PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction Boom Resumes in Pakistan

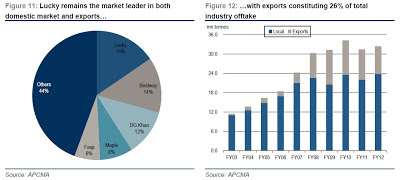

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on June 25, 2014 at 3:37pm

-

The first ten months of this fiscal year have witnessed 21.3 million tonnes of cement industry dispatches in local market, showing a growth of 2.7 per cent as compared to same period last year. The overall situation during the period showed a growth of 1.17 per cent as compared to the same period of the last fiscal year, as total dispatches increased to 27.986 million tonnes against 27.664 million tonnes from July 2012 to April 2013.

-

Comment by Riaz Haq on June 26, 2014 at 7:49am

-

Here's Tech In Asia on Pakistan's online real estate listings portals:

In Pakistan, one homegrown startup is now facing a wave of overseas tech companies entering the country as more investors see the appeal of this growing – yet troubled – emerging market. In the online property listings niche, Zameen started early, founded by British-Pakistani entrepreneur brothers Zeeshan Ali Khan and Imran Ali Khan way back in 2006. It then grew to become the nation’s top real estate site. According to Shehryar Qureshi, Zameen’s marketing manager, it now covers 500,000 verified listings of places to rent or buy across Pakistan. Despite Pakistan having barely 15 million mobile internet users (from about 130 million total mobile SIM subscribers), foreign firms are rushing in to compete in some of the most easily monetizable parts of the web – things like ecommerce and ad-supported web portals. That includes online property listings. As a consequence, Zameen is now up against classifieds sites like OLX Pakistan (a branch of Argentina-born OLX) and the brand-new Dekho.com.pk (created by Sweden-based venture incubator Saltside, which got US$25 million in funding last week to expand into more emerging nations). But Zameen’s biggest challenger is a dedicated property site of the same genus – Rocket Internet’s Lamudi. Lamudi launched in Pakistan in January this year, marking the 16th nation entered by this spin-off from the German startup dynamo that is Rocket Internet. It’s more like Zameen than any other competitor and is the rival most likely to scale quickly. It’s part of a huge push into Pakistan by Rocket, which now covers seven startup sites in the nation. See: The future of the mobile internet is in Asia So far, Zameen is keeping its lead. Aside from having more listings, Qureshi says that the incumbent site is ahead with 700,000 monthly visitors in Pakistan alone. Qureshi points out that Zameen is adding more funding and extra know-how to prepare it for the tougher battle ahead. Last month Zameen secured an undisclosed amount of funding from Singapore’s Catcha Group and Malaysia-based Frontier Digital Ventures that gives the new investors a collective 30 percent stake. That also brings in expertise from Frontier Digital Ventures co-founder Shaun Di Gregorio, the CEO of iProperty, who joins the startup’s board of directors. Earlier in 2012 a similar thing happened when French investor Gilles Blanchard, who co-founded SeLoger, France’s largest property portal, came on board as an angel investor and also took up the role of Zameen chairman. Since the startup’s founders are part of the Pakistani diaspora, the business is taking into account the spending power of the nation’s overseas businesspeople. That’s why Zameen has extra offices in London and Dubai, catering to members of the diaspora looking for property investment opportunities in their home country.

Read more: Pakistan’s Zameen braces for growing competition from every startup’s nemesis: Rocket Internet....

http://www.techinasia.com/pakistan-zameen-property-portal-battles-r...

-

Comment by Riaz Haq on October 9, 2014 at 11:28pm

-

Pakistan is a country is identified as one of the rapidly emerging markets, which is further reaffirmed by the fact that Pakistan has the 27th largest purchasing power parity in the world. It is also the 15th largest trader of goods and seventh largest trader of services.

The Ministry of Finance in Pakistan conducts an annual economic survey, and according to the survey for the year 2012 – 2013, the ‘manufacturing sector accounts for 13.2% of Gross Domestic Product (GDP) and 13.8% of the total employed labour force. Large Scale Manufacturing (LSM), at 10.6% of GDP, dominates the overall sector, accounting for 81% of the sectoral share.’ The manufacturing industry is considered to be the backbone of economic prosperity for any country and, therefore, growth of the sector itself is very important.

