PakAlumni Worldwide: The Global Social Network

The Global Social Network

Vibrant Financial Services Sector in Pakistan

Pakistan has been ranked 34 out of 52 countries in the World Economic Forum's first Financial Development Report, which was released in Pakistan through the Competitiveness Support Fund (CSF) in December, 2008.

The report is a comprehensive analysis of financial systems and capital markets in 52 countries that explores key drivers of financial system development and economic growth in developing and developed countries and serves as a tool by which countries can benchmark themselves and establish priorities for financial system improvement.

Arthur Bayhan, Chief Executive of the Competitiveness Support, told the media: "I am very happy to see that financial system in Pakistan is well reformed and competitive vis-à-vis Asia and Europe. Pakistan is ranked ahead of the Russian Federation (35), Indonesia (38), Turkey (39), Poland (41), Brazil (40), Philippines (48) and Kazakhstan (45)."

The United States narrowly edged the United Kingdom to take the top position in the Financial Development Index. The United Kingdom was second while China ranked 24 and India 31.

The Financial Development Index is based on three main pillars - Factors, Policies and Institutions, Financial Intermediation and Capital Availability and Access. These are further divided into sub - pillars.

Under Factors, Policies and Institutions pillar, Pakistan ranks 49th in institutional environment, 50th in business environment and 37th in Financial Stability. In the Financial Intermediation Pillar Pakistan ranks 25th in banks, 42nd in non banks and 17th in Financial Markets. Under Capital Availability and Access, Pakistan ranks 33rd.

Indicators showed that in business environment Pakistan had development advantage in Cost to Export, ranking 6th, Cost of closing business 5th.

In Financial Stability Change in Real Effective Exchange rate ranked 20th, External debt to GDP 10th, Frequency of banking crises 1st, stability index 15th.

In corporate governance Pakistan ranked at the very top in shareholder rights index, 14th in strength of investor protection.

In the Non banks pillar, Pakistan ranked 9th in the Real growth of direct insurance premiums. In equity market movement Pakistan ranked at the top again in equity market turnover.

Importance of Financial Services Sector:

Banks are often described as a nation's economic engine, in part because they provide financial intermediation functions between savers/investors who are looking for safety and growth and consumers/businesses who are looking for access to credit and capital.Banks also play a major role as instruments of the government's monetary policy aimed at regulating interest rates and money supply in the economy. The current economic crisis in the United States and Europe, marked by the ongoing weakness of major banks and the resulting credit and capital crunch, underlines the critical importance of the banking sector in national and global economies. Recognizing the crucial importance of the financial sector in global economic recovery, the Obama administration is allocating the bulk of the stimulus money to restore the health of major U.S. banks.

Banking in Pakistan:

Between 2002 and 2007, Pakistan's accelerated economic growth was underpinned by a strong banking sector. Classified as Pakistan’s and region’s best performing sector, the banking industry’s assets rose to over $60 billion, its profitability remains high, non-performing loans (NPLs) are low, credit is fairly diversified and bank-wide system risks are well-contained. Almost 81% of banking assets are in private hands. Likewise, the present foreign stake comes to 47% of total paid-up capital of all the financial institutions regulated by Pakistan's central bank, the State Bank of Pakistan.

Pakistan's foreign reserves hit a record high of $16.5 billion in October 2007 but fell to $6.6 billion in November, largely because of a soaring import bill. As the commodity prices rose and inflation in Pakistan reached near 25%, the State Bank of Pakistan was forced to raise its discount rates to as high as 15%. However, there has been a dramatic decline in the cost of imports such as oil during the last few months, spelling relief for Pakistan and other non-OPEC developing nations. The price of oil has dropped to about a quarter of what it was last summer.

Pakistan signed a $7.6 billion loan agreement with the International Monetary Fund in November to stave off a balance of payments crisis. It received its first tranche of $3.1 billion that month. In its first assessment since November, IMF has expressed satisfaction with Pakistan's progress. “Initial developments under the program have been positive,” IMF spokesman David Hawley told a regular news briefing, according to Pakistan's Dawn newspaper. “The foreign exchange rate has appreciated somewhat and preliminary information suggests that end-December targets for net international reserves and net domestic assets at the State Bank of Pakistan were met,” he added.

Pakistan's economy deteriorated sharply over the course of 2008, as inflation surged, and the current account deficits jumped on the back of rising oil and food prices, according to a World Bank report.

