PakAlumni Worldwide: The Global Social Network

The Global Social Network

Current Debt Crisis Threatens Pakistan's Future

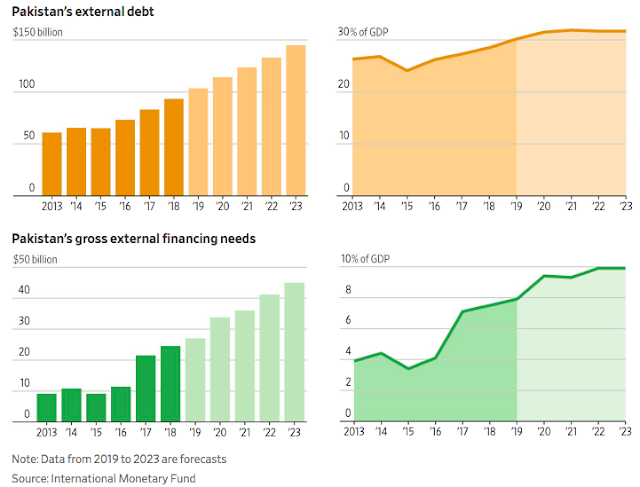

Pakistan is battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, unsustainable external debt payments, and soaring sovereign debt. This crisis has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

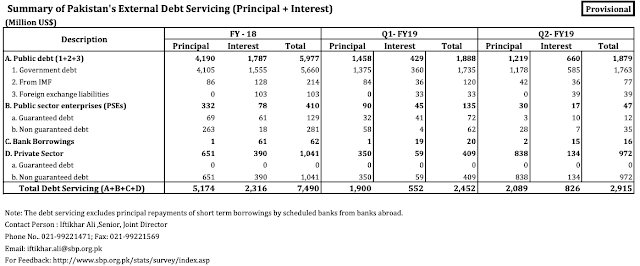

Pakistan's debt repayment costs rose to $5.4 billion for first half of fiscal 2019 ( July 2018-Dec 2018), up from $7.5 billion for the entire fiscal 2018 (July 2017-June 2018), according to the State Bank of Pakistan. At this rate, the total debt service cost for current fiscal 2019 will exceed $11 billion, adding to the nation's debt crisis.

This $11 billion debt service cost will add to the projected trade deficit of nearly $40 billion for the current fiscal year. How can Pakistan fund this balance of payments deficit of about $50 billion? Remittances of $21 billion in current FY2019 from Pakistani diaspora are expected to reduce it to $30 billion. PTI government has taken on billions of dollars in loans from Gulf Arabs and China. Given the low rates of foreign investments in the country, a big chunk of the remaining deficit will have to be met by borrowing even more funds which will further increase future debt service costs.

Pakistan's Current Account Deficit. Source: Trading Economics |

As a result, Pakistan is now battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, onerous external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

Pakistan Debt as Percentage of GDP. Source: Trading Economics |

In the short term, PTI government's efforts are beginning to pay off. The current account deficit (CAD) in first 8 months of FY2019 (July-Feb 2018) declined to $8.844 billion, down 22.5%, from $11.421 billion in same period last year, according to SBP as reported by Dawn newspaper.

Pakistan's Debt Burden Highest Among 25 Emerging Nations |

However, Pakistan's economic woes are far from over. The country's twin deficits are structural. Its exports and tax collections as percentage of its GDP are among the lowest in the world. British civil society organization Jubilee Debt Campaign conducted research in 2017 that showed that Pakistan has received IMF loans in 30 of the last 42 years, making this one of the most sustained periods of lending to any country.

History of Pakistan's IMF Bailouts |

Pakistan needs to find a way to build up and manage significant dollar reserves to avoid recurring IMF bailouts. The best way to do it is to focus on increasing the country's exports that have remained essentially flat in absolute dollars and declined as percentage of GDP over the last 5 years. Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be concerted effort involving various government ministries and departments working closely with industry groups. At the same time, the new government needs to crack down on illicit outflow of dollars from the country.

|

| Pakistan Debt Service as Percentage (45%) of Budget Among World's Highest |

Azad Labon Ke Sath host Faraz Darvesh discusses Imran Khan's challenges with Misbah Azam and Riaz Haq (www.riazhaq.com)

Related Links:

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last...

