PakAlumni Worldwide: The Global Social Network

The Global Social Network

Blowout Concerns Delay Confirmation of Pakistan Offshore Oil Discovery

Blowout concerns have stopped offshore drilling in Pakistan yet again. It was underway to confirm discovery of oil and gas in at Kekra-1 well in G-bloc with pre-drill estimate of over 1.5 billion barrels of oil. It was scheduled to restart on April 20, 2019 after pause of 12 days, according to Pakistani media reports. Now it is delayed until the blowout preventer equipment is fixed and ready to use again.

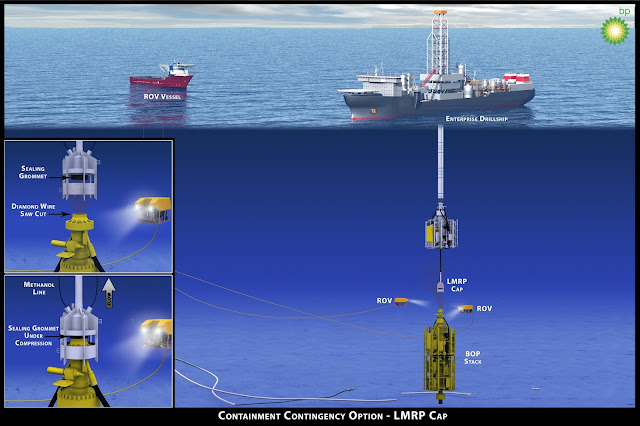

Offshore Blowout Preventer Stack. Courtesy: British Petroleum |

Blowout Preventer Problem:

The drilling was stopped on April 8 at the depth of 4,810 meters for cementing and casing process which took almost 12 days to complete. Now there are concerns about the proper functioning of the blowout preventer (BOP). Once the BOP repair is completed, Mobile Exxon and ENI as joint operators at Kekra-1 well will resume drilling of the remaining 650-800 meters.

Time required to drill the remaining 650-800 meters will depend on the rate of penetration (RoP). Pakistan petroleum ministry officials were quoted by The News as saying that they "don’t yet have precedents to form a reliable estimate for the RoP for offshore Indus-G, where Kekra-01 is being drilled. An RoP of 10 meters per hour (generally considered low) would mean that it would take 80 hours or a little more than three days to reach the target depth.’’

Top 3 Offshore Drilling Sites in Asia-Pacific. Source: Bloomberg |

Exxon-Mobil's Entry in Pakistan:

American energy giant Exxon-Mobil has joined the offshore oil and gas exploration efforts started by Oil and Gas Development Corporation (OGDC), Pakistan Petroleum Limited (PPL) and Italian energy giant ENI, according to media reports.

Each company will have 25% stake in the joint venture under an agreement signed at the Prime Minister’s Secretariat in May among ExxonMobil, Government Holdings Private Limited (GHPL), PPL, ENI and OGDC.

Exxon-Mobile's entry in Pakistan brings deep offshore drilling technology, its long experience and financial resources to the country. It is expected to accelerate exploration and more discoveries.

Pakistan Oil Basins:

A Pakistan Basin Study conducted in 2009 found that the country has six onshore and two offshore basins; offshore basins being the Indus basin and the Makran basin in the Arabian Sea.

The Indus offshore basin is a rift basin that geologists say developed after the separation of the Indian Plate from Africa in the late Jurassic period. It is believed to be the second largest submarine fan system in the world after the Bay of Bengal with high probability of hydrocarbon discoveries.

The Makran Offshore basin is separated from the Indus Offshore basin by Murray ridge, according to Syed Mustafa Amjad's report in Dawn. It is an oceanic and continental crust subduction zone with deepwater trenches and volcanic activity. The basin consists of oceanic crust and periodic emergence of temporary mud islands along the coast suggesting strong evidence of large hydrocarbon deposits.

Pakistan Hydrocarbon Potential:

The United States Energy Information Administration (EIA) estimates that Pakistan has 586 TCF (trillion cubic feet) of gas in Pakistan of which 105 TCF is technically recoverable.

In addition to gas deposits, US EIA estimates there are 227 billion barrels of oil in Pakistan with 9.1 billion barrels being technically recoverable.

Pakistan also has 185 billion tons of coal deposits in Thar desert which are just beginning to be extracted by Sindh Engro Coal Mining Corporation.