Pakistan’s cement industry – yesterday

With the industry facing its own share of ups and downs, the history of the cement sector in Pakistan has been an eventful one. The industry, which started with only four plants and a production capacity of 0.5 million t, now boasts 24 integrated facilities and an installed production capacity of 44.64 million t.

During the 1950s, five cement plants were set up with a combined capacity of 2.8 million t. This number soared to 14 operational plants by the end of 1969. However, setbacks such as the nationalisation of state-owned plants, to form the State Cement Corporation of Pakistan following the Economic Reforms Era in 1972, hampered growth.

Nevertheless, policy changes in the late 1980s and ever increasing demand for housing encouraged the private sector to step forward. Seven more plants were set up with a combined capacity of 2.54 million t. The public sector also invested in four new cement grinding units, thereby increasing the total production capacity. However, it was not until the year 2000 that the country’s cement industry began to experience rapid expansion, with production capacity increasing from 16 million t to over 44 million t today.

Pakistan’s cement industry – today

At present, the cement industry directly and indirectly employs over 150 000 people and supports a host of subsectors, including the construction, shipping, packaging and logistic industries. The industry contributes handsomely to the national exchequer in the form of duties and taxes, and is bringing in foreign reserves through exports.

In the first nine months of FY14, the cement sector exported 6.017 million t of cement and clinker. The domestic cement market is divided into two large clusters, namely the North and the South regions, which absorb a large portion of local production. The remaining portion is exported to countries such as Afghanistan, South Africa, Iraq, India, Sri Lanka, Tanzania, Djibouti, Mozambique, Sudan and Kenya, among many others.------

Pakistan is one of the top 20 producers and the eighth leading exporter of cement in the world. With the global cement market constantly expanding, there is a huge opportunity for Pakistani cement manufacturers to export their products to the Middle East, Africa and developing countries in other regions.

Lucky Cement has recently started operations in Iraq in an effort to meet the immense demand in the country as it rebuilds its infrastructure. The plant, Al Mabrooka Cement, is a joint venture grinding unit located near the port in Basrah. The company is now set to start operations in DR Congo in 2016 in another joint venture cement plant, Nyumba Ya Akiba.

Additionally, Gwadar, a planned free trade port city on the Arabian Sea coastline of Pakistan in the Balochistan province, is expected to help increase exports due to its strategic location and close proximity to the Gulf countries. Even within the country, the industry can greatly contribute to the government’s plan to upgrade infrastructure, constructing dams and providing housing to the poor.

http://www.worldcement.com/news/cement/articles/Pakistans-Potential...

-

Comment by Riaz Haq on October 25, 2014 at 11:14am

-

LAHORE: The cement industry of Pakistan is one of the main stream sectors that generates foreign exchange for the country due to its certified quality.

The main reason why Pakistani cement is preferred by other countries is due to the abundance of its basic raw material, limestone. However, the country is still far behind in introducing different varieties of cement to be used in different categories. The most commonly used cement is the Ordinary Portland Cement (OPC) in order to meet all construction requirements.

“The construction sector is expanding and there is dire need to introduce new cement qualities in Pakistan for better efficiency and cost reduction,” said Nabeel Asghar, head of project and operations, Technology Up gradation and Skill Development Company (TUSDEC), while talking to The Express Tribune.

Tusdec is operating a subsidiary – Cement Research and Development Institute – through which it is testing the quality of cement and allied materials. The institute was established in 1983 by the State Cement Corporation, at that time primarily for the Kalabagh Dam. Inauspiciously, the institute started lurking into dormancy and was looming in abjection in 2005, when Tusdec was entrusted with its operations on January 2006.

The institute after its re-launch was primarily testing different samples from cement manufacturers, contractors and consultants for quality certifications, however, the institute started testing samples to introduce Blended cement, and Fly-Ash cement.

Though blended cement is being manufactured in Pakistan by a single manufacturer, but at large, the contractors of mega projects mix other materials in OPC for mega structures, like dams, bridges, highways etc.

