PakAlumni Worldwide: The Global Social Network

The Global Social Network

Current Debt Crisis Threatens Pakistan's Future

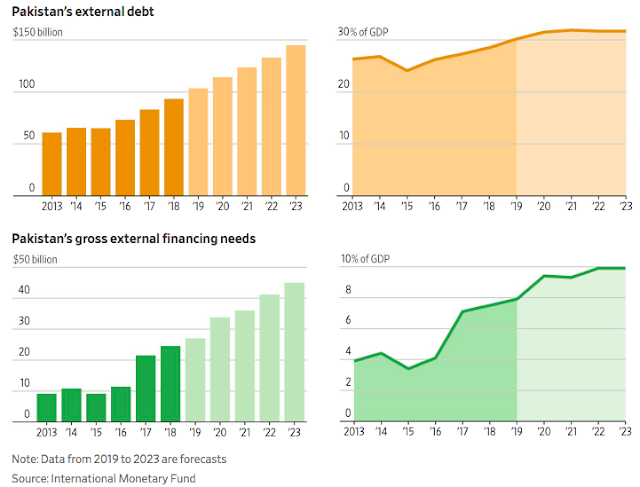

Pakistan is battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, unsustainable external debt payments, and soaring sovereign debt. This crisis has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

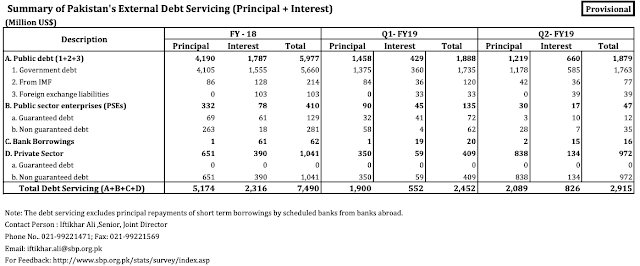

Pakistan's debt repayment costs rose to $5.4 billion for first half of fiscal 2019 ( July 2018-Dec 2018), up from $7.5 billion for the entire fiscal 2018 (July 2017-June 2018), according to the State Bank of Pakistan. At this rate, the total debt service cost for current fiscal 2019 will exceed $11 billion, adding to the nation's debt crisis.

This $11 billion debt service cost will add to the projected trade deficit of nearly $40 billion for the current fiscal year. How can Pakistan fund this balance of payments deficit of about $50 billion? Remittances of $21 billion in current FY2019 from Pakistani diaspora are expected to reduce it to $30 billion. PTI government has taken on billions of dollars in loans from Gulf Arabs and China. Given the low rates of foreign investments in the country, a big chunk of the remaining deficit will have to be met by borrowing even more funds which will further increase future debt service costs.

Pakistan's Current Account Deficit. Source: Trading Economics |

As a result, Pakistan is now battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, onerous external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

Pakistan Debt as Percentage of GDP. Source: Trading Economics |

In the short term, PTI government's efforts are beginning to pay off. The current account deficit (CAD) in first 8 months of FY2019 (July-Feb 2018) declined to $8.844 billion, down 22.5%, from $11.421 billion in same period last year, according to SBP as reported by Dawn newspaper.

Pakistan's Debt Burden Highest Among 25 Emerging Nations |

However, Pakistan's economic woes are far from over. The country's twin deficits are structural. Its exports and tax collections as percentage of its GDP are among the lowest in the world. British civil society organization Jubilee Debt Campaign conducted research in 2017 that showed that Pakistan has received IMF loans in 30 of the last 42 years, making this one of the most sustained periods of lending to any country.

