PakAlumni Worldwide: The Global Social Network

The Global Social Network

Comprehensive Energy Plan Crucial to Pakistan's Future

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era. In recent years, the rapid growth in computers and mobile phones spawned by the Information and Communications Technology (ICT) revolution has further increased demand for energy. Currently somewhere between 5-10% of

electrical consumption is for ICT and it's likely to continue to grow rapidly.

Energy Consumption:

Energy consumption in this day and age generally indicates a nation's level of industrialization, productivity and standards of living. Going by this yardstick, Pakistan's 14 million BTUs per capita consumption in 2009 indicates that the country has a long way to go to achieve levels comparable with the world average productivity signified by 71 million BTUs per capita as estimated by US Energy Information Administration for 2009.

Regional Comparison:

Although Pakistan's 14 million BTUs per capita energy use is ahead of Bangladesh's 6 million BTUs and Sri Lanka's 10 million BTUs, it is less than India's 18 million BTUs, and far behind China's 68 million BTUs and Malaysia's 97 million BTUs.

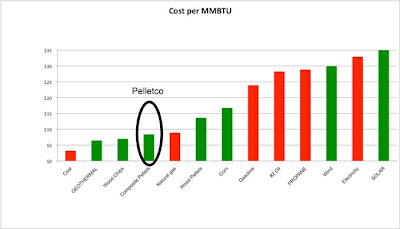

Energy Costs:

Fossil fuels are currently the primary source of the bulk of energy used. Cost of producing energy from various fossil fuels ranges from $2-4 per million BTUs for coal to $19-20 per million BTUs from oil. Costs of energy from natural gas vary widely depending on the source. Cost of shale gas in the United States has plummeted to about $2 per million BTU recently, while Pakistan has signed agreements to purchase gas from Iran and Turkmenistan in the range of $10 to $12 per million BTUs. Cost of production of domestic natural gas is in the range of $2 to $4 per million BTU.

Impact on Economy:

Energy costs have had a huge impact on Pakistan's economy. Its heavy dependence on imported oil has been a big contributor to balance of payments crises in the past. In 2008, for example, the oil prices jumped from less than $50 a barrel to $150 a barrel and forced the country to seek IMF bailout. Pakistan oil import bill has increased from about $7 billion in 2007 to over $12 billion in 2011. Energy shortages have also put a significant dent in Pakistan's GDP growth.

Pakistan's Fuel Options:

If Pakistan could generate all of the 14 million BTUs of energy per capita from coal, the cost would be $28 to $56 for each person. Alternatively, the cost of using oil for the entire production would add up to about $280 per person, a significant chunk of Pakistan's per capita income of $1372 in 2011-12. The costs therefore range from a low of $28 to a high of $280 per Pakistani.

Energy Policy Suggestions:

As the nation develops and the energy demand increases, the policy makers have to try and produce as much of the needed energy at costs closer to the low-end of the range from $2 to $20 per million BTUs. Here are some policy suggestions for Pakistan's energy policy going forward:

1.

Develop Pakistan's shale gas reserves estimated at 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that

investment in shale gas can increase production quite rapidly and prices

brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU

recently. Pursuing this option requires US technical expertise and

significant foreign investment on an accelerated schedule.

2.

Increase production of gas from nearly 30 trillion cubic feet of

remaining conventional gas reserves. This, too, requires significant

investment on an accelerated schedule.

3. Convert

some of the idle power generation capacity from oil and gas to imported

coal to make electricity more available and affordable.

4.

Utilize Pakistan's vast coal reserves in Sindh's Thar desert. The

problem here is that the World Bank, Asian Development Bank and other

international financial institutions (IFIs) are not lending for coal

development because of environmental concerns.And the Chinese who were

showing interest in the project have since pulled out.

5. Invest in hydroelectric and other renewables including wind and solar. Several of

these projects are funded and underway but it'll take a while to bring

them online to make a difference.

6. Curb widespread power theft, improve collection of electricity dues from consumers, and resolve spiraling circular debt to make Pakistan's energy sector attractive to domestic and foreign investors.

