PakAlumni Worldwide: The Global Social Network

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 2021-22 |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

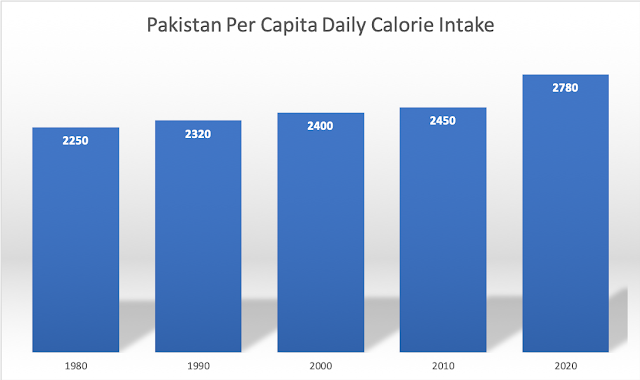

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of Pakistan 2021-22 |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 Pandemic

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

Riaz Haq

Pakistan's IMF deal offers economic pain relief but no panacea

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic...

Pakistan stepped away from the brink of bankruptcy by striking a deal with the International Monetary Fund to resume a $6 billion loan program this month. But experts warn that there is much more work to do, and that political instability poses a major obstacle to a true economic revival.

Islamabad on July 14 reached a staff-level agreement with the IMF to restart their stalled Extended Fund Facility. Pakistan will get a first tranche of $1.17 billion from the IMF in the coming weeks, which could pave the way for securing further loans from other lenders.

Nevertheless, the country is facing heavy foreign exchange pressure, with troubling echoes of the crisis that has gripped South Asian neighbor Sri Lanka this year.

Pakistan needs $41 billion in foreign exchange over the next 12 months, according to Finance Minister Miftah Ismail. "We have to repay $21 billion loans, need $12 billion current-account deficit financing and another $8 billion to maintain foreign exchange reserves," Ismail said during a budget seminar last month.

The agreement with the IMF was finalized at a time when -- due to a combination of political instability and the strong U.S. dollar -- the Pakistani rupee has been hitting all-time lows against the greenback. Ratings agency Fitch downgraded Pakistan's outlook from "stable" to "negative" earlier this week, after which the rupee touched a low of about 225 to the dollar.

Experts say the IMF agreement is a critical step toward unlocking external financing that Pakistan needs to avoid a default.

The deal "provides some level of comfort to the market that the country will have the necessary support from the IMF, and by extension from other multilateral and bilateral creditors, to meet its financing needs in the coming weeks," Uzair Younas, director of the Pakistan Initiative at the Atlantic Council's South Asia Center, told Nikkei Asia.

Younas added that it is important to follow up with policies that moderate growth and minimize the current-account deficit. The government "needs to proactively build buffers and reduce aggregate demand in the economy to slow down the dollar needs in the economy," he said.

Pakistan cannot solve its problems without structural reforms, according to experts.

"Pakistan needs to increase exports, widen the tax net, increase energy production and reduce circular debt," said Ahmed Naeem Salik, a research fellow at the Institute of Strategic Studies Islamabad. "If we do not carry out these reforms, then in the future the IMF will be extremely tough on Pakistan and might not extend loans."

At the same time, IMF loans alone will not be enough to meet the country's external financing needs. Pakistan will have to borrow from friendly countries.

Mosharraf Zaidi, chief executive of Tabadlab, a think tank based in Islamabad, agreed that the most crucial next steps for stability will be obtaining loans and grants from Saudi Arabia, China and the United Arab Emirates. "These three partners have, in the past, been more enthusiastic supporters of Pakistan's economic stability than they are now," Zaidi told Nikkei. He stressed that Pakistan will need to regain the confidence of Riyadh, Beijing and Abu Dhabi.

But the growing threat of political instability could make all of this more difficult for the government of Prime Minister Shehbaz Sharif.

The unexpected victory of ousted Prime Minister Imran Khan's Pakistan Tehreek-e-Insaf (PTI) party in by-elections in Punjab Province has raised fresh questions about the longevity of Sharif's government. The result showed that Khan's politics still resonate with a large segment of the population.

Jul 23, 2022

Riaz Haq

Pakistan's IMF deal offers economic pain relief but no panacea

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic...

Since his removal in a no-confidence vote in April, Khan has been demanding early national elections, while Sharif appears intent on holding the next vote on schedule in the second half of 2023.

Experts say the Punjab outcome does not alter the economic fundamentals but does cast doubt on the prospects for political stability -- considered a prerequisite for economic stability. "Unlike Sri Lanka, where an economic collapse has triggered political bedlam, the crisis of the Pakistani rupee is a consequence of Pakistani politics," argued Tabadlab's Zaidi.

Younas agreed that the political dynamics in Pakistan are the biggest risk to the economy. "A government gearing up for elections or facing protests from the PTI will find it difficult to impose austerity, given that such decisions erode its political capital," he said.

Younas suggested that it is crucial for the country to reach a consensus on the timing of elections and the need for economic stability. "Populist decisions such as the cut to petrol prices last week will only create further risks, and the government must continue making tough choices to achieve stability, even if this comes at a loss of political capital," he said.

Sharif said his government was passing on lower international prices to consumers by reducing the cost of fuel.

The Institute of Strategic Studies' Salik, on the other hand, argued for holding elections sooner rather than later: "The only way to get out of the political instability amid the economic crisis is to hold general elections in Pakistan as soon as possible."

Jul 23, 2022

Riaz Haq

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Many of the particular root causes of Pakistan’s situation are different than in Sri Lanka — they didn’t ban synthetic fertilizer or engage in sweeping tax cuts. The political situations of the two countries, though both dysfunctional, are also different (here is a primer on Pakistan’s troubles). But there are enough similarities at the macroeconomic level that I think it’s worth comparing and contrasting the two.

In my post about Sri Lanka, I made a checklist of eight features that made that country’s crisis so “textbook”:

An import-dependent country

A persistent trade deficit

A pegged exchange rate

Lots of foreign-currency borrowing

Capital flight

An exchange rate crash (balance-of-payments crisis)

A sovereign default

Accelerating inflation

-----

Fuel is the biggie here — more than a quarter of Pakistan’s total import bill goes to pay for fuel. In recent years it has become a lot more dependent on imports of liquified natural gas.

Food doesn’t look to be as big of a problem — Pakistan imports a fair amount of food, but it also exports a fair amount. That said, Pakistan’s population is pretty poor and malnourished, so even small disruptions to food imports could cause a lot of suffering there. And a cutoff of fuel imports would probably disrupt local agriculture quite a bit, which could cause output to crash and force Pakistanis to rely on imported food that they suddenly couldn’t afford.

