PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction Boom Resumes in Pakistan

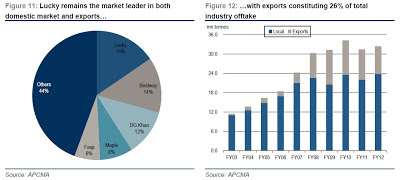

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on November 17, 2012 at 9:58am

-

Here's a News report on Deputy Chairman of Planning Commission criticizing economists at Pak Society of Development Economists (PSDE) conf:

Deputy Chairman Planning Commission, Dr Nadeem Ul Haq, on Thursday lambasted technocrats and economists for giving bad policy advice to politicians in Pakistan. He said that advisers did not focus on government expenditures and only concentrated on increasing revenue through funding from multilateral donors. Wasteful expenditures ballooned as subsidies alone were consuming approximately Rs500 billion per annum, he said.

“As a nation, we failed to increase tax to GDP ratio since independence,” said Haq while chairing the concluding session of a three-day conference that was organised by PIDE in collaboration with HEC, FES, IGC and WWF-CCaP-EU.

He asked why economists do not look at the expenditure side of government operations. Economists blamed politicians for not implementing the desired reform agenda but on the flip side, economists themselves were not presenting the correct agenda to the politicians, he said.

“There has been no growth in the economy as it has followed a dysfunctional model,” he said. Further, everyone was talking about macro stability as the first step and then taking care of growth, he said. “Why can’t we prefer growth? – and I am advocating this despite being affiliated with the IMF in my carrier,” he added. There has been a trade off between two objectives and the economists should come forward to devise a future course of action. Pakistanis built universities without teachers and research, built offices without required officers and built infrastructure without thought, he said. The politicians did not have the ability and understanding to grasp these issues and followed what technocrats advised them to do, he said.

-----------

Former Governor State Bank of Pakistan, Dr. Ishrat Husain, said that the nature of reforms that Pakistan should undertake contain two components – stabilisation and long-term structural reforms. He examined the record of the last 65 years with respect to those reforms as well as political and economic developments.The incumbent government could not manage the lingering crisis in 2009 forcing Pakistan to approach the IMF in November 2009. A homegrown reform package, consisting mainly of mobilising additional taxes to bring fiscal deficit under control, was agreed upon, he said.

Lack of political consensus on General Sales Tax (GST) and Agriculture Income Tax (AIT) among the coalition partners led to the breaking down of the agreement with the Fund – but only after incurring a heavy financial obligation of eight billion dollars, to be repaid in 2012 and 2013, he said....

http://www.thenews.com.pk/Todays-News-3-143061-Economists-come-unde...

-

Comment by Riaz Haq on November 17, 2012 at 10:08am

-

Here's a News report on Oct jump in FDI in Pakistan:

Pakistan’s foreign direct investment (FDI) climbed sharply to $125.4 million during October, providing some relief to the deteriorating balance of payments position, according to the data released by the State Bank of Pakistan (SBP) on Thursday.

The FDI inflows increased to $125.4 million just in the single month of October as compared to $59.6 million during the same month last year, depicting a significant jump of $71.2 million, or 131 percent, it said.

The increase in FDI inflows was evident from the fact that foreign companies invested $187.1 million in various sectors of the economy during October as compared to $186.4 million during the corresponding month last year.

Nonetheless, the FDI outflows, including divestments and repatriation from the foreign investors stood at $61.7 million as against the outflows of $126.8 million during October 2011.

Oil and gas exploration, trade, electrical machinery and transport were the main sectors, which attracted a significant amount of foreign direct investment in the country during the last month.

Economic experts say that improvement in the FDI inflows is a positive sign for the economy, showing revival in investors’ confidence in Pakistan.

The inflows of FDI in Pakistan plummeted by 24.2 percent to $244.4 million during the first four months of the current fiscal year as against $322.7 million during the same period last year.

The fall in FDI inflows during July-October FY13 amounted to $638.5 million as compared to $766.6 million a year ago.

The provisional figures released by the Satate Bank of Pakistan showed that foreign private investment attracted $370.8 million during July-October FY13.

The net inflows of foreign investment in Pakistan stood at $365.2 million as compared to $221.2 million a year ago, showing a growth of 65.1percent.

The portfolio investment at the Karachi Stock Exchange stood at $126.4 million as against the outflow of $74.9 million during the corresponding period last year.

During October, the portfolio investment was recorded at $30.1 million as against the outflow of $28 million last month.

