PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan: Impact of Labor Force Expansion on Savings, Investments and GDP Growth

Pakistan's labor force expansion is the 3rd biggest in the world after India and Nigeria, according to UN World Population Prospects 2017. Rising working age population and growing workforce participation of both men and women in developing nations like Pakistan will boost domestic savings and investment, according to Global Development Horizons (GDH) report. Escaping the low savings low investment trap will help accelerate the lagging GDP growth rate in Pakistan, as will increased foreign investment such as the Chinese investment in China-Pakistan Economic Corridor.

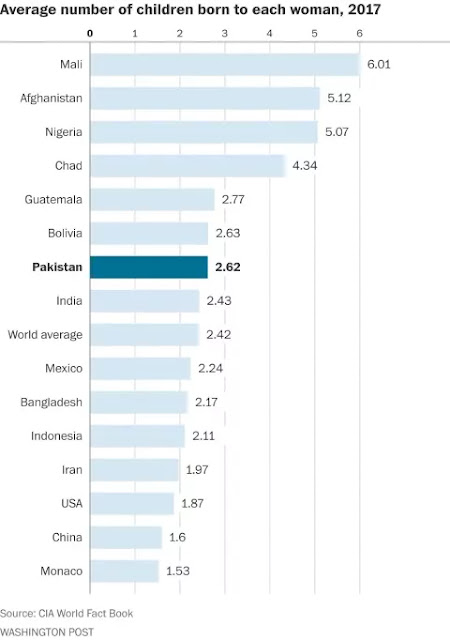

Pakistan's Total Fertility Rate 2.62 Children Per Woman. Source: Wa... |

Labor Force Expansion:

The latest Census 2017 results show that Pakistan's population growth rate has declined to 2.34% between 1998 and 2017, down from 2.61% (from 1981 to 1998) and 3.4% (from 1961-81). Life expectancy has increased from about 62 years in 1998 to 66.5 years now. The total fertility rate has declined from 4.6 children per woman in 1998 to to 2.62 children per woman in 2017. At the same time, Pakistan's labor force is growing at a rate of 3.6% a year, faster than the 2.34% overall population growth. Given Pakistan's human capital growth in recent years, it is a welcome situation that is expected to produce significant demographic dividend for the country.

Source: World Bank Report "More and Better Jobs in South Asia" |

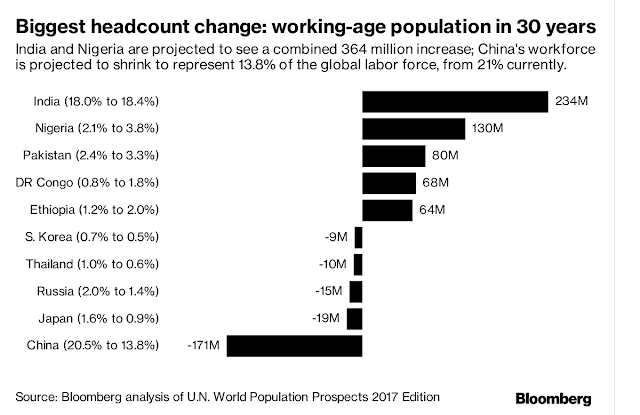

Pakistan's working age population in 15-64 years age bracket is expected to increase by 27.5 million people to 147.1 million in 10 years, according to Bloomberg News' analysis of data reported in UN World Population Prospects 2017. Pakistan's increase of 27.5 million is the third largest after India's 115.9 million and Nigeria's 34.2 million increase in working age population of 15-64 years old. China's working age population in 15-64 years age group will decline by 21 million in the next 10 years.

Pakistan's labor force growth will continue by adding 80 million workers n 30 years' time, third only to India's 234 million and Nigeria's 130 million additional workers in 15-64 years age group. China's work force will decline by 171 million workers in this time period.

Savings, Investment and GDP Growth:

Currently, about a third of Pakistan's population is below the age of 15, dependent on working age adults. This high ratio of dependent population results in low savings, low investment and consequent slower economic growth and sub-par socio-economic development.