The report titled ‘Global Economic Prospects 2009’ says political turmoil and ongoing security concerns have also taken a toll on Pakistan’s economy, while the global financial crisis added substantial downward pressures on its financial markets. Pakistan and the International Monetary Fund agreed to lower the target for the gross domestic growth this fiscal year to 2.5 per cent from 3.5 per cent but many analysts said even achieving this target would be very ambitious.

The general deterioration in regional trade balances has been offset by large remittance inflows, which represent a sizable, and generally increasing share of GDP: during 2007, 14 per cent in Nepal, 8 per cent in Bangladesh and Sri Lanka, 4 per cent in Pakistan, and 3 per cent in India.

Given strong underlying growth dynamics in South Asia, the negative feedback effects of the global financial crisis are expected to be temporary. A relatively rapid rebound is expected in 2010, with a projected revival of GDP growth to 7.2 per cent.

During 2001-2007, former Prime Minister Shaukat Aziz, a banker by training and extensive experience in New York, understood the role of banking, finance, investment and consumer credit in economic growth of a nation. He focused on building strong banking, investment and finance sectors in Pakistan to underpin its economy. He strengthened capital availability, an essential and increasingly important economic input, in addition to labor and land improvements. With higher education budget up 15-fold and overall education spending up 36% in two years, he focused on education to improve the availability of skilled labor to fill new jobs. He pushed land development and public and private construction spending to improve infrastructure and facilities to attract greater business investment and create jobs. Mr. Aziz was largely successful in his efforts.

In general, there are primarily two types of banks in Pakistan: Commercial Banks and Investment Banks. Both types of banks provide financial services essential for Pakistan's economy to function and grow.

Commercial Banks:

Commercial Banks are privately-owned institutions that, generally, accept deposits and make loans. Deposits are money people entrust to an institution with the understanding that they can get it back at any time or at an agreed-upon future date. A loan is money let out to a borrower to be generally paid back with interest. This action of taking deposits and making loans is called financial intermediation. A bank's business, however, does not end there.

Most people and businesses pay their bills with bank checking accounts, placing banks at the center of our payments system. Banks are the major source of consumer loans -- loans for cars, houses, education -- as well as main lenders to businesses, especially small businesses. When banks are strong and the credit flows, it helps the overall economic growth. When banks are in crisis, the impact on business and consumers multiplies the weakness in the economy.

Following is an incomplete list of commercial banks in Pakistan:

* Allied Bank of Pakistan, Karachi

* Arif Habib Bank Limited, Karachi - (Formerly Arif Habib Rupali Bank)

* Askari Bank, Rawalpindi

* Atlas Bank, Karachi

* Bank AL Habib, Karachi

* Bank Alfalah, Karachi

* Crescent Commercial Bank, Karachi.

* Faysal Bank, Karachi www.faysalbank.com

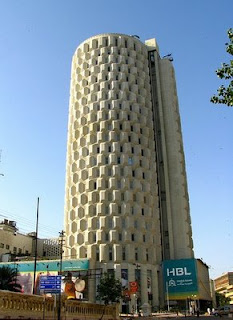

* Habib Bank, Karachi

* Habib Metropolitan Bank, Karachi

* JS Bank

* KASB Bank, Karachi

* MCB Bank Limited (formerly Muslim Commercial Bank), Islamabad

* Mybank Limited, Karachi

* NIB Bank, Karachi

* PICIC Commercial Bank, Karachi

* Saudi Pak Non-Commercial Bank, Karachi

* Soneri Bank, Karachi

* Union Bank, Karachi - Standard Chartered Bank has acquired Union Bank

* United Bank, Karachi

* Bank Of Punjab, Lahore

* Citi bank,Islamabad

* Standard chartered Bank Ltd,Karachi

* ABN Amro Bank Ltd,Karachi Now merged in RBS (Royal Bank of Scotland)

* HSBC Ltd,Lahore

Investment Banks:

Investment banks provide four primary types of services: raising capital (private equity or public offerings of shares), advising in mergers and acquisitions, executing securities sales and trading, and performing general advisory services. Most of the major Wall Street firms are active in each of these categories. Smaller investment banks may specialize in two or three of these categories.

