PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economy "Not in a Good Place"? Atif Mian's Gloom Justified?

Pakistani-American economist Atif Mian has recently analyzed Pakistan's economy in a series of tweets. He has said "Pakistan's economy is not in a good place", adding that the nation's "per capita income has not risen in 3 years (in fact down slightly)". He has particularly mentioned the country's "exaggerated external demand driven by its rentier economy", "flawed energy policy" and "a broken economic decision system" among the main causes for poor economic performance. Is Atif Mian's diagnosis correct? Is the official reported data Atif Mian using accurate? What is the current PTI government doing or not doing to correct the problems identified by Mr. Mian? Let's try and assess the situation.

|

| Economist Atif Mian's Tweet on Pakistan Economy |

Per Capita Income:

Pakistan's officially reported GDP and per capita incomes are grossly understated. These are based on the last economic census that was done from April 2003 to December 2003 and published in 2005. The last agriculture census was in 2010, and livestock census in 2006, according to Dr. Ishrat Husain, former governor of The State Bank of Pakistan. The country's economy has changed significantly since then, adding several new economic activities while others have become less important. For example, the Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has moved up to higher value added products as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Bangladesh just rebased its GDP in 2020-21 to 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In this age of big data, it is important for Pakistan to ensure that its bureaucracy at Pakistan Bureau of Statistics (PBS) keeps the national economic data as current as possible. PBS should release the results of the Census of Manufacturing Industries CMI 2015-16 and the finance ministry should rebase Pakistan's economy to year 2015-16 to better reflect the current economic realities. This data is extremely important for businesses, investors, lenders and policymakers.

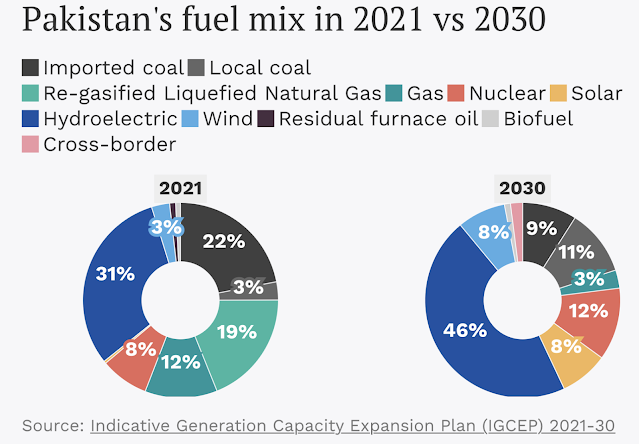

Energy Mix:

|

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Exports Trend 2011-21. Courtesy of Ali Khizer |

|

| Pakistan Textile Exports Trend 2011-21. Courtesy of Ali Khizer |

|

|

|

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 20, 2023 at 11:18am

-

#Pakistan and #China sign $4.8 billion 1200 MW #nuclear #power plant deal. Work on Chashma 5 project would begin immediately. China's support will help Pakistan make the transition away from reliance on #FossilFuels . #nuclearenergy #electricity

https://www.reuters.com/business/energy/pakistan-china-sign-48-bln-...

Pakistan and China signed a $4.8 billion deal on Tuesday to build a 1,200-megawatt nuclear power plant, Prime Minister Shehbaz Sharif said, hailing the investment by a country that Pakistan views as its most dependable ally.

Work on the Chashma 5 project would begin immediately, Sharif said on state-run news channel PTV following the signing of the memorandum of understanding (MOU) between China National Nuclear Cooperation and Pakistan Atomic Energy Commission.

"Investment from China in this project to the tune of $4.8 billion sends a message loud and clear that Pakistan is a place where Chinese companies and investors continue to show their trust and faith," Sharif said.

The Chashma 5 project will be built in the central province of Punjab. China's support will help Pakistan make the transition away from reliance on fossil fuels.

Pakistan's total nuclear energy production capacity rose to 1,400 mw, when the country's sixth nuclear power plant opened two years ago. Located in the southern port city of Karachi, that 1,100 mw plant was also constructed with Chinese assistance.

Sharif, whose government is desperately struggling to stave off a balance of payments crisis, thanked the Chinese partners for offering a $100-million discount for the latest project.

It is unclear whether the new investment is part of the $65 billion that China has pledged in infrastructure building for Pakistan under its Belt and Road Initiative.

The new project was originally planned to start a couple of years ago, and Sharif expressed thanks to the Chinese side for not rescheduling costs despite the long delay. Instead, he said, the Chinese had disbursed an initial 30 billion Pakistani rupees ($104.53 million) to start the project.

Comment

- ‹ Previous

- 1

- …

- 3

- 4

- 5

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

IMF Questions Modi's GDP Data: Is India's Economy Half the Size of the Official Claim?

The Indian government reported faster-than-expected GDP growth of 8.2% for the September quarter. It came as a surprise to many economists who were expecting a slowdown based on the recent high-frequency indicators such as consumer goods sales and durable goods production, as well as two-wheeler sales. At the same time, The International Monetary Fund expressed doubts about the Indian government's GDP data. …

ContinuePosted by Riaz Haq on November 30, 2025 at 11:30am

Retail Investor Growth Driving Pakistan's Bull Market

Pakistan's benchmark index KSE-100 has soared nearly 40% so far in 2025, becoming Asia's best performing market, thanks largely to phenomenal growth of retail investors. About 36,000 new trading accounts in the South Asian country were opened in the September quarter, compared to 23,600 new registrations just three months ago, according to Topline Securities, a brokerage house in Pakistan. Broad and deep participation in capital markets is essential for economic growth and wealth…

ContinuePosted by Riaz Haq on November 24, 2025 at 2:05pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network