PakAlumni Worldwide: The Global Social Network

The Global Social Network

ADB Increases Pakistan Growth Forecast Amid India's War Talk

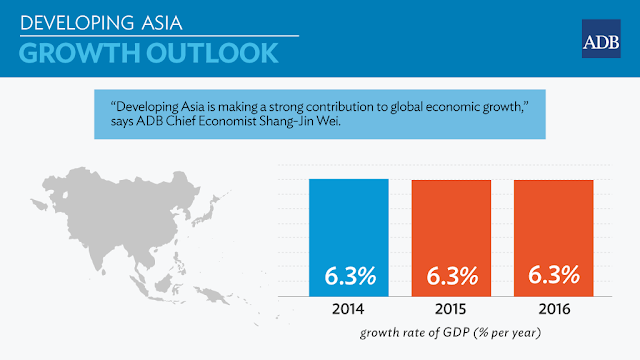

The Asian Development Bank (ADB) has raised Pakistan's economic growth forecast for fiscal year 2017 (from July 2016 to June 2017) from 4.8% to 5.2%. The Bank also sees brighter outlook for the the entire South Asian region. However, the prospects of even a limited India-Pakistan war could derail the economies of the entire South Asia region. I hope that sanity will prevail in New Delhi to tone down its war rhetoric, abstain from escalation and maintain the current economic momentum.

ADB Forecast:

"...assuming further improvement in energy supply and security, and likely recovery in cotton and other agriculture-the growth forecast (for Pakistan) for FY2017 is revised up to 5.2%", says the Asian Development Outlook 2016 Update released September 27, 2016.

The ADO which is launched annually in March and updated in September provides a comprehensive analysis of macroeconomic issues in developing Asia.

The ADB report says that "growth in Pakistan will outperform the ADO 2016 projection for 2017". Here's an excerpt from the ADB report:

"In Bangladesh and Pakistan, estimated growth in the 2016 fiscal year, to 30 June, exceeded the forecasts because robust performance in manufacturing and services more than compensated for unexpected weakness in agriculture. Increased consumption and public investment contributed to the better performance in Bangladesh in 2016. A slower growth forecast for 2017 is retained as agriculture growth is expected to moderate. Growth in Pakistan will outperform the ADO 2016 projection for 2017 on improvements in energy supply, higher infrastructure investment in an economic corridor project, and a better security environment. Improved growth in these two large economies contrasts with Nepal, where the growth estimate for the 2016 fiscal year, which ended on 15 July, is below the forecast following disruption to supply and trade, delayed reconstruction of earthquake damage, and a poor monsoon. The economy is expected to recover in 2017 as forecast in ADO 2016 on markedly accelerated reconstruction spending and a good monsoon able to lift agricultural output."

Impact of US Interest Rate Hikes:

On the impact of possible interest rate hikes by US Federal Reserve on national debt situation in South Asia, the ADB report says

"Interest rates pose less risk to India and Pakistan, where public debt is held mostly by domestic investors. However, where a significant share of such debt is short term, as in Pakistan, rollover risks are high and debt dynamics remain vulnerable to shocks. For all these economies, staying on course with fiscal consolidation through sound debt management and the progressive expansion of the tax base will help provide the fiscal resources and resilience needed to cope with future domestic or external shocks."

Macroeconomic Indicators:

ADO 2016 Update says that the planned reduction in Pakistan's fiscal year 2017 budget deficit would enhance funding for private sector credit and better enable it to support rising domestic demand. The federal government budget for FY2017 projects further reduction in the deficit to 3.8% of GDP achieved through new revenue measures and streamlining current expenditure.

Tax revenues are projected to increase by half a percentage point, raising the ratio of tax to GDP to 12.8% by eliminating more tax concessions and exemptions, expanding the withholding system as part of administrative reform to widen the tax base, and raising some excise taxes and customs duties, the report added.

The report says that Pakistan's current account deficit is expected to widen in FY2017 to about $5 billion, or 1.6 % of GDP, which is higher than forecast in March. The revision reflects rising global oil prices, declining exports and continued expansion in imports stemming from faster economic growth.

Industrial Indicators:

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects. Prospects of even a limited war in South Asia could derail the economies of the entire region. I hope that sanity will prevail in New Delhi to abstain from escalation and maintain the current economic momentum.

Related Links:

Is Pakistan Ready For War With India?

India's Israel Envy: Surgical Strikes in Pakistan?

Growing Middle Class in Pakistan

China-Pakistan Economic Corridor

-

Comment by Akhtar Hussain on September 29, 2016 at 11:47am

-

Excellent News !!

-

Comment by Riaz Haq on September 29, 2016 at 6:26pm

-

Real Estate is a promising and growing sector of the Pakistani economy. Pakistan spends $5.2 billion on construction in a year and according to the Pakistan Bureau of Statistics, construction output accounts for 2% of GDP.

With the rate of urbanization that Pakistan has been experiencing, there is a growing need for urban planning. Pakistan is home to Asia's largest real estate investors Bahria Town.

---

---

Former chairman and present consultant of Bahria Town, Malik Riaz Hussain has signed an agreement with His Highness Sheikh Nahyan bin Mubarak al Nahyan, Chairman Abu Dhabi Group, Union National Bank and United Bank Limited under which $45 billion will be invested in Pakistan.

---

The top players in the real estate industry are undoubtedly the DHA and Bahria Town. The latter has played a pioneering role in commercializing the real estate development and establishing it as a formal sector. Now the real estate investments come under the tax net. Similarly, DHA is also a top notch housing society. It is well-engineered and has state-of-the-art infrastructure facilities such as schools, colleges, universities, hospitals, cinemas, parks, marriage lawns, clubs, security management and traffic control system etc. Furthermore, the earthquakes in Pakistan have brought to the attention of regulatory bodies and the end consumers the need for enforcement of building codes and quality construction practices. According to survey of some Pakistani property portals including lamudi.pk, Homespakistan.com and Pakistan real estate.net interviewed several buyers of residential homes and commercial buildings and confirms that they prefer quality designing rather than cheaper and casually designed units. Hence, this makes it a perfect case to invest in the booming real estate sector of Pakistan.

Real Estate Investment Trust

Investors piled into Pakistan’s first real-estate investment trust, which was launched this year with a public offer that was heavily over-subscribed, the REIT’s lead manager and analysts said on Thursday.

The Dolmen City REIT offered investors a 25% stake in a 22.24 billion rupee ($218.5 million) shopping mall and an office complex at Dolmen City, one of the most prominent real estate developments in Karachi, Pakistan’s largest city and its economic hub. The Arabian Sea-front project includes three other structures not included in the REIT.

Traders and the REIT’s main advisor said the initial offer for 75% of the trust to institutional investors and high net-worth individuals through book building on Monday and Tuesday drew demand of more than 7 billion rupees for an offering of shares worth 4.17 billion rupees at a floor price of 10 Pakistani rupees ($0.10). At the strike price, the initial offer raised 4.59 billion rupees, according to the REIT’s lead manager.

The remaining 25% of the stake was to be offered to the public on Friday at a strike price of 11 rupees ($0.11). Analysts and the REIT’s management expected the Friday offering to be fully subscribed as well, raising another 1.53 billion rupees.

“The interest rate is at a 42-year low, with the discount rate at 7%, so for people who invest in fixed-income instruments, REITs are attractive,” said Muhammad Tahir Saeed, deputy head of research at Topline Securities, a Karachi-based brokerage.

https://www.linkedin.com/pulse/real-estate-pakistan-spends-52-billi...

Happiness for some in Pakistan's gated communities

https://www.youtube.com/watch?v=ZvKOCZuZAiM

-

Comment by Riaz Haq on September 29, 2016 at 8:37pm

-

“Doesn’t it just look like Mars?” says a Pakistan Army lieutenant colonel, as laborers toil under the blinding sun, building a road across the barren deserts of Balochistan.

Against a backdrop of scorched mountains, workers cut steel bars and prepare rock for crushing near a viaduct that crosses a dry river bed. In the distance, a truck kicks up dust, bringing materials to the site. Army vehicles patrol the road with signal jammers, while snipers scan the hills—the lair of armed separatists and bandits until a military campaign cleared most of them out a few years ago.

This is Chinese President Xi Jinping’s biggest gambit in his so-called One Belt, One Road project to rebuild the ancient Silk Road, a trading route connecting China to the Arabian Sea that slices through the Himalayas and crosses deserts and disputed territory to reach the ancient fishing port of Gwadar, about 500 miles by boat from Dubai.

-------

The project includes coal-fired, solar and wind power stations and a network of highways running 3,000 kilometers down the length of the country, from the freezing passes of the Karakoram Highway to the Arabian Sea. They will run through Kashmir, an area claimed by both India and Pakistan that is subject to frequent border clashes, and restive Balochistan, which Pakistan annexed in 1948.

“The energy policy was there for anyone to come and invest, but others were just looking at the political risk,” Planning Minister Ahsan Iqbal said in an interview in Islamabad on July 25. “China took a bet on Pakistan when others were shy.”

---------

The cornerstone of the project is Gwadar, 30 minutes from the border with Iran, or an eight-hour drive from Karachi along a two-lane coastal highway that twists through jagged weather-beaten hills and across arid dust-blown plains.

Bought from the Sultanate of Oman in the 1950s, Gwadar is not connected to Pakistan’s power grid, using electricity imported from Iran, also a major source of fuel and consumer goods, much of it smuggled across the border.

Kids here play soccer, rather than the cricket that is popular elsewhere in Pakistan, wearing jerseys of European stars like England captain Wayne Rooney and France’s Paul Pogba. For centuries, the city looked to the sea for its wealth. Wooden fishing boats clustered in the bay haul lobsters and jumbo shrimp that now find their way to China and other markets in East Asia.

-----

For 26-year-old Mohammad Younis, Chinese money has meant an escape from needing to find a job at sea. As a teenager he joined a gang of fuel smugglers, driving pickups from Iran. After the authorities clamped down, he landed a job as a driver at the Pearl Continental, a five-star hotel built in 2006 that hosts Chinese engineers.

The hotel plans to triple capacity within five years and add office and apartment blocks, said General Manager Salman Saeed Khan.

“Development is happening at a faster pace than ever before, now that the Chinese have come,” said Younis. “It’s good. We will get jobs.”

http://www.bloomberg.com/news/articles/2016-09-29/china-s-new-silk-...

-

Comment by Riaz Haq on September 29, 2016 at 8:46pm

-

Op Ed by Neeraj Thakur from Catch News

wars have never had a constructive effect on any country. Not only are human lives lost, but participating nations' economies suffer as well. Money meant to be spent on development is diverted towards buttressing the armed forces.

Wars also damage the infrastructure within a country - such as roads, highways and ports - as well as telecommunication towers.

Hospitals come under pressure due to casualties at borders, as well as interior areas in case of surgical strikes by opponents.

In this scenario, let's analyse whether India can afford a war with Pakistan, especially at a time when the Indian economy is trying to recover from a slump.

01

The impact on inflation

The Indian economy has been struggling with inflation for quite a few years. Since 2008, the average Consumer Price Index, also known as retail inflation, has been at 8.73%, which is 100% more than the Reserve Bank of India's comfort zone.

India witnessed two consecutive droughts in 2014 and 2015, due to which the prices of food items had skyrocketed, making most food items unaffordable for the lower and middle classes.

To put in things in perspective, the 1971 war broke out in the month of December. The following year, India reported a 109% rise in the average inflation, at 6.42% .

Given that India's current retail inflation is already above 5% , in case of a war, one can expect the inflation to easily go above 10%, making life difficult for people.

02

Job loss

Wars destroy the value of money and the demand for products. This leads to consumer durable, FMCG and automobile companies losing business, which, in turn, forces companies to cut jobs.

So, in case India and Pakistan go to war, apart from those who are working in the government sector, most people will face the threat of job loss. India is already facing its highest unemployment rate in five years, at 5% of the workforce, which is estimated at above 50 crore.

Should there be war, lakhs of people may have to sit at home in the coming years.

03

No salary hikes

As discussed above, when two countries fight, governments divert all their resources towards armed forces expenditure. While this may generate revenue for certain types of companies, the overall economy suffers.

So, in case you don't lose your job, there are chances that you will not get a salary hike next year.

04

Poverty alleviation programmes on the backburner

According to Business Today, the 1999 Kargil War cost India Rs 10,000 crore, followed by an increase in the defence expenditure, which went up from Rs 39,897 crore in 1998-99 to Rs 47,071 crore during the year of the Kargil conflict - 1999-2000 - a jump of 18%.

The increased budgetary support for defence forces results in a cut in expenditure for poor in the country.

India is home to the largest population of poor people in the world. According to a study conducted in 20011-12 by the then-chairman of the Prime Minister's Economic Advisory Council, C Rangarajan, India had an estimated 363 million, or 29.5% of its 1.2 billion population living below the poverty line. According to that study, people living on less than Rs 32 a day in rural areas and Rs 47 a day in urban areas were considered poor.

In case the country's resources are diverted towards war, the suffering for those living below the poverty line would be unimaginable.

05

Long term impact on growth

Growth comes through the development of infrastructure. Wars only lead to the destruction of that infrastructure, be it roads, ports, or oil and gas pipelines. This infrastructure takes decades of investment to be built up, but can be destroyed with one bomb.

Given that Pakistan and India both have long range ballistic missiles, both countries are capable of destroying each other's important infrastructure, which can handicap the economies of both countries.

http://www.catchnews.com/business-economy-news/can-indian-economy-a...

-

Comment by Riaz Haq on October 2, 2016 at 6:12pm

-

#China and #Pakistan pin hopes on Arabian Sea port of #Gwadar. #CPEC https://www.ft.com/content/06388212-855b-11e6-8897-2359a58ac7a5 … via @FT

From the window of his plush office, Dostain Jamaldini, the moustachioed chairman of the Gwadar Port Authority, looks upon the mostly deserted, three-berth deep seaport that he argues could one day rival Dubai, Hong Kong or Singapore.

Presently, no cargo ship is visible in the tranquil Arabian Sea waters — just the small fishing trawlers.

But Mr Jamaldini says the empty port, built with Chinese financial and technical help at a cost of $248m, finished nearly a decade ago and barely used since, will buzz with traffic by December 2017. By that time, Gwadar should be linked by road to the rest of Pakistan, a key part of the plan to create a vibrant and bustling hub.

“Gwadar has the potential to become one of the world’s biggest ports,” he says. “Once we have connectivity, the port will see traffic. We are now waiting for the road.”

The long-anticipated road is slated to be a modern highway network that seamlessly links Gwadar to China’s Xinjiang province, giving the landlocked Chinese region access to the Indian Ocean. A train should run alongside and Beijing also wants to build oil pipelines from Gwadar to western China, potentially a quicker and easier route for supply from the Gulf.

Yet realising this ambitious vision requires extensive ground infrastructure in Balochistan — one of Pakistan’s poorest, most troubled provinces, with a long history of armed separatist insurgency. Analysts say the region’s volatility could prove an obstacle to realising the $46bn China-Pakistan economic corridor.

In August, Quetta, Balochistan’s provincial capital, was rocked by a sophisticated suicide bomb that killed 70 people, many of them lawyers. Pakistan — which has established a 15,000-man security force to protect the infrastructure and the Chinese engineers — publicly called the attack an attempt to disrupt the massive development.

------

Prime minister Narendra Modi electrified Indians — and raised the hackles of the Pakistan establishment — in August when he proclaimed New Delhi’s moral support for residents of Pakistan’s troubled Balochistan province.

Islamabad has long accused its rival, India, of covertly assisting Balochistan’s separatist insurgents. But former US officials say Washington has never found evidence of Indian military aid beyond New Delhi’s hospitality for Baluchi leaders. Speculation is mounting that New Delhi could be poised to do what Pakistan has always suspected — as it seeks a new, more muscular approach to a neighbour that it blames for numerous terror attacks on its soil.

But security analysts say the prospect of Indian aid for Baluchi rebels is limited by its lack of direct access to the territory. “Actual physical assistance is going to be incredibly difficult,” says Sumit Ganguly, an Indiana University professor. “Geography imposes a certain kind of constraint.”

Chinese analysts also play down the likelihood of India deliberately targeting a Chinese-developed infrastructure project. “It is unlikely that India will act to directly disrupt the CPEC,” Mao Siwei, China’s former consul-general in Kolkata, told the Financial Times. “But strained India-Pakistan relations are extremely detrimental.”

-

Comment by Riaz Haq on October 6, 2016 at 7:52am

-

#Moody's maintains stable outlook for #Pakistan banks reflecting strengthening #economy and high liquidity buffers http://fw.to/SBkib8C

Limassol, October 06, 2016 -- Moody's Investors Service has maintained its stable outlook on Pakistan's banking system, reflecting the rating agency's expectation that the country's banks will continue to benefit from a stable deposit base, high liquidity buffers and an accelerating economic growth under the IMF program, which will create lending opportunities over the next 12-18 months.

Moody's report, entitled "Banking System Outlook -- Pakistan: Economic expansion and ongoing reforms drive our stable outlook" is available on www.moodys.com. Moody's subscribers can access this report via the link provided at the end of this press release. Please note that this report does not constitute a rating action.

"We expect the strengthening economy and the central bank's monetary easing to provide banks with plenty of business opportunities and stimulate loan growth to around 12% over the next 12-18 months," says Elena Panayiotou, an Assistant Vice President at Moody's.

The rating agency expects GDP growth to expand by 4.9% in the fiscal year ending in June 2017, which would be the fastest pace since 2008, as the country completes for the first time an IMF program and implements infrastructure projects under with the China-Pakistan Economic Corridor (CPEC).

Although the strengthening of the domestic economy will contribute to the improvement in Pakistani banks' asset quality, Moody's expects the level of credit risk will remain high as banks are heavily exposed to the low-rated Pakistan sovereign (B3, stable) through holdings of securities and government-related loans, which are equivalent in size to 7.7x Tier 1 capital, exposing banks to event risk.

"We expect problem loans will decline to around 10% of total loans by the end of 2017 compared with 11.1% at the end of June 2016. Banks, however, will remain heavily exposed to the low-rated Pakistan sovereign, linking the banks' creditworthiness to that of the sovereign'' says Ms Panayiotou.

In terms of capital, the rating agency expects buffers will come under pressure due to weakening profitability and loan growth, reducing the banks' ability to absorb losses. The pressure on profitability will stem from declining yields on government securities and lower interest rates, which are eroding net interest margins, while higher lending growth and lower provisioning requirements will only partially offset this pressure.

On the other hand, Moody's expects Pakistani banks to maintain ample liquidity and continue to benefit from large volumes of low-cost and stable customer deposits. "We expect inflows of remittances from workers abroad will grow a lower pace but will remain substantial and continue to drive the growth in bank deposits and support banks' funding bases,'' says Ms Panayiotou.

Moody's expects the sector to also maintain strong liquidity buffers, with cash and interbank placements at 9% of total assets as of June 2016, and liquid securities, mainly in the form of government securities, at another 47% of total assets.

Subscribers can access the full report at http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_1031983

-

Comment by Riaz Haq on October 7, 2016 at 5:01pm

-

From Bloomberg: http://www.bloomberg.com/news/articles/2016-10-06/pakistan-seeks-1-...

Pakistan is seeking foreign investment of $1.7 billion to build a new highway in the southern province of Sindh to supplement a Chinese-funded infrastructure network being laid across the country.

The National Highway Authority will ask for bids next week for the 296-kilometers (184 miles) highway between the cities of Hyderabad and Sukkar, the agency’s Chairman Shahid Ashraf Tarar said in an interview in the capital, Islamabad.

“Other than the Chinese, this time we expect that Turkish, Malaysians and South Koreans will come and bid,” Tarar said.

Pakistan’s economic growth has accelerated to almost 5 percent in the past three years after averting a balance-of-payments crisis in 2013 by submitting to an International Monetary Fund loan program worth $6.6 billion, which ended last month. Along with an easing of inflation and as domestic security threats have abated, China announced last year it would invest in projects worth about $46 billion in Pakistan as part of a so-called economic corridor.

Infrastructure Landscape

Prime Minister Nawaz Sharif is pegging his 2018 re-election campaign on bridging chronic energy and infrastructure gaps as his administration targets a 7 percent economic growth rate within two years. The construction of a six-lane highway on the eastern route of the China-Pakistan Economic Corridor is expected to start in the first quarter of next year.

“There is big gap between the potential and the actual road network,” said Mohammed Sohail, chief executive officer of Topline Securities Pakistan Ltd. in Karachi. “Investors will look into this opportunity” as the economy continues to expand, he said.

Start your day with what’s moving markets.

Get our markets daily newsletter.

The highway authority has so far started over $9.5 billion worth of projects in the past three years and is hoping to attract another $5 billion investment in the next five, more than half of which will be pegged to upgrade the China corridor routes, Tarar said. The length of the main highway will be tripled to 1,800 kilometers by linking all road arteries with industrial zones on the route, he said.

The 3,000-kilometer-long corridor stretches from Xinjiang in western China to Pakistan’s Gwadar on the Arabian Sea. Of China’s planned investment, $11 billion is allocated for infrastructure projects and big chunk of it will be spent in Balochistan province, home to the deep-sea port in Gwadar.

“The landscape of infrastructure is going to be transformed in the next three years,” said Tarar. “Imagine you travel from Karachi to Peshawar on the motorway, the time and energy it’ll save with security ensured. Unless you have good infrastructure the economy will drag.”

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network