In other words, if Pakistan’s currency (the Pakistani rupee) crashes in value and it suddenly can’t afford imports, its economy is in big trouble.

-----------

Remember that the reason a currency crash represents a crisis for an import-dependent country is that when the currency crashes, it’s a lot harder for a country to buy the foreign currency (“foreign exchange”) that it needs to buy imports.

There’s another way to get foreign exchange — by exporting. When you export, you get paid in foreign currency. But if a country runs a large and persistent trade deficit, then it doesn’t have a cushion to fall back on.

So that’s bad news for Pakistan. It means that when the Pakistani rupee crashes, it will have to borrow to get foreign exchange — at a time when borrowing will suddenly have gotten a lot more expensive.

Jul 23, 2022

Riaz Haq

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Remember, foreign-currency borrowing makes a country more vulnerable to a big crash in its exchange rate. If Pakistani banks or companies borrow in dollars, it means that they have to pay a certain number of dollars back each year. If the rupee falls in value, that makes those dollar repayments much more expensive. And this comes at the worst possible time — right when a country needs to borrow more money to pay its suddenly expensive import bills! Borrowing in foreign currency is thus a dangerous game.

And Pakistan has, unfortunately, been playing this game. Here’s a chart from Bloomberg showing how much dollar debt is coming due in the next few years:

Now this isn’t as bad as Sri Lanka. The amounts of dollar debt Pakistan needs to pay back in the next couple of years are about the same as for Sri Lanka, but its economy is almost four times as large. So this isn’t as catastrophic, but it’s still pretty bad.

Who has Pakistan been borrowing from? Well, a lot of people — the World Bank, the Asian Development Bank, the IMF, Saudi Arabia, and Japan. But Pakistan’s biggest foreign creditor is China.

Just like Sri Lanka, Pakistan has been borrowing heavily from China in order to fund domestic infrastructure projects, largely as part of China’s Belt and Road scheme. In fact, Pakistan has received more Belt and Road investment than any other country. But as in most countries, the Belt and Road projects have not been an economic success, due to various local factors that the Chinese planners either didn’t expect or didn’t care about. As with Sri Lanka, Pakistan has been left holding the bag.

Pakistan has been slowing down its Belt and Road projects and begging China for debt relief for years now. But while China has allowed Pakistan to roll the debt over, it has not canceled any of the debt yet — Pakistan is still on the hook. This outcome should give pause to all the people who pooh-pooh the danger of Chinese “debt traps”.

Even without China, though, Pakistan has simply borrowed too much in foreign currencies. In a previous post about Pakistan’s long-term growth, I called it a “low-income consumption society” — Pakistan borrows from abroad just to keep its desperately poor citizenry alive.

Capital flight is generally what precipitates a currency crisis. When people try to get their money out of a country, they have to sell that country’s currency in order to do it, which puts downward pressure on the exchange rate. Suddenly everyone is dumping rupees, so the rupee gets cheaper. Pakistan, unfortunately, is highly prone to capital flight. And this time is no exception — people are rushing to get their money out, and the government is trying to implement capital controls to stop them from getting their money out.

Jul 23, 2022

Riaz Haq

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Capital flight is putting downward pressure on the Pakistani rupee. There hasn’t been as dramatic a crash as in Sri Lanka, but the rupee has lost around 30% of its value since 2021, and the decline seems to be accelerating:

This isn’t yet a full-on currency crisis, but it’s getting there.

7. A sovereign default ❓

Remember, a currency crash makes a sovereign default likely when a country has a lot of foreign-currency debt. Pakistan hasn’t defaulted on its sovereign debt yet, as Sri Lanka has. But Pakistan’s bond yields have skyrocketed to 27%. This means that people are charging a very, very high price to lend Pakistan money. Why? Because people think there’s a high probability that Pakistan will soon default.

8. Accelerating inflation ❓

If a country has a lot of foreign-currency debt that it suddenly can’t afford to pay back, it can default, and/or it can print local currency to pay back the foreign-currency debt (even though this drives the exchange rate even lower). Printing a bunch of rupees would cause high inflation, as it has in Sri Lanka. So far, Pakistan’s inflation rate hasn’t spiked to the degree Sri Lanka’s has, but it’s not looking good:

So to sum up, Pakistan shares a lot in common with Sri Lanka. It doesn’t have a pegged exchange rate, it’s not as dependent on imported food, and it doesn’t have quite as much foreign-currency debt. But the basic ingredients for a slightly more drawn-out version of the classic emerging-markets crisis are there, and there are some indications that the crisis has already begun.

Pakistan’s long-term problems

Because Pakistan didn’t peg its exchange rate and didn’t borrow quite as much in foreign currencies as Sri Lanka, it made fewer macroeconomic mistakes than its island counterpart. But in terms of long-term economic mismanagement, it has done much worse than Sri Lanka. No, it didn’t ban synthetic fertilizers — that was an especially bizarre and boneheaded move. But one glance at the income levels of Sri Lanka and Pakistan clearly shows how much the development of the latter has lagged:

Jul 23, 2022

Riaz Haq

Pakistan is in big trouble

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Pakistan went from 3/4 as rich as Sri Lanka in 1990 to only about 1/3 as rich today. That’s an incredibly bad performance on Pakistan’s part.

Assessing just why Pakistan has failed so badly for so long is difficult. I wrote a post about it a year ago, but that only scratched the surface:

Basically, Pakistan invests very little of its GDP, so it can’t build up capital over time. Low investment is probably a result of various bad economic policies, but it’s also probably due to political instability — Pakistan frequently alternates between military and civilian control, and civilian administrations tend to be chaotic and fractious (as in the current turmoil). That’s not a very good climate to invest in!

Instead of investing, Pakistan keeps its population on life support with constant external borrowing — from international organizations, from China, from Saudi Arabia, from whoever will loan it money. It uses these loans to fund consumption of basics like fuel. Mian discusses how this has resulted in a perverse fuel subsidy — a pretty common practice for governments that want to keep their populations pacified, but one that Pakistan is particularly ill-equipped to afford.

So Pakistan constantly limps along at the knife-edge of desperate poverty, decade after decade, as generals and politicians fight over who gets to be in charge. Currency crisis or no currency crisis, that is a long-term recipe for disaster.

Jul 23, 2022

Riaz Haq

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

Jul 23, 2022

Riaz Haq

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

Pakistan's economy is facing another crisis as the country reaches a staff-level agreement with the International Monetary Fund to resume the support program that was suspended earlier this year. The finalization of the agreement will unlock inflows of almost $1.2 billion, critical to helping stabilize the country's economy.

This latest crisis is part of the decades-long economic decline of the country, which has been captured by a kleptocratic elite. This system is underpinned by Pakistan's powerful military, which operates a multibillion-dollar corporate empire across various sectors.

