PakAlumni Worldwide: The Global Social Network

The Global Social Network

Is There a Culture of Corruption in Pakistan?

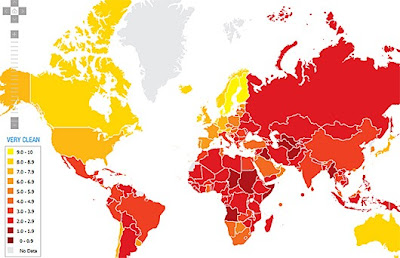

Is this corruption and lawlessness rooted in the absence of adequate law enforcement, or the lack of independent judges? Or is it a national culture of corruption that ranks such nations among the most corrupt in the world on Transparency International surveys?

A paper titled "Cultures of Corruption: Evidence from Diplomatic Parking Tickets" by Ray Fisman of Columbia University and Edward Miguel of University of California, Berkeley attempts to answer the above question by using parking violations data on international diplomats living in New York City during 1997-2005.

Since all foreign diplomats have immunity from prosecution in the host country, they do not have to pay fines for any parking violations in New York City. The authors argue that the way the diplomats from different nations behave in such a situation is entirely based on the cultural norms of the nations they represent.

The data presented by the authors shows that Pakistani diplomats with 69.4 tickets per diplomat are the tenth worst offenders, behind those from Kuwait (246.2), Egypt (139.6), Chad (124.3), Sudan (119.1), Bulgaria (117.5), Mozambique (110.7), Albania (84.5), Angola (81.7) and Senegal (79.2). The authors also report that diplomats from low corruption countries (e.g., Norway and Sweden with zero parking citations) behave remarkably well even in situations where they can get away with violations, suggesting that they bring the social norms or corruption “culture” of their home country with them to New York City. Others with no parking violations include diplomats from Oman, Turkey and UAE.

In addition to a strong correlation between number of parking tickets and TI's corruption index, Fisman and Miguel also find that officials from countries that have less favorable popular views of the United States commit significantly more parking violations, providing nonlaboratory evidence on the role that sentiment and affinity play in economic decision-making.

With 69.4 tickets for each official ranking them at number 10, Pakistani diplomats in New York are also the worst among fellow South Asian diplomats. Bangladeshi diplomats rank 28 (33 tickets), Sri Lanka ranked 40 (17.2 tickets), Nepal ranked 43 (16.5 tickets) and India ranks 79 (6.1 violations per diplomat).

Going by the highly persuasive data and arguments by Fisman and Miguel, it is hard to see how better law-enforcement and independent judiciary can solve the highly corrosive problem of widespread corruption in Pakistani society, unless it is also accompanied by a national campaign to promote a culture of honesty in the country. Such an effort must begin with open acknowledgment of the seriousness of the corruption crisis and an earnest desire to change, followed by wide-ranging ethics reforms in all spheres of life which are actively role-modeled and led by civil, social, political, business, military and religious leaders of the country.

Related Links:

Haq's Musings

Pakistani Judges' Jihad Against Corruption

Incompetence and Corruption in Pakistan

Zardari Corruption Probe

NRO Amnesty Order Overturned

Transparency International Rankings 2009

Transparency International Corruption Index 2010

-

Comment by Riaz Haq on June 15, 2011 at 9:14am

-

Can civil society fight corruption? asks Soutik Biswas of BBC:

Are sections of India's civil society subverting democracy to pressure the government to push through tough anti-corruption laws?

The beleaguered Congress-party led government appears to think so. The senior-most minister Pranab Mukherjee has fired an uncharacteristic broadside at activist Anna Hazare's anti-graft agitation for resorting to hunger strikes, making unreasonable demands like video graphing meetings of a joint panel to discuss an ombudsman law and imposing deadlines on the parliament.

