PakAlumni Worldwide: The Global Social Network

The Global Social Network

Bumper Crops And Soaring Credit Drive Pakistan's Tractor Sales Boom

First seven months of the current fiscal year have seen tractor sales soar 45% to 38,173 units, according to data of the Pakistan Automotive Manufacturers Association. It is driven by a combination of soaring credit availability and bumper harvests of Pakistan's top three crops by area: wheat, cotton and rice.

Tractor Sales:

First seven months of the current fiscal year have seen tractor sales soar 45% to 38,173 units, according to data of the Pakistan Automotive Manufacturers Association. This is good news for Pakistan's tractor industry that has been in slump for several years as the agriculture output was stagnant.

Pakistani farmers use tractors for a variety of usual tasks ranging from tilling and planting to harvest and transport. Tractor owners recover their costs from more efficiently working their farms and renting out equipment when they are not in their own use.

Agriculture Credit Growth:

Pakistani banks provided Rs 500 billion (nearly $5 billion) worth of agricultural credit during the first seven months, July-January period, of current fiscal year. It represents a 45% jump from the same period last year, according to media reports.

According to State Bank of Pakistan (SBP), commercial banks, specialized banks, Islamic banks, domestic private banks, microfinance banks and other microfinance institutions have together disbursed Rs 499.645 billion during the period under review, up Rs. 351.358 billion in the same period of last fiscal year.

Top Three Crops:

Wheat output is expected to be near all time high of 26 million tons. Cotton production is forecast to exceed 11.5 million bales, up from 10.6 million bales last year.

Pakistan rice exports have reached 2.59 million tons worth US$ 1.224 billion in the first 7 months, up from 2.27 million tons worth US$.961 Million last year, recording growth of 27% in value and 14% quantity.

Pakistan ranks among the world's biggest producers of a variety of crops including wheat, cotton, rice, corn, sugarcane, onions, chickpeas and fruits, according to Food and Agriculture Organization Stats (FAOSTAT).

Crops vs Livestock:

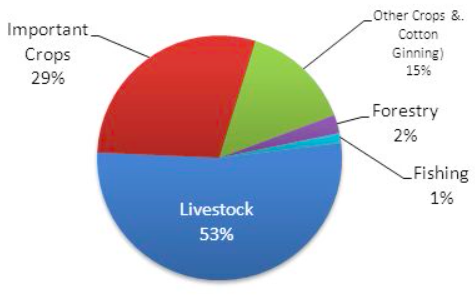

Livestock farming contributes 53% while crops make up about 42% of Pakistan's agriculture output. The rest comes from fishing and forestry.

Pakistani livestock sector has growing much faster than the crop sector and more recent estimates show its contribution has increased to 56.3% of the value of agriculture and nearly 11% to the agricultural gross domestic product (AGDP). It's driven by growing domestic demand for meat and dairy products.

Crop Yields:

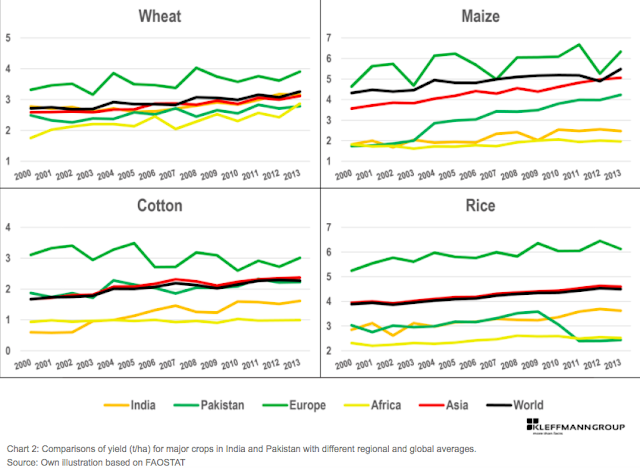

Pakistan's crop yields are comparable to India, among the lowest in the world, according to FAO (Food and Agriculture Organization) data.