To many observers, the military's dominant role in the economy must be curtailed if Pakistan is to achieve sustainable growth. But well-meaning as they might be, these efforts have consistently failed to date, meaning that Military Inc. continues to be the dominant player in Pakistan's economy.

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

Jul 23, 2022

Riaz Haq

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

The experience of the last few years shows that there is, at least in the near term, no political party capable of challenging and dislodging the military from its dominant role.

The next best alternative is to leverage the military's economic empire to transform the country's economy. But the question is: Do Pakistan's generals have it in them to reform in a way that generates wealth for their country?

With millions of younger Pakistanis joining the workforce and failing to find jobs, the time for a different approach is now.

Jul 23, 2022

Riaz Haq

A Mitchell

@aem76us

@haqsmusings

Every entrepreneur seeking overseas investment in Pakistan should include this article in their supporting documents.

@rogueonomist

provides a clear-headed, factually-based & surprisingly optimistic assessment of the country’s debt situation:

https://twitter.com/aem76us/status/1551207098926637060?s=20&t=S...

-------------

Default: more noise, less substance

OpinionAmmar Habib KhanJuly 24, 2022

https://www.thenews.com.pk/amp/976268-default-more-noise-less-subst...

Over the last few weeks, the noise regarding a sovereign default by Pakistan has gained traction, further amplified by social media activity. The noise is largely devoid of facts, and speculative in nature as it mostly draws strength through parallels with Sri Lanka, which recently 3declared a sovereign default and is undergoing a political and economic crisis of its own.

Although we do have our fair share of political crises, and a perennial balance of payments crisis grounded in mismanagement by successive governments, we are still not even close to a sovereign default. Such noise often gains traction as soon as we get close to the peak of a balance of payments crisis, and eventually subsides. Similar concerns have gained traction at least half a dozen times in the last 25 years, wherein the country has seen much worse crises, but has never defaulted. Pakistan has never been in default on its sovereign debt, except for a technical default that occurred in the last decade of last century due to sanctions that were imposed on the country following nuclear tests.

It is important to first understand what the conditions of a sovereign default are. A sovereign default occurs when a sovereign nation is not able to pay back its creditors, whether the interest or principal amount as per its commitment. In case a default materializes, ideally all creditors sit together and work out a restructuring plan, such that the sovereign can eventually pay back its debt. Pakistan has been an active borrower from the capital markets over the last two decades, but relative to total external debt, debt from global investors or commercial financial institutions is about 17 per cent of total external debt. Similarly, debt from global investors or commercial financial institutions in Foreign Currency (FCY) is around eight per cent of total debt. It is essential to understand the context here.

It is important to understand the composition of Pakistan’s debt position here. Roughly 63 per cent of debt is PKR based, which means it is domestic debt, subscribed by the population and institutions of the country, largely through banks, which utilize individual and institutional deposits alike to invest in government debt. The sovereign can’t really default on this, as it can theoretically print more currency, and repay earlier PKR-based creditors. Although printing more money creates more problems than it solves; the logical consequence of it is inflation, which means erosion in purchasing power for everyone. Cash in Circulation has substantially increased over the years largely due to the SBP printing more money, which continues to fuel inflation.

External debt (mostly US$) makes up 37 per cent of our total debt. Further breaking down external debt, 24 per cent is due to other sovereign nations (mostly friendly), 57 per cent of external debt is due to multilateral institutions, while another 17 per cent is due to private investors through Eurobonds, Sukuks, and commercial loans. Multilateral institutions have rarely (if ever) called on a default, they negotiate with the borrowing country, no matter how stubborn, and eventually work out a restructuring plan. Similar to what has happened in our case during the last half century, wherein we have reached out to the International Monetary Fund (IMF) on an average of every three years. Debt due to other sovereign nations is an extension of the relationship that exists between the sovereigns.

Jul 24, 2022

Riaz Haq

Default: more noise, less substance

OpinionAmmar Habib KhanJuly 24, 2022

https://www.thenews.com.pk/amp/976268-default-more-noise-less-subst...

Finally, it is the private investors subscribing to the country’s debt who may call on a default in case an interest or principal payment is not made. These private investors need to be the first ones to be paid, and it is estimated that the country needs to pay $3.1 billion to these investors during the current year. A sovereign with a GDP of more than $380 billion, which has posted growth rates to the north of five per cent during the last two years isn’t really going to default on an amount less than one per cent of its GDP, or just about equivalent to a month of remittances. This is more of a liquidity crisis rather than a credit issue. Rapid rise in commodity prices after the pandemic, as well as geopolitical volatility has put budgets of countries around the world under strain, particularly of commodity importers. However, as recessionary fears materialize globally, there has been a decline in commodity prices across the board, which will provide some respite to Pakistan and provide some breathing space in terms of liquidity.

This time it is slightly different though, as none of the friendly sovereign nations is willing to extend any fresh debt, or rollover, till we get the IMF programme in place, which means till we agree to ensure some kind of fiscal and monetary discipline. We have flirted with default multiple times over the last three decades, but we cannot stay safe from it forever. This may be our last chance, thereby necessitating structural reforms which institutes fiscal, and monetary discipline. An uncontrollable expense budget, and demonstrated inability to generate tax revenues are issues that need to be resolved. Without structural reforms, we may potentially default during the next ten years, because the punch bowl isn’t going to last forever.

The current crisis pales in comparison to many other economic crises that Pakistan has faced earlier. This however does not mean that we should continue living dangerously, and considerably beyond our means. This may be the country’s last chance to put the house in order and gradually move away from import dependent consumption, and reconfigure the economy to be more export oriented, with an expansive and progressive tax base.

A resolution of the decision-making crisis and a much-needed consensus among all political and non-political actors would stave away any risk of sovereign default. If the country continues to inch towards a default this time around, it would solely be a consequence of the current political crisis, in addition to consistently bad policymaking during the last 50 years.

The writer is an independent macroeconomist.

Jul 24, 2022

Riaz Haq

Pakistan's Financing Needs Fully Met for This Year, Central Bank Chief Says

https://www.voanews.com/a/pakistan-s-financing-needs-fully-met-for-...

Pakistan's $33.5 billion external financing needs are fully met for financial year 2022/23, the central bank chief said on Saturday, adding that "unwarranted" market concerns about its financial position will dissipate in weeks.

Fears have risen about Pakistan's stuttering economy as its currency fell nearly 8% against the U.S. dollar in the last trading week, while the country's forex reserves stand below $10 billion with inflation at the highest in more than a decade.

"Our external financing needs over the next 12 months are fully met, underpinned by our on-going IMF program," the acting governor of Pakistan's State Bank, Murtaza Syed, told Reuters in an emailed reply to questions.