Mr Hazare is a well meaning Gandhian, who has a record of fighting corruption in his home state of Maharashtra. But he also has a predilection for making clumsy statements - he endorses capital punishment for the corrupt, for example. But few Indians deny that Mr Hazare has touched a chord, mostly among the country's fretful, politician-loathing middle classes, by pressuring the government to take a tough stand against corruption. Graft has become a way of Indian life, kept alive by the rulers and ruled alike.

Mr Mukherjee's barb is clearly not aimed at Mr Hazare alone. Last fortnight, Baba Ramdev, a thriving yoga guru with political ambitions, also began a hunger strike in Delhi demanding that the illicit money stashed away in foreign banks by rich Indians be brought back home. After futile negotiations with the guru, the government cracked down on his fast in the middle of the night, baton charged sleeping supporters and evicted him from Delhi. The police action earned the opprobrium of many Indians, and further battered the government's fast-eroding credibility.

Now the government appears to be trying to bottle the genie of Mr Hazare and Baba Ramdev's "movements", both of which it legitimised in the first place through recognition and negotiation. It seems to be also unable to handle the vicissitudes of these agitations, with its leaders blowing hot and cold against the government. Such a civil society movement, Pranab Mukherjee said, amounts to a "sinister move of destroying the fine balance between the three organs of government enshrined in our constitution".

"If someone dictates terms from outside to the government, does it not weaken or subvert democracy? It is a big question... We are all civil society, no one is uncivil."

Clearly, Mr Mukherjee's definition of civil society in the haste of a press conference is literal. The World Bank defines civil society to "refer to a wide array of non-governmental and not-for-profit organisations that have a presence in public life, expressing the interests and values of their members or others, based on ethical, cultural, political, scientific, religious or philanthropic considerations".

---

India has seen deeper, meaningful civil society movements which have been blithely ignored by most of middle class in the past. Only when a protest comes to Delhi in the full glare of 24/7 news television does it get attention. And more so, when it rallies against corruption - which actually hurts the poor more than the rich and the middle class.

By all means, many believe, an enlarged and more representative civil society - ideally a larger, wider group of people from all over the country, not just a bunch of well meaning lawyers and activists from Delhi - should be putting pressure on a stubborn government to act against corruption. Also, as development expert Rajesh Tandon reminds us, civil society is not intrinsically virtuous. And good graft-free governance does not come from reforming the state alone - it demands the reformation of society and its people. There are no short cuts to a more virtuous India.

-

Comment by Riaz Haq on May 4, 2012 at 9:22am

-

Here are some excerpts from Raymond Baker's book "Capitalism's Achilles Heel" regarding Pakistan's venal politicians:

"While Benazir Bhutto hated the generals for executing her father, Nawaz Sharif early on figured out that they held the real power in Pakistan. His father had established a foundry in 1939 and, together with six brothers, had struggled for years only to see their business nationalized by Ali Bhutto’s regime in 1972. This sealed decades of enmity between the Bhuttos and the Sharifs. Following the military coup and General Zia’s assumption of power, the business—Ittefaq—was returned to family hands in 1980. Nawaz Sharif became a director and cultivated relations with senior military officers. This led to his appointment as finance minister of Punjab and then election as chief minister of this most populous province in 1985. During the 1980s and early 1990s, given Sharif ’s political control of Punjab and eventual prime ministership of the country, Ittefaq Industries grew from its original single foundry into 30 businesses producing steel, sugar, paper, and textiles, with combined revenues of $400 million, making it one of the biggest private conglomerates in the nation. As in many other countries, when you control the political realm, you can get anything you want in the economic realm."

-----------

Like Bhutto, offshore companies have been linked to Sharif, three in the British Virgin Islands by the names of Nescoll, Nielson, and Shamrock and another in the Channel Islands known as Chandron Jersey Pvt. Ltd. Some of these entities allegedly were used to facilitate purchase of four rather grand flats on Park Lane in London, at various times occupied by Sharif family members. Reportedly, payment transfers were made to Banque Paribas en Suisse, which then instructed Sharif ’s offshore companies Nescoll and Nielson to purchase the four luxury suites.

