PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Exports Surging At The Fastest Rate in South Asia

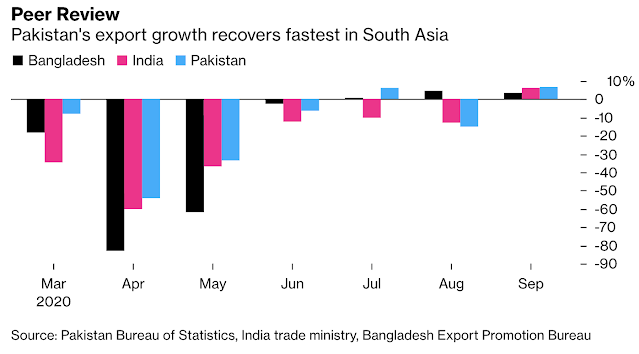

With several major brands moving production to Pakistan amid the COVID19 pandemic, the country's exports have grown at a faster pace than those of Bangladesh and India, according to Bloomberg News. Pakistan's total textile shipments rose 7% in September, compared with India’s 6% and Bangladesh’s 3.5%.

|

| South Asia Region's Exports. Source: Bloomberg |

“Pakistan has seen orders shifting from multiple nations including China, India and Bangladesh,” said Shahid Sattar, secretary general at the All Pakistan Textile Mills Association, in an interview with Bloomberg's Faseeh Mangi. “Garment manufacturers are operating near maximum capacity and many can’t take any orders for the next six months.”

|

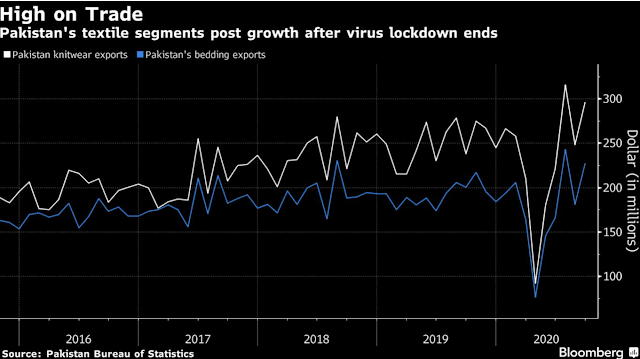

| Pakistan's Textiles Growth. Source: Bloomberg |

Bloomberg attributed Pakistan's export surge to Prime Minister Imran Khan’s administration to be the first in South Asia to ease the COVID19 lockdown after controlling the spread of the disease. It helped draw companies like Guess Inc., Hugo Boss AG, Target Corp. and Hanesbrands Inc.

|

| IPO Spree in Karachi Stock Market. Source: Bloomberg |

|

| Covid19 Cases in Pakistan. Source: Our World in Data |

|

| Pakistan Monthly Quantum Index of Manufacturing. Source: PBS |

Cement Sales:

Pakistan is once again experiencing a construction boom with new incentives under Naya Pakistan Housing Program. Monthly cement sales rose to near all-time high of almost 5 million tons in July 2020 as construction activity picked up in both housing and CPEC-related projects.

|

| Pakistan Cement Sales. Source: Bloomberg |

Car Sales:

Gasoline sales in June, 2020 hit new record and local car deliveries rose to about 10,000 units as people returned to work after easing of lockdown in May, 2020. Kia Motors Corp.’s local unit is planning to add a second shift at its factory in Karachi from January.

|

| Pakistan Car Sales Recovery. Source: Bloomberg |

Multiple Sectors Growing:

Sectors including food, beverages & tobacco, coke & petroleum products, pharmaceuticals and non metallic mineral products saw an increase in production in July 2020. Muzzammil Aslam, chief executive officer at Tangent Capital Advisors Pvt., was quoted by Bloomberg as saying, “It has surprised everybody". Aslam expects Pakistan economy at 4%-5% in current fiscal year, higher than the government’s 2.1% target. “The growth is led by an aggregate demand push.”