The list of investment banks in Pakistan includes the following:

* Al-Towfeek Investment Bank Limited

* Invest Capital Investment Bank Limited

* Atlas Investment Bank Limited

* Crescent Investment Bank Limited

* Escorts Investment Bank Limited

* First Credit and Investment Bank Limited

* First International Investment Bank Limited

* Fidelity Investment Bank Limited

* Franklin Investment Bank Limited

* Islamic Investment Bank Limited

* Jahangir Siddiqui Investment Bank Limited

* AMZ Securities

* Orix Investment Bank (Pakistan) Limited

* Prudential Investment Bank Limited

* Trust Investment Bank Limited

Finance Expo 2009:

Finance Expo Pakistan 2009 Exhibition was held last week in Karachi to showcase the most competent, dynamically growing and innovative companies that demonstrate the latest financial systems and methods stimulating the development of the banking and finance industry.

The Expo was an opportunity to network with decision makers, economists and experts of Banks, Takaful, Modaraba, Insurance Companies, Asset Management Companies, Stock Exchanges, Security Companies, Financial Education Institutes, & Leasing Companies and also of the fast growing industries like IT & Telecom, Oil & Gas, Alternative Energy & Power Industries, Agriculture, Pharma, Textile, Builders & Developers, Auto as well as Media.

The event is a platform for banking and financial institutions to come together and share ideas and the challenges presented to this rapidly growing industry.

The exhibition and conference highlighted the value that banking, financial institutions and other revenue generating industries bring to boost the economy of Pakistan. Moreover, the Event presents opportunities for displaying products, services and solutions towards the potential buyers.

Summary:

In spite of the international economic crisis, continuing political turmoil and rising militancy in Pakistan, the financial services sector has held up fairly well in the last year. Its future, however, remains tied to a measure political stability in the country that allows economic activity to occur unhindered. Let's hope the nation's political and ruling elites can find a way to find a peaceful way forward.

Related Links:

Introduction to Banking and Economy

Introduction to Investment Banking

Pakistan's Banking Reform

-

Comment by Riaz Haq on November 29, 2015 at 8:26am

-

Investing deposits in risk-free government securities is lazy banking. The practice allows banks to grow profits while avoiding risks associated with the expansion of the private-sector loan book.

One obvious casualty of lazy banking is economic growth, which depends in large measure on the availability of affordable credit to private businesses.

CEOs of banks operating in Pakistan take offense when they are called lazy bankers.

Moody’s changes Pakistan’s banking system outlook to ‘stable’

While bank CEOs insist their conservative lending policy is not driven by the profit motive, latest banking data suggests otherwise.

Banks operating in Pakistan made a combined profit of Rs148 billion in Jan-Sept, up a whopping 28.7% from earnings recorded in the same nine-month period of 2014, according to the State Bank of Pakistan’s quarterly compendium on the banking system released last week.

Banks are commercial enterprises and their earnings growth – however quick and mind-boggling – should not be held against them. Nonetheless, it is perfectly legitimate to look into the source of the outlandish increase in banks’ profitability over such a short period.

DESIGN: NABEEL AHMED

Bank deposits increased 5.2% in the first nine months of 2015 as opposed to a corresponding rise of 2% in advances (another name for loans that banks extend to businesses and individuals). This means deposits mobilised by banks in Jan-Sept (Rs485 billion) far outweighed the advances generated (Rs89 billion) over the same period in both absolute and percentage terms.

No wonder the advances-to-deposits ratio stood at 46.7% at the end of September, slightly lower than 48.2% recorded at the end of December 2014.

So what did the banks do with the disproportionately high deposit mobilisation if they held back loans to businesses in the last nine months? Banking data suggests they simply invested that money in riskless government papers, like Pakistan Investment Bonds (PIBs) and treasury bills, and saw their bottom lines grow further.

Banks’ investments increased 26.4% to Rs6.7 trillion at the end of the first nine months of 2015. In a nutshell, the net increase in banks’ advances was Rs89 billion over the first nine months of 2015 while the corresponding rise in their investments clocked up at more than Rs1.4 trillion over the same period.

Resultantly, the investments-to-deposits ratio (IDR) at the end of September stood at 69.1% compared to 57.5% recorded at the end of 2014. Banks held 79.3% of all outstanding government securities at the end of October, according to a separate publication of the SBP.

Speaking to The Express Tribune, Invest & Finance Securities CEO Muzammil Aslam said banking investments in government securities is at an all-time high.

Banking spread lowest in 11 years

“The standard threshold for government treasuries was 20% while 75% of deposits were supposed to be reserved for credit off-take and 5% for meeting regulatory cash reserve requirements. That doesn’t seem to be the case anymore,” he said.

http://tribune.com.pk/story/997034/financial-sector-lazy-banking-hu...

