PakAlumni Worldwide: The Global Social Network

The Global Social Network

Soaring Exports of Pakistan's Information Technology and Pharma Industries Amid COVID Pandemic

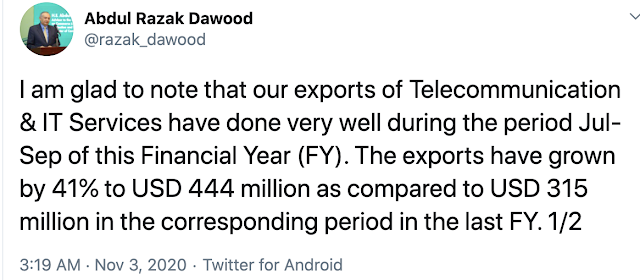

Pakistan’s IT exports increased by 44% during the first quarter (July, August and September) of the fiscal year 2020-21, according to a tweet by Razzak Dawood, Special Assistant to Prime Minister Imran Khan. Pharmaceutical exports saw 22.6% increase in the same period over last year. Pakistan's information technology and pharmaceutical exports are soaring by double digits amid the COVID pandemic, much faster than the overall exports.

|

| Razzak Dawood on IT Exports |

In Fiscal Year 2019-20 ending in June, 2020, the Information Telecommunication (IT) and IT enabled Services (ITeS) export remittances surged 23.71% to $1.230 billion from $994.848 million during the same period in the prior year, according to Pakistan Bureau of Statistics as reported by Pakistani media.

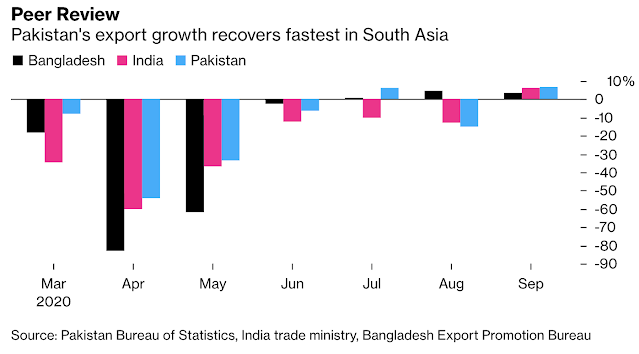

With several major brands moving production to Pakistan amid the COVID19 pandemic, the country's exports have grown at a faster pace than those of Bangladesh and India, according to Bloomberg News. Pakistan's total textile shipments rose 7% in September, compared with India’s 6% and Bangladesh’s 3.5%.

|

| South Asia Region's Exports. Source: Bloomberg |

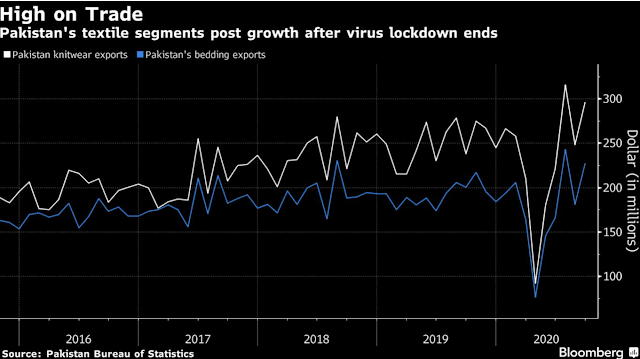

“Pakistan has seen orders shifting from multiple nations including China, India and Bangladesh,” said Shahid Sattar, secretary general at the All Pakistan Textile Mills Association, in an interview with Bloomberg's Faseeh Mangi. “Garment manufacturers are operating near maximum capacity and many can’t take any orders for the next six months.”

|

| Pakistan's Textiles Growth. Source: Bloomberg |

Bloomberg attributed Pakistan's export surge to Prime Minister Imran Khan’s administration to be the first in South Asia to ease the COVID19 lockdown after controlling the spread of the disease. It helped draw companies like Guess Inc., Hugo Boss AG, Target Corp. and Hanesbrands Inc.

|

| IPO Spree in Karachi Stock Market. Source: Bloomberg |

|

| Covid19 Cases in Pakistan. Source: Our World in Data |

|

| Pakistan Monthly Quantum Index of Manufacturing. Source: PBS |

Cement Sales:

Pakistan is once again experiencing a construction boom with new incentives under Naya Pakistan Housing Program. Monthly cement sales rose to near all-time high of almost 5 million tons in July 2020 as construction activity picked up in both housing and CPEC-related projects.

|

| Pakistan Cement Sales. Source: Bloomberg |

Car Sales:

Gasoline sales in June, 2020 hit new record and local car deliveries rose to about 10,000 units as people returned to work after easing of lockdown in May, 2020. Kia Motors Corp.’s local unit is planning to add a second shift at its factory in Karachi from January.

|

| Pakistan Car Sales Recovery. Source: Bloomberg |

Multiple Sectors Growing:

Sectors including food, beverages & tobacco, coke & petroleum products, pharmaceuticals and non metallic mineral products saw an increase in production in July 2020. Muzzammil Aslam, chief executive officer at Tangent Capital Advisors Pvt., was quoted by Bloomberg as saying, “It has surprised everybody". Aslam expects Pakistan economy at 4%-5% in current fiscal year, higher than the government’s 2.1% target. “The growth is led by an aggregate demand push.”

Summary:

Pakistanis have defied all foreign and domestic doomsayers, including media, activists and think tanks of all varieties. Pakistan has successfully fought off the deadly COVID19 virus and begun to bounce back economically. Pakistan’s IT exports increased by 44% during the first quarter (July, August and September) of the fiscal year 2020-21, according to a tweet by Razzak Dawood, Special Assistant to Prime Minister Imran Khan. Pharmaceutical exports saw 22.6% increase in the same period over last year. With several major brands moving production to Pakistan, the country's exports are rebounding faster than its peers in South Asia. Moody's rating agency has raised Pakistan's economic outlook from "under review for downgrade" to "stable". Pakistan's Planning Minister Asad Umar is talking of a "V-shaped recovery". Monthly cement sales have rebounded to pre-pandemic level, fuel sales have increased, tax collection is up, exports are rising and the Karachi stock market is booming again. Prime Minister Imran Khan and Army Chief General Javed Bajwa have been on the same page in tackling the health and economic crises faced by Pakistan. Contrary to the critics of Pakistan's civil-military ties, Khan-Bajwa cooperation has been one of the keys to the country's success in dealing with the twin crises.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Pharma Industry

COVID19 in Pakistan: Test Positivity Rate and Deaths Declining

Construction Industry in Pakistan

Pakistan's Pharma Industry Among World's Fastest Growing

Pakistan to Become World's 6th Largest Cement Producer by 2030

Is Pakistan's Response to COVID19 Flawed?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Coronavirus Antibodies Testing in Pakistan

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by ZAHRA ZAFAR on November 5, 2020 at 1:54am

-

NICE ONE KEEP POSTING

-

Comment by Riaz Haq on November 6, 2020 at 7:33am

-

#Pakistan #cement sales grow 33% year over year to a new monthly record 5.7 million tons in October, up from 4.4Mt in September 2020. Increased domestic and export demand as well as the speedy momentum in Pakistan's #economy. #COVID19 #construction https://www.cemnet.com/News/story/169795/pakistan-records-33-growth...

Pakistan's domestic and overseas cement dispatches figures for October 2020 are officially yet to be released by the All Pakistan Cement Manufacturer Association (APCMA), but Lucky Cement Ltd's CEO, Mohammad Ali Tabba, has estimated a record growth to 5.7Mt, increasing from 4.4Mt in September 2020. The MoM rise of 29.5 per cent in dispatches in October was possible due to the increase in domestic and export demand as well as the speedy momentum in Pakistan's economy.

During an interview to a local broadcasting channel, Mr Tabba requested the government to announce a long-term policy for the manufacturing sector of the county as it has potential, along with textile sector, to earn US$40bn in next 4-5 years. He expressed that Pakistan's cement industry had sustained the impact of COVID-19 due to the smart lockdown policy of the government and a series of incentives announced by the Central Bank of Pakistan for short- and long-term financial support to industrialists during this period. In addition, government provided a unique package for the growth of the construction sector. Mr Tabba was optimistic that growth potential exists in all sectors as the government’s policies are conducive for their development and progress, besides some challenges on energy and agriculture sectors.

On the same lines, Pakistani business tycoon, stock trader and the founder/chairman of the AKD Group (trading and research house), Aqeel Karim Dhedhi, has confirmed the unprecedented growth in cement dispatches in

-

Comment by ZAHRA ZAFAR on November 9, 2020 at 12:31am

-

Pakistan's exports have also gotten off to a great start this year, in Q1 of the fiscal year 2021 to $68.1 million from $55.6 million last year. Export of pharmaceutical products accelerated in September with 57.99% increase from a year earlier, according to the latest data released by the PakistanBureau of Statistics.

-

Comment by Riaz Haq on November 10, 2020 at 10:24am

-

#China signs contracts to buy commodities from 15 countries including #Pakistan. Planned imports include #grain, #fruit, #textiles and #chemicals. https://www.hellenicshippingnews.com/china-signs-contracts-to-buy-c...

China’s State Development and Investment Corp has announced that it has signed procurement contracts with 20 foreign companies during the ongoing third China International Import Expo being held in Shanghai.

The purchase covers more than 20 kinds of commodities including grain, fruit, textiles and chemical products from 15 economies such as Pakistan, Cambodia, Indonesia and South Africa, according to China Daily on Saturday.

“The timely CIIE demonstrated China’s determination to continue to open up to the outside world. At the same time, it reflected confidence from the international community in the prospects of the Chinese market,” said Bai Tao, Party secretary and chairman of SDIC.

China is committed to taking initiative in the mechanism of global sharing and enabling the global cooperation to be more flexible with an open mind and measures, Bai said.

“SDIC will continue to deepen cooperation in important fields and key industries with partners both at home and abroad, so as to share opportunities brought by the CIIE, go hand in hand and contribute to the promotion of global economic development and regional economic and trade exchanges,” he added.

Meanwhile, the first batch of cherries is expected to be exported from Pakistan to China next year, said Li Wei, business representative of Huazhilong International Trading Private Ltd. Pakistan.

“Pakistani cherries are really good, including sweetness and quality. China can provide technical assistance to manage orchards, while Pakistan can provide workers, so that both sides can achieve win-win cooperation,” he said in an interview with the CEN at the third China International Import Expo (CIIE) being held in east China’s Shanghai.

Previously, media reported that export of Pakistani cherries has been hindered by cold chain management, market information system, packaging and processing facilities.

Li Wei said that to tackle the problem of cherry fruit fly, 60-70 degree hot water bath treatment and the following cold storage is a solution. Now as cold chain technology lags behind in Pakistan, we will develop it and strive to solve it next year.

Referring to why he embarked on export business of agricultural products from Pakistan, Li Wei said the general manager of the company visited Pakistan by chance and found that there was a great business opportunity for the export of agricultural products from Pakistan to China.

Therefore, in the second half of 2018, 24 tons of mango were exported from Pakistan to China and sold out in Xinfadi, a large wholesale market of fruits, vegetables, and meat for Beijing. “It was the first to enter Beijing by air cargo transport from Lahore.” This year, the company was officially registered in Pakistan.

According to Li Wei, Pakistani mango is comparable to those from Australia and the Philippines. Although the price is more expensive than domestic mango, Pakistani mango is better in terms of variety, appearance, quality, among others. The sugar content of ripe mango can reach 22.68%. “It tastes best at 75% – 80% maturity,” he added.

There is seasonal difference in the marketing of Pakistani mango in China. “The mango season in Pakistan starts from August 20 to November 20, while there are almost no mangoes in southern China in November. Pakistani mango can extend the mango season by two months compared with Chinese mango. It has a time advantage,” Li Wei explained.

The mango orchard adopts the cooperation mode between China and Pakistan. “Chinese side provides technology and sends technical staff in fields of inorganic fertilizer, bagging, picking, disinfection, transportation, while Pakistani side provides labor. Finally, through cross-border e-commerce air transportation, Chinese customers can eat fresh mango within a week after placing an order,” he added.

If the pandemic improves next year, China will import large quantities of Pakistani mangoes. On the development of high value-added mango products, he said that in the next step, they may cooperate with domestic snack manufacturers to produce dried mango products.

Regarding the other potential agricultural products in Pakistan, Li Jinhuan, Executive Director of Huazhilong International Trading Private Ltd. Pakistan, said that besides mango, the company also exports other Pakistani agricultural products such as cotton, Morchella, rice and corn. “We have received orders for Morchella from China before. Similar to fungus, Morchella is also a kind of medicinal material. It is scarce in China, with large demand and high price. Although the Morchella output in Pakistan is low and it’s difficult to buy, the price is much lower than that in China,” Li Jinhuan added.

The China International Import Expo (CIIE), hailed as “an innovation in the history of global trade,” opened its third edition in Shanghai on Nov.4 and will last until Nov. 10.

Source: APP

-

Comment by Riaz Haq on November 10, 2020 at 12:35pm

-

#Pakistan rupee becomes 3rd best #Asian currency. PKR hit almost eight-month high at Rs158.91 against the #US dollar in the interbank market. https://tribune.com.pk/story/2271680/rupee-becomes-3rd-best-asian-c...

Pakistani rupee became the third best-performing currency in Asia after the currency hit almost eight-month high at Rs158.91 against the US dollar in the interbank market on Monday, experts said.

The development may help to tackle high inflation as Pakistan has turned net importer of wheat, sugar and cotton this year to improve supplies. Earlier, a shortfall in the production of agricultural commodities caused a surge in their prices in the country.

With fresh recovery of Rs0.18 on Monday, the rupee has cumulatively regained Rs9.52 or 5.65% over the past 11 weeks since touching all-time low of Rs168.43 on August 26. The rupee was last seen around Monday’s (November 9) closing level of Rs158.91 on March 20.

“Pakistani rupee entered the list of best-performing currencies in Asia, appreciating by 3.1% against the US dollar since October 1, 2020, thereby securing the position of third best-performing currency in Asia after Indonesian rupiah and South Korean won,” Alpha Beta Core CEO Khurram Schehzad said in a commentary.

Indonesian rupiah had regained 4.5% while South Korean won recovered 3.6% since October 1, 2020, he added.

“Improvement in rupee-dollar parity reduces pressure on the external debt as well as imported inflation in the country,” the analyst added.

On the other hand, exports should not be hurt in the short run as the country’s export industries, as per reports, are already operating at 100-120% of their capacity, while the Real Effective Exchange Rate (REER) index (measuring competitiveness through relative currency parity) has also room for further improvement.

“Improving currency parity should result in improved ability of the country to service its external debt as well as tackle imported inflation that affects the masses,” he said.

BMA Capital Executive Director Saad Hashmi said the rupee may maintain the uptrend following Joe Biden’s victory in the US presidential election. “Biden aims to improve US relationship with Iran; the development should push down crude oil prices in the international market as Iran is a major oil producer,” he said.

Hashmi said the policy change would directly or indirectly benefit Pakistan as it was a net importer of crude oil and petroleum products. It meets over 70% of energy requirement through imports and the share of energy in total imports stands at around 25% per annum.

He said the rupee had continued to strengthen with higher inflow of dollars into the national economy. “Dollar inflows have remained high on account of receipt of workers’ remittances and export earnings,” he added.

Market talk about textile exporters suggests they are working at full capacity. Their share in total exports of the country stands at 60% per annum.

Experts, however, are wary of anticipating the rupee’s outlook. The future rupee-dollar parity may be impacted by Pfizer’s announcement of a successful Covid-19 vaccine and international oil prices as the world is experiencing the second wave of Covid-19.

Pfizer vaccine may not be commercially available before December while any increase in international oil prices may be a short-term phenomenon with Iran likely to stage a comeback to the oil export market.

Besides, Pakistan is likely to pay back debt worth $2 billion to Saudi Arabia; $1 billion next week and the remaining $1 billion in January 2021.

The development may stand neutral for the rupee considering Pakistan may arrange $2 billion from China and is all set to launch Eurobond and Sukuk worth $2 billion in February 2021, it has been learnt.

-

Comment by Riaz Haq on November 12, 2020 at 4:16pm

-

October #remittances to #Pakistan grow 14% to $2.3 billion, the 5th consecutive month above $2 billion. Remittances up 26.5% to $9.4 billion during the first 4 months of FY21, compared with July-Oct FY20. #economy #ImranKhan #PTI- Profit by Pakistan Today https://profit.pakistantoday.com.pk/2020/11/12/october-remittances-...

Workers’ remittances amounted to $2.3 billion during October 2020, showing an increase of 14.1 per cent when compared with October 2019.

This is for the fifth consecutive month that workers’ remittances remained above $2 billion, according to latest figures released by the State Bank of Pakistan (SBP) on Thursday.

A large part of the year-on-year (YoY) increase in October this year, 30pc, was sourced from Saudi Arabia, 16pc from the United States of America and 14.6pc from the United Kingdom (UK).

“Improvements in Pakistan’s FX market structure and its dynamics, efforts under the Pakistan Remittances Initiative (PRI) to formalise the flows and limited cross-border travelling contributed to the growth in remittances,” the SBP stated.

Meanwhile, on a cumulative basis, workers’ remittances rose 26.5pc to $9.4bn during the first four months of FY21, when compared with July-Oct FY20.

“These numbers were expected. The whole South Asia region is getting above-average inward remittances due to lockdown and reduction in flights and movement of unofficial funds,” said Muhammad Sohail of Topline Securities.

“In the short-run, this [the increase in remittances] will support local currency,” he added.

Earlier, a World Bank report had projected that remittances to Pakistan to grow at about 9pc in 2020, totalling about $24bn.

The World Bank attributed this increase to the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions.

-

Comment by Riaz Haq on November 14, 2020 at 11:10am

-

#Pakistan has not used its geographical advantage to become a #trading nation. But Pakistan will soon become a trade artery for China through the #China Pakistan Economic Corridor (#CPEC). #Gwadar #Karachi https://indianexpress.com/article/opinion/columns/pakistan-trading-... via @IndianExpress

by Khaled Ahmad

Its (Pakistan's)status as a connection between China and the Gulf economies is quite clear but the lateral function of this road — in the east India and the west Afghanistan — is not clear although India trades with Afghanistan and Central Asia and would like to use Pakistan’s territory to make this more viable. China, India’s largest trading partner — $94 billion both ways — has to use the roundabout route through Southeast Asia to transport its goods. Yet, Pakistan is on the verge of changing its identity from a war-fighting nation to a trading one. But if it continues to view India with fear, the new identity of a trading nation with a prosperous population will not be achieved.

In October 2008, a World Bank official in Islamabad said the Bank was ready to lend Pakistan $2.25 billion for a trade and energy corridor. He could have added the Iranian-Pakistan-India (IPI) pipeline to the above “projects of peace” but for the complex tripartite negotiations going on about the IPI. But a much more important thing happened during President Asif Ali Zardari’s meeting with the Indian Prime Minister Manmohan Singh, in New York in 2012. The report said: “The two met on the sidelines of the 63rd United Nations’ General Assembly session and announced mutual agreement on a number of vital business-related issues. On top of everything else came Pakistan’s agreement to allow Indians an overland access to Afghanistan.”Pakistan and India have missed many opportunities to become “normal” neighbours. Unlike India’s praiseworthy option of trading with China which it considered a rival, Pakistan never traded with India which led to much smuggling that benefited no one in Pakistan. Recently, after the Pulwama incident, it stopped even the border trade with India that caused untold hardship to the Pakistani population in Sindh. Clearly, India and Pakistan — as nuclear powers — must opt for normalisation through trade and trade routes to make South Asia a prosperous region.

-

Comment by Riaz Haq on November 14, 2020 at 8:42pm

-

During the period, the PTI government repaid 78 percent more debt than PML-N government, the (Finance) advisor (Hafeez Shaikh) tweeted on Saturday.

https://www.brecorder.com/news/40032870

He said that despite the challenges posed by Covid-19, Pakistan's industrial sector was thriving as Large scale Manufacturing Industry (LSMI) including textile production and auto-sales were on the rise. "PTI government incurred 48pc less external liabilities in first 9 quarters compared to

PML-N government's last 9 quarters while doing 78pc more debt servicing. Despite the challenges posed by Covid-19, Pakistan's industrial sector is thriving. LSM, textile production & auto-sales are on the rise," the advisor tweeted."

The advisor shared State Bank of Pakistan's data which showed that the net to external debt stood at $24.8 billion during PML-N tenure from March 2016 to June 2018, where as in PTI's tenure from June 2018 to September 2020, the net external debt stood at $18.5 billion.

The overall liabilities impact was recorded at $31.1 billion during the PML-N period under review whereas the overall liabilities impact has been recorded at $16.1 billion in PTI's tenure under review.

The external debt serviced (principal + interest) stood at $16.7 billion in PML's period whereas it stood at $29.7 billion during the PTI's tenure of nine quarters under review.

Meanwhile, quoting Pakistan Bureau of Statistics latest statistics, he said, the Large Scale Manufacturing growth increased 7.65 percent in September 2020, compared to last September whereas it grew by 4.81 percent during the first quarter of the current fiscal year (July-Sept 2020-21).

On year-on-year basis, the non-metallic mineral products grew by 21 percent in September 2020, pharmaceuticals by 20 percent, food by 10pc, autos by 28 percent, textiles by 2.5 percent, fertilizers by 8 percent, paper and board by 12 percent, chemicals by 8 percent and rubber 15 percent.

On the other hand, the car sales have increased from 10,853 units in October 2019 to 14,054 October 2020, showing an increase of 29 percent.

Likewise, the sale of motorcycles also increased by 12 percent, from 156,872 units in last October to 175,294 units in October 2020 whereas the sale of tractors went up from 2,861 to 4,482, showing growth of 57 percent and trucks and buses sale grew from 349 units to 388 units, a growth of 11 percent.

-

Comment by Riaz Haq on November 15, 2020 at 4:56pm

-

#Pakistan exporting $100m worth of #COVID19 products, including #PPE (face #mask, respirator, surgical gloves, face shield), Covid-19 test kit, mechanical ventilator, etc. #exports #coronavirus https://tribune.com.pk/story/2272360/pakistan-exporting-100m-worth-...

Minister for Science and Technology Fawad Chaudhry has said Pakistan has become self-sufficient in manufacturing Covid-19 related material thanks to the efforts of its scientists, engineers and technicians.

“The country lacked the medical equipment to fight the pandemic when the first phase of Covid-19 appeared in the month of February, but now the situation is different,” the Radio Pakistan quoted the minister as saying.

Separately, in his address at the launching ceremony of a new model of ventilator, the minister said Pakistan is now exporting coronavirus related products worth 100 million dollars.

On June 28, the minister announced that the first batch of ventilators manufactured in Pakistan would be delivered to the National Disaster Management Authority (NDMA). In a video statement, Chaudhary had said Pakistan has joined the ranks of those few countries which are producing their own ventilators.

The minister had expressed hopes that the country would be able to meet its own need for ventilators and would also be able to export the equipment, which, according to him, is a "complicated machine and not a lot of countries in the world have the capacity to make it".

"When the first Covid-19 case was recorded in February 26, we were not producing anything. Within a few months, we have become capable of producing our own equipment," he had said.

The minister had also congratulated the Pakistan Engineering Council (PEC), the National Radio and Telecommunication Corporation (NRTC) and other scientists and technicians for making it possible.

The contagious coronavirus disease has given an unprecedented boost to the use of personal protective equipment (PPEs) that include surgical mask, respirator, surgical gloves and face shield.

There has also been a global spike in the demand for medical equipment needed for treatment of this flu-like infection. The medical equipment comprise Covid-19 testing kit, mechanical ventilation, open-source ventilator and extracorporeal membrane oxygenation.

In April, Alpha Rubber and Plastic Works – a Lahore-based company which manufactures auto parts –developed a splitter through which oxygen could be provided to two to four patients at once by using a single ventilator.

Osama Usman, head of the private firm, had told The Express Tribune that 'Plan 9' of the Punjab IT Board (PITB) had approached them to manufacture the connector using the 3D printer prototype.

The part was initially being manufactured by the PITB using the 3D printer technology which was a time-taking and costly procedure. The firm, however, managed to find an alternative and started manufacturing 1,000 ventilator connectors on a daily basis for government and private hospitals.

-

Comment by Riaz Haq on November 17, 2020 at 5:57pm

-

#Pakistan #textile hub #Faisalabad to utilise all 80,000 power looms. “Pakistan has seen orders shifting from multiple nations including #China , #India & #Bangladesh ..#Garment manufacturers are operating near maximum capacity” unable to take more orders

https://profit.pakistantoday.com.pk/2020/11/12/countrys-textile-hub...

Faisalabad is currently experiencing a financial boom with the operationalisation of 50,000 power looms and expecting the opening of another 30,000 units.

Known as the country’s textile hub, Faisalabad, for the first time after 1990, has seen a massive economic growth following a high demand of export items and the government’s recently announced incentive of supplying electricity to the industrial sector at reduced rates.

In this regard, Prime Minister (PM) Imran Khan in a tweet on Thursday shared a television news report about the increased economic activity in Faisalabad and the resultant shortage of 0.2 million labourers required to meet the high demand of orders in the textile sector.

Factories and power looms faced closures owing to a power crisis as emerged due to the apathy of previous governments in the recent past. However, during the coronavirus situation, orders in the textile sector were diverted towards Pakistan from various countries.

The news report mentioned that Faisalabad had 1.3 million workers with one million natives and 0.3 million belonging to other districts.

Bloomberg in its recent report ‘Opening early helped Pakistan boost exports during pandemic’ also mentioned a surge in Pakistan’s textile exports.

“Pakistan has seen orders shifting from multiple nations including China, India and Bangladesh,” All Pakistan Textile Mills Association (APTMA) Secretary General Shahid Sattar said, as quoted by Bloomberg.

“Garment manufacturers are operating near maximum capacity and many can’t take any orders for the next six months,” he added.

Further, Pakistan’s decision to loosen pandemic restrictions early has helped the nation’s exports emerge stronger than its South Asian peers.

Bloomberg said that Pakistan’s outbound shipments grew at a faster pace than Bangladesh and India as textiles, which account for half of the total export.

“Islamabad saw total shipments grow 7pc in September, compared with New Delhi’s 6pc and Dhaka’s 3.5pc,” it said.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 7 Comments

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network