PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Vast Oil Reserves

Pakistan has more shale oil than Canada, according to the US Energy Information Administration (EIA) report released on June 13, 2013.

The US EIA report estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In addition, the latest report says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

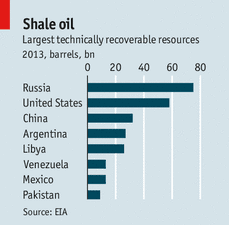

The top ten countries by shale oil reserves include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

Pakistan's current annual consumption of oil is only 150 million barrels. Even if it more than triples in the next few years, the 9.1 billion barrels currently technically recoverable would be enough for over 18 years. Similarly, even if Pakistan current gas demand of 1.6 trillion cubic feet triples in the next few years, it can be met with 105 trillion cubic feet of technically recoverable shale gas for more than 20 years. And with newer technologies on the horizon, the level of technically recoverable shale oil and gas resources could increase substantially in the future.

|

| Source: US EIA Report 2013 |

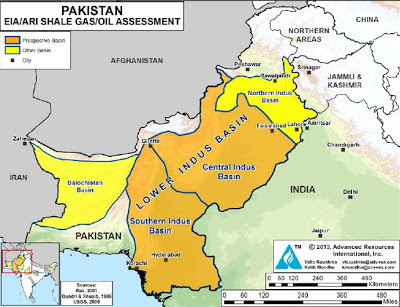

As can be seen in the shale resource map, most of Pakistan's shale oil and gas resources are located in the lower Indus basin region, particularly in Ranikot and Sembar shale formations.

|

| Source: US EIA Report 2013 |

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy has become the life-blood of modern economies. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era. Every modern, industrial society in history has gone through a 20-year period where there was extremely large investment in the power sector, and availability of ample electricity made the transition from a privilege of an urban elite to something every family would have. If Pakistan wishes to join the industrialized world, it will have to do the same by having a comprehensive energy policy and large investments in the power sector. Failure to do so would condemn Pakistanis to a life of poverty and backwardness.

The availability of large domestic shale oil and gas expands the opportunity to reduce Pakistan's dependence on imports to overcome the current energy crisis and to fuel the industrial economy. But it'll only be possible with high priority given to investments in developing the energy sector of the country.

Related Links:

Haq's Musings

US EIA International Data on Per Capita Energy Consumption

Pakistani Guar in Demand For American Shale Fracking

Affordable Fuel for Pakistan's Electricity

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on March 21, 2015 at 3:38pm

-

Pakistan’s exclusive economic zone has grown by 150 nautical miles, adding around 50,000 square kilometres of international waters to its territory.

A United Nations commission has accepted Pakistan’s claim for extension of its continental shelf limits from 200 nautical miles to 350 nautical miles, according to a statement issued by the Pakistan Navy on Friday. “This adds over 50,000 sq kms of continental shelf to the existing 240,000 sq kms of EEZ under Pakistan’s jurisdiction,” its added.

Pakistan now enjoys exclusive rights over the seabed and subsoil resources, allowing it to drill for petroleum or lay submarine cables or pipelines in the added area.

Article 76 of the UN Convention on the Law of the Sea allows coastal states to extend their continental shelf beyond 20 nautical miles. However, the state is required to prove its case through technical data to the UN Commission on the Limits of the Continental Shelf – a body of 21 experts in geology, geophysics, hydrography and related disciplines.

In 2005, the navy and the National Institute of Oceanography with the science and technology ministry had started this project. After years of processing technical data, a submission was made to the UN on April 30, 2009.

A seven-member commission after over a year-long scrutiny, adopted the recommendations for extension of the country’s continental shelf. Pakistan’s delegation gave the final presentation on March 10. The UN has now announced the adoption of Pakistan’s claim.

The navy statement termed the decision a landmark in the country’s history which would bring vast economic benefits through the exploitation of extensive natural resources.http://tribune.com.pk/story/856716/territorial-waters-pakistans-sea...