-

Comment by Riaz Haq on June 27, 2016 at 5:10pm

-

#Pakistan’s financial system remains sound but banks must deal with non-performing #loans: #SBP http://go.shr.lc/296oyp9 via @Shareaholic

The banking sector observed year-on-year growth of 16.8 per cent in CY15 (average growth of 13.2 per cent during CY13-CY15) to reach PKR 14.1 trillion as of end December, 2015. During the same period, advances grew at a modest pace of average 8.1 per cent (average 8.7 per cent during CY13-CY15); while Investments - mostly in government securities - increased by 30 per cent (average 20.1 per cent during CY13-CY15).

The asset expansion has mainly been financed by deposits growth of 12.6 per cent (average 12.5 per cent during CY13-CY15) followed by financial borrowings. Asset quality improved with reduction in infection ratio (11.4 per cent in CY15 compared to 13.3 per cent in CY13) and rise in provision coverage (84.9 per cent in CY15 compared to 77.1 per cent in CY13). However, banks do face challenge in reducing the high stock on non-performing loans.

To this end, SBP is working on various legal and regulatory measures. The operating performance observed considerable improvement as banking sector posted record after tax profit of PKR 199 billion during CY15, largely contributed by growing income share from investment in government papers.

As a result, profitability indicators have improved; return on assets (after tax), increased to 1.5 per cent in CY15 from 1.1 per cent in CY13 and ROE (after tax) increased to 15.6 per cent from 12.4 per cent in CY13. The solvency has also remained robust with high capital adequacy ratio at 17.4 per cent in CY15 (14.9 per cent in CY13). Islamic banking increased its share in overall assets to 11.4 per cent in CY15 (9.6 per cent in CY13) in line with the Strategic Plan for the Islamic Banking Industry 2014-18.

While banks are maintaining high capital levels, expected growth in credit and gradual enhancement in minimum capital requirements prescribed by the regulators require banks to shore up their efforts for further strengthening their capital. Apart from banks, non-bank financial institutions (NBFIs) including development finance institutions (DFIs), leasing companies and mutual funds have performed reasonably well during the Financial Year 2015 (FY15) except for investment finance companies which have continued to post losses.

Insurance sector has posted healthy profits and increase in gross premiums improved the overall penetration rate of the sector to 0.8 per cent in CY15 (0.5 per cent in CY13). Financial markets (Money, FX, and Equity) also performed smoothly during CY15; though, some volatility was seen in equity and FX markets during the second half of CY15 (post Yuan devaluation and anticipated rise in interest rates in the US). FSR also highlighted few challenges facing the financial system.

------------

Though credit to private sector has improved in recent years, however, prime risk taking activity that is lending, is still at a low level. Consequently, advances to deposit ratio is falling for the last few years. This could be contributed by both demand and supply side factors, particularly challenging economic and business environment due to various structural issues such as power shortages facing the economy.

As such, banks have increased their inclination towards risk free investments in government securities and their balance sheets - loaded with PIBs and MTBs - are more prone to market risk due to interest movements. On the funding side, the deposit growth in past couple of years, although decent, has remained short of meeting asset growth requirements of both the private and public sector.

-

Comment by Riaz Haq on September 22, 2017 at 11:06am

-

(Germany's) InsuResilience Investment Fund to acquire 25pc equity stake in (Pakistan's) Asia Insurance:

http://nation.com.pk/business/22-Sep-2017/insuresilience-investment...

LAHORE - The InsuResilience Investment Fund, set up by the German Development Bank KFW and managed by Swiss-based Impact Investment Manager Blue Orchard Finance, has entered into an agreement to acquire a significant minority stake in Lahore-based Asia Insurance Company Ltd, a general insurance company offering agriculture insurance to over 100,000 farmers in Pakistan.

The Blue Orchard managed InsuResilience Investment Fund and Asia Insurance Company Ltd, an innovative and fast growing general insurance company based in Pakistan, have signed an agreement according to which the Fund will subscribe to a rights issue in the insurance company for a 25 percent equity stake in the company post-equity injection, taking the company’s total equity to approximately Rs 1.04 billion. Asia Insurance Company is a leading player in agriculture, livestock and farm implements micro-insurance with approximately 44% of its gross written premium in 2016 coming from these areas. The proceeds of the investment will help Asia Insurance Company to grow by increasing the company’s risk capital and supporting its underwriting capacity in agriculture, hereby extending its outreach to low income farmers.