Pakistan's national savings was about 10% of GDP in 1960s. It increased to above 15% in 2000s in Musharraf years, but declined afterwards. It is well below the savings rates in South Asia region with India's 30%, Bangladesh's 28%, and Sri Lanka's 24.5%.

Higher levels of inequality in India, Bangladesh and Sri Lanka account at least partially for their higher savings rates than Pakistan's because people in higher income groups tend to save more of what they earn. But the other probably more important reason for Pakistan's lower savings rate is the larger percentage of children under the age of 15 who do not work and depend on their parents' incomes.

Summary:

Pakistan's labor force growth is forecast to be the 3rd biggest in the world after India's and Nigeria's, according to UN World Population Prospects 2017. Rising working age population and growing workforce participation of both men and women in developing nations like Pakistan will boost domestic savings and investment, according to Global Development Horizons (GDH) report. Escaping the low savings low investment trap will help accelerate the lagging GDP growth rate in Pakistan as will increased foreign investment such as Chinese investment in China-Pakistan Economic Corridor over the next several decades.

Related Links:

Pakistan's Population Growth: Blessing or Curse?

Pakistan's Expected Demographic Dividend

World Bank Report on Job Growth in Pakistan

Underinvestment Hurting Pakistan's GDP Growth

China-Pakistan Economic Corridor

Musharraf Accelerated Growth of Pakistan's Financial and Human Capital

-

Comment by Riaz Haq on September 7, 2017 at 5:00pm

-

The rising number of its billionaires masks #India’s widening income #inequality. #Modi #BJP https://qz.com/1070450 via @qzindia

India is staring at a staggering income-inequality crisis.

A research paper published by French economist Thomas Piketty and Lucas Chancel—based on the latest income tax data—suggests that inequality in India may be at its highest level since 1922, when India introduced the income tax.

The share of national income held by the top 1% of the country’s population has increased dramatically, particularly since the 1980s, the economists say in their paper published on Sept. 05 (pdf).

“The top 1% of earners captured less than 21% of total income in the late 1930s, before dropping to 6% in the early 1980s and rising to 22% today,” the paper says.

Piketty is widely recognised for his work on income inequality, particularly through his bestselling book Capital in the Twenty-First Century. Chancel is the co-director of the World Inequality Lab and of the World Wealth & Income Database (WID.world) at the Paris School of Economics.

Their study shows that income inequality was the lowest in the 1970s and 1980s, a period when India was still a government-controlled economy and its GDP growth was quite low.

“Over the 1951-1980 period, the bottom 50% group captured 28% of total growth, and incomes of this group grew faster than the average, while (the) top 0.1% incomes decreased,” their paper says. “Over the 1980-2014 period, the situation was reversed; the top 0.1% of earners captured a higher share of total growth than the bottom 50% (12% vs. 11%), while the top 1% received a higher share of total growth than the middle 40% (29% vs. 23%).”

Last year, a report by Credit Suisse Research Institute said that the top 1% of the country’s population held 58.4% of its wealth, up from 53% in 2015. Within the BRICS group, only Russia’s wealthy controlled more of their country’s wealth. Since 2010, India has added a billionaire every 33 days and Indians’ share in the global billionaires’ club has grown from 1% to 5% over the last 20 years.

Meanwhile, Piketty has also reiterated his demand for more transparency in sharing income tax data. Access to data is crucial in measuring inequality and understanding the distribution of wealth. India used to publish the All India Income Tax Statistics until 2000. In 2016, the income tax department released tax tabulations for the period between 2012 and 2014.

https://qz.com/1070450/the-rising-number-of-its-billionaires-masks-...

http://wid.world/document/chancelpiketty2017widworld/

-

Comment by Riaz Haq on September 8, 2017 at 5:40pm

-

ADB says Pakistan enjoys growth despite trade contraction

https://www.thenews.com.pk/print/228626-ADB-says-Pakistan-enjoys-gr...