Of the total FDI of $244.4 million, major investment was made in the oil and gas exploration sector followed by IT services and information technology, and the transport sectors.

http://www.thenews.com.pk/Todays-News-3-143063-FDI-rises-to-$1254m-in-October

-

Comment by Riaz Haq on November 17, 2012 at 11:48pm

-

Barron is reporting that Vanguard has set up an ETF for FTSE emerging market index that includes KSE-100 stocks Abbott Pakistan and Unilever Pakistan.

Pakistan and the United Arab Emirates are probably two markets many U.S. investors haven't given much thought to, but that's beginning to change after news that one of the most popular emerging-market ETFs will have some exposure to these countries.

Vanguard recently said it would start tracking the FTSE Emerging Markets index rather than the MSCI Emerging Markets index for its popular Vanguard MSCI Emerging Markets ETF (ticker: VWO), which will soon be renamed. That means the fund won't have exposure to Korea, which FTSE doesn't consider an emerging market, and it will now have some holdings in Pakistan and the UAE. With those countries combined only making up about half a percentage point of the index, investors won't exactly be loading up on the Middle East. But the switch is already attracting interest to a region that has largely been ignored by investors.

That attention may be warranted. Despite the turmoil in Syria and concerns about Iran, the region has plenty to offer investors, including some of the world's best-capitalized banks, a young population, and governments spurred by the Arab Spring to invest in infrastructure and try to address high unemployment. So says Julie Dickson, equity product manager for emerging-markets specialist Ashmore Investment, which oversees $68 billion in assets. The MSCI Pakistan index is up 20% this year; MSCI UAE is up 21%.

Even with the run-up, Andrew Brudenell, manager of the HSBC Frontier Markets fund (HSFAX) in London, says Pakistan is one of the cheapest markets he follows, at about seven times earnings. He notes that earnings growth has kept pace with the market. The firms, he adds, are typically cash-rich, boast strong return on equity levels in the 20% range, and pay good dividends.

In Pakistan, the informal, cash-based economy for goods and services is larger than the formal economy. Consumer-oriented firms can tap into that demand, so they are a favored play for managers, especially subsidiaries of well-respected global firms like Abbott Pakistan (ABOT.Pakistan) and Unilever Pakistan (ULEVER.Pakistan) that give them more comfort about governance.

While the story attracting investors to Pakistan is domestic, the United Arab Emirates is more of a play on the rest of the Middle East, since it is increasingly a trade and financial hub and has recently acted as a safe haven for people elsewhere in the region. Many people associate the UAE with lavish construction projects and a property bubble, but that bubble popped and the industry is on the mend, with occupancy rates beginning to rise. The country's firms are also well managed and attractively priced, says Brudenell, who favors property developers, banking-service firms and global-ports operator DP World (DPW.Dubai).

http://online.barrons.com/article/SB5000142405274870452610457811502...

-

Comment by Riaz Haq on November 20, 2012 at 10:33am

-

Here's ET on Saudi Arabian group planning $1b investment in Cement, Energy, Autos in Pakistan:

ISLAMABAD: Al-Qarnain Group of Saudi Arabia has said it is planning to invest $1 billion in the areas of energy, construction, hospitality and automobiles in Pakistan over the medium term.

Group’s Chief Executive Officer Eyad Al-Baaj, in a meeting with officials of the Board of Investment (BOI), apprised the Pakistani authorities of their investment plans, according to an announcement made by BOI here on Tuesday.

He discussed with BOI Chairman Saleem H Mandviwalla and Secretary Shaikh Anjum Bashir investment opportunities in various sectors of mutual interests of Saudi Arabia and Pakistan.

Al-Baaj said the group would invest $400 million in the first couple of years and increase the investment to over $1 billion in five years. These funds would become part of foreign direct investment in Pakistan and the group was interested in investing in energy, building and construction, hotel and automobile sectors, he added.

“The group is also entering into joint venture with Pakistani cement company Dandore. Current capacity of Dandore is 350 tons a day, which will be enhanced up to 7,500 tons,” he said.

The CEO stressed that the group was aware of the energy problems in Pakistan and was interested in constructing independent power plants with production capacity of 150 to 200 megawatts. The group is also keen on producing solar panels, their installation and back-up services to consumers.

Al-Qarnain, which is one of the biggest construction groups of Saudi Arabia, has also submitted proposals for construction of low-cost housing schemes in Pakistan.

In the automobile sector, the group plans to establish a state-of-the-art assembly plant for heavy trucks and buses with a comprehensive licence from Belarus. The CEO hopes that the plant will meet domestic demand, but its main target is to export vehicles to Gulf states, African countries and other buyers around the globe

http://tribune.com.pk/story/438694/saudi-arabian-group-planning-1b-...

