PakAlumni Worldwide: The Global Social Network

The Global Social Network

Vibrant Financial Services Sector in Pakistan

Pakistan has been ranked 34 out of 52 countries in the World Economic Forum's first Financial Development Report, which was released in Pakistan through the Competitiveness Support Fund (CSF) in December, 2008.

The report is a comprehensive analysis of financial systems and capital markets in 52 countries that explores key drivers of financial system development and economic growth in developing and developed countries and serves as a tool by which countries can benchmark themselves and establish priorities for financial system improvement.

Arthur Bayhan, Chief Executive of the Competitiveness Support, told the media: "I am very happy to see that financial system in Pakistan is well reformed and competitive vis-à-vis Asia and Europe. Pakistan is ranked ahead of the Russian Federation (35), Indonesia (38), Turkey (39), Poland (41), Brazil (40), Philippines (48) and Kazakhstan (45)."

The United States narrowly edged the United Kingdom to take the top position in the Financial Development Index. The United Kingdom was second while China ranked 24 and India 31.

The Financial Development Index is based on three main pillars - Factors, Policies and Institutions, Financial Intermediation and Capital Availability and Access. These are further divided into sub - pillars.

Under Factors, Policies and Institutions pillar, Pakistan ranks 49th in institutional environment, 50th in business environment and 37th in Financial Stability. In the Financial Intermediation Pillar Pakistan ranks 25th in banks, 42nd in non banks and 17th in Financial Markets. Under Capital Availability and Access, Pakistan ranks 33rd.

Indicators showed that in business environment Pakistan had development advantage in Cost to Export, ranking 6th, Cost of closing business 5th.

In Financial Stability Change in Real Effective Exchange rate ranked 20th, External debt to GDP 10th, Frequency of banking crises 1st, stability index 15th.

In corporate governance Pakistan ranked at the very top in shareholder rights index, 14th in strength of investor protection.

In the Non banks pillar, Pakistan ranked 9th in the Real growth of direct insurance premiums. In equity market movement Pakistan ranked at the top again in equity market turnover.

Importance of Financial Services Sector:

Banks are often described as a nation's economic engine, in part because they provide financial intermediation functions between savers/investors who are looking for safety and growth and consumers/businesses who are looking for access to credit and capital.Banks also play a major role as instruments of the government's monetary policy aimed at regulating interest rates and money supply in the economy. The current economic crisis in the United States and Europe, marked by the ongoing weakness of major banks and the resulting credit and capital crunch, underlines the critical importance of the banking sector in national and global economies. Recognizing the crucial importance of the financial sector in global economic recovery, the Obama administration is allocating the bulk of the stimulus money to restore the health of major U.S. banks.

Banking in Pakistan:

Between 2002 and 2007, Pakistan's accelerated economic growth was underpinned by a strong banking sector. Classified as Pakistan’s and region’s best performing sector, the banking industry’s assets rose to over $60 billion, its profitability remains high, non-performing loans (NPLs) are low, credit is fairly diversified and bank-wide system risks are well-contained. Almost 81% of banking assets are in private hands. Likewise, the present foreign stake comes to 47% of total paid-up capital of all the financial institutions regulated by Pakistan's central bank, the State Bank of Pakistan.

Pakistan's foreign reserves hit a record high of $16.5 billion in October 2007 but fell to $6.6 billion in November, largely because of a soaring import bill. As the commodity prices rose and inflation in Pakistan reached near 25%, the State Bank of Pakistan was forced to raise its discount rates to as high as 15%. However, there has been a dramatic decline in the cost of imports such as oil during the last few months, spelling relief for Pakistan and other non-OPEC developing nations. The price of oil has dropped to about a quarter of what it was last summer.

Pakistan signed a $7.6 billion loan agreement with the International Monetary Fund in November to stave off a balance of payments crisis. It received its first tranche of $3.1 billion that month. In its first assessment since November, IMF has expressed satisfaction with Pakistan's progress. “Initial developments under the program have been positive,” IMF spokesman David Hawley told a regular news briefing, according to Pakistan's Dawn newspaper. “The foreign exchange rate has appreciated somewhat and preliminary information suggests that end-December targets for net international reserves and net domestic assets at the State Bank of Pakistan were met,” he added.

Pakistan's economy deteriorated sharply over the course of 2008, as inflation surged, and the current account deficits jumped on the back of rising oil and food prices, according to a World Bank report.