The InsuResilience Investment Fund, as part of the InsuResilience Initiative of the German G7/G20 presidencies, aims to contribute to the adaption to climate change by improving access to and the use of climate risk insurance in developing countries and emerging economies. The Fund has been set up as a public-private partnership and combines private equity and private debt investments. The investment is subject to regulatory approvals.

“Pakistan experiences various natural disasters and consequences of climate change, but has a low level of insurance coverage, leaving a significant part of its low-income population without protection. We are looking forward to partnering with Asia Insurance Company Ltd, a leading Pakistani insurance company, to extend the insurance coverage of poor and vulnerable households,” says Ernesto Costa, Co-Head of Private Equity at BlueOrchard.

“The agriculture sector directly and indirectly makes up a large portion of Pakistan’s economy. Now more than ever, with our country being impacted by recurring natural calamities, the need for extensive loss mitigation for this sector is paramount. Asia Insurance has been actively involved in providing coverage for farmers, crops, tractors and other various factors of this sector for 5 years, and with InsuResilience Investment Fund’s investment, will expand our outreach and our range of insurance products for this market with a view to innovative solutions tailored to Pakistan’s needs,” says Ihtsham ul-Haq Qureshi, CEO of Asia Insurance Company Ltd.

Luxembourg-based InsuResilience Investment Fund has been set up by KfW, the German Development Bank, on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ). The overall objective of the InsuResilience Investment Fund is to contribute to the adaptation to climate change by improving access to and the use of insurance in developing countries. The specific objective of the fund is to reduce the vulnerability of low-income households and micro, small and medium enterprises (MSME) to extreme weather events. The InsuResilience Investment Fund has been set up as a public-private-partnership and combines private debt and equity investments in two separately investible sub-funds as well as technical assistance and premium support.

Asia Insurance Company Ltd is a general insurance company based in Lahore, authorized and supervised by the Insurance Division of the Security Exchange Commission of Pakistan.

-

Comment by Riaz Haq on January 29, 2018 at 8:35am

-

Bahrain’s Ithmaar Bank plans aggressive expansion in Pakistan

Bahrain-based lender to add more than 100 branches in Pakistan this year through its subsidiary Faysal Bank

http://gulfnews.com/business/sectors/banking/bahrain-s-ithmaar-bank...

Dubai: Bahrain-based Ithmaar Bank plans to add more than 100 branches in Pakistan this year through its subsidiary Faysal Bank, to capitalise on the country’s low penetration rate of banking services, a senior executive said.

Ithmaar Bank owns 66 per cent of Faysal Bank, whose contribution to the Islamic retail bank’s overall balance sheet would likely grow to more than half as a result of the expansion, Ithmaar Deputy Chief Executive Abdul Hakeem Al Mutawa said on Monday.

“We are planning to be over 500 branches this coming year and are aggressive in this,” Al Mutawa said in an interview.

“Banking penetration is around less than 20 per cent in Pakistan, so there are good opportunities to grow.” Faysal Bank, which is listed on the Pakistan Stock Exchange, focuses on corporate, commercial, retail and consumer banking activities.

Al Mutawa was speaking after Ithmaar Bank’s parent company, Ithmaar Holding, listed on the Dubai Financial Market on Monday.

The company is already listed in Bahrain and Kuwait.

“The listing is good news for the company for growth capital and we are well established now to approach the capital markets,” Al Mutawa said, adding that the bank had no imminent plans to raise funds through a bond or loan.

In Bahrain, Al Mutawa said there were opportunities to grow the business from working with the government on providing financing for social housing. The bank currently has 16 branches in the kingdom.

Bahrain’s Ithmaar Holding is exploring the sale of its 25.4 per cent stake in Bahrain’s BBK BSC, which has operations in Bahrain and Kuwait, India and Dubai, sources familiar with the matter told Reuters in August.

Al Mutawa declined to comment on the time frame for the disposal of the BBK stake or identify the name of the company advising IB Capital, Ithmaar Holding’s investment subsidiary managing the asset.

“The performance of BBK is very good and still part of the portfolio of IB Capital, and if there are opportunities to maximise shareholder value I’m sure the board will take those,” he said.

-

Comment by Riaz Haq on March 11, 2018 at 7:37pm

-

Accelerating economy to support Pakistan’s banking sector growth

Modest capital and large holdings of government bonds remain risk factors

Published: 14:06 March 11, 2018 Gulf News

Babu Das Augustine, Banking Editor

http://gulfnews.com/business/sectors/banking/accelerating-economy-t...