Summary:

Pakistanis have defied all foreign and domestic doomsayers, including media, activists and think tanks of all varieties. Pakistan has successfully fought off the deadly COVID19 virus and begun to bounce back economically. With several major brands moving production to Pakistan, the country's exports are rebounding faster than its peers in South Asia. Moody's rating agency has raised Pakistan's economic outlook from "under review for downgrade" to "stable". Pakistan's Planning Minister Asad Umar is talking of a "V-shaped recovery". Monthly cement sales have rebounded to pre-pandemic level, fuel sales have increased, tax collection is up, exports are rising and the Karachi stock market is booming again. Prime Minister Imran Khan and Army Chief General Javed Bajwa have been on the same page in tackling the health and economic crises faced by Pakistan. Contrary to the critics of Pakistan's civil-military ties, Khan-Bajwa cooperation has been one of the keys to the country's success in dealing with the twin crises.

Related Links:

Haq's Musings

South Asia Investor Review

COVID19 in Pakistan: Test Positivity Rate and Deaths Declining

Construction Industry in Pakistan

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Is Pakistan's Response to COVID19 Flawed?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Coronavirus Antibodies Testing in Pakistan

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on November 3, 2020 at 9:17am

-

#Pakistan's Trade deficit contracts 22.6% in October 2020. #Exports increased 2.1% to $2,066 million as compared to $2,024 million in October 2019. Imports declined 10.3% from $4,074 million in October 2019 to $3,653 million in October 2020. https://profit.pakistantoday.com.pk/2020/11/03/trade-deficit-contra... via @Profitpk

A meeting of the Ministry of Commerce was held on Tuesday under the chairmanship of Advisor to Prime Minister on Commerce and Investment Abdul Razak Dawood to review the country import-export trends.

The meeting was informed that as per the provisional trade data for the month of October 2020, the country’s exports increased 2.1pc to $2,066 million as compared to $2,024 million in October 2019. On the import side, the country witnessed a contraction of 10.3pc, as imports fell from $4,074 million in October 2019 to $3,653 million in October 2020.

Based on the import-export data, Pakistan’s trade deficit shrank 22.6pc ($1,587 million) in October 2020, showing an improvement of $463 million over the same month of last year.

The adviser was briefed that during the July-October FY21 period, exports decreased marginally by 0.1pc. The exports during this period stood at $7,540 million as compared to $7,547 million in July-Oct FY20.

During the period under review, the country’s balance of trade declined 4.5pc to $7,424, as compared to $7,776 million last year.

The advisor expressed satisfaction at the export trends and praised Pakistani exporters for bringing the exports back to pre-Covid levels despite uncertainty and contraction in the country’s major markets.

Meanwhile, the meeting was also briefed on the trends of major exportable products. It was informed that during July-October FY21, an increase in export volume was witnessed mostly in the value added sectors. These included home textiles (10.0pc), women garments (20.8pc), jerseys & pullovers (35.3pc), made-up articles of textile (10.4pc), stockings & socks (19.2pc), cement (10.8pc), pharmaceutics (26.8pc), tarpaulins (66.8pc), and made-up clothing accessories (245.2pc).

On the other hand, exports in the non-value added sectors recorded a decrease during July-October FY21; cotton fabric (-8.0pc), cotton yarn (-40.1pc), worn clothing (-63.6pc), raw leather (-38.4pc), crude petroleum (-53.7pc), and cotton (-95.7pc).

The meeting was further briefed on the geographical spread and growth of exports. As compared to the same period last year, Pakistan’s top five growing markets during July-October FY21 remained Indonesia (39.3pc), Qatar (34.5pc), Denmark (24.9pc), S Korea (22.5pc) and Afghanistan (15.6pc).

The advisor hoped that Pakistan’s economy would continue with its upward recovery trend and directed the ministry officials to proactively facilitate exporters and businessmen. “No stone be left unturned to counter the effect of the second wave of Covid-19 in the country’s major markets.”

----------------

I am glad to note that our exports of Telecommunication & IT Services have done very well during the period Jul-Sep of this Financial Year (FY). The exports have grown by 41% to USD 444 million as compared to USD 315 million in the corresponding period in the last FY. https://twitter.com/razak_dawood/status/1323585594354786304?s=20

-

Comment by ZAHRA ZAFAR on November 6, 2020 at 1:40am

-

The advisor hoped that Pakistan’s economy would continue with its upward recovery trend and directed the ministry officials to proactively facilitate exporters and businessmen. “No stone be left unturned to counter the effect of the second wave of Covid-19 in the country’s major markets.”

-

Comment by Riaz Haq on November 10, 2020 at 12:11pm

-

#China signs contracts to buy commodities from 15 countries including #Pakistan. Planned imports include #grain, #fruit, #textiles and #chemicals.

https://www.hellenicshippingnews.com/china-signs-contracts-to-buy-c...

