PakAlumni Worldwide: The Global Social Network

The Global Social Network

Comparing Pakistan Gas Deals With Qatar and Iran

Pakistan will import as much as 20 million tons of the super-chilled gas annually from various sources including Qatar, enough to fuel about two-thirds of Pakistan’s power plants. Gas shortage has idled half the nation’s generators. A 75 percent drop in LNG prices since 2014 has dramatically reduced the cost of the South Asian country’s energy needs, according to a Bloomberg report.

LNG arriving in Pakistan from Qatar will fetch 13.37% of the preceding three-month average price of a Brent barrel (considering the present Brent price as a proxy, that would equate to $167.5 per 1000 cubic meters), according to a report in Azerbaijan's Trend News. It translates to $4.50 per million BTUs.

A comparison with Iran's gas deals with Turkey and Iraq indicates that Iranian gas will not be competitive with Qatari LNG on Pakistani market.

In 2014 Iran was exporting gas to Turkey at above $420 per 1000 cubic meters, but the figure plunged to $225, or $6 per million BTUs, currently due to low oil price. Iran previously said that the price of gas for Iraq would be similar to Turkey's price.

International Chamber of Commerce (ICC) arbitration court has recently ordered Iran to reduce its gas price to Turkey by 15% after Turkey complained. It's not clear if Iran will comply but even if it does, its price will still be $5.10 per million BTUs, much higher than the Qatari LNG price of $4.50 per million BTUs for Pakistan.