-----------

Upon taking office in 1988, Bhutto reportedly appointed 26,000 party hacks to state jobs, including positions in state-owned banks. An orgy of lending without proper collateral followed. Allegedly, Bhutto and Zardari “gave instructions for billions of rupees of unsecured government loans to be given to 50 large projects. The loans were sanctioned in the names of ‘front men’ but went to the ‘Bhutto-Zardari combine.’ ” Zardari suggested that such loans are “normal in the Third World to encourage industrialisation.” He used 421 million rupees (about £10 million) to acquire a major interest in three new sugar mills, all done through nominees acting on his behalf. In another deal he allegedly received a 40 million rupee kickback on a contract involving the Pakistan Steel Mill, handled by two of his cronies. Along the way Zardari acquired a succession of nicknames: Mr. 5 Percent, Mr. 10 Percent, Mr. 20 Percent, Mr. 30 Percent, and finally, in Bhutto’s second term when he was appointed “minister of investments,” Mr. 100 Percent.

http://books.google.com/books?id=Wkd0--M6p_oC&printsec=frontcov...

http://books.google.com/books?id=Wkd0--M6p_oC&printsec=frontcov...

-

Comment by Riaz Haq on June 26, 2014 at 10:21pm

-

Here's a NY Times story about Indian Swiss accounts which may also be relevant to Pakistan:

NEW DELHI — Generations of Indians have grown up imagining a bank with high ceilings and chandeliers in Switzerland, where shadowy Indians go to leave a lot of illicit cash in the care of practical white men. In popular lore, the “Swiss bank account” is an essential part of Indian villainy, even though illicit money is a common household possession.

So, last week, when a news agency quoted a Swiss official as saying that Switzerland was willing to share with the Indian authorities information about Indians of dubious nature who hold bank accounts in that country, the Indian government appeared to give the news considerable importance. Considering the infamy of the Swiss bank account in the Indian imagination, data released last week by Switzerland’s central bank, the Swiss National Bank, contained a surprise.

Indians, not all of them shady, held about $2.3 billion in Swiss banks last year. That’s 40 percent more than in 2012, but just a third of what they had parked in 2006. Indian accounts represented just 0.15 percent of the total holdings by foreigners in Swiss banks in 2013.

When Indians talk about their country’s illicit money, which is chiefly tax-evaded funds and income by illegal means, there is, of course, righteous contempt. But there is also a swagger over the sheer size of this shadow economy, because, after all, it is Indian. So a mere $2.3 billion was not what most Indians would have expected their rich and corrupt to have stashed in their Swiss nests.

It is possible that Indian money has fled to safer havens over the years, or has returned to India disguised as respectable investments.

Nobody knows just how big India’s illicit economy is, but in recent years Indians have come to accept that it is very big. From the range of numbers that claim to measure the shadow economy, Indians tend to believe in the highest.

A popular notion is that $1.4 trillion of illicit Indian money has flown out of the country over the decades and is held in various parts of the world. The apparent source of this figure is an analysis in 2009 by the academic R. Vaidyanathan. He had extrapolated it from a report released by Global Financial Integrity, a think tank in Washington; $1.4 trillion swiftly became a widely accepted estimate of Indian illicit money held abroad.

---

Mr. Kar’s report hit India at a time when the middle class was convinced that it was disgusted by corruption. The $500 billion figure was picked up by politicians, reformers and officials, who quoted each other to support their claim.

A study published in 2006 by Friedrich Schneider on the world’s shadow economies dealt briefly with the “tax morality” of Germans. According to the study, two-thirds of the Germans surveyed regarded tax evasion as a “trivial offence,” while only one-third judged stealing a newspaper this way. Indian tax morality is similar, but it makes a distinction between expatriate illicit money, which is viewed as a serious crime perpetrated by the very corrupt, and money held within India, which is perceived as a practical measure.

