PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

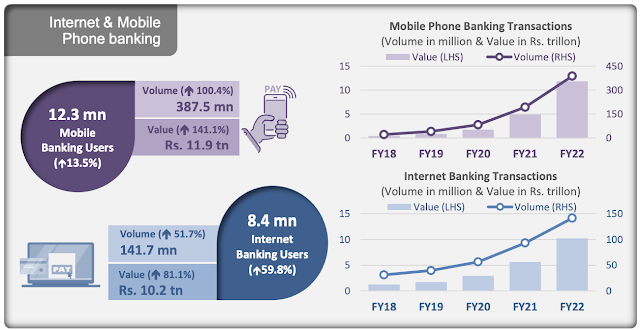

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

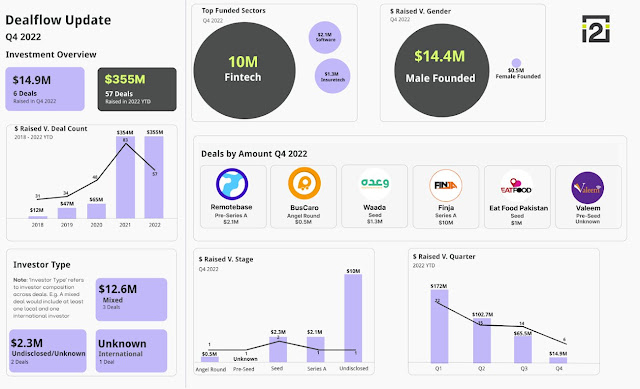

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

-

Comment by Riaz Haq on January 15, 2025 at 6:32pm

-

Google Pay to launch in Pakistan by March 2025 - Profit by Pakistan Today

https://profit.pakistantoday.com.pk/2025/01/13/google-pay-to-launch...

Service to enable Pakistani users to link their bank-issued debit and credit cards to Google Pay for seamless contactless payments

Google Pay, the global contactless payment platform, is set to officially launch in Pakistan by mid-March 2025, marking a significant milestone in the country’s expanding digital payment landscape.

According to sources, the rollout, confirmed by Google in November 2024, will be facilitated through collaborations with Visa, Mastercard, and leading local banks.

The service will allow Pakistani users to link their bank-issued debit and credit cards to Google Pay via the Google Wallet app, enabling seamless contactless payments at compatible terminals.

While the launch will focus initially on enabling basic contactless payments, the full suite of Google Wallet features, including loyalty cards and public transport passes, will not be available in the first phase.

Sources confirmed that preparations for the launch are well underway, with four to six prominent banks working closely with Visa and Mastercard to meet technical requirements.

Pakistan’s payment infrastructure is well-positioned to support the service, boasting 133,000 point-of-sale (POS) terminals, 99% of which are already equipped to accept mobile contactless payments, according to the State Bank of Pakistan.

Industry experts see Google Pay’s entry as a boost for Pakistan’s burgeoning digital payments sector, which has witnessed rapid growth in recent years. According to Profit’s analysis of data published by the State Bank of Pakistan, electronic payments now account for 9.3% of the total value of all transactions that take place in the country, a number that has doubled over the past two years.

The launch of a digital application like Google Wallet, which is compatible with payment cards of any financial institution will accelerate the expansion of digital payments through POS machines and e-commerce websites.

-

Comment by Riaz Haq on January 28, 2025 at 4:52pm

-

Looking into the DEEP: Advancing Pakistan’s DPI | Biometric Update

https://www.biometricupdate.com/202501/looking-into-the-deep-advanc...

Pakistan is progressing toward a digitally empowered society, with initiatives such as the Digital Economy Enhancement Project(DEEP) playing a crucial role. According to a press release by the National Database and Registration Authority (NADRA), on January 23, in Islamabad, NADRA hosted a high-level World Bank delegation that included Martin Raiser, Vice President for the South Asia Region, and Najy Benhassine, Country Director for Pakistan. The conversation focused on DEEP, a transformative effort to strengthen Pakistan’s digital economy and digital identity systems.