“SDIC will continue to deepen cooperation in important fields and key industries with partners both at home and abroad, so as to share opportunities brought by the CIIE, go hand in hand and contribute to the promotion of global economic development and regional economic and trade exchanges,” he added.

Meanwhile, the first batch of cherries is expected to be exported from Pakistan to China next year, said Li Wei, business representative of Huazhilong International Trading Private Ltd. Pakistan.

“Pakistani cherries are really good, including sweetness and quality. China can provide technical assistance to manage orchards, while Pakistan can provide workers, so that both sides can achieve win-win cooperation,” he said in an interview with the CEN at the third China International Import Expo (CIIE) being held in east China’s Shanghai.

Previously, media reported that export of Pakistani cherries has been hindered by cold chain management, market information system, packaging and processing facilities.

Li Wei said that to tackle the problem of cherry fruit fly, 60-70 degree hot water bath treatment and the following cold storage is a solution. Now as cold chain technology lags behind in Pakistan, we will develop it and strive to solve it next year.

Referring to why he embarked on export business of agricultural products from Pakistan, Li Wei said the general manager of the company visited Pakistan by chance and found that there was a great business opportunity for the export of agricultural products from Pakistan to China.

Therefore, in the second half of 2018, 24 tons of mango were exported from Pakistan to China and sold out in Xinfadi, a large wholesale market of fruits, vegetables, and meat for Beijing. “It was the first to enter Beijing by air cargo transport from Lahore.” This year, the company was officially registered in Pakistan.

According to Li Wei, Pakistani mango is comparable to those from Australia and the Philippines. Although the price is more expensive than domestic mango, Pakistani mango is better in terms of variety, appearance, quality, among others. The sugar content of ripe mango can reach 22.68%. “It tastes best at 75% – 80% maturity,” he added.

There is seasonal difference in the marketing of Pakistani mango in China. “The mango season in Pakistan starts from August 20 to November 20, while there are almost no mangoes in southern China in November. Pakistani mango can extend the mango season by two months compared with Chinese mango. It has a time advantage,” Li Wei explained.

The mango orchard adopts the cooperation mode between China and Pakistan. “Chinese side provides technology and sends technical staff in fields of inorganic fertilizer, bagging, picking, disinfection, transportation, while Pakistani side provides labor. Finally, through cross-border e-commerce air transportation, Chinese customers can eat fresh mango within a week after placing an order,” he added.

If the pandemic improves next year, China will import large quantities of Pakistani mangoes. On the development of high value-added mango products, he said that in the next step, they may cooperate with domestic snack manufacturers to produce dried mango products.

Regarding the other potential agricultural products in Pakistan, Li Jinhuan, Executive Director of Huazhilong International Trading Private Ltd. Pakistan, said that besides mango, the company also exports other Pakistani agricultural products such as cotton, Morchella, rice and corn. “We have received orders for Morchella from China before. Similar to fungus, Morchella is also a kind of medicinal material. It is scarce in China, with large demand and high price. Although the Morchella output in Pakistan is low and it’s difficult to buy, the price is much lower than that in China,” Li Jinhuan added.

-

Comment by Ameer Alam on November 16, 2020 at 3:01pm

-

Very good news, after a long time.

-

Comment by Riaz Haq on November 17, 2020 at 4:30pm

-

#Car sales in #Pakistan rose 25% to 11,997 units in October 2020, from 9,566 units in October 2019. Sales of #motorcycles and 3-wheelers jumped from 156,872 units in Oct 2019 to 175,294 units in Oct 2020, up 11.7%. #AutomotiveIndustry #manufacturing #LSM https://profit.pakistantoday.com.pk/2020/11/11/car-sales-rise-25pc-...

Car sales in Pakistan rose 25 per cent to 11,997 units in October 2020, as against the sale of 9,566 units in October 2019, according to data released by the Pakistan Automotive Manufacturing Association (PAMA) on Wednesday.

Cumulatively, the sale of cars increased 8pc YoY to 43,865 units during the first four months (July-Oct) of the current fiscal year (2020-21), as against 40,583 units in same period of last year.