Black money, as illicit money is called in India, is a significant part of Indian life. Most Indians of means, including many who protested on the streets against political corruption, deal in illicit money when they buy or sell real estate, or when they need foreign exchange to import goods. Huge amounts of cash travel across India during election seasons to bribe voters. Rich ladies prowl Delhi’s malls with bricks of cash in their bags, or with attendants who carry the bricks for them. And, there is a network of quaint people much in demand for their ability to magically transmute rupees collected anywhere in India into dollars that can be made to appear almost anywhere else in the world.

http://www.nytimes.com/2014/06/26/world/asia/indias-underground-eco...

-

Comment by Riaz Haq on July 7, 2015 at 8:59am

-

#Pakistan’s #Sharif brothers, #Zardari figure on NAB’s list of 150 ‘high-profile’ #corruption cases. https://shar.es/1qUoYH via @sharethis

Pakistan’s National Accountability Bureau (NAB) has reportedly submitted a list of 150 mega corruption cases, involving high-profile figures such as, Prime Minister Nawaz Sharif, his brother and Punjab Chief Minister Shahbaz Sharif, former premiers, ministers and top bureaucrats, before the country’s Supreme Court.

The report said that an inquiry was being carried out against the incumbent prime minister and his brother in a case pertaining to the construction of a road from Raiwind to Sharif family House worth Pakistani rupees 126 million, reported the Dawn.

Former Prime Minister Raja Pervaiz Ashraf is also being scrutinised for the rental power plants (RPP) case.

Also, a case has been launched against former President Asif Ali Zardari for possessing assets beyond resources.

It also mentioned 50 cases of monitory irregularities, misuse of powers and land scams.

Among the monitory irregularities, inquiries were being conducted in 22 cases, with probes launched into 13 cases and references in 15 cases.

In land scams, on the other hand, 29 cases were under inquiry, 13 cases were being investigated and references had been filed in eight cases.

The report also showed that inquiries were underway in 20 cases of abuse of power, while a probe had been launched into 15 cases and references filed in 15 cases.

The case, which was filed by Manzoor Ahmed Ghauri earlier this year against NAB chairman and other officials, is being heard by a three-member bench headed by Justice Jawwad S. Khawaja.

The report was submitted after the court expressed disappointment over what they claimed was an extreme form of ‘maladministration’ in the anti-corruption body.

-

Comment by Riaz Haq on April 3, 2016 at 4:59pm

-

The Panama Papers reveal hidden wealth of 12 world leaders including #Pakistan #PM #NawazSharif in offshore account http://gu.com/p/4tvm5/stw

The hidden wealth of some of the world’s most prominent leaders, politicians and celebrities has been revealed by an unprecedented leak of millions of documents that show the myriad ways in which the rich can exploit secretive offshore tax regimes.

The Guardian, working with global partners, will set out details from the first tranche of what are being called “the Panama Papers”. Journalists from more than 80 countries have been reviewing 11.5m files leaked from the database of Mossack Fonseca, the world’s fourth biggest offshore law firm.

The records were obtained from an anonymous source by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists with the Guardian and the BBC.

Though there is nothing unlawful about using offshore companies, the files raise fundamental questions about the ethics of such tax havens – and the revelations are likely to provoke urgent calls for reforms of a system that critics say is arcane and open to abuse.

The Panama Papers reveal:

Twelve national leaders are among 143 politicians, their families and close associates from around the world known to have been using offshore tax havens.

A $2bn trail leads all the way to Vladimir Putin. The Russian president’s best friend – a cellist called Sergei Roldugin - is at the centre of a scheme in which money from Russian state banks is hidden offshore. Some of it ends up in a ski resort where in 2013 Putin’s daughter Katerina got married.