History of Pakistan's IMF Bailouts |

Pakistan needs to find a way to build up and manage significant dollar reserves to avoid recurring IMF bailouts. The best way to do it is to focus on increasing the country's exports that have remained essentially flat in absolute dollars and declined as percentage of GDP over the last 5 years. Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be concerted effort involving various government ministries and departments working closely with industry groups. At the same time, the new government needs to crack down on illicit outflow of dollars from the country.

|

| Pakistan Debt Service as Percentage (45%) of Budget Among World's Highest |

Azad Labon Ke Sath host Faraz Darvesh discusses Imran Khan's challenges with Misbah Azam and Riaz Haq (www.riazhaq.com)

Related Links:

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

-

Comment by Riaz Haq on July 5, 2019 at 6:27am

-

#IMF package to bring $38 billion in loans to #Pakistan from other creditors. #Debt-servicing amounted to $9.5 billion during the last financial year and projected at $11.8 billion during the current fiscal year. https://www.dawn.com/news/1492216

Pakistan on Thursday welcomed $6bn bailout package approved by the executive board of the International Monetary Fund (IMF), saying it would lead to inflows of $38bn from other lenders in three years.

Read: IMF approves $6 billion loan for Pakistan

Speaking at a hurriedly called news conference, PM’s Adviser on Finance and Revenue Dr Abdul Hafeez Shaikh said the approval of 39-month reform programme by the IMF executive board without opposition from any member would provide stability to Pakistan. “The board has given us trust to prove ourselves good partners and deliver on reform promises,” he said.

He said this had improved the country’s standing and other institutions had also started extending their financial support. He said the Asian Development Bank would disburse about $2.1bn out of $3.4bn agreed funds to Pakistan this year and the World Bank had also agreed to additional assistance purely for budgetary support. Discussions with the World Bank were in progress for assistance only for the purpose of government expenditure, he said.

Giving a breakdown of $38bn expected financial support from lenders other than IMF, Dr Shaikh said about $8.7bn funds had been lined up against project loans, $4.2bn for programme loans, about $14bn of rollover loans and up to $8bn in commercial loans. He did not go into details and sources of these loans.

Responding to a question, he said Pakistan’s outflows for debt-servicing amounted to $9.5bn during the last financial year and projected at $11.8bn during the current fiscal year.

The adviser said there had been different exaggerations and unfair comments about IMF conditions while the government was in talks but it would also become clear as to what are the conditions when the IMF releases full details of the programme.

He said the government decision to enter into the IMF programme was a message to the world and other lending agencies that Pakistan was serious and ready to prove its responsibility towards managing expenditures, enhancing revenues and taking difficult decisions while protecting the vulnerable segments.

Dr Shaikh said there was also no condition or IMF demand in the programme about the privatisation as it would become clear from the documents to be released by the Fund. Instead Pakistan has to develop a comprehensive programme to decide which loss making entities could be improved and run in the public sector, which can be better run by the private sector and which require liquidation.

Pakistan has said this programme will be completed by September 2020, but there was also a possibility that we finalise the restructuring plan before this target. This is because these entities are a direct burden on the public finance and should be tackled at the earliest and if the Pakistan State Oil and Pakistan International Airlines are not being run in an efficient manner then this is not in the interest of our people.

The adviser said what should matter to all was that the IMF was an international institution from whom Pakistan could secure financial support and by taking benefit from this fiscal space set the stage for sustainable reforms in the long-term interest of the people and the country and ensure how to learn lesson from the past and not to repeat mistakes.

He said the government had given independence to the State Bank of Pakistan so that it emerged as a strong institution like others in the world.

-

Comment by Riaz Haq on July 17, 2019 at 1:02pm

-

#Pakistan's current account #deficit shrinks by 32% year over year. It fell to $13.59 billion during the fiscal year-2018-19, down 32 per cent, from $19.90 billion in the same period last year. #PTI #ImranKhan #IMF #economy #debt https://arynews.tv/en/current-account-deficit-shrinks/

Owing to business friendly policies adopted by the incumbent government to boost exports, current account deficit fell by 32 per cent during the current fiscal year, ARY News reported.

The Statistics Division has reported that the current account deficit (CAD) fell to $13.59 bn during the fiscal year-2018-19, decreasing by 32 per cent, from $19.90 bn in the same period last year.

