PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction Boom Resumes in Pakistan

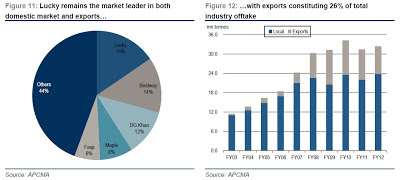

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on December 9, 2012 at 2:25pm

-

In an Express Tribune article titled "Pakistan's tarred reputation", Pak economist Javed Burki paints a grim picture of Pakistani economy and references media stories of violence published in The Economist and The New York Times as a deterrent to foreign investors, governments and IFIs like IMF and World Bank.

http://tribune.com.pk/story/477347/pakistans-tarred-reputation/

What Brurki doesn't say (or maybe he doesn't understand?) is that governments, investors and corporations who do their own research know that Pakistan is too big and important a country which they can not afford to ignore for long.

Pakistan has a large and growing consumer base as well as a growing stockpile of sophisticated nuclear weapons. It can be highly profitable or highly dangerous depending how the world chooses to deal with it.

That's why the total foreign currency inflows into Pakistan have continued to grow for over a decade. Decline in FDI has been more than made up by growing remittances, grants and loans as well as significant increase in exports.

-

Comment by Riaz Haq on December 11, 2012 at 5:42pm

-

Here's an interesting Huffington Post piece by investment adviser Dan Solin:

Pakistan is often in the news and usually in unflattering terms. The relationship between the U.S. and Pakistan is troubled, characterized by deep mutual distrust and conflicting goals.

The economy of Pakistan is equally troubled. According to the Heritage Foundation, its economy has been plagued by "political instability and violence." Much needed economic reform has been stalled by bureaucratic delays and lack of political will. Property rights in Pakistan are "compromised." The rule of law is "fragile." Taxation is "poorly administered." Its public debt is over 50 percent of total domestic output. Foreign investment is declining. Its overall ranking on economic freedom is below the world and even regional averages, placing it in the category of "mostly unfree" economies. To put this in perspective, there is more economic freedom in Yemen, Senegal and Nigeria than in Pakistan. Its unemployment rate is a staggering 15 percent. Its inflation rate is 11.7 percent.

Does this country seem like a good place to invest to you?

Now for the shocker: Year-to-date returns for the stock market of Pakistan were 46.73 percent. That's not a typo. Year-to-date returns for the U.S. during the same period were 11.90 percent.

Here are some other interesting facts. The stock markets in Nigeria and Kenya

were 27.26 percent and 26.56 percent, respectively. What about the returns in fast-growing economies like Brazil and China? Brazil was an anemic 1.43 percent. China was a loss of 10.20 percent.If you are a typical investor, you believe paying attention to the financial news is important to your investing success. You read the financial media. You watch CNBC and pay special attention to the fund managers who "explain" the stock markets to you and encourage you to follow their advice (often by investing with their firms). Maybe you follow the stock picks served up by Jim Cramer, who appears to have an encyclopedic knowledge of all things financial.

Let me ask you this question. Did any source of financial news advise you to invest in the stock markets of Pakistan, Nigeria or Kenya? Or Turkey, which topped the list with returns of 47.31 percent? How about your broker or financial adviser? They make it appear they have special insight into the financial markets. Did they advise you to invest in any of the countries reporting returns higher than the U.S.?

The average returns of the 77 countries is a positive return of 8.47 percent. In 2011, the average was a negative 14.15 percent and the list of top performers was markedly different, with Venezuela, Jamaica and Botswana turning in stellar results, along with Pakistan which came in second.

Trying to predict which country will perform best in 2013 is a crapshoot. So is trying to pick stocks that are mispriced, or betting on which asset class will outperform. Yet the securities industry continues to thrive by persuading you to pay its members fat fees for dispensing precisely this kind of "advice."

The next time your broker peers into his crystal ball and makes a recommendation, ask this question: Did you predict stellar returns in Pakistan, Nigeria or Kenya for 2012?

http://www.huffingtonpost.com/dan-solin/you-learn-investors-pakista...

-

Comment by Riaz Haq on December 15, 2012 at 8:34am

-

Here's a Bloomberg report on central bank rate cut in Pakistan:

Pakistan cut its benchmark interest rate to the lowest level in five years as policy makers seek to stimulate an economy battered by an energy crisis and insurgency that is likely to need more International Monetary Fund aid.