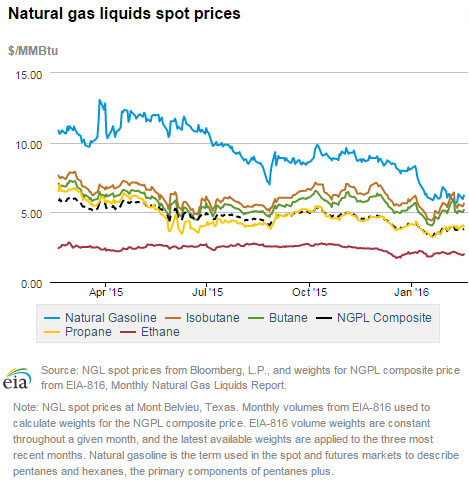

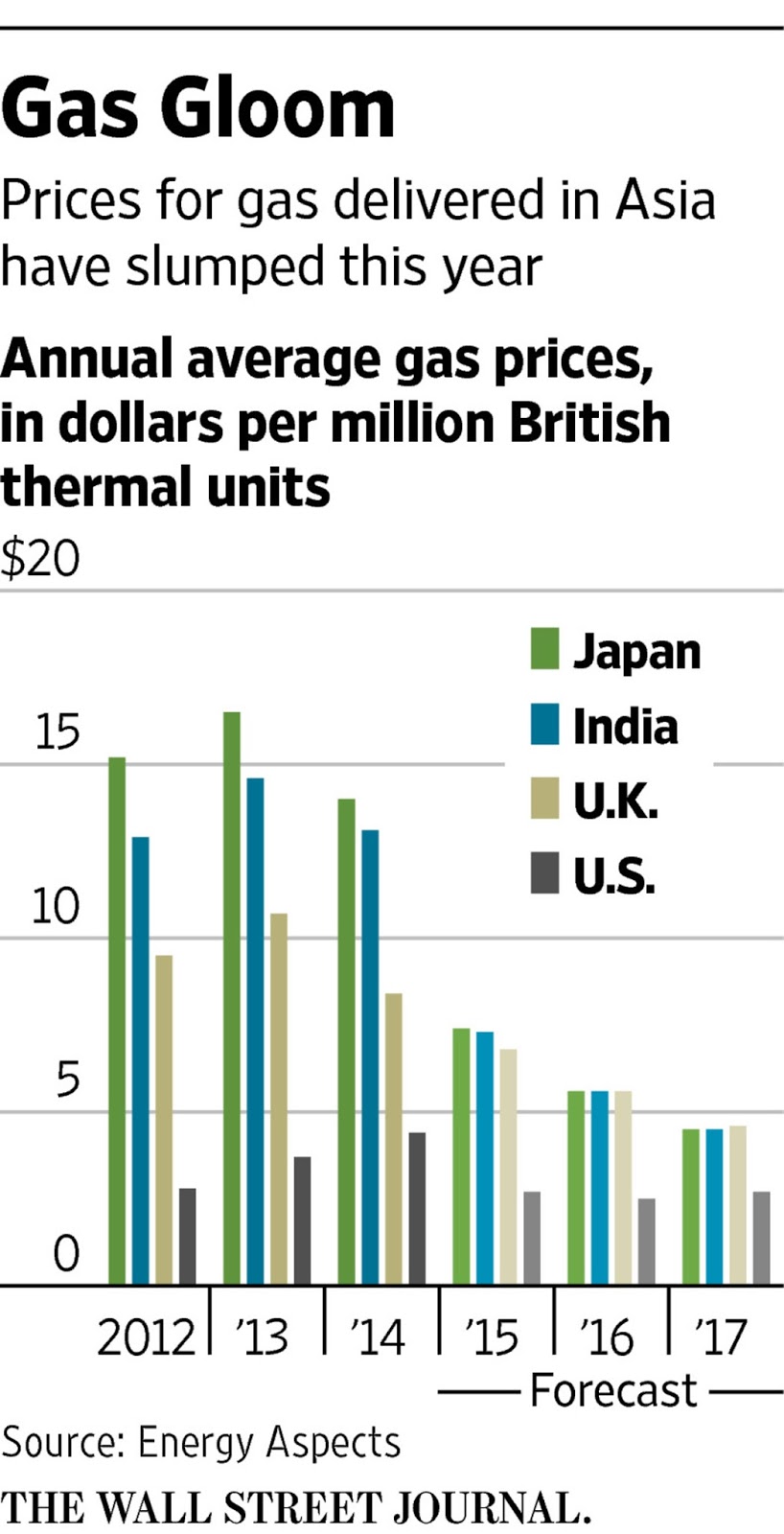

As recently as two years ago, LNG shipped to big North Asian consumer like Japan and Korea sold at around $15 to $16 a million British thermal units. Late last year, the price hit $6.65 a million BTUs, down 12% from September, according to research firm Energy Aspects. It expects prices to fall further in Asia this year, to under $6 per million BTUs, as a wave of new gas supply in countries from the U.S. to Angola to Australia comes on line, according to Wall Street Journal.

Petronet LNG Ltd, India’s biggest importer of liquefied natural gas (LNG), is saving so much money buying the commodity from the spot market that it’s willing to risk penalties for breaking long-term contracts with Qatar.

Will Pakistan be able to negotiate a better price with Iran? It seems difficult given the fact that Iranians have a reputation of being very difficult to deal with. Here's an excerpt about Iranians' negotiating style from Iranian-American author Vali Nasr's book "The Dispensable Nation":

"I remember a conversation in 2006 with Jack Straw, who was then Britain’s foreign secretary, about his time talking to Iran. He said, People think North Koreans are difficult to negotiate with. Let me tell you, your countrymen [Iranians] are the most difficult people to negotiate with. Imagine buying a car. You negotiate for a whole month over the price and terms of the deal. You reach an agreement and go to pick up the car. You see it has no tires. “But the tires were not part of the discussion,” the seller says. “We negotiated over the car.” You have to start all over again, now wondering whether you have to worry about the metal rim, screws, or any other unknown part of the car. That should give you a sense of what talking to Iran looks like".

|

| Source: US EIA |

|

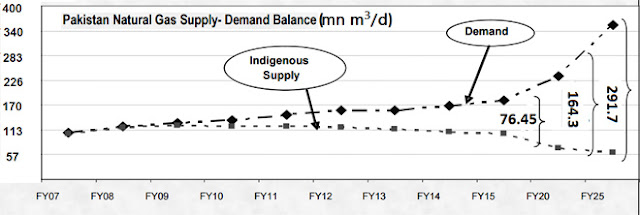

| Growing Demand-Supply Gap in Pakistan |

In addition to signing the Qatar LNG deal, Pakistan has launched its first LNG import terminal in Karachi and started receiving shipments from Qatar. Pakistan has also signed a $2 billion deal with Russians to build a north-south pipeline from Gwadar to Lahore. But the country needs to rapidly build up capacity to handle imports and distribution of significant volumes of LNG needed to resolve its acute long-running energy crisis.

Here's a related video discussion:

http://dai.ly/x3ccasi

Pakistan Local Elections; Indian Hindu... by ViewpointFromOverseas

https://vimeo.com/144586144

Pakistan Local Elections; Indian Hindu Extremism; LNG Pricing; Imra... from WBT TV on Vimeo.

https://youtu.be/LZavD-tkReg

Related Links:

Haq's Musings

Can Pakistan Take Advantage of Historic Low LNG Prices?

