PakAlumni Worldwide: The Global Social Network

The Global Social Network

Auto Sector in India, Pakistan and China

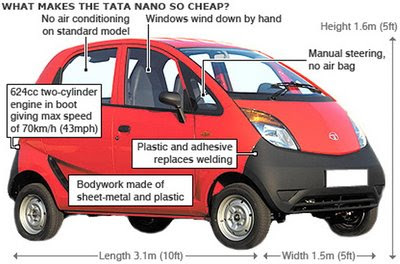

Tata Motors is set to launch its low-cost Nano minicar Monday, March 23, according to media reports from India. With a starting price of about $1,945, which doesn't include dealer markup and other charges that consumers will pay, the Nano will be one of the world's cheapest cars. This product launch comes at a time when the auto industry is facing a severe downturn, attributed to the worldwide consumer credit crunch amidst a serious global financial crisis.

Like other auto makers around the world, Tata Motors is also contending with declining demand, both for its bread-and-butter commercial vehicles in India and its luxury brands, Jaguar and Land Rover. The company reported its first quarterly net loss in seven years in the October-December 2008 quarter, and saw its debt rating cut by ratings firms. More immediately, Tata Motors faces a June deadline to repay $2 billion in loans related to its Jaguar-Land Rover acquisition from Ford Motor Co. last year, according to the Wall Street Journal.

The automobile industry in India—the tenth largest in the world with an annual output of 2 million units last year—is expected to become one of the major global automotive industries in the future. A number of domestic companies produce automobiles in India and the growing presence of multinational investment, too, has led to an increase in overall growth. Following the economic reforms of 1991 the Indian automotive industry has demonstrated sustained growth as a result of increased competitiveness and reduced restrictions. The monthly sales of passenger cars in India exceed 100,000 units, according to a related Wikipedia entry.

In comparison with the rest of the world, the Chinese market for automobiles appears to be relatively robust. Monthly auto sales in China surpassed those in the U.S. for the first time in January, but automakers and industry watchers say the news may tell us more about the troubles in the U.S. than about China's growing car market, says a report published in San Francisco Chronicle.

Data released in February by the China Association of Automobile Manufacturers shows 735,000 new cars were sold in China last month, down 14.4 percent from the record of 860,000 set in January 2008. U.S. sales, meanwhile, fell 37 percent to 656,976 vehicles — a 26-year low.

In Pakistan, Engineering Development Board (EDB) is attempting to increase the GDP contribution of the automotive sector to 5.6%, boost car production capacity to half a million units as well as attract an investment of US$ 3 billion and reach an auto export target of US$ 650 million.

In addition to the growing defense industry, auto industry can become a driving force for the much needed manufacturing industrial base in Pakistan to create significant employment opportunities for its large population. Last year, the auto sector contributed US$ 3.6 billion, only about 2% of the GDP, to the national economy, and employed about 192,000 people.

Pakistan's auto parts manufacturing is a billion US dollars a year industry. Sixty percent of its output goes to the motor cycle industry, 22% is for cars, and the rest is consumed by trucks, buses & tractors.

After a significant growth spurt in 2002-2006, the auto sector is feeling the pain of economic slow-down in Pakistan. The industry is continuing in a slump which began in the previous financial year and according to Business Monitor International's recently published Pakistan Automotives Report, the industry’s performance this year will get worse. In FY08, which ended in June 2008, total vehicle sales fell by 6.2%. The downturn carried over into FY09, with sales for the first half of the year (July to December 2008) down by 48% year-on-year to 52,927 units for cars and light commercial vehicles (LCVs), while compared with November, sales for December were down 55%. These results support BMI’s forecast for a drop in sales of cars and LCVs to around 112,000 units in FY09. BMI expects the total auto market in Pakistan to contract by over 32%, with the worst damage done in the car and bus segments, which is forecast to fall by 45% each. Pakistan’s Economic Co-ordination Committee (ECC) is to consider a tax cut of 10% for domestic car manufacturers, which has been proposed by the Ministry of Industries and Production. However, the plan is not without its opposition, as the Federal Board of Revenue is reportedly against supporting individual sectors as this would prompt other industries to seek help. Moreover, with just five carmakers producing locally, the automotive industry is relatively small. On the other hand, the industry is also largely self-sufficient as the majority of its output is sold within Pakistan; this reduces the country’s reliance on imports and raises issues such as the protection of local jobs and the industry’s contribution to the overall economy.