-

Comment by Riaz Haq on November 21, 2012 at 5:49pm

-

Here's an ET story on Unilever targeting Pakistan market as a priority:

It is a global food and consumer goods giant that serves over 2 billion consumers every day in more than 180 countries around the world, but Unilever’s global management team is convinced that the key to their future success lies in 16 emerging markets, of which Pakistan is one.

Paul Polman, the CEO of Unilever, and Harish Manwani, the chief operating officer, visited Pakistan on Tuesday in what appears to be part of their global push to gear the company’s growth strategy towards emerging markets. “We want to be in every market with more than 100 million consumers,” said Manwani. “And we want to be in every market where the purchasing power of the consumer is growing. Pakistan meets both of those criteria, the first one by quite a lot.”

About 56% of Unilever’s revenues come from emerging markets, a number that Manwani says could rise to as high as 75% over the next few years. In Pakistan, the company operates two subsidiaries, Unilever Pakistan and Unilever Pakistan Foods, both of which are publicly listed on the Karachi Stock Exchange. For the year 2011, the company’s Pakistani subsidiaries earned combined gross revenue of over Rs73 billion, or about 1.3% of the global total for Unilever.

Growth in Pakistan is significantly higher. While Unilever’s global revenues grew by around 5%, revenues in Pakistan grew by a much stronger 9.9%, even when taking into account the rupee’s depreciation against the euro, the company’s global reporting currency. In Pakistani rupees, gross revenues of both companies grew by nearly 17%.

But it is not just the current growth figures that appear to be attracting Unilever’s attention to Pakistan, but rather what is clearly a rapid expansion of the Pakistani middle class, which is causing purchasing power – and thus the propensity to buy branded products – to rise among a wide and diverse array of Pakistani consumers. Unilever is increasingly finding that it is selling its products to everyone from the bank CEO who works on Karachi’s II Chundrigar Road to the small shop owner in rural Sanghar to the grain merchant in a small town outside Sialkot.

------------

Malik said that the company is actively trying to reach consumers in small towns and rural areas, well beyond the larger cities in the country. The company reaches 50,000 retailers in rural areas, said Malik, a number that keeps on expanding rapidly.That focus on rural consumers appears to be part of the global strategy: Paul Polman said that Unilever’s connection to farmers and rural communities is part of its efforts to integrate its business strategy with social responsibility. “Over 40% of the world’s population is in agriculture. We want to integrate over 500,000 of them into our global supply chain. They tend to be more reliable suppliers and help us reduce our volatility. In turn, we provide them with a better livelihood,” said Polman.

Unilever’s global CEO was effusive in his praise of the team in Pakistan. “The water conservation techniques pioneered in Pakistan will now be replicated in Unilever factories around the world,” he said. “Pakistan has always provided us with talent, and is in fact exporting talent. Over 55 Pakistanis are now working in senior positions in Unilever all over the world.”...

http://tribune.com.pk/story/469350/food-consumer-goods-unilever-tar...

-

Comment by Riaz Haq on November 29, 2012 at 9:24pm

-

Here's a BR report on Sheraton's expansion in Pakistan:

"Two new Sheraton properties are under construction in Islamabad", revealed Antoine Joignant in a recent interview with BR Research. He elaborated that one site is located on the Islamabad-Murree road, called Sheraton Golf & Country Club; while the other overlooks the Rawal Lake in Islamabad.

"The Sheraton Golf & Country Club shall be the most spectacular property in the country, as it has been designed by the same architects that designed the Atlantis in Dubai. This 367-room hotel shall include an 18-hole golf course with many other amenities for guests," he said. He also revealed that the Sheraton Islamabad shall be a 180-room hotel primarily catering to business travelers.

--.

According to Antoine Joignant, being a part of the Starwood group provides an edge to the Sheraton Karachi over its competitors. One key differentiator is our ability to personalise our services and guest experience through various Starwood online tools which allow real-time tracking of maintenance work and guests' feedback.

As is the norm at most hotels, guests would previously fill out survey cards at the end of a typical stay which would then be sent to be compiled by the relevant department. But the system in place at Starwood Hotels allows guests to offer their feedback online, which is then compiled automatically.

"Now instead of receiving survey results at the end of the month like other hotels, we are receiving guest responses instantaneously. That is revolutionary as it gives us the ability to address clients' requests while they are still at our hotel, instead of waiting for them to come back the next time," he explained.