“For instance if we talk about the overall housing industry, contractors widely use OPC for constructing walls, and for renovating them,” Asghar said, adding that very few know that in the modern world Masonry cement is used for wall furnishings since low level cement is required.

Counterfeiting the impact of its strengths, the cement industry of the country is lagging behind when it comes to innovation due to the sink in latest technological advancements, he said.

The industry is also suffering from a lack of skillful human resource at each tier. The induction of manpower is required to enhance the output quality while minimising the cost and augmenting the distribution channels.http://tribune.com.pk/story/780103/construction-sector-cement-indus...

-

Comment by Riaz Haq on November 12, 2014 at 8:48pm

-

Pakistani cement sales volumes up almost 9% in first 4 months

In Pakistan, cement sales have reportedly grown 8.87% in the first four months of the current fiscal year, reaching more than 8 million t. Customs Today reports that overall exports decreased y/y to 2.79 million t, a 4.43% drop.

There is something of a north/south divide in sales, with the northern region seeing a 10.4% gain in domestic sales but a 12.3% drop in exports, while southern cement producers reported a much smaller increase in domestic sales but a 12.5% increase in exports.

The All Pakistan Cement Manufacturers Association has reportedly claimed that government inaction has impeded industry growth. Fuel and power cost increases have put pressure on companies’ margins, as shown in the quarterly results reported last month. Increased taxes were also reported as an issue affecting the companies’ bottom lines.

http://www.worldcement.com/news/contracts/articles/Pakistani-cement...

-

Comment by Riaz Haq on January 15, 2015 at 10:24pm

-

Pakistan’s first real estate investment trust will offer an initial 9 percent dividend and stakes in one of Karachi’s most prominent malls and office towers when it sells shares within three months.

A 25 percent stake in the Dolmen City Real Estate Investment Trust will be offered to foreign and domestic investors, said Nasim Beg, chairman of Arif Habib Dolmen REIT Management Ltd. The trust’s assets will be the Dolmen Mall, which hosts stores including Mango and Debenhams, and the adjacent office building that houses Engro Corp. Both are near the Karachi seafront, one of Pakistan’s wealthiest areas.

“The outlook of the real estate market is not too relevant,” Beg said yesterday in an interview in Karachi. “Investors will be paid dividends from rental income that will continue to grow as per agreements.”

The trust is likely to pay a dividend of 9 percent in first year and increase to 14 percent in the fifth year, said Muhammad Ejaz, chief executive of Arif Habib Dolmen REIT Management. The dividend yield of the benchmark KSE100 stock index is currently 4.4 percent, according to data compiled by Bloomberg.

Prime Minister Nawaz Sharif’s government is broadening investment options in Pakistan as it seeks to spur economic growth in the midst of an escalating conflict with domestic Islamist militants. The Pakistani Taliban killed 134 students on Dec. 16 in one of the country’s worst terrorist attacks.

Beg said he expects four or five other REITs to be listed on the Karachi Stock Exchange within two years.

“Improved regulation surrounding the creation of real estate investment trusts could pave the way for increased investment via this format and lead to more Pakistani investment being directed in the home market rather than overseas,” London-based Business Monitor International said in its latest report on Pakistani real estate, released this month.

The property that will go into the Dolmen City REIT is owned 80 percent by Dolmen Group and 20 percent by Arif Habib Group. After the IPO of the trust, those stakes will drop to 60 percent and 15 percent respectively.

http://www.bloomberg.com/news/2015-01-15/first-pakistan-reit-to-off...

-

Comment by Riaz Haq on February 12, 2015 at 8:04am

-

With over 6% growth in sales in the first seven months of the current fiscal year, analysts say the cement industry is set to post highest-ever growth rate in the last five years.

This growth is more important for the cement industry officials as it is mainly based on local sales unlike the pre-2010 period when the industry used to equally rely on exports.

“Cement industry’s domestic sales have surprised everyone and the growth has surpassed all market estimates. Industry is likely to grow over 6% as it has risen in the first seven months (Jul-Jan 2014-15),” industry analyst Saad Hashmi commented.