Pakistan last week reached a staff level agreement with the International Monetary Fund (IMF) for the disbursement of $1.17 billion in critical funding under resumed payments of a bailout package.

"The recently secured staff-level agreement on the next IMF review is a very important anchor that clearly separates Pakistan from vulnerable countries, most of whom do not have any IMF backing," he said.

Jul 24, 2022

Riaz Haq

Mattias Martinsson

@Tundra_CIO

Had the honor to participate in a panel on #SriLanka. Was asked about comparisons to #Pakistan. Will they too default on their commercial debt?

1/X

1) Going into 2022 Sri Lanka's foreign public debt to GDP was 40-45%, vs Pakistan's 20-25% (interval as no final GDP number)

https://twitter.com/Tundra_CIO/status/1551105929927688192?s=20&...

------------------

Mattias Martinsson

@Tundra_CIO

2/X

More importantly the commercial share of #SriLanka's FX debt (the part that is owned by bond investors in London and NY) was 22-25% of GDP, vs #Pakistan's 5-6%. Both had ca USD 18bn in commercial debt, but #Pakistan is a significantly larger economy.

https://twitter.com/Tundra_CIO/status/1551107814159949825?s=20&...

----------------

Mattias Martinsson

@Tundra_CIO

3/X

#SriLanka's government refused IMF negotiations when covid hit (and USD 4bn of tourism revenue was no longer an option). Instead introduced capital controls, hoping that tourism would recover in time for them to make their debt payments. They ran FX reserves down to zero (0)

https://twitter.com/Tundra_CIO/status/1551109782387433472?s=20&...

-----------

Mattias Martinsson

@Tundra_CIO

4/X

I can only explain this as a gamble with 21 million people's lives, which they lost. When #Ukraine #Russia crisis hit the bluff was called. Coffer was empty, no money to buy fuel, no money for medicines, you name it.

https://twitter.com/Tundra_CIO/status/1551110512301285377?s=20&...

--------------------

Mattias Martinsson

@Tundra_CIO

5/X

#SriLanka defaulted on their eurobonds because there was literally 0 USD to pay with. #Pakistan has USD 2bn in maturing eurobonds in 2022, another 2 in 2024. If they want to, they can pay these.

https://twitter.com/Tundra_CIO/status/1551111415221592064?s=20&...

------------

Mattias Martinsson

@Tundra_CIO

6/X

#Pakistan can be forced to enter a debt restructuring but it will then be due to failing negotiations with IMF and friendly states. It will NOT be their commercial debt that trips them. This makes the question of default more of a political discussion, than anything else.

https://twitter.com/Tundra_CIO/status/1551112196305944578?s=20&...

Jul 24, 2022

Riaz Haq

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

After Sri Lanka, it’s the latest emerging economy to falter in the wake of COVID, the war in Ukraine, and skyrocketing inflation. But the stakes are higher: Pakistan borders China, India, Iran, and Afghanistan, and it sits at the crossroads of the Persian Gulf and the Indian Ocean. It’s embroiled in a battle against rising terrorism, and it has nuclear weapons.

But the world’s fifth-most populous country — where 220 million live under a political system plagued by corruption and extremism ± isn’t just broke. Polarized and isolated, it’s going through a period of instability not seen since its civil war in 1971, when it lost a majority of its population as East Pakistan seceded to become Bangladesh.

A serious rethink is needed about the way Pakistan manages itself and its diplomacy. So, are its rulers making the right adjustments?

Debt and doubt are mounting. The Pakistani rupee lost 8.3% of its value last week — an all-time low. Its stocks are the worst performing in Asia, and it has less than two months' worth of foreign exchange reserves, which means Pakistan needs an IMF bailout immediately.

But the country has a habit of not mending its ways: Pakistan is one of the most bailed-out countries on the IMF’s books, having received 22 loans since 1958. It borrows, refuses to reform, then borrows again. Now, the IMF wants more than Pakistan’s empty promises, and assurances from a guarantor like Saudi Arabia before offering another lifeline.

Political turmoil has paralyzed governance. The military remains all-powerful but is threatened by recently ousted Prime Minister Imran Khan. Once an ally of the generals, Khan lost their support this spring and paid for it with a no-confidence vote that saw him replaced by a military-backed coalition of older political dynasties, the Sharifs and Bhuttos. But high prices, power cuts, and removal of public subsidies have quickly eroded support for the new government.

Despite his own track record of maladministration, Khan is gaining the sympathy of the street, turning protests into votes, bashing his former benefactors, and threatening further unrest.

Security and geopolitical problems are also escalating. After backing the Taliban for two decades while pretending to be America’s ally, Pakistan’s gotten more than it bargained for. It’s suffering attacks from terrorists based in Afghanistan, and its relationship with Washington has deteriorated. American diplomatic interest and financial investments have all but dried up. This has pushed Pakistan to embrace China and its expensive loans tied to Beijing’s Belt and Road Initiative.

But as China tries to make inroads, its personnel and projects have been targeted by insurgents, forcing Beijing to go slow on investments there.

Meanwhile, Pakistan’s poisonous relationship with India has only worsened. Narendra Modi’s Hindu-nationalist regime has tightened its grip in Delhi while anti-India generals continue to dominate Islamabad’s foreign policy. Despite a back channel, the two sides barely trade or talk, and instead support proxy militants on each other’s turf. Moreover, Islamabad has seen relations chill with once-friendly neighbors like Saudi Arabia, the UAE, and Iran, all of whom now have warmer ties with New Delhi because of India’s increasing economic clout.

If the most immediate threat is default, can Pakistan avoid it? Even though the rupee saw its biggest drop last week since 1998, its central bank thinks it can meet its obligations for yet another IMF bailout. Others are not so sure.

“Pakistan is significantly closer to default today than it was a few days ago,” says Uzair Younus, director of the Pakistan Initiative at Washington’s Atlantic Council. “Does this mean default is imminent? No, but domestic elites are signaling that they are bracing for impact and a hard landing.”

Jul 24, 2022

Riaz Haq

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

Crucially, the political will to improve the situation seems to be lacking. “There’s little incentive for politicians to cooperate and bring Pakistan back from the brink,” Younus says about the leadership, which is dominated by exploitative landed and industrial classes who maintain their assets abroad.

This was evident on Friday, when the election of the chief ministership of Punjab, the country's largest province, didn’t go to Imran Khan’s candidate despite being poised for a majority. Rather, backroom politicking robbed Khan and his allies of their prize, resulting in protests. With such political wrangling and brinkmanship, there is only one disciplinarian: the Pakistan military.

“The chaos may once more open the door for enhanced involvement of the military in stabilizing the political economy,” says Younus.