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

-

Comment by Riaz Haq on April 16, 2019 at 4:51pm

-

#Pakistan #textile industry now operating at full capacity & adding capacity to grow #exports. A big textile group is eyeing its sales to grow by around 20% in the next two years, but is expecting all the increase in sales to come from #exports. #economy https://www.brecorder.com/2019/04/16/489570/betting-long-on-textile...

The ministry of finance sources are expecting textile exports to grow to $7-7.5 billion in the April-June quarter – average monthly exports of $2.3-2.5 billion versus $2.0 billion in Jul18-Feb19, and $2.2 billion in Apr18-Jun18. Although industry players are not too bullish on immediate off-take, they certainly are seeing significantly high numbers in 2-3 years. For details read “Textile ready to take off“, published on 14th December 2018.

One big textile group is eyeing its sales to grow by around 20 percent in the next two years, but is expecting all the increase in sales to come from exporting. On the flip, the higher concentration of sales growth in the past five years was in domestic sales. That is the story of a big player, which is reaching a size where big expansions are hard to come by without resolving the issues of basic raw material – cotton.

However, there are many other companies that have the potential to grow at a much higher pace because of their relatively smaller size. The positive sentiments are across the board where many players are aggressively expanding. The potential is in value addition. There are multiple reasons for exuberance – currency devaluation, subsidy to textile, and availability of energy at regional competitive rates are known to all.

One big booster is improvement in perception. The overall image of the country is improving and the opening up of visa regimes is helping as well. The buyers are visiting and new orders are being placed, and there is soft commitment of new businesses, given that the expansions are carried out.

The textile exports, in volume terms, stopped growing, in the last decade. The problem of currency overvaluation is more of a recent phenomenon – started in 2014. Prior to that, energy and security started hitting the exports bad. Enough has been said on the energy, and its availability is paying dividends.

The perception improvement needs to be highlighted. The textile and other exporters swayed away from exporting to domestic sector, before the currency was capped by Dar. Buyers were not coming and it was hard to get new business. There were fears of getting shipment delayed from Pakistan and that had helped Bangladesh to grow.

Now the situation is changing. If the travel advisory from the US is relaxed, it would be a game changer for Pakistan exports – be it in goods or services. With recent tariff war between US and China, and protests against low wages in Bangladesh, buyers are thinking to diversify from these two markets. Pakistan has the opportunity to grab its lost share.

However, building requisite backward linkages are required. Three big textile players resonated that without enhancing cotton production, it is hard for textile industry to reach its true potential. One of the reasons for competitiveness erosion is fall in cotton production, which has reduced from its peak of 14-15 million bales per annum to around 10 million bales.

The long term strategy should be to take annual cotton production to 20 million bales in 5 years or so. The need is to work on our agriculture strength. The cotton seed market is orphan today with too many kids on the street – every district has multiple unregulated seed companies. The stewardship is missing. Industry players are of the opinion that the seed industry needs to be regulated and serious consolidation is required to improve the yield. The other factor is to do away with price support to other crops – such as sugarcane, which has resulted in substitution to sugarcane from cotton

-

Comment by Riaz Haq on April 16, 2019 at 5:06pm

-

Textile ready to take off

BR ResearchDecember 14, 2018

The currency has depreciated over 30 percent in last 12 months but textile exports grew by a mere 6 percent during Nov17-Oct18 over the same period last year. This implies that currency adjustment alone is not sufficient to boost exports.

https://www.brecorder.com/2018/12/14/459105/textile-ready-to-take-off/

Pakistan textile exports grew by 85 percent from $5.8 billion to $10.8 billion during FY02-07 at a time when currency and cotton prices were sticky. Since then, there has been no significant growth in textile exports during the last decade, despite the fact that the value of dollar has more than doubled against the rupee during the same period. FY11 was the only exception when textile exports jumped by 34 percent due to over 100 percent increase in cotton prices during that year.

