PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan to Become World's 6th Largest Cement Producer By 2030

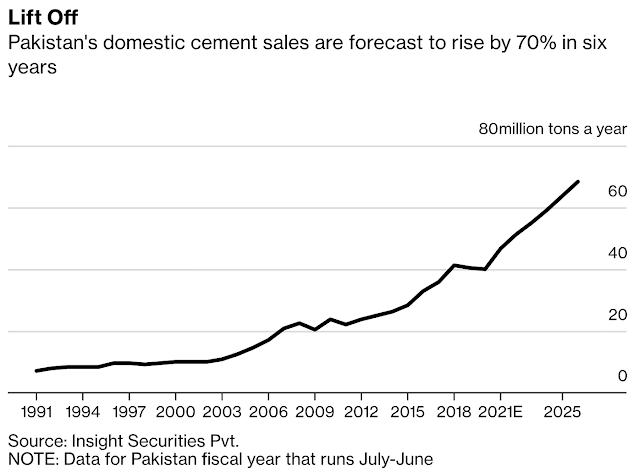

Pakistan's rank as world's leading cement producer will rise from 16th in 2018 to 6th by 2030. It will replace Japan among the world's top 10 cement producing nations in 2030, according to World Cement Association forecast. Cement consumption is an important indicator of development activity and economic growth. Pakistan's domestic cement sales are continuing to grow, up 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4-month period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year.

| Source: World Cement Association |

Last year, Pakistan produced 41.14 million tons of cement, according to International Cement Review. The country's cement industry has already built capacity to produce 59.5 million tons in anticipation of future demand for housing and infrastructure. World Cement Association expects Pakistan to produce 85 million tons, 2% of the world's cement production in 2030.

|

| Cement Sales in Pakistan. Source: Bloomberg |

Currently, China produces more than half of all the cement used in the world. India produces 8% and and European Union 3%. The three will continue to be at the top in 2030. However, China's share will drop to 35% while India's share will double to 16%.

|

| Top Cement Producing Countries in 2019 |

Pakistan's domestic cement sales grew 9.2% in October, 2019 from the same month last year. Total sales (local and export) in 4 months period between July and October 2019 stood at 16.117 million tons, 4.5 per cent higher than 15.419 million tons during the same period last year. Cement consumption is an important indicator of the state of economy. It is the most important construction material. It drives construction industry that is among the biggest employers in the world. Cement is used to build homes, factories, schools, hospitals, roads, bridges, ports and all kinds of other infrastructure.

|

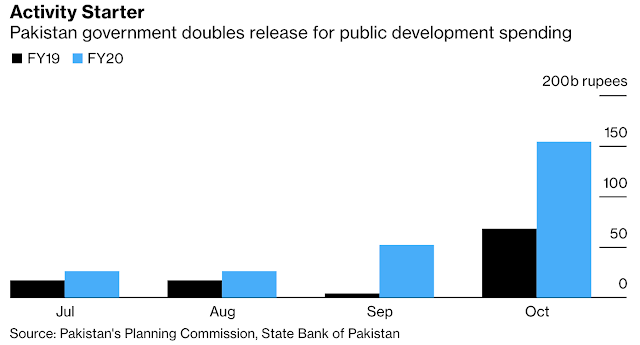

| Recent Spike in Public Sector Development Spending (PSDP) |

Development of infrastructure under China Pakistan Economic Corridor projects is continuing to drive cement demand in the country. In addition, construction of major new housing communities is underway. One example of such a community is Karachi's Bahria Town. It is being built on the outskirts of Pakistan's financial capital is among the world's largest privately developed and managed cities. It is spread over an area of a little over 70 square miles, larger than the 49 square miles area of San Francisco. When completed, Bahria Town will house over a million people, more than the entire population of San Francisco.

-

Comment by Riaz Haq on January 2, 2020 at 10:34am

-

#Pakistan #cement industry to add another 10 million tons capacity to reach 70 million tons in 2020. #construction #CPEC #NayaPakistan #Housing https://www.cemnet.com/News/story/167897/10mta-of-new-cement-capaci...