World's highest crop yields are seen in Europe while the lowest are in Africa.

|

| Maize, Potato, Rice and Wheat Yields in Hectograms/Hectare. Source:... |

Value Added Agriculture:

Livestock revolution enabled Pakistan to significantly raise agriculture productivity and rural incomes in 1980s. Economic activity in dairy, meat and poultry sectors now accounts for just over 50% of the nation's total agricultural output. The result is that per capita value added to agriculture in Pakistan is almost twice as much as that in Bangladesh and India.

Although Pakistan's value added to agriculture is high for its region, it has been essentially flat since mid-1990s. It also lags significantly behind developing countries in other parts of the world. For example, per capita worker productivity in North Africa and the Middle East is more than twice that of Pakistan while in Latin America it is more than three times higher.

CPEC Long Term Plan:

Beyond the current phase of China Pakistan Economic Corridor (CPEC) focus on energy and infrastructure projects, there is a long term plan that deals with modernizing Pakistan's agriculture. CPEC LTP outlines a more comprehensive effort involving the entire supply chain from agriculture inputs like seeds, fertilizer, credit and pesticides to logistics such as storage and transportation systems.

Summary:

Pakistan ranks among the world's top producers of a number of major crops including wheat, cotton and rice. Soaring tractor sales are being driven by a combination of rising credit availability and bumper harvests of major crops in the country this year. But the farm productivity and yields are still among the lowest in the world. CPEC LTP (long term plan) offers hope of significant improvements in agriculture sector to reach its full potential.

Related Links:

Value Added Agriculture in Pakistan

Agribusiness Drawing Investors to Pakistan

China Pakistan Economic Corridor

An Indian Farmer Commits Suicide Every 30 Minutes

-

Comment by Akhtar Hussain on March 25, 2018 at 12:16am

-

Impressive stuff. And they said Pakistan is a failed state ??

-

Comment by Riaz Haq on April 8, 2018 at 8:27pm

-

Pakistan’s economy set to surpass last year’s growth rate

https://dailytimes.com.pk/224735/pakistans-economy-set-to-surpass-l...

Pakistan’s economy is set to surpass last year’s growth rate, with continued strong performances by agriculture and services, and a four-year record high large-scale manufacturing growth during the first half of FY18. Inflation and the fiscal deficit were both contained, whereas revenue growth has outpaced last year’s level.

The report pointed out that increased consumer spending has led to a strong growth in durables such as automobile and electronics, while the ongoing infrastructure and construction activities have stimulated the allied sectors of cement and steel.

Encouragingly, various industrial players across different sectors are investing in capacity expansions and product diversification. The private sector also continued its borrowing from scheduled banks for long-term projects.

On the agriculture front, while all major kharif crops performed well, wheat production came under pressure due to lower area under cultivation.

With adequate inventory of key food items, such as wheat, sugar and pulses, prices of these commodities remained low, keeping food inflation in check.

Favorable adjustment in the duty structure of cigarettes led to a sharp fall in its price. Meanwhile, core inflation remained higher on average in H1-FY18 due to continuously rising education and healthcare costs. However, its pace has stabilized in recent months.

The report highlighted that the growth in revenue collection outpaced the increase in expenditures in H1-FY18, which led to a broad-based improvement in fiscal indicators.

The overall fiscal deficit was contained at 2.2 percent of GDP, down from last year’s 2.5 percent. Revenue growth gained impetus from greater real economic activity, rising imports (both quantum and prices), and higher sales volumes of POL products.

Non-tax revenues also rose over last year, led by higher SBP profit and a surge in receipts from property and enterprise, civil administration and other miscellaneous receipts.

On a cautionary note, the report added that while the real sector of the economy was performing well, the external account presented challenges.

The 8-month-long consecutive export growth and a rebound in workers’ remittances were welcome developments, but they were overshadowed by rising imports.

Resultantly, the current account deficit increased to $ 7.4 billion in H1-FY18, from $ 4.7 billion last year. Even though financial inflows were higher this year, they were insufficient to offset the rise in the current account deficit.