Earlier on June 16, Adviser to Prime Minister on Finance, Revenue and Economic Affairs Dr. Abdul Hafeez Shaikh had said that due to effective measures taken by the government ,current account deficit had shirked to $7 billion during past few months.

Addressing a post budget conference, ‘Pakistan Back on Track’ in Islamabad, Hafeez Shaikh had said that the current government had inherited $20 bn current account deficit and it required 2000 billion rupees for debt servicing.

The advisor had said that the government was striving hard to overcome the fiscal and current account deficit to stabilize economy.

-

Comment by Riaz Haq on March 8, 2020 at 11:58am

-

Bangladesh, Pakistan and Sri Lanka, all of which suffered from widening current account deficits in 2018, witnessed a reduction in their current account deficits – a much needed boost to macroeconomic stability. Vietnam on the other hand continues to post a current account surplus thanks to rising exports.

https://seekingalpha.com/article/4313892-afc-asia-frontier-fund-201...

GDP growth in Asian frontier markets is also expected to be bottoming out for countries like Pakistan and Sri Lanka, while economic growth rates remain robust in Bangladesh, Kazakhstan, Mongolia, Myanmar, Uzbekistan and Vietnam. However, despite stable to improving macro-economic indicators, investor sentiment towards frontier and emerging markets was extremely weak in 2019 due to the factors mentioned above, i.e. trade tensions and their impact on global economic growth rates.Importantly, Asian frontier markets remain under-researched and this trend is continuing given the soft sentiment towards frontier markets. The table below shows the number of sell side analysts covering well-established blue-chip companies within our universe relative to larger emerging markets. In the current environment, many of these companies besides being under-researched are also now being ignored by a large set of investors due to the current sentiment towards frontier markets. The result is that there are a number of bargains available. Furthermore, in line with our policy of being on the ground for research, our team conducted visits in 2019 to Bangladesh, Cambodia, Iraq, Jordan, Kazakhstan, Mongolia, Myanmar, Oman, Pakistan, Sri Lanka, Uzbekistan, and Vietnam. Through this, our team carried out close to 200 one-to-one meetings with company management teams.

Sentiment towards Pakistan remained negative for most of 2019 and the fund rightly had a low weight to the country for most of the year. The Pakistan KSE100 Index had lost −29.5% in USD terms until the end of August 2019. However, this drawdown had factored in most of the negatives such as the currency depreciation, higher interest rates and slower economic growth. With the International Monetary Fund (IMF) deal coming through in the summer, sentiment began to change as it gave investors more confidence on anticipated reforms while the weakened currency and high interest rates brought down imports significantly, helping to lead to a large reduction in the current account deficit. In addition to this, on the fiscal side as well the government was able to reduce its primary deficit and the State Bank of Pakistan kept interest rates unchanged in its policy meetings in September and November 2019 after raising rates aggressively since the beginning of 2018.

With an improving macro environment, the fund began increasing its weight to Pakistan from October 2019 onward as we believe that earnings for most sectors are close to bottoming, if they haven’t already, and the State Bank of Pakistan could begin cutting interest rates from the second quarter of 2020. We therefore believe that cyclical stocks in the auto and cement sectors can do well over the next year as their valuations have corrected significantly over the past two years while their profit margins are also bottoming. The fund has increased its exposure to Pakistani auto and cement companies and this has already helped with performance as the KSE100 Index has rallied by 29% since the end of September 2019 making Pakistan one of the best performing markets globally in the past three months. The fund’s Pakistani holdings have returned 31% in the same time period.

The important point to remember is Pakistan has a population of 200 mln people with very favorable demographics while the stock exchange offers a number of well-established consumption focused names in the auto, consumer staples and pharmaceutical space and more importantly valuations remain very attractive despite the recent run-up in the market.