The report titled ‘Global Economic Prospects 2009’ says political turmoil and ongoing security concerns have also taken a toll on Pakistan’s economy, while the global financial crisis added substantial downward pressures on its financial markets. Pakistan and the International Monetary Fund agreed to lower the target for the gross domestic growth this fiscal year to 2.5 per cent from 3.5 per cent but many analysts said even achieving this target would be very ambitious.

The general deterioration in regional trade balances has been offset by large remittance inflows, which represent a sizable, and generally increasing share of GDP: during 2007, 14 per cent in Nepal, 8 per cent in Bangladesh and Sri Lanka, 4 per cent in Pakistan, and 3 per cent in India.

Given strong underlying growth dynamics in South Asia, the negative feedback effects of the global financial crisis are expected to be temporary. A relatively rapid rebound is expected in 2010, with a projected revival of GDP growth to 7.2 per cent.

During 2001-2007, former Prime Minister Shaukat Aziz, a banker by training and extensive experience in New York, understood the role of banking, finance, investment and consumer credit in economic growth of a nation. He focused on building strong banking, investment and finance sectors in Pakistan to underpin its economy. He strengthened capital availability, an essential and increasingly important economic input, in addition to labor and land improvements. With higher education budget up 15-fold and overall education spending up 36% in two years, he focused on education to improve the availability of skilled labor to fill new jobs. He pushed land development and public and private construction spending to improve infrastructure and facilities to attract greater business investment and create jobs. Mr. Aziz was largely successful in his efforts.

In general, there are primarily two types of banks in Pakistan: Commercial Banks and Investment Banks. Both types of banks provide financial services essential for Pakistan's economy to function and grow.

Commercial Banks:

Commercial Banks are privately-owned institutions that, generally, accept deposits and make loans. Deposits are money people entrust to an institution with the understanding that they can get it back at any time or at an agreed-upon future date. A loan is money let out to a borrower to be generally paid back with interest. This action of taking deposits and making loans is called financial intermediation. A bank's business, however, does not end there.

Most people and businesses pay their bills with bank checking accounts, placing banks at the center of our payments system. Banks are the major source of consumer loans -- loans for cars, houses, education -- as well as main lenders to businesses, especially small businesses. When banks are strong and the credit flows, it helps the overall economic growth. When banks are in crisis, the impact on business and consumers multiplies the weakness in the economy.

Following is an incomplete list of commercial banks in Pakistan:

* Allied Bank of Pakistan, Karachi

* Arif Habib Bank Limited, Karachi - (Formerly Arif Habib Rupali Bank)

* Askari Bank, Rawalpindi

* Atlas Bank, Karachi

* Bank AL Habib, Karachi

* Bank Alfalah, Karachi

* Crescent Commercial Bank, Karachi.

* Faysal Bank, Karachi www.faysalbank.com

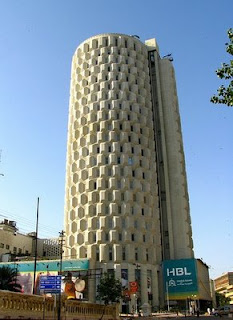

* Habib Bank, Karachi

* Habib Metropolitan Bank, Karachi

* JS Bank

* KASB Bank, Karachi

* MCB Bank Limited (formerly Muslim Commercial Bank), Islamabad

* Mybank Limited, Karachi

* NIB Bank, Karachi

* PICIC Commercial Bank, Karachi

* Saudi Pak Non-Commercial Bank, Karachi

* Soneri Bank, Karachi

* Union Bank, Karachi - Standard Chartered Bank has acquired Union Bank

* United Bank, Karachi

* Bank Of Punjab, Lahore

* Citi bank,Islamabad

* Standard chartered Bank Ltd,Karachi

* ABN Amro Bank Ltd,Karachi Now merged in RBS (Royal Bank of Scotland)

* HSBC Ltd,Lahore

Investment Banks:

Investment banks provide four primary types of services: raising capital (private equity or public offerings of shares), advising in mergers and acquisitions, executing securities sales and trading, and performing general advisory services. Most of the major Wall Street firms are active in each of these categories. Smaller investment banks may specialize in two or three of these categories.