Pakistanis aren’t unfamiliar with military interventionism in their daily lives. The world’s sixth-largest military has ruled Pakistan directly or indirectly for most of the last 75 years since independence.

If the military leans in, it could lead to one of two types of scenarios: direct rule, which the army has exercised intermittently for over three decades; or indirect rule, which means the brass appoint an apolitical and technocratic government, a model the generals have also toyed with in the past.

While admitting that Pakistan’s economic and political situation is becoming untenable, senior security officials, speaking on condition of anonymity, denied that direct rule is in the cards. But a former Pakistani diplomat said he got a “heads-up to stand by in case of a technocratic set-up by the ‘Establishment’.” That’s Pakistan-speak for the army and its praetorian intelligence apparatus.

Even if autocrats take over or bring in technocrats from Pakistan’s diaspora to run things, certain realities will be hard to change. India, not Pakistan, is Washington’s new best friend in South Asia. And while India has graduated to a $3.3 trillion economy, overtaking the UK as the world’s fifth-largest, Pakistan’s over-investment in remaining a national security state has only unraveled its potential.

Aid packages and military interventions can’t fix that. Pakistan has retained a military it can’t afford and backed proxies it can’t control while allowing its financial and administrative institutions to falter. With an anemic tax regime, stagnant industrialization, a shrinking middle class, the biggest gender income gap in South Asia, and a falling education rate (with nearly half of 5-16-year-olds unenrolled in school), Pakistan needs more than multilateral institutions and donors to come to its aid. It needs economic reforms and a security rethink.

No friend or ally has been able to convince the country to mend its ways. But of all its partners – and there aren’t many – China is the most likely to pick up the tab. Beijing has long seen Islamabad as a bulwark against their common rival, India, but the economic and diplomatic costs of supporting Pakistan, its “Iron Brother,” are mounting. The $65 billion China-Pakistan Economic Corridor, for example, is struggling because of Pakistan’s inability to deliver.

“CPEC was the crown jewel of Xi Jinping’s Belt and Road Initiative and the downward spiral of Pakistan, weighed down after binging on Chinese debt, will undermine China's economic diplomacy,” says Younus.

Jul 24, 2022

Riaz Haq

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

Given its size, location, and its nukes, many Pakistani leaders have often scoffed at the notion of collapse or default, insisting the country is too big to fail. That’s one reason why the country has failed to develop a sounder economic system, relying instead on bailouts.

But Pakistan’s weakness isn’t just financial; it’s also existential. With such divisive politics, it can’t afford another military or technocratic regime. Considering the rough neighborhood it resides in, becoming a Chinese dependent is also dangerous. Critically, with failures on so many fronts — economics, war, democracy, human rights — Pakistan is running out of time to correct its course.

Jul 24, 2022

Riaz Haq

Global Markets: Rice – Pakistan Export Forecast Rises to Record While Importing More Wheat

https://agfax.com/2022/07/16/global-markets-rice-pakistan-export-fo...

2021/22 Pakistan rice exports are forecast up 450,000 tons to 4.8 million, almost 30 percent higher than the previous year. Favorable export conditions are expected to continue as large stocks, competitive export prices, and strong demand from key markets are expected to spur exports further to 4.9 million tons in 2022/23.

Pakistan retains ample supplies following two consecutive record crops, despite hot and dry conditions delaying the 2022 May/June planting season. The Pakistan Meteorological Department forecasts ample monsoon rains which are expected to be beneficial for this season’s harvest.

In addition to favorable weather and market conditions, abundant supplies, and the devaluation of the Pakistani rupee have kept its prices globally competitive. Over the past year, Pakistani rice prices have closely mirrored Indian prices, which have been extremely low for almost 2 years; however, strong export demand has caused Pakistani quotes to spike in recent weeks.

Pakistan’s top export markets include a diverse group of countries to which it exports different rice varieties, including fragrant long-grain basmati, regular milled, and broken rice. In recent years, Pakistan has emerged as a major supplier to China, the world’s largest rice importing and consuming country.

In fact, in the first few months of 2022, Pakistan exported more rice to China than Vietnam, the historic top supplier. Pakistan exports both milled rice and broken rice to China, the latter primarily used in feed. Pakistan also exports competitively priced milled rice to East Africa – particularly Kenya, Mozambique, and Tanzania – and neighboring countries in Central Asia, mainly Afghanistan.

Pakistan is also a producer and exporter of basmati rice, a premium product known for its aromatic qualities. Demand for basmati rice has grown in recent years, especially in the European Union and the Middle East. While still facing stiff competition from India, the top global basmati exporter, Pakistan is a significant basmati supplier to the European Union, the United Arab Emirates, Saudi Arabia, and the United Kingdom.

Rice is an important food in Pakistan; however, wheat is the principal grain consumed domestically. Unfortunately, the same hot and dry planting conditions that delayed planting of the 2022 rice crop in Punjab and Sindh provinces have adversely affected Pakistan’s wheat production.

This month, Pakistan’s 2022/23 wheat import forecast has been raised 500,000 tons to 2.5 million as the government has aggressively procured international and domestic wheat. Historically, the government intervenes heavily in wheat production, marketing, and trade to ensure sufficient supplies of a commodity critical to food security.

Jul 25, 2022

Riaz Haq

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

There will be no easy way forward. Reversing Pakistan’s dependence on imported fossil fuels by accelerating the shift to low-cost domestic renewable energy sources will be crucial for energy security and economic growth. In the meantime, Pakistan needs a coherent LNG procurement strategy that avoids locking in high prices for upcoming decades.

Ripple effects of low LNG supply

In the aftermath of Russia’s invasion of Ukraine, Europe is buying significantly more volumes of LNG to cut its dependence on Russian gas. But with almost no spare global LNG supply capacity, European buyers have pulled existing cargoes away from developing nations by offering higher prices.

Pakistan is suffering the consequences. In July, state-owned Pakistan LNG Limited (PLL) issued a tender to buy ten cargoes of LNG through September but did not receive a single bid.

This is the fourth straight tender that went unawarded. In a previous tender, PLL received only one bid from Qatar Energy at a price of US$39.80 per million British thermal unit (MMBtu). At this price, a single cargo would cost over US$131 million, but the government rejected the offer to conserve its dwindling foreign exchange reserves.

The effects have been disastrous. Power cuts are crippling household and commercial activities, while gas rationing to the textile sector has resulted in a loss of US$1 billion in export orders. Despite energy conservation efforts, many areas continue to experience load shedding of up to 14 hours, as the generation shortfall reached 8 gigawatts (GW).

LNG procurement: spot purchases vs. long-term contracts?

Some countries are shielded from extreme LNG price spikes by long-term purchase contracts. But Pakistan sources roughly half of its LNG from spot markets, increasing the country’s exposure to global price volatility.