The State Bank of Pakistan reduced the discount rate by 50 basis points to 9.5 percent, Syed Wasimuddin, spokesman, told reporters in Karachi yesterday. The decision was predicted by 14 of 15 economists surveyed by Bloomberg News. One saw no change.

Pakistan’s economy will probably expand 3.5 percent in the 12 months through June, the IMF forecast Nov. 29, less than the 4.3 percent predicted by the government. Fighting with militants along the nation’s northwest border is sapping the budget and undermining confidence among businesses that are already struggling with record power outages that have shut factories and left thousands of people jobless.

“Pakistan is likely to go back to the IMF for another loan next year,” Hamad Aslam, head of research at Lakson Investments Ltd in Karachi who predicted yesterday’s decision, said before the announcement.

Pakistan is scheduled to repay about $7.5 billion to the Washington-based IMF between 2012 and 2015, with $1.2 billion due in June. A partially disbursed $11.3 billion loan program expired in September 2011.

The central bank’s reduction reflects inflation slowing to a 41-month low of 6.93 percent in November. Today’s cuts add to 2 percentage points of easing since August. The new rate will be effective from Dec. 17.

“Deceleration in inflation is faster than the projected path and credit extended to private businesses remains muted,” the State Bank said in its monetary policy statement yesterday. Average inflation for the year ending June will be below the 9.5 percent target, it said.

While the central bank has scope for a larger cut, it may opt for a conservative approach amid IMF repayments, Uzma Taslim, an analyst at Alfalah Securities Pvt. Ltd. in Karachi, said before the announcement.

The rupee traded at a record high against the dollar this week, after falling 9 percent earlier this year.

“Government finances are also under pressure,” Moody’s Investors Service said in November. “The budgeted deficit of 4.7 percent for the year ending June is likely to see slippage due to optimistic revenue and expenditure assumptions.”

Pakistan recorded the highest budget deficit in two decades in the fiscal year ended June.

www.bloomberg.com/news/2012-12-14/pakistan-cuts-key-rate-to-5-year-...

-

Comment by Riaz Haq on December 17, 2012 at 2:01pm

-

Here's a Daily Times report on a new steel mill starting production in Karachi:

Pakistan’s largest steel producing mill in private sector Tuwairqi Steel Mills Limited (TSML) is ready for commercial production in the first week of January 2013.

It would cater not only the steel needs of the country but would be able to export value-added products to other countries.

The setting up of such a mega project would entice foreign investors in the country despite the fact that local investors are also shifting their entities abroad because of bad law and order situation and energy crisis.

TSML mega project over $350 million is mainly sponsored by Saudi Arabian-based Al-Tuwairqi Company (ISPC) and Posco of South Korea.

TSML Director Project Zaigham Adil Rizvi at a seminar on Monday said this state-of-the-art Direct Reduction route of Iron (DRI) making plant would be starting commercial production but financial crunch put the project so late.

Posco-South Korean steel giant have invested $16 million to make this mega project keep going.

A revolution of industrial growth is in the offing as TSML is ready for commercial production in coming January. It is Pakistan’s first private sector integrated environment-friendly steel manufacturing project.

TSML will serve as a catalyst for the industrial growth in the country as steel has basic and vital role in the economic development of any country.

He said DRI technology is the latest in the world and is being used in not only developed countries but also in our region like Iran and India, so consistent highly quality of product can be achieved through this state-of-the-art technology, he said adding that this technology is environment-friendly.

Rizvi divulged TSML’s DRI plant after commercial production, would not only meet country’s steel requirements but would also create job opportunities for technical and skilled labour force for local people.

He said his team along with Posco delegates has started searching raw material in Balochistan and hoped they would not spend huge foreign reserves in importing raw material rather they would use the local material.

He claimed country’s workforce, especially the youth was not only dedicated and committed but also hard work, so the future of Pakistan was very bright.

Pakistan’s largest steel capacity of 1.28 million tonnes per annum plant would not only cater country’s requirements but also provide job opportunities to skilled and unskilled people.

Other countries including Korea wanted to purchase total production of TSML but TSML management has decided in principal that we would prefer to distribute all our products within the country and in this regard we have selected Lahore-based Shajarpak Company, as our sole distributor.

Khawaja Usman of Shajarpak said currently Pakistan was depending on imports for the production of heavy mechanical structures and engineering goods but after producing high-quality steel at TSML plant, Pakistan would be able to manufacture such heavy equipment locally.