A big number of capacities will be added in Pakistan's cement industry, later this month and in early next year, according to market analysts. Current capacity projects are forecast to add around 10Mta of extra capacity to the present 59.42Mta. This is expected to lead to higher levels of competition and price wars in the coming year.

According to IMS Research, from December 2019 onwards, the northern market will see multiple expansions with Lucky Cement (2.6Mta in December 2019), Kohat Cement (2.3Mta in December 2019) and Pioneer Cement Ltd (PIOC) (2.6Mta slated for 3QFY20). In the south PIOC is adding 2.5Mta in 3QFY20. The extra output is anticipated to test pricing power, particularly in the north due to limited export opportunities following the suspension of exports to India, although a sustainable growth trend may be able to hold prices at current levels.

Growth in November 2019

While reviewing the dispatch data for November 2019, experts attribute it to the second postponement of CNIC condition on sales (delayed until January 2020) and a pick-up in construction activity (especially on the private side). Disbursements under Public Sector Development Programme (PSDP) have also increased by 64 per cent YoY during FY20TD, to PKR297bn (US$1.79bn).

-

Comment by Riaz Haq on March 20, 2020 at 5:01pm

-

#Pakistan records 28% growth in #export of #cement/clinker in 8 months of fiscal year. It reached 5.94 million tons in 8MFY19-20 & can be attributed to an increase in cement exports to #Afghanistan & unprecedented surge in clinker exports to world #market https://www.cemnet.com/News/story/168502/pakistan-records-28-growth...

All Pakistan Cement Manufacturers' Association (APCMA) has reported that country saw a growth of 28 per cent in cement and clinker exports during first eight months of the ongoing financial year 2019-20. It reached 5.939Mt in 8MFY19-20 and can be attributed to an increase in cement exports to Afghanistan and unprecedented surge in clinker exports to the global market.

However, Pakistan's Federal Bureau of Statistics is yet to release official data for the export of cement and clinker from Pakistan for the period of February/July – February 2019-29.

According to APCMA, cement exports to Afghanistan rose by 54.8 per cent to 1.737Mt 8MFY20, but exports to India remain suspended since last year. Cement exports from Pakistan to other international markets fell by three per cent to 1.297Mt. However, clinker exports continued to bode well, recording growth of 100 per cent with dispatches of over 2.904Mt clinker.

Outlook

Moving forward, the corona virus pandemic has engulfed global trade and industry. Pakistan has closed its borders with Afghanistan and Iran in a bid to stop spread of virus and this has also suspended export of cement from Pakistan to Afghanistan.

In addition, State Bank of Pakistan (SBP) is scheduled to announce its monetary policy today. The industry, including cement, is desperately expecting reduction in interest rate from 13.25 per annum following the impact of the corona virus, slowdown in the world economy, little fall in inflation, etc. If is reduced, it would greatly benefit the industry on financing front in Pakistan.

-

Comment by Riaz Haq on July 13, 2020 at 6:08pm

-

#PAKISTAN - #Cement price up by Rs55/bag in Punjab, KP. Big difference in prices in north (Rs 505-525/bag) & south (Rs. 650/bag) regions..."we can call it that the cement sector has reached up to its old price level from where it declined.” #construction https://www.intercem.com/Intercem-Insights/News/ArtMID/683/ArticleI...

Pakistan cement manufacturers on Wednesday increased cement wholesale prices by upto Rs55/bag (or $0.375) in northern region (Punjab and Khyber Pakhtunkhwa), cement dealers confirmed to The News.

This increase would be effective from the today (Thursday). In South regions (Sindh and Balochistan) the prices have been kept unchanged, the reason being its prices are already much higher than north region. With this hike, cement prices in north region stands at average of Rs505-525 per bag.