Consequently, SBP’s liquid reserves came under pressure, and the PKR/USD parity depreciated by 5.0 percent in H1-FY18.

While concluding, the report referred to the Pakistan economy having reached a familiar juncture, where Balance of Payments challenges warrant concerted and timely measures to preserve the macroeconomic stability and growth momentum.

If the external challenges are addressed, other fundamentals are strong enough to put it on a sustainably high growth path.

-

Comment by Riaz Haq on April 12, 2018 at 8:32am

-

#Pakistan's #manufacturing growth increases 6.24% for 8 months of FY 2017-18. #LSM Quantum Index Numbers (QIM) rose to 145.28 points July 2017 to Feb 2018 compared with 136.75 points in same period in prior fiscal year. #economy #industry - Xinhua | http://www.xinhuanet.com/english/2018-04/11/c_137101207.htm#0-twi-1... …

Pakistan's large scale manufacturing (LSM) industries grew by 6.24 percent during the first eight months of the fiscal year of 2017-18 on a yearly comparison, the Pakistan Bureau of Statistics (PBS) said on Tuesday.

According to the official data, the South Asian country's LSM Quantum Index Numbers (QIM) were clocked at 145.28 points during the period for July 2017 to February 2018 when compared with 136.75 points recorded during the same duration of the previous fiscal year.

The Pakistan Bureau of Statistics, which is Pakistan's premier government institution to release official economic data, said Pakistan recorded the highest growth of 4.08 percent in the indices monitored by the Ministry of Industries, followed by 1.54 percent growth in the products monitored by the Provincial Bureau of Statistics, and 0.62 percent growth in the indices of the Oil Company Advisory Committee (OCAC).

In the month of February 2018, the South Asian country's industrial growth surged by 5.52 percent when compared with the same month of last year. On the other hand, the industrial growth shrank by 1.51 percent in February 2018 when compared with the growth posted in January 2018.

According to the official figures, the major sectors which posted growth during the reporting period were textiles with 0.47 percent, food, beverages and tobacco with 2.33 percent and 10.26 percent in coke and petroleum products sector.

On the flip side, the LSM industries which remained in the red ink included chemicals production, fertilizers production, leather products, and wood products.

The Pakistan Bureau of Statistics computes the provincial QIM on the basis of the latest production data of 112 items, which is sourced from the OCAC, the Ministry of Industries and Production, and the Provincial Bureaus of Statistics.

-

Comment by Riaz Haq on April 16, 2018 at 10:30pm

-

Pakistan economy accomplished a decent growth rate of 5.79% April 16 2018 09:07 PM

http://www.gulf-times.com/story/589222/Pakistan-economy-accomplishe...

Maintaining a steady path and supported by an overall performance by key sectors, Pakistan’s economy has accomplished a decent growth rate of 5.79%, highest in 13 years since 2004-05 when it grew by 7.52%.

With the rate of inflation still below 4% in the first nine months of the current fiscal year, this high-growth-low-inflation scene can be compared to a text book description of an economy at the take-off stage unless rising external vulnerabilities revert back to a crash landing and need for stabilisation during the upcoming political transition.

Some critics may still like to highlight slippages on some targets including the GDP growth target itself 5.79% growth instead of the 6% target – and a particularly lower than anticipated output by the industrial sector.

Yet it is heartening that the agriculture and services sectors performed better than targeted. This in fact partly compensated for the industrial sector’s growth.

Most of the numbers approved by the National Accounts Committee for GDP performance are subject to the usual revision based on availability of actual numbers for the entire fiscal year.

--------------

The rise in production of three important crops namely rice, sugarcane and cotton was estimated at 8.7%, 7.4%, and 11.8% respectively. On the contrary, decline in production, although provisional, was estimated at 4.4% for wheat crop and 7.1% for maize.