Pakistan has experienced economic growth despite contraction in external trade, pointing to the movement towards the localisation of supply to serve domestic demand, Asian Development Bank (ADB) said on Friday.

The country, which is one of the most populous economies in the region, recorded a decade high growth of 5.3 percent during the last fiscal year of 2016/17.

Manila-based lender, in a report, said share of exports of goods and services in GDP has been decreasing during the last six years, while share of imports has been increasing during the period.

The country’s household consumption is growing year on year. It soared 6.9 percent during the last year, ADB said in its 48th edition of ‘Key Indicators for Asia and the Pacific 2017’ report. Share of household consumption expenditure to GDP ratio stands at 80 percent.

ADB’s statistical review provides data on a comprehensive set of economic, financial, social, environmental, and sustainable development goal indicators for its 48 regional members. The Bank said private sector offtake is on the upward trend.

Banking credit to private sector is, however, one of the lowest in the region as it accounts for half of GDP as compared to more than 100 percent in Fiji, Vietnam, China, Australia and Japan, its data revealed.

Nonperforming bank loans to GDP ratio is one of the highest at 10 percent, only less than Afghanistan and Maldives. The Asian Development Bank said Pakistan is one of the region’s four largest recipients of official development assistance and other official flows to the agriculture sector, amounting to $291.7 million in 2015.

Alone South Asia’s agriculture sector received nearly $1.5 billion in dole-outs during 2015. Agriculture sector’s value addition to GDP ratio stood at 24.6 percent in 2016 in the country where acreage covers half of its land.

Forest area covers a minuscule 1.9 percent of total land area, which is one of the lowest in the region. The country has been annually receiving an average $744 million as financial and technical assistance between 2008 and 2015.

Share of gross capital formation in GDP declined during the past six years. Non-infrastructure investment accounted for 63 percent of gross fixed capital formation. Meanwhile, President Takehiko Nakao at ADB said the bank would continue to lend financial and technical support to Pakistan to improve infrastructure and regional connectivity.

“There is an immense potential for regional connectivity projects in the CAREC (Central Asia Regional Economic Cooperation) region,” Nakao said in a statement on Friday. He met with Finance Minister Ishaq Dar in Urumqi, China.

The Bank further said external debt to gross national income ratio is one of the lowest in the region, standing below 50 percent. It said stock markets in Fiji, New Zealand, and Pakistan were the region’s top performers in 2016.

“In Pakistan, an improved growth outlook—supported by better security, macroeconomic stability, and strengthened economic fundamentals—was reflected in a sovereign rating upgrade from Standard & Poor’s and significant gains in share prices of 13.2 percent on an annual basis,” it added. ADB said more than half of urban population in Pakistan lives in slums, informal settlements or inadequate housing.

The proportion, however, slid 3.2 percent during the four years for which data is available, it added. Urban population living in slums in the country dropped to 45.5 percent in 2014 from 48.7 percent in 2000. India brought this proportion down to 24 percent from 41.5 percent during the period.

https://www.adb.org/sites/default/files/publication/357006/pak.pdf

-

Comment by Riaz Haq on September 9, 2017 at 8:48am

-

INDIA - Bloomberg reports that India's Youth will be the World's Future by having the strongest workforce in the world.

Half of India's population are millennials, under the age of 25 whereas two-thirds of the country's population is below the age of 35.

India's workforce is expected to increase to a billion people between the ages of 16 and 54.

The workforce is expected to derive from North India where Uttar Pradesh has a fertility rate of nearly 3 whilst its neighbouring state, Bihar boasts a fertility rate of 3.3. Taking into account Bihar's already 100 million population, the state is expected to contribute generously to the establishment of a leading workforce.

India's current demographic transition is occurring on a large scale.

Compared to China's generation mainly in their 50's who have removed their country from poverty to middle-status income, India's population in their 20's are expected to do the same.

Similarly, South Africa's increasing workforce have been trained and prepared for the workplace by Workforce Holdings this year. Independent Online reported in March that diversified services company, Workforce Holdings have trained nearly 15 000 individuals in preparation for the workplace.