-

Comment by Riaz Haq on November 19, 2015 at 8:40pm

-

#Pakistan confirms it has 105 trillion cubic ft #shale gas, 58 billion barrels of shale oil reserves #energy http://www.dawn.com/news/1220955

Pakistan has confirmed recoverable reserves of around 200 trillion cubic feet (TCF) of natural gas and around 58 billion barrels of oil in its shale structure — many times larger than existing conventional gas reserves of around 20 TCF and 385 million barrels of oil.

This was stated by Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi at a press conference held here on Thursday to explain main findings of a recently concluded Shale Gas Study based on actual data of existing wells.

“The conclusion (of the study) is that Pakistan has huge potential of shale gas and oil which is much bigger than previous estimates of the United States Energy Information Administration (USEIA) and technology is available at home to produce this resource,” he said.

Also read: Oil and gas reserves found in Mianwali

Mr Abbasi said the country had a massive potential of 10,159 TCF shale gas and 2.3tr barrels of oil. He said the USEIA had reported in April 2011 the presence of 206 TCF shale gas in lower Indus Basin out of which 51 TCF was termed technically recoverable.

However, in June 2013 the USEIA revised the shale gas resource in Pakistan at 586 TCF in place out of which 105 TCF was tipped as risked technically recoverable and also included 9.1bn barrels of shale oil risked technically recoverable out of 227bn barrels shale oil in place.

He said a shale gas study initiated in January 2014 with the support of USAID had been completed. It proved that Pakistan had 10,159 TCF of shale gas resource and 2,323bn barrels of shale oil.

He said the findings were reached when recoverable data of 1,611 wells were collected and shale formation of 1,312 wells through drill was examined. The study covered lower and middle Indus Basin, geographically spread over Sindh, southern Punjab and eastern Balochistan. He said 70 per cent of wells data were used to develop the study.

The minister said the samples were sent to New Tech Laboratory in Houston to verify shale gas and oil resource in place. The study confirmed that Pakistan had the potential of shale gas and oil which was more than expectations.

He said Pakistan had the technology for exploring conventional oil and gas that could be used for exploiting shale oil and gas. However, the country requires more technology for exploiting shale oil and gas resource on a larger scale. He said that real challenges were environmental issues, availability of water and higher cost of drilling. He said one well required 3-8m barrels of water.

Shale gas will cost $10 per Million British Thermal Unit. “We have assigned OGDCL and PPL to explore shale gas and oil from one well to determine cost of extracting them.”

Responding to a question, Mr Abbasi said the natural gas would be available only for domestic consumers in Punjab and even they would not get it between 10pm and 5am. The demand of gas in domestic sector in Punjab is about 950mmcfd, but supplies will be around 650 mmcfd and the difference would need to be met through pressure management.

He said the power plants and fertiliser units would be run on LNG. “CNG sector may also get LNG if supply is available,” he said, adding that captive power plants would also be switched to LNG.

In reply to another question, he said a transparent process had been followed in awarding LNG contract and all required information and record were provided to the National Accountability Bureau. “I have been engaged personally in process of LNG and, therefore, take full responsibility and am available for any questioning or accountability,” he said.

He said that a summary had also been moved to the Council of Common Interests to approve regulation of LPG prices to provide relief to consumers but the CCI had not met for 10 months.

-

Comment by Riaz Haq on November 19, 2015 at 9:09pm

-

#Pakistan has 10,159 trillion cubic feet of #shale gas & 3.2 trillion barrels of shale oil reserves: #USAID #energy http://tribune.com.pk/story/994883/hydrocarbon-presence-pakistan-ha... …

Pakistan has massive deposits of 10,159 trillion cubic feet (tcf) of shale gas and 2.3 trillion barrels of oil – estimates that are several times higher than figures given by the US Energy Information Administration (EIA), reveals a study conducted with the help of US Agency for International Development (USAID).

EIA had reported in April 2011 that 206 tcf of shale gas was present in the lower Indus Basin, of which 51 tcf were technically recoverable.