Together, important crops posted a healthy growth rate of 3.57% against 2% target while other crops increased by 3.33% against 3.2% target. Cotton ginning also contributed significantly with a 8.72% growth rate compared to 6.5% target and last year’s growth of 5.6%. With 3.76% growth, livestock was close to 3.8% while forestry sub-sector stayed far behind the 10% target at 7.17% – almost half the 14.5% growth delivered last year.

On the whole, the industry is estimated to have grown 5.8% against a target of 7.3% and revised growth of 5% last year. Here the manufacturing showed a 6.24% growth instead of the targeted 6.4% and 5.3% growth last year.

Large scale manufacturing posted a 6.13% growth, slightly below its 6.3% target but much better than last year’s 5% increase. Major contributors to this growth were cement (12%), tractors (44.7%), trucks (24.41%) and petroleum products (10.26%).

Construction, another priority sector of the current government, also increased by 9.13%, against 9% increase last year, and missed by a wide margin the target of 12.1%.

The major contribution to 5.79% GDP growth rate came from 3.85% share from the services sector. The remaining 1.94% share to GDP came from industrial sector (1.21%) and agriculture (0.73%). The services sector has achieved 6.43% growth during current fiscal year second year in a row to have achieved above 6% growth but was primarily driven by general government services aka salary increases, inflation and other public sector expenditures.

-

Comment by Riaz Haq on April 20, 2018 at 7:30am

-

Current account deficit increases and so do Pakistan’s worries

https://tribune.com.pk/story/1690144/2-current-account-deficit-incr...

Pakistan’s current account deficit continued to expand, adding to the worries of economic managers as the gap widened 50.6% year-on-year to $12.03 billion in the nine months of the current fiscal year.

The State Bank of Pakistan (SBP) reported that the deficit now stands at over $12 billion during July-March, just shy of last-year’s 12-month figure of $12.62 billion. The nine-month deficit for 2016-17 amounted to $7.99 billion.

The growth in the current account deficit suggests that measures taken by the government have yet to take effect, which includes devaluation of the currency in two phases, and imposing regulatory duty to curtail imports.

A widening deficit eats up a country’s foreign exchange reserves, putting it at risk of a balance of payments crisis.

Economists have estimated the full fiscal year’s deficit to stand at around $16 billion.

Analysts say the deficit may continue to increase by an additional $100 million per month on a year-on-year basis due to uptrend in international oil prices, as Pakistan remains a net oil and gas importing country.

Experts anticipated the government would further devalue the rupee against the dollar and other world major currencies during the ongoing fiscal year to bring the currency at par with its peers in order to create some sort of balance in external trade and the overall economy.

In a statement issued on Thursday, the central bank said exports of goods increased 11.97% to $18.26 billion in the nine-month period, compared with $16.31 billion in the same period last year.

However, the import of goods surged 16.60% to $40.56 billion from $34.79 billion in the corresponding period last year.

The influx of foreign shipments remains on the higher side due to heavy imports of machinery and other construction material for multi-billion dollar projects under the China-Pakistan Economic Corridor (CPEC).

The trade deficit (of goods and services) increased 22.48% in the period under review to $26.15 billion from $21.35 billion.

Workers’ remittances, which play a significant role in financing the current account deficit, has started showing positive trends in recent months due to deprecation of the rupee.

Current account deficit widens 50% in July-February

Total remittances for the first nine months of the current fiscal year amounted to $14.60 billion, 3.55% higher than $14.10 billion in the corresponding period last year, the central bank reported.

Foreign direct investment in the nine months improved 4.4% to $2.09 billion from $2 billion in the same period last year. However, a significant portion of the foreign investment in local businesses is coming from China.

-

Comment by Riaz Haq on August 16, 2018 at 10:11am

-

Mutant Varieties Satisfy Market and add USD 6 Billion to Pakistan’s Economy

https://www.iaea.org/newscenter/news/mutant-varieties-satisfy-marke...

