PakAlumni Worldwide: The Global Social Network

The Global Social Network

How Has Bangladesh Left Pakistan Behind in Per Capita Income?

A headline in the Economist magazine's recent issue screams: "Bangladesh's GDP per person is now higher than Pakistan's". Let's examine this development to understand its causes.

Per Capita GDP:

The Economist article explains its headline as follows: "Last month revealed a remarkable turnaround. Bangladesh’s GDP per person is now higher than Pakistan’s. Converted into dollars at market exchange rates, it was $1,538 in the past fiscal year (which ended on June 30th). Pakistan’s was about $1,470....Strange as it may sound, Bangladesh jumped ahead because of an advance in Pakistan. On August 25th Pakistan released the results of its census, updating earlier population estimates. They showed that the country has 207.8m people, more than 9m more than previously thought. It may now have the fifth biggest population in the world, surpassing Brazil’s. But the new count also lopped 4-5% off Pakistan’s GDP per person, the arithmetic consequence of revealing so many more people."

|

| Pakistan Growth By Decades. Source: National Trade and Transport Fa... |

Economic Growth Trends:

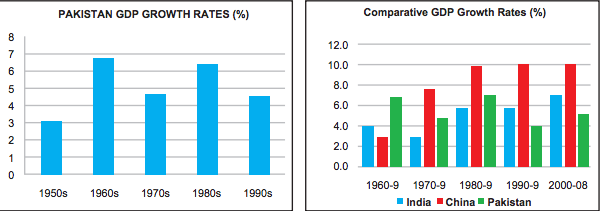

One can quibble with the Economist on details of its report but the fact remains that Bangladesh's economy has been growing significantly faster than Pakistan's for about a decade. To understand why, it's important to look into savings and investments, population growth trends and security situation in the two countries. Let's examine each in a little more detail.

Investment as Percentage of GDP Source: State Bank of Pakistan |

Savings and Investment:

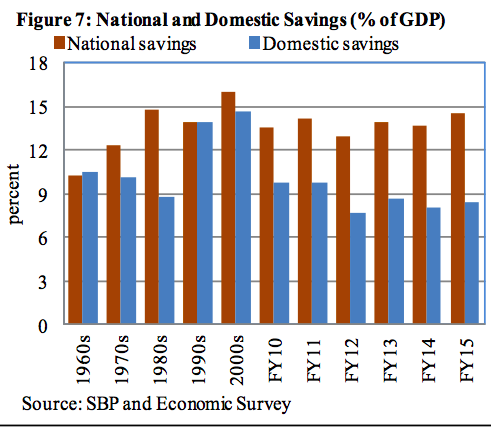

There's a strong relationship between investment levels and gross domestic product. The more a country saves and invests, the higher its economic growth. A State Bank of Pakistan report explains it as below:

"National savings (in Pakistan) as percent of GDP were around 10 percent during 1960s, which increased to above 15percent in 2000s, but declined afterward. Pakistan’s saving rate also compares unfavorably with that in neighboring countries: last five years average saving rate in India was 31.9 percent, Bangladesh 29.7 percent, and Sri Lanka 24.5 percent..... Similarly, domestic savings (measured as national savings less net factor income from abroad) also declined from about 15 percent of GDP in 2000s, to less than 9 percent in recent years. Domestic savings are imperative for sustainable growth, because inflow of income from abroad (remittances and other factor income) is uncertain due to cyclical movements in world economies, exchange rates, and external shocks".

Net Foreign Direct Investment Source: State Bank of Pakistan |

Population Trends:

The total fertility rate (TFR) in Bangladesh has declined faster in Bangladesh than in Pakistan in the last few decades. Currently, Bangladesh is at 2.17 children per woman while Pakistan is at 2.62 children per woman.

As a result of reduced birth rates and more female labor participation rates, a larger percentage of Bangladeshi population is in the work force than Pakistan's. There are now more wage earners and fewer dependents in each Bangladeshi household. This demographic trend has helped boost Bangladesh's per capita income faster than Pakistan's.

Rising working age population and growing workforce participation of both men and women in Pakistan will significantly boost domestic savings and investment. Increased foreign direct investment such as Chinese investment in China-Pakistan Economic Corridor over the next several decades will help fill the gap between the national savings rate and investments required to reach 7% annual GDP growth to create over 2 million jobs a year.