Energy Conservation:

In addition to significantly increasing energy production, Pakistan needs to take prudent steps to conserve by promoting the use of energy-saving electric bulbs and machines. Concerns about the environment have propelled many developed nations to cut energy consumption in recent years. For example, serious conservation efforts have reduced Japan's 172 million BTUs per capita in 2009 down from 178 in 2005, Germany is at 163 million BTUs in 2009 down from 175 in 2005, and the United States is down to 308 million BTUs in 2009 from 340 million BTUs per person per year in 2005.

Summary:

Instead of addressing different pieces of the energy puzzle in an ad hoc fashion under multiple ministries and bureaucracies fighting turf battles, Pakistani policy makers need to look at the big picture for the sake of the nation's future. Nothing short of a holistic approach with a comprehensive energy policy formulated and implemented under a competent and powerful energy czar will do.

Related Links:

Haq's Musings

US EIA International Data on Per Capita Energy Consumption

Affordable Fuel for Pakistan's Electricity

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on July 18, 2012 at 8:12am

-

Here's a Bloomberg report on FDI in Pakistan's energy sector:

Pakistan may receive the most overseas investment in four years as companies set up wind and coal generation plants, helping curb the nation’s record energy shortage, a government agency official said.

“Pakistan serves as the gateway to Iran, central Asia and even India so we have a lot of potential to attract foreign investment,” Mohammad Zubair Motiwala, chairman, Sindh Board of Investment, said in an interview in Karachi today. “Energy is a field where an investor can come and really make money.”

Pakistan needs to increase overseas investment to help meet an economic growth target of 4.3 percent in the year that began July 1. Power outages lasting as long as 18 hours a day have led to factory shutdowns and riots across the nation.

Foreign direct investment may rise to $2.5 billion in the year that began July 1, mostly in energy, said Motiwala, 56. That would be the highest since the 12 months ended June 30, 2009, when overseas companies invested $3.7 billion. Overseas investment declined 50 percent to $813 million in the year ended June 30, according to the central bank.

Norway’s NBT AS and Malaysia’s Malakoff Corp. Bhd signed an agreement with Pakistan yesterday to build a $600 million wind power plant in the southern province of Sindh that will generate 500 megawatts a day within 18 months, Motiwala said.

South Korea, China and India are among the countries “most interested” to invest in Pakistan, he said.

Pakistan’s $200 billion economy faces the fastest inflation in Asia, an insurgency on the Afghan border and reduced aid flows. Political tension has increased after a dispute between civilian leaders and the judiciary led to Yousuf Raza Gilani’s ouster as prime minister last month.

http://www.bloomberg.com/news/2012-07-18/pakistan-targets-2-5-billi...

-

Comment by Riaz Haq on October 16, 2012 at 8:09am

-

Here's Platts on Pakistan's new energy exploration policy:

Pakistan has released 60 oil and gas exploration and production blocks for auction, a Ministry of Petroleum official said Tuesday.

The release is part of a new policy to spur development of the country's oil and gas industry that includes a rise in rates for any gas produced to $6-6.60/MMBtu, from $4.20/MMBtu earlier, the official said. The rate for offshore blocks in areas designated shallow zones is set higher at $7/MMBtu, deep zones at $8/MMBtu and ultra-deep zones at $9/MMBtu.

"Interested oil and exploration companies and countries have almost two months to submit bids, the official said.

The bids will be opened December 13 and the names of successful bidders announced a week later, he added.

The government is hoping to sell four of the blocks under government- to-government agreements, he added.

Exploration activity in Pakistan has slowed in recent years due to the low prices offered by the government and the impact of circular debt issues in the oil and gas sector. The country has gas reserves of 23 Tcf/day.

Pakistan's current domestic gas demand exceeds its production capacity of 4.2 Bcf/day by 1.2-1.4 Bcf/day, which increases to 2 Bcf/day in winter. If adequate gas is not discovered within 3-4 years, the shortfall is projected to increase to 2.5-3 Bcf/day.

http://www.platts.com/RSSFeedDetailedNews/RSSFeed/NaturalGas/8822519

-

Comment by Riaz Haq on November 1, 2012 at 11:05pm

-

Here's Peninsula Qatar story on new power generation capacity addition in Pakistan:

SLAMABAD: In order to meet the higher demand for power, the government of Pakistan has spent Rs138.213bn ($1.455bn) on different power generation projects and has managed to generate only 2,996 megawatts (MW) extra in the last five years, sources in the Ministry of Water and Power revealed.

