Happy 2023! Our Insights team at

@Invest2Innovate

put out of a 2022 EOY roundup re: Pakistan startup funding space, a much deeper dive into what happened this past year that looks at overall trends. I'll give some broad takeaways but u can find it here:

https://drive.google.com/file/d/1-Og0XefqLvdiQE3hnwApuuqJuneWj9JC/view

In 2023, the funding slowdown will likely continue, though our belief is that good companies with

strong business models (i.e., not burning lots of cash indefinitely) will still be able to raise in the

coming year. Valuations will also go down to match the Pakistan market realities, which will be

necessary given the waning international investor appetite. If you're a founder, focus on executing,

and if you need to raise, be mindful that it may take longer than it would have in 2021.

-

Comment by Riaz Haq on January 3, 2023 at 6:52pm

-

Global Innovation Index 2022

https://www.wipo.int/edocs/pubdocs/en/wipo-pub-2000-2022-section3-e...

Pakistan is a prominent climber in the GII 2022 ranking, entering the top 90 at 87th place.

This year, Indonesia, Uzbekistan and Pakistan entered the group of Innovation Achievers

for the first time by performing above expectation on innovation for their level of economic

development (see Table 3 and Figure 11).

Sixteen out of the 25 economies from Sub-Saharan Africa covered this year improved their

ranking. Botswana took the biggest leap forward, reaching 86th position, and in so doing

overtaking Kenya (88th) among the top 3 for the region. Other notable improvers within the

region are Mauritius (45th), Ghana (95th), Namibia (96th) and Senegal (99th). South Africa remains

unchanged in 61st place – and continuing to fail to improve consistently over time.

-----------

Middle-income economies China, Türkiye and India continue to change the

innovation landscape; others like the Islamic Republic of Iran and Indonesia show

promising potential

Apart from group leaders China, Bulgaria and Malaysia, Türkiye (37th) and India (40th) are the two

other middle-income economies to make it into the top 40. Thailand (43rd), Mauritius (45th), the

Russian Federation (47th), Viet Nam (48th) and Romania (49th) make into the top 50, but with only

Mauritius moving up the ranking this year.

Among the middle-income group, the Islamic Republic of Iran (53rd) and Indonesia (75th) have

notably improved their ranking, not only this year but also over the past decade, and join Türkiye,

Viet Nam and the Philippines (59th) in having an increasingly important potential for transforming

the global innovation landscape.

Morocco (67th) has shown innovation potential for a number of years, whereas Pakistan (87th) and

Cambodia (97th) are also starting to show signs of increased innovation potential.

India overtakes Viet Nam as leader of the lower middle-income group (Table 2). It continues to lead

the world in the ICT services exports indicator (1st) and hold top rankings in other indicators, including

Venture capital recipients’ value (6th), Finance for startups and scaleups (8th), Graduates in science and

engineering (11th), Labor productivity growth (12th) and Domestic industry diversification (14th).

------

However, there is change too this year. Indonesia (75th), Uzbekistan (82nd) and Pakistan (87th) are

Innovation Achievers in 2022 for the first time ever. For these three economies, this achievement

coincides with an important shift in their rankings of between four and 12 positions. In addition,

Jamaica (76th), Jordan (78th), Zimbabwe (107th), Mozambique (123rd) and Burundi (130th) all make it

back into the select group of Innovation Achievers for 2022. Brazil (54th), the Islamic Republic of

Iran (53rd) and Peru (65th) keep their achiever status for a second consecutive year. These three

economies also gain between three and seven positions in the rankings, with Brazil moving

forward since 2019. In 2022, Brazil makes marked improvements in innovation outputs, notably in

Creative outputs, including in Intangible assets and Online creativity, as well as in the indicators

Trademarks (19th) and Mobile app creation (34th).

-----------

Relative to 2021, 27 economies switched performance groups. Four economies raised their performance

status from below expectation to matching expectation, namely, Sri Lanka (85th), Bangladesh (102nd),

Ethiopia (117th) and Yemen (128th). Conversely, 12 economies fell back from matching expectation to

come below expectation, half of them the Latin America and Caribbean economies of Uruguay (64th),

Paraguay (91st), Ecuador (98th), El Salvador (100th), Guatemala (110th) and Honduras (113th).