To mitigate the situation , Pakistan has expressed openness to signing new long-term contracts, with one official claiming the country would go for an unusually long 30-year contract. The contracts will most likely be signed with Qatar and United Arab Emirates.

However, Pakistan’s experience with long-term contracts has been problematic. Term suppliers had defaulted at least 12 times over the past 11 months, most recently in July when Pakistan desperately needed fuel.

Long-term contracts—which are typically tied to a ‘slope’ or a percentage of the Brent crude oil price—are reportedly 75% more expensive than one year ago. If Pakistan signed a deal now with a 16-18% slope, and assuming current Brent crude prices of US$100, a single cargo would cost roughly US$55-61 million. At the 11-13% slope of Pakistan’s current contracts, meanwhile, a cargo would cost US$37.5-44.3 million. Although Brent crude prices will vary, it is clear that Pakistan would risk locking in higher prices by signing new long-term contracts in the current LNG environment.

Moreover, with limited global LNG supply, long-term contracts would likely not start until 2026, when significant new global supply capacity is expected online. Pakistan’s LNG needs are more immediate.

Rather than lock in high prices for the long-term, buyers in Pakistan can consider signing shorter five-year contracts with portfolio players. Industry representatives have suggested there is space in the market for shorter contracts. Although shorter terms typically come at a price premium, they may temporarily help alleviate Pakistan’s exposure to extreme spot market volatility.

Jul 25, 2022

Riaz Haq

The ongoing global energy crisis has left countries scrambling for fuel. As wealthy buyers of liquefied natural gas (LNG) offer top dollar for every available cargo, Pakistan faces dire fuel and power shortages with little end in sight.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakista...

Short-term contracts have to carry higher penalties in instances of non-delivery to avoid repeated supplier defaults. Coupled with the existing long-term contracts and spot purchases, short-term contracts would diversify the country’s supply portfolio, potentially allowing better price management, supply security, and flexibility.

Permanent shift away from LNG

In the longer term, cutting Pakistan’s dependence on imported fossil fuels altogether is the most affordable solution. Low-cost, domestic renewables like wind and solar can prove to be a crucial hedging mechanism against high, US dollar-denominated fossil fuel prices.

The government is beginning to recognize the unreliability and unaffordability of LNG compared to domestic renewables. Policymakers recently indicated that they would announce a new solar policy geared towards reducing LNG dependence, reducing high energy costs, and improving energy security.

Under the policy, due out August 1, 7-10 GW of residential solar systems would be deployed by the summer of 2023. In addition, the policy would allow the installation of seven utility-scale solar plants at the sites of existing thermal power plants.

This is a major step in the right direction, one that will help reduce gas and LNG demand in the power sector. We also identified other measures in a recent IEEFA report to limit LNG demand, such as reforming gas distribution company revenue regulations to reduce gas leakage, along with energy efficiency incentives.

Ultimately, there will be no one-size-fits-all solution to the current energy crisis, but a portfolio of short to long-term plans is necessary to mitigate Pakistan’s unsustainable reliance on LNG imports.

Jul 25, 2022

Riaz Haq

Pakistan’s financing worries are ‘overblown’ insists central bank governor

Murtaza Syed rejects comparisons with Sri Lanka and anticipates IMF funding tranche in August

https://www.ft.com/content/ba25a90c-e319-470b-9b74-27eda1c4f291

Pakistan’s central bank governor has rejected market concerns about Islamabad’s worsening liquidity crunch as “overblown” and said he expected the IMF to sign off on $1.3bn of new funding for the cash-strapped Asian country in August.

Murtaza Syed also told the Financial Times that Pakistan was engaged in talks with Middle Eastern countries, such as Saudi Arabia, as well as China “to get a little bit of the extra money that we need” as it contends with rising commodity prices, falling foreign exchange reserves and a depreciating currency.

“On the external debt servicing side, the next 12 months — while they look challenging — are not as dire as I think some people make them out to be,” Syed said. “Especially as we have the cover of the IMF programme during what is going to be a very difficult 12 months globally.”

Sri Lanka’s default on its foreign debt in May has stoked fears over the risk of defaults in other emerging economies.

The Pakistani rupee lost more than 7 per cent of its value against the US dollar last week, the steepest weekly drop since 1998, after a regional poll victory for Imran Khan, who was ousted as prime minister just a few months ago.

Pakistan’s widening current account deficit has drained its foreign exchange reserves, which have fallen by $7bn since February to just over $9bn in July, Syed said, equivalent to a month and a half of imports.

Fitch Ratings revised its outlook for the country to negative from stable last week because of what it called “significant deterioration in Pakistan’s external liquidity position and financing conditions since early 2022”.

However, Syed, who worked for the IMF for 16 years, said Pakistan’s debt vulnerability could not be compared with Sri Lanka’s problems. “Those fears are overblown and in fact, Pakistan is not in that very bad category of countries,” he said.

Unlike Sri Lanka’s tourism-reliant economy, he said, Pakistan “had a pretty good Covid”, with a milder economic contraction and stronger recovery than its smaller neighbour.

While Sri Lanka owes about 40 per cent of its debt to commercial lenders, most of Pakistan’s debt is owed to multilateral institutions and bilateral lenders, he added.

“We have external financing needs of about $34bn in the next 12 months and we have financing already identified because of the IMF programme of over $35bn,” he said. “So we are over-financed, actually.”

Syed said that he expected the next $1.3bn IMF disbursement from its $7bn facility to be approved in August, though this might be complicated by summer holidays. “We are trying to push for it sooner rather than later,” he said.

Khan’s upset victory last week in Punjab, the country’s largest province, has raised the likelihood of an early election that could unseat Shehbaz Sharif’s government.

However, Syed said that his “strong baseline” was that the Sharif government would remain in power. Even in the “hypothetical” event of an early election, he added, the IMF had a history of proceeding with programmes with caretaker governments.

“I think there is wide recognition across the political spectrum that the next 12 months are going to be hard for emerging markets and are going to be hard for Pakistan, too,” he said.

Jul 26, 2022

Riaz Haq

Arif Habib Limited

@ArifHabibLtd

Current Account Balance FY22

CAB: $ -17.4bn (+6.2x YoY)

Remittances: $31.2bn (+6% YoY)

Total imports: $84.2bn (+34% YoY)

Total exports: $39.4bn (+25% YoY)

https://twitter.com/ArifHabibLtd/status/1552313401535242246?s=20&am...

-----------------

SBP

@StateBank_Pak

1/2 As foreshadowed by earlier PBS data, a surge in oil imports saw CAD rise to $2.3bn in Jun despite higher exports & remittances. So far in Jul oil imports are much lower & deficit is expected to resume its moderating trajectory. Visit #EasyData https://bit.ly/3Ox6ZwI

https://twitter.com/StateBank_Pak/status/1552280965606768641?s=20&a...

