PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction and Manufacturing Driving Double-Digit Growth in Pakistan Cement and Steel Production

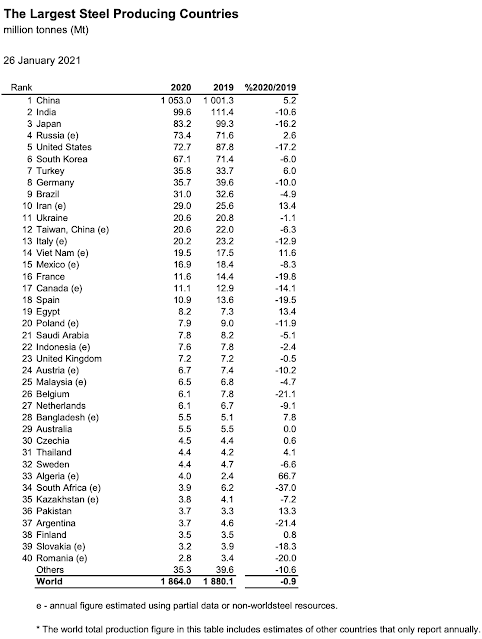

Pakistan steel production grew by 13.3% in 2020, the second fastest among the top 40 steel producing countries, according to data published by the World Steel Association. At the same time, Pakistan Bureau of Statistics revealed that the nation's steel imports rose by 18% year-over-year. The demand for steel was driven by construction and manufacturing sectors which are leading Pakistan's economic recovery.

|

| World Steel Production. Source: World Steel Association |

Pakistan steel-makers produced 3.7 million tons of steel in 2020, up 13.2% from 3.2 million tons in 2019. Neighboring India saw 10.6% decline in steel production in the same period. Global steel production declined 0.9% in 2020. Pakistan also imported $2.1 billion worth of iron, steel and scrap in the first 7 months (July 2020- January 2021) of the current fiscal year. It's a jump of 18% from the same period in prior fiscal year. Pakistan steel industry reached peak production of 5 million tons in 2017 before declining to 4.7 million tons in 2018 and 3.3 million tons in 2019.

Construction boom helped Pakistan grow its domestic cement consumption by 17% in the first 7 months (July 2020-January 2021) of the current fiscal year. Domestic cement sales rose to 27.65 million tons in this period, while exports grew by 10.23% to 5.71million tons from 5.186 million tons in the same period last year. The total cement sales (local and exports) were 33.36 million tons, up 15.77% over the corresponding period of the last fiscal year.

Related Links:

Pakistan to Become World's 6th Largest Cement Producer By 2030

Pakistan's Response to COVID19 Pandemic

Pakistan Digital Economy Surged 69% Amid Covid19 Pandemic

Soaring Food Prices Hurting Pakistanis

Najam Sethi on Desperation in PDM Ranks

India's Firehose of Falsehoods Against Pakistan

-

Comment by Riaz Haq on January 31, 2022 at 7:41am

-

@haqsmusings

·

13h

Unfortunately,

@AtifRMian

only sees #Pakistan’s glass half empty. He refuses to even acknowledge the country’s progress on growing #export & change in #energy mix to lower imports.He ignores transitory high #energy prices causing current account deficits. https://southasiainvestor.com/2022/01/pakistan-economy-not-in-good-...

Omer Zeshan Khan

@OmerZeshanKhan

·

8h

Export growth is low end and for limited time (a bonus). Previous Govt did a few things for localisation (car/mobile/edible oil). Haven’t seen these guys doing anything. They are just sitting and talking. Pakistan’s economy is robust enough to feed people while Govt waits.

Omer Zeshan Khan

@OmerZeshanKhan

·

·

Riaz Haq

@haqsmusings

·

3h

#ImranKhan’s #NayaPakistan housing program is a good idea, especially the incentives for small & medium mortgages for the lower middle class. It’s boosting #employment in #Construction & #manufacturing sectors as well as the housing stock http://riazhaq.com/2020/07/naya-pakistan-low-cost-home-loans-and.html

Omer Zeshan Khan

@OmerZeshanKhan

·

2h

Can you name one project under Naya Pakistan Housing?

Riaz Haq

@haqsmusings

Replying to

@OmerZeshanKhan

@Muslims4USA

and

@AtifRMian

#Housing #Mortgage financing in #Pakistan jumped 85% last year, according to the State Bank. “Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021”

https://twitter.com/haqsmusings/status/1488166329769070596?s=20&...

https://www.thenews.com.pk/amp/923033-banks-disburse-rs355bln-housi...