The list of investment banks in Pakistan includes the following:

* Al-Towfeek Investment Bank Limited

* Invest Capital Investment Bank Limited

* Atlas Investment Bank Limited

* Crescent Investment Bank Limited

* Escorts Investment Bank Limited

* First Credit and Investment Bank Limited

* First International Investment Bank Limited

* Fidelity Investment Bank Limited

* Franklin Investment Bank Limited

* Islamic Investment Bank Limited

* Jahangir Siddiqui Investment Bank Limited

* AMZ Securities

* Orix Investment Bank (Pakistan) Limited

* Prudential Investment Bank Limited

* Trust Investment Bank Limited

Finance Expo 2009:

Finance Expo Pakistan 2009 Exhibition was held last week in Karachi to showcase the most competent, dynamically growing and innovative companies that demonstrate the latest financial systems and methods stimulating the development of the banking and finance industry.

The Expo was an opportunity to network with decision makers, economists and experts of Banks, Takaful, Modaraba, Insurance Companies, Asset Management Companies, Stock Exchanges, Security Companies, Financial Education Institutes, & Leasing Companies and also of the fast growing industries like IT & Telecom, Oil & Gas, Alternative Energy & Power Industries, Agriculture, Pharma, Textile, Builders & Developers, Auto as well as Media.

The event is a platform for banking and financial institutions to come together and share ideas and the challenges presented to this rapidly growing industry.

The exhibition and conference highlighted the value that banking, financial institutions and other revenue generating industries bring to boost the economy of Pakistan. Moreover, the Event presents opportunities for displaying products, services and solutions towards the potential buyers.

Summary:

In spite of the international economic crisis, continuing political turmoil and rising militancy in Pakistan, the financial services sector has held up fairly well in the last year. Its future, however, remains tied to a measure political stability in the country that allows economic activity to occur unhindered. Let's hope the nation's political and ruling elites can find a way to find a peaceful way forward.

Related Links:

Introduction to Banking and Economy

Introduction to Investment Banking

Pakistan's Banking Reform

-

Comment by Riaz Haq on April 18, 2014 at 4:55pm

-

Here's a report on insurance sector in Pakistan:

KARACHI: Pakistan non-life insurance stands 0.3 percent of Gross Domestic Product (GDP) with immense scope for private insurance companies to tap un-served market through their products of non-life insurance, Tahir Ahmed Chief Executive Officer Jubilee General Insurance said.

At ‘2nd South Asian Association for Regional Cooperation (SAARC) Insurance Regulators’ Meet and International Conference on Wednesday, he said the government, stakeholders and industry players should be on one page and implement a national plan to get the people and industries insured.

He said the national insurance scheme should be introduced and implemented at faster pace in true letter and spirit which could enhance the penetration rate of 0.3 percent to 6.5 percent in only one year.

The insurance companies do have potential to book Rs 20 billion premium amount of insurance from various sectors from their policy as it was estimated through a study conducted by State Bank of Pakistan, Securities and Exchange Commission of Pakistan and different industry players.

In the non-life insurance sector, agriculture sector is the biggest having 21 percent contribution in the GDP but when it comes to insurance, it is 100 percent undeserved. The sector could be tapped to generate billion of rupees in premium whereas the rate of GDP could be enhanced to 4.5 percent from the current 0.3 percent.

As far as vehicle insurance is concerned, merely 3 million vehicles are insured out of the total 15 million vehicles plying on roads regardless of the fact the insurance is mandatory for all vehicles. This could enhance the penetration rate from 4.5 percent to 5.5 percent of GDP.

Large Scale Manufacturing having contribution of 10 percent in the GDP could be tapped to further increase the GDP rate to 6 percent, he added.

There is a big scope to insure mobile phone handsets as 130 million people carry mobile phones, Ahmed added.

CEO Jubilee Insurance stressed the need to reach out to the customers through the products and in rural and urban areas with the massage in Urdu or in their local language.

He stressed financial literacy was not a big issue as illiterate people were very conscious about their assets and security.

Speakers at the conference stressed the need to enhance efforts to give financial cover to trade, business and people as natural calamities usually devastate economy of many countries in the SAARC region.

Fredrick de Beer CEO Adamjee Insurance, Taher Sachak CEO EFU Life Insurance and Gerry Gunadas CEO Continental Insurance Lanka also spoke on the occasion.http://www.dailytimes.com.pk/business/17-Apr-2014/pakistan-non-life...