|

| Pakistan Tractor Sales. Source: Trading Economics |

Among the automakers, Indus Motors and Pakistan Suzuki reported positive earnings: The two leading car assemblers PSMC and INDUS posted positive earnings for 2008. PSMC reported operating losses of Rs 399 million. However, increase in other income by 77 percent offset their losses helping PSMC post positive earnings of Rs 26 million, according to Daily Times. Honda posted a loss after tax of Rs 190 million for the period July-December 2008 after a decline in net sales by 5 percent and a massive surge in operating expenses over the corresponding period last year.

The poor state of the industry is reflected in BMI’s Business Environment Rating for the automotive industry in Asia Pacific, where Pakistan is in last place on a score of 42.4 out of a possible 100. The market is held back by low production growth potential and an average rating for sales growth. However, as a signatory to the Trade Related Intellectual Property Rights Agreement (TRIPS) under the auspices of the World Trade Organization (WTO), the country’s regulatory environment scores well. A number of free trade agreements also contribute to this criterion, although forming FTAs with non-Asian countries would improve this rating further. Despite low marks for bureaucracy and corruption, the market does score well for its long-term economic risk and policy continuity.

With just a handful of manufacturers, Pakistan’s competitive landscape remains narrow. Japanese car manufacturers control most of the country’s passenger car production and sales. Figures for FY08 show that Suzuki-brand models represented 62% of total Pakistani passenger car production and 51.7% of sales. Toyota is gaining, however, with Corolla becoming the country’s best-selling model in the first half of FY09.

According to Daily Times, as many as 60,000 workers and staffers in Pakistan's auto sector have lost their jobs from July, 2008 to January, 2009 due to falling demand for cars. More jobs cuts are feared with continuing weakness in demand.

Given strong underlying growth dynamics in South Asia, the negative feedback effects of the global financial crisis are expected to be temporary. A relatively rapid rebound is expected in 2010, with a projected revival of GDP growth to 7.2 per cent. The long term prospects for the auto industry in the continent of Asia appear to be quite favorable. As the current financial crisis ebbs, there will be significant pent-up demand for automobiles in Asia, including India, Pakistan and China, that will drive the growth in auto industry.

Related Links:

Pakistan Automobiles Report 2009

Auto Pakistan Expo 2009

Automobile Technology in Pakistan

A Review of Global Road Accident Fatalities

Pakistan Automotive Report

China Surpasses US in Auto Sales

Auto Industry in India

India's Global Shopping Spree

-

Comment by Riaz Haq on October 6, 2012 at 11:14pm

-

Here's BMI report on vehicle sales in Pakistan:

Pakistan’s auto industry suffered mixed fortunes over FY12, which ended in June 2012. Passenger carsales and production were both up strongly, while the commercial vehicles sector continued to lag. EndFY12 sales figures released by the Pakistan Automotive Manufacturers Association (PAMA) showed thatpassenger car sales were up by 23% y-o-y, to reach 157,325 CBUs. Jeep and pick-up sales were up by17.6%, at 21,472 CBUs. This was slightly ahead of BMI’s forecasts and reflected the robust nature ofdemand in the new car market. The past year also saw a one-off boost to sales from the Punjab Province’s‘Yellow Cab’ taxi purchasing scheme, which saw Pak Suzuki deliver some 20,000 Bolan and Mehranmodels. Total vehicle sales for FY12 stood at 231,545 units, an increase of 6% year-on-year (y-o-y).

Breaking down the headline figure, sales of passenger cars with engine size less than 1000cc increased by41.6% y-o-y, to 61,528 CBUs. Mid-size engine cars (1,000-1,300cc) saw sales growth of 28.3% overFY12, to reach 29,981 CBUs, with larger engine cars (1,300cc+) showing the smallest growth, up just7.6%, at 65,816 CBUs.

Over FY12, long-time market leader Pak Suzuki retained its dominance of the Pakistani new passengercar and pick-up sales market, selling 112,166 units for a market share of 62.7%. Indus Motor retained itsposition as the second most-important player in the local market, with sales of 54,477 CBUs over FY12,up by 9.9%, for a market share of 30.5%, with Honda Atlas suffering a 22.2% annual decline in sales,down to just 12,119 CBUs, for a market share of 6.8%.