KARACHI: Credit to the housing and construction sector increased by record Rs163 billion or 85 percent in 2021, mainly driven by the central bank’s rules to encourage mortgages and incentives and penalties for lenders with respect to achieving or failing housing finance targets.

Banks disbursed Rs355 billion housing loans in 2021, compared with Rs192 billion in the previous year, the State Bank of Pakistan said in a statement on Thursday.

Disbursement of low-cost housing loans under the Government Markup Subsidy scheme, also known as Mera Pakistan Mera Ghar (MPMG), reached Rs38 billion last year. In December, banks extended Rs9.3 billion loans to the borrowers; highest monthly disbursement since January 2021.

Analysts said tighter monetary conditions usually affect mortgages as the SBP has jacked up interest rates by 275 basis points in three moves since September. Currently, the policy rate hovers at 9.75 percent.

However, the government’s mark-up subsidy scheme looks to remain protected from an upward move in interest rates as the government is providing subsidy to the mortgage clients for the first 10 years.

Habib Bank, Meezan Bank and Bank Al Habib were the top three contributors, said the SBP.

Banks also made significant progress in the provision of financing under MPMG scheme, introduced in 2020, it added.

“Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021. The banks have received requests of financing of Rs276 billion from potential customers, which indicates that approvals and disbursements will keep growing in coming months.”

Bank Alfalah emerged as the leading bank with highest disbursement of Rs3.3 billion followed by nine banks with disbursements of over Rs2 billion each. These include Meezan Bank, Bank Islami, National Bank, Standard Chartered Bank, HBFCL, United Bank, MCB Bank, Bank of Punjab and Habib Bank, said the statement.

Financing for housing and construction and particularly under MPMG witnessed impressive growth on the back of many enabling regulatory environments introduced after extensive consultation with stakeholders, the SBP noted.

Further, the SBP said it advised the banks to increase their housing and construction finance portfolios to at least 5 percent of their domestic private sector advances till December 2021, introducing a set of incentives and penalties to ensure compliance.

-

Comment by Riaz Haq on January 31, 2022 at 7:49am

-

@haqsmusings

·

13h

Unfortunately,

@AtifRMian

only sees #Pakistan’s glass half empty. He refuses to even acknowledge the country’s progress on growing #export & change in #energy mix to lower imports.He ignores transitory high #energy prices causing current account deficits. https://southasiainvestor.com/2022/01/pakistan-economy-not-in-good-...

Omer Zeshan Khan

@OmerZeshanKhan

·

8h

Export growth is low end and for limited time (a bonus). Previous Govt did a few things for localisation (car/mobile/edible oil). Haven’t seen these guys doing anything. They are just sitting and talking. Pakistan’s economy is robust enough to feed people while Govt waits.

Omer Zeshan Khan

@OmerZeshanKhan

·

·

Riaz Haq

@haqsmusings

·

3h

#ImranKhan’s #NayaPakistan housing program is a good idea, especially the incentives for small & medium mortgages for the lower middle class. It’s boosting #employment in #Construction & #manufacturing sectors as well as the housing stock http://riazhaq.com/2020/07/naya-pakistan-low-cost-home-loans-and.html

Omer Zeshan Khan

@OmerZeshanKhan

·

2h

Can you name one project under Naya Pakistan Housing?

Riaz Haq

@haqsmusings

Replying to

@OmerZeshanKhan

@Muslims4USA

and

@AtifRMian

#Housing #Mortgage financing in #Pakistan jumped 85% last year, according to the State Bank. “Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021”

https://twitter.com/haqsmusings/status/1488166329769070596?s=20&...

https://www.thenews.com.pk/amp/923033-banks-disburse-rs355bln-housi...

KARACHI: Credit to the housing and construction sector increased by record Rs163 billion or 85 percent in 2021, mainly driven by the central bank’s rules to encourage mortgages and incentives and penalties for lenders with respect to achieving or failing housing finance targets.

Banks disbursed Rs355 billion housing loans in 2021, compared with Rs192 billion in the previous year, the State Bank of Pakistan said in a statement on Thursday.

Disbursement of low-cost housing loans under the Government Markup Subsidy scheme, also known as Mera Pakistan Mera Ghar (MPMG), reached Rs38 billion last year. In December, banks extended Rs9.3 billion loans to the borrowers; highest monthly disbursement since January 2021.

Analysts said tighter monetary conditions usually affect mortgages as the SBP has jacked up interest rates by 275 basis points in three moves since September. Currently, the policy rate hovers at 9.75 percent.