However, in June 2013, EIA revised the estimate upwards to 586 tcf, of which 105 tcf were tipped as technically recoverable. Apart from gas, EIA also saw the presence of 9.1 billion barrels of shale oil that were technically recoverable out of the estimated deposits of 227 billion barrels.

Speaking at a press conference, Petroleum and Natural Resources Minister Shahid Khaqan Abbasi said the study was undertaken with the support of USAID in January 2014, and was completed in November this year.

He said the study confirmed that Pakistan had 10,159 tcf of shale gas and 2,323 billion barrels of oil reserves.

“Risked technically recoverable resource is 95 trillion cubic feet of shale gas and 14 billion barrels of shale oil,” Abbasi said, adding the data of 1,611 wells had been collected and shale formation of 1,312 wells was done through drilling.

He said 70% of data was used to develop the study and samples were sent to the New Tech laboratory in Houston, US for assessment. “Pakistan has the potential to produce shale gas and oil, which is more than expectations,” he remarked.

Abbasi insisted that the technology in Pakistan for exploring conventional oil and gas deposits could also be used for extracting shale reserves. Still, more technology was required for producing shale oil and gas on a large scale.

He cited environmental issues, provision of water and high cost of drilling as the real challenges. A well requires 3 to 8 million barrels of water.

“We have water but the real issue is its disposal,” he said, adding shale gas would cost $10 per million British thermal units. However, the cost will come down with the increase in recovery of untapped deposits.

He said the world was exploring shale gas and oil and Pakistan also wanted to harness that potential. “We have asked OGDC (Oil and Gas Development Company) and PPL (Pakistan Petroleum Limited) to extract shale gas and oil from a well in order to determine its cost.”

A policy for shale deposits will be formulated after the cost of drilling is determined.

According to Abbasi, Pakistan has 20 trillion cubic feet of conventional gas and 385 million barrels of oil. “Gas is enough to meet the needs for 15 years at the existing pace of production,” he said.

Adviser to Ministry of Petroleum Zaid Muzaffar revealed that OGDC was working on one conventional gas well in a bid to find shale gas and oil. “We hope it will get results in two to three months.”

A well needs $2 to $3 million of additional cost to reach the shale reserves.

Gas supply in winter

Abbasi said gas would be available in Punjab to domestic consumers only and liquefied natural gas (LNG) would be consumed to run power and fertiliser plants.

Compressed natural gas (CNG) stations may get LNG if it was available and captive power plants would also be switched to this fuel, he said.

The minister stressed that the petroleum ministry had followed a transparent process in the award of LNG contract. It has provided all information to the National Accountability Bureau, which has asked for a presentation.

He revealed that the ministry had sent a summary to the Economic Coordination Committee for deregulating oil prices, but it was turned down. “We are looking at the petroleum situation again to assess whether it should be deregulated or not.”

-

Comment by Riaz Haq on November 20, 2015 at 3:52pm

-

Drilling of first #shale oil& gas wells starts in #Sindh, #Pakistan: Minister Abbasi | Business Recorder http://www.brecorder.com/fuel-a-energy/193:pakistan/1248354:drillin... …

The state-owned Exploration and Production (E&P) companies; Pakistan Petroleum Limited (PPL) and Oil and Gas Development Company Limited (OGDCL), have started drilling of country''s first ever shale oil/gas well in Sindh. This was stated by Federal Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi, who was flanked by State Minister for Petroleum Jam Kamal Khan and Advisor Petroleum Ministry Zahid Muzafar, while addressing a press conference here ion Thursday.

He said that in a new study undertaken by Director General Petroleum Concession (DGPC) with financial support from United States Agency for International Development (USAID) the shale gas revised in place resources of the country stand at 10,159 Trillion Cubic Feet (TCF) against previous estimated resources of 586 TCF. The minister said that out of this an estimated 200 TCF of shale gas resources are recoverable against 105 TCF of previous study.