As per the data, the sale of Honda cars (Civic and City) increased sharply by 80pc, from 1,032 units in October 2019 to 1,858 units. The sale of Toyota Corolla, however, registered a decrease of 33pc, from 1,982 units to 1,314 units in Oct 2020.

During the month under review, the sale of Suzuki Swift increased 19pc to 180 units (151 units in Oct 2019), while that of Suzuki Wagon-R surged 70pc to 1,198 units (530 units in Oct last year).

On the other hand, the sale of Suzuki Alto plummeted to 2,893 units in Oct 2020 from 4,048 units last year, showing a decline of 48.5pc. The sale of Suzuki Cultus also declined by 30pc to 816 units in Oct 2020 from 1,179 units in Oct last year.

The newly launched Toyota Yaris witnessed a sale of 3,058 units in Oct 2020 as compared to the sale of 2,421 units in September 2020, showing an increase of 26.3pc on a monthly basis.

Meanwhile, the sale of motorcycles and three-wheelers jumped from 156,872 units in Oct 2019 to 175,294 units in Oct 2020, showing a rise of 11.7pc.

-

Comment by Riaz Haq on November 17, 2020 at 5:58pm

-

#Pakistan #textile hub #Faisalabad to utilise all 80,000 power looms. “Pakistan has seen orders shifting from multiple nations including #China , #India & #Bangladesh ..#Garment manufacturers are operating near maximum capacity” unable to take more orders

https://profit.pakistantoday.com.pk/2020/11/12/countrys-textile-hub...

Faisalabad is currently experiencing a financial boom with the operationalisation of 50,000 power looms and expecting the opening of another 30,000 units.

Known as the country’s textile hub, Faisalabad, for the first time after 1990, has seen a massive economic growth following a high demand of export items and the government’s recently announced incentive of supplying electricity to the industrial sector at reduced rates.

In this regard, Prime Minister (PM) Imran Khan in a tweet on Thursday shared a television news report about the increased economic activity in Faisalabad and the resultant shortage of 0.2 million labourers required to meet the high demand of orders in the textile sector.

Factories and power looms faced closures owing to a power crisis as emerged due to the apathy of previous governments in the recent past. However, during the coronavirus situation, orders in the textile sector were diverted towards Pakistan from various countries.

The news report mentioned that Faisalabad had 1.3 million workers with one million natives and 0.3 million belonging to other districts.

Bloomberg in its recent report ‘Opening early helped Pakistan boost exports during pandemic’ also mentioned a surge in Pakistan’s textile exports.

“Pakistan has seen orders shifting from multiple nations including China, India and Bangladesh,” All Pakistan Textile Mills Association (APTMA) Secretary General Shahid Sattar said, as quoted by Bloomberg.

“Garment manufacturers are operating near maximum capacity and many can’t take any orders for the next six months,” he added.

Further, Pakistan’s decision to loosen pandemic restrictions early has helped the nation’s exports emerge stronger than its South Asian peers.

Bloomberg said that Pakistan’s outbound shipments grew at a faster pace than Bangladesh and India as textiles, which account for half of the total export.

“Islamabad saw total shipments grow 7pc in September, compared with New Delhi’s 6pc and Dhaka’s 3.5pc,” it said.

-

Comment by Riaz Haq on November 22, 2020 at 4:11pm

-

#Pakistan gets $800 million in #debt relief. #China $347 million, #US $128.3 million, #France $170 million, #Germany $86.1 million, #Sweden 14.4 million and #Canada $8 million. Negotiations underway with 5 nations for additional $1 billion relief. #G20 https://dunyanews.tv/en/Pakistan/574563-Pakistan-secures-$800-million-in-debt-relief-#.X7r8S0Xb23c.twitter

Pakistan has secured $800 million in debt relief by completing 36 agreements with 16 G20 countries for May to December 2020.

According to the report 14 countries ratified their agreements with Pakistan during the past seven months, which has provided fiscal space of $800 million to Islamabad for the time being.

Pakistan received $347 million from China, $128.3 million from the United States, $170 million from France and $86.1 million from Germany, 14.4 million from Sweden and $8 million relief from Canada.

Negotiations are underway with 5 countries for another $1 billion relief for Pakistan.

Agreements will be reached with Russia, Japan, the United Kingdom, the United Arab Emirates and Saudi Arabia. Negotiations with the five countries will be completed by December 31, 2020.