Turning to commercial vehicles sales, sales of trucks were down by 18.6%, at 2,394 units, while bus saleswere up by 13.1%, at 609 units. The worst performing sub-segment of the industry over FY12 was farmtractors, whose sales fell by 28.1% y-o-y, to just 49,745 units. This reflected the collapse in demandduring H1FY12, following the government’s decision to implement a 16% general sales tax on tractorpurchases, which was later reduced to 5% as of January 2012. Since this time, tractor sales haverebounded strongly, from a year-low of just 369 tractors sold in January 2012, back up to 8,368 tractorssold in June 2012. However, with the government still planning to increase GST on tractors to 10% in2013 and then to 16% in 2014, it remains to be seen what effect these staggered tax hikes will have ontractor sales over the medium term.

Turning to production, passenger car production stood at 154,255 CBUs for FY12, an increase of 15.1%y-o-y. This was a strong performance, given the disruption to supplies suffered by Honda Atlas over theend of 2011 and the start of 2012. Indeed, Honda did not produce any cars in Pakistan between December2011 and February 2012. Pak Suzuki remained the dominant producer, producing 107,736 passenger carsand pick-ups. In second place was Indus Motor, on 54,917 passenger cars and pick-ups, with Honda Atlasin third place, on 12,484 passenger cars (Civic and City models).

Looking forward, BMI is targeting new vehicle sales growth of 3% for FY13, to reach 238,491 units,with production set to increase by 5%, to reach 235,689 units.

http://www.marketresearch.com/Business-Monitor-International-v304/P...

-

Comment by Riaz Haq on November 11, 2012 at 9:56am

-

Here's an ET report on the opening a new assembly plant for trucks and light commercial vehicles in Karachi:

Prime Minister Raja Pervez Ashraf said on Saturday that it is the government’s policy to promote the private sector so that it can play a leading role in the development and prosperity of the country.

Addressing a function after formally inaugurating Al-Haj FAW Motors’ automobile assembly plant on the National Highway in the vicinity of Bin Qasim Port, the premier said the private sector is the key to economic prosperity and development of a country, and this government fully realises this.

“It is a great pleasure for me to see that our industrial group has started this very important automobile facility in partnership with China,” he remarked, and hoped that this project would prove a milestone for the automobile industry in Pakistan.

Sindh Governor Dr Ishratul Ebad Khan, Federal Minister for Defence Syed Naveed Qamar, the Chinese consul general in Karachi and a group of other provincial ministers were also present.

With the launch of its assembly line, Al-Haj FAW Motors said that the company is all set to significantly increase its market share in Pakistan in both trucks and pick-ups.

“After making a respectable impression in the trucks market of Pakistan, our company is ready to gain a share in the pick-up market also,” Al-Haj FAW Motors Chief Executive Hilal Khan Afridi told The Express Tribune on the launch day of its only plant in Karachi.

The company said that it had completed construction of its assembly line near Karachi with an investment of Rs1 billion. The plant will be capable of producing trucks, prime movers, light commercial vehicles and passenger cars.

The company has already been assembling two 1,000cc vehicles at the plant since June 2012. Afridi said that his company has sold a few hundred pick-ups assembled at this plant over the last few months.

Al-Haj FAW Motors – a joint venture between the largest and oldest Chinese vehicle maker First Automobile Works (FAW) Motors and Al-Haj Motors, an established commercial importer of heavy vehicles in Pakistan – has been importing completely built units (CBU) from China for the last few years.

With its assembly plant in action, the company is now targeting to launch new vehicles and passenger cars of 1,000-1,500cc engine capacity within the next few years. It has been assembling trucks since October 2011 and plans to produce 6,000 trucks and 12,000 light vehicles every year.

However, the company’s ambitions may be tempered by the economics of demand and supply. The truck market has slowed over the last few years in Pakistan, a representative of Hinopak Motors – the largest truck maker in Pakistan – said.

Industry officials say that the decline in overall economic activity and continuous disruptions in Nato supplies to Afghanistan have resulted in significantly low sales of trucks in Pakistan.