-

Comment by Riaz Haq on January 4, 2023 at 12:25pm

-

Increasing optic fibre penetration

IT benefits cannot be enjoyed unless country has robust telecom infrastructure

https://tribune.com.pk/story/2373645/increasing-optic-fibre-penetra...One measure of optic fibre penetration in a country is the percentage of towers connected with the fibre. In Pakistan, it is 10%. For comparison, in Thailand, it is about 90%, in Malaysia about 50%, in India about 30%, and in Bangladesh 27%.

In Pakistan, every city is connected with optic fibres, and thanks to the efforts of PTA (obligating new/ renewal of fixed-line licensees to lay fibre cables) and USF (obligating subsidy winners to lay fibres), the fibres connecting cities and villages are increasing. But fibre penetration is poor within smaller towns and relatively less affluent localities of larger cities.

In Islamabad, many streets have up to three optic fibres buried in parallel (where only one would more than suffice). In contrast, large Mohallahs even in the neighbouring Rawalpindi have no optic fibres.

This is understandable, as all fibre investors are Internet Service Providers (ISPs) who must fiercely compete with each other. They cannot share the capacity of their fibres. They would rather lay their own fibres.

Consequently, the fibre-to-the-premises (FTTP) in Pakistan is very low. Out of 119 million broadband subscriptions, only 2 million are fibre connected. It reflects negatively on Pakistan’s ranking on various global indices, where Pakistan is lagging behind all the regional countries (except Afghanistan).

A significant cause of low overall performance is also the unusually high telecom taxes, and the process and cost of Right of Way (RoW). Telecom operators have been clamouring for the government to address these for years. Addressing these demands would undoubtedly speed up investments.

Still, where every ISP has to lay its own fibres, it may take another 25 to 30 years to serve a considerable part of the population.

-

Comment by Riaz Haq on January 4, 2023 at 6:13pm

-

Good things come to those who wait and for Pakistan’s tech ecosystem, the wait finally seemed to be over in 2021. Funding surged over 5x to $366 million and tech exports crossed $2 billion. Big shot investors entered the market, things were on the go and optimism was all abound.

https://www.dawn.com/news/1729409

But that cliched saying doesn’t really mention anything about good things lasting, and that’s exactly what happened in 2022. Despite a solid start which saw almost $173m raised in Q1, investment activity plunged and reached a 10-quarter low. The annual total still came in at over a healthy $351m, but the slowdown was glaringly obvious.

The change in global macros and the subsequent carnage in venture capital cut short the newfound love for Pakistani startups among foreign investors, as the country’s risk premium became too high for the available return potential. The doomsday peddlers and default mongers would tell you this might be the end of a rather short-lived era. And perhaps we might not return to the 2021-2022 levels, but would still stay reasonably above our 2020 total of around $65m.

However, for the near future, the deal flow will remain depressed, especially for relatively later-stage startups — as per Pakistani standards, those looking for Series A or further. Based on this criteria, there are at least 14 companies that might need to raise follow-on rounds soon (ignoring all those who had seed deals in 2021). For the remaining, the deals might still continue, albeit at much lower valuations and at a slower pace.

One reason to believe that while investment value plunged by a massive 79 per cent year-on-year in Q4-2022, the deal count fell by relatively less to eight. That too because a number of investment rounds actually went unreported and the small base amplifies the decline in percentage terms. The source of early-stage capital could tilt towards accelerators, whose $100,000-$250,000 cheques might have seemed like peanuts to some founders during the good times.

That said, the cycles do change, even if the gloom today might not seem like it, as did the optimism from last year. Markets often have amnesia and move on sentiments — which will improve sooner or later. Well, at least as far as the global macros are concerned, if not Pakistan’s. Beyond the venture funding environment — which honestly takes up an outsize share in tech-related discussion — there is one missed theme from 2022. One that is a little concerning.

In Q1-2021, Pakistan’s digitally paid e-commerce transactions fell to 9.1m, from 136m in the preceding period. While the number did recover to over 10.1m in the second quarter, it still spells trouble, especially considering how our macroeconomic situation worsened from July onwards. For example, inflation peaked in August and the past few months have been marred by complete chaos for anyone trying to run a business. It’s not just the data. Market talks paint a pretty bleak picture as major e-commerce stores see declines in orders. Last year, the situation was the exact opposite — almost everyone struggled to keep up with the demand and supply squeezed. Now, the players are reportedly sitting on excess capacity, which has its own overheads, or trying to renegotiate terms with partners.