Pakistan has completed 9 agreements with USA, 8 with China, 2 each with Belgium, Canada, Spain, Netherlands, 2 with Germany, 1 with Australia, 1 each with Finland, France, Italy, South Korea, 1 with Kuwait, Norway, Switzerland and, one agreement with Sweden.

Pakistan expects 800 to 900 million in debt relief in the second phase. In the second phase, debt relief is expected from January to June 2021.

-

Comment by Riaz Haq on November 23, 2020 at 7:52am

-

Recent data suggest a further strengthening and broadening of the recovery observed since July, led by construction and manufacturing. Sales of Fast Moving Consumer Goods (FMCGs) rebounded in FY21 Q1, average sales volumes of POL and automobiles have surpassed their pre-Covid levels of FY20, and cement sales are at an all-time high.

https://www.brecorder.com/news/40034595/sbps-monetary-policy-commit...

Large scale manufacturing (LSM) continues to rebound, expanding by 4.8 percent (y/y) in FY21 Q1, against a contraction of 5.5 percent in the same quarter last year. Nine out of fifteen major manufacturing sectors have shown gains, including textiles, food and beverages, petroleum products, paper and board, pharmaceuticals, chemicals, cement, fertilizer, and rubber products. The MPC noted that the recovery was being supported by stimulus provided by the government, the round of policy rate cuts and the SBP’s timely measures to mitigate the impact of the COVID pandemic.

These measures included principal extension and loan restructuring, payroll financing, and Temporary Economic Refinance Facility (TERF) which injected liquidity, reduced layoffs and provided incentives for investment. In agriculture, the impact of the expected decline in cotton production is likely to be offset by growth in other major crops and higher wheat production due to the rise in support prices and recently announced subsidies on fertilizers and pesticides. While social distancing continues to weigh more heavily on certain parts of the services sector, wholesale and retail trade and transportation are expected to benefit from the knock-on impacts of the ongoing pick-up in construction, manufacturing and agriculture.

External sector

The external sector continues to strengthen, with the current account in FY 21 Q1 recording the first quarterly surplus in more than five years. After remaining in positive territory for all four months of this fiscal year, the cumulative current account through October reached a surplus of $1.2 billion against a deficit of $1.4 billion in the same period last year. This turnaround was supported by an improvement in the trade balance and record remittances.

As per SBP, exports have recovered to their pre-COVID monthly level of around $2 billion in September and October, with the strongest recovery in textiles, rice, cement, chemicals, and pharmaceuticals.

Remittances recorded strong growth of 26.5 percent (y/y) during July-October, primarily due to orderly exchange rate conditions, supportive policy measures taken by the government and SBP, travel restrictions, and increased use of formal channels. Meanwhile, subdued domestic demand and low global oil prices have kept imports in check.

The sizable current account surplus and improving outlook and sentiment for the economy have supported a 3½ percent appreciation in the PKR since the last MPC and further strengthened external buffers, with SBP’s foreign exchange reserves increasing to $12.9 billion, their highest level since February 2018.

Based on the performance to date, the outlook for the external sector has improved further and the current account deficit for FY21 is now projected to be below 2 percent of GDP.

Fiscal sector

In line with this year’s budget, the government continues to make concerted efforts to maintain fiscal discipline, including adhering to its commitment of no fresh borrowing from SBP. Despite lower non-tax revenue, the primary balance posted a surplus of 0.6 percent of GDP in FY21 Q1, similar to the levels achieved during the same period last year. However, the higher overall budget deficit due to larger domestic interest payments should taper as the benefits of recent interest rate cuts filter through. PSDP-releases, which are an important stimulant of economic activity, recorded an increase of 12.8 percent (y/y) during the first four months of this year.

-

Comment by Riaz Haq on December 19, 2020 at 8:24pm

-

#Pakistan #Textile #exports rise 4.88% year-on-year to $6.04 billion between July to November FY21 compared to $5.76 billion in the same period last year. In November, export proceeds were up by 9.27% from a year ago. #economy #Covid_19 https://www.dawn.com/news/1596602

In November, export proceeds were up by 9.27pc from a year ago. In October, export proceeds were up by 6.18pc and in September, they grew by 11.03pc while a decline of 15pc was recorded in August.

In the first month of the current fiscal year, exports recorded a robust increase of 14.4pc on a year-on-year basis. The rebound in exports of textile and clothing is the outcome of a series of incentives to support exporters to meet the challenges in the wake of the pandemic and disruption in supplies.