The government spent Rs38.729bn in government-owned power generation companies (GENCOs) for investment in new power plants, Rs47.6bn in National Transmission and Despatch Company (NTDC) for improvement of transmission network and Rs51.884bn in distribution companies for revamping of their 132 KV, 11 KV and Low Voltage Network.

The sources said that these expenditures enabled the government to transmit output of 2,996 MW of the new power plants to load centres.

It will also be providing capacity for accommodating future increase in load demand and removing transmission network constraints to allow distribution of power to constrained areas of main load centres and Balochistan.

The government has also spent the amount in improvement and revamping of power distribution companies (DISCOs) networks for meeting load demand, accommodating new connections and reducing losses.

In addition, the government has spent generously under the head of subsidy to mitigate electricity crisis in the country and spent Rs701.2bn in the last five years.

The subsidy injection enabled DISCOs to pay the outstanding bills of independent power producers (IPPs) to overcome fuel shortage.

This crisis mitigation effort resulted in an overall increase in electricity generation and electricity consumption by 10 percent over the last three years and 3.0 per cent per annum on compound growth basis.

In addition the works of village electrification and new connections were facilitated. Consequently 57,777 villages were electrified and 3.926m connections were installed.

http://thepeninsulaqatar.com/pakistan-afghanistan/212884-pakistan-s...

-

Comment by Riaz Haq on November 7, 2012 at 9:19pm

-

Here's a Nation story on KESC's planned investments to add capacity and reduce cost of generating power:

Karachi Electric Supply Company has reaffirmed its commitment towards Pakistan by announcing an ambitious investment plan in excess of Rs40 billion. According to the statement, KESC has already invested around USD one billion over the last four years in various large scale projects in generation, transmission and distribution. The new Rs40 billion investment plan is aimed at enhancing KESC’s generation capacity, improving its generation fleet efficiency, reducing the cost of power generation and building the requisite transmission capacity to meet growing power demand across its service territory. These projects will be completed over the next 18-36 months and KESC will be arranging required funding from local and foreign institutions in shape of both debt and equity.CEO KESC, in a related statement said, “We believe in the potential that Pakistan offers and despite the difficult operating environment we have demonstrated this through unprecedented investments in the past. The new investment plan is just a reiteration of this belief and comes at a time when Pakistan is witnessing dampening of investors’ sentiments, both local and foreign”.Under the new investment plan, KESC is undertaking combined cycle projects at its three power plants at Korangi and SITE that will significantly enhance the efficiency of these plants and add additional 47 MW of generation capacity. A specially designed ‘Transmission Package’ will see the installation of new transformer bays, addition of 3 new grid stations at strategic locations and extension of 6 existing grid stations. In line with the strategic intent to bring down the cost of generation, the new investment plan will allow KESC to convert two of its oil-fired units of 210 MW each at its Bin Qasim-I to coal. KESC is also undertaking to develop a bio-waste to energy project which will convert cattle manure from Landhi Cattle Colony and organic food waste to produce 22MW of electricity. The new investment plan will help KESC accomplish many strategic objectives, including creation of social and environmental values.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-onli...

-

Comment by Riaz Haq on November 8, 2012 at 6:56pm

-

Here's a BR report on 35% increase in power generation machinery imports in Pakistan:

Import of power generation machinery witnessed a surge of some 35 percent during the first quarter of fiscal year 2012-13 (FY13) over the same period of last fiscal year owing to power crisis in the country. Importers said that despite all efforts, the government and power generation companies seemed failed to resolve power crisis. Therefore, continuing power shortage forced the general public, industrialists and exporters to acquire their own power generation machinery.

Presently, they said, industrialists are the major buyers of power generation machinery to produce their own electricity as the energy crisis is directly hurting the production and export of industries, resulting in huge losses and unemployment. Industrialists also want to free their industries of the ongoing energy crisis to avoid losses, they added.