According to Hammad Khan, the co-founder of AlphaVenture — the digital agency behind the price comparison website Pakistanistores.com, sales have declined around 10-15pc this year compared to 2021 despite more people coming online. “Even though our website traffic went up 5pc year-on-year in November 2022, it hasn’t necessarily translated into more orders for stores as major players in the industry are having a relatively slower period.”

“But more than demand, supply has been the issue as almost all sectors — regardless of online or traditional channels — struggle to source products. If companies cannot source products in the first place, how are they even going to fulfil orders?”

-

Comment by Riaz Haq on January 4, 2023 at 6:13pm

-

Changing times for tech

https://www.dawn.com/news/1729409

The troubles are now coming for e-commerce transactions to foreign merchants, as banks have to settle them by first purchasing dollars from the open market. This is making payments to vendors like hosting providers, software etc — a necessity in any tech-enabled business — even more expensive.

On the technology exports side, things are a bit more unclear. Not the part where proceeds have slowed down — that much is clear enough, but rather the why of it. After all, till mid-2022, telecom group exports were growing monthly at upwards of 20pc year-on-year but then declined to single digits. In certain periods, not even that.

These pages have explored that topic in more detail and discussed how the political and economic uncertainty, especially with regard to paying for services in dollars, is discouraging companies from bringing money back to Pakistan.

And that theme will most likely continue in the near future as we don’t seem to be heading near stability anytime soon. In fact, the heavy-handedness and panic of policymakers might even leave deeper scars and do more long-lasting damage.

-

Comment by Riaz Haq on January 5, 2023 at 7:30am

-

2023 PPP GDPs, according to IMF

Pakistan $1.62 trillion

Bangladesh $1.48 trillion

Egypt $1.8 trillion

https://www.imf.org/external/datamapper/PPPGDP@WEO/PAK/BGD/EGY

-

Comment by Riaz Haq on January 5, 2023 at 10:25am

-

Informal Savings in Pakistan

https://www.dawn.com/news/1725956

According to research by Oraan, around 41pc Pakistanis saved via committees (or Rosca), whereas Karandaaz puts that figure at 34pc. Assuming the informal economy accounts for roughly 30pc, as suggested by research from the Pakistan Institute of Developing Economics, it translates into annual committees of Rs4 trillion at base prices, using conservative inputs.

While this back-of-the-envelope calculation is far from scientific, it helps contextualise how big the informal savings market really is. Everyone from a widow looking to save up for her children’s education to young adults trying to save up for their marriage, committees are what they turn to.

This phenomenon is not exclusive to Pakistan. According to a note by Middle East Venture Partners (one of the investors in Bykea), “the global market is largely untapped and ripe for disruption with 2.4 billion people using money circles through traditional channels.”

They recently participated in the Egyptian digital committees’ startup MoneyFellows’ $31m Series B.

Apart from the traditional financial institutions’ general apathy towards the customer, committees appeal to an average Pakistani for several reasons: they are a community-based instrument with some level of flexibility and there is no interest involved.

Most importantly, it helps them manage cash flow better due to habitual change. For women, the product enjoys particular popularity since the former financial services are largely inaccessible.

However, since committees are primarily cash-based with virtually no money trail involved, it poses massive risks, as we saw recently when a girl, Sidra Humaid, who ran a network of committees through social media, defaulted on Rs420m of payments.

----

Even beyond this, committees have flaws by design, only amplified by Pakistan’s macros. For instance, the person receiving the first lump sum amount will always be at an advantage since their instalments in the subsequent months would be worth less due to both inflation and rupee depreciation. The recipient of the last payment would see the amount’s purchasing power eroded substantially by the time they get it.

Moreover, due to the community-based nature of the product, the risk of network defaulting is higher as people of usually similar risk profiles would be pooling in their money.

For example, if employees from an organisation have running office committees, delayed salaries or layoffs within the organisation would lead to a bad equilibrium, creating losses for the rest of the group, often resulting in default.