-

Comment by Riaz Haq on June 11, 2014 at 4:40pm

-

Excerpt from Wall Street Journal:

Here's my thesis: Just as Amazon turned publishing upside down, an online competitor will do the same thing to financial advisers.

To explore that, I visited several wealth management websites. Robo-advisers charge from zero to 50 basis points, depending on assets under management. The low cost makes them formidable competitors. But what about the quality of their advice?

I completed a handful of asset-allocation surveys. The questions were surprisingly similar. What would I do, for example, if I lost 20% of my portfolio during turbulent markets? Would I 1) sell stocks, 2) buy stocks, or 3) ride it out?

Ernest Hemingway once said, "The best way to find out if you can trust somebody is to trust them." To paraphrase him, the best way to know what you will do if you lose 20% is to lose 20%.

Regrettably, I know. I'm still licking my wounds from the crash of 2008-2009. So I completed the questionnaires with the benefit of perfect hindsight.

The results really surprised me. There was so much "sameness" to the online forms, but the recommendations differed substantially.

One site created a portfolio with 40% allocated to fixed income. Another indicated that 11% was plenty. Some recommendations included an allocation to alternatives. Others didn't. U.S. equities varied from 25% to 48%.

"Ah-hah," I thought. There is no way to understand somebody's risk profile without the iterative, time-consuming process every adviser goes through with his or her clients. That is where advisers add value.

I called James Carlson, Chief Product Officer of Questis. His website asks eight questions and delivers portfolios within seconds. He would defend, I assumed, the new, new way of doing things.

Not quite.

"The robo-adviser isn't the solution," says Mr. Carlson. "You need the right balance of humans and algorithms." His company offers a hybrid model to clients. For Questis the questionnaires are a first cut at give-and-take dialogue, which leads to thoughtful, asset-allocation recommendations.

"Phew," I thought. "There will always be a place for financial advisers even if our compensation models come under pressure."

Not so fast.

Amazon changed publishing because it looked at the world in an unexpected way. E-readers, for example, revolutionized the way we think about books. What if an organization approaches investors with a tool other than questionnaires, something outside the box? Or compensation models based on a formula other than assets under management?

These questions led me to BidnessEtc.com, a hip new website that discusses individual stocks. The graphics look more like something you find in a comic-book store than a ho-hum-if-I-read-another-disclaimer-I'll-scream financial website.

I Skyped with Nadir Khan and Babar Din, the two founders, and asked if they plan to introduce asset-allocation or estate-planning tools on their website. BidnessEtc is based in Pakistan, but the founders built much of their financial expertise in U.S. equity markets.

Mr. Khan says BidnessEtc is rolling out a business search engine this week. It is curated by humans and targeted at investors.

Initially, the engine will focus on individual companies. But over time, it will broaden its reach to include "asset planning," "retirement planning," and "every possible vertical."

"There's a big problem in the wealth management industry," says Mr. Khan, "and that's visibility. That's why the fees are too high. If you give wealthy people discovery of those mechanisms, margins are going to zero." That is a huge thought. If the founders of BidnessEtc are right, wealth management as we know it will be over.

The new, new competitors are companies that empower investors to make financial decisions without financial advisers. Think this sounds like another the-sky-is-falling prediction from a do-it-yourselfer?

Maybe. But maybe it is the long game, a business strategy that will catch fire as baby boomers pass their wealth to the next generation.

Mr. Din of BidnessEtc says the world has changed. "Gen Y is living their lives on social media, mobile phones and gadgets and has higher interest in investing." The experience during the financial crisis has made them more prudent about "financial planning at a younger age than their parents."

Right now, BidnessEtc is pretty much the upstart, with lots of other online advice services getting more mainstream attention. But my take: The competitors we should fear the most are probably the ones we know the least.

http://online.wsj.com/news/articles/SB10001424052702304178104579535...

-

Comment by Riaz Haq on November 13, 2014 at 12:25pm

-

A rally in Pakistan bonds bodes well for the world’s second-biggest Muslim nation as it prepares to sell global sukuk for the first time since 2005.

The government may issue $500 million of dollar Islamic notes by month-end, Finance Minister Ishaq Dar told reporters in Dubai on Nov. 8, reviving the sale initially scheduled for September. The yield on the nation’s conventional five-year U.S. currency debt sold in April dropped to a five-month low of 6.16 percent and Union Investment Privatfonds GmbH is predicting 6 percent for a similar-maturity sukuk.