Turning around stunted growth in textile exports requires more than just currency depreciation Yes, there are advantages of recent currency adjustments; but given the capacity constraints of value added sectors, growth may remain restricted to 5-10 percent this year.

In order to go beyond, textile industry needs to significantly increase its capacity as it happened during 2002-06. No significant sector wide expansion has been recorded in the industry during the last decade which could have led to a exportable surplus. It appears that stars have aligned for significant expansion in textile over coming periods: government has set the price for gas at 6.5 cents per unit and electricity at 7.5 cents per unit, is providing long term financing at attractive rates, and is seemingly committed to flexible exchange rate. These factors are making players to seriously consider massive expansions. It takes a year or two for the industry to expand and for that process to kick start more clarity is needed in implementation, and a few more incentives are warranted.

For example, the government has to do away with 0.25 percent tax for export development fund which is wasted in TDAP and other such nuisances, and refunds of exporters need to be cleared sooner or later. Anyhow, the direction is right.

Another major impediment is the falling cotton production in the country. Back in FY05, cotton production peaked at 14.3 million bales which was aligned with industry expansion. Cotton production has been downhill since; averaging at 12.7 million bales per year during FY06-15, before further spiraling downward to average annual production of 10.8 million bales by FY16-18.

One reason for recent dip is the shift of cotton production area to sugarcane which is due to undue incentives for sugarcane production in the form of support price mechanism. Per hectare yield has also deteriorated substantially over the same period. For context, yield in Indian Punjab is around 50 percent higher than Pakistani Punjab, even though domestic yield was not far behind as recent as in FY12.

The major problem is in cotton seed research which is poor in Pakistan. Three big textile players (Nishat, Sapphire and Fatima) have formed a cotton seed company (Safina) to resolve the problem. Such interventions can resolve the problem of germination and purification of seeds; but without stewardship of a global player such as Bayer (ex Monsanto), resistance against pesticides and other harming elements cannot be developed. India, Brazil, US and many other economies have done it; it is time for Pakistan to move towards GMOs in cotton production.

-

Comment by Riaz Haq on April 16, 2019 at 9:39pm

-

#Pakistan All Set To Cross USD 15 billion Mark In #Textile #Exports. “The textile industry exports is likely to cross $15 billion mark in case it continues to grow by 10 percent on an average for the remaining period of current fiscal.

https://www.textileexcellence.com/news/pakistan-all-set-to-cross-us...

Gohar Ejaz, patron in chief of APTMA (All Pakistan Textile Manufacturers Association) stressed that the availability of energy at regionally competitive price has boosted textile exports by 8.5% in the month of January 2019 on a y-o-y comparison in the corresponding period.“The textile industry exports is likely to cross $15 billion mark in case it continues to grow by 10 percent on an average for the remaining period of current fiscal. It would likely be a record achievement of textile exports in such a short span of time. The exports of USD 3.5 billion yarn and fabric annually may boost textile exports to USD 14 billion in case closed capacity worth USD 3 billion exports is revived through the enablers ensured by the government,” pointed out Ejaz.

-

Comment by Riaz Haq on April 16, 2019 at 9:45pm

-

THE EXPRESS TRIBUNE > BUSINESS

Interloop to raise Rs4.9b at PSX this week

https://tribune.com.pk/story/1927532/2-interloop-raise-rs4-9b-psx-w...

Interloop Limited – the world’s largest socks exporter based in Faisalabad with Puma, Nike and H&M among its big clients – is set to raise record financing in the private sector at the Pakistan Stock Exchange (PSX) this week.

It is estimated to raise a minimum of Rs4.9 billion through the sale of 109 million shares at the bidding price starting from Rs45 per share, which may go to Rs63 during the two-day book-building process on Wednesday and Thursday.