India is giving more importance to its industrial sector while concerned authorities in Pakistan are least bother in this regard.

He hoped raw material from Balochistan would help steel industry to sell its products on low price.

http://www.dailytimes.com.pk/default.asp?page=2012\12\18\story_18-12-2012_pg5_7

-

Comment by Riaz Haq on January 12, 2013 at 7:16pm

-

Here's Daily Times on Twariqi Steel Mill plant inauguration in Karachi:

KARACHI: Tuwairqi Steel Mills Limited (TSML) Pakistan’s first private sector integrated environment-friendly steel manufacturing complex of Al-Tuwairqi Holding (ATH)/ISPC of the Kingdom of Saudi Arabia inaugurated by Prime Minister Raja Pervez Ashraf at Port Qasim Karachi on Saturday.

The plant in its first phase has the capacity to produce up to 1.28 million tonnes of high quality Direct Reduced Iron (DRI), which is evidently steel’s most versatile metallic and a preferred raw material for quality steel making worldwide.

Raja Pervez Ashraf congratulated the entire team of TSML on the successful completion of the first phase and committed to extend all possible support from the government for the expansion plans of ATH and POSCO in Pakistan. He said, “It is a matter of great pride for us Pakistan has now started producing DRI, with the completion of the first phase of TSML. We are committed to transform our country into an industrial hub and for that we seek more projects-especially in the steel sector, since steel is the backbone of the industrial growth. TSML in poised to serve as a catalyst for the industrial growth of Pakistan.”

He was of the view currently Pakistan was among the countries that rely mostly on imports when it comes to heavy mechanical structures and engineering goods. By producing high quality steel within Pakistan we can manufacture such equipment locally by value addition with the help of downstream industries, he concluded.

He distributed shields among outstanding employees of TSML as a token of appreciation of their hard work and dedication to successfully complete the first phase.

The first phase has been completed with an investment of over $350 million. The plant spreads over an area of 220 acres at Bin Qasim Karachi and employs the world’s most advanced DRI technology of the MIDREX process owned by Kobe Steel of Japan. ATH/ISPC and POSCO have signed a memorandum of understanding (MoU) with the government of Pakistan for the backward and forward integration with an estimated investment 3 times higher than of the DRI plant. Forward integration would be a further value addition through a Melt Shop, producing world standard steel grades, while backward integration would be to the extent of exploring iron ore locally in Balochistan, its beneficiation and pelletisation as well.

Dr Hilal Hussain Al-Tuwairqi, Chairman Al-Tuwairqi Holding appreciated the efforts of TSML employees. He said Al-Tuwairqi’s vision was to participate in the development of national economy in order to have a long sustaining growth of Pakistan.

“We are looking forward to create for our younger generations, ample job opportunities to build a strong and prosperous nation on the face of this plant. Al-Tuwairqi sees Pakistan as a land of opportunities and we are very clear in our perception that Pakistan as a country has to grow and we are determined to play an instrumental role in its development, he remarked.

Joon Yang Chung Chairman and CEO POSCO of South Korea congratulated the entire team of TSML. He said it was heartening to learn that TSML has increased the production capacity of Pakistan by 1.28 million tonnes per annum, which would help meet the ever growing demands of steel in Pakistan.

Zaigham Adil Rizvi Director (Projects) TSML said TSML has massive expansion and modernisation plans not only to enhance production capacity at an exponential rate but also to improve productivity and efficiency, matching the highest global standards. Pakistan’s current per capita steel consumption is only 40 kilogramme, which is exuberantly low, when compared with the global average of 215 kilogramme. This establishes a dire need increased emphasis on achieving international benchmarks to become a modern and an efficient economy.http://www.dailytimes.com.pk/default.asp?page=2013\01\13\story_13-1-2013_pg5_2

-

Comment by Riaz Haq on January 12, 2013 at 10:49pm

-

Here's an ET report on cement sales in July-Dec 2012 period in Pakistan:

Cement consumption in the country increased 11% to 2.24 million tons in December 2012, the highest-ever sales for the month, industry people say.

However, a slump in exports persisted with overseas shipments declining by 10.55% to 580,000 tons in December.

The numbers were released by the All Pakistan Cement Manufacturers Association here on Friday.

In a statement, a spokesman for the association said cement sales in the domestic market rose 7.61% to stand at 11.728 million tons in the first six months (July-December) of financial year 2012-13. Exports remained under pressure, dropping by 5.28% to 4.22 million tons.