DEEP, a World Bank-funded project coincides with the Digital Pakistan Policy and aims to transform how the government delivers services to citizens and businesses. The initiative aims to improve financial inclusion, ease access to government services, and promote economic prospects by developing strong digital public infrastructure (DPI).

The World Bank delegation praised NADRA’s progress in the implementation of DEEP, emphasizing its essential role in Pakistan’s digital transformation. The project is focused on creating responsible data-sharing protocols, digital authentication systems, and verifiable credentials. These components seek to increase accessibility, public service delivery, and social protection. This collaboration emphasizes the importance of international partnerships in accelerating national progress toward a digital economy.

Advancing DPI with DEEP

DEEP is a World Bank-assisted project to enhance the government’s capacity for digitally enabled public service delivery for citizens and businesses. While also building a more equitable economic framework by promoting an integrated, government-wide digital infrastructure. It promotes the creation of responsible data-sharing networks and strong digital authentication technologies, assuring secure and verified credentials.

The government’s goal with DEEP is to digitize governmental services, making them more accessible to citizens and companies. This transition is projected to drive economic growth, improve social protection systems, and expand financial inclusion, particularly among marginalized populations, Dawn News reports.

NADRA’s leadership

NADRA has played a significant role in Pakistan’s digital transformation under the DEEP initiative, reaching remarkable milestones such as the integration of crucial government services to allow citizens seamless digital access. NADRA is developing a single digital ecosystem to ensure efficient service delivery under the Digital Pakistan Policy. The World Bank’s support demonstrates global trust in this endeavor to improve infrastructure, data interchange, and digital identity for a more robust digital economy.

Digital Pakistan

The World Bank project DEEP aims to fill Pakistan’s digital gap, fuel economic growth, and ensure unbiased access to digital services for citizens. DEEP is aligned with the 2018 Digital Pakistan Policy, which emphasizes a comprehensive enterprise architecture and the integration of government databases. It focuses on broadband expansion, enabling policies, and legal frameworks to assist the digital economy. The project’s strategy is to improve public service delivery by modernizing digital public infrastructure, which includes a secure data exchange layer, digital wallets, and authentication methods. NADRA, the Ministry of Information Technology and Telecommunications (MoITT), and the Board of Investment (BoI) are key implementation agencies. DEEP, with financial and technical support from the World Bank, assists Pakistan in transitioning to a sustainable and inclusive digital economy by dealing with systemic obstacles and supporting digital transformation.

-

Comment by Riaz Haq on March 7, 2025 at 9:36am

-

IT exports soar as digital transformation accelerates

https://tribune.com.pk/story/2532564/it-exports-soar-as-digital-tra...

Key achievements include record IT exports of $3.223 billion in FY 2023-24, reflecting a 24% increase. Broadband penetration surged by 5%, benefiting over 139 million subscribers. Policies supporting AI, cloud computing, and digital entrepreneurship are empowering startups and freelancers.

The Digital Economy Enhancement Project (DEEP) is expanding digital infrastructure, boosting IT exports, and enhancing digital skills. Pakistan now ranks in Tier 1 of the Global Cybersecurity Index and has improved its standing in the UN E-Government Development Index.

The adoption of e-office solutions has cut decision-making time by 70%, streamlining governance. The launch of the Hajj App and One Patient One ID system has enhanced public service efficiency.

Over 600,000 individuals have been trained under DigiSkills.pk, equipping the workforce with essential digital expertise. More than 166 startups have emerged, generating 5,000+ jobs and attracting Rs260 million in investments.

Pakistan is gearing up for 5G with a scheduled spectrum auction and the National Fiberisation Policy. Broadband expansion has benefited 4.1 million people, while regulatory reforms and the introduction of Wi-Fi 6E and the National Space Policy are paving the way for next-generation connectivity.

Pakistan has introduced key policy frameworks to strengthen its digital ecosystem. Provinces, including Gilgit-Baltistan and Azad Jammu Kashmir, have adopted Cloud First Policy (PCFP). National AI & Semiconductor Policies, finalised to accelerate Pakistan's entry into advanced technology sectors.