Oil and Gas exploration and production companies are currently planning to drill 90 wells in different parts of the country. Under the plan, as many as 50 exploratory and 40 development wells would be drilled in a bid to make the country self-sufficient in the energy sector, according to media reports.

During the last five years, the sources said the exploration and production companies drilled 445 new wells, out of which 221 were exploratory, adding that the increased exploration activities resulted in 116 new oil and gas discoveries.

Current Account Deficits:

Energy imports make up a big chunk of Pakistan's total imports. Bulk of the annual 200 million barrels of oil demand has to be imported. Rising oil prices worsen the current account deficit and put pressure on Pakistan's reserves, forcing the country to seek periodic IMF bailouts.

Pakistan's trade deficit is nearly $40 billion a year and debt service costs are about $11 billion a year. How can Pakistan fund this balance of payments deficit of about $50 billion? Remittances of $21 billion in current FY2019 from Pakistani diaspora are expected to reduce it to $30 billion. PTI government has taken on billions of dollars in loans from Gulf Arabs and China. Given the low rates of foreign investments in the country, a big chunk of the remaining deficit will have to be met by borrowing even more funds which will further increase future debt service costs.

Pakistan's Current Account Deficit. Source: Trading Economics |

As a result, Pakistan is now battling massive twin deficits, deteriorating foreign currency reserves, low exports, diminishing tax revenues, a weak currency, onerous external debt payments, and soaring sovereign debt. This crises has forced the country to seek IMF (International Monetary Fund) bailout, the 13th such request in Pakistan's 72 year history.

Summary:

Blowout concerns have stopped offshore drilling in Pakistan yet again. It was underway to confirm discovery of oil and gas in at Kekra-1 well in G-bloc with pre-drill estimate of over 1.5 billion barrels. Pakistan made 2 key oil and gas discoveries in 3rd quarter and another 3 discoveries in the 4th quarter of 2017. These discoveries appear to have prompted US-based Exxon-Mobil to join off-shore drilling efforts in Pakistan. American energy giant's entry in Pakistan brings advanced ultra deep sea drilling technology, its long experience in offshore exploration and financial resources to the country. It is expected to accelerate exploration and lead to more discoveries. US Energy Information Administration (EIA) estimates that Pakistan has technically recoverable deposits of 105 trillion cubic feet (TCF) of gas and 9.1 billion barrels of oil. Reducing energy imports by increasing domestic production will likely ease Pakistan's current account deficits and reduce its need to seek repeated IMF bailouts.

Here's a discussion on the subject:

Here's a video explaining offshore drilling for oil and gas:

Related Links:

US EIA Estimates of Oil and Gas in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on May 1, 2019 at 4:55pm

-

Pakistan bullish on oil, gas discovery at Kekra-1

https://www.thenews.com.pk/print/465327-pakistan-bullish-on-oil-gas...

Pakistan is expecting discovery of oil and gas reserves in ultra-deep waters offshore Karachi as the drilling at Kekra-1 has almost reached its climax, an official said on Tuesday.

“There is an optimistic prospect of finding energy resources at Kekra-1,” the Special Assistant to the Prime Minister for Petroleum Nadeem Babar said. He was talking to a delegation, headed by Alex Volkov, chairman of Liquefied Natural Gas (LNG) Market Development at Exxon Mobil.

Led by US oil and gas company Exxon Mobil, a consortium consisting of Italian ENI, Oil and Gas Development Company and Pakistan Petroleum Limited is currently conducting offshore drilling at the block. The joint venture of Indus-G block spud an exploratory well – namely Kekra-1 – in ultra-deep water on 13 January, 2019. The well will be drilled up to the total depth of 5,660 meters in ultra deep waters, which is currently at 4,810 meters.

“Drilling has been entered in the phase where it will be easy to estimate that there is any oil or gas,” an official statement said.

Minister for Petroleum Omar Ayub Khan said the government would give all assistance to international investment. The government will defend free and safe investment in the country. The minister said employment would be generated after exploration.

Irtiza Syed, president of Exxon Mobil said the Exxon Mobil is interested in drilling of more offshore blocks and in LNG imports into the country. The company could also help in making of environmental friendly policy for off shore drilling.