In southern parts of the country, sales of cement units in the first half registered a growth of 7.98% in the domestic market, but exports fell by 16.34%.

In the north, where most of the cement is produced, the industry posted a growth of 7.52% in domestic sales while exports edged down 1.31%.

The spokesman was the view that despite much hype, trade with India had not significantly benefitted the cement industry as sales to the neighbour stood at only 209,000 tons in the past six months, down a whopping 40.41%. “This is well below expectations of the cement sector,” he commented.

In fact, he said, exports to India had been on a constant decline ever since the two countries opened their borders for liberal trade. “The decline is not due to lack of demand, but because of very stringent non-tariff barriers imposed by our neighbour,” he said and pointed out that Pakistan’s cement was preferred by the Indians because of better quality.

Stressing that cement exporters have a potential to export a big quantity to the Indian market, he said they were facing strict resistance with barriers still in place even after discussions on the matter in different rounds of official and unofficial talks between the two countries.

Setting aside India, Afghanistan’s market has proved to be quite lucrative for the cement industry. In the past six months, the industry exported 2.41 million tons to the neighbour, where demand stood high in the wake of reconstruction work.

Exports to other destinations through sea also remained stable in the period under review.

http://tribune.com.pk/story/489137/cement-sales-grow-7-exports-lag-...

-

Comment by Riaz Haq on January 13, 2013 at 9:15am

-

Here's a SteelFirst report on steel imports in Pakistan:

Pakistan's imports of iron and steel products were 13% higher year-on-year in November, as troubles at state-owned Pakistan Steel continued to encourage purchasing from outside the country.

Imports reached 155,517 tonnes in November, up from 137,548 tonnes a year earlier and a little down from 156,427 tonnes in October this year.

The struggling Pakistan Steel, the country's main producer with 1.1 million tpy of capacity, has been operating at an average utilisation of 20% during 2012 because of financial troubles. Steelmakers in Pakistan also faces higher costs and problems with intermittent power supply.

Both these factors have kept output restrained, encouraging more imports of finished products to fill the gap.

At the same time, the production problems have led to much lower scrap import volumes.

Inbound shipments of ferrous scrap in November dropped to 100,673 tonnes, down 48% on the month and 25% year-on-year.

http://www.steelfirst.com/Article/3134894/Pakistans-steel-imports-u...

-

Comment by Riaz Haq on January 22, 2013 at 10:26am

-

New shopping mall to open in Islamabad, reports The Nation:

ISLAMABAD (PR) - The Centaurus Mall, Pakistan’s mega shopping and entertainment destination, is all-set to open its doors by the middle of next month, says a press release.

“We are all set to make a soft launch. Quite a few brands have confirmed their readiness by the date we have communicated to them, and others are working day in and day out to make sure they don’t miss out on this opportunity,” the release stated.

The Centaurus Mall, located at the heart of federal capital, is a multi-facility complex featuring a deluxe mega shopping mall (covering 400,000 sq. ft), 5-screen Cineplex, a state-of-the-art kids entertainment area, and food court offering a variety of cuisines.

“The word is out now, and we are mulling the date of 17th February to make this luxurious dream become a reality. Dozens of top-of-the-line brands are going to be there and the rest of the mall features like Cineplex, and kids play area, health club etc will be up and ready within 20 days of the launch, ShahbazRana, Head Business Development of The Centaurus confirmed.

The multi-billion project is a joint venture of Al-Tamimi Group of Saudi Arabia and Sardar Builders of Pakistan.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on January 23, 2013 at 10:22pm

-

Here's PakistanToday on a new skyscraper in Karachi:

KARACHI - City’s tallest building, which has been constructed at a huge investment of Rs 7 billion, is all set to open its doors to the public and corporate sector with the objective to spur business and commercial activities in safe, secure and world class environment.

The high-rise project named Ocean Tower was set to break the record of being the tallest building in the country with 393-feet height and 28 floors, whereas the record was currently being held by a private bank building with a height of 370-feet containing 24 floors, situated on II Chundrigar Road.

Ocean Tower had been built according to international architectural standards and had state-of-art shopping centre and business centre. We have gathered a world of business and entertainment under one roof in the tallest building of the country in which top international brands of clothing, cosmetics, toiletries, food and cinema were available for the masses, said Siddiq Sons CEO Tariq Rafi, the company responsible for building Ocean Tower.