Corporations and high net-worth individuals will participate in the bidding to find a strike price, at which the shares will be sold to them and later to the general public at the same price. The company will be listed at the PSX in the second week of April.

“The financing to be raised through book building and IPO (initial public offering) will be invested in expansion of hosiery production and setting up a new plant for (stitched) denim jeans,” Shahid Ali Habib, CEO of Arif Habib Limited, the IPO consultant, told The Express Tribune.

Senior associate investment banker at the consultant firm Dabeer Hasan added that Interloop Limited produced 50-55 million dozen of socks a year at its existing four hosiery plants – three in Faisalabad and one in Lahore.

Besides, it is also running an associate hosiery firm in Bangladesh. The world’s largest socks exporter, having 3.5-4% market share in global socks supplies, is aimed at setting up another hosiery plant in Faisalabad and a stitched denim jeans plant in Lahore, he said.

Interloop emerged as the top global supplier of hosiery after a former top Chinese exporter diverted sales to the domestic market recently, he added.

“The expansion is estimated to cost a total of Rs11.2 billion. This includes (a minimum) Rs4.9 billion through the sale of shares at the PSX,” Hasan revealed.

Besides, it has already raised a debt of Rs2.8 billion from Habib Bank Limited (HBL) for the expansion. “The expansion projects are expected to come on line in the next two years. So as and when the firm will feel the need for required gap funds, it may utilise internal resources or may take loans from banks,” he said.

The company is expanding production, keeping in view growing demand from around the world in hosiery segment, while it is sharing its stitched denim designs with its clients including Levi’s and H&M these days, said the senior associate.

“Interloop is not only in talks with its existing customers, but is also approaching new customers for its denim range. Given the global growth forecast in both hosiery and denim segments and the overall growth forecast in the garment industry, Interloop is positioned to add to its long-term growth in revenue and market share,” the company stated in its prospectus.

Habib said the company posted a profit of Rs2.2 billion in the first half (July-December) of current fiscal year 2018-19. It had recorded a profit of Rs3.8 billion in FY18.

“The company is offering shares for sale at a price (Rs45 per share), which is equivalent to 7.9 times of earnings per share (EPS) for FY19 and 6.5 times of FY20,” he said, adding it was going to be the first listing at the PSX in 2019.

Out of the total 109 million shares allocated for sale during the IPO, the company would sell 75% (or 81.75 million shares) to institutional investors and high net-worth individuals and 25% (27.25 million shares) to retail investors.

-

Comment by Riaz Haq on April 19, 2019 at 7:42am

-

#Pakistan #trade deficit at $23.67 billion, down 13% in 9 months of current FY19. #Exports up 0.11% to $17.08 billion. #Imports down by 7.96% to $40.75 billion. #Textile exports flat at $10 billion. #Petroleum imports #10.6 billion, up 3.81%. https://nation.com.pk/19-Apr-2019/textile-exports-unchanged-at-9-99b

Pakistan’s textile exports were recorded at $9.99 billion during nine months (July to March) of the ongoing fiscal year. The country’s textile exports had remained at the same level of previous year, showing no growth. The incumbent government had provided several incentives to the five exports oriented sectors including textile to enhance the country’s exports. The government had depreciated the currency and reduced the prices of electricity and gas but it failed to achieve the desired results.

The data released by PBS showed that country’s overall exports had increased by only 0.11 percent to $17.08 billion during July to March period of the year 2018-19. The major chunk of the overall exports is from the textile sector, which remained at $9.99 billion. Exports from all other sectors are only $7.09 billion during nine months of the ongoing fiscal year.

In textile sector, according to PBS, exports of knitwear had enhanced by 9.29 percent during July to March period of the year 2018-19 over a year ago. Similarly, exports of bed wear had also recorded an increase of 2.69 percent and exports of made-up articles had gone up by 1.26 percent. Meanwhile, exports of ready-made garments had also surged by 2.02 percent in first nine months of the current financial year. The PBS data showed that exports of cotton cloth had recorded a decline of 2.09 percent. Similarly, exports of raw cotton had tumbled by 71.84 percent. Exports of cotton yarn witnessed decrease of 15.44 percent. Meanwhile, exports of towels had declined by 1.85 percent.