Among national leaders with offshore wealth are Nawaz Sharif, Pakistan’s prime minister; Ayad Allawi, ex-interim prime minister and former vice-president of Iraq; Petro Poroshenko, president of Ukraine; Alaa Mubarak, son of Egypt’s former president; and the prime minister of Iceland, Sigmundur Davíð Gunnlaugsson.

Six members of the House of Lords, three former Conservative MPs and dozens of donors to UK political parties have had offshore assets.

The families of at least eight current and former members of China’s supreme ruling body, the politburo, have been found to have hidden wealth offshore.

Twenty-three individuals who have had sanctions imposed on them for supporting the regimes in North Korea, Zimbabwe, Russia, Iran and Syria have been clients of Mossack Fonseca. Their companies were harboured by the Seychelles, the British Virgin Islands, Panama and other jurisdictions.

A key member of Fifa’s powerful ethics committee, which is supposed to be spearheading reform at world football’s scandal-hit governing body, acted as a lawyer for individuals and companies recently charged with bribery and corruption.

One leaked memorandum from a partner of Mossack Fonseca said: “Ninety-five per cent of our work coincidentally consists in selling vehicles to avoid taxes.”

http://www.theguardian.com/news/video/2016/apr/03/the-panama-papers...

-

Comment by Riaz Haq on April 3, 2016 at 5:23pm

-

Names figuring in the (Panama) leak included the king of Saudi Arabia and Pakistan Prime Minister Nawaz Sharif. Ayad Allawi, ex-interim prime minister and former vice-president of Iraq was also listed, the Guardian said.

The (Panama Papers) data contains secret offshore companies linked to the families and associates of Egypt's former President Hosni Mubarak, Libya's former leader Muammar Gaddafi and Syria's President Bashar al-Assad as well.

The documents reveal many Israeli connections and disclose people with Israeli citizenship as well as Israeli banks and entities have used the offshore law firm to register companies in tax havens around the world, Haaretz reported.

Several Israeli banks appear in the files, Haaretz said. Bank Hapoalim managed some of its trusteeship activities for trust funds through the law firm. This activity, carried out by means of the subsidiary Poalim Trust Services, closed down in 2011. The documents also contains many correspondences concerning Bank Leumi activity in Jersey in the Channel Islands.

Blacklisted interests

At least 33 people and companies in the documents had been blacklisted by the US for wrongdoing, such as some Iranian interests and those of Lebanon's Hezbollah, the ICIJ said.

One of the companies exposed in the leaked documents provided fuel for aircraft used by the Syrian government to bomb and kill thousands of its citizens, Haaretz said.

"These findings show how deeply ingrained harmful practices and criminality are in the offshore world," said Gabriel Zucman, an economist at the US-based University of California, Berkeley, and author of the book The Hidden Wealth of Nations: The Scourge of Tax Havens.

Zucman, who participated in the ICIJ investigation, said that the publication of the leaked documents should encourage governments to impose “concrete sanctions” on countries where such firms are registered and on institutions that provide confidentiality for companies using tax havens, Haaretz said.

The leaked data from 1975 to the end of last year provides what the ICIJ described as a "never-before-seen view inside the offshore world."

The investigation yielded the millions of documents from about 214,000 offshore entities, the ICIJ said. The source of the documents, Mossack Fonseca, is a Panama-based law firm with offices in more than 35 countries. It is the world’s fourth-biggest offshore law firm, the Guardian said.

Though most of the alleged dealings are said by the ICIJ to be legal, they are likely to have serious political impact on many of those identified.

Among the main claims of the ICIJ investigations:

Close associates of Putin, who is not himself named in the documents, "secretly shuffled as much as $2bn through banks and shadow companies," the ICIJ said.

The files identified offshore companies linked to the family of Chinese President Xi Jinping, who has led a tough anti-corruption campaign in his country, the ICIJ said.

In Iceland, the files allegedly show Prime Minister Sigmundur David Gunnlaugsson and his wife secretly owned an offshore firm holding millions of dollars in Icelandic bank bonds during the country's financial crisis.