The outlook for banks in Pakistan is stable over the next 12-18 months driven by an accelerating economy and stable funding, according to rating agency Moody’s.

“Our stable outlook for Pakistan’s banking system is driven by an accelerating economy, boosted by domestic demand and China-funded infrastructure projects. Economic growth will stimulate lending and support a slight improvement in asset quality. Despite margin pressure, we expect profitability to remain flat. Stable funding from customer deposits and high liquidity are further strengths,” said Constantinos Kypreos, a Moody’s Senior Vice President.

Pakistan’s real GDP growth is projected at 5.5 per cent and 5.6 per cent in the fiscal years ending June 2018 and June 2019. Infrastructure investment and solid domestic demand will be the main drivers of economic growth and will fuel lending growth of 12 per cent to 15 per cent for 2018. The economy, however, remains susceptible to political instability and a deterioration in domestic security.

Analysts expect problem loans (NPLs at 9.2 per cent of gross loans as of September 2017) to decline in the current supportive macro environment, helped by the banks’ diversified loan portfolios and low corporate debt. Asset risk remains high, however, due to weaknesses in the legal framework, inefficient foreclosure processes and scant information for assessing borrower creditworthiness.

-----------------------

With regard to asset risk, analysts expect asset quality to improve in the current supportive macroeconomic environment, helped by the banks’ diversified loan portfolios and low corporate debt.

Moody’s says that the banks’ profitability will remain flat amid margin compression. However, profits will be supported by strong lending growth, a focus on low-cost current accounts and moderate provisioning needs. Interest margins should level off towards the end of 2018, once pressure from the reinvesting of legacy high-yielding Pakistan investment bonds reduces, as the remaining of these mature.

Credit growth to pick up pace

Credit growth in Pakistan is expected to gain momentum in 2018-19 driven by robust growth in both private and public sector credit demand, according to rating agency Moody’s.

“We expect lending to the private sector to grow between 12 to 15 per cent during 2018, a result of the improved economic conditions. This is despite a widening fiscal deficit (5.8 per cent of GDP for 2017), which the banks will continue to partly finance,” said Constantinos Kypreos, a Moody’s Senior Vice President.

Loan growth and deepening financial penetration is expected to be supported by state initiatives, such as branchless banking. Regulations amended to allow customers to open bank accounts through biometric devices at agent locations, as well as through mobile phones, to facilitate remittances are expected to boost growth on both assets and liabilities. A central bank-initiated policy targets a 17 per cent share of private-sector credit for SME financing compared to 9 per cent at year-end 2016. The policy initiative has set minimum portfolio targets for banks; introduced risk coverage and refinancing schemes for SMEs; established g a registry to allow SME borrowers to obtain credit using pledged assets as collateral; and prudential incentives such as a relaxation of general provisioning and capital requirements.

-

Comment by Riaz Haq on March 8, 2020 at 11:38am

-

#Citibank #Pakistan scaled back, and became bigger than ever. Just 7 years after ending its retail operations in the country, the #global #bank is more #profitable than at any point in its history in Pakistan… and remains a breeding ground for top talent

https://profit.pakistantoday.com.pk/2020/02/24/citibank-pakistan-sc...

And its return on equity – the all-important measure of bank profitability – is higher than it has ever been over the past two decades for which data is publicly available. Despite accounting for just 0.7% of the banking industry’s deposits, as of September 30, 2019, the latest period for which financial data is available, Citibank Pakistan accounts for 2.5% of its profits.

And Citibank was able to do this by going back to its roots: a global corporate and investment bank, with a presence across most economies around the world, a connecting financial institution that forms part of the backbone of the global financial system.

Citibank’s unique place in Pakistan

There is perhaps no foreign bank that captures the Pakistani imagination more than Citibank. Despite being much smaller than its current rival Standard Chartered, Citibank seems to have produced more financial leaders in Pakistan than any other financial institution. In both Corporate Pakistan – as well as the government – it means something special to be able to call oneself an “ex-Citibanker”, more so than any other financial institution.

The bank’s alumni in Pakistan include two former federal finance ministers – Shaukat Aziz and Shaukat Tarin – one of whom (Aziz) went on to become Prime Minister. They also include two provincial finance ministers – Murad Ali Shah of Sindh and Hashim Jawan Bakht of Punjab – one of whom (Shah) went on to become provincial chief minister. While Shah and Bakht are both from politically influential families, Aziz and Tarin’s rise in the federal government was in no small part due to the stature they gained as being highly successful global bankers who spent a significant portion of their careers at Citigroup.