Meanwhile, the exports of food commodities had recorded decrease of 2.4 percent during first nine months of the current fiscal year. In food commodities, exports of fruits recorded growth of 8.66 percent, vegetables exports declined by 2.48 percent and oil seeds, nuts and kernels exports had gone up by 117 percent. Similarly, the exports of petroleum group and coal had enhanced by 21.52 percent during July to March period of the ongoing fiscal year.

Imports

The country’s imports had gone down by 7.96 percent to $40.75 billion during the nine-month period (July-March 2018/19) over the same period of the last financial year.

The country spent $10.6 billion on the imports of petroleum group, 3.81 percent higher than a year ago. In the petroleum sector, the government imported petroleum products worth $4.62 billion and spent $3.38 million on petroleum crude. Similarly, the country imported liquefied natural gas (LNG) worth $2.4 million and liquefied petroleum gas (LPG) worth $207 million.

The PBS data showed that country had spent $6.74 billion on importing machinery during July and March period of the ongoing fiscal year. The third biggest component was food commodities whose imports rose to $4.26 billion during first nine months of the ongoing financial year.

Trade deficit

The country’s trade deficit was recorded at $23.67 billion during nine months of the current financial year as against the deficit of $27.21 billion during corresponding period of the previous year. This depicts 13.02 percent or ($3.54 billion) reduction in the deficit.

-

Comment by Riaz Haq on April 20, 2019 at 10:09pm

-

#FDI in #Pakistan's #export industries #textile, #chemicals, #pharmaceuticals, and electrical #machinery up 50-800% but total FDI down 51% in first nine months of current fiscal 2018-19 due to outflow of #Chinese #investments from the local power sector https://www.dawn.com/news/1477425

Pakistan’s ll major industrial sectors attracted considerably high foreign direct investments (FDI) during the current financial year indicating an attraction for industrial growth in near future.

The country’s key industries such as textile, chemicals, pharmaceuticals, and electrical machinery saw their inflows jumping by 50-800 per cent.

However, the overall FDI plunged by 51pc during the first nine months of 2018-19 mainly due to outflow of Chinese investments from the local power sector, which in turn eroded the positive impact on inflows in the major industries. Outflow of Chinese investment during the period was $294 million, as compared to net inflow of $929m in same months of last fiscal year.

The highest inflows were recorded in electrical machinery, which attracted $126.6m during 9MFY19 as against $13.8m in corresponding period last year, reflecting an increase of 813pc.

Transport sector came in second as inflows into the sector jumped by 663pc to $84.3m, led by FDI worth $89.6m in cars whereas buses, trucks, vans and trails posted a $5.3m outflow.

Similarly, inflows in chemicals soared by 322pc to $113.9m during 9MFY19 versus $27.6m in same period of 207-18 while those in pharmaceutical rose 274pc to $55m from $14.7m.

The FDI in textile sector clocked in at $54m during the nine-month period, up 50pc over $36.6m in corresponding months of FY18. The sector earns over 60pc of all export proceeds for the country.

For the last couple of years, only two sectors – power and construction – have found themselves on the radar of investors while the rest have seen limited activity in terms of inflows. If latest data is to serve as an indicator for reversal, it could help boost sentiments in the local industry.

Power sector saw a steep decline in FDI as it recorded a net outflow of $293m in 9MFY19 as against $929m in corresponding period last year. Construction also seems to be ceding its gains with inflows shrinking steeply as investment in the sector slowed down to $385.4m, from $527m.