However, the government’s mark-up subsidy scheme looks to remain protected from an upward move in interest rates as the government is providing subsidy to the mortgage clients for the first 10 years.

Habib Bank, Meezan Bank and Bank Al Habib were the top three contributors, said the SBP.

Banks also made significant progress in the provision of financing under MPMG scheme, introduced in 2020, it added.

“Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021. The banks have received requests of financing of Rs276 billion from potential customers, which indicates that approvals and disbursements will keep growing in coming months.”

Bank Alfalah emerged as the leading bank with highest disbursement of Rs3.3 billion followed by nine banks with disbursements of over Rs2 billion each. These include Meezan Bank, Bank Islami, National Bank, Standard Chartered Bank, HBFCL, United Bank, MCB Bank, Bank of Punjab and Habib Bank, said the statement.

Financing for housing and construction and particularly under MPMG witnessed impressive growth on the back of many enabling regulatory environments introduced after extensive consultation with stakeholders, the SBP noted.

Further, the SBP said it advised the banks to increase their housing and construction finance portfolios to at least 5 percent of their domestic private sector advances till December 2021, introducing a set of incentives and penalties to ensure compliance.

-

Comment by Riaz Haq on February 7, 2022 at 5:30pm

-

#Pakistan’s Ijara Starts 5 Billion PKR ($29 million) Private Equity Fund to Support #Construction, #RealEstate. It claims to offer an internal rate of return between 25% and 30%. PM Imran Khan #PMIK encourages a construction boom. #PTI #jobs #economy

https://www.bloomberg.com/news/articles/2022-02-07/pakistan-s-ijara...

Pakistan’s Ijara Capital Partners Ltd. has launched a private equity fund to raise five billion rupees ($29 million) to invest in real estate projects as Prime Minister Imran Khan encourages a construction boom.

The fund will be raised and deployed in multiple projects within six months, Farrukh Ansari, chief executive officer at Ijara Capital, said in an interview. It will offer an internal rate of return between 25% and 30%, he said.

-

Comment by Riaz Haq on February 11, 2022 at 10:59am

-

#imrankhanPTI: over 70,000 #housing projects worth Rs1.4 trillion have been approved, which will have an overall impact of Rs 7.3 trillion on the #construction industry, and 1.2 million new #jobs will be created. #Pakistan #NayaPakistan https://www.brecorder.com/news/40153680

Prime Minister Imran Khan said that over 70,000 housing projects worth Rs1.4 trillion have been approved, which will have an overall impact of Rs7.3 trillion on the construction industry, and 1.2 million new jobs will be created.

“It is our government’s huge achievement that out of the total 80,000 applications, 35,420 applications amounting to Rs130 billion have been approved. A total of Rs46 billion has been disbursed to 13,407 applicants so far,” he said, while chairing a meeting of the NCC on Housing, Construction and Development, here on Thursday.

He added that applications worth Rs7 billion are being received weekly out of which Rs4 billion are approved and Rs2 billion is being disbursed every week, which shows that the devised system is working efficiently. “PTI’s government has achieved huge milestones regarding provision of low-cost housing to lower and middle-income class,” he added. He further said the government’s biggest challenge was to change the elitist mindset of financial institutions and ensure facilitation of common people in getting loans.

Average loan worth 36 lakhs in the approved and disbursed loans figure shows that the biggest beneficiary of subsidized loans is the middle- and lower-income class, he said.

In the last three years of the government, a 148 percent increase in housing finance and expected approval of Rs517 billion till December 2022, reflects the steps taken by the government to facilitate low-cost housing and construction industry, he added.

Housing Finance: Growth, but!

The prime minister said that in line with the manifesto of the PTI, the government is moving in the direction to add one percent every year in the housing finance against our GDP that will result in a construction boom and provision of houses to the lower and middle income class.

The meeting was briefed that for the very first time in the history of Pakistan, a sustainable ecosystem for low-cost housing has been developed and implemented, which has enabled the sector to achieve exponential growth.

The Foreclosure Law has been implemented in letter and spirit and long-term loans (up to 20 years) with subsidized mark-up (as low as only two percent) are being given. In addition to that a cost subsidy of Rs300,000 for low-income housing schemes and 90 percent tax waiver has resulted in encouraging the private sector, which is actively participating in the construction of housing units under the schemes.

The projects include urban, peri-urban, urban regeneration, government-funded and private sector projects.

The meeting was also briefed about the transparent and automated process to receive and process the applications, which has resulted in targeting the needful lower and middle-income class.

This is being ensured by the development of one-window digital portal with automated application tracking system by development authorities.