Importers said for last many years the government is claiming to end power crisis, however power shortage issue stays unresolved. According to Pakistan Bureau of Statistics (PBS) the import of power generation machinery rose to $254 million in first quarter of FY13 compared to $189 million in the corresponding period of FY12, depicting an increase of 34.50 percent or $65 million in three months.

Month on month basis, the import bill of power generation machinery for September 2012 rose by 33 percent to $80.37 million as compared to $60.52 million in the same period of last fiscal year. Importers said bulk of power generation machines is being imported from China followed by US, Japan, UK, however China is the largest supplier of power generation machinery and contributing over 70 percent share in Pakistan''s generator import.

Chinese generators are available in all specifications and are cheaper than the US, Japan and UK brands, therefore general public prefers Chinese generators. "We are expecting that import of power generation machinery may witness some rise in coming months owing to persistent long power outages across the country," importers said.

Although, the country is facing severer power crisis with hours'' long loadshedding, Punjab is the most affected province, where domestic and commercial consumers are worst hit. Usually, Punjab''s different cities especially Faisalabad is seen in the grip of power riots, they said. The situation in Karachi - the economic hub of the country - is slightly better than Punjab but not satisfactory as people and industry also suffering from loadshedding. Therefore, Punjab is the main market for power generation machinery as compared to Karachi, which generators'' sale is slow. Since 2004-05 the country has been witnessing a massive surge in the demand and import of power generation machinery. It has spent over one billion dollars on the import of power generation machinery during the last fiscal year (2011-12).

http://www.riazhaq.com/2012/05/educational-attainment-in-india.html

-

Comment by Riaz Haq on December 13, 2012 at 10:27pm

-

Here's a Reuters' story on Italian energy giant exploring oil and gas onshore and offshore in Pakistan:

MILAN: Italy’s Eni has strengthened its hand in Pakistan by agreeing to buy offshore gas acreage as the oil and gas major continues to channel cash into more profitable upstream activity.

In a statement on Thursday Eni said it had signed a deal with Pakistan and state oil company OGDCL to acquire 25 per cent and operatorship of the offshore Indus Block G licence, located in Pakistan’s Indus Basin.

Eni is the leading foreign producer in Pakistan with an equity output of 58,000 barrels of oil equivalent per day (boed).

In September it announced a significant onshore gas discovery in a country which it is counting on as part of its strategy to develop assets and bring them to market rapidly.

Huge cost overruns and delays at Kashagan, the world’s largest oil development, have raised questions about its ability to deliver large-scale projects on budget and on time.

Eni, the world’s No. 7 oil company in terms of production, is selling non-core assets like gas transport group Snam and Portuguese energy group Galp Energia to focus on oil and gas exploration.

The company, which produced 1.7 million boed in 2011, has said it is looking to add more than 1.3 million boed of new production by 2022.

Over the past year, Eni has dispelled some of the scepticism about its profitability and growth potential by clinching a deal with Russia’s Rosneft and scoring exploration successes in Norway and Mozambique.

The 7,500-square-kilometre block in Pakistan is “in ultra deep water of an underexplored and promising area offshore Pakistan”, Eni said.

The consortium managing the block is composed of the two state companies OGDCL and Pakistan Petroleum, Eni and United Energy Pakistan Limited – each holding a 25 per cent stake.

http://dawn.com/2012/12/13/eni-to-buy-new-exploration-block-in-paki...

-

Comment by Riaz Haq on December 21, 2012 at 11:20am

-

Here's Reuters on opening of a new refinery in Pakistan:

Karachi-based Byco Oil said it had completed Pakistan's largest oil refinery at Balouchistan with a capacity of 120,000 barrels per day, which is expected to reduce the country's imports of oil products.

The new refinery, manufactured in the UK and assembled in Pakistan, is currently in the pre-commissioning stage, with tests being done on various equipment, the company said on its website. Byco Oil is the parent company of listed Byco Petroleum .