--------------

SBP

@StateBank_Pak

2/2 3.3mn metric tons of oil was imported in Jun, 33% higher than in May. Together with higher global prices, this more than doubled the oil import bill from $1.4bn to $2.9bn. By contrast, non-oil imports ticked down. See report: https://sbp.org.pk/ecodata/Balancepayment_BPM6.pdf

https://twitter.com/StateBank_Pak/status/1552280968391712768?s=20&a...

Jul 27, 2022

Riaz Haq

Arif Habib Limited

@ArifHabibLtd

CAD clocked in at 4.6% of GDP during FY22; last 10 years average 2.5%

https://twitter.com/ArifHabibLtd/status/1552316041367375872?s=20&am...

Jul 27, 2022

Riaz Haq

Pakistan may be able to avoid a full-blown economic crisis

But only if everything goes right

https://www.economist.com/asia/2022/07/28/pakistan-may-be-able-to-a...

On the list of unfortunate economies that markets think might soon follow Sri Lanka into debt default and economic crisis, Pakistan sits near the top. It relies heavily on imported food and energy. As commodity prices have soared, its current-account balance has widened and hard currency has drained away. In the past year, Pakistan’s foreign-exchange reserves have shrunk by more than half, to just over $9bn, about six weeks’ worth of imports. Its currency, the rupee, has lost 24% of its value against the dollar in 2022. Many reckon that a crisis is inevitable.

Not Murtaza Syed. A former employee of the International Monetary Fund (imf) now serving as acting head of Pakistan’s central bank, Mr Syed believes the country is well equipped to survive its current troubles. It is thanks only to lazy markets’ unwillingness to take a nuanced view of individual countries’ circumstances that Pakistan finds itself lumped in with other, more endangered economies.

Mr Syed has something of a point. At 74% of gdp, Pakistan’s public-debt load is high for a poor country, but below the level of many other vulnerable economies. Importantly, it owes much less to foreigners, and does not rely very heavily on bond markets. Pakistan’s funding problems mostly stem from bad timing; it owes a lot to external creditors over the next year, at a time when global financial conditions are deteriorating and the cost of imports is spiking. If it can survive this pinch point, Mr Syed reckons, things will look up.

Hopes for survival received a big boost on July 13th, when the government concluded an agreement with the imf to revive a pre-existing bail-out arrangement, clearing the way for about $1.2bn to flow in. With that money, Pakistan just about has the financing to meet an estimated $35bn in external obligations over the next year. Crucially, the imf’s renewed involvement should dissuade big creditors (including China) from demanding immediate repayment; rolling over those debts would meet nearly a third of Pakistan’s funding needs. The agreement might also convince markets that they have underestimated Pakistan’s financial health.

The problem with this plan is that it leaves little margin for error. Pakistan’s current-account deficit, which mostly reflects that more is being spent on imports than foreigners are spending on Pakistan’s exports, is responsible for a huge share (about a third) of its projected financing needs over the coming year. If in the coming months that deficit turns out to be larger than anticipated then the sums no longer add up. Weak inflows of capital, because of reduced investment or remittances, could also upset the delicate balance. Maintaining market confidence will be crucial. imf reports on the economy may well help in this regard, particularly if the new government shows that it is making progress towards its ambitious goals for trimming its budget deficit, which last year stood at 6% of gdp. But establishing that credibility will take time.

And time may not be on Pakistan’s side. As the troubles of the emerging world grow, markets are showing signs of becoming less discriminating, not more. This pervading gloom may help explain why Mr Syed has gone on a public-relations offensive. Yet in these conditions, markets do not seem especially inclined to listen. ■

Jul 28, 2022

Riaz Haq

Pakistan July Imports Decline Amid Efforts to Bridge Trade Gap

ByRajesh Kumar Singh

https://www.bloomberg.com/news/articles/2022-07-31/pakistan-july-im...

The value of Pakistan’s imports in July declined to $5 billion from $7.7 billion last month, reflecting the government’s efforts to stem the country’s “large” current account gap, Finance Minister Miftah Ismail said.

The federal government is “determined to minimise the large current account deficit” left behind by its predecessor, the minister said in a Twitter post. Ismail didn’t provide an update on exports, although he had said earlier this week that July imports will be lower than the value of exports and remittances from other countries.

South Asian economies, including Pakistan -- heavily reliant on energy imports -- have been roiled by soaring prices of crude oil, natural gas and coal following Russia’s invasion of Ukraine. Pakistan is seeking help from the International Monetary Fund to avoid a default and stave off fears of a protracted economic crisis like the one being witnessed in Sri Lanka.

Pakistan’s Rupee Has Worst Month Ever Amid IMF Loan Concern

A delay in an IMF bailout tranche and a shortage of dollars has pushed the rupee to record lows. The currency fell more than 14% against the dollar in July, ending Friday’s trading at 239 per greenback, the biggest monthly slide since Bloomberg started compiling data in 1989. It’s among the worst currency decliners globally for the month.

The pressure on the currency is expected to drop in the next two weeks, Ismail said separately in a news conference in Islamabad.

Jul 31, 2022

Riaz Haq

FRIM Ventures

@FRIMVentures

These tables show Pakistan’s debt profile portrays a very low likelihood of default. Maturity of external debt is mere $1.4bn for under one year (just 1.4% of total FX debt). (1/2)

https://twitter.com/FRIMVentures/status/1554009897443942401?s=20&am...

-----------------

FRIM Ventures

@FRIMVentures

Eurobonds contribute just 3% to public debt and total external financing requirements stand at just 9% of GDP and 36% of total debt (2/2)

https://twitter.com/FRIMVentures/status/1554009902753914881?s=20&am...

---------

FRIM Ventures

@FRIMVentures

*external financing requirement is 9% of GDP and external debt is 36% of total debt

https://twitter.com/FRIMVentures/status/1554027948193234944?s=20&am...

Aug 1, 2022

Riaz Haq

#India, #SriLanka, #Pakistan #debt woes evoke memories of 1997 #Asian currency crisis. Back then, #Thailand’s devaluation led to a #global #market collapse. A sequel might be in the works. #PKR #INR #inflation #economy #rupee https://www.bloomberg.com/news/articles/2022-08-03/india-sri-lanka-...

Pakistan is scrambling for a bailout to avert a debt default as its currency plummets. Bangladesh has sought a preemptive loan from the International Monetary Fund. Sri Lanka has defaulted on its sovereign debt and its government has collapsed. Even India has seen the rupee plunge to all-time lows as its trade deficit balloons.

Economic and political turbulence is rattling South Asia this summer, drawing chilling comparisons to the turmoil that engulfed neighbors to the east a quarter century ago in what became known as the Asian Financial Crisis.