"We already have a programme in place for our most frequent clients, whom we call ambassadors, whereby a dedicated member of our team helps make arrangements for them according to their personal preferences, he said. The system not only sends clients' comments to hotel management in real-time; it also provides live scores for each location against the hotel chain's benchmarks allowing the hotel management to follow their relative performance. "Globally, we are the only hotel chain to have such a system in place, which is why our service is distinguishable from competitors", he summed up.

PAKISTAN: THE DIAMOND IN THE ROUGH "Pakistan is a treasure trove of culture, natural beauty and mouth-watering cuisines for world travelers," says Antoine. A long list of attractions ranging from the pristine beaches of Karachi and Balochistan, awe-inspiring peaks of the Northern Areas, local art and handicrafts; to the historic sites of Moenjodaro and Harappa, rolled off his tongue like that of a well-traveled local.

"It is very unfortunate that the image that has become attached with this beautiful country is set in violence and unrest," he said. He highlighted recent events such as the Grand Opera, Peshawari Night and food festivals that the hotel conducted to attract international travelers and locals alike; pledging grander functions in the future. He expressed hope that these attractions will play a part in countering negative international perceptions regarding Pakistan.

Antoine Joignant also highlighted that the value for money which guests receive in Pakistan is much higher than that provided by hotels in other countries in the region. He admitted that the local hotel industry is facing tough times given the subdued flow of foreign tourists to the country, but he stressed that occupancy rates have been on the rise for Sheraton Karachi over the past three years.

-

Comment by Riaz Haq on November 30, 2012 at 11:00am

-

Here's Dawn on KSE continuing rally to set ew records:

Pakistani stocks hit a record high for the fourth day in a row on Friday, closing the week up nearly 3 per cent, driven by a rally in cement shares and expectations that the central bank will ease rates next week.

The Karachi Stock Exchange’s (KSE) benchmark 100-share index surged as high as 16,651.10 in intraday trading.

It closed at 16,573.86, up 0.28 per cent or 46.78 points from the previous session.

“Investors remained bullish in cement stocks, while the textile sector also joined the bandwagon,” said Samar Iqbal, an equity dealer with Topline Securities.

“With the end of the year approaching, there was also renewed interest in the banking sector.” Fauji Cement rose 2.05 per cent, or 0.14 rupees, to 6.98 per share, while National Bank was up 4.99 per cent, or 2.37 rupees, to 49.87 per share.

Karachi Electric fell 0.72 per cent, or 0.05 rupees, to 6.88 per share.

The market also found support from expectations that the State Bank of Pakistan will cut its discount rate with inflation under control.

The government will publish November inflation figures on Monday, while the central bank meets later in the week to decide on monetary policy.

In the currency market, the Pakistani rupee strengthened to 96.49/96.54 to the dollar, compared to Thursday’s close of 96.54/96.59.

Overnight rates in the money market remained flat at 9.50 per cent.

http://dawn.com/2012/11/30/pakistani-stocks-hit-fresh-record-high-r...

-

Comment by Riaz Haq on December 3, 2012 at 6:03pm

-

Here's a BR story on rising cement demand in Pakistan:

KARACHI - The decline in the cement exports to India continues unabated where the uptake of Pakistani cement reduced by 38.50 percent during the first five months of the current fiscal year, 2012-2013. During July-Nov 2011 last year, Pakistan exported 298,214 tons of cement to India which reduced to 183,387 tons this year.

Although cement sector posted a healthy export growth of 11.71 percent in November 2012,India was the only exporting destination where exports declined in November as well.Pakistan exported 45,096 tons of cement to India in November 2011 which declined alarmingly to only 25,207 tons in November 2012. The cement sector of Pakistan otherwise showed healthy growth in the month of November, as for the first time this fiscal, both domestic consumption and cement exports posted double digit growth, on year to year basis. Total cement dispatches at 2.649 million tons during the month of November were, however, lower than dispatch of 2.766 million tons, a month earlier. However, when compared to November 2011 when the total cement dispatches were 2.255 million tons, the sales in the month of November 2012 were higher by 19.63%. Traditionally, cement dispatches in October are higher than in November. The market analysts term the current domestic market situation encouraging as during past five months of this fiscal, the local consumption has increased in four months and declined only in August by 3.41 percent. The local uptake of the commodity increased in two months out of five during this fiscal by over 19 percent. The first time it posted over 19 percent growth was in September 2012 and the second time in November 2012. The overall growth in local dispatches during the first 5 months of this fiscal was 6.78 percent. The cement exports from South zone during July-Nov 2011 were 0.986 million tons that declined in July-Nov 2012 to 0.837 million tons depicting an overall reduction of 15.06 percent. The cement exports from North zone declined nominally by 0.64 percent during this period to 2.804 million tons from 2.823 million tons in the first five months of this fiscal.http://www.pakistantoday.com.pk/2012/12/04/news/profit/cement-conju...