Advisor Petroleum Ministry Zahid Muzafar, who is also Chairman Board of Directors OGDCL, in response to a question on the completion of first shale oil/gas well of the country said that it would be completed within four to five months and after the completion of first well the government will be in a position to determine wellhead price for shale gas/oil. He added that it would be around $10 per Million British Thermal Unit and on the basis of the pilot project the government will devise shale oil/gas policy to formally invite the local as well as international E&P companies to invest in the sector. Abbasi said that the new study had put the shale oil resources at 2,323 Billions of Stock Tank Barrels (BSTB) of which technically recoverable resources were 58 BSTB and risked technically recoverable resources estimated at 14 BSTB.

----

Talking to reporters on the occasion DGPC Saeedullah Shah said that the US Energy Information Administration (USEIA) in April 2011 reported presence of 206 TCF Shale Gas in Place Resource in Lower Indus Basin out of which 51 TCF were technically recoverable. However, in June 2013, USEIA revised Shale Gas resource in Pakistan as 586 TCF in place out of which 105 TCF were tipped as risked technically recoverable and also included 9.1 Billion Barrel Shale Oil risked technically recoverable resource out of 227 Billion Barrel Shale Oil in place.

The DGPC added that to get authenticate Shale Gas Resources in the country, Shale Gas Study with financial support from USAID was initiated in January 2014. The objectives of the study were to (i) validate Shale Gas Resource estimate of USEIA, (ii) assess availability of required technology and infrastructure for Shale Gas operations and (iii) formulate guidelines for Shale Gas Policy. The study was completed in November 2015 with a total cost of $2.2 millions. The study covered lower and middle Indus basin which geographically spread over Sindh and southern part of Punjab and eastern part of Balochistan province. Total area under the study was 271,700 km, which constitutes 33 percent of total sedimentary area of Pakistan. Under the study, detailed analysis of 124 wells were carried out including laboratory analysis on Shale Cores and Cuttings in USA. The study has confirmed presence of substantial Shale Gas and Shale Oil as under:

In place resource: Free gas (TCF), 3,778, adsorbed gas (TCF), 6,381Total gas (TCF), 10,159 and Oil (BSTB), 2,323 of which technically recoverable resource include free gas 188 TCF and Oil 58 BSTB. Risked technically recoverable resources are free gas 95 TCF and oil 14 BSTB.

-

Comment by Riaz Haq on November 20, 2015 at 4:14pm

-

Pak shale gas, oil reserve far higher than past estimate

Pakistan has around 200 trillion cubic feet of recoverable reserve of natural gas and around 58 billion barrels of oil in its shale structure which is higher than estimated previously, Minister for Petroleum and Natural Resources said.

Sharing findings of a recent Shale Gas Study, Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi said the new data shows that reserves were many times larger than existing conventional gas reserves of around 20 trillion cubic feet (TCF) and 385 million barrels of oil.

A shale gas study initiated in January 2014 with the support of United States Agency for International Development (USAID) had been completed, proving that Pakistan had 10,159 TCF of shale gas resource and 2,323 billion barrels of shale oil.

“The conclusion (of the study) is that Pakistan has huge potential of shale gas and oil which is much bigger than previous estimates of the United States Energy Information Administration (USEIA) and technology is available at home to produce this resource,” he said.

He also said the USEIA had reported in April 2011 the presence of 206 TCF shale gas in lower Indus Basin out of which 51 TCF was termed technically recoverable.

USEIA in June 2013 revised it saying that the shale gas resource was at 586 TCF, out of which 105 TCF was tipped as risked technically recoverable.

It also included 9.1 billion barrels of shale oil risked technically recoverable out of 227 billion barrels shale oil in place.

Abbasi said Pakistan’s conventional oil and gas exploration technology could be used for exploiting shale oil and gas but it still needed more advanced technology for exploiting shale oil and gas resource on a larger scale.

He said that the exploration of shale reserves involves huge cost and two local companies Oil and gas Development Corporation Limited and Pakistan petroleum were asked to explore shale gas and oil from one well to determine the cost.