Aug 5, 2022

Riaz Haq

Pakistan’s finance minister says the country has avoided a Sri Lanka-like default crisis

https://www.cnbc.com/2022/08/10/pakistans-finance-minister-says-cou...

Pakistan’s finance minister (Miftah Ismail) said the government has taken steps that will put the country on the right track and help the South Asian nation avoid an economic collapse. But that will cause pain for its people, he added.

“There were serious worries about Pakistan heading Sri Lanka’s way. Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening, and I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

The country is desperately fighting for its survival as the recent rise in commodity and energy prices have exacerbated its debt problems.

“There were serious worries about Pakistan heading Sri Lanka’s way, Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening. And I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

“We are now in an IMF program. We have reached the staff-level agreement. We expect to get a board approval later this month. We’ve taken off subsidies from fuel, from power ... We’ve raised taxes. So, I think we’re headed in the right direction.”

Nevertheless, Ismail acknowledged that recent measures taken by the government will be difficult for Pakistan and would mean a lot of pain for the people.

“But look at the alternative. If we had gone the Sri Lankan way this would have been much worse,” the minister said.

Aug 10, 2022

Riaz Haq

75 Years

Economic Journey of Pakistan

Toward a Vibrant Pakistan

https://www.finance.gov.pk/75_Years_Economic_Journey_of_Pakistan.pdf

Government of Pakistan

Ministry of Finance

August 13, 2022

Aug 13, 2022

Riaz Haq

#SriLanka Collapsed First, but It Won’t Be the Last. 60% of low-income & 30% of middle-income nations are in #debt distress. #Pakistan, #Bangladesh, Tunisia, Ghana, #SouthAfrica, #Brazil, Argentina, Sudan — the list of those in trouble is growing rapidly. https://www.nytimes.com/2022/08/15/opinion/international-world/sri-...

By Indrajit Samarajiva

Mr. Samarajiva is a Sri Lankan writer who publishes at his blog Indi.ca.

"We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse"

As a Sri Lankan, watching international news coverage of my country’s economic and political implosion is like showing up at your own funeral, with everybody speculating on how you died.

The Western media accuses China of luring us into a debt trap. Tucker Carlson says environmental, social and corporate governance programs killed us. Everybody blames the Rajapaksas, the corrupt political dynasty that ruled us until massive protests by angry Sri Lankans chased them out last month.

But from where I’m standing, ultimate blame lies with the Western-dominated neoliberal system that keeps developing countries in a form of debt-fueled colonization. The system is in crisis, its shaky foundations exposed by the tumbling dominoes of the Ukraine war, resulting in food and fuel scarcity, the pandemic, and looming insolvency and hunger rippling across the world.

Sri Lanka is Exhibit A. We were once an economic hope, with an educated population and a median income among the highest in South Asia. But it was an illusion. After 450 years of colonialism, 40 years of neoliberalism, and four years of total failure by our politicians, Sri Lanka and its people have been beggared.

Former President Gotabaya Rajapaksa deepened our debt problems, but the economy has been structurally unsound across administrations. We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse.

But we are just the canary in the coal mine. The entire world is plugged into this failing system and the pain will be widespread.

Here’s how the past few months have felt.

I have a car, which has now turned into a giant paperweight. Sri Lanka literally ran out of gas, so my kids asked if they could play inside it. That’s all it is good for. Getting fuel required waiting for days in spirit-crushing queues. I gave up. I got around by bus or bicycle. Most of the economy stopped moving at all. Now fuel has been rationed, but irrationally. Rich people get enough fuel for gas-guzzling S.U.V.s while working taxis don’t get enough and owners of tractors struggle to get anything at all.

The rupee has lost almost half its value since March and many goods are out of stock. You learn to react at the first sign of trouble: When power cuts started a few months ago my wife and I bought an expensive rechargeable fan; days later, they were sold out. When fuel cuts became dire we immediately bought bicycles, and the next day their price went up. Staples like rice, vegetables, fish and chicken have soared in price.

Many Sri Lankans are going on one meal a day; some are starving. Every week brings to my door a new class of people reduced to begging to survive.

I earn in dollars as a writer online so when the rupee depreciated and was devalued, I effectively got a raise. We can afford solar and battery backups to keep the power on. But many others are at the mercy of blackouts. People couldn’t work as factories and other workplaces shut down and children couldn’t sleep in the heat. The first major protests kicked off in March after a full night of this, when it seemed that the entire country was sleep-deprived and furious.

Aug 15, 2022

Riaz Haq

Last month, protesters breached the presidential residence and prime minister’s office, and it was the one thing that felt good. Along with thousands of ordinary Sri Lankans, I got to see inside these colonial-era fortresses for the first time. It was spontaneous, safe and respectful. Couples went on dates there; parents brought their kids. I saw people singing in the president’s house, a mother dancing with her toddler, people swimming in the pool. I walked around a hall lined with plaques bearing the names of British colonizers, which seamlessly became the names of our own presidents.

At the prime minister’s office, someone played the piano and a shirtless man draped in a Sri Lankan flag slept on a couch. Four guys had set up a game of carrom and were flicking the discs around. A child joyfully cartwheeled across the lawn outside, and a community kitchen served rice to anyone that was hungry. It was a beautiful sight in a space where elites had nibbled on canapes before, surrounded by armed guards. It felt hopeful.

But what had briefly felt like true democracy didn’t last. Parliament merely replaced President Rajapaksa with one of his cronies, Ranil Wickremesinghe, who has been prime minister a handful of times but lost his parliamentary seat in 2020. He has turned the military on demonstrators and arrested protesters and trade unionists. It’s all been “constitutional,” eroding faith in the whole liberal democratic system.

Sri Lanka — like so many other countries struggling for solvency — remains a colony with administration outsourced to the International Monetary Fund. We still export cheap labor and resources, and import expensive finished goods — the basic colonial model. The country is still divided and conquered by local elites, while real economic control is held abroad. The I.M.F. has extended loans to Sri Lanka 16 times, always with stringent conditions. They just keep restructuring us for further exploitation by creditors.

And as much as the West blames Chinese predatory lending, only around 10 to 20 percent of Sri Lanka’s foreign debt is owed to China. The majority is owed to U.S. and European financial institutions, or Western allies like Japan. We died in a largely Western debt trap.

Other countries face the same peril. Around 60 percent of low-income nations and 30 percent of middle-income ones are in debt distress or at high risk of it. Pakistan, Bangladesh, Tunisia, Ghana, South Africa, Brazil, Argentina, Sudan — the list of those in trouble is growing rapidly. An estimated 60 percent of the world’s workforce has lower real incomes than before the pandemic, and the rich countries offer little to no help.