Investors have sent the benchmark stock index to a record and the rupee to its strongest in more than two months as they focus back on the economy as Prime Minister Nawaz Sharif overcame pressure from opposition members to step down in August. Global sales of sukuk are heading for the worst fourth quarter since 2008, aggravating a shortage of Islamic securities that may support demand for Pakistan’s offering.

“The macroeconomic outlook of the country has vastly improved,” Vasseh Ahmed, chief investment officer of Faysal Asset Management Ltd., which oversees $85 million in Karachi, said in a Nov. 11 e-mail. “There is expected to be substantial interest owing to the lack of investment avenues for Islamic investors.”

Shrinking Sales

Worldwide sales of Islamic bonds dropped 81 percent this quarter to $2 billion from the previous three months, data compiled by Bloomberg show. Issuance climbed 11 percent in 2014 to $38.9 billion, trailing 2012’s record $46.8 billion total.

Pakistan tapped the international debt market in April for the first time since 2007. It sold $2 billion in total of 7.25 percent non-Shariah-compliant notes due in 2019 and 10-year 8.25 percent bonds whose yield was at a three-month low of 7.46 percent, data compiled by Bloomberg show. Demand exceeded the amount on offer by 14 times.

The nation has no global sukuk outstanding, only local-currency Shariah-compliant notes that were last issued in June.

A five-year note will pay from 6 percent to 6.5 percent and 10-year securities 7 percent to 7.5 percent, Mohammed Sohail, Karachi-based chief executive officer at Topline Securities Pakistan Ltd., said in a Nov. 11 e-mail.

---------

The South Asian nation’s foreign-exchange reserves totaled $14 billion in September, compared with $8.7 billion at end-2013, central bank data show. The fiscal deficit narrowed to 5.8 percent of gross domestic product in the 12 months through June, from 8.2 percent the previous year, according to official data on June 3.

‘Attractive Yield’

“The key factor will be the domestic political situation,” Sajjad Anwar, chief investment officer at NBP Fullerton Asset Management Ltd., which manages $456 million, said by phone on Nov. 11 from Karachi. “The economy is in better shape now and the response to the sukuk will be very encouraging.”

The nation, which is rated below investment grade at B- by Standard & Poor’s, is still likely to attract investor interest because of its higher yields. Qatar’s global Shariah-compliant debt due in 2023 yields 2.99 percent, while Malaysia’s 2021 sukuk pay 2.93 percent, according to data compiled by Bloomberg.

Pakistan has engaged in economic reforms to meet conditions of an International Monetary Fund bailout. The Washington-based lender said in a Nov. 8 statement that it will seek board approval to release $1.1 billion in loans in December. The reforms are “broadly on track” with growth forecast at 4.3 percent in the fiscal year ending June 2015, the fund said. GDP increased 4.1 percent in the last financial year.

“Pakistan is a very well known name to the sukuk investor community,” Union Investment’s Dergachev said in a Nov. 11 e-mail. “It still offers a very attractive yield compared to other sukuk issuers both in the sovereign and corporate space and that matters in a low-yield environment.”

http://www.bloomberg.com/news/2014-11-13/sharif-weathering-protest-...

-

Comment by Riaz Haq on November 16, 2014 at 5:32pm

-

Pakistan regulators merging three Islamic investment firms

Nov 17 (Reuters) - Pakistan regulators are merging three small Islamic investment firms after the central bank took control of Karachi-based KASB Bank Limited, accelerating efforts to strenghten financing by investment partnerships.

Last week, the government directed the central bank to reorganize or amalgamate KASB Bank in the next six months, after the lender failed to meet minimum capital requirements.

On Friday, KASB Modaraba said it had taken management control of First Pak Modaraba and First Prudential Modaraba, three of a total 26 modarabas active in the country.

Modarabas are a form of Islamic investment partnership where assets are managed on behalf of clients, with income and expenses shared under a pre-agreed ratio.

The sector remains a tiny part of the country's Islamic finance industry, with several firms lacking scale to compete.

Last week, First Habib Bank Modaraba, a unit of Pakistan's largest lender HBL Bank, liquidated its business.