The leaked documents were reviewed by a team of more than 370 reporters from over 70 countries, according to the ICIJ.

The BBC cited Mossack Fonseca as saying it had operated "beyond reproach" for 40 years and had never been charged with any criminal wrongdoing.

Haaretz, however, reported that authorities in the British Virgin Islands fined Mossack Fonseca $37,500 for violating laws against money laundering - it had registered a company in the name of former Egyptian President Hosni Mubarak’s son, but did not report its relationship to the two even after both father and son were charged with corruption in their country.

It was not immediately clear who was the original source of the leaked documents.

- See more at: http://www.middleeasteye.net/news/huge-tax-leak-exposes-leaders-sau...

-

Comment by Riaz Haq on April 5, 2016 at 11:33am

-

#Pakistan PM #NawazSharif's children raised £7m against #UK flats owned offshore. #PanamaPapersLeak http://gu.com/p/4tvnf/stw

The children of Pakistan’s prime minister, Nawaz Sharif, raised a £7m loan from Deutsche Bank against four flats in Park Lane in London owned by offshore companies.

Acquired while Sharif was in opposition, the properties were owned by British Virgin Islands shelf companies on the books of the offshore agent Mossack Fonseca, the Panama Papers show.

The Sharif family’s investment in upmarket London property was disclosed in 1998 by Rehman Malik, a political opponent and the head of Pakistan’s Federal Investigation Agency, who had fled to London after allegedly being arrested and tortured.

Malik compiled a report that he claimed showed the Mayfair homes had been bought using “ill-gotten wealth earned through corrupt practices”. He claimed they had not been declared on tax returns, in breach of Pakistani law.

In April 2000, after Sharif had been toppled from his second term as prime minister and put in prison by Pakistan’s then military leader, Pervez Musharraf, the country’s chief corruption prosecutor repeated the allegations, saying: “We believe the money used to buy these apartments was stolen from the people of Pakistan.”

Sharif and members of his family have always denied any wrongdoing, and none have ever been convicted of any offence. Supporters say the charges against them are politically motivated. It is not illegal to own property through an offshore company.

Yesterday the family responded to the furore in Pakistan with a statement saying the Panama Papers “have made no allegations of wrongdoing against the Sharif family”, and that “all of the corporations owned by the Sharif family are legal and financially sound”.

In October 2008, Nawaz Sharif’s son Hussain and daughter, Mariam, turned to the Swiss arm of Deutsche Bank to borrow large sums, using the flats as collateral.

Three BVI companies were used to raise the loan, which entitled Nawaz Sharif’s adult children to borrow £3.5m in cash and a further £3.5m in money to be invested in “liquid assets” by Deutsche Bank.

Deutsche Bank said: “We fully recognise the importance of this issue. We have enhanced our procedures for bringing clients on board and verifying with whom we are doing business, and our policies, procedures and systems are designed to ensure that we comply with all applicable rules and regulations.”

Deutsche began auditing its private banking clients in 2013, seeking confirmation that they complied with all relevant tax rules. Checks on its Swiss and Luxembourg clients are now understood to be complete.

The flats in question are at Avenfield House overlooking Park Lane, where Sharif was once photographed at a press conference with his political rival Benazir Bhutto. They are held by two BVI entities on the books of Mossack Fonseca, Nielsen Enterprises and Nescoll Limited.

-

Comment by Riaz Haq on June 30, 2016 at 12:28pm

-

Money in #Swiss banks: With 1.5 billion Swiss Francs, up 16% YoY, #Pakistan overtakes #India - The Economic Times

http://economictimes.indiatimes.com/news/politics-and-nation/money-...

This included funds amounting to CHF 1,477 million held directly by Pakistani nationals and entities and CHF 36 million through fiduciaries or wealth managers.

This is the second straight year of rise in Pakistan- linked funds in Swiss banks, while the same for India has fallen for the second consecutive year and stood at CHF 1,217 million (Rs 8,392 crore) at the end of 2015 - a decline of 33 per cent.