-

Comment by Riaz Haq on December 5, 2012 at 10:07pm

-

Here are a few excerpts of State Bank Governor Yasin Anwar's interview with Dawn:

Q. What is the outlook for inflation?

A. As you very well know, inflation has declined considerably over the past five to six months; from 12.3 per cent in May 2012 to 7.7 per cent in October 2012. Also, the pace of decline in inflation has been faster than our earlier estimates. Therefore, we are quite confident that inflation may remain below the target of 9.5 per cent for FY13. We discussed this assessment in the monetary policy statement of October 2012 as well. Currently, we are in the process of updating our inflation outlook in the light of latest developments. All I can say is that the likelihood of meeting the inflation target for FY13 remains quite high.

Q. Without additional foreign inflows, and IMF repayments, is the BOP situation under control?

A. In the first four months of FY13, balance of payment position has shown significant improvement over the last year.

Particularly, the external current account balance has turned into a surplus; $258 million, against a deficit of $1.7 billion in the corresponding period of last year. In the remaining months of FY13, we are expecting a deficit in the external current account.

However, this would remain moderate compared to both international standards and Pakistan’s own economic history.

The developments that need to be monitored carefully are those related to financial inflows. For the overall health of balance of payments, it is important that all the budgeted financial flows materialise. In case of shortfall or delays, the BOP may experience some stress, but, at this point in time, we expect the position to remain manageable during FY13. We do not foresee any difficulty in the repayment of IMF loans and other debt obligations that have already been factored in.

Q. Why, then, is the rupee constantly under pressure?

A. Like in most emerging economies, the day-to-day value of the currency in Pakistan is essentially determined by market forces of demand and supply of foreign exchange. While export receipts, remittances and financial inflows are the main sources of supply of foreign exchange; import payments, financial outflows and debt repayments influence the demand. The overall macroeconomic conditions such as inflation relative to trading partners and other factors like perceptions of economic stability also influence the behaviour of participants in the foreign exchange market. The SBP does not target any specific level of exchange rate. Our interventions in the foreign exchange market are essentially geared towards dealing with excessive volatility to ensure smooth functioning of the market.

As I have mentioned earlier, the trade balance together with remittances is in surplus during the first four months of FY13. It is the weak financial inflows that are creating some pressure in the foreign exchange market. As the budgeted financial inflows are realized in the coming months, the situation would become more manageable.

-

Comment by Riaz Haq on December 5, 2012 at 10:14pm

-

Here's a PakObserver report on Pak-South Korean deal for Malakand Tunnel project:

Pakistan and South Korea Wednesday inked two agreements for the Malakand Tunnel Construction Project and for development of water resources infrastructure including dams. The agreement on Malakand Tunnel Construction Project was signed during meeting of President Asif Ali Zardari with Kim Yong-Hwan‚ Chairman Export Import Bank of Korea‚ who called on him at the local hotel in Seoul‚ Korea Wednesday.

Under the Malakand Tunnel Loan Agreement‚ an amount of US $78 million will be provided for the project. The Korea Eximbank is an official export credit agency providing comprehensive export credit and guarantee programs to support Korean enterprises in conducting overseas business.

Malakand tunnel will provide a short route not only to people of Dir‚ Malakand and Swat and adjacent localities but would also be an easy access to central Asian states‚ providing the market access to the country for its products. Malakand Pass lies between Dargai-Batkhela and is situated at an altitude of 470 metres and 663 metres‚ respectively.

The South Korean government pledged the $78 million funding through the Economic Development Co-operation Fund (EDCF) for the construction of Malakand Tunnel project in Khyber Pakhtunkhwa province. The 9.7 km project also includes approach roads on both sides of the tunnel and three bridges.

The initial feasibility study of the tunnel has already been completed by South Korean consultants in collaboration with National Highway Authority Pakistan‚ which is also the Project executing agency.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan Minerals Investment Forum Draws Interest of Global Investors

Pakistan's mineral resources, estimated to be over $6 trillion, attracted global investor interest at the Pakistan Minerals Investors Forum 2025 (PMIF2025) held recently in Islamabad on April 8th and 9th. It was attended by major international companies and government officials from Australia, Canada, China, Saudi Arabia, Turkiye, the US and other nations. …

ContinuePosted by Riaz Haq on April 12, 2025 at 11:30am

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 4 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network