Communications saw a net outflow of $141m, led by telecommunications which recorded outflows worth $157

-

Comment by Riaz Haq on April 25, 2019 at 7:21am

-

#Pakistan #energy #imports up 3.8% in nine months (July 2018-March 2019) of current fiscal year , led by liquefied natural gas (#LNG) , higher by 49.3% and crude oil up 15.19%. Cost of #petroleum product dipped 15.33% during the nine-month period. https://www.hellenicshippingnews.com/pakistan-oil-import-up-3-8pc-i...

The country’s oil import bill went up 3.8 per cent year-on-year to $10.6 billion during 9MFY19, from $10.22bn in same period last year, according to data from the Pakistan Bureau of Statistics (PBS).

The rise in imported value of the petroleum group was led by surge in liquefied natural gas, higher by 49.3pc and crude oil 15.19pc. On the other hand, cost of petroleum product dipped 15.33pc during the nine-month period, whereas a 33.9pc decline was recorded in terms of the quantity imported, bringing the total down to 7.57 million tonnes.

The overall import bill during July-March FY19 fell by 7.96pc year-on-year to $40.75bn, leading to a 13pc decline in trade deficit to reach $23.67bn.

Barring petroleum and agriculture groups, all other categories saw their value of imports shrink during the period under review.

Food imports contracted 9.92pc to $4.73bn during July-March 2018-19, from $4.26bn in corresponding months last year. This decline was largely due to a 10.22pc fall in the value of palm oil, which decreased to $1.39bn in 9MFY19, from $1.54bn.

Import bill of the machinery clocked in at $6.74bn during the nine months, lower by 20.54pc, from $8.48bn in same period last year. The biggest contributor to the decrease was power generating machinery, which plunged by 49.09pc, followed by 17.26pc contraction is electrical and 8.86pc in telecom.

Similarly, transport group — another major contributor to the trade deficit – also receded during July-March FY19 as it posted a 35.7pc decline, with decrease in imported value of almost all sub-categories.

On the other hand, agriculture imports inched up by 1.6pc to $6.58bn, from $6.47bn on the back of 16.49pc increase in fertiliser, 13.32pc insecticides and 7.31pc medicinal products.

Textile exports inch up

The textile and clothing export proceeds posted a paltry growth of 0.08pc year-on-year to $9.991bn during 9MFY19, as against $9.983bn in same period last year.

Product-wise details show that exports of ready-made garments went up by 2.02pc, knitwear 9.29pc, bedwear 2.69pc while those of towels declined 1.85pc and cotton cloth 2.09pc.

Among primary commodities, cotton yarn exports dipped by 15.44pc, yarn other than cotton by 3.23pc, raw cotton 71.84pc whereas made-up articles — excluding towels — increased by 1.26pc and tents, canvas and tarpaulin gained 3.49pc in value during the period under review.

The slow growth in textile and clothing exports comes despite government’s support in the form of cash subsidies, special export packages and multiple rupee depreciations during the last year.

Source: Dawn

-

Comment by Riaz Haq on May 13, 2019 at 7:40am

-

Pakistan agrees to 13th bailout in 30 years from the IMF

https://www.cnn.com/2019/05/13/asia/pakistan-khan-imf-intl/index.html

"Pakistan is facing a challenging economic environment, with lackluster growth, elevated inflation, high indebtedness, and a weak external position," IMF representative Ernesto Ramirez Rigo said in statement.

"This reflects the legacy of uneven and procyclical economic policies in recent years aiming to boost growth, but at the expense of rising vulnerabilities and lingering structural and institutional weaknesses. The authorities recognize the need to address these challenges, as well as to tackle the large informality in the economy, the low spending in human capital, and poverty."

Khan met with IMF director Christine Lagarde in February, as he sought to secure funding from the agency despite being a longterm critic of its previous dealings in Pakistan.

The IMF has been criticized in the past for imposing strict austerity on receiver nations, forcing governments to cut social programs and privatize national industries.

Khan has spoken of the need for a major anti-poverty program to boost Pakistan's economy and help its worst off citizens, but this will involve considerable spending that is typically antithetical to the conservative IMF.