The meeting was also briefed on figures regarding the total low-cost housing construction activity so far after 2018. A total of 161,924 low-cost housing units were approved, out of which 45,191 units are under construction and 20,898 units have been completed, which is significant, bearing in mind that before the subsidies by the government, foreclosure law and low-cost housing schemes by the PTI’s government, the sector was in a shambles.

A break-up of the government financed low-cost housing projects was also given according to which 4,000 units in Farash Town, 4,000 units in LDA City, 1,320 units in Jalozai, 245 units in Raiwind, 324 units in Sargodha and Chiniot, and 1,800 units at Angoori Road are being constructed with completion deadlines before the end of 2022.

-

Comment by Riaz Haq on May 5, 2022 at 5:12pm

-

Pakistan steel production rose from 3.3 million tons in 2019 (rank 40) to 3.8 million tons in 2020 (36).

In addition, Pakistan imported 2.3 million tons of steel in 2020.

Total Consumption in 2020: 6.1 million tons.

https://worldsteel.org/wp-content/uploads/2021-World-Steel-in-Figur...

-

Comment by Riaz Haq on May 13, 2022 at 7:31am

-

#Pakistan’s #Manufacturing (LSMI) grew by 26.6% YoY during March 2022 and 10.4% YoY during July-March FY22 as compared to the same period of the previous fiscal year. #PTI #imrankhanPTI #economy @PTIofficial @ImranKhanPTI https://mettisglobal.news/lsmi-output-records-highest-growth-of-27-...

https://twitter.com/haqsmusings/status/1525119740947050497?s=20&...

May 13, 2022 (MLN): Pakistan’s Large Scale Manufacturing Industries (LSMI) production grew by 26.6% YoY during March 2022 which was the highest YoY increase after May’21, Pakistan Bureau of Statistics (PBS) reported on Thursday.

On a month-on-month basis, the LSMI growth witnessed an increase of 8.2% in the month against the previous month, whereas on average, the LSM grew by 10.4% YoY during July-March FY22 as compared to the same period of the previous fiscal year.

The growth during the month of March’22 was led by the Furniture, Food, and Apparel sectors as they posted growth of 186.5% YoY, 85% YoY, and 78.6% YoY respectively followed by Other Manufacturing (Football) (64.1% YoY), Wood Products (32.6% YoY), Automobiles (26% YoY), Chemical products (17.1% YoY), Fertilizer (16.9% YoY), Pharmaceuticals (12.6% YoY), Paper & Board (11.6% YoY), Iron & Steel Products (11.2% YoY), Petroleum Products (8.1% YoY), Computer, electronics and Optical Products (6% YoY), Textile (5.1% YoY), Non-Metallic Mineral Products (4.2% YoY), and Rubber Products (0.2% YoY).

While the industries that contracted during the month were Beverages (-6% YoY), Tobacco (-1.4% YoY), Leather Products (-7.6% YoY), Machinery and Equipment (-10.9% YoY), Fabricated Metal (-6.1% YoY), Electrical Equipment (-1.5% YoY), and Other Transport Equipment (-11.7% YoY).

On a cumulative basis, during 9MFY22 out of 22 major industries, 17 posted positive growth while the rest of the 5 industries' witnessed a decline.

The sector-wise performance revealed that the production in Food, Beverages, Tobacco, Textile, Chemicals, Automobiles, Iron & Steel Products, Leather Products and Paper & Paperboard sectors have surged by 11.7% YoY, 0.7% YoY, 16.7% YoY, 10.61% YoY, 3.2% YoY, 7.8% YoY, 54.1% YoY, 16.5% YoY, 1.5% YoY, and 8.5% YoY respectively during Jul-March FY22, compared to the performance in Jul-March FY21.

On the other hand, the dismal numbers were witnessed in Pharmaceuticals, Rubber Products, Fabricated Metal, Electrical Equipment, and Other Transport Equipment industries as their production dropped by 0.4% YoY, 20.6% YoY, 7.2% YoY, 1.1% YoY, and 10.2% YoY respectively during 9MFY22.

-

Comment by Riaz Haq on June 13, 2022 at 1:40pm

-

Economic Survey of Pakistan 2021-22 (Manufacturing & Mining Chapter)

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

During July-March FY2022, LSM staged

the growth of 10.4 percent against 4.24

percent growth in the corresponding

period last year. Production of 11 items

under the Oil Companies Advisory

Committee increased by 2.0 percent, 36

items under the Ministry of Industries and

Production surged by 10.3 percent, while 76 items reported by the Provincial Bureaus

of Statistics increased by 12.1 percent. The expansion of LSM is also appeared to be

broad based, with 17 out of 22 sectors of LSM witnessed a positive growth. Furniture,

Wood Products, Automobile, Footballs, Tobacco, Iron & Steel Products, Machinery and

Equipment, and Chemical Products remained the top performing sectors of LSM.