As of March, the three modarabas held a combined 1.9 billion rupees ($18.7 million) worth of assets, dwarfed by larger peers such as Standard Chartered Modaraba with 5.3 billion rupees in assets.

The Securities and Exchange Commission of Pakistan (SECP) has also developed risk management guidelines for modarabas, last year introducing sharia compliance and sharia audit mechanisms to strengthen the sector.

http://www.reuters.com/article/2014/11/17/pakistan-modarabas-idUSL6...

-

Comment by Riaz Haq on November 16, 2014 at 9:33pm

-

Dr. Ishrat Husain on deregulation in Pakistan

As in most debates in Pakistan there are sharply polarised views on the regulation and deregulation of private-sector activities. Some advocate regulation by the state as an effective tool to curb the market’s excesses. Others think markets should be left to themselves and the state should have few regulations.

------.

Financial markets have some unique features that are missing in product and factor markets. This distinction is lost sight of in this polarised debate. Shareholders’ equity in bank balance sheets ranges from 8pc to 10pc. The banks are highly leveraged as they raise 90pc to 92pc of their money from depositors and borrowings from other financial institutions and markets. This high leverage effect magnifies both upside gains and downside risks, inducing the bank management, whose compensations are linked to short-term profits, to resort to excessive risk-taking.

The upside gains of the leveraged bets accrue mainly to shareholders and managers, while downside losses are so heavy that the state has to bail them out using taxpayers’ money. This asymmetric treatment of the risks incurred and the accrual of rewards places a heavy responsibility on regulators to ensure that shareholders, and not taxpayers, bear the brunt of excessive risk-taking. Therefore, given the market’s structure in the financial sector, state regulation is not only justifiable but desirable.

---------

The same logic cannot be applied to the market for goods and inputs. If a farmer’s income is determined by forces outside his control he has no incentive for higher production and improved productivity. In Pakistan, the government controls wheat prices, and fertiliser prices are subsidised, largely benefiting big farmers. Irrigation water is allocated in a discriminatory manner inducing inefficiency. The food department procures wheat at official prices from those who are influential or who grease their palms. Under such stringent price and quantity regulation why should the average farmer maximise his efforts to produce more?

The differential in the yield between a progressive and an average farmer ranges between 50pc to 70pc. If there was deregulation of prices and quantity (except for a certain amount of reserves), wheat production could jump to at least 30 million tons — a conservative estimate.

Contrast this with the deregulated milk market. Except for hygiene regulations, milk supply and demand determine the prices. The fastest growth in the average farmer’s cash income has taken place through money from milk. For other non-cereal products, market committees that are inefficient and operate in collusion with officials of the agriculture department have distorted prices.

--------

The sugar market has, at different times, faced waves of regulation, fixed cane price and opaque market interventions. The government steps in when there is surplus production; it procures from local sugar mills and sells in international markets at loss.

In times of shortages, the government imports sugar, and sells at a price mostly to the mills’ advantage. Efficient and inefficient mills are treated equally; there is no pressure on the latter to exit the market as they are insulated from facing the market test. Thus over-regulation, procurement by the government at non-market prices and intrusive and discriminatory practices have tilted the sugar market against the consumers. Here deregulation is badly needed.

In the manufacturing sector, as many as 40 agencies and departments of the federal, provincial and local governments are involved in giving clearances, no-objection certificates, grants of permits, licences, etc. Most factory owners have reconciled to this situation, making monthly payments to functionaries of these departments commensurate with their nuisance value. A labour inspector can arbitrarily shut down a factory, causing enormous loss to the owners, for whom the easy course is to keep the inspector contented.

http://www.dawn.com/news/1144559/deregulating-the-economy

-

Comment by Riaz Haq on January 4, 2015 at 1:26pm

-

....To regain momentum, Mr Modi this weekend pledged to give greater independence to struggling public sector lenders, while tempting global investors to participate in plans to raise Rs1.6tn ($26bn) by selling down government bank stakes.

Speaking at a summit of the heads of all of India’s public sector financial institutions, Mr Modi promised to end the country’s heritage of “lazy banking”, a term often used to criticise risk-averse lenders.

Addressing concerns that banks face political pressure to give loans to favoured companies, Mr Modi said lenders “would be run professionally” in future, and promised “no interference” from New Delhi.