-

Comment by Riaz Haq on March 7, 2025 at 9:38am

-

Mashreq partners with Mastercard to lunch in Pakistan - ThePaypers

Mastercard has signed a multi-year agreement with Mashreq to support the company’s launch as a digital bank in Pakistan.

The State Bank of Pakistan granted Mashreq Pakistan a restricted licence for pilot operations as part of the government's strategy to optimise the country’s digital potential and provide greater access to financial services for underserved communities.

https://thepaypers.com/online-mobile-banking/mashreq-partners-with-...

Mashreq to become a digital bank in Pakistan

This collaboration introduces modern digital services to individuals and businesses that aim to help grow the digital economy, accelerate digital payment adoption, and drive financial inclusion in Pakistan.

The partnership highlights Mastercard’s and Mashreq’s shared vision to support Pakistan’s growth by offering better customer experiences and financial accessibility. By leveraging Mastercard’s collaboration, Mashreq has access to improved efficiency, reliability, and security across card products for both businesses and consumers. The company aims to simplify payments through fast and secure transactions, improve service delivery that supports financial growth, and drive mutual value and financial support.

Through this collaboration, Mastercard aims to develop the financial service ecosystem in the country and aid Mashreq with its launch as a digital bank in Pakistan. This move will transform the digital economy and broaden access to digital financial services across Pakistan.

Pakistan’s transformation plans

Vision 2025 was a plan launched in 2014 by the Government of Pakistan to guide the country’s socio-economic development. It focused on seven pillars, including developing human and social capital, achieving sustained and inclusive growth, strengthening governance and institutions, ensuring sustainable resources, boosting innovation, optimising education, and expanding trade routes. However, the plan faced challenges in implementation, and political changes impacted its continuity.

Another framework emerged in 2024, which aims to transform Pakistan into a USD 1 trillion economy by 2035. Key objectives include increasing exports from USD 30 billion to USD 100 billion within eight years and implementing efficient energy solutions to meet future demands.

-

Comment by Riaz Haq on March 13, 2025 at 10:11am

-

Google Wallet launches in Pakistan - Business - DAWN.COM

https://www.dawn.com/news/1897434

Digital wallet app Google Wallet became available in Pakistan on Wednesday, according to a statement issued by the tech giant.

According to the statement, Google Wallet provides people a safer, simpler, and more helpful payment experience. It also supports digital items such as loyalty cards and boarding passes. Users can get started by downloading the application through the Google Play Store.

“Pakistan’s digital payments landscape is evolving rapidly, and with more people embracing digital transactions, Google Wallet provides a secure, seamless, and efficient way to make payments, shop, and travel,” said Farhan Qureshi, Country Director for Google Pakistan.

“It will enable Pakistanis to tap-and-pay in stores, check out seamlessly online, and easily access their boarding passes when they travel,” he added.

“Google Wallet helps keep everything protected in one place, no matter where they go. More importantly, this launch will go a long way in supporting financial inclusion in Pakistan and unlock economic opportunities for all,” Qureshi continued.

“This milestone further cements Google’s unwavering commitment to Pakistan, reinforcing our belief in its digital future and potential.”

From today, cardholders of Bank AlFalah, Bank of Punjab, Faysal Bank Noor, HBL, Jazzcash, Meezan Bank, and UBL will be able to add their cards to Google Wallet and pay with their Android phones or Wear OS devices — wherever contactless payments are accepted.

Additionally, cardholders of Allied Bank, easypaisa Digital Bank, JS Bank and Zindigi will be able to add their cards to Google Wallet soon. Payment cards from Google Wallet can be used to pay online or in-app at merchants.

The statement read that online merchants such as Onic, Gul Ahmed, Sana Safinaz, J. and KE will also be available with PayFast’s integration with Google Pay.

In addition to storing and accessing payment cards, users can add boarding passes from Batik Air and Thai Airways to Google Wallet. With boarding passes in Google Wallet, travellers will be notified of changes to departure time and gate changes to ensure a hassle-free experience at the airport.

Furthermore, they will be able to tap and pay securely using Google Wallet during their overseas travel, without the need for their physical card.

If a user already has an eligible credit or debit card saved to their Google account, it will automatically appear in Google Wallet. Simply follow the on-screen steps to set it up for contactless payments.