The demand for country’s exports had collapsed in months following March due to the Covid-19 pandemic, while there has been a gradual improvement since June from international buyers.

Adviser to PM on Commerce in a tweet said that in November, the exports of cotton yarn declined by 25pc, raw leather by 21pc, and cotton fabric by 12.2pc. “This is an indication that exports of low value-added products are decreasing and we are moving towards more value-added exports”, he said while adding that “I urge our exporters to keep pursuing this policy.”

The PBS data showed that ready-made garment exports edged up by 4.36pc in value while plunging in quantity by 44.64pc during July to November this year from a year ago. Exports of knitwear increased by 14.34pc in value and 32.35pc in quantity; bedwear exports were up 12.28pc while dipped 7.95pc in quantity.

Towel exports went up 14.24pc in value and 3.79pc in quantity, whereas those of cotton cloth dipped 8.73pc and 31.78pc in quantity.

Among primary commodities, cotton yarn exports plunged by 37.34pc, yarn other than cotton by 16.69pc, made-up articles — excluding towels — was up 15.53pc and tents, canvas and tarpaulin increased by a massive 58.05pc during the months under review.

Textile machinery imports dropped by 6.07pc during the first five months of current fiscal year — a sign that no expansion or modernisation projects were taken up by the industry in the given period.

Petroleum imports declined 22.78pc in the first five months (July-November) to $3.94bn, compared to $5.11bn over the last year, the PBS data showed.

Of these, petroleum product imports were down 16.51pc in value in the first five months’ despite increasing by 54.42pc in quantity. Similarly, import of crude oil dipped 27.01pc in value, but posted a growth of 14.78pc in quantity during the period under review while those of liquefied natural gas fell by 34.73pc in value. On the other hand, liquefied petroleum gas (LPG) imports jumped 52.06pc in value in July-Nov, largely to plug a shortfall in local production.

Machinery imports went down 5.78pc to $3.37bn in the first five months from $3.58bn last year. The decline in imports was recorded in almost all kinds of machinery except power generating machinery, office machinery and mobile phones.

The power generating machinery imports went up 21.73pc in the first five months mainly due to revival of power projects under the China-Pakistan Economic Corridor and office machinery increased by 0.7pc during the months under review.

In the telecommunication sector, imports surged by 31.32pc on the back of mobile handsets arrivals which were up by 45.26pc. This was the result of a crackdown on smuggling and doing away with free imports in baggage schemes. Import of other apparatus fell by 6.39pc.

The overall transport group witnessed a growth of 13.92pc. This growth was mainly driven by an increase in imports of road motor vehicles (build unit, CKD/SKD) and CBU during the months under review.

An increase of 60.36pc was seen in imports of textile group — raw cotton, synthetic and artificial silk yarn.

-

Comment by Riaz Haq on December 22, 2020 at 9:16am

-

PM Imran lauds ‘remarkable turnaround’ in Pakistan’s economy

https://tribune.com.pk/story/2276921/pm-imran-lauds-remarkable-turn...

Prime Minister Imran Khan on Tuesday said the country's foreign reserves have risen to around $13 billion, the highest in three years.

The premier said that despite the Covid-19 pandemic, which brought a global slowdown in economic activity in 2020, there is "great news on the economy" and a "remarkable turnaround".

Pakistan has achieved a current account surplus of $447 million for the month of November, added the prime minister. He further said there is a surplus of $1.6 billion for the fiscal year so far versus a deficit of $1.7 billion during the same period last year.

Earlier this month, the premier attributed the positive trends in the country’s economy – improvement in stock market performance and increase in investors’ confidence – to the business-friendly policies of the PTI led federal government.

The Asian Development Bank (ADB) has said that Pakistan’s economy was on the path of recovery. Some official estimates suggested 2.8% growth rate during the current fiscal year.

“Pakistan’s growth is forecast to recover in fiscal year 2020-21 as economic sentiment improves with the expected subsiding of Covid-19 and the resumption of structural reform,” said the ADB.

The country's remittances have also continued to increase over the past months. Cumulatively, in the first five months (July-November) of current fiscal year, remittances grew 27% to $11.77 billion compared to the same period of last year.

Pakistan had received remittances in the range of $1.78-1.9 billion per month in the prior five months - January-May 2020.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network