Jayant Sinha, minister of state for finance, said that the moves were “a very important step” to repair the banking sector, which must raise an estimated $50bn to meet new capital rules over the next four years while also reversing recent increases in bad loans.

“To bring everyone together at this event, and to ask all of India’s banking system to look seriously at bold structural reforms, is an unprecedented move,” Mr Sinha said.

India is now likely to bring forward measures to increase the autonomy of bank boards, ensure the independence of senior appointments, and introduce market-linked pay for bank executives.

The banking reforms come in advance of the likely appointment this week of Mr Panagariya, a widely respected and liberally-minded economist, to lead the government think-tank set up to replace India’s Soviet-era planning commission.

In August, Mr Modi scrapped the planning commission, which had guided India’s economic development for six decades through the publication of weighty five-year plans. He accused the body of excessive centralisation, obstructing the plans of state-level governments.

Mr Modi will officially chair the replacement — to be called the NITI Aayog, or National Institution for Transforming India — but two people familiar with the matter confirmed that Mr Panagariya had accepted the position as vice-chairman, making him its operational head.

http://www.ft.com/intl/cms/s/0/9a776db4-93e3-11e4-92dd-00144feabdc0...

-

Comment by Riaz Haq on June 7, 2015 at 7:19am

-

Dubai: From a medium-term perspective, gradual privatisation of Pakistan’s banking sector will be crucial to increase overall efficiency, said BMI Research, a Fitch Group company, in a recent report.

The government recently raised $1.02 billion (Dh3.7 billion) by selling 609 million of its remaining government shares in Habib Bank, the country’s largest bank.

The sale is part of Pakistan’s wider plans to privatise 68 public companies, including 10 banks. While most of the companies are making losses, Habib Bank is profitable and growing. In March, the bank announced that it had signed an agreement with Barclays Bank for the acquisition of the its banking business in Pakistan.

Analysts say China’s recent announcement big investments in Pakistan will be a big boost to the economy and the banking sector. China pledged $45 billion for roads, ports and power plants when President Xi Jinping visited Pakistan last month. The planned investment, 28 times more than the foreign direct investment Pakistan received in the year ended June, will spur investment activity and help ease the country’s growing energy shortage, Moody’s said in a recent report.

As per the agreement, both Pakistan and China will allow banks to open branches in each other’s country. Initially, National Bank of Pakistan (NBP) and Habib Bank are expected to open branches in China, with significant opportunities likely to be available in the remittance business.

Pakistan took a $6.6 billion loan from the International Monetary Fund in 2013 to avert a balance-of-payments crisis and has cleared six programme reviews. Oil prices have fallen 38 per cent over the past year, lowering Pakistan’s import bill, easing price pressures and giving the central bank room to cut interest rates.

To further improve market discipline and enhance assessment of the financial sector, State Bank of Pakistan (SBP) has evaluated and identified the ‘encouraged’ set of financial services institutes (FSIs). As of end-December 2014, asset quality has slightly improved, with a decline in non-performing loan (NPL) ratio to 12.3 per cent and net NPLs to net loans ratio falling to 2.7 per cent.

The risk to banking system seems to be negligible, as they encompass only 1.39 per cent of banking system assets. The number of Capital Adequacy Ratio (CAR) non-compliant banks has fallen from three to two due to capital injections. The combined CAR shortfall for two non-compliant private banks has decreased by Rs3.3 billion (Dh118 million) over the quarter to Rs7.96 billion (less than 0.03 per cent of gross domestic product) as of end December 2014.

http://gulfnews.com/business/sectors/banking/pakistan-privatisation...

-

Comment by Riaz Haq on June 18, 2015 at 5:29pm

-

Software Failure Leads to US Sanctions Penalty for National Bank of #Pakistan in New York. http://on.wsj.com/1BlWupQ via @WSJ

The National Bank of Pakistan’s New York branch settled “apparent violations” of sanctions with U.S. authorities Thursday, agreeing to a penalty of $28,800. The case illustrates how companies can be penalized for violating sanctions, even if the illegal transactions are only processed because of flaws in screening software.

The U.S. Treasury Department’s Office of Foreign Assets Control found that the New York branch of the state-0wned bank processed wire transfers totaling $55,952 for the blacklisted Kyrgyzstan airline, Kyrgyz Trans Avia, OFAC said in a statement. The bank’s sanction screening software failed to recognize the name of the account name LC Aircompany Kyrgyztransavia as belonging to Kyrgyz Trans Avia account, OFAC said.