When Pakistani farmers harvested fields planted with a new mutant variety of cotton, not only did they have a higher yield, they also received a higher price at the market because of the improved fibre quality. Farmers who adopted mutant varieties of sesame released in 2016 saw yields double and income increase, and now these new varieties cover 50 percent of the area planted to sesame in the entire country. Those who planted a mutant variety of castor bean released in 2017, bred for early maturity and high oil content, have already planted it on 2 000 ha and are making an extra USD 618 per ha. These are just a few of dozens of advances made possible by Pakistan’s Nuclear Institute for Agriculture and Biology (NIAB) which, with the support of the Joint FAO/IAEA Division, has used mutation breeding to improve varieties of eight different crops – benefitting millions of Pakistani farmers and their families, and adding billions to the Pakistan economy.

Across the millennia, those entrusted with saving seeds for planting in future seasons have always made decisions related to the environment, choosing seeds from varieties that will give them the best chance of a good harvest. Even as science has advanced the field from simply saving seeds to cross breeding and now to mutation breeding, the crucial role of the plant breeder has remained largely unchanged – developing varieties that can thrive in whatever the local environment has to offer and be resilient enough to adapt to change. Since 1969, Pakistan’s Nuclear Institute for Agriculture and Biology (NIAB), an institute of the Pakistan Atomic Energy Commission, has overseen the development of 43 mutant crop varieties, ranging from sesame seed to castor bean to mandarin to cotton – all bred in response to what Pakistan’s farmers and their consumers need.

The government of Pakistan recognizes the importance of breeding crop varieties specifically for the Pakistan situation – its terrain, its climate, the needs and capacities of its farmers and, of course, when it comes to food crops, the taste and texture that will appeal to consumers. This government support of the NIAB mutant breeding programme has paid back in terms of increased yields and higher quality products, which have not only contributed to farmers’ livelihoods, it has meant more food for the marketplace and improved food security. Two sesame varieties released in 2016 and 2017 have double the yield of traditional varieties and are more suitable for modern cultivation techniques. The mutant mandarin variety, NIAB Kinnow, released in 2017, has an increased yield of more than 30 percent and reduced seed count from around 50 to just 3-5 seeds per fruit, which makes it more valuable and popular for export.

NIAB has received support from the Joint Division for more than 30 years, including equipment and technology packages for mutation breeding, individual staff trainingthrough fellowships, and national and regional training courses. The mutation breeding process calls for irradiating and then planting crop seeds, and then screening them as they grow in the following generations to see which induced changes that emerge could be helpful for breeding in future generations – from aesthetics of colour and texture to physiological changes that account for traits such as heat or cold tolerance, resilience or length of the growing period.

-

Comment by Riaz Haq on August 21, 2018 at 8:54pm

-

Hybrid wheat a success in Pakistan, to spread to B&R

By Cao Siqi Source:Global Times Published: 2018/8/21 23:01:48 Last Updated: 2018/8/22 0:45:10

http://www.globaltimes.cn/content/1116470.shtml

Drought, extreme heat post challenge to hybrid wheat: expert

China's hybrid wheat has been successfully grown in pilot areas in Pakistan, and will be introduced into more countries along the routes of the China-proposed Belt and Road initiative soon.

Song Weibo, vice president of Sinochem Group Agriculture Division, China's biggest agricultural inputs company and integrated modern agricultural services operator, told the Global Times on Tuesday that the company's hybrid wheat, using the two-line hybrid technique, has been harvested on a large scale in Pakistan, and is also highly praised in Bangladesh and Uzbekistan.

The company will continue to promote hybrid wheat in other Belt and Road countries and establish demonstration bases in Europe and North America, Song said.

An expert at the Beijing Academy of Agricultural and Forestry Sciences (BAAFS), Zhang Shengquan, who oversees the hybrid wheat project in Pakistan, told the Global Times on Tuesday that wheat production in northern Pakistan increased 50.1 percent between 2017 and 2018, citing data from Pakistan's University of Agriculture Peshawar.