The group provides a number of work-related services including temporary as well as permanent recruitment. 1 100 permanent staff are employed by Workforce Holdings and the company has 32 000 temporary contractors weekly.

Workforce Holdings is also listed on the AltX board of the JSE.

https://www.iol.co.za/business-report/india-may-soon-knock-out-chin...

-

Comment by Riaz Haq on September 9, 2017 at 10:50am

-

Raghuram Rajan flags India's biggest worry that could cost Modi a win in 2019 elections: Slow Job Growth

http://economictimes.indiatimes.com/news/economy/policy/raghuram-ra...

"Remember that we have what we call the population dividend. A million new people entering the labor force every month," Rajan said. "If we don’t provide these jobs that are required, you have a million dissatisfied entrants. And that could create a lot of social mischief."

Rajan is right in this aspect. India will have the world’s biggest labor force by 2027 and the millennial generation is crucial to anchor one of the fastest paces of economic growth. However, fresh employment opp ..

Under Modi, just over 10,000 jobs a month are being created instead, according to government figures from 2015.

Read more at:

http://economictimes.indiatimes.com/articleshow/60434472.cms?utm_so...

-

Comment by Riaz Haq on September 13, 2017 at 4:27pm

-

Pakistan Govt not going to IMF for any bailout: Finance Division spokesman

https://www.samaa.tv/economy/2017/09/govt-not-going-imf-bailout-fin...

The spokesman of the Finance Division gave following comments in response to the report:

The fact that Pakistan’s economic indicators are positive has been acknowledged internationally. Recently, the Asian Development Bank (ADB) stated that Pakistan enjoyed growth despite trade contraction.

The external sector which was under strain in the last two years due to falling exports and declining remittances has now started showing positive and impressive growth both in exports and remittances.

In August 2017, exports have witnessed a growth of 12.89 percent over the same period of 2016, while over previous month the exports are higher by 14.41 percent and imports are only 2.42 percent and during July-August, FY 2018 exports have registered a growth of 11.80 percent.

Similarly, workers’ remittances have shown a growth of 13.18% during July-August, FY 2018 and on month on month basis higher by 26.8 percent in August 2017.

These all bode well that pressure on current account will ease, going forward. The growth in FDI is also on upward trajectory. During July 2017, FDI posted a stellar growth of 162.8 percent.

With regard to taxation, it is to be noted that the share of direct taxes in total taxes has increased over the years.

In 1990-91 the direct taxes were just around 20% of total taxes, rose to 31.1 percent in 2004-05, 38.2 percent in 2012-13 and 39.1 percent in 2015-16.

In FY 2016-17 the share of direct taxes reached 40% and it has become the single largest tax collected by FBR.

The government is focused on further increasing the share of direct taxes through various policy and administrative reforms including broadening of tax base.

Substantial progress has been made to bring potential taxpayers in the tax net during the last four years. As a result of these efforts the number of income tax return filers which was around 766,000 for the tax year 2012 has risen to 1.26 million in the tax year 2016 and would further increase in coming years.

The reforms program has started paying dividends in shape of higher tax revenues, an efficient, modern, transparent and taxpayers’ friendly revenue organization.

The revenue collection has witnessed a substantial increase during last four years. The net collection increased from Rs 1,946 billion in 2012-13 to Rs 3,362 billion in FY 2016-17, registering an overall growth of around 73%.

In absolute terms revenue collection has been increased by Rs 1.4 trillion. The tax-GDP ratio of the country has reached 12.5 percent in FY 2016-17.

With regard to debt, the claim that PML(N) government borrowed record Rs 10.8 trillion is incorrect and based on incorrect projections. The actual increase in present Government’s 4 year tenure is around Rs 6.1 trillion.

Even if the year 2018 is added as projected, the total debt increase in 5 years is expected to remain around Rs 7.5 trillion until 2018. The statement is only intended to mislead the general public by propagating increase in total debt by Rs 10.8 trillion by the current government, which is based on mere projections and may include PSE debt and other external debt and liabilities as well, which are not part of total government debt.