Once exploited, the new reserves will change the economic landscape of Pakistan, which is suffering massive energy shortages.–PTI

http://www.indiapost.com/pak-shale-gas-oil-reserve-far-higher-than-...

-

Comment by Riaz Haq on June 17, 2016 at 9:23pm

-

#Hungary's MOL makes it an even dozen #oil & #gas discoveries in #Pakistan http://upi.com/6332948t via @crudeoilprices

Hungarian energy company MOL said Friday it made a new discovery of oil and gas in Pakistan, bringing the total there so far to an even dozen.

Operating through a national subsidiary in Pakistan, the company said its discovery in the so-called TAL block in Pakistan is No. 8 so far in that basin and No. 12 in its history in the country. MOL has worked in Pakistan for the last 17 years.

"We are very proud of our 8th discovery in the MOL-operated TAL block," Berislav Gaso, MOL's chief officer for exploration and production, said in a statement. "This new discovery will help to improve the energy security of the country."

Pakistan consumes most of the natural gas it produces and the country has faced power issues because of aging infrastructure. According to the Asian Development Bank, addressing chronic energy issues is one of the ways in which Pakistan can ensure its economic growth remains on course.

Pakistan's economy is expected to expand from a 4.2 percent growth rate in 2015 to 4.8 percent by next year. A net importer of energy resources, the ADB said lower oil prices and soft inflationary pressures were pushing Pakistan's economy forward.

MOL said it was producing around 80,000 barrels of oil equivalent per day from the TAL block so far. Reserves flowed from the latest confirmed discovery at a test rate of around 2,000 barrels of oil per day and 900 barrels of oil equivalent in natural gas per day.

-

Comment by Riaz Haq on June 29, 2016 at 4:16pm

-

#Pakistan’s discoveries add 50 million cubic ft per day (mmcfd) of #gas, 2,359 barrels per day (bpd) of #oil levels.

http://tribune.com.pk/story/1132448/pakistans-oil-gas-discoveries-t...

Pakistan has made the highest number of oil and gas discoveries in the current month as exploration companies found fresh hydrocarbon deposits in six wells that will add 50.1 million cubic feet per day (mmcfd) of gas and 2,359 barrels per day (bpd) of oil to the existing production levels.

Of these, major discoveries have been made in Sindh that already has a big share in total gas output in the country.

Gas utilities: World Bank recommends single transmission firm

Petroleum and Natural Resources Minister Shahid Khaqan Abbasi, while speaking during a meeting of the National Assembly Standing Committee on Petroleum and Natural Resources chaired by Bilal Ahmed Virk on Tuesday, said four discoveries were made in Sindh and the remaining two in Khyber-Pakhtunkhwa.

Of these, Oil and Gas Development Company made two finds, MOL Pakistan two and Petroleum Exploration Limited and United Energy Pakistan one each. The discoveries have shown presence of 31.6 mmcfd of gas and 339 bpd of crude oil in Sindh and 18.5 mmcfd of gas and 2,020 bpd of oil in K-P.

Sui Northern Gas Pipelines Limited (SNGPL) Managing Director Amjad Latif warned that the country’s gas reserves were depleting and no gas was available for the domestic consumers in Punjab. He pointed out that the purchasing cost of gas for domestic consumers stood at Rs510 per million British thermal units (mmbtu) but the consumers coming under the first slab were receiving it at Rs110 per mmbtu.

Eighty-five per cent of domestic consumers were paying less than 50% of the cost of gas and the industrial and commercial consumers were cross-subsiding the domestic consumers, he said.

However, now industrial and commercial consumers were being provided imported liquefied natural gas (LNG), so the burden of cross-subsidy had been shifted to SNGPL that was feeling the strain on its finances.

Though the gas production was declining, Latif told the committee that the company would lay pipelines over 8,000 km in the current year. At present, 1.5 million applications for new gas connections are awaiting approval of the company.

The country was facing gas shortages as politicians were using it as a tool to win elections.