If a user does not have a card saved and would like to add a new one, they would have to tap “Add a card” in the carousel at the top of the page, review and accept the issuer’s terms and conditions, and complete the verification process. The card will then be tokenised and ready for use in Google Wallet.

Similarly, Bookme.pk users can add boarding passes, bus, train, and event tickets, while Sastaticket.pk users can save their boarding passes into Google Wallet.

Users can start to add digital items such as boarding passes, bus, train, and event tickets into their Google Wallet.

According to the statement, privacy and security are the cornerstones of Google Wallet, “offering industry-standard tokenisation to keep transactions safe”.

When making a payment, Google Wallet uses an alternate card number (a token) that is device-specific and associated with a dynamic security code that changes with each transaction.

Banks also require verification before adding a card to the user’s device, and screen lock protection ensures that only the user can access the Wallet.March 13, 2025 at 10:05 AMReplyDelete

-

Comment by Riaz Haq on March 19, 2025 at 6:30pm

-

Pakistani Fintech PayFast Partners with Google Pay

https://propakistani.pk/2025/03/13/payfast-becomes-the-first-paymen...

PayFast, a leading State Bank-licensed PSO/PSP and MSP for Raast P2M payments in Pakistan, has unveiled an exciting partnership with Google Pay, making it the first fintech in the country to launch this innovative payment solution. This milestone brings seamless, secure, and fast transactions to online shoppers, allowing them to check out with Google Pay on their favorite eCommerce platforms powered by PayFast.

With this partnership, PayFast merchants can now offer their customers a frictionless payment experience, enhancing convenience and security in digital transactions. Google Pay enables users to store their card details securely and make quick payments without manual card entry, significantly reducing checkout times and improving user satisfaction.

Additionally, Google Pay is seamlessly integrated with the Google Wallet app, allowing users to manage all their payment methods and transactions from a single platform. With Google Pay, users can:

✔️ Make fast and secure payments at online stores.

✔️ Pay bills directly from their smartphones.

✔️ Link their bank accounts or cards for easy transactiona

-

Comment by Riaz Haq on March 29, 2025 at 10:25am

-

Pakistan Welcomes Starlink. But Can It Deliver on Its Promise? – The Diplomat

https://thediplomat.com/2025/03/pakistan-welcomes-starlink-but-can-...

Starlink could help close the urban-rural internet access gap — if the rollout is inclusive, affordable, and thoughtfully managed.

In Pakistan, the digital divide is not merely a technological issue; it is an economic and social barrier. While the country has over 142 million broadband subscriptions, nearly 99 percent are mobile-based, and fixed broadband penetration remains under 1 percent. Still, the economic potential is hard to ignore. Pakistan’s digital economy is steadily expanding – IT exports hit $3.2 billion in fiscal year 2024 – and more than 1.5 million freelancers are already contributing to global platforms from across the country. But most of that growth is happening in big cities.

In rural Pakistan, untapped talent remains offline, not by choice, but because the infrastructure simply isn’t there. Starlink could help close that gap – if the rollout is inclusive and thoughtfully managed. Starlink could empower a new generation of freelancers, online entrepreneurs, and remote workers in smaller towns and villages, provided access is widespread and affordable. The small and medium enterprise (SME) sector, which contributes nearly 40 percent of GDP and employs over 80 percent of Pakistan’s non-agricultural workforce, could benefit from stable, high-speed internet to adopt digital tools, cloud platforms, and e-commerce models.

Education stands to gain even more. Pakistan has over 22 millionout-of-school children, with the highest concentrations in regions that also suffer from poor internet access. Less than 15 percent of public schools nationwide are connected to the internet – and in rural areas, that number drops below 10 percent. In Balochistan, for instance, 65 percent of school-age children are out of school. During the COVID-19 pandemic, only a small percentage of rural households could access any form of digital learning. Starlink can change this equation by enabling digital classrooms, national curriculum portals, and virtual teacher training in regions where qualified educators are scarce or security risks prevent regular school attendance. Especially for girls in conservative areas, home-based online education could offer a culturally acceptable and practical solution to improve literacy and life outcomes.