Average growth in cement production was just 2.9% in the last three years. However, cement sales have shown an exceptional 6.2% growth in the first seven months in fiscal year 2015. Even if the industry succeeds in maintaining the current growth at the end of the fiscal year, it will be the highest expansion rate in the last five years.

Cement production posted the highest-ever number of 34.28 million tons in the last fiscal year 2013-14. Dispatches increased to 20.02 million tons during the first seven months of 2014-15 compared to 18.86 million tons in the same period of previous fiscal year. This means the industry can touch 36.6 million tons by the end of June 2015 if it grows at the current pace of 6.2%.

In all likelihood, Hashmi said the cement industry will succeed in maintaining 6% growth because the remaining five months (February to June) are all those in which the construction activity remains high.

Owing to the continuous decline in cement exports over the last five years, the industry is increasingly dependent on local sales. The impact of the rise in domestic consumption is so strong that while issuing the latest data, the spokesperson for the All Pakistan Cement Manufacturers Association recently claimed, “higher cement uptake depicts a turnaround in the economy.”

Commenting on the ‘immense satisfaction’ of the industry from rising domestic demand, he said cement companies have been reaping the benefits of record low international coal prices that have significantly reduced the cost of production.

Construction sector

Association of Builders and Developers Pakistan (ABAD) former senior vice chairman Saleem Kassim Patel told The Express Tribune that the private sector is showing a strong growth, which is one of the main causes of high cement consumption in the country.

“There is a huge backlog of houses, which is why this sector will continue to attract investments. What is more important is that the current rise in construction activities can turn around the economy if the government starts supporting it,” said Patel.

However, one of the biggest hurdles to the fast growth of the construction sector is the moratorium on new gas connections for high-rise buildings. Without gas, thousands of already constructed residential buildings are still unoccupied, causing financial losses of millions of rupees to the builders and their clients, he added.

Owing to the growing shortage of gas, the PPP-led previous government banned all new gas connections to CNG stations, high-rise buildings and industries in 2011. Since then, builders and developers say the ban has been proving damaging for new investments in this sector.http://tribune.com.pk/story/833623/cement-industry-sector-likely-to...

-

Comment by Riaz Haq on April 13, 2015 at 3:39pm

-

Last year, the world produced 3.6 billion tons of cement—the mineral mixture that solidifies into concrete when added to water, sand and other materials—and that amount could increase by a billion tons by 2050. Globally, the only substance people use more of than concrete, in total volume, is water.

Cement’s virtues, Vlasopoulos says, have long been plain: It is inexpensive, pourable and, somewhat inexplicably, becomes hard as a rock. But one other important detail is seldom acknowledged: Cement is dirty. Not dirty as in it won’t come off your clothes—although that problem has dogged construction workers for centuries. The key ingredient is limestone, mostly calcium carbonate, the remains of shelled marine creatures. The recipe for making cement calls for heating the limestone, which requires fossil fuels. And when heated, limestone sends carbon dioxide gas wafting into the atmosphere, where it traps heat, contributing to global warming. Cement production is responsible for 5 percent of the world’s human-produced carbon dioxide emissions; in the United States, only fossil fuel consumption (for transportation, electricity, chemical manufacturing and other uses) and the iron and steel industry release more of the greenhouse gas. And with booming countries such as China and India using cement to construct their rise, cement’s dirtiness looms as one of the foremost downsides of globalization.

-------

People have been trying to build a better cement since just about the beginning of history. More than 2,000 years ago, the Romans devised a mixture of lime, volcanic ash and chunks of stone to form concrete, which was used to make harbors, monuments and buildings—the glue of early cities—including the Pantheon and the Colosseum. In the 1820s, in Leeds, England, about 200 miles from Imperial College, a stone mason named Joseph Aspdin invented modern cement. Aspdin heated a concoction of finely ground limestone and clay in his kitchen. After he added water, the mixture hardened. Voilà—the building block of the Industrial Revolution was born. Because the material looked like a popular building stone from the Isle of Portland, Aspdin called his invention Portland cement. The patent, issued in 1824, was for “an improvement in the mode of producing an artificial stone.”