Pakistan's Twin Energy Crises of Gas and Electricity

Affordable Fuel For Pakistan's Power Generation

Pakistan Shale Oil and Gas Deposits

China-Pakistan Economic Corridor

Blackouts and Bailouts in Energy Rich Pakistan

Pakistanis Suffer Load Shedding While IPPs Profits Surge

-

Comment by Riaz Haq on February 19, 2016 at 8:49pm

-

Under the (LNG) agreement (with Qatar), the LNG price with QG2 could be reviewed once, after the 10th anniversary of the start date. In case of failure of price review, either party could terminate the agreement with effect from the end of the contract year in which the termination notice was served. Simply put, the minimum supply period under the agreement would not be less than 11 years.

The price agreed for each LNG cargo discharged in a particular month is 13.37pc of preceding three month average of Brent value. Annual contract LNG quantity for first year (2016) would be prorate of 2.25m tons and first quarter of 2017 after which the quantity would be increased to 3.75m tons per annum beginning second quarter of 2017.

The long-term agreement also provides for annual upward and downward flexibilities of up to three LNG cargoes per contract year. Downward flexibility can be accumulated for two contract years. Under the ‘take or pay’ clause of the agreement, Pakistan is required to take full contracted LNG or else pay full cost even if it fails to receive LNG quantities for any reason. The PSO would be required to make full payment 15 days after the completion of LNG unloading.

In order to ensure that the payment is made within 15 days, the PSO would provide Standby Letter of Credit to Qatargas at 105pc of the value of four LNG cargoes during the first year. From second year onwards, the PSO would provide the letter of credit of 105pc of the value of six cargoes.

The government said it had also carried out a price comparison of all long-term gas import options, including previous LNG import attempts at indicative Brent price of $40 per barrel, suggesting that LNG import from Qatar would be the lowest.It said the delivery ex-ship price of LNG under the Mashal Project terminated following court disputes at $40 per barrel worked out at $6.94 per MMBTU.

The price of integrated LNG import project at $40 Brent (Current Price is $30) was calculated at $6.01 per MMBTU ( Current $4.50 per MMBTU ).

Qatar had last offered $6.56 per MMBTU at Brent price of $40 per barrel while the current price is $5.35.

Compared with the natural gas import options, the government claimed the delivery price at border under the Iran-Pakistan gas pipeline was $5.70 per MMBTU at $40 Brent price and that of Turkmenistan-Afghanistan-Pakistan-India was $5.90.

-

Comment by Riaz Haq on March 1, 2016 at 9:08am

-

World's Largest #LNG ship with 216,000 cubic meters from #Qatar docks at Port Qasim in #Karachi #Pakistan http://www.samaa.tv/economy/2016/03/largest-lng-ship-docked-at-port... …

The first-ever ship of Liquified Natural Gas (LNG), after reaching an agreement between Pakistan and Qatar on LNG import last month, entered Pakistan’s maritime economic zone and was docked at Elengy Terminal at Port Qasim, Tuesday evening.

The Qatari ship is the largest vessel carrying LNG to Elengy Terminal and is one of the largest ships anchored at Port Qasim.

Its capacity is 216,000 cubic metres, said Elengy Terminal statement here.

After docking, the LNG ship was hooked up with FSRU Unit of Elengy Terminal for re-filling of gas process.

The ship would remain hooked up at the Elengy Terminal for two days till the process of re-gasification in pipeline is completed.

The next LNG ship from Qatar is scheduled to arrive at Port Qasim on March 8, 2016.

The Engro’s Elengy Terminal capacity has been enhanced to 400 mm CEFD, the statement said

-

Comment by Riaz Haq on April 23, 2016 at 1:07pm

-

#Iran envoy in #Delhi accuses #US, #India #LNG industry of blocking #Iran-#Pakistan-#India #gas pipeline project

http://www.newindianexpress.com/world/Iran-Pakistan-India-Gas-Pipel... …

Iranian ambassador Gholamreza Ansari also stressed that the "Americans will not let it happen".

"Those who have invested in the LNG (liquified petroleum gas) projects in India will not allow the pipeline venture to take off, he said at a media interaction at the Foreign Correspondnets' Club here Thursday evening..

"People who have invested in LNG in India, I don't think they will let any pipes to come in," he said.

"Americans are looking for the Indian market for the future and any sort of pipeline will put and end to these investments. So, I don't think pipeline can be a serious project. I am sure Americans will not let this project go ahead," he added.

He said that the Chabahar port project that will open up access to central Asia has been almost finalised.