--------------------

Standard Chartered, while a London-headquartered global bank, does not have a significant presence in investment banking. It is a strong corporate and commercial bank, but not an investment bank. In the world of capital markets and investment banking, Standard Chartered shows up nowhere in the global league tables (essentially, a ranking of financial institutions by total investment banking revenue).

Citi, on the other hand, is consistently in the top 5, earning $4.3 billion in investment banking revenue in 2019, according to data from Refinitiv, a financial data provider owned by Reuters.

What does any of this mean?

It means that while Standard Chartered can use its rupee-denominated local deposits to buy local, rupee-denominated bonds from the government of Pakistan, if Islamabad wants to issue dollar-denominated bonds to investors outside the country, the only bank with a local office it can talk to is Citi. (Technically, Deutsche Bank has also been a global investment banking powerhouse, and has offices in Pakistan, but its global investment bank has effectively self-immolated, so the less said about that, the better.)

And this is not just a theoretical capability: it is one that Citigroup has actively cultivated, having served as the government of Pakistan’s investment banker on nearly all global bond issuances, and several privatisation transactions as well.

-

Comment by Riaz Haq on March 8, 2020 at 1:58pm

-

According to the Mid-Year Performance Review (MPR) of the banking sector released by the State Bank of Pakistan on 21st October, 2019, banking sector maintained its growth trajectory during the first half of 2019 on account of decent increase in deposits, thanks to an amnesty scheme announced by the government.

https://www.brecorder.com/2019/10/25/537689/banking-sector-review-f...

On the liabilities side, deposit growth accelerated to 6.8 percent during January-June, 2019, up from 5.7 percent in the comparable period of last year. A good portion of these deposits was mobilised in June, 2019, leaving a very little time to deploy the funds in higher yielding earning assets. On the assets side, private sector advances witnessed a broad-based slowdown while public sector advances declined due to lower utilisation of commodity financing and retirement of energy sector advances. Resultantly, banks' borrowings declined by 12.7 percent and advances to deposit ratio dipped to 53.2 in June, 2019 compared to 55.8 in December, 2018. Overall, the risk profile of banking sector remained satisfactory and Capital Adequacy Ratio (CAR) at 16.1 percent was well above the local and international benchmark of 11.9 percent and 10.5 percent, respectively. Advances (net) decelerated to 1.9 percent compared to the rise of 12.3 percent in H1CY18 while investments also witnessed a slight increase of 0.7 percent in the first half of 2019 against a contraction of 3.6 percent in the same period of the preceding year.

So far as the second half of 2019 is concerned, the demand of private sector credit is expected to remain subdued due to stabilisation measures initiated by the government and subdued economic activity in the country. Projected slowdown in world economic activity, particularly in the US and the Euro area, is likely to influence exports and demand for advances. Banks may continue to remain risk-averse in their lending behaviour due mainly to a pick-up in NPLs and weakening repayment capacity of firms. The government's commitment to cease its borrowings from State Bank of Pakistan was expected to increase its reliance on commercial banks for financing needs. As such, investments of banks in gold-edged securities is expected to rise further. The rise in Minimum Saving Rate (MSR) is likely to induce depositors to opt for more saving and fixed deposits. Earnings of banking sector are also likely to remain decent in the second half of 2019 due to higher interest earnings and expected pick-up in banks' investment in government securities.

-

Comment by Riaz Haq on December 19, 2020 at 7:26pm

-

‘Growing debt market crucial to Pakistan’s economic progress’

https://www.thenews.com.pk/print/760808-growing-debt-market-crucial...

Growing and dynamic debt market is crucial for the economic progress of Pakistan and it is imperative for all stakeholders of the financial ecosystem to take the country’s debt market to regional and international levels, PSX chief executive officer said on Friday.

Farrukh Khan, chief executive officer of Pakistan Stock Exchange (PSX) said this during a gong ceremony to welcome Bank of Punjab (BOP) onboard as a market maker for conventional and shariah-compliant debt instruments on PSX.

“BOP is one of the first banks to become a market maker on PSX. We welcome this development as this will lead to increased growth and dynamism in the debt market, which is crucial for the economic progress of Pakistan,” Khan said in a statement. “We believe this step will play a significant role towards achieving that end. We are also in discussions with BOP to bring some of their SME [small and medium enterprise] clients to list on the new GEM [growth enterprise market] board. This will also be an important development for Pakistan’s economy, the SME sector and PSX.”