The Australian developers had tried a new recipe, mixing Portland cement with magnesium oxide. They hoped to reduce carbon emissions because magnesium oxide can take the place of some of the limestone, and magnesium oxide does not have to be heated at such a high temperature. Limestone must be heated to 2,600 degrees Fahrenheit, but magnesium oxide can be prepared for cement at 1,300 degrees, a temperature that can be attained with biomass and other fuels that release less carbon, cutting down on fossil fuel consumption.

But Vlasopoulos quickly discovered that the blend did not reduce overall carbon dioxide emissions. In some tests, the emissions nearly doubled, because magnesium oxide itself is produced by heating magnesium carbonates, a process that releases carbon dioxide.

“I remember feeling very disappointed because when you see that the project you’re working on is not actually what you thought it was going to be, you lose motivation,” he said. “But we felt it was a very worthwhile project, a worthwhile idea, so we tried to find another way to solve the problem.”

At the time Vlasopoulos took up the question, in 2004, big cement firms around the world were looking for new ways to make Portland cement more environmentally palatable. The producers added steel byproducts, such as slag; coal residues, such as fly ash; and other materials, such as magnesium oxide, to bulk up the cement mixture, requiring less Portland cement. They experimented with mineral additives to reduce the temperatures needed to prepare the materials.

Read more: http://www.smithsonianmag.com/science-nature/building-a-better-worl...

-

Comment by Riaz Haq on June 30, 2015 at 4:47pm

-

In the 'Best Hidden' Frontier Market, a Boom Signals a Pakistan RevivalConstruction is leading the way in a big expansionby Faseeh MangiJune 30, 2015 — 12:00 PM PDT

The Bahria Town Icon, right, under construction stands over the Sufi shrine of Abdullah Shah Ghazi in Karachi, on June 28, 2015. Photographer: Asim Hafeez/Bloomberg

The Sufi shrine that dates to the 8th century in Karachi’s posh Clifton neighborhood has served as the area’s defining landmark for decades. Not anymore.

Dwarfing the monument today is a gleaming 62-story highrise, coming up right next door. The building is one of at least half a dozen projects springing up in the locality as developers from Dubai’s Emaar Properties PJSC to local tycoons change the face of Pakistan’s financial hub and the skylines of many smaller towns.The construction boom also marks the nation’s emergence as a frontier market after Prime Minister Nawaz Sharif averted a balance-of-payments crisis with help from the International Monetary Fund and resumed selling stakes in state companies. He is boosting infrastructure spending as the $232 billion economy expands at the fastest pace since 2008 amid the cheapest borrowing costs in 42 years.“It is the best, undiscovered investment opportunity in emerging or frontier markets,” said Charlie Robertson, London-based chief economist at Renaissance Capital Ltd. “What’s changed is the delivery of reforms -- privatization, an improved fiscal picture and good relations with the IMF.”Shrugging off sectarian violence, bombings, killings and kidnappings, the benchmark KSE100 stock index has advanced about 16 percent in the past 12 months, featuring among the world’s top 10 performers.D.G. Khan Cement Co., controlled by billionaire Mian Muhammad Mansha, and Cherat Cement Co. have announced expansion plans, while steelmakers are selling shares.Steel IPOsAmreli Steels Ltd., the nation’s biggest maker of steel bars used in construction, isplanning a share sale to help double capacity. Mughal Iron & Steel Industries Ltd. completed an initial public offering in April.Pakistan’s cement industry has rallied 57 percent in the past year, more than triple the gains by the benchmark, according to data compiled by Bloomberg. D.G. Khan Cement, the third-largest maker of the construction material, has jumped 62 percent and Maple Leaf Cement Factory Ltd. has surged 161 percent and Fauji Cement Co. Ltd. has gained 81 percent.“The construction industry is seeing a boom, and there is still juice left in the cement rally,” said Mir Muhammad Ali, chief executive officer of UBL Fund Managers Ltd. that handles about 56 billion rupees ($550 million) in stocks and bonds in Karachi. “Overall economic improvement has also helped.”Sharif, who took power in May 2013, boosted infrastructure spending by 27 percent to 1.5 trillion rupees for the year starting Wednesday, July 1.IMF ProgramPakistan is making “significant progress” in meeting targets under its $6.6 billion loan program, the International Monetary Fund said in May. The lender predicted a 4.5 percent growth in the economy in the year starting July 1, following a 4.1 percent expansion last fiscal year.Easing prices are also set to buoy consumer spending. Inflation in South Asia’s second-largest economy slowed each month this year through April as transport and food prices fell, prompting the central bank to cut the benchmark interest rate in May to the lowest level in 42 years.Moody’s Investors Service upgraded Pakistan’s sovereign credit ratings for the first time since 2008 in June but said stalling of the ongoing IMF program or an unstable political environment would be credit negative.ChinaViolence, mostly from Taliban-linked insurgents who want to impose their version of Islamic law, has claimed more than 60,000 lives since 2001. Sharif survived a scare last August when opposition parties demanded his resignation over accusations he rigged the elections in 2013. He denied the allegation but agreed to a probe by a tribunal.Standing by Pakistan is the nation’s long-time strategic ally. In April, Asia’s biggest economy, China, signed deals for $28 billion of investments in Pakistan as part of a planned $45 billion economic corridor that includes power plants and dams.The development in cities and smaller towns is trickling down and is good news for smaller contractors as well .“Business has been very good, and there’s no doubt my work has tripled in five years,” said Mohammed Hassan Bakshi, 43, a builder in Karachi. “There’s huge demand from the middle class for affordable housing.”Builders in Pakistan are seeking technology from China to help cut down construction and project execution times to as little as six months from as long as five years, he said.The nation’s construction sector grew by 11.3 percent in the year through June 2014, almost double the 5.7 percent target, according to central bank data. Pakistan is a reform story like neighboring India’s, but only better, said Renaissance’s Robertson.“All of this is a big change on 2013,” he said. “Credit rating agencies are beginning to recognize this.”