These types of restrictions are one of the reasons Khan has been publicly attempting to avoid returning to the IMF to seek more funding. In October, Saudi Arabia agreed to advance Islamabad $6 billion in financial support. But that has not been enough to plug the gaps in Pakistan's economy -- issues Khan inherited and has been struggling to get under control.

The Pakistani Prime Minister has also turned to China for help. Beijing has invested heavily in the country under President Xi Jinping's Belt and Road Initiative.

"I can tell you one thing, the Chinese have been a breath of fresh air for us ... They have been extremely helpful to us," Khan said earlier this year.

China's increasing presence in Pakistan has not been without incident, however. On Sunday, militants attacked a five-star luxury hotel in Gwadar, in Balochistan province. The city is at the center of China's multi-billion-dollar Belt and Road infrastructure project.

Five people were killed in the attack, for which a Pakistani separatist group claimed responsibility, warning of more attacks in China and Pakistan in a post on an unverified Twitter account. CNN could not independently confirm whether the account, which claims to belong to the Baolchistan Liberation Army, is authentic.

-

Comment by Riaz Haq on June 6, 2019 at 10:25am

-

#Kuwait plans big investment across #Pakistan with initial #investment fund of $20 billion. Kuwait investing in Pakistan since 1960 in companies like Meezan Bank, Careem and Pak-Kuwait Investment Company. Now planning 500 MW power plant in #Balochistan

https://tribune.com.pk/story/1975356/2-kuwait-plans-big-investment-...

“The mode of investment will depend on the viability of projects,” he said, adding that the projects might require guarantees and a recovery mechanism.

He (KIA representative Dr Ahmad Idrees) recalled that Kuwait had been investing in Pakistan since 1960 and had entered into collaboration with many companies including Meezan Bank, Careem and Pak-Kuwait Investment Company.

“Now, it is the second phase of major investment,” he said.

Idrees pointed out that KIA had also signed a memorandum of understanding with the Balochistan government for setting up a 500-megawatt power plant.

For streamlining projects and strengthening the investment programme, a three-member coordination committee, headed by Special Assistant to Chief Minister Ashfaq Memon, was also constituted. It was tasked with finalising the projects after due consultations with the stakeholders.

KIA’s representative revealed that his country focused mainly on food security and desired to extend financial and technical assistance to projects related to food security. “Hence, agricultural and livestock projects including food preservation can be included.”

Idrees said his company was also ready to construct a large number of houses in Sindh with payments in easy installments – for instance Rs20,000 a month. “This formula has proved very successful throughout the world,” he said.

Speaking during the meeting, the Sindh minister for works, services and irrigation highlighted that the provincial government mainly focused on food security in the province.

He told the KIA representative that Pakistan Peoples Party Chairman Bilawal Bhutto-Zardari also held a meeting of provincial departments to discuss problems related to food security and issued directives for taking every possible step to overcome the challenge.

Sindh Forest and Livestock Secretary Abdul Rahim Soomro, who was also present in the meeting, said the Sindh government was interested in steering bio-diversity and improving the ecosystem.

“Keeping food security in view, there is a need for developing wetlands,” he said in response to KIA’s willingness to release funds for food security.

Sindh Minister for Local Government Saeed Ghani pointed out that although the provincial government had forged partnerships with the World Bank and Asian Development Bank, “we need additional partners for swift development including that of slum areas.”

He said Sindh was completely prepared to receive investment from Kuwait and other countries.

In response to the KIA’s offer to construct houses in Sindh, some mega development projects were identified by the Works and Services Department, which included the construction of a bridge parallel to the Guddu Barrage to ease the traffic load on it.

-

Comment by Riaz Haq on June 6, 2019 at 10:25am

-

#Pakistan’s #exports increase by 7% as #production rose. Razzak Dawood said exports of #garments went up by 29%, #cement 25%, basmati #rice 21% and #footwear 26% in the current fiscal year. #Imports declined $4 billion. https://www.gulftoday.ae/business/2019/06/05/pakistan-exports-incre...