However, there are ways to address some of those challenges. First of all, to (partially) protect your lump sum from depreciation or devaluation, you can enter a committee with a duration of up to 10 months. Given Pakistan’s macros of late, you’d still lose money in real terms but to be fair, that’d most likely be the case in any other instrument as well, including the risk-free government papers.

In fact, contrary to popular perception, there are certain ways to further alleviate the inflation problem. Digital committees have an option of gamifying the experience by rewarding good payment behaviour through loyalty programs and/or brand partnerships to provide discounts on utilities-based services and products.

Secondly, digital committees help create a trail of money which, coupled with a centralised authority (the platform itself), brings in accountability and recourse in the event of a default. The receipt and/or ledger helps with basic accounting in committees creating transparency for people within the group.

The third benefit of digital committees is the security factor. The participant has to go through a know-your-customer and credit check process to make sure there is no fraudulent behaviour that could negatively impact the group, along with the participant’s ability and willingness to pay to create an overall environment for responsible finance.

-

Comment by Riaz Haq on January 5, 2023 at 10:26am

-

Plotistan: The mystery of low savings rate

https://profit.pakistantoday.com.pk/2022/02/27/plotistan-the-mystery-of-low-savings-rate/

Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments

There is a lot of noise regarding the savings rate, and how a transition towards the formal economy would enhance the savings rate. This is indeed a novel idea, and recent digitization measures would certainly boost savings rate as an increasing number of transactions flow through the system, while the size of the informal economy contracts. Over the last ten years, Pakistan has had a savings rate of 14.5 percent, stooping to a low of 12.5 percent only a few years back. Savings rate in Pakistan has gradually dropped in this century, after hitting a peak of 23 percent in 2004.

A traditional national income identity, where cumulative GDP for a country is a function of consumption, investment, government expenditure, and net exports (negative if imports are higher), suggests that as savings in an economy increases, overall investment also increases. The underlying assumption is that rational agents in an economy would save for a certain rate of return, which they would get by investing in the economy. As the overall stock of savings increases, the overall investment also increases. The overall increase in investment enhances the overall national income, with a spillover effect on increasing consumption (higher employment, and higher disposable income), as well as higher exports – if investments are routed towards export-oriented activities.

However, the real world is slightly different. Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments. National accounts often consider what can be measured, or what is formal, and disregard the informal, or the shadow economy. Savings that either result in an increase in bank deposits, stock of national savings, or flow into the capital markets, among other avenues can be counted as savings in national accounts, eventually being routed as investments – with banks lending into the real economy (or back to the government), while various businesses raise capital in the primary and secondary markets, and so on. However, if the same capital is simply redeployed in a multitude of real estate schemes, which are not developed and simply operate secondary market of ‘plot files’, then that truly is savings – but isn’t really an investment that would be recognized in national accounts.

The last ten years have resulted in emergence of plotistan. An economy which encourages investment in plots (whether legal, or illegal) for accumulation of wealth, rather than allocating that capital towards more productive areas of the economy. The capital markets have barely seen a sliver of fresh retail capital flowing into it, depressing valuations, and discouraging businesses from fresh listings given unattractive valuations. Meanwhile, the value of plots in cities across the country have grown multifold.

A marginal, and negligible taxation regime, massive distortion in reported value and transaction value of real estate, and amnesty schemes to further accelerate scarce capital to move towards real estate rather than actual productive enterprise has ensured that plots remain a safe haven for preservation of grey capital. A largely cash based market also ensures that fire sales are far and few in between, as investors (or plot-ists) as they like to call themselves are fine with staying underwater as that still remains a more tax efficient structure than investing in the formal economy. A drop in savings rate during the last ten years has been accompanied by an increase in cash in circulation as a % of GDP, signifying how an increasing number of economic activity is being conducted in cash, rather than through formal financial institutions.

-

Comment by Riaz Haq on January 5, 2023 at 10:27am

-

The size of the informal economy in Pakistan is much larger.

https://www.southasiainvestor.com/2021/12/has-bangladesh-really-lef...

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. Compared to Bangladesh and India, there is a lot more currency in circulation as a percentage of overall money supply in Pakistan. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%, according to the State Bank of Pakistan. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 2 Comments

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network