----------

Automobile sector marked a vigorous growth of 54.1 percent during July-March FY2022

against 21.6 percent growth last year. New Auto Policy, to promote new technologies

including Electric Vehicles (EVs) and Hybrid, and accommodative monetary policy to

promote auto financing paved the way to grew automobiles production. Besides, tax

incentives to promote locally manufactured cars also pent-up the demand as well as the

production of the given sector such as locally manufactured hybrid sales tax reduced

from 12.5 percent to 8 percent and FED reduced by 2.5 percent upto 1300cc for locally

manufactured cars. Moreover, during July-March FY2022 car production and sale

increased by 56.7 and 53.8 percent, respectively. Trucks & Buses production and sale

increased by 66.0 and 54.0 percent and tractor production and sale increased by 13.5

and 12.1 percent, respectively. Though the relief measures in form of waiving of taxes

pushed up the sector, in the meanwhile reduced the revenues of national exchequer and

built the pressure on imports besides creating uncertainty in market sentiments.

-------------

In case of passenger cars, the production and sales are up by 57 percent and 54 percent

with 166,768 and 172,612 units, respectively. In this regard, higher growth has been

observed in up to 800cc and up to 1000cc segments registering 77 percent and 65

percent growth, respectively. Growth in exceeding 1000cc segment was 35 percent. For

similar reasons, the production and the sales of light commercial vehicles (LCV) and

SUVs registered increase by 44 percent and 46 percent, respectively. In the SUV and SUV

crossover segment two new products appear from Beijing Automotive Industry, BAIC

BJ40L and BAIC X25 with modest numbers which are expected to grow in time.

Farm tractor sector has shown growth with production and the sales up by 13.5 percent

and 12 percent respectively. This pleasant upward surge was due to overall growth in

agriculture sector ensuing better crop prices and consequent more buying power of the

farmers. However, these numbers are not even close to the highest numbers this

industry had achieved in the past.

The two/three wheelers sector showed modest fall in production and the sales by 3.5

percent and 4.1 percent respectively. This fall is due intra-industry production losses by

some units, while other units have shown their natural growth. Two/three wheelers

offers most economical public transport alternate for the lower income group, however,

at same time, it is extremely price sensitive. Massive exchange rate losses kicked off

inflationary conditions resulting inevitable price increase. Still, this sector offers most

preferred means of transport and best alternative in the absence of Public Transport in

the cities and thus holds a dependable and continued potential for growth in the coming

years.

-

Comment by Riaz Haq on July 9, 2022 at 9:51pm

-

Pakistan’s cement dispatches drop in 2022 financial year

https://www.globalvillagespace.com/pakistans-cement-exports-fall-by...

According to the dispatch split, northern-based mills shipped 39.44Mt of cement domestically during the FY21–22, which is 2.8% less than the 40.58Mt shipped during the FY20–21. From FY21–22 to FY21–22, the north’s exports decreased by 64.5% to 910,685t, compared to 2.56Mt exported in the prior fiscal year.

Domestic shipments by southern-based mills in FY21–22 totaled 8.19 Mt, up 8.7% from 7.53 Mt of cement in the prior fiscal year. However, exports from the southern zone had a significant reduction of about 35.6%, falling from 6.74Mt in the fiscal year to 4.34Mt in FY21-22.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump's Tariffs on India: Can China or Russia Make Up For Lost Exports to US?

The United States is the biggest export market for India. Among its top 5 trading partners, the US is also the only country with which India runs a trade surplus. This surplus is now at risk with the 50% tariff recently imposed by President Donald Trump on imports from India. Can Prime Minister Narendra make up for it by cozying up to China and Russia? Recent trade data shows he…

ContinuePosted by Riaz Haq on September 8, 2025 at 7:00pm

US-India Ties: Does Trump Have a Grand Strategy?

Since the dawn of the 21st century, the US strategy has been to woo India and to build it up as a counterweight to rising China in the Indo-Pacific region. Most beltway analysts agree with this policy. However, the current Trump administration has taken significant actions, such as the imposition of 50% tariffs on India's exports to the US, that appear to defy this conventional wisdom widely shared in the West. Does President Trump have a grand strategy guiding these actions? George…

ContinuePosted by Riaz Haq on August 31, 2025 at 6:30pm — 11 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network