Mohammad Ali Tabba, Chief Executive Officer of the Lucky Cement Limited, when contacted said, “Since start of March 2020, and after approval of the Ordinance, cement demand has recovered up to 90 percent, and in the north region it has recovered full demand and has even achieved 10 percent more over the last year.”

Regarding the price hike, he said that since demand for cement had eroded in first two months (Jan-Feb), while at the same time, three manufacturers including our company had made expansion in their capacities, this pushed the prices to as low as Rs450/bag in north region from earlier Rs550 to 600/bag.

He said, “We cannot say it an increase in prices, but we can call it that the cement sector has reached up to its old price level from where it declined.” He said that the manufacturers have increased the prices in the range of Rs45 to 55/bag. Our company has increased the price by Rs50 in north region.

It is worth mentioning that there is a huge difference in the prices of cement in north and south regions. Average price in south is Rs650/bag, while in north region it is now around Rs505 t0 525/bag.

A cement dealer in Islamabad told The News that the senior companies’ representatives held the meeting and they have decided the price hike. He said that Fauji cement has increased its price by Rs45/bag while all other brands including Lucky Cement, Cherat Cement, DG Khan Cement and other producers in north region have increased the prices by Rs55/bag each. He said, “After this package, the demand for construction materials has increased.”

-

Comment by Riaz Haq on November 6, 2020 at 9:04am

-

#Pakistan #cement sales grow 33% year over year to a new monthly record 5.7 million tons in October, up from 4.4Mt in September 2020. Increased domestic and export demand as well as the speedy momentum in Pakistan's #economy. #COVID19 #construction https://www.cemnet.com/News/story/169795/pakistan-records-33-growth...

Pakistan's domestic and overseas cement dispatches figures for October 2020 are officially yet to be released by the All Pakistan Cement Manufacturer Association (APCMA), but Lucky Cement Ltd's CEO, Mohammad Ali Tabba, has estimated a record growth to 5.7Mt, increasing from 4.4Mt in September 2020. The MoM rise of 29.5 per cent in dispatches in October was possible due to the increase in domestic and export demand as well as the speedy momentum in Pakistan's economy.

During an interview to a local broadcasting channel, Mr Tabba requested the government to announce a long-term policy for the manufacturing sector of the county as it has potential, along with textile sector, to earn US$40bn in next 4-5 years. He expressed that Pakistan's cement industry had sustained the impact of COVID-19 due to the smart lockdown policy of the government and a series of incentives announced by the Central Bank of Pakistan for short- and long-term financial support to industrialists during this period. In addition, government provided a unique package for the growth of the construction sector. Mr Tabba was optimistic that growth potential exists in all sectors as the government’s policies are conducive for their development and progress, besides some challenges on energy and agriculture sectors.

On the same lines, Pakistani business tycoon, stock trader and the founder/chairman of the AKD Group (trading and research house), Aqeel Karim Dhedhi, has confirmed the unprecedented growth in cement dispatches in

-

Comment by Riaz Haq on November 23, 2020 at 11:14am

-

Pakistan: Cement producers dispatched a record 5.74Mt in October 2020. Exports rose by 12% to 875,000t from 784,000t. The Nation newspaper has reported that the figure brings Pakistan’s total dispatches for the first four months of the 2021 financial year, from 1 July 2020 to 31 October 2020, to 19.3Mt, up by 20% from 16.1Mt in the first four months of the 2020 financial year.

The All Pakistan Cement Manufacturers Association said that cement consumption may increase further if the government rationalises duties and taxes and withdraws excise duty.

https://www.globalcement.com/news/item/11571-pakistan-dispatches-re...

-

Comment by Riaz Haq on April 3, 2021 at 7:32am

-

#Pakistan #Cement sales jump 44.4% in March to 5.773 million tons from 3.722 million tons in the same period last year with huge increase in domestic consumption and exports. Total cement sales in July20-March21 were 43.325m tons, up 17% from last year. https://profit.pakistantoday.com.pk/2021/04/03/cement-sales-grow-re...