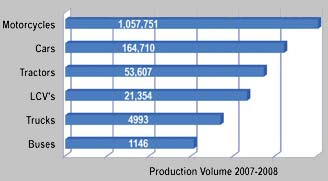

The installed capacity of Hinopak Motors is 5,000 trucks, but it produced only 1,237 trucks in fiscal 2011-12. The historical high figure of truck production in the country’s history is 4,993, achieved in fiscal year 2007-08, according to the Pakistan Automotive Manufacturers Association (PAMA).

Al-Haj FAW Motors claim that they are now number two in the list of truck producers in Pakistan, assembling around 700 trucks annually in the country. However, their claim is difficult to prove as they are currently not members of PAMA –the representative body of vehicle manufacturers in Pakistan.

There are four truck assemblers currently operational in Pakistan. With the addition of Al-Haj FAW Motors to that group, five truck assemblers will now vie for the Pakistani market – all operating from their bases in the port city of Karachi.

http://tribune.com.pk/story/463957/al-haj-faw-motors-inaugurates-au...

-

Comment by Riaz Haq on November 23, 2012 at 4:28pm

-

Here's an Automotive World story on Pakistan restricting used car imports:

With local policy aimed at making Pakistan a favourable trading country, rather than a manufacturing one, the significant inflow of used cars into Pakistan has, in the past, constricted the local automotive industry. This may be about to change, however, following a decision by the country’s Economic Coordination Committee (ECC).

The ECC has decided to reduce the age limit of used car imports into Pakistan to three years, from the previous limit of five years, according to The News International. This directive will come into effect on 15 December 2012.

The Economic Coordination Committee is a cabinet-level body responsible for final decisions pertaining to Pakistan’s economy. Set up under the Chairmanship of the country’s Central Finance Minister, the committee comprises ministers in charge of the country’s economic ministries.

This decision has drawn mixed reactions from the various automotive industry bodies in Pakistan. The Pakistan Automotive Manufacturers Association (PAMA) has welcomed this decision, as it favours local vehicle manufacturers. The association’s Chairman, Parvez Ghias, feels that this move is in the greater national interest.

The All Pakistan Motor Dealers Association (APMDA), on the other hand, has called this move unfair and unjust, as it is a setback to the import of used cars. Chairman HM Shahzad says this cut in age limit, along with the depreciation policy in force at present, will push the prices of cars significantly.

Earlier, Daily Times, citing industry experts, said the government lost nearly Pakistani Rs16.5bn (US$171.79m) due to the import of 55,000 vehicles. Around US$371m were reportedly spent on the import of used cars last year. According to Shahzad, though, this move to restrict import of used cars into Pakistan will result in a Pakistani Rs32bn loss to national exchequers

---------

The report stated that there were more than 100 vehicle assemblers in the country. These companies assemble cars, buses, trucks, two- and three-wheelers and tractors. The number of automotive parts manufacturers, however, totals approximately 1,700.Japanese companies lead the list of vehicle assemblers in Pakistan, while local companies form the bulk of the country’s parts manufacturers. This is compounded by a weakness in terms of manufacturing systems and technology in the supply industry, which the report attributes to a lack of competition brought on by localisation requirements.

....http://www.automotiveworld.com/articles/manufacturing-logistics/ecc...

-

Comment by Riaz Haq on January 20, 2013 at 7:58pm

-

Here's ET on cost difference in Indian and Pakistani cars:

In support of his claim, he said average cost of a Pakistani car (excluding taxes) is Rs750,000. An average Pakistani car uses 60% of local components and the value of such components is around Rs450,000. This is the amount that the parts makers lost on each imported car, he said.

Most people believe that locally assembled cars are much more expensive than vehicles manufactured in other countries, but this is a wrong perception, the industry representatives said while giving a comparison between prices of Pakistani cars and those manufactured in regional countries.

Pakistani cars are cheaper than most cars manufactured in India, Allawala claimed, adding 1,800cc Toyota Corolla is being sold in India for $16,334 (retail price excluding taxes) while the price of the same car in Pakistan is $13,253, lower by $3,081.

Including taxes, the retail price of Toyota Corolla in India is $26,744 while in Pakistan it is $19,781, a difference of $6,963.

Similarly, the retail price of 1,800cc Honda Civic in India he said was $19,216 (excluding all taxes) while the same car is being sold for $15,214 in Pakistan, a difference of $4,002, he said.