Security Issues:

Pakistan has paid a heavy price for its proximity to and involvement in "war on terror" in Afghanistan. It has cost Pakistan dearly in terms of loss of thousands of precious lives and lower investments due to investors' security concerns. Recent operations by Pakistan Army have helped turn the tide against terrorists, bringing more hope and greater confidence in Pakistan's future. Rising FDI in CPEC-related projects in the last couple of years are an indication of this confidence.

Future:

Pakistan is now experiencing the demographic dividend that Bangladesh has seen in the last few decades in terms of more of its population earning and fewer dependents. Pakistan's labor force is growing at 3.6% a year, much faster than its population growth rate of 2.34%. This should help boost Pakistan's per capita and its domestic savings rate.

At the same time, China-Pakistan Economic Corridor (CPEC) related projects are bringing more foreign direct investment, thereby speeding up the economic growth in the country. Pakistan's GDP growth is accelerating from less than 5% two years ago to 6% forecast for fiscal 2017-18. In its latest economic growth projections, Kennedy School's Center for International Development (CID) at Harvard University expects Pakistan's annual GDP growth to average 5.97% over the next 8 years, ranking it as the world's 6th fastest growing economy. It is within the realm of possibility that economic growth in Pakistan could exceed 7% in the next couple of years.

Summary:

Pakistan has fallen behind Bangladesh and India in per capita income as its growth rates have slipped in recent years mainly due to declining savings and investment rates and security issues. Demographic trends and improved security situation now favor Pakistan's future growth as its workforce grows and household sizes shrink.

Related Links:

-

Comment by Riaz Haq on September 17, 2022 at 8:21pm

-

Since mid-2021, global commodity prices, especially of oil, have begun to rise. This was intensified by the Russian invasion of Ukraine in March. As a consequence, Bangladesh, as a major energy importer, is facing a number of challenges. Its foreign currency reserves are declining and the value of its currency, the taka, is weakening. Electricity load shedding has worsened, adding to the woes of citizens.

https://scroll.in/article/1031735/how-global-economic-instability-i...

As a result, the cost of imports in Bangladesh has increased significantly even as earnings from exports have increased only moderately.

In the financial year 2022, the expenditure on imports increased by 36%, compared to 20% the previous financial year. The high import cost is due in part to the increased demand for imported goods and in part to the higher import prices on the global market.

As a result, the terms of trade have gone against Bangladesh. During 2021-’22, the import-price index increased by 5.06%, while the export-price index increased by 3.23%. This has hurt the current account balance.

In the financial year 2022, the current account balance reported a deficit of $18.70 billion compared to the previous year’s deficit of $4.58 billion.

The current account deficit in Bangladesh is generally met by remittances from abroad, which have also decreased significantly in the financial year 2022. Remittances fell by 14% in the financial year 2022, following a 36% increase in the financial year 2021. This has affected the balance of payments, foreign currency reserves, and weakened the taka against the US dollar.

Despite adjusting the exchange rate to match the market demand, the Bangladesh Bank continued to sell dollars from reserves to keep the taka stable. As a result, reserves declined further.

Foreign currency reserves fell to $39.77 billion on July 14 from $46.39 billion the previous year. Though the country has received relatively large remittances from expatriates in July due to Eid, the taka’s value against the dollar is deteriorating.

Foreign exchange reserves are not only critical for maintaining the exchange rate of domestic currency but also contribute significantly to increased capital investment and long-term economic growth.

To keep the taka’s value stable, the Bangladesh government and Bangladesh Bank have taken measures to reduce imports and increase the flow of dollars. The government has discouraged the import of luxury items. The depreciation of the taka compelled the government to seek a loan from the International Monetary Fund. Only a year ago, Bangladesh had supported Sri Lanka with $250 million.

The weakening of the Taka against the dollar not only makes imports more expensive, but also raises the domestic prices of imported goods and other non-imported goods due to the substitution effect – which is when the sales of a product decline due to an increase in its price which prompts consumers to switch to cheaper alternatives. This worsens inflation.

Inflation at 9-year-high

For the past few years, inflation in Bangladesh had been under control but it began to increase in 2021 and has now risen to 7.56% according to official accounts, though the actual rate is thought to be much higher. The prices of rice, wheat, edible oil and other essential commodities are increasing and the inflation rate has climbed to a nine-year-high.