-

Comment by Riaz Haq on May 14, 2020 at 5:50pm

-

#Interest Payments on #Debt as Percentage of Annual Budget: #India 26%, #Nigeria 41%, #Pakistan 45%, #Egypt 45%, #SriLanka 66%. #PMLNN #PPP #corruption #theft #economy #loans

https://twitter.com/haqsmusings/status/1261095545528958976?s=20

-

Comment by Riaz Haq on September 12, 2020 at 7:27pm

-

Is Pakistan’s Growth Rate

Balance-of-Payments Constrained?

Policies and Implications

for Development and Growth

Jesus Felipe, J. S. L. McCombie, and Kaukab Naqvi

No. 160 | May 2009

https://www.adb.org/sites/default/files/publication/28250/economics...

------------

The basic premise of the BOP-constrained growth model is that in the long run, no

country can grow faster than the rate consistent with balance on the current account,

unless it can finance evergrowing deficits. Indeed, if imports grow faster than exports, the

current account deficit has to be financed by borrowing from abroad, i.e., by the growth

of capital inflows.6 But this cannot continue indefinitely. The seminal paper is Thirlwall

(1979).

-------

This paper examines the extent to which Pakistan’s growth has been, or is

likely to be, limited or constrained by its balance-of-payments (BOP). The

paper begins by briefly considering the BOP-constrained growth model in

the context of demand and supply-oriented approaches to economic growth.

Evidence presented suggests that Pakistan’s maximum growth rate consistent

with equilibrium on the basic balance is approximately 5% per annum. This is

below the long-term target rate of a growth of gross domestic product of 7–8%

per annum. This BOP-constrained growth approach provides some important

policy prescriptions for Pakistan’s development policy. Real exchange rate

depreciations will not lead to an improvement of the current account. Pakistan

must lift constraints that impede higher growth of exports. In particular, it must

shift its export structure to products with a higher income elasticity of demand

and sophistication.

----------

Pakistan’s output growth rate since the 1960s has averaged 5.3% per annum, and

2.5% in terms of productivity growth. While these figures are respectable by world

standards, they are not so impressive compared with those of the East Asian economies

when they were at a similar stage of development in the late 1960s. In the 1950s and

1960s Pakistan started transforming from a poor agricultural economy into a rapidly

industrializing one; yet it never subsequently achieved growth rates similar to those of

the Asian tigers or, more recently, the People’s Republic of China (PRC). The country’s

Poverty Reduction Strategy (April 2007) has targeted a growth rate of gross domestic

product (GDP) of 7–7.5% per annum for the next decade. The question that naturally

arises is whether this is feasible or whether it is a hopelessly overoptimistic target. If

the former, what are the necessary policy measures that should be taken to ensure this

outcome? If the latter, what impedes higher growth?

-------------------

In particular, there are concerns about the changing composition of output and the rise

of substantial deficits on the current and fiscal accounts. In 2001–2003, export growth

made a significant contribution to GDP growth. But in 2004–2007, when the growth rate

was higher, consumption, investment, and government expenditure were the largest

contributors. From the supply side, the service sector was the largest contributor to GDP

growth (Felipe and Lim 2008). Exports plus net factor income from abroad has fallen as

a percentage of GDP while the rapid growth has sucked in imports. This is reminiscent of

the early periods of high growth in the 1980s and 1990s when there were also significant

deficits in the current account. In fiscal year 2007–2008, the current account deficit

rose to 8.4% of GDP. This has led to a serious BOP crisis. As a consequence, rating

agencies Standard and Poor’s and Moody’s downgraded Pakistan. This will have serious

consequences for overseas borrowing.2

-

Comment by Riaz Haq on February 20, 2021 at 10:44am

-

Revenue from oil, gas products rises by 44pc

https://www.dawn.com/news/1534956

The government is estimated to have collected almost 43.7 per cent higher revenue on key oil and gas products during the first half of this fiscal year than the same period last year despite over 10pc drop in domestic production and 20pc fall in imports, it emerged on Sunday.