OFAC blacklisted Kyrgyz Trans Avia in May 2013 after authorities alleged the airline helped Iran acquire aircraft used to bring in “illicit cargo to Syria for the Assad regime’s violent crackdown against its own citizens.”

The increased complexity of sanctions and an ever increasing number of blacklisted entities have made it hard for automated screening tools to keep up, experts say.

Under the strict liability of sanctions laws, companies can be punished for transactions, even if they are processed because of a software failure. The penalty was light, OFAC said, because supervisors at the bank cooperated with authorities and were unaware of transactions with the blacklisted airline.

-

Comment by Riaz Haq on July 6, 2015 at 9:19pm

-

Robert Mazur brought down #Pakistan BCCI now says it was singled out;other guilty banks were spared. #moneylaundering

http://tribune.com.pk/story/868778/the-man-behind-the-bust-a-chance...

Robert Mazur is the man behind the downfall of, perhaps, a Pakistani’s greatest commercial achievement.

He is the former US Customs agent who led the sting operation which proved Bank of Credit and Commerce International (BCCI) laundered money for Colombian drug traffickers.

And now, ironically, many years later, he says that he is convinced many other foreign banks were doing the same and that they should have faced a similar fate.

----------

The lowest point in his entire story is how BCCI got entangled in the money laundering affair. It is important to make a distinction here. In this sting operation, it was not the cartel which led agents to BCCI. Rather Mazur took the money to the bank and asked if it could be moved discreetly.

“As I cruised down palm-lined Ashley Drive in downtown Tampa in a money-green Mercedes 500 SEL provided by customs, a building containing the upscale offices of Bank of Credit and Commerce International caught my eye. BCCI in large gold letters glittered from the second story and screamed of overseas accounts, so I called an officer and scheduled an appointment,” he writes in his book.

And this is how BCCI got involved.

“I swear to God that’s exactly how it happened. I was driving and saw BCCI written in gold letters and decided to call up someone there,” he said.

“You also must understand that Tampa is not a cosmopolitan city. It’s not as huge as Miami and they don’t have many banks in the area.”

His first contact in the bank was Rick Argudo, vice president of the Tampa branch, who grilled Mazur about his business history and finally agreed to open up an account. It was also when Mazur realised the bank was up to something big.

Argudo was told that the account will be used to bring in money from Panamanian bank accounts where Mazur’s Colombian clients were accumulating wealth to be invested in the US.

But when Argudo asked if he wanted to move money in the opposite direction from US to Panama and offered a way to avoid IRS (Internal Revenue Service) his suspicion rose.

-

Comment by Riaz Haq on July 6, 2015 at 10:24pm

-

“When I debriefed BCCI executives after the operation, they didn’t understand what was happening with them. They used to say they hadn’t done anything which other banks weren’t doing,” Mazur said in an hour-long interview with The Express Tribune over phone from London.

“At that time I thought they were lying. But now I am 100% sure that they were being honest. Many other banks laundered money too –they still do.”

The anger and anguish felt by many former bank employees for being targeted is completely understandable, he says.

“They had done what they were accused of doing. But I am sure if I had walked into any other bank, I would have witnessed the same sort of dealings. I can understand that they [BCCI employees] feel like they were singled out.”

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Improved US-Pakistan Ties: F-1 Visas For Pakistani Students Soaring

The F-1 visas for Pakistani students are soaring amid a global decline, according to the US government data. The US visas granted to Pakistani students climbed 44.3% in the first half of Fiscal Year 2025 (October 2024 to March 2025) with warming relations between the governments of the two countries. The number of visas granted to Indian students declined 44.5%, compared to 20% fewer US visas given to students globally in this period. The number of US visas granted to Pakistani…

ContinuePosted by Riaz Haq on October 19, 2025 at 10:00am

Major Hindu American Group Distances Itself From Modi's India

"We are not proxies for India in the US", wrote Suhag Shukla, co-founder and executive director of the Hindu American Foundation (HAF) in a recent article for The Print, an Indian media outlet. This was written in response to Indian diplomat-politician Shashi Tharoor's criticism that the Indian-American diaspora was largely silent on the Trump administration policies hurting India. …

ContinuePosted by Riaz Haq on October 11, 2025 at 2:00pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network