Moreover, the contention of large borrowing from external sources is incorrect. Out of total debt, external debt proportion fell from 21.4 percent of GDP in 2013 to 20.6 percent of GDP in 2017. Against the total external debt, the largest component is multilateral and bilateral concessional debt, which constitutes around 85 percent.

External debt sustainability has increased manifold during the tenure of present government as recent debt sustainability analysis shows that external debt would remain on a downward trend over the medium term and staying well below the risk assessment benchmarks.

-

Comment by Riaz Haq on September 14, 2017 at 10:37am

-

Are we entering into a "jobless" growth phase in South Asia?

By Dr. Selim Raihan, Professor, Department of Economics, University of Dhaka, Bangladesh, and Executive Director, South Asian Network on Economic Modeling (SANEM).

http://www.thedailystar.net/opinion/economics/are-we-entering-joble...

The relationship between economic growth and employment is an important issue in economics discourse. Promotion of inclusive growth also requires economic growth processes to be employment friendly. The measure that captures the employment effect of economic growth is the "employment elasticity" of economic growth, which is the ratio of percentage change in employment to the percentage change in real gross domestic product (GDP).

We have calculated the employment elasticity with respect to the change in real GDP for the South Asian countries for three different periods from 2001 to 2015. There are mixed patterns among the South Asian countries. During 2001 and 2005, Maldives had the largest employment elasticities (1.39) and Sri Lanka had the lowest one (0.08). India, with a share of 75 percent of the total population in South Asia, had the employment elasticity of only 0.38, one of the lowest in South Asia. Two other large countries, Pakistan and Bangladesh, had employment elasticities of 0.70 and 0.77 respectively.

For the period of 2006-2010, India experienced a drastic fall in employment elasticity to only 0.03 despite the fact that the average GDP growth rate of India increased from 6.6 percent (2001-2005) to more than 8 percent (2006-2010). Over these periods, Bangladesh also had a similar experience where employment elasticity declined from 0.77 to 0.4 in the wake of a rising average GDP growth rate from 5 to 6 percent. While Afghanistan, Maldives, and Nepal also experienced a decline, Pakistan and Sri Lanka could increase the elasticities.

Over the recent period between 2011 and 2015, Bangladesh experienced a further fall in the employment elasticity to 0.28, while India's improvement is meagre (from 0.03 to only 0.09). Despite the slower economic growth rates during this period, Afghanistan, Maldives, Nepal, and Pakistan could increase their employment elasticities. Sri Lanka had a further fall in employment elasticity to only 0.14. During this period, India had the least employment elasticity among all South Asian countries.

The aforementioned analysis points to the concern that two major South Asian countries, India and Bangladesh, experienced a substantial reduction in employment elasticities throughout the periods of high economic growth. While during 2001 and 2005, the annual average job creation in Bangladesh and India were 1.6 million and 11.3 million respectively, in 2011-2015, such numbers declined to 1 million and 3.2 million for Bangladesh and India respectively. Most of the other South Asian countries experienced either volatile, or slow or stagnant economic growth, and therefore, despite a rise in employment elasticities, the actual employment generation in these countries had not been substantial. It is also important to mention that while SDG 8 talks about ensuring "decent" jobs for all, South Asian countries are seriously lagging far behind. In most of the South Asian countries, there are persistent employment challenges such as lack of economic diversification, poor working conditions, low productivity and a high degree of informality. This is reflected by the fact that among the top five countries in the world with very high proportion of informal employment in total employment, four are from South Asia (Bangladesh, India, Nepal, and Pakistan).

-

Comment by Riaz Haq on November 20, 2021 at 6:51pm

-

2020 labor force participation rate in Pakistan is 50.2%, higher than India's 46.3% but lower than Bangladesh's 55.7%.

https://www.ceicdata.com/en/indicator/india/labour-force-participat...

https://www.macrotrends.net/countries/PAK/pakistan/labor-force-part...

https://www.macrotrends.net/countries/IND/india/labor-force-partici...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 3 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network