The entry of Exxon Mobil in Pakistan is a positive signal for the exploration and production sector of the country. The petroleum division of ministry of energy has already drafted Pakistan Offshore (Exploration and Production) Rules 2019 and Model Production Sharing Agreement 2019, which will be submitted to the cabinet for approval. The government has already waived duties and taxes on import of drilling equipment to encourage indigenous exploration and production of energy resources as the country is confronted with widening gap in energy demand and supply.

The Oil and Gas Regulatory Authority (Ogra) said the gap between the supply and demand is expected to increase to the tune of 4,600 million metric cubic feet / day in FY2022/23 and 6,700 mmcfd by the FY2027/28. The country currently produces around 4,000 mmcfd of natural gas – accounting for 48 percent share in the primary energy mix – against demand of more than 6,000 mmcfd. The demand-supply gap of gas during FY2017/18 was 1,447 mmcfd. The gap is expected to rise to 3,720 mmcfd in the next fiscal year starting from July 2019.

“The possible gap would be bridged through enhancement in indigenous gas exploration and production through incentivising the sector, import of interstate natural gas – through development of cross-country gas pipelines – and increased import of liquefied natural gas,” the Ogra said in its latest state of petroleum industry report.

-

Comment by Riaz Haq on May 8, 2019 at 4:52pm

-

Drilling resumes for #oil #gas at Kekra-1 well (pre-drill est 1.5 billion barrels) offshore from #Karachi in #Pakistan. Now at 5,148 meters depth with 312 m still left to be spudded to reach almost 5,500 meters for final confirmation of massive reserves. https://www.thenews.com.pk/print/467995-final-phase-of-drilling-at-...

ISLAMABAD: At last the drilling at Kekra-1 well in G-bloc, Pakistan’s ultra-deep sea has begun after a long pause of over almost 23 days and entered the final phase by reaching the depth of 5,148 meters and will reach at the required depth of 5,460 meters within days, a senior official told The News.

The joint venture headed by ENI is operator comprising Exxon Mobile, OGDCL and PPL started the drilling on January 13, 2019 at the cost of sunk money of $75 million, which has increased to $90 million so far.

When the drilling reaches the depth of 5,460 meters, the official said, the operator will likely do wire line logging which could take another three or four days. This will likely be followed by another casing and cementing exercise that can take four to six days. At this stage a substantial amount of information regarding the well prospects will be known, however, the results (discovery or dry well) will require completion of proper testing.

Spokesman for the Petroleum Division Additional Secretary Sher Afgan confirmed that the drilling has entered the final phase and reached the depth of 5,148 meters and only 312 meter is left to be spudded as it has to reach almost 5,500 meters. He said after reaching the required depth the operator will get the specimen that will be sent to Italy for information if there is a reservoir of oil and gas in the well or not.

The last snag hit the drilling when the blowout preventer (BOP) that prevents from any blow out or any kick pressure that can result into eruption of fire, had gone out of order and its repair took some days and then its testing took the reasonable time. Before it, the drilling stopped on April 8 because of the cementation and casing continued owing to which the drilling could not start.

So far the drilling witnessed many upheavals starting from January 2019 up till now and it has got delayed by one month as it was earlier scheduled to get completed by April end which is now rescheduled up to the middle of May at the maximum.

The drilling was initiated with 19 percent probabilities, which, according to the experts, get reduced when side tracking starts taking place. In Kekra-1 well case, second side tracking was underway. Officials said when side tracking process is initiated, this means that first plan of drilling was not well worked out.

Earlier when at Kekra well vertical drilling reached at depth of 4,799 meters on February 21, a high pressure was felt causing huge mud loss and because of unsafe operation the well was plugged by March 23. Then the first side tracking started and when it reached down to 3,100 meters, it again met failure, which is why the hole was also blocked. After that the second side tracking began which is still underway and may reach at the required depth within days.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am

Builder.AI: Yet Another Global Indian Scam?

A London-based startup builder.ai, founded by an Indian named Sachin Dev Duggal, recently filed for bankruptcy after its ‘neural network’ was discovered to be 700 Indians coding in India. The company promoted its "code-building AI" to be as easy as "ordering pizza". It was backed by nearly half a billion dollar investment by top tech investors including Microsoft. The company was valued at $1.5 billion. This is the latest among a series of global scams originating in India. …

ContinuePosted by Riaz Haq on June 8, 2025 at 4:30pm — 9 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network