"It will enhance overall crude oil refining capacity in the country from an existing 12.25 to 18 million tonnes per year and will significantly contribute in reducing a shortage of refined petroleum products in the country," the statement read.

Byco officials could not be reached for comment.

The new plant will more than triple Byco's current capacity of 35,000 bpd at its existing refinery.

The refinery can be further expanded up to 180,000 bpd, the company said.

An isomerisation plant to produce higher volumes and cleaner motor gasoline is also being commissioned with the refinery.

Pakistan operates five other refineries, the largest of which is Pak-Arab Refinery's 100,000 bpd plant.

Pakistan State Oil, a major oil importer in the country, imports about 250,000 tonnes of diesel every month through term volumes, they added.

http://www.reuters.com/article/2012/12/21/pakistan-refinery-idUSL4N...

-

Comment by Riaz Haq on December 29, 2012 at 6:13pm

-

Here's an ET story on decline in circular debt:

The good news is that circular debt in the energy sector is going down. The bad news is that it is doing so for all the wrong reasons.

Circular debt has now become shorthand for the crippling string of financial liabilities that energy companies owe each other because the federal government fails to live up to its promise to pay out energy subsidies that it announces as vote pleasers. This debt has resulted in a massive cash shortage virtually all along the energy chain and significantly reduced the ability of power companies to operate at full capacity, which in turn causes massive power outages throughout the country, particularly during the summer months of peak demand.

But now at last, it appears that the government is paying out what it owes in subsidy payments. Azfar Naseem and Sateesh Balani, research analysts at Elixir Securities, an investment bank, estimate that total circular debt throughout the energy chain has not only stopped growing, but has shrunk by about Rs137 billion during the first six months of the fiscal year ending June 30, 2013.

Part of this reduction has come from higher subsidy payouts to the energy sector from the finance ministry, which rose to Rs160 billion between July 1 and December 20 of this year, about 5% higher than the net payouts throughout the whole previous fiscal year that ended June 30, 2012.

Another significant chunk came when the government effectively forced the state-owned Oil & Gas Development Company (the largest company in Pakistan by market capitalisation) to buy about Rs82 billion in government bonds meant to clear out the outstanding liabilities. The bonds do not mean that the government has paid out its liability: they just mean that they forced OGDC to pay the rest of the energy chain and promised to pay OGDC back.

-----------

The government was given this fiscal breathing room by the inflow from the United States in the form of $1.1 billion in outstanding dues on account of the Coalition Support Fund. That entire amount, by some accounts coming out of the finance ministry, was spent on power subsidies. Yet the government may well be running out of accounting tricks to patch up the power sector before the elections.The reason the government has tried to juggle around its scarce cash reserves is because it wants to make sure that the power companies have enough cash to buy the fuel they need to keep the lights on in the country, at least most of the time, in the run-up to the elections, expected around May 2013.

These techniques appear to be having at least some positive impact: the outstanding receivables at Pakistan State Oil, the largest oil retailer in the country, are down by almost 40% to around Rs120 billion. Receivables at Hub Power Company and Kot Addu Power Company (which supplies politically important regions of southern Punjab) are also down substantially....

http://tribune.com.pk/story/485765/energy-crisis-circular-debt-is-g...

-

Comment by Riaz Haq on January 17, 2013 at 10:55pm

-

Here's a News story on automatic meter reading (AMR) roll-out in Pakistan:

ISLAMABAD: The United States Agency for International Development (USAID), in its effort to assist government-owned power distribution companies in loss reduction and revenue enhancement, is in the final stages of rolling out a nationwide installation of Automated Meter Reading (AMR) projects.

According to a press statement of USAID issued here on Thursday, initially, the project would be targeting areas with high thefts and high line losses. The AMR would provide highly accurate electronic meter readings with very little human intervention, using computer technology to transmit meter readings data via GSM/GPRS and radio frequency.

This would help distribution companies in monitoring the energy consumption trends among different consumer categories, understand consumer patterns, reduce electricity losses and increase their revenues.

The installation of AMR meters would start in the first quarter of 2013. With the intervention approaching its installation phase, the USAID Power Distribution Programme organised an AMR solution requirements workshop in Lahore. The main objective of the workshop was to better understand and gather distribution companies’ business requirements.