Ocean Tower would welcome a large number of shoppers from across the country, where they could buy goods related to food, health and entertainment, Tariq said. It was a premier place for conducting business and engaging in shopping, he added.

Furthermore, he said that all leading multinational companies and the country's business tycoons have set up their offices in Ocean Tower because they were facilitated into a dream corporate life in which business meetings, seminars and dinners could be arranged in one building while the companies could gain a good image in their relevant industries, he added.

Moreover, Tariq said that Ocean Tower had been built by keeping in mind the demands of modern and luxury lifestyle. The security system would be managed efficiently by man and machines, while uninterrupted power supplies and fire security compliances were also installed for the benefit of investors, he added.

Ocean Tower had been designed and built in such a way that it could effectively withstand earthquake jolts of 8.5 on Richter scale, which was well above the limit of any quake shocks experienced by the country so far. In addition to this, Ocean Tower had been equipped with UFLM fire safety standard, Tariq said, while adding that the building had 4,500 square feet dedicated space for car parking where more than a 1,000 cars could be easily parked.http://www.pakistantoday.com.pk/2013/01/24/city/karachi/pakistans-t...

-

Comment by Riaz Haq on February 5, 2013 at 10:16am

-

Here's the latest cement report on Pakistan:

The All Pakistan Cement Manufacturers Association reported a 10.10% increase in domestic cement consumption in January. The country, which has almost 45 million t of cement capacity, has seen exports fall in recent years as expansion programmes increase capacity in Pakistan’s traditional export markets and new exporters have joined the competition. However, domestic demand is on the rise, hitting an all-time high of almost 24 million t in FY11/12.

January saw domestic sales reach 2.135 million t, comprised of 1.706 million t from the north and 429 000 t from the south of the country. Demand has been pushed by private construction as well as government infrastructure projects, a trend set to continue as the per capita cement demand in the country is well below average at 152 kg.

Energy shortage threatens production

However, a new threat is energy shortages, which the APCMA says hampered production in northern areas last month. The Islamabad High Court recently removed the Rs.50/mmbty Gas Development Infrastructure Cess (GIDC), declaring it illegal. Though this will bring down input costs for cement producers in the south, it is reported that it will have no benefit for the more numerous northern producers, who ‘have now been given least priority for gas supply’ (The Nation, 3 February). Some plants are looking into alternative energy supplies – DG Khan Cement, for example, is set to be one of the first applications for Kalina cycle technology in the cement industry.

Lucky Cement prospers

Meanwhile, Lucky Cement Limited has recorded a 42.15% y/y increase in half yearly profit for 2012/13. As of the end of December, the company reported profits of Rs.4.29 billion and improved net sales of Rs.17.511 billion, up 13.9% y/y. The company reportedly plans to upgrade its existing mills and packing machines to reduce operational costs. More information about the company can be found in the February issue of World Cement in the article ‘Pakistan: Cementing its Position’ from Lucky Cement. Subscribers can download the issue by signing in.

Lafarge appoints new country CEO

Finally, Lafarge Pakistan Cement has appointed Amr Reda as the new country CEO of Lafarge Pakistan. Reda had previously been the regional business controller of Lafarge Middle East and Pakistan and has been on the board of directors of Lafarge Pakistan since January 2007.

http://www.worldcement.com/news/cement/articles/Pakistan_domestic_c...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Barrick Gold CEO "Super-Excited" About Reko Diq Copper-Gold Mine Development in Pakistan

Barrick Gold CEO Mark Bristow says he’s “super excited” about the company’s Reko Diq copper-gold development in Pakistan. Speaking about the Pakistani mining project at a conference in the US State of Colorado, the South Africa-born Bristow said “This is like the early days in Chile, the Escondida discoveries and so on”, according to Mining.com, a leading industry publication. "It has enormous…

ContinuePosted by Riaz Haq on November 19, 2024 at 9:00am

What Can Pakistan Do to Cut Toxic Smog in Lahore?

Citizens of Lahore have been choking from dangerous levels of toxic smog for weeks now. Schools have been closed and outdoor activities, including travel and transport, severely curtailed to reduce the burden on the healthcare system. Although toxic levels of smog have been happening at this time of the year for more than a decade, this year appears to be particularly bad with hundreds of people hospitalized to treat breathing problems. Millions of Lahoris have seen their city's air quality…

ContinuePosted by Riaz Haq on November 14, 2024 at 10:30am — 1 Comment

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network