Data released by the finance ministry puts the total revenue collection from seven important oil and gas products at Rs205bn in six months (July-December 2019) compared to Rs151bn of the same period in 2018, showing about 35pc increase. In addition, energy ministry officials put another Rs160bn collection as General Sales Tax (GST) on oil products in the first half of the current fiscal year compared to Rs103bn of the same period last year, showing an increase of over 55pc.

As the total revenue from only these eight heads amounted to Rs365bn in July-Dec 2019 compared to Rs254bn of July-Dec 2018, indicating an increase of about 43.7pc, the oil and gas sector is emerging as the single largest contributor to the country’s revenue stream.

Three major factors are estimated to have contributed to the surge in petroleum revenues including a substantial increase in various tax rates, removal of legal challenges and higher international prices.

These estimates do not include provincial tax collections through oil and gas and taxes arising out of value addition to oil products, for example the power generation that is almost 70 per cent dependant on furnace oil, liquefied natural gas and natural gas. Also, the revenue on sale of natural gas and LNG to consumers is also not part of these estimates.

According to the data released by the finance ministry, the collection of petroleum levy on various oil products increased by almost 69pc in six months during the current fiscal year than the first half of last year, as the government collected Rs138bn in July-Dec 2019 compared to Rs82bn in July-Dec 2018. Likewise, the natural gas development surcharge also increased by 51pc to Rs4.6bn in six months this year compared to Rs3.037bn last year.

However, the government reduced the gas infrastructure development cess (GIDC) by about 56pc. The GIDC collection thus dropped from Rs11.45bn during the six months of last fiscal year to as low as Rs5.03bn during the first half of this financial year.

The government collected about Rs44bn worth of royalty on oil and gas during six months of current fiscal year, showing an increase of about 5.3pc over Rs41.8bn of same period last year. Similarly, discount retained oil and gas in first half of current year contributed about Rs7.2bn to the national exchequer when compared to Rs6.5bn of same period last year, up 11pc.

This was despite the fact that production of petroleum products in the first half of the current year dropped by 10.33pc to about 6.8bn litres when compared to about 7.6bn litres of the same period last year, according to the Pakistan Bureau of Statistics (PBS). The bureau reported that production of two major projects — petrol and high speed diesel — dropped by about 9pc and 10pc respectively — a sign of slower economic activities in the country.

Also, the PBS reported about 20pc reduction in oil imports during the first half of the fiscal year in dollar terms and about 2.75pc fall in value of Pakistani rupee. The total oil import bill has dropped from $7.66bn in July-Dec 2018 to $6.14bn in July-Dec 2019.

The import value of petroleum products dropped from $3.4bn to $2.59bn during the period under review, showing a 24pc drop. The value of crude imports also fell by 27pc to $1.77bn in the first half of the current fiscal year when compared to $2.43bn of the same period of last financial year.

The imports of petroleum products and crude oil in terms of quantities also reduced by 13pc and 14pc, respectively, during the first six months of this fiscal year.

-

Comment by Riaz Haq on February 20, 2021 at 10:48am

-

THE (PTI) government’s plan to settle the outstanding dues of IPPs amounting to Rs450bn in three tranches is only the first step towards liquidation of the power sector’s circular debt. According to reports, the IPPs will get 30pc of their existing debt stock this month and the remaining amount in two equal tranches in June and December. Under the plan, one-third of the arrears will be paid to the power producers in cash and the remainder in the form of Pakistan Investment Bonds at the floating rate. The IMF also gave its nod to the plan after the government agreed to heftily increase the base electricity tariff as demanded by the lender of the last resort. The payment of the first tranche will immediately lead to materialisation of the MoUs signed between the government and power producers in August last year into formal agreements. The MoUs provide for changes in the terms of the existing power purchase agreements that will reduce the size of the guaranteed capacity payments or fixed costs paid to the IPPs, a major source of accumulation of the circular debt. The government is expecting savings of Rs850bn over a period of 10 years, following the modifications in PPAs. The IPPs, which had demanded full payment of their money before they agreed to implement their revised PPAs, seem to have moved away from their earlier position in the ‘larger interest of the country’ as the plan will also help them improve their tight liquidity position and make new investments in new schemes.