-

Comment by Riaz Haq on August 31, 2015 at 9:40pm

-

Pakistan’s Lucky Cement Ltd. is close to winning a permit to extract limestone in Punjab province, signaling expansion plans by the nation’s largest maker of the building material by market value.

The company will get a limestone quarry for a cement plant in Punjab, and the local administration has approved the deal, said Arshad Mehmood, secretary for Punjab’s mines and minerals department. An agreement is expected to be signed in the next few days, he said.

The Karachi-based cement maker is set to join producers including Attock Cement Pakistan Ltd. and D.G. Khan Cement Ltd. that have announced expansion plans as Prime Minister Nawaz Sharif looks to boost infrastructure spending.

“Everything is positive for construction,” Bilal Khan analyst at Karachi-based Global Securities Pakistan Ltd., said by phone. “If growth stays at the same pace, the person who decides to expand today is the winner.”

Sharif is seeking to accelerate growth in the $247 billion economy to the fastest pace since 2008 with the spending, while China and Pakistan have announced a 3,000-kilometer, $46 billion economic corridor, which includes roads, ports, power plants and dams.

Lucky Cement’s shares have advanced about 50 percent in the past year, outperforming the 21 percent gain in the benchmark KSE100 Index. Shares fell 1 percent to 523 rupees as of 10:21 a.m. local time. They rose to a record last month.

The company operates two plants at 85 percent of capacity in Pakistan. It also has a cement grinding facility in Iraq and is part of a venture that will build a cement plant in the Democratic Republic of Congo.http://www.bloomberg.com/news/articles/2015-08-31/pakistan-s-bigges...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India's Modi Brags About Ordering Transnational Assassinations

In a campaign speech on May 1, Indian Prime Minister Narendra Modi bragged about his campaign of transnational assassinations of individuals he has labeled "terrorists". “Today, India doesn't send dossiers to the masters of terrorism, but gives them a dose and kills them on their home turf", he is reported to have said, according to a tweet posted by his BJP party. Last…

ContinuePosted by Riaz Haq on May 3, 2024 at 5:09pm — 2 Comments

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network