"It has almost been finalised. Only the signatures at the ministerial level is due," he said.

-

Comment by Riaz Haq on February 9, 2018 at 10:04am

-

#Pakistan #LNG deal with #Qatar signed at higher than market rates, says audit report

https://tribune.com.pk/story/1629923/2-lng-deal-qatar-signed-higher...

The auditors complained that the petroleum ministry did not give the original document for audit.

Out of 32 audit paragraphs, only one directly referred to the LNG purchase from Qatar. “The price (13.37% of Brent crude) negotiated with Qatar was at a higher rate as Qatar was the source supplier of LNG whereas trading companies in open market were offering average rates lower than the one finalised with Qatar,” according to the audit’s objections.

Had open competition been allowed and other LNG producing countries permitted to submit bids for consideration of the Economic Coordination Committee (ECC), the government would have been able to procure LNG at lower rates, the audit report said.

The ECC in 2012 had decided that there would be international competitive bidding which the PML-N government changed and signed a sovereign deal.

The AGP department worked out the higher price by only comparing the five-year LNG import contracts signed by Pakistan State Oil (PSO) with the sovereign deal.

The price negotiation committee had recommended 13.9% of the Brent price, but the final deal was signed at 13.37% on the basis of short-term contracts that PSO signed with global commodity trader Gunvor for 60 LNG shipments, said the report.

But Pakistan entered into a 15-year contract that would require approximately 500 shipments, it added.

The AGP department had initiated the audit on its own and later the then petroleum minister expressed the desire to give a presentation to the auditors to explain the whole issue, said former Auditor General of Pakistan Rana Asad Amin.

The study said the federal cabinet did not approve the LNG deal with Qatar and approvals were given by the ECC. The agreement for cooperation in the energy sector was signed between the two states while the sale-purchase agreement was inked by PSO and Qatar Gas-2 in 2016.

The report said the petroleum ministry did not analyse the expert studies carried out by two consulting firms – Fact Global Energy and QED Gas Consulting – and the studies were missing from the ministry’s records.

However, the report did highlight some irregularities committed by PSO, Sui Southern Gas Company (SSGC), Sui Northern Gas Pipelines (SNGPL), Inter State Gas Systems (ISGS), Engro Elengy Terminal Limited (EETL) and PSO.

The auditors objected to the Rs16.4 billion worth of LNG procurements by PSO terming them irregular as these were done without inviting tenders.

The special study also declared Rs10.2 billion worth of LNG procurements by PSO as “mis-procurements”, due to rate revisions after the opening of bids. But the petroleum ministry argued that the government saved money since the revised rates were lower than those quoted by the bidders.

PSO has also been accused of irregularly procuring Rs7.7 billion worth of LNG by giving less than the required time to the bidders for bid submission, which was in violation of the Public Procurement Regulatory Authority rules.

PSO was also accused of paying fender charges to EETL despite there being no such clause in the agreement.

The study said the agreed payment mechanisms had not been followed in the LNG supply chain, which in 2015-16 alone created Rs8.9-billion liability for SNGPL. SNGPL also could not recover Rs4.8 billion from independent power producers (IPPs) due to non-observance of the agreed payment mechanisms.

Doha to host Qatar-Pakistan business investment moot

The auditors pointed out that SNGPL did not receive standby letters of credit from the IPPs equivalent to Rs55 billion.

-

Comment by Riaz Haq on September 29, 2018 at 8:15am

-

#Qatar Petroleum to enhance #investment in #Pakistan. #LNG #gas http://disq.us/t/36rcydu

Doha: Qatar Petroleum President and CEO Saad Sherida Al Kaabi held talks in Islamabad with Imran Khan, the Prime Minister of Pakistan, on cooperation in the field of energy.

Al Kaabi reviewed Qatar Petroleum’s global portfolio and activities, particularly its efforts to help meet growing global demand for natural gas. He also expressed Qatar Petroleum’s keen interest to enhance its investment in Pakistan and to build on the existing solid relations between both sides.

Qatar Petroleum to enhance investment in Pakistan

The Peninsula

Doha: Qatar Petroleum President and CEO Saad Sherida Al Kaabi held talks in Islamabad with Imran Khan, the Prime Minister of Pakistan, on cooperation in the field of energy.

Al Kaabi reviewed Qatar Petroleum’s global portfolio and activities, particularly its efforts to help meet growing global demand for natural gas. He also expressed Qatar Petroleum’s keen interest to enhance its investment in Pakistan and to build on the existing solid relations between both sides.