Data from Pakistan-based Guard Agricultural Research and Services Company shows that during the same period, wheat production in the country's middle regions has increased by 45 percent, Zhang said.

Analysts hailed the project as a typical example of China's commitment to transfer advanced technologies and promote regional development in the framework of the Belt and Road initiative.

Providing food security

China is promoting domestically developed hybrid wheat for commercial purposes. The two-line hybrid technique is often used in hybrid rice and wheat. It can increase wheat production by 20 percent.

The technique was developed by BAAFS' Engineering Research Center for Hybrid Wheat in 1992. The hybrid wheat has been proven to outperform standard wheat in terms of yield, water usage and resistance to disease.

Song told the Global Times that Sinochem has sent many experts to Pakistan to teach local farmers how to grow the wheat. "Around 150 experts have been sent to Pakistan, where they visited over 20 cities."

Zhang said that drought and high temperatures are the major challenges to planting hybrid wheat in Pakistan. Frequent changes in Pakistan's governments also make it difficult to sustain the project, he noted.

University of Agriculture Peshawar professor Muhammad Arif told China Radio International that the world has been studying hybrid wheat but no one has achieved China's level of success.

With help from Chinese experts, the technique could yield around 6,000 kilograms per hectare, twice that of local wheat production, Arif said, adding it could free up land for other agriculture products.

Zhao Gancheng, director of the Shanghai Institute for the International Studies Center for Asia-Pacific Studies, said the project could help Pakistan ensure food security and also promote China-Pakistan ties.

"Pakistan's population has been rapidly increasing, but the country is short on farmland. The project is win-win cooperation," Zhao told the Global Times on Tuesday.

Sinochem said the company has also been promoting hybrid rice technology in Bangladesh since 2015.

In October 2016, the company launched the first overseas development center in Bangladesh and helped the country conquer agriculture obstacles by developing a variety that suits local cultivation conditions and consumption customs.

-

Comment by Riaz Haq on September 3, 2018 at 8:52am

-

Driving Pakistan’s agri future

Syed Wajeeh ul Hasan Naqvi

The potential of and challenges to Pakistani tractors.

https://aurora.dawn.com/news/1143184

Agriculture is the mainstay of Pakistan’s economy; it therefore follows that agricultural machinery holds significant value for the country. Tractors account for most of the farm mechanisation in Pakistan and we are now on the verge of complete localisation in terms of production.

The tractor market is growing and in 2017, over 60,000 tractors were sold. The market is dominated by three manufacturers. Millat Tractors (Massey Ferguson), Al-Ghazi Tractors (New Holland – formerly Fiat) and IMT Tractors; their market share is 60, 35 and one percent respectively. Smaller brands, such as Belarus Tractors, John Deere and others, import tractors as completely built-up units (CBU) and semi knocked-down (SKD) units and cater to the remaining four percent. Production capacity stands at 70,000 units per annum and models range from 55 to 85hp. Thanks to an indigenisation programme initiated in the eighties by the Pakistan Tractor Corporation, the industry has achieved 95% localisation in terms of production.

“Labour is cheap and we indigenised production a long time ago. We are only importing five percent of the components, mainly pistons and fuel pumps as completely knocked-down (CKD) units. So there is no amortisation cost; hence, we only have the variable cost of production. This is why, Pakistan makes the lowest priced tractors in the world. A 55hp tractor that costs about $7,000 in Pakistan would cost in the region of $20,000 in Turkey, $25,000 in Europe and $30,000 in USA” said Saeed Mushtaq, Head of Marketing, Al-Ghazi Tractors.

The low prices of Pakistani tractors have given manufacturers an edge in international markets who are exporting to Afghanistan and many African countries. However, exports are limited to certain countries due to internal agreements between the brand owners and their Pakistani producers and because of the lack of technological advancement in Pakistani tractors.

Yet, despite the lower prices, penetration in Pakistan still stands at 0.9hp per hectare of cultivable land, much lower than the international norm of a minimum 1.7hp per hectare. This is because the sales depend on the interplay of numerous factors, including the availability of capital for the farmer, interest rates on lease, government subsidy programmes for the purchase of tractors and fertilisers as well as the presence of small and scattered landholdings.