https://www.dawn.com/news/1599538

The settlement scheme covers the 50-odd IPPs which were set up in the 1990s and 2000s and had consented to the alterations proposed in their power purchase deals with the government. The majority of these plants have completed their life cycles or paid off their debts. Therefore, we should not expect an immediate resolution of the circular debt problem even after materialisation of the revised deals with the IPPs. In recent years, the major build-up in the circular debt has been caused by capacity payments to large power projects set up since 2015, primarily as part of the multibillion-dollar CPEC initiative, with Chinese money. So far, no progress has been made to get the terms of the PPAs with these companies renegotiated although we are told that contacts have been made with Beijing at the highest level. Until these contacts pay off, the resolution of the mounting power-sector debt will have to wait.

-

Comment by Riaz Haq on March 30, 2022 at 9:22pm

-

#China Agrees to rollover a whopping $4.2 billion in #Pakistan #debt. The request for rollover was reportedly made by Prime Minister #ImranKhanPTI during his meeting with #Chinese President #XiJinping last month at #WinterOlympics. #CPEC #economy #PTI https://www.business-standard.com/article/international/china-agree...

China on Wednesday acceded to Pakistan's request to rollover a whopping $4.2 billion debt repayment to provide a major relief for its all-weather ally, which is reeling under major economic crisis.

Chinese Foreign Minister Wang Yi in his meeting with Pakistan counterpart Shah Mehmood Qureshi on the sidelines of the 3rd meeting of the 'Foreign Ministers of Neighbouring Countries of Afghanistan' in China's eastern Anhui province has conveyed Beijing's decision to rollover the debt.

In a video message, Qureshi said Wang has conveyed China's decision to rollover Pakistan $4.2 billion to enable Islamabad to tide over the current economic crisis.

"I am immensely happy to share that the Chinese FM has given a nod of approval on the rollover of commercial loan as well," Qureshi was quoted as saying by Pakistan daily Dawn.

The USD 4.2 billion debt, which was maturing this week, has been rolled over providing major financial relief to Pakistan, the daily reported.

"The procedural formalities are being completed by relevant authorities. An announcement will be made as soon as they're sorted," Qureshi said.

The request for rollover was reportedly made by Pakistan Prime Minister Imran Khan during his meeting with Chinese President Xi Jinping here last month to attend the opening ceremony of the Beijing Winter Olympics.

Pakistan continues to undergo a huge economic crisis despite heavy investment by China in the $60 billion China Pakistan Economic Corridor (CPEC). In addition to Pakistan, Sri Lanka, a major recipient of Chinese loans and investments, too has asked China to reschedule its debt as it is going into a crippling financial crisis.

China is considering a fresh request from Sri Lanka for a loan of USD one billion and a credit line of USD 1.5 billion, Chinese Ambassador to Sri Lanka Qi Zhenhong told the media in Colombo last week. He, however, was silent about Sri Lankan President Gotabaya Rajapaksa's request for rescheduling of debt repayments.

-

Comment by Riaz Haq on October 3, 2022 at 9:06pm

-

MoWaq

@mowaqsh

@MiftahIsmail

at

@MAP_Pakistan

:"Our growth model is based on import substitution. Richest ppl get loans to kickstart manufacturing at subsidized rates. This fuels import driven consumption from cars to machinery. It's not a competitive model. We fall in elite capture. 1/n

https://twitter.com/mowaqsh/status/1576905324657004544?s=20&t=d...

---------------------

MoWaq

@mowaqsh

"When we slowdown the economy, the middle class & poor segments get hit the most. The protection amount is almost equal to value addition. No reason to become efficient.We need to think abt exports, education & building the #Pakistan brand."