This is the first time in the last three years that the funds linked ..

As per the SNB data, the total funds linked to Pakistan in Swiss banks stood at a record high level of CHF 3.43 billion in the year 2001, but has come down considerably since then.

By 2013, it fell to as low as CHF 1.23 billion, the lowest since 1996 since when this data is available. However, it has risen by 6 per cent and 16 per cent during the last two years 2014 and 2015, respectively.

In case of India, the quantum of such funds has fallen in the last two years.

Read more at:

http://economictimes.indiatimes.com/articleshow/52991078.cms?utm_so...

-

Comment by Riaz Haq on August 26, 2017 at 9:04pm

-

Post-Panama case Pakistan

Dr Ikramul Haq, Huzaima Bukhari August 27, 2017 Leave a comment

The institutional structure of economy is designed to generate rents for the elite at the expense of the middle classes and the poor. So what is at stake?

http://tns.thenews.com.pk/post-panama-case-pakistan/

The hidden wealth of some of the world’s most prominent leaders, politicians and celebrities has been revealed by an unprecedented leak of millions of documents that show the myriad ways in which the rich can exploit secretive offshore tax regimes — The Panama Papers: how the world’s rich and famous hide their money offshore [The Guardians, April 3, 2016]

Through the report titled, Panama Papers: Politicians, Criminal & Rogue Industry That Hide Their Cash, some of the crooks of the world — drug dealers, mafias, corrupt politicians and tax evaders — have been exposed. Pakistanis who are part of this undesirable club are unveiled through a year-long investigation project by journalist Umar Cheema in his write-up, Pak politicians, businessmen own companies abroad [The News, April 4, 2016].

Post-Panama case Pakistan is emerging as a dangerous place where the government is openly protecting and patronising the convicted and accused. There is no will to end state-sponsorship of organised crimes. Notorious laws — sections 5 and 9 of the Protection of Economic Reforms Act, 1992 and section 111(4) of the Income Tax Ordinance, 2001 — are still protecting dirty money, financing of terrorism and encouraging tax evasion. In the presence of such laws, the judiciary has punished the three-time elected prime minister — an unprecedented move that can be a starting point to end mafia-like rule in Pakistan as happened in Colombia after years of power of dirty money muzzling institutions or eliminating those who were not purchasable.

------------------

How can we eliminate corruption and tax evasion in Pakistan in the presence of permanent money-laundering and tax amnesty scheme in the form of section 111(4) of the Income Tax Ordinance, 2001 that facilitates the whitening of dirty money and tax evaded funds. It ensures that for money brought into Pakistan through normal banking channels no question would be asked by tax officials or FIA. Through this section, criminals and tax evaders get their undeclared money whitened by paying just an extra 3 to 4 per cent to any money exchange dealer to get remittances fixed in their names.

It is thus clear, brilliantly explained by Dr. Akmal Hussain in Restructuring for economic democracy, that “the institutional structure of Pakistan’s economy is designed to generate rents for the elite at the expense of the middle classes and the poor.” It is this structural characteristic of the economy and not just bribery that prevents sustained high economic growth and equity in Pakistan. Unless we change this structure of economy, the morbid story of corruption and tax evasion will continue. In the presence of these maladies, no decision of Supreme Court can help Pakistan progress and become an egalitarian state.

-

Comment by Riaz Haq on February 6, 2018 at 10:14am

-

New #UK #property law could spell doom for #Pakistan politicians. #NawazSharif #MaryamNawaz #PanamaPapers #London #Corruption

https://www.aninews.in/news/world/europe/new-uk-property-law-could-...

London [UK], Feb 5 (ANI): The United Kingdom Government has introduced new rules which gives the law enforcement officers sweeping powers to usurp assets and properties that have been accrued through "dirty money."