Growth in this sector is still not stable and there are spells of extremely high and low sales. Sales decline considerably when farmers bear losses and bounce back when the government initiates farmer-friendly policies or there is a bumper crop. The average agricultural landholding size is approximately 12.5 acres, due to which it is not viable for most farmers to invest in a tractor unless banks provide leasing facilities on low mark-up rates or the government provides subsidies on their purchase.

-

Comment by Riaz Haq on September 3, 2018 at 8:55am

-

Farm Power Available for Utilization in Philippine Agriculture

https://www.researchgate.net/publication/315783506_Farm_Power_Avail...

In 1992, the Regional Network for Agricultural Machinery (cited by PCARRD, 2002) reported the mechanization level of the Philippines to be 0.52 hp/ha. During the same period of time, the mechanization level of our neighboring countries were reported to be as follows: Japan, 7 hp/ha; Republic of Korea, 4.11 hp/ha; China, 3.88 hp/ha; Pakistan, 1.02 hp/ha; India, 1 hp/ha, and; Thailand, 0.79 hp/ha. Later, Rodulfo et al., (1998) determined the level of mechanization in rice and corn farms of the Philippines to be 1.68 hp/ha. Power from motorized machines contributed 80 percent while human and draft animals contributed 14 and 5 percent, respectively, of the total farm power. The most recent study on farm mechanization was the project on, “National farm mechanization needs survey and analysis” (Franco et al., 2001), which was implemented by the University of the Philippines at Los Baños and funded by the Bureau of Agricultural Research in 2001. The level of mechanization was expressed qualitatively as: low, intermediate, high and full mechanization to indicate the degree of utilization of mechanical power. The latest quantitative assessment of the level of mechanization was in 1992 with the

3 1991 Census of Agriculture as the main source of information on human, draft animals and machine power.

(PDF) Farm Power Available for Utilization in Philippine Agriculture. Available from: https://www.researchgate.net/publication/315783506_Farm_Power_Avail... [accessed Sep 03 2018].

-

Comment by Riaz Haq on September 3, 2018 at 9:03am

-

Agriculture continues to constitute the backbone of Pakistan’s economy by contributing 21.4% tonational GDP raw material to important industries such as textile and sugar industry. 65% of its population isdirectly or indirectly involved with agriculture, but still farm productivity is much less as compared to othercountries. One the reason for low farm productivity is lack of farm mechanization. Farm mechanization impliesthe use of mechanical technology in the varied farming operations such as sowing, harvesting, threshing,leveling, watering, spraying, weeding and similar other farm operations. Farm mechanization is viewed aspackage of technology to ensure timely field operations, increased productivity, reduced crop losses andimproved quality of grain or product. So far, Pakistan has only experienced selective farm mechanization as thisconcept has remained limited to use of tractors only and currently Pakistan’s per hectare use of horsepoweris 1.50, India's 2.50, China's 3.88 and Japan's 7.0. The number of tractors in 2004 was 401 thousand against thefigure of 157 thousand, ten years back in 1994 and tractors of 50 to 85 horse power were available at the priceranging from Rs.619000 to Rs.166000. The number of combine harvester (Wheat + Paddy) was 6000 in 2004 andwheat thrashers were 137 thousand in the same year, while the number of tractor mounted sprayers was 40thousand in 2004. There is a need to adopt locality specific farm mechanization keeping in view the small landholdings and poor economic condition of farmers. Large scale farm mechanization can only be adopted ifcooperative farming gains roots in Pakistan

(PDF) In Pakistan, Agricultural Mechanization Status and Future Prospects. Available from: https://www.researchgate.net/publication/278019970_In_Pakistan_Agri... [accessed Sep 03 2018].

https://www.researchgate.net/publication/278019970_In_Pakistan_Agri...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 5 Comments

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network