-------------------

MoWaq

@mowaqsh

"We need to introspect what is wrong with us as an individual. Do the religious minorities feel safe in Pakistan or are ready to move to Canada on the first opportunity.We need to do 4 things1) Focus on exports

2) Improve agri sector. We import $2b cotton,$1b pulses. Our agri..

------------------

MoWaq

@mowaqsh

productivity is lower than the world in everything yet we call ourselves agri country.3) We need to live within our means.

4) Educate our children. Most important job is parenting. 2 schools Aitchison & KGS account for all Ministers etc. There's no social mobility in Pak.-----------------

MoWaq

@mowaqsh

"1/3 of #Pakistan is under water. Many have lost everything they had. Yet the nation moves on. We are resilient. But I don't want us to just be resilient. I want Pakistan to be richer, not be hungry & more educated."https://twitter.com/mowaqsh/status/1576905346236678145?s=20&t=d...

-

Comment by Riaz Haq on March 8, 2025 at 4:04pm

-

Pakistan nearing $4.4 billion loan to ease power sector debt

https://www.arabnews.com/node/2592811/pakistan

Pakistan’s government is negotiating 1.25 trillion Pakistani rupee loan with commercial banks

Plugging unresolved power sector debt is top priority under ongoing IMF bailout program

KARACHI: Pakistan’s government is negotiating a 1.25 trillion Pakistani rupee ($4.47 billion) loan with commercial banks to reduce its bulging energy sector debt, the power minister and banking association said.

Plugging unresolved debt across the sector is a top priority under an ongoing $7 billion International Monetary Fund (IMF) bailout, which has helped Pakistan dig its way out of an economic crisis.

“The loan will be repaid over a period of 5 to 7 years,” Power Minister, Awais Leghari told Reuters, adding that the term sheets are yet to be signed.

Pakistan’s government, the largest shareholder or owner of most power companies, faces a challenge in resolving debt due to fiscal constraints. To address this, Islamabad has raised energy prices, as recommended by the IMF, but still needs to settle the accumulated debt.

“We’ve approached many banks, let’s see how many participate. It’s a commercial transaction and they have the choice of participating, however, we think there is liquidity in the system for it and banks have the appetite,” Leghari said.

The government plans to reduce “circular debt” — public liabilities that build up in the power sector due to subsidies and unpaid bills — this year by eliminating government-guaranteed debt and moving to a revenue-based system.

This approach is expected to lower financing costs, enabling the government to pay off interest and service debt obligations, he added.

“Such repricing of liabilities induces more efficiency, and reduces cost for consumers,” said Ammar Habib Khan, adviser to the power minister.

Zafar Masud, Chairman of the Pakistan Banks Association, told Reuters that the interest rate would be a floating exchange rate and the country’s top banks would participate, in addition to those who are already part of the outstanding loan.

“This will help in clearing up all the debt in the next 4 to 6 years which has been sitting on banks’ balance sheets,” he said.

Masud added that more than half of the 1.25 trillion debt is already on the banks’ books and is undergoing restructuring through self-liquidating facilities, which currently lack identifiable cash flows to support them.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Earth Day: Pakistan's Progress Toward Low-Carbon Economy

Pakistan celebrates Earth Day on April 22 every year by organizing various events sponsored by the government and non-government organizations to raise awareness of the issues faced by the earth. Today it is being observed with a range of initiatives, including pledges for zero waste, commitments to sustainable practices, and community-based actions to protect the planet. Pakistan contributes less than 1% of global carbon emissions, but it is among the countries considered most vulnerable to…

ContinuePosted by Riaz Haq on April 22, 2025 at 5:00pm

International Schools: Pakistan Ranks Among Top 5 Countries in the World

Pakistan ranks among the top 5 nations in terms of international schools offering schooling based on International Baccalaureate (IB) and IGCSE (Cambridge) curricula. China leads with 1,000 international schools, followed by India (900), UAE (784), Pakistan (598) and Brazil (415). The medium of instruction in these schools is English. …

Posted by Riaz Haq on April 19, 2025 at 8:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network