Several studies indicate that low-income citizens are struggling to cope with the high prices of essential commodities and compromising on their food and nutrition.

The government recently hiked urea fertiliser and fuel oil prices without implementing measures to improve the management of the energy sector and reduce inefficiency and system loss.

-

Comment by Riaz Haq on September 18, 2022 at 7:32pm

-

Global supply and Bangladesh

Mahtab Uddin Chowdhury | Published: 00:00, Sep 19,2022 | Updated: 23:21, Sep 18,2022

https://www.newagebd.net/article/181441/global-supply-and-bangladesh

According to the report, based on Dun & Bradstreet data, at least 374,000 businesses worldwide depend on Russian suppliers, while at least 241,000 businesses across the world rely on Ukrainian suppliers. As stated in Forbes magazine, ‘If the pandemic crippled the global supply chain, the war in Ukraine knocked it to its knees.’ The war generally destroys natural resources and creates enormous barriers to the market. This general tendency is manifested in the aftermath of the Russia-Ukraine war when commodity and oil prices saw an increase, global economic activities slowed down and inflation rate increased. Reportedly, the war reduced global GDP by about 1.5 per cent and led to a rise in global inflation of about 1.3 per cent.

Bangladesh’s post-pandemic economic recovery programme even before gaining momentum is at risk because of the Russia-Ukraine war. In terms of oil production, Russia ranks third in the world; hence high oil prices are hurting the entire economy. Bangladesh, an oil-importing nation, is already under strain from hefty import duties. Additionally, given that Russia is a significant market for Bangladesh’s ready-made garment products, global sanctions on Russia imply that Bangladesh’s trade with Russia will be impacted. In the last July–February, the revenue from exporting clothing to Russia was $482.23 million, or $60.15 on an average per month, but the revenue fell to $27.05 million in March–May 2022.

Furthermore, the high import dependency of Bangladesh has created a serious economic stagnation. Since Bangladesh primarily imports wheat from the Black Sea region, the price of wheat flour sharply increased. The government raised diesel prices by approximately 23 per cent in November 2021, which is already reflected in the high cost of transport and other necessities. Additionally, there has been a significant increase in the price of soybean oil.

All these things are causing the country’s inflation rate to be high, approximately 7.42 in May which is the highest in the last eight years. Let’s not forget the foreign debt that Bangladesh needs to pay back. At the end of fiscal 2020–21, Bangladesh’s external debt was $60.15 billion. However, the underlying concern is that, according to prominent economist Debapriya Bhattacharya, although Bangladesh’s external debt status is now in the green, it may move into the yellow zone by 2024–25.

Under this circumstances, Bangladesh is in dire need of taking some bold and dynamic steps to stabilise the economy. Bangladesh should look for alternative sources of importing goods. It’s essential to avoid being overly dependent on any one location or nation for specific products. In this context, the government of Bangladesh initiated some talks with Canada and some other countries.

The government has initiated these dialogue particularly after India stopped exporting its supply of wheat to Bangladesh. Similarly, Bangladesh needs to diversify its agricultural production to reduce import dependency. More research should be facilitated to encourage innovative approaches in this sector, particularly focusing on regularly imported products such as wheat, corn, and oilseed.

When it comes to talking about a better supply chain system, port management plays a vital role in Bangladesh or elsewhere. Based on a report by the World Bank and S&P Global Market Intelligence, the Chattogram port has been ranked as Asia’s least efficient trade hub for handling containers. Considering the low ranking, the government should focus more on improving the efficiency of the port management so that quick tracking and a better supply of goods can be ensured.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

Builder.AI: Yet Another Global Indian Scam?

A London-based startup builder.ai, founded by an Indian named Sachin Dev Duggal, recently filed for bankruptcy after its ‘neural network’ was discovered to be 700 Indians coding in India. The company promoted its "code-building AI" to be as easy as "ordering pizza". It was backed by nearly half a billion dollar investment by top tech investors including Microsoft. The company was valued at $1.5 billion. This is the latest among a series of global scams originating in India. …

ContinuePosted by Riaz Haq on June 8, 2025 at 4:30pm — 12 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network