AMR project teams from all five distribution companies (Islamabad Electric Supply Company, Peshawar Electric Supply Company, Lahore Electric Supply Company, Hyderabad Electric Supply Company and Multan Electric Power Company) actively participated in the workshop.

http://www.thenews.com.pk/Todays-News-3-154887-USAID-to-roll-out-la...

-

Comment by Riaz Haq on January 18, 2013 at 9:11pm

-

Here's the latest on IP pipeline from PakistanToday:

ISLAMABAD - The $ 1.2 billion Iran-Pakistan gas pipeline project, set to be completed next year, may prove a bonanza for the hard-pressed energy sector of Pakistan’s economy as the initiative will supply 750 million cubic feet of gas besides helping to contribute 4000 MW of electricity to the national power grid.

Iran is stated to have completed 900 km of work on its side while Pakistan launched its part of work last month, thus setting the stage for an ambitious undertaking which will greatly overcome Pakistan’s severe energy shortages.

In the prevailing energy crunch, the PPP-led coalition decided to go ahead with the project despite stiff opposition from some quarters.

However, the Pakistani government despite the pressure has signed the agreement with Iran to meet its energy shortages.

President Asif Ali Zardari and Iranian President Mahmoud Ahmadinejad signed the Inter-Governmental Framework Declaration (IGFD) of the IP project in Tehran on May 24, 2009. After signing ceremony of the Sovereign Guarantee Agreement (SGA), Pakistan’s then Minister for Petroleum and Natural Resources Naveed Qamar signed Gas Sales and Purchase Agreement (GSPA) with Iran on June 5, 2009 through which Pakistan would import one million cubic feet gas per day.

The government had also appointed the engineering and project management teams in April 2012, to conduct route surveys on IP, who later submitted a final detailed report on the project.

Pakistan is experiencing a prolonged power crisis, low gas pressure and suspension of Compressor Natural Gas (CNG), adding to the problems of the masses.

Advisor on Petroleum and Natural Resources to the Prime Minister Dr Asim Hussain said the government wanted to complete the project as soon as possible in order to overcome the looming power and gas crises.

He termed the project beneficial for both countries and said, “We are dependent on this project as there is no other substitute at present to meet the growing energy demand.”

He said the government of Pakistan had started work on the project in December 2012, while Iran had already constructed more than 900 km of the gas pipeline on their side.

Asim stated that after completion of the project, it would start supplying 750 million cubic feet gas per day.

He said the implementation of the project showed that Pakistan had a flexible foreign policy.

In a press conference on the sidelines of the summit of the Group of Eight Developing Countries (D8) in Islamabad on November 22, Iranian President Mahmoud Ahmadinejad vowed to complete the multi-billion dollar project within the stipulated time.

He said the portion of pipeline on Iranian side was about to be completed while Iran was also extending financial assistance to Pakistan to complete the project.

Another purpose of signing this pact was to strengthen the bilateral relations between the two countries.http://www.pakistantoday.com.pk/2013/01/19/news/profit/ip-gas-proje...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pak-Saudi Joint Defense: Is Pakistan A Major Power or Bit Player in the Middle East?

The recently signed “Strategic Mutual Defense Agreement” between Saudi Arabia and Pakistan states that “any aggression against either country will be considered an aggression against both”. It is being seen by some geopolitical analysts as the beginning of an "Islamic NATO". Others, such as Indian-American analyst Shadanand Dhume, have dismissed Pakistan as no more than a "bit player"…

ContinuePosted by Riaz Haq on September 27, 2025 at 5:30pm — 1 Comment

Silicon Valley Pakistani-Americans Among Top Donors to Mamdani Campaign

Omer Hasan and Mohammad Javed are the top donors to Zohran Mamdani’s mayoral campaign in New York City, according to media reports. Both are former executives of Silicon Valley technology firm AppLovin. Born and raised in Silicon Valley, Omer is the son of a Pakistani-American couple who are long-time residents of Silicon Valley, California. …

ContinuePosted by Riaz Haq on September 19, 2025 at 9:00am

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network