Market makers perform the role of providing liquidity and depth to the market by facilitating investors to buy and sell securities through continuously quoting two way prices – bid and offer prices.

Zafar Masud, CEO of Bank of Punjab said the bank will be the first bank in the Pakistan market making for both conventional and shariah-compliant securities as well as corporate debt instruments at the PSX portal.

“This makes us the first public sector bank offering a bouquet of services in collaboration with PSX,” said Masud. “We see our role expanding beyond a market maker for debt securities. Through this agreement, we are committing to becoming a leading player in development of capital markets in Pakistan by enabling greater investor participation and enabling listing of more debt, equity and non-conventional instruments at PSX.”

“We can partner with PSX in promoting privatisation and listing of public sector projects for example Punjab thermal power and Quaid-e-Azam solar power through the stock exchange. Moreover, we plan to design instruments to bring projects like Kamyab Jawan Program, SME financing project and low cost housing scheme to PSX platform,” he said.

-

Comment by Riaz Haq on February 19, 2022 at 4:51pm

-

Digital transactions record robust growth

https://www.dawn.com/news/1653511

According to the State Bank’s latest Annual Payment Systems Review (PSR) for FY21 issued on Friday, the transactions processed through the SBP’s large-value payments segment, known as Real-time Inter-Bank Settlement Mechanism (PRISM), recorded a growth of 60 per cent by volume and 12.8pc by value.

As of June 30 this year, the PRISM system had 51 direct participants — 34 banks, seven microfinance banks, nine development finance institutions and one non-bank entity (Central Depository Company). During FY21, PRISM processed 4.2 million transactions amounting to Rs444.6 trillion.

-

Comment by Riaz Haq on July 16, 2022 at 8:13pm

-

#Finnish fund buys 17.6% stake in TPL #Insurance in #Pakistan. The size of #Finnfund #investment is $3 million, which amounts to Rs632.8 million at the current exchange rate. https://www.dawn.com/news/1699871

KARACHI: TPL Corporation said on Friday a Finnish fund has successfully completed the transaction to acquire 17.59 per cent shareholding in TPL Insurance, a subsidiary of the Pakistani conglomerate.

Speaking to Dawn, TPL Insurance Ltd CEO Muhammad Aminuddin said the size of the transaction is $3 million, which amounts to Rs632.8 million at the current exchange rate.

Finnish Fund for Industrial Cooperation Ltd, a private firm incorporated in Finland, was originally going to invest roughly Rs540m in the Pakistani insurer through a special rights transaction. However, the investment size increased in the local currency because of the recent depreciation in the exchange rate.

“The investment will come through the issuance of new shares for which we’ve received approval from the regulator,” said the CEO.

Finnfund is a development financier and impact investor that buys stakes in “responsible and profitable” businesses in developing countries.

This is the second investment by an “impact investor” in TPL Insurance, which also raised last year an equity equalling 19.9pc of share capital from DEG, the private equity arm of the German government. The technology-driven business model of TPL Insurance supplemented by the Finnish fund’s global experience and knowledge will result in new product lines, a regulatory filing said.

According to the annual report for 2021, TPL Corporation and TPL Holdings held a collective stake of 64.38pc in TPL Insurance. After the transaction, the stake of the TPL Group in the insurer will reduce to 52pc, said Mr Aminuddin.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Improved US-Pakistan Ties: F-1 Visas For Pakistani Students Soaring

The F-1 visas for Pakistani students are soaring amid a global decline, according to the US government data. The US visas granted to Pakistani students climbed 44.3% in the first half of Fiscal Year 2025 (October 2024 to March 2025) with warming relations between the governments of the two countries. The number of visas granted to Indian students declined 44.5%, compared to 20% fewer US visas given to students globally in this period. The number of US visas granted to Pakistani…

ContinuePosted by Riaz Haq on October 19, 2025 at 10:00am — 1 Comment

Major Hindu American Group Distances Itself From Modi's India

"We are not proxies for India in the US", wrote Suhag Shukla, co-founder and executive director of the Hindu American Foundation (HAF) in a recent article for The Print, an Indian media outlet. This was written in response to Indian diplomat-politician Shashi Tharoor's criticism that the Indian-American diaspora was largely silent on the Trump administration policies hurting India. …

ContinuePosted by Riaz Haq on October 11, 2025 at 2:00pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network