Talking to Chairman Faisalabad Industrial Estate Development and Management Company, Mian Kashif Ashfaq in Lahore, Razak Dawood said the trade gap is narrowing down as exports are showing steadying trajectory while imports have reduced by four billion dollars.

Chief Operating Officer FIEDMC Aamir Saleemi was also present on this occasion.

Terming the project of Allama Iqbal Industrial City imperative for industrial development in the country, the Adviser said projects like Faisalabad Industrial Estate Development & Management Company (FIEDMC), would help the industry generating economic activities by attracting foreign and local investors besides enhancing volume to exports to meet the challenges of trade deficit.

Razak Dawood said Pakistan’s exports went up by 7 per cent as production line had gone up despite difficult environment.

“The trade gap was narrowing down as exports were showing steadying trajectory while imports got reduced by $4 billion and overall current account deficit also improved,” he added.

He said that the situation on economic front was not as bad as being portrayed by some quarters and they were ready as well to correct things. However, he also conceded that the economic situation must have improved at much accelerated pace.

He said that the exports of garments went up by 29 per cent, cement 25 per cent, basmati rice 21 per cent and footwear 26 per cent in the current fiscal year.

Abdul Razak Dawood said that the government provided subsidy to export-oriented sector on electricity and gas and it would be continued in coming year.

FIEDMC Chief Mian Kashif Ashfaq unfolding the distinctive features of Allama Iqbal Industrial City to Advisor said this sole project would house as many as 400 industries besides giving employments to 2,500, 00 people. He said approximately Rs400 billion foreign and local investments would be pumped into this project and development project is being carried out on fast track.

He further said FIDEMC always provided state of the art facilities to its customers besides resolving their issues through one window operation on top priority basis. He said the confidence of the investors on is being restored after completion of M3 project.

Mian Kashif said that Prime Minister Imran Khan has changed the image of the country within a short span of time since he formed the government in August last year. “Pakistan which suffered huge economic losses during the last 20-years due to militancy and war against terror, has now come out as a progressive new country under Imran’s leadership,” he added.

He appreciated Abdul Razak Dawood for taking serious steps for the revival of national economy. He said Pakistan’s economic indicators are now improving and soon the government would announce relief packages for the poor strata of the society.

He also said FIEDMC was committed to improve Pakistan’s ease of doing business ranking to under 100 within two years to attract international investors to the country.

Meanwhile a well renowned personality of Maritime Sector Chairman Pakistan Ship’s Agents Association (PSAA), Vice President Pakistan Stevedores Conference Ltd (PSCL), and Former Vice President Federation of Pakistan Chambers of Commerce & amp; Industry (FPCCI) Tariq Haleem says that the Pakistani nation, industrialists and the business community should not be disheartened.

---

Certain amendments in relevant SRO’s are required to make Gwadar Port and Gwadar Free Zone operational. Huge investment is pending due to delays in the amendments. Afghan Transit Trade issues need to be addressed to bring back our lost revenue generating cargoes.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Earth Day: Pakistan's Progress Toward Low-Carbon Economy

Pakistan celebrates Earth Day on April 22 every year by organizing various events sponsored by the government and non-government organizations to raise awareness of the issues faced by the earth. Today it is being observed with a range of initiatives, including pledges for zero waste, commitments to sustainable practices, and community-based actions to protect the planet. Pakistan contributes less than 1% of global carbon emissions, but it is among the countries considered most vulnerable to…

ContinuePosted by Riaz Haq on April 22, 2025 at 5:00pm

International Schools: Pakistan Ranks Among Top 5 Countries in the World

Pakistan ranks among the top 5 nations in terms of international schools offering schooling based on International Baccalaureate (IB) and IGCSE (Cambridge) curricula. China leads with 1,000 international schools, followed by India (900), UAE (784), Pakistan (598) and Brazil (415). The medium of instruction in these schools is English. …

Posted by Riaz Haq on April 19, 2025 at 8:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network