The healthcare sector, too, is poised for transformation. Telemedicine has long been touted as a solution for Pakistan’s rural health deserts, but without broadband, its reach has remained limited. With Starlink, remote clinics in places like Chitral, Dera Bugti, or Tharparkar could finally access diagnostic platforms, connect with specialists in urban hospitals, and digitize patient records. This could reduce maternal mortality, improve early disease detection, and allow real-time responses to outbreaks – all without the need for new brick-and-mortar hospitals.

Yet the promise of Starlink is constrained by its cost. At present, Starlink’s projected pricing in Pakistan is approximately 35,000 Pakistani rupees per month (around $120), plus 110,000 rupees (around $375) in equipment costs. For perspective, the average rural household in Pakistan earns between 20,000–30,000 rupees per month. A typical 10 Mbps unlimited home broadband package costs around 1,500–2,000 rupees ($5-7) – affordable to urban middle-class households but often out of reach for rural families.

-

Comment by Riaz Haq on May 12, 2025 at 8:16pm

-

Pakistan eyes expansion of digital wallet coverage

https://coingeek.com/pakistan-eyes-expansion-of-digital-wallet-cove...

A digital wallet project that the Pakistani government initiated two months ago has been a massive success, closing the gender gap and reaching citizens with disability, the country’s prime minister says.

PM Shehbaz Sharif commissioned the distribution of the Ramazan Relief Package in early April, partly via digital wallets for the first time. The Rs 20 billion ($71 million) initiative was overseen by the IT & Telecommunications Ministry and sought to make welfare and aid distribution “efficient, transparent, and respectful.” It aligned with the Digital Nation Pakistan Bill, which was passed by parliament in January and seeks to transition Pakistan into a digitally empowered nation.

Speaking at a recent event, Sharif lauded the success of digital wallets in boosting efficiency and transparency in fund transfers.

“Through digital wallets, 79% of the funds in the relief program were transferred seamlessly and transparently,” the PM stated.

Starting 2026, all welfare distribution will be done via digital means, he added.

According to local outlets, over 900,000 Pakistanis received aid through their newly created digital wallets and conducted nearly 2 million transactions. Significantly, a sizable portion of the users were women, which the PM says plays a role in reducing the gender gap in the program. Over 2,500 disabled people also used the digital wallets, further underscoring the initiative’s importance in promoting diversity and inclusion.

“This is more than a one-time relief package. It’s about fostering long-term digital habits that empower individuals and integrate them into the formal economy,” commented IT Minister Shaza Fatima Khawaja.

Pakistan is undergoing a digital payment transformation. In the last three months of 2024, retail digital payments grew 12%, according to data from the central bank. Pakistanis made over three billion transactions worth Rs154 trillion ($554 billion).

This growth is attracting global giants. In March, Google Wallet (NASDAQ: GOOGL) announced its entry into the Pakistani market, partnering with half a dozen local banks to allow cardholders to make payments via the app.

“The launch of Google Wallet is a solid testament to Pakistan’s rising digital payments adoption and will serve as a signal to other global payment solutions about the market’s potential,” commented Mutaher Khan, whose Data Darbar provides market intelligence in the country.

However, the market still faces significant challenges. One of these is the country’s massive undocumented economy, which the government reckons is as big as the formal economy. Operators in this cash-based market operate beyond the scope of the government and pay no taxes; this makes digital payments a direct threat as they would expose the market.

-

Comment by Riaz Haq on June 8, 2025 at 8:19am

-

Pakistan eyes expansion of digital wallet coverage

https://coingeek.com/pakistan-eyes-expansion-of-digital-wallet-cove...

A digital wallet project that the Pakistani government initiated two months ago has been a massive success, closing the gender gap and reaching citizens with disability, the country’s prime minister says.

PM Shehbaz Sharif commissioned the distribution of the Ramazan Relief Package in early April, partly via digital wallets for the first time. The Rs 20 billion ($71 million) initiative was overseen by the IT & Telecommunications Ministry and sought to make welfare and aid distribution “efficient, transparent, and respectful.” It aligned with the Digital Nation Pakistan Bill, which was passed by parliament in January and seeks to transition Pakistan into a digitally empowered nation.