Al Kaabi also stressed the importance Qatar Petroleum places on Pakistan as a promising energy market after the signing of the recent LNG agreement, and the commitment to secure its future energy needs, particularly LNG.

On his part, Khan welcomed Qatar Petroleum’s investment in Pakistan’s energy and petroleum sectors. He assured Al Kaabi of the Pakistani government’s full support and cooperation in this regard.

-

Comment by Riaz Haq on August 10, 2021 at 8:04am

-

#LNG prices surge as energy transition-driven demand outstrips supply. It’s especially bad news for poorer nations like #Pakistan and #Bangladesh that reworked entire #energy policies on the premise that the fuel’s price would be lower for longer. http://www.worldoil.com/news/2021/8/6/natural-gas-prices-surge-as-e...

The era of cheap natural gas is over, giving way to an age of far more costly energy that will create ripple effects across the global economy.

Natural gas, used to generate electricity and heat homes, was abundant and cheap during much of the last decade amid a boom in supply from the U.S. to Australia. That came crashing to a halt this year as demand drastically outpaced new supply. European gas rates reached a record this week, while deliveries of the liquefied fuel to Asia are near an all-time high for this time of year.

With few other options, the world is expected to depend more on cleaner-burning gas as a replacement to coal to help achieve near-term green goals. But as producers curb investments into new supply amid calls from climate-conscious investors and governments, it is becoming apparent that expensive energy is here to stay.

Already, there are signs around the world that supplies will fall short:

Beyond a massive expansion in Qatar, few new LNG export projects have been cleared since the start of 2020.

End-users have been less willing to take equity stakes in upstream projects or sign long-term supply deals due to uncertainty surrounding government-led efforts to reduce emissions.

U.S. shale drillers aren’t immediately responding with additional production, as they’re under pressure from investors to curb spending and avoid creating another glut, while key pipeline projects struggle to move forward.

“No matter how you look at it, gas will be the transition fuel for decades to come as major economies are committed to reach carbon emission targets,” said Chris Weafer, chief executive officer of Moscow-based Macro-Advisory Ltd. “The price of gas is more likely to stay elevated over the medium-term and to rise over the longer-term.”

Strong Consumption

By 2024, demand is forecast to jump 7% from pre-Covid-19 levels, according to the International Energy Agency. Looking further out, the appetite for liquefied natural gas is expected to grow by 3.4% a year through 2035, outpacing other fossil fuels, according to an analysis by McKinsey & Co.

Surging natural gas prices means it will be costlier to power factories or produce petrochemicals, rattling every corner of the global economy and fueling inflation fears. For consumers, it will bring higher monthly energy and gas utility bills. It will cost more to power a washing machine, take a hot shower and cook dinner.

It’s especially bad news for poorer nations like Pakistan and Bangladesh that reworked entire energy policies on the premise that the fuel’s price would be lower for longer.

European natural gas rates have surged more than 1,000% from a record low in May 2020 due to the pandemic, while Asian LNG rates have jumped about six-fold in the last year. Even prices in the U.S., where the shale revolution has significantly boosted production of the fuel, have rallied to the highest level for this time of year in a decade.

While there are several one-off factors that have pushed gas prices higher, such as supply disruptions, the global economic rebound and a lull in new LNG export plants, there is a growing consensus that the world is facing a structural shift, driven by the energy transition.

A decade ago, the IEA declared that the world may be entering a “golden age” of natural gas demand growth due to historic expansion of low-cost supply. Indeed, between 2009 and 2020, global gas consumption surged by 30% as utilities and industries took advantage of booming output.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan to Explore Legalization of Cryptocurrency

Islamabad is establishing the Pakistan Crypto Council (PCC) to look into regulating and legalizing the use of cryptocurrencies, according to media reports. Cryptocurrency refers to digital currencies that can be used to make purchases or investments using encryption algorithms. US President Donald Trump's endorsement of cryptocurrencies and creation of a "bitcoin reserve" has boosted investors’…

ContinuePosted by Riaz Haq on March 28, 2025 at 8:30pm — 3 Comments

World Happiness Report 2025: Poor Ranking Makes Indians Very Unhappy

Pakistan has outranked India yet again on the World Happiness Index, making Indians very very unhappy. Indian media commentators' strong negative emotional reaction to their nation's poor ranking betrays how unhappy they are even as they insist they are happier than their neighbors. Coming from the privileged upper castes, these commentators call the report "…

ContinuePosted by Riaz Haq on March 22, 2025 at 10:30am — 7 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network