The cement sector posted the highest-ever monthly growth of 44.39 per cent in March at 5.773 million tonnes from 3.722m tonnes in the corresponding period last year due to a massive increase in domestic consumption and exports.

According to a local media report that compiled data released by the All Pakistan Cement Manufacturers Association (APCMA), local cement dispatches in March 2021 stood at 4.563m tonnes, up by 42pc compared to 3.214m tonnes in the same period last year whereas, exports surged by 60pc from 507,480 tonnes in March 2020 to 810,962 tonnes in March 2021.

During the month under review, cement mills in the North dispatched 3.809m tonnes to local markets against 2.749m tonnes in March 2020, up by 38.52pc. In March 2021, south-based mills dispatched 753,704 tonnes in domestic markets, which was 62.28pc higher than 464,440 tonnes in the same period last year.

Exports from North-based mills registered an enormous increase of 162.58pc as the volumes increased from 106,759 tonnes in March 2020 to 280,330 tonnes in March 2021.

Exports from the South rose by 32.42pc to 530,632 tonnes in March 2021 from 400,721 tonnes during the same month last year.

During the first nine months of the current fiscal year (9MFY21), total cement dispatches (domestic and exports) were 43.325m tonnes that was 17pc higher than 37.035m tonnes during the corresponding period of last fiscal year.

-

Comment by Riaz Haq on May 11, 2021 at 7:28am

-

Pakistan’s cement production capacity to increase to 99Mt/yr

https://www.globalcement.com/news/item/12381-pakistan-s-cement-prod...

The All Pakistan Cement Manufacturers Association (APCMA) says that the country’s installed cement production capacity will reach 99Mt/yr within the next few years, with most of the planned work to be completed by mid-2023. The Dawn newspaper has reported that producers are launching new cement plant projects and expanding existing plants with a total new capacity of 18Mt/yr. Upon completion, the current projects will increase domestic cement production capacity by 43% to 99Mt/yr from 69Mt/yr. 94Mt/yr of the new capacity is situated in Northern Pakistan and 5.0Mt/yr in Southern Pakistan.

APCMA says that the reason behind the new expansion cycle is estimated annual sales growth of 10 – 15% from 2021.

-----------

Cement makers to expand production capacity by 40pc

https://www.dawn.com/news/1622795

Pakistan’s cement producers plan to expand their capacity by more than 40 per cent from nearly 69 million tonnes to nearly 99m tonnes over the next several years in anticipation of 10-15pc growth in their sales every year, claims an All Pakistan Cement Manufacturers Association (APCMA) official.

Speaking with Dawn, the APCMA official, who requested anonymity, said almost every cement manufacturer had planned to increase their production capacity through greenfield and brownfield projects. Many projects, especially the brownfield ones, are expected to come on line in the next two years, adding nearly 18m tonnes to the existing capacity.

“Almost 95pc of the new capacity is being planned in the north – mostly in Punjab – where the most growth in demand is coming,” he said.

According to him, the industry was of the view that cement sales will spike as construction activity picks up further going forward on the back of a generous housing package announced last year by the prime minister to help the economy to recover from the Covid-19 pandemic impact. The announcement of mega infrastructure schemes and resumption of work on CPEC related projects and dams too are driving the industry sentiment.

The massive reduction of 625bps in the central bank’s policy rate from 13.25pc to 7pc during March and June last year to offset the impact of the Covid-19 pandemic as well as the availability of cheaper long-term financing for new and old projects under the Temporary Economic Refinance Facility (TERF) initiative, which has diluted the borrowing cost of the industry across different sectors, have also contributed to the cement producers’ decision to undertake expansions.

Most cement makers have already disclosed their expansion plans through bourse filings over the last few months.

The new investments represent the fourth expansion cycle by the cement industry.