Speaking at a recent event, Sharif lauded the success of digital wallets in boosting efficiency and transparency in fund transfers.

“Through digital wallets, 79% of the funds in the relief program were transferred seamlessly and transparently,” the PM stated.

Starting 2026, all welfare distribution will be done via digital means, he added.

According to local outlets, over 900,000 Pakistanis received aid through their newly created digital wallets and conducted nearly 2 million transactions. Significantly, a sizable portion of the users were women, which the PM says plays a role in reducing the gender gap in the program. Over 2,500 disabled people also used the digital wallets, further underscoring the initiative’s importance in promoting diversity and inclusion.

“This is more than a one-time relief package. It’s about fostering long-term digital habits that empower individuals and integrate them into the formal economy,” commented IT Minister Shaza Fatima Khawaja.

Pakistan is undergoing a digital payment transformation. In the last three months of 2024, retail digital payments grew 12%, according to data from the central bank. Pakistanis made over three billion transactions worth Rs154 trillion ($554 billion).

This growth is attracting global giants. In March, Google Wallet (NASDAQ: GOOGL) announced its entry into the Pakistani market, partnering with half a dozen local banks to allow cardholders to make payments via the app.

“The launch of Google Wallet is a solid testament to Pakistan’s rising digital payments adoption and will serve as a signal to other global payment solutions about the market’s potential,” commented Mutaher Khan, whose Data Darbar provides market intelligence in the country.

However, the market still faces significant challenges. One of these is the country’s massive undocumented economy, which the government reckons is as big as the formal economy. Operators in this cash-based market operate beyond the scope of the government and pay no taxes; this makes digital payments a direct threat as they would expose the market.

-

Comment by Riaz Haq on June 23, 2025 at 10:42am

-

E-Agri Leads AgriTech Revolution in Pakistan with Euronet Pakistan and CMA as Strategic Digital Payment Partners

https://propakistani.pk/2025/06/19/e-agri-leads-agritech-revolution...

E-Agri has officially launched a breakthrough digital platform designed to overhaul the country’s agricultural landscape. This game-changing initiative, conceptualized and led by E-Agri, brings together the power of artificial intelligence, real-time data, and digital finance to empower farmers at an unprecedented scale.

To enable seamless financial transactions within this bold digital ecosystem, E-Agri has onboarded Euronet Pakistan and CMA as payment processing partners—leveraging their global expertise to support the scale and complexity of Pakistan’s agriculture-driven economy.

E-Agri’s platform delivers a comprehensive, farmer-centric experience—combining AI-powered crop intelligence, weather analytics, expert advisories, and localized agri-research with fully integrated financial services. From seed to sale, farmers are now empowered to make informed decisions, access digital payments, and engage in transparent market transactions—all from their mobile devices.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistan Pharma Begins Domestic Production of GLP-1 Weight Loss Drugs

Several Pakistani pharmaceutical companies have started domestic production of generic versions of GLP-1 (Glucagon-Like Peptide-1) drugs Ozempic/Wegovy (Semaglutide) and Mounjaro/Zeptide (Tirzepatide). Priced significantly lower than the branded imports, these domestically manufactured generic drugs will increase Pakistanis' access and affordability to address the obesity crisis in the country, resulting in lower disease burdens and improved life quality and longer life expectancy. Obesity…

ContinuePosted by Riaz Haq on December 19, 2025 at 10:00am — 1 Comment

WIR 2026: Income and Wealth Inequality in India, Pakistan and the World

The top 1% of Indians own 40.1% of the nation's wealth, higher than the 37% global average. This makes India one of the world's most unequal countries, according to the World Inequality Report. By contrast, the top 1% own 24% of the country's wealth in Pakistan, and 23.9% in Bangladesh. Tiny groups of wealthy elites (top 1%) are using their money to buy mass media to manipulate public opinion for their own benefit. They are paying politicians for highly favorable laws and policies to further…

ContinuePosted by Riaz Haq on December 15, 2025 at 1:00pm — 8 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network