The new rules have been designed to stop corrupt people from using the UK as a safe haven to amass unaccounted wealth. Individuals can be fined and jailed if they make misleading statements.

British authorities have the right to freeze and recover properties of more than 50,000 pounds if individuals cannot give a genuine explanation on the source of the property and legal proof showing that they have acquired the property legally, The Dawn reported.

The UWO (Unexplained Wealth Order) that initially came into force on February 1, looked to target Russian businessmen and industrialists having assets in the UK. However, the new property law could, however, spell the same trouble for some Pakistani politicians.

Another issue that goes against Pakistani politicians is "the lower threshold as a UWO made in relation to a non-EEA [European Economic Area] PEP [Politically Exposed Person] would not require suspicion of serious criminality".

London-based anti-corruption group, Transparency International (TI) said that it has identified properties worth 4.4 billion pounds in the UK that can be taken up in the new legislation.

It has already prepared a list of five cases and feels that the investigation would not be delayed for long. This also includes the Avenfield House flats case, involving former Pakistan Prime Minister Nawaz Sharif.

Suspecting Sharif as the owner of four Avenfield House flats worth eight million pounds, TI said in a statement, "The Land Registry documents showing the four properties are owned by two companies registered in the British Virgin Islands- Nescoll Limited and Nielsen Limited.

"According to information published as part of Panama Papers, these companies were controlled by the former prime minister of Pakistan, Nawaz Sharif. In 2017, Pakistani authorities initiated an investigation into these assets, which found that they were purchased without a mortgage between 1993 and 1995, just after Sharif reported a growth in wealth without any plausible declared source of income. In July 2017, Sharif was removed from the office after the investigation found that he had failed to disclose these properties on his official asset declaration," added TI.

Igor Shuvalov, the Russian first deputy prime minister is the alleged owner of two flats worth 11.44 million pounds at 4 Whitehall Court in London.

Sharif is not the only politician to have links to a series properties in the UK.

Other media reports have mentioned that various Pakistani politicians have also purchased properties and amassed unaccounted wealth in the UK.

India's most wanted terrorist Dawood Ibrahim has been reportedly linked to a series of properties across the United Kingdom, according to a UK media report.

The UK newspaper compared the details from documents prepared by Indian authorities related to the records held by UK's Companies House, Land Registry and the Panama Papers.

The documents also alleged that Ibrahim's right-hand man, Muhammed Iqbal "Mirchi" Memon, amassed huge properties in the UK, such as hotels, mansions, and houses in South-East England.

Memon held at least 11 company directorships in tiling, construction and lettings firms in the UK before he died in 2013 after suffering a heart attack. He had consistently denied his involvement in Ibrahim's cartel.

Memon, also a suspect in the 1993 Mumbai attacks, had sought refuge in London after the blasts and attempts to extradite him to India had failed. He sought refuge in London after the 1993 Mumbai attacks. India has tried to extradite him but in vain.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Improved US-Pakistan Ties: F-1 Visas For Pakistani Students Soaring

The F-1 visas for Pakistani students are soaring amid a global decline, according to the US government data. The US visas granted to Pakistani students climbed 44.3% in the first half of Fiscal Year 2025 (October 2024 to March 2025) with warming relations between the governments of the two countries. The number of visas granted to Indian students declined 44.5%, compared to 20% fewer US visas given to students globally in this period. The number of US visas granted to Pakistani…

ContinuePosted by Riaz Haq on October 19, 2025 at 10:00am — 1 Comment

Major Hindu American Group Distances Itself From Modi's India

"We are not proxies for India in the US", wrote Suhag Shukla, co-founder and executive director of the Hindu American Foundation (HAF) in a recent article for The Print, an Indian media outlet. This was written in response to Indian diplomat-politician Shashi Tharoor's criticism that the Indian-American diaspora was largely silent on the Trump administration policies hurting India. …

ContinuePosted by Riaz Haq on October 11, 2025 at 2:00pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network