Cement dispatches have consistently been rising since the resumption of economic activities last summer ever since the Covid-19 curbs on the construction industry, and other businesses, were lifted. Total cement dispatches – domestic and exports both – jumped 19pc to 48.3m tonnes during the period between July and April from 40.5m tonnes a year ago. Domestic sales are up by almost 19pc to 40.2m tonnes and exports by about 20pc to 8m tonnes.

-

Comment by Riaz Haq on July 5, 2021 at 4:51pm

-

#Pakistan #cement consumption grows by 13% in June to 5.211 million tons from 4.623Mt in June 2020. Cement sales jumped 20% to 48.119Mt in 11MFY21 from 39.96Mt from 11MFY20. #ImranKhan's #NayaPakistan Housing & PSDP allocation boosted #construction.

https://www.cemnet.com/News/story/171040/pakistan-cement-dispatches...

Pakistan’s cement sector posted a robust YoY growth of 12.73 per cent in June 2021, as total dispatches rose to 5.211Mt against 4.623Mt in June 2020. Cement dispatches rose by 20.40 per cent to 48.119Mt in 11MFY21 from 39.96Mt during the eleven months of the last financial year 2019-20, according to data released by the All Pakistan Cement Manufacturers Association (APCMA).

The rise is attributed to construction activities under the Naya Pakistan Housing Scheme (NPHS), vital government initiatives, and in anticipation of higher Public Sector Development Program (PSDP) allocation for the year 2021-22.

Intermarket Securities Ltd also supported the same growth sentiment and argued that the construction sector will remain in the limelight as cement dispatches continue to grow on the back of a normalisation of construction activities. This has been led by the relief package announced by the government coupled with progress on the NPHS.

An APCMA spokesman said that FY20-21 had been a good year for cement, as demand has grown considerably. The cement industry is expanding its capacity from 70Mt to around 100Mt. The expectation is that the market will increase by 15 per cent annually for the next three years due to an increase in projects funded by the PSDP and China-Pakistan Economic Corridor (CPEC), as well as expanding housing and industrial demand.

Export

According to APCMA, exports also increased from 7.847Mt during the financial year 2019-20 to 9.314Mt during the outgoing financial year 2020-21, showing a growth of 18.69 per cent. Pakistan usually exports cement overland to Afghanistan and by sea to the Middle East, Africa, and South and Central Asia.

-

Comment by Riaz Haq on July 17, 2021 at 10:31am

-

#imrankhanPTI's #NayaPakistan #Construction Bet Boosts Investment. #Pakistan’s cement production capacity to grow by 31% to 91 million tons a year after announced expansions are completed. Pak home mortgage grew by 18% to a record Rs. 97.8 billion in May https://www.bloomberg.com/news/articles/2021-07-13/khan-s-construct...

https://twitter.com/haqsmusings/status/1416448327764221952?s=20

#imrankhanPTI's #NayaPakistan #Construction Bet Sees #Cement Firms Boosting #Investment. #Pakistan’s cement production capacity will increase by 31% to 91 million tons a year after the announced expansions are completed. #economy https://www.bloomberg.com/news/articles/2021-07-13/khan-s-construct...

A group of 19 cement manufacturers have seen their shares rise 67% in the past year, compared with the KSE-100 Index’s 30% gain. About 1,000 projects have registered under the government initiative with the boom just about to start on the ground, according to Mohammed Hassan Bakshi, a member of Khan’s Naya Pakistan Housing Program.

----------

Pakistani cement companies are investing to expand capacity a year after Prime Minister Imran Khan chose the construction sector to stimulate the economy.

Lucky Cement Ltd., Bestway Cement Ltd., and D.G. Khan Cement Co. are among more than half-a-dozen firms to announce plans in recent months. Pakistan’s cement production capacity will increase by 31% to 91 million tons after the announced expansions are completed, according to Insight Securities Pvt.

Khan’s government last year said it will subsidize low-cost housing and forgive tax evaders if they invest in construction projects. Banks have also been asked to increase their outstanding mortgages by at least 5% by December. Cement stocks have outpaced the nation’s benchmark index.