During the meeting, National Assembly member Mian Tariq Mehmood, who belonged to the ruling PML-N, alleged that SNGPL had provided 100 gas meters in his constituency to please his political rival Imtiaz Safdar Warraich, though his requests for new meters were turned down repeatedly.

He insisted that the provision of gas meters to his opponent had damaged his political image. NA Standing Committee Chairman Bilal Ahmed Virk accused Director General Petroleum Concession Saeedullah Shah of not responding to the committee for the last two years.

Sui lease extension: PPL to pay 10% bonus to Balochistan

Describing Shah’s attitude as non-sense, he said he was not cooperating with the committee and sought the record of past meetings to show response of the director general of petroleum concession.

The committee also took up for review the issuance of licences for liquefied petroleum gas (LPG) stations to the defaulters that were previously running CNG stations.

It recommended that rules of Oil and Gas Regulatory Authority (Ogra) should be amended to ensure the clearance of outstanding bills of SNGPL, Water and Power Development Authority and banks before issuing licences for setting up LPG stations.

-

Comment by Riaz Haq on June 7, 2023 at 1:02pm

-

A review of Pakistani shales for shale gas exploration and comparison to North American shale plays

Author links open overlay panel Ghulam Mohyuddin Sohail a, Ahmed E. Radwan b, Mohamed Mahmoud c

https://www.sciencedirect.com/science/article/pii/S235248472200840X

Recent advancements in technologies to produce natural gas from shales at economic rates has revealed new horizons for hydrocarbon exploration and development worldwide. The importance of shale oil and gas has aroused worldwide interest after the great success of production in North America. In this study, different marine source rocks of Pakistan are evaluated for their shale gas potential using analogs selected from various North American shales for which data have been published. Pakistani formations reviewed are the Datta (shaly sandstone), Hangu (sandy shale), Patala (sandy shale), Ranikot (shaly sandstone), Sembar (sandy shale) and Lower Goru (shaly sandstone) formations, all of which are known source rocks in the Indus Basin. Available geological data of twenty-six wells (e.g., geological age, depositional environment, lithology and thickness), geochemical data (e.g., total organic carbon (TOC), vitrinite reflectance (Ro), rock pyrolysis analysis and maturity), petrophysical data (e.g., porosity and permeability) and dynamic elastic parameters estimated from logs (Young’s modulus and Poisson’s ratio) have been investigated. According to this study, the Pakistani shales are explicitly correlated with the most active shale gas plays of North America. The burial depths or geological position of the Pakistani shales are generally comparable to or slightly higher than the North American shales based on the available data. The thicknesses of the Pakistani (except for the Sembar shale) and North American shales fall in similar ranges. In terms of mineralogical composition, all of the Pakistani shales except the Ranikot and Hangu shales have quartz contents in the 40% to 50% range (approximately), which is similar to most of the North American shales. The high maximum TOC of the Hangu and Sembar shales (10%) is comparable to the New Albany, Antrim and Duvernay shales. The maximum TOC values for the Ranikot (3%), Lower Goru (1.5%) and Datta (2%) shales are lower than all North American shales. The TOC of Patal Shale (

5%–10%) is comparable to Fayetteville and Eagle Ford shales. The geological and geochemical parameters of all the Pakistani shales reviewed in this work are promising regarding their shale gas prospects. However, geomechanical data are required before conclusions on these shales’ economic production can be made with confidence.

-------------------

The exploitation of shale gas reservoirs may enhance gas production and reduce the severity of the ongoing energy crisis. The main challenge in Pakistan is to evaluate the shales using limited data and samples. That is why only a few companies are working on shale gas reservoirs in Pakistan now. The researchers need to assess and rank prospective Pakistani shales to entice companies to consider shale gas development. The geological characterization of Pakistani shales has been investigated by several authors (e.g., Warwick et al., 1995, Kazmi and Abbasi, 2008, Ahmad et al., 2012, Hakro and Baig, 2013, Jalees, 2014), but detailed work is required on geochemical, petrophysical and geomechanical characterization for assessing the actual potential of shales in Pakistan (Abbasi et al., 2014).

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network