After including all taxes, the difference in prices of Honda Civic in Pakistan and India is $7,403. In India, Civic is being sold for $30,455 while it is available at $23,052 in Pakistan.

The automakers and vendors have underlined the need for revision in the import duty slabs, saying the old duty structures are favouring car importers.

In response to a question, PAMA Director General Abdul Waheed cautioned the consumers, who are opting for imported used cars, saying they were making a wrong decision.

“The buyers of used cars may spend less initially, but eventually they pay much more in terms of expensive maintenance and low resale value compared to a new car,” he said.

http://tribune.com.pk/story/478485/auto-assemblers-say-cannot-susta...

-

Comment by Riaz Haq on February 19, 2013 at 9:48pm

-

Here's a BR story on 217% increase in annual car sales from 2001 to 2011:

The Competition Commission of Pakistan (CCP) has revealed in its research study on automobile sector that car sales in the country increased by 217 percent during 2001-2011.

In the study, the competition assessment of the passenger cars in the automobile sector in Pakistan has been analyzed, which shows that there are currently three major car manufacturers and assemblers in the car industry in Pakistan namely Pak Suzuki Motor Company Limited, Indus Motor Company Limited (Toyota) and Honda Atlas Cars Limited.

Between 2001 and 2011, car sales in Pakistan increased by 217% and the sales of the above mentioned three players mainly contributed towards this growth.

The CCP as part of its on-going programme of sectoral research has released the updated draft study on automobiles sector titled Competition Impact Assessment Studies, to assess the competition vulnerabilities in various sectors.

---

Indus Motors, Pak Suzuki Motors and Honda Atlas have increased their sales by almost 322%, 241% and 217% respectively in this time period.

Currently, in the 800 cc and 1000 cc market segment, Pak Suzuki is the sole local manufacturer, assembler while in the 1,300-1,800 cc cars, the state of competition is slightly better with Honda, Suzuki and Toyota competing amongst each other for market share.

Parallel increase and decrease in prices by manufacturers in the last three years from 2010-12 may be a cause of concern from a competition perspective.

In all the three market-segments, the manufacturers and assemblers have excess installed capacities and by not utilizing their excess capacities, the incumbent firms signal their inward looking approach towards the domestic industry.

The study also states that Pakistan automobile industry is inward looking and it tries to protect itself through the use of regulatory instruments.

Pakistan needs to develop the automobile industry instead of protecting it and in this regard, imports have a disciplinary impact on domestic firms.

Currently, the import of cars is allowed only under the Gift, Personal and Baggage Schemes with restriction on allowable age limits.

---

Furthermore, on August 31, 2012, the depreciation rules were also changed. If the cumulative effect of both these policy changes is taken into account, a further protection was landed to protect the domestic automobile industry at the expense of consumers.

For enforcing safety and quality standards, the government established Pakistan Standards and Quality Control Authority (PSQCA) in 2000 which has so far developed standards for only 2 wheelers.

Due to the absence of regulation, the domestic automobile manufacturers do not offer safety features, such as anti-lock breaking system (ABS), airbags and lower CO emissions along with quality specifications such as alloy rims, power steering and windows in all their vehicles.

In addition, Pakistan has an aging automobile population which is an increasing burden to the economy due to increased emission levels and a growing safety hazard.

The current dealership and supply chain structure in the industry does not allow for meaningful competition as dealerships are behaving merely as agents of the manufacturing companies and have no real incentive to compete in the market. Due to delay in deliveries, premiums are charged in the secondary markets.

The study recommended that the domestic market should be opened to the import of new cars at reasonable tariffs and reducing protection of local industry to allow foreign competition for the benefit of consumers will bring in new technology and offer more choice to the consumers.....

http://www.brecorder.com/pakistan/business-a-economy/106820-car-sal...

-

Comment by Riaz Haq on February 22, 2013 at 8:12am

-

Here's a report of Japanese investment in Pakistan:

TOKYO (Kyodo) -- Yamaha Motor Co. will build a motorcycle plant in Pakistan with the aim of starting production in 2015, in an attempt to expand its business in an untapped emerging market, company President Hiroyuki Yanagi said Friday in an interview with Kyodo News.

Yamaha will first invest 1.3 billion yen in the Pakistani plant before increasing the amount to a total of 10 billion yen by 2020 to raise its production capacity to 400,000 units a year.

"Motorcycles sold now in Pakistan are mainly Chinese-made, but they are very old," Yanagi said. "We'd like to stimulate the market by introducing new models."

Yamaha has set its initial production target at 40,000 units per year.

The motorcycle market in Pakistan is expected to double to 3 million units in 2020 from the 2013 level of 1.5 million, according to the Japanese manufacturer.

http://www.manufacturing.net/news/2013/02/yamaha-building-motorcycl...

-

Comment by Riaz Haq on March 12, 2014 at 11:31pm

-

Here's a Daily Times story on export potential for bullet-proof cars:

Pakistan is likely to enter into lucrative export market of bulletproof cars as the company manufacturing bullet-proof cars has received export inquiries from Indonesia.Managing Director Toyota Central Motors (TCM) Salim Godil on the eve of 8th Toyota Dream Car Contest at TCM said his manufacturing plant in Karachi was already in full production and converting around 25 cars a month. He said, “If Pakistan enters into export arena of bullet-proofing it may prove to be the most lucrative export sector as bullet proofing cost is ranging from Rs 4 million to Rs 12.8 million depending upon the models and shapes of the vehicles”. He said majority of the customers were interested in bullet-proofing of their 4X4 vehicles which usually costs Rs 4 million while cars like Mercedes cost up to Rs 12.8 million. Pakistan has fully capable in converting vehicles into bulletproof as the best and number one bullet-proofing company in the world has given franchise to him.

TCM has also exhibited a locally bulletproof 4X4 vehicle on the occasion, which was also shown to the media. He said at present his manufacturing unit has limited production capacity and if the government formulates a policy to encourage this industry, export of bulletproof cars might fetch huge foreign exchange to the national exchequer.

He said production of locally assembled cars has dropped at a significant level as government has allowed import of secondhand cars. He demanded of the government to impose restrictions on import of secondhand vehicles in order to rescue local automobile industry. He said hybrid cars’ future in Pakistan was yet to be clear as only a limited number of such vehicles have been imported since the government announced to encourage these cars. He said unless and until hybrid cars get economical, they might not become popular in Pakistan.

Taimur Soori of Indus Valley School of Art and chief of the jury announced the names of the winners of the nationwide contest. A number of schools from Karachi and upcountry participated in the contest. The winners of the contest would be sent to Japan for global contest to be held there.http://www.dailytimes.com.pk/business/13-Mar-2014/pakistan-likely-t...

-

Comment by Riaz Haq on February 26, 2015 at 4:27pm

-

KARACHI: Auto sales outlook remains bright as import of completely knocked down (CKD) kits of locally-produced heavy vehicles, cars and bikes rose by 37, 51 and 23 per cent, respectively, in the first seven months of this fiscal year from the same period last year.

According to the figures of Pakistan Bureau of Statistics (PBS), import of CKD kits for buses, trucks and heavy vehicles increased to $91.4 million in July-Jan 2014-15 from $66.5m in the same period last year.

Import of CKDs of locally-produced cars and bikes swelled to $280m and $51.5m from $185m and $42m, respectively.

However, higher imports of used cars seemed to have not caused any serious blow to the locally-produced cars whose sales went up to 74,497 units in July-Jan 2014-15 as compared to 64,835 units in corresponding period of last year.

Total import of cars, in which the share of used cars is over 90pc, rose by 32.5pc to $148.5m in the period under review compared to $112m in the same period last year.

Declining trend in imports of completely built up (CBU) buses, trucks and other heavy vehicles in the recent months has been giving much support to the sales of locally produced vehicles.

The import of buses, trucks and other heavy vehicles fell by 43pc to $59m in July-Jan period of 2014-15 as compared to $103m in the same period last year.

Sales of locally-produced trucks and bus jumped to 2,027 and 2,326 units from 1,249 and 1,579 units, showed Pakistan Automotive Manufacturers Association (Pama) data.

The rising trend of purchasing costlier heavy bikes (new and used ones) has now slowed down which is evident from 52pc fall in CBU imports of bikes to $987,000 from $2m.

Sales of locally-produced Honda and Suzuki bikes plunged to 355,174 and 12,647 units in July-Jan 2014-15 as compared to 376,003 and 13,852 units in same period last year.

Around 3,563 units of DYL Motorcycles were sold in the first seven months of this fiscal year as compared to 9,592 units in the corresponding period last year. Hero bike sales fell to 6,937 units from 8,823 units.

Published in Dawn February 26th , 2015

http://www.dawn.com/news/1165917

-

Comment by Riaz Haq on September 19, 2015 at 10:17pm

-

#Pakistan Auto industry shows robust growth despite chronic energy, tax, labor woes - Nikkei Asian Review http://s.nikkei.com/1LgFPH0

KARACHI, Pakistan -- This country's auto industry has seen sharp increases in production and sales lately, following a long period of doldrums since their previous peak in 2007. This shows that the sector is well ahead of other industries in taking advantage of the country's burgeoning economic recovery. But Japanese automakers operating here continue to face tough challenges, including chronically unstable power and gas supplies, a shortage of skilled workers, and the negative impact of the tax system on their sales.

In April, Japanese motorcycle manufacturer Yamaha Motor resumed assembling motorcycles in Pakistan for the first time in seven years at its new factory in the Bin Qasim industrial park in the outskirts of Karachi, Pakistan's commercial hub. The new assembly line is turning out Yamaha's new YBR125 sport bike, equipped with higher-end features, such as an electric starter and cast wheels. The YBR125, a top-of-the-line model from Yamaha, costs approximately 129,000 rupees ($1,238), roughly double the average price for the 70cc models that are the most popular in Pakistan. The company expects the model's first year shipments to reach 30,000 units. Yasushi Ito, managing director of Yamaha Motor Pakistan, said the company aims to produce up to 400,000 units annually by 2020.

Hirofumi Nagao, managing director of Pak Suzuki Motor, a Pakistani subsidiary of Japanese automaker Suzuki Motor -- which holds a 54% share of the domestic automobile market -- said: "The Pakistani rupee is holding steady, inflation has calmed down and auto loan rates have dropped to 11% per annum after climbing to around 20%. If loan rates fall below 10%, it will help boost sales significantly."

Output at Pak Suzuki is likely to surpass 130,000 units and reach an all-time high this year, thanks in part to "special demand" from the Punjab state government, which has ordered from Pak Suzuki 50,000 cabs under its taxi scheme to boost employment in the province.

Indus Motor, a joint venture between the Habib group, one of the leading business groups in Pakistan, and Toyota Motor, registered sales of over 57,000 units in fiscal 2014, up 70% from the previous year, thanks to brisk sales of a new Corolla model.

-

Comment by Riaz Haq on December 29, 2015 at 7:52pm

-

#Chinese #Trucks Market Share Could Surpass #Japanese Share in #Pakistan. #China #Japan #Pakistan #CPEC http://bloom.bg/1QVIzx3 @business

Chinese trucks may become a more common sight than Japanese rigs on Pakistan’s roads as rising infrastructure investment creates demand for cheap and durable commercial vehicles.

To benefit from their expected growth in popularity, Karachi-based Ghandhara Nissan Ltd. began assembling China’s Dongfeng trucks in 2013, in addition to Japan’s UD brand. Ghandhara forecasts its Chinese truck sales will more than double to about 200 units in the year ending June and surpass UD deliveries in the next two years, according to Muazzam Pervaiz Malik, senior executive director for marketing at the company.“Initially they were scared about the quality, but China has improved,” Malik said in an interview. “With the China-Pakistan economic corridor, more dams and motorways, we expect truck demand to grow.”

South Asia’s second-largest economy is forecast to grow at the fastest pace since 2008 and is seen as a beneficiary of the $45 billion that China has pledged in infrastructure investment to more tightly link its economy with Europe through central and western Asia.

The spending may help drive a 50 percent increase in truck sales to as many as 7,000 units a year by 2020, according to Ghandhara’s estimates. The company’s revenue will rise about 10 percent in the year ending June 30, buoyed by higher Dongfeng sales, Malik said.

Ghandhara’s stock has surged more than threefold this year for the biggest gain among auto retailers globally, buoyed by the truck demand and expectations that it will begin producing passenger cars in 2017. The shares dropped 4.7 percent to 181.4 rupees in Karachi yesterday.

The local newspaper Dawn reported in August that Ghandhara plans to start assembling Nissan Motor Co.’s Datsun cars in 2017. Ghandhara declined to comment on its future plans, while Nissan said no decision has been made on production in Pakistan.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network