“Construction-related activities have a very, very big multiplier effect in emerging economies,” said Waleed Saigol, director at Maple Leaf Cement Factory Ltd. “The government has realized that the private sector has to play a leading role in getting the wheels turning again.”

-------------------

The construction boom is also having other effects. Pakistan’s consumer home finance, which is one of the lowest in South Asia, has increased by 18% to a record 97.8 billion rupees in May, according to Foundation Securities Pvt. The country has also seen its first real estate investment trust in more than six years.

The nation’s economic growth is “supported by a continued strengthening of domestic consumption and resilient manufacturing and construction activity,” Fitch Ratings Ltd. said in May. However, a fresh wave of Covid-19 cases “could disrupt the positive momentum.”

-

Comment by Riaz Haq on October 3, 2021 at 8:51pm

-

#Pakistan domestic #cement sales during August 2021 increased to 3.814 million tons from 2.805 million tons in August 2020, showing a healthy increase of 35.98%. #construction #infrastructure #housing https://tribune.com.pk/story/2318570/cement-sales-surge-228-in-august

The cement sector posted a growth of 22.77% in August 2021 as total cement dispatches were recorded at 4.336 million tons against 3.531 million tons in the same month of previous year.

According to data released by the All Pakistan Cement Manufacturers Association (APCMA), local cement sales during August 2021 increased to 3.814 million tons from 2.805 million tons in August 2020, showing a healthy increase of 35.98%.

Exports, however, continued to decline as the volumes fell from 726,687 tons in August 2020 to 521,468 tons in August 2021, decreasing by 28.24%.

During August 2021, the north-based cement mills dispatched 3.141 million tons to domestic markets, an increase of 25.42% over 2.504 million tons in August 2020.

South-based mills dispatched 673,572 tons of cement to local markets during August 2021, registering a robust increase of almost 124% compared to sales of 300,750 tons in August 2020.

Exports from north-based mills declined 33.14% as shipments dropped from 212,076 tons in August 2020 to 141,804 tons in August 2021. Exports from south decreased 26.22% to 379,664 tons in August 2021 from 514,611 tons in the same month of last year.

Read Cement, steel price hike worries construction sector

During the first two months of current fiscal year, total cement dispatches (domestic and overseas) were 8.235 million tons, which were 1.61% lower than the 8.37 million tons dispatched during the corresponding period of last fiscal year.

North-based mills sold 6.033 million tons of cement in domestic markets during the first two months of current fiscal year, showing a slight increase of 1.57% than the dispatches of 5.939 million tons during July-August 2020.

Exports from north declined by 17.16% to 277,422 tons during July-August 2021 compared with 334,899 tons exported during the same period of last year.

Domestic dispatches by south-based mills during July-August 2021 were 1.228 million tons, showing a healthy increase of 50.01% over 818,600 tons dispatched during the same period of last fiscal year.

There was, however, a massive decline of around 45% in exports from the south zone as the volumes reduced to 696,823 tons in the first two months of current fiscal year from over 1.277 million tons during the corresponding period of last fiscal year.

An APCMA spokesperson said that the landed price of coal, a major input for the cement mills, which cost around Rs18,000 per ton in August 2018 has increased multiple times since then and the current landed cost comes to around Rs31,500 per ton, increasing the cost of production by approximately Rs90 per bag.

Similarly, the electricity rate, which was Rs11.68 per unit in August 2018, is now Rs19.40 per unit. This has impacted the cost of production by around Rs35 per bag.

Read more Tarin stresses need for cut in cement prices

Other input costs like packing material, provincial taxes on raw material and fuel prices have also gone up, which has increased the overall cost of production.

He emphasised that the current demand for imported coal from the cement sector is around 8.120 million tons but there is only one terminal in the country to handle all coal shipments.

Due to this, the cement industry is continuously facing delays in unloading coal shipments, resultantly paying demurrages and incurring extra costs on its operations.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 6 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network