PakAlumni Worldwide: The Global Social Network

The Global Social Network

Top Global Investor Sees "Brighter Future For Pakistan"

Joseph Mark Mobius of Templeton Emerging Markets Group sees "many reasons for a brighter future for Pakistan". Mobius, armed with B.A. and M.S. degrees in Communications from Boston University, and a Ph.D in economics from MIT, is a top global fund manager with a good track record of investing in emerging markets.

In a blog post titled "Building Corridors to the Future in Pakistan", an obvious reference to China-Pakistan Economic Corridor (CPEC), Mobius says he and his team "have been investing in Pakistan for a number of years, and see it as an overlooked investment destination with attractive valuations due to negative macro sentiment". It should be noted that Karachi Stock Exchange listed companies' average price-earnings multiple of just 10 is less than half of regional markets such as Mumbai with PE ratio of over 20.

In addition to new foreign investment in CPEC and low PE ratios, Mobius offers the following key reasons for his bullish outlook for Pakistan:

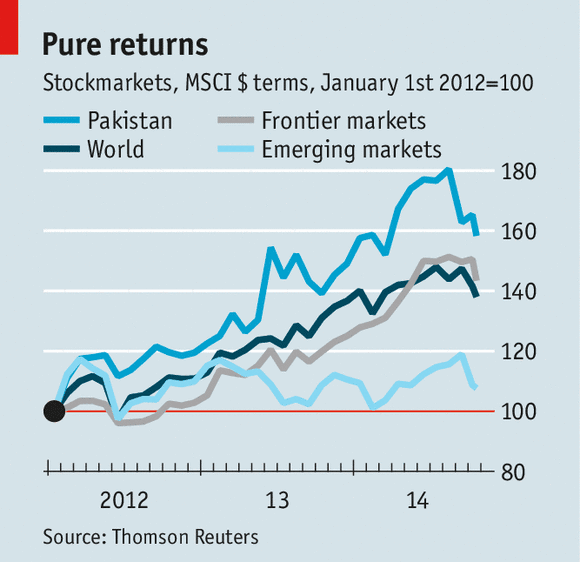

1. The Pakistani stock market has been one of the top-performing markets in the last five years (ended June 2015).

2. The MSCI Pakistan Index has more than doubled with a 129% return during that time frame, compared with a 45% return for the MSCI Frontier Index and 22% increase in the MSCI Emerging Markets Index in US dollar terms.

3. Even after KSE-100 strong performance, valuations of Pakistani stocks still remain relatively attractive. As of end-June 2015, the trailing price-to-earnings ratio of the MSCI Pakistan Index was 10 times, versus 11 times for the MSCI Frontier Index and 14 times for the MSCI Emerging Markets Index.

4. Pakistan government efforts on expenditure control and divestments have been positive, but the government will need to remain committed to the economic and structural reform program.

5. An internal anti-terrorism drive was made in the wake of the tragic Peshawar incident in December 2014, which targeted schoolchildren. Mobius thinks these efforts need to be maintained over the longer term to develop a better security climate for businesses and the society as a whole.

6. In the political environment, delays in the implementation of reforms or deterioration in the political or security situation could adversely impact the country’s macroeconomic development and fiscal position, hinder investment and weaken investor confidence.

Bottom line for Mobius: Despite a number of ongoing challenges, there are "many reasons for a brighter future for Pakistan".

Related Links:

China Deal to Set New FDI Records in Pakistan

Post Cold War Realignment in South Asia

Haier Pakistan to Expand Production From Home Appliances to Cellpho...

Pakistan Bolsters 2nd Strike Capability With AIP Subs

Pakistan Starts Manufacturing Tablets and Notebooks

-

Comment by Riaz Haq on August 27, 2015 at 8:36pm

-

KARACHI: As global crude prices showed some recovery, the stock index on Thursday grew on the back of gains in oil shares.

Additionally, a relief from the regional downturn made investors more relaxed with small and medium caps experiencing increased investor participation.

Cement stocks also dominated the charts as news of the Asian Development Bank (ADB) agreeing to fund projects provided vital support. Other stocks that showed recovery were from fertiliser and pharmaceutical sectors.

At close, the Karachi Stock Exchange’s (KSE) benchmark 100-share index recorded a rise of 1.26% or 423.87 points to end at 33,961.29. Elixir Securities analyst Faisal Bilwani said Pakistan equities shared the joy in regional markets and closed just shy of 34,000 points as index-heavy oil shares continued to find fresh interest.

“The wider market opened positive tracking regional markets and gains were gradually added as the day progressed on local institutional flows in index names,” said Bilwani. Small and medium caps experienced increased participation from retail and other investors.

Midday comments by Finance Minister Ishaq Dar about the rupee value and confidence in economy and capital markets helped sustain the gains, he said.

JS Global analyst Ahmed Saeed Khan said following the rally in global equity markets, the KSE-100 index also extended gains to hit an intraday rise of 1.4%. “Khan said local investors looked keen on the cement sector in the wake of ADB’s announcement of new projects. “Biggest gainers in the sector were Maple Leaf Cement (+5%), Cherat Cement Company (+3.7%) and DG Khan Cement (+2.3%).”

Trade volumes fell to 223 million shares compared with Wednesday’s tally of 278.69 million shares.

Shares of 378 companies were traded. At the end of the day, 258 stocks closed higher, 102 declined and 18 remained unchanged. The value of shares traded during the day was Rs10.8 billion.

Pace Pakistan was the volume leader with 15.8 million shares, gaining Rs0.66 to finish at Rs7.23. It was followed by Jahangir Siddiqui and Company with 13.7 million shares, gaining Rs1.06 to close at Rs24.71 and K-Electric Limited with 13.1 million shares, gaining Rs0.07 to close at Rs7.71.

Foreign institutional investors were net sellers of Rs516 million worth of shares during the trade session, according to data maintained by the National Clearing Company of Pakistan Limited.

http://tribune.com.pk/story/946148/market-watch-bourse-soars-with-t...

-

Comment by Riaz Haq on August 29, 2015 at 4:59pm

-

Pakistan's ambassador to the UN Maleeha Lodhi has invited the American business community to the country, which she said offers "the most investor-friendly policies in the (South Asia) region", media reported on Saturday.

Speaking before New York's Nasdaq bell ringing ceremony on Friday to mark Pakistan's 69th Independence Day, Lodhi said, "Pakistan's strategic location gives it a pivotal role in promoting regional connectivity," Dawn reported.

On the China-Pakistan Economic Corridor (CPEC), she informed the business leaders that "plans are under way to make Pakistan a regional economic hub, providing trade, energy and communication corridors linking Central Asia to South and Southwest Asia and beyond".

"Pakistan today has a functioning democracy, an independent judiciary and a free and lively media," she mentioned.

The ambassador observed that the country's economy has "staged an impressive recovery while our security situation is improving by the day".

"Pakistanis are not only making a mark in their countries of adoption but sending back remittances which are at a record level today," she added.

http://www.business-standard.com/article/news-ians/pakistan-envoy-t...

-

Comment by Riaz Haq on September 8, 2015 at 9:51am

-

In #Pakistan, a prime minister and a country rebound — at least for now. #Nawazsharif #PMLN #ZarbEAzb #PakistanArmy http://wapo.st/1JPAZ18

One year after he was nearly bounced from office, Pakistani Prime Minister Nawaz Sharif has hung on amid signs the country could be on the cusp of a surprising turnaround.

After years of terrorist attacks, military coups and political upheaval, Pakistan for now has settled into a period of relative calm. Over the past nine months, government statistics show, major terrorist attacks have declined 70 percent, and Pakistanis are flocking back to shopping malls, resorts and restaurants.

The relaxed and optimistic mood here is benefiting Sharif politically, despite the humiliation he faced a year ago when he had to cede a chunk of his power to Pakistan’s military. Still, the arrangement is allowing Sharif to do something that Pakistani leaders have struggled to accomplish for much of the past decade: implement a road map for what a peaceful, stable Pakistan could look like. And in the process, Sharif is winning over skeptics despite his low-key leadership style.

“People are feeling more secure. There are development projects, and the perspective of people is changing to say, ‘Okay, now we can see things are going well,’ ” said Zafar Mueen Nasir, dean of business studies at the Pakistan Institute of Development Economics. “Of course, there will always be some criticism and always a second opinion, but as far as I am concerned, this government is at least showing some progress.”

Last summer, after Sharif’s first year in office was marked by disputes with political rivals and the country’s powerful military, tens of thousands of protesters camped out near his mansion, demanding his resignation. At the time, there was widespread speculation that military leaders were considering a coup to oust Sharif over his diplomatic outreach to Pakistan’s arch rival, India.

But as Islamabad slipped into an unusually chilly fall, Sharif outlasted the protesters. To remain in office, he reportedly had to make significant concessions to military commanders, including giving them full authority to make major decisions related to government policy toward Afghanistan and India.

Now, despite his reduced power, Sharif has turned his attention toward trying to rebuild a chronically sluggish economy while also delivering shiny new amenities for residents.

It’s a strategy that has become easier to implement this year, as a military campaign in Pakistan’s tribal belt and its largest city, Karachi, has been credited with reducing terrorist attacks and other crimes.

In the first eight months of this year, 680 civilians have been killed in terrorist attacks, compared with 1,194 in the same period last year and 2,246 in 2013, according to the South Asia Terrorism Portal, which monitors violence in the region.

[Pakistani military says it achieved major victory in mountain assault]

A rapidly growing country of 180 million, Pakistan has plenty of obstacles to overcome.

----

Pakistan’s bare-knuckled political system also remains unsettled. Sharif, who still has 2 ½ years remaining in his term, will continue to face relentless challenges from political foes eager to exploit the next crisis.

But in recent months, speculation about a civil war or an economic collapse has died down. Instead, credit agencies are boosting Pakistan’s bond ratings and large investment firms are advising clients to take a second look at opportunities here.

“It is the best, undiscovered investment opportunity in emerging or frontier markets,” Charlie Robertson, London-based chief economist at Renaissance Capital, told Bloomberg News in late June.

The International Monetary Fund, which has extended a $6.2 billion loan, released a report last month crediting Pakistan for its 4.1 percent growth in gross domestic product this year, with a bump up to 4.5 percent projected for next year.

-

Comment by Riaz Haq on September 12, 2015 at 8:12am

-

#Pakistan Central Bank Cuts Interest Rate to 6% to Bolster Economic Growth http://bloom.bg/1L7Mbs7 via @business

Pakistan cut its benchmark interest rate as the central bank seeks to encourage economic growth amid falling oil prices.

Governor Ashraf Mahmood Wathra lowered the target policy rate to 6 percent from 6.5 percent, the State Bank of Pakistan said in a statement on its website on Saturday. The move was predicted by 11 of 21 economists in a Bloomberg survey, with the rest seeing no change. The country also cut its discount rate to 6.5 percent from 7 percent.

“For another year and a half we don’t see rates bouncing back unless oil bounces back,” Mohsen Siddiqui, portfolio manager at Abbasi Securities Pvt., said by phone from Karachi before the decision. “So far we see downward volatility in oil prices.”

Brent crude has tumbled about 50 percent over the past year. Pakistan’s exports fell in August for the fourth straight month, imperiling Prime Minister Nawaz Sharif’s goal of spurring economic expansion to the fastest since 2008.

“Recent increases in gas prices and their likely second round impacts would be offset by lower global oil price that has yet to find the bottom,” the central bank said in its statement.

Pakistan raised the price of natural gas this month for different industries to lower subsidies and meet the terms of an International Monetary Fund loan. The largest gas-price increase was a 63 percent surge for some fertilizer manufacturers, Oil Minister Shahid Khaqan Abbasi said in August.

-

Comment by Riaz Haq on September 12, 2015 at 8:47am

-

Credit Suisse positive on #Pakistan - Ali Naqvi, Head of Equities #Asia Pacific, Credit Suisse | Business Recorder http://www.brecorder.com/company-news/235:pakistan/1226009:credit-s... …

Commenting further on Pakistan's economic outlook, Naqvi brimmed with confidence saying, "I see the glass more than half full". Part of his optimism is driven by the oil price slump which in Naqvi's word "is certainly a blessing for an oil importing country like Pakistan".

"Even if the oil price goes up, we do not expect it to touch $80-100 per barrel anytime soon. Crude oil priced anywhere at or under $70 a barrel is comfortably manageable for Pakistan," added Naqvi. For the oil price to go up drastically, the Chinese economy, in his opinion, would have to show promising growth. "Oil goes up if China goes up by 9 percent and that seems unlikely at the moment. So the oil price could well stay on the lower side which is to Pakistan's advantage".

Consumer driven growth is what Naqvi believes will continue to underpin growth in Pakistan. "The consumption trends are encouraging. With incomes improving, people are spending more and that creates whole avenues for growth," However, Naqvi delivered the optimism with a word of caution on the long-term sustainability of growth; "Pakistan's biggest risk today is the lack of any globally competitive industry or sector. The country needs to devise policies allowing it to become globally competitive in at least a few industries and sectors. Naqvi was particularly positive on the progress in the energy sector.

While some out there may think that the sector has not seen any improvement, Naqvi thinks otherwise. "Yes, the problems are huge, but the focus for the first time is on the right areas. Results will take time to come, but the plans in generation, distribution and governance areas seem well placed and have sent a positive signal". That said, Naqvi added that the progress has been rather slow, but quickly added that "there is progress nonetheless".

Without commenting on specific sectoral preference, Naqvi reiterated his overall liking for anything that has a consumer play. On Pakistani stock markets' regional standings he said the discount is still there but that can turn into an opportunity. "Pakistan trades at a roughly 40 percent discount to the regional markets". Such is the variation in multiples that India trades at two times the multiple of Pakistan, whereas China is at par with Pakistan.

Quizzed over his thoughts on Pakistan's banking sector, Naqvi said, "Banks perform in cycles and with the government not crowding out the market, banks will have to start lending to the private sector more aggressively, at some point. They have already started entertaining 'riskier' borrowers. They have no choice but to lend to the private sector as competition will be stiffer by the day and new technologies pose the biggest threat to banks, especially the more complacent ones".

Concluding the conversation, Naqvi said, "Consumer empowerment through technology (a global phenomenon) and domestic consumption are the key growth drivers and luckily both are happening at the same time for Pakistan". His final verdict on Pakistan was that Credit Suisse's view on Pakistan is positive, without any caveats." Pakistan's market is in serious danger of becoming mainstream again", he quipped.

-

Comment by Riaz Haq on September 13, 2015 at 4:14pm

-

Seeking Alpha: The Global X MSCI #Pakistan ETF (NYSEARCA:PAK) is an excellent value pick

http://seekingalpha.com/article/3492516-the-global-x-msci-pakistan-etf-high-growth-low... …

The Global X MSCI Pakistan ETF (NYSEARCA:PAK) is an excellent value pick, and a closer examination of Pakistan's economy, stock market, and political risk all verify that the soon to be an emerging market, Pakistan, has an excellent investment climate. The fund's P/E ratio is currently 9.12, which is low for Pakistan, and is also lower when compared to other ETFs in frontier and emerging markets. The ETF was just created this year and its price has consistently been between 14.00-16.94.

Pakistan's stock market has risen substantially since 2012, yet valuation is still extremely low.

Pakistan's stock exchange has had substantial performance with a YTD return of 8.87%, and a 1-year return 21.18%.

Terrorism has been decreasing substantially in Pakistan, according to a report released by the Department of State.

Inflation has recently improved from the high levels consistently experienced between 2010 and 2014.

Certain industries have displayed substantial growth, such as the cement industry, which grew by 57% this year.The S&P BSE Sensex is down over 4,000 points from the highs it hit in March. The index has already wiped out all the gains made in 2015, down nearly 7 per cent, weighed down by both global as well as domestic factors.

Domestic factors such as weak GDP growth in April-June, a slowdown in manufacturing output, below-average monsoon and weak corporate earnings growth have weighed on sentiments.

Read more at:

http://economictimes.indiatimes.com/articleshow/48932107.cms

-

Comment by Riaz Haq on September 22, 2015 at 12:32pm

-

Business confidence soaring in #Pakistan: LCCI-LSE report http://www.pakistantoday.com.pk/?p=443234 via @ePakistanToday

Business confidence in Pakistan has soared in 2015 as both the investments and revenues registered have surged during this period. It is revealed in the LCCI-LSE business confidence report launched on Thursday at the Lahore Chamber of Commerce & Industry.

LCCI President Ijaz A Mumtaz, former presidents Bashir A Baksh, Mian Muzaffar Ali, Rector Lahore School of Economics Shahid Chaudhary, Dean of Economics Faculty Dr Azam Chaudhary and LCCI executive committee members were present on the occasion.

LCCI President Ijaz A Mumtaz said that one could not find a solution to the problem until and unless correctly identified, therefore, the Lahore Chamber of Commerce & Industry decided to conduct a detailed survey in collaboration with the Lahore School of Economics and prepared a “LCCI-LSE Business Confidence Report” after months long exercise.

The LCCI-LSE business confidence report says that “a significant number of firms in the manufacturing sector said that their export sales increased over the last year and they expected it to increase again in 2015. A majority of firms said that investment increased over the last year and the largest increase in investment in 2014 came in the manufacturing sector where around 70 per cent of firms were able to increase their investment. Across all firms, the increase in investment in 2014 was not financed by bank borrowing but by the enhanced sales revenues. More than 60 per cent firms in the manufacturing and services sectors plan to increase their investment in 2015. A significant majority of firms do not plan to utilise bank borrowing for financing their higher levels of investment in 2015. A significant proportion of manufacturing and service sector firms managed to increase their number of employees in 2014 and both these sectors seem optimistic about further increase in their employment level in 2015. There was significant optimism when firms were asked about their expectations about Pakistan’s economy, with approximately 50 per cent of the firms expecting the economy to do better in 2015. Access to finance was considered shortage of skilled labour to have a major impact on business and this proved to be a key issue for the manufacturing and services sectors.”

-

Comment by Riaz Haq on September 23, 2015 at 4:08pm

-

#Pakistan to offer $1b Eurobond this week | http://GulfNews.com http://bit.ly/1MJPdod

Cash-strapped Pakistan will raise at least $1 billion (Dh3.67 billion) from international debt markets in the next two days by Eurobonds offerings, a media report said on Wednesday.

Finance Minister Ishaq Dar during his visit to the US will lead the Pakistani team to launch a Eurobond.

Pakistan has opted the easier but more expensive path of capital markets financing rather than implementing tough but necessary energy sector reforms and accessing the much cheaper financing available from international aid agencies, The Express Tribune reported.

“The bond will be priced on September 24 and is being underwritten by Citibank, Deutsche Bank and Standard Chartered Bank, which were appointed less than three weeks ago,” it said.

The Eurobonds are expected to be of either five or 10-year maturities, or possibly both.

Based on the last issue, the interest rate is likely to be in the 7 per cent range.

By comparison, had the government implemented energy sector reforms, the country would have availed the same amount from the World Bank and Asian Development Bank (ADB) at a 2 per cent interest rate for a period of 25 years.

The launching of the Eurobond, the third global issue in less than two years, highlights the government’s lack of commitment to structural reforms hampering economic growth, according to independent economists.

Although, the government had included $1 billion Eurobond in its annual budgetary estimates, it advanced the calendar and also decided to issue the sukuk.

International lenders’ refusal to extend USD 1 billion in budgetary support before end of this month heightened the urgency to try luck in international debt markets.

The World Bank (WB), ADB and Japan have withheld approval of $1 billion loan after they questioned the government’s commitment to reform the ailing energy sector.

The government’s inability to implement promised reforms led to delay of approval of the loan, which was originally planned for April this year.

Under the Development Policy Credit-II, the WB was supposed to give USD 500 million in loan, the ADB $400 million loan and Japan $100 million in grant.

Earlier, in March last year, the government raised $2 billion by floating five and ten year dollar-denominated bonds at interest rates ranging between 7.25 per cent and 8.25 per cent.

In the second attempt, the government issued five-year $1 billion Ijara-Sukuk bonds at 6.75 per cent.

-

Comment by Riaz Haq on September 24, 2015 at 8:25am

-

#Pakistan hopes to raise $1B with Eurobond http://on.wsj.com/1KAuGvx via @frontiermarkets

Pakistan is set to issue a Eurobond this week, the finance ministry said, with one government official estimating on Wednesday that the bond could raise “around $1 billion” in a bid to boost the country’s financial position.

The bond, whose final pricing is scheduled for Thursday, is part of the government’s plans to lift Pakistan’s economy, which include bolstering foreign exchange reserves through divestments from and privatization of state-run enterprises, improvement of infrastructure and structural reforms.

“The minimum to be raised is $500 million, but based on the interest so far, we’re…looking at around $1 billion,” a senior finance ministry official said. The official asked not to be named because he was not authorized to comment on the matter. Finance Minister Ishaq Dar traveled to New York for the bond’s final roadshow on Wednesday.

Officials at the Finance Ministry declined to offer further details about the issue, including tenor and yield. The country’s foreign exchange reserves stood at $18.73 billion on September 11, according to the State Bank of Pakistan.

Moody’s assigned a (P)B3 rating last week to the bond offer, with a stable outlook, citing Pakistan’s “moderate economic strength with a supply-constrained economy that has been resistant to structural change.”

The agency added that the country’s weak fiscal position, the risk of political instability, and structural problems, especially in the power sector, are among the major factors that determined the bond rating.

Prime Minister Nawaz Sharif’s government has said that it plans to improve Pakistan’s power sector through reform and investment to boost growth, and hopes to end chronic power shortages that have crippled the economy for years. Power and transportation are the key elements of a $46-billion Chinese infrastructure investment plan unveiled earlier this year, which aims to create an economic corridor linking China with Pakistan.

The government’s GDP growth target for 2015-16 is 5.5%, up significantly from 4.24% in the previous year. The International Monetary Fund said last month that it expects a 4.5% growth for this fiscal year.

Pakistan returned to the global bond markets last year in April after a seven-year break, raising $2 billion. Later in 2014, it raised another $1 billion through an Islamic bond issue.

-

Comment by Riaz Haq on September 25, 2015 at 4:32pm

-

#Pakistan crimps bond issue to US$500 million at 8.25% in face of weak demand http://on.wsj.com/1G7wr2m via @frontiermarkets

Pakistan’s decision to limit its bond issue this week to $500 million has been described as a slight setback for the country’s government by analysts, who are questioning the timing of the bond sale.

Pakistan on Thursday issued the 10-year, $500-million Eurobond at a yield of 8.25%, limiting itself to the original target instead of the expected $1 billion, citing “weak market conditions”.

Although the issue was oversubscribed, attracting a demand of $1 billion, the government “decided that it would be prudent to restrict the issue to the intended and announced level of $500 million.”

The bond will fund the upcoming maturity of a 10-year, $500-million bond issued in 2006.

Analysts described the issue as a “slight setback” for the government, saying the timing of the issue was less than ideal considering global market conditions.

“They’ve got less money [than expected], and I think it’s slightly expensive. We were expecting 8% or below,” said Mohammed Sohail, chief executive of Topline Securities, a Karachi-based brokerage, adding that expectations were based on Pakistan’s improved economic situation since the last bond issue in April 2014, which also had an 8.25% yield.

Prime Minister Nawaz Sharif’s government says it has made progress on the economic front despite domestic political instability and the ongoing battle against militancy. “Investors were appreciative of the progress made in stabilizing the economy and reforms carried out in critical sectors of energy, privatization, tax administration and [the] investment climate,” the country’s finance ministry said.

The government recently received a vote of confidence from the IMF in its reform efforts. But ratings agency Moody’s warned last week that the threat of political instability, infrastructure weaknesses and the slow pace of structural reform remain key factors in Pakistan. The agency assigned the latest bond issue a (P)B3 rating.

Analysts said that the government’s decision to limit itself to a $500-million issue despite oversubscription at $1 billion suggested that the yield demand for the additional $500 million was even higher than 8.25%.

Pakistan’s finance ministry said global circumstances had weighed on its decision to restrict the issue, citing “the economic downturn in China and uncertainty created by [the] Fed decision.”

The U.S. Federal Reserve kept short-term interest rates unchanged last week, but Chairwoman Janet Yellen said on Thursday that she expects an increase this year.

Analysts are questioning the timing of the issue. “If there is uncertainty in the global environment, markets are under pressure…they could have waited for a few months,” said Sohail of Topline Securities.

Another analyst pointed to a possible lack of interest from frontier-market investors, many of whom have suffered losses in recent months.

“Maybe if the global market wasn’t like this, [Pakistan] could’ve got a natural yield,” said Zeeshan Afzal, head of research at Taurus Securities